For discerning individuals with global interests, a critical question often arises: in the event of a medical emergency abroad, will a Blue Cross Blue Shield plan cover the cost of an air ambulance for repatriation?

The answer is a qualified yes—a "yes" fraught with significant limitations that can result in staggering personal expense. While BCBS plans typically cover 'medically necessary' air transport, the policy language contains strict definitions, network limitations, and authorization protocols ill-suited for a crisis in a foreign country.

Deconstructing Your BCBS Air Ambulance Coverage

As an individual accustomed to bespoke solutions, you understand that standard offerings rarely suffice. Your domestic health insurance is no exception. While Blue Cross Blue Shield provides excellent coverage within the United States, its framework is fundamentally misaligned with the complexities of a medical emergency overseas.

The vulnerability lies deep within the policy's contractual language. Your plan will almost certainly cover an air ambulance, but only to the nearest appropriate medical facility. That specific phrase is the fulcrum upon which financial and medical outcomes pivot. What occurs if the "nearest" hospital in a remote location does not meet your personal standard of care?

The Financial Exposure You Face

This ambiguous policy language creates a grey area that can lead to seven-figure out-of-pocket expenses. This is not a theoretical risk; it is a frequent and harsh reality for expatriates and global travelers who rely solely on their domestic insurance plans.

While BCBS may cover medically necessary flights, the primary financial trap is the out-of-network provider. Analysis by the Peterson-KFF Health System Tracker found that in 2022, an estimated 79% of air ambulance transports were out-of-network. When this occurs, patients often receive a "balance bill" for the uncovered portion, which can average tens of thousands of dollars. You can explore more about air ambulance market trends and confirm why these costs are so profoundly unpredictable.

To protect your assets, it is essential to understand the distinction between two critical services:

- Air Ambulance Service: This is what BCBS typically covers. It is an emergency flight to the closest hospital capable of managing your condition.

- Medical Evacuation: This is a comprehensive logistical service that transports you to a hospital of your choice or, more importantly, repatriates you to your home country for world-class care from your trusted physicians.

Consider this analogy: a standard domestic policy provides an emergency taxi to the nearest hospital. A true global medical solution is a private medical jet that ensures your arrival at a premier specialist you trust, regardless of your location.

This fundamental difference underscores why a supplemental International Private Medical Insurance (IPMI) policy is not an indulgence—it is a strategic necessity. It is the only reliable method for safeguarding both your health and your wealth from the substantial, unpredictable costs of a medical crisis abroad. The subsequent sections will delve deeper into these risks, from the precise definition of 'medical necessity' to the mechanics of the claims process.

The Critical Meaning of Medical Necessity

For any professional accustomed to precise, ironclad agreements, the term "medical necessity" appears straightforward. However, within the context of Blue Cross Blue Shield air ambulance coverage, this phrase is the single most critical—and dangerously ambiguous—criterion. It determines whether your claim is approved or denied, and its interpretation during a crisis can have profound financial consequences.

Your policy does not cover any emergency flight on demand. It covers a transport that your insurer, often with the benefit of hindsight, agrees was the only clinically viable option. This is not a determination made solely by you or your attending physician. The insurer's clinical review team will dissect the entire event retrospectively to ascertain if it met their rigid criteria.

The Insurer's Deciding Factors

When an air ambulance claim is submitted, Blue Cross Blue Shield examines it under a clinical microscope, posing several key questions. Your claim's approval hinges on their answers, not on the urgency you experienced at the moment.

Their core criteria typically distill to the following:

- Was Ground Transport an Option? Could a ground ambulance have transported you to an appropriate hospital safely and within a medically acceptable timeframe? If a land route existed and the onboard care was sufficient to maintain stability, a claim for air transport may be denied.

- Were Local Hospitals Truly Inadequate? Could the initial facility have provided the necessary level of care? The insurer will analyze whether that facility was genuinely incapable of managing your condition, making a transfer essential for survival or prevention of permanent impairment.

- Did Your Condition Demand Speed? Did your medical state require the velocity of air transport? This criterion assesses whether the time saved by flying was critical to preventing loss of life or limb.

This review process can feel impersonal and bureaucratic, particularly during recovery from a traumatic medical event. The insurer is not questioning the validity of your illness; they are questioning whether the decision to incur a cost often exceeding $50,000 met their strict, contractual definition of necessary.

Imagine you suffer a major cardiac event while on business in a developing nation. The local hospital stabilizes you but lacks the cardiac catheterization lab required for the definitive procedure. In this instance, an air ambulance to a major, well-equipped hospital several hundred miles away would almost certainly be deemed medically necessary.

Scenarios Where Claims Can Fail

Conversely, consider a different scenario. You sustain a complex fracture while yachting in the Mediterranean. The injury is painful and serious, but the hospital in the port town can set the bone and manage your immediate care. While it is not the world-class orthopedic center you would choose at home, it is competent.

In this situation, even if your personal physician advises a transfer, the insurer might argue that the local care was "adequate." They could conclude that ground transport to a regional airport for a commercial flight would have been a reasonable alternative to a private air ambulance. This is precisely where a standard Blue Cross Blue Shield policy reveals its inadequacy for a global professional.

This ambiguity is the primary source of financial risk for international executives. Your perception of adequate care and your insurer's contractual definition can be worlds apart. Relying solely on a domestic plan designed for a predictable network of US hospitals is a significant gamble when your health and wealth are at stake in a foreign country. This is why a specialized insurance strategy—one that removes this uncertainty entirely—is not a luxury, but a necessity.

The Financial Risk of Out-of-Network Providers

During a medical crisis abroad, your focus is on immediate, life-sustaining care, not on verifying the network status of an air ambulance provider. You have no control over which service responds. This introduces the single greatest financial threat of relying on a domestic plan like Blue Cross Blue Shield overseas: the out-of-network provider.

When the responding air ambulance is not part of your insurer's approved medical network, a significant coverage gap is created. The provider has no pre-negotiated rate with BCBS, granting them the freedom to charge their full, often dramatically inflated, retail price. This leads to a financially devastating scenario known as balance billing.

The Anatomy of Balance Billing

Balance billing occurs when an out-of-network provider bills you directly for the difference between their total charge and the amount your insurance deems "reasonable and customary." It is a direct liability against your personal assets, capable of transforming a medical emergency into a financial catastrophe.

Imagine an air ambulance company charges $75,000 for a transport. Your BCBS plan reviews the claim and determines a "reasonable" payment is $25,000. They remit their portion, and the provider then issues you a "balance bill" for the remaining $50,000. This is not an opening for negotiation; it is a demand for payment.

This is analogous to being forced to charter a private jet in your most vulnerable moment, only to be presented with a non-negotiable, six-figure invoice after the fact.

This is not an infrequent occurrence. A 2022 analysis by the Peterson-KFF Health System Tracker revealed that 79% of air ambulance transports were out-of-network, leaving a vast number of patients exposed to significant balance bills. As you can learn from the in-depth research on air ambulance charges, this represents a substantial and unpredictable financial risk.

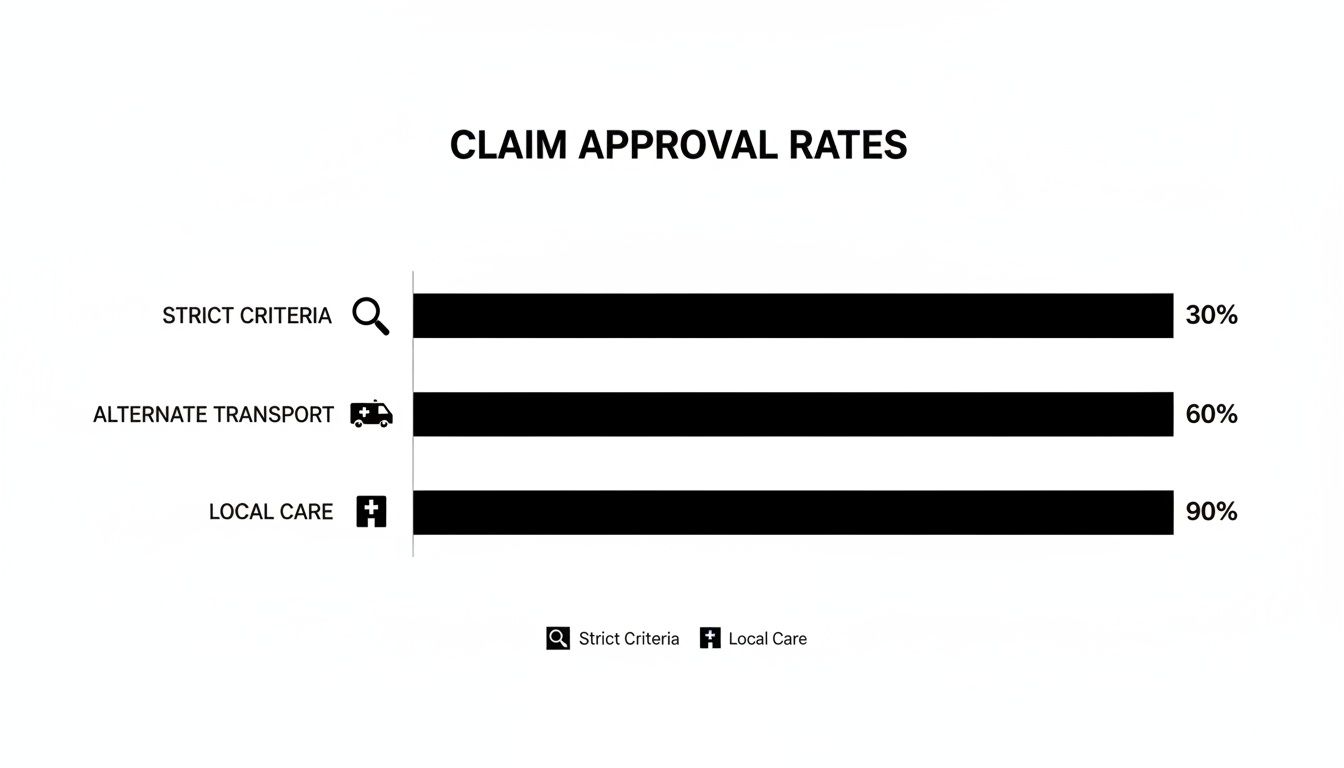

The chart below illustrates the stringent criteria domestic insurers apply, which further complicates out-of-network situations.

They rigorously question if alternate transport was viable or if local care was sufficient, creating multiple avenues for a claim to be denied.

Visualizing the Cost Disparity

The financial chasm between relying on a domestic plan and possessing a dedicated international solution is immense. The following table makes the risk tangible, illustrating the potential cost of an out-of-network emergency.

Cost Exposure Analysis: BCBS vs. IPMI with Medevac

| Cost Component | Typical BCBS Out-of-Network Scenario | Comprehensive IPMI Medevac Scenario |

|---|---|---|

| Total Air Ambulance Charge | $80,000 | $80,000 |

| BCBS Payment (Allowed Amount) | $30,000 | N/A (Direct payment arranged) |

| Balance Bill (Your Responsibility) | $50,000 | $0 |

| Deductible & Coinsurance | Up to $10,000+ | Typically $0 for evacuation |

| Total Out-of-Pocket Exposure | Potentially $60,000+ | $0 |

The contrast is stark. It highlights the core weakness of utilizing domestic insurance in a global context. Even a premium BCBS plan is engineered to function within a specific network of providers. Outside that network—particularly in the unregulated domain of international air transport—its protections can diminish significantly.

Conversely, a robust International Private Medical Insurance (IPMI) policy is designed for precisely this scenario. It operates on a principle of direct settlement with providers worldwide, effectively eliminating the concept of "out-of-network." The IPMI provider's assistance team coordinates the entire evacuation and guarantees payment directly to the air ambulance company, shielding you completely from balance billing and any direct financial liability. This is the prudent way to safeguard your assets.

Air Ambulance Versus Medical Evacuation

A common and costly misconception among executives is equating "air ambulance" with "medical evacuation." While they sound similar, in the world of international medical emergencies, this confusion can lead to disastrous gaps in care and crippling financial liability.

For any individual operating on a global stage, understanding this distinction is not a matter of semantics—it is fundamental to personal security.

Your Blue Cross Blue Shield air ambulance coverage serves one very specific, limited purpose. It is designed to transport you from the point of injury to the nearest appropriate medical facility. The operative words are "nearest" and "appropriate," and the entity that defines them is not you, but the insurance company, based on clinical necessity and logistical constraints.

It is a crucial lifeline, certainly. But it only answers one question: "Where is the closest hospital that can prevent imminent death or serious impairment?"

A Tale of Two Transports

To be practical, think of an air ambulance covered by a domestic policy like BCBS as an emergency medical taxi. Its function is to transport you from the scene of an incident to the nearest emergency room equipped to handle the trauma. The service concludes upon arrival. The destination is chosen for you, and the goal is simply stabilization.

Medical evacuation, by contrast, is a private medical jet service. This is the cornerstone of any serious International Private Medical Insurance (IPMI) plan. Its objective is not merely survival—it is to optimize your clinical outcome. It transports you to a world-class hospital of your choosing or, just as importantly, repatriates you to your own trusted physicians.

For an executive who demands access to the best specialists, not just the nearest available hospital bed, this distinction is paramount. One is about immediate survival; the other is about ensuring the best possible long-term result.

This need for rapid, specialized care is a significant driver in the global healthcare market. The global ambulance services market was valued at USD 45.41 billion in 2023 and is projected to grow substantially. Within this, surprise billing remains a major issue. Research from the Peterson-KFF Health System Tracker has consistently shown a high percentage of out-of-network ambulance claims, with air ambulance charges being particularly high and variable. You can delve into a deeper analysis of the ambulance services market here to review the data.

Beyond the Initial Flight: What Domestic Policies Miss

A true medical evacuation plan, the kind designed for global professionals, includes critical services that a standard air ambulance benefit almost never covers. These are the elements that provide genuine security.

- Medical Repatriation: You have been stabilized in a foreign hospital. What is the next step? A standard policy's obligation is fulfilled. A proper IPMI plan arranges and covers the cost of bringing you home for recovery and rehabilitation once you are medically cleared to fly.

- Companion Travel: A medical crisis abroad can be an isolating and distressing experience. A dedicated evacuation plan will often cover flights and accommodation for a family member to be by your side, providing essential support.

- Choice of Destination: This is the most significant advantage. You are not confined to the local option. With a true medevac benefit, you can direct your transport to a top facility in London, Singapore, or back home in New York to ensure you are in the hands of the world's leading experts.

Ultimately, a BCBS air ambulance benefit is a reactive, emergency tool. A comprehensive medical evacuation plan is a proactive, strategic asset designed to protect your health to the highest possible standard, regardless of your location.

Securing Your Health with a Tailored IPMI Solution

After analyzing the fundamental deficiencies of a domestic policy like Blue Cross Blue Shield for international emergencies, the prudent course of action becomes clear. Relying on a plan not designed for the realities of a global lifestyle introduces unacceptable risks to both your health and your financial portfolio. The solution is not to find a "better" domestic plan, but to adopt a strategy built for the life you lead: an International Private Medical Insurance (IPMI) policy with robust medical evacuation benefits.

These specialized policies are engineered to close the dangerous gaps left by standard US insurance. They are not travel insurance add-ons; they are comprehensive health solutions that operate seamlessly across borders, providing the certainty and control you expect in every other aspect of your life.

The IPMI Advantage for Global Professionals

An IPMI solution operates on a different philosophy than a domestic plan. It assumes you will require world-class care, irrespective of your location, and builds its benefits around that core principle. This approach delivers several critical advantages that directly neutralize the weaknesses of standard Blue cross blue shield air ambulance coverage.

The most significant of these is the shift from mere transport to strategic evacuation. As established, BCBS might cover a flight to the nearest acceptable hospital. An IPMI plan, however, is designed to transport you to a center of medical excellence that you and your medical team choose, ensuring the quality of care aligns with your exacting standards.

An IPMI policy functions as your personal crisis management team. It replaces uncertainty and administrative friction with decisive action and expert logistical support, managed by a team dedicated to your interests, not those of a domestic insurance network.

Furthermore, these plans are structured to eliminate the financial shocks that accompany a crisis. They operate on a direct-payment basis, coordinating with air ambulance providers and hospitals globally to guarantee payment. This single feature completely shields you from the catastrophic risk of seven-figure out-of-pocket payments and balance billing.

Key Features of a Bespoke IPMI Plan

For a high-net-worth individual, the value of an IPMI policy extends far beyond the evacuation flight itself. It encompasses the entire ecosystem of support that surrounds you during a medical emergency. A well-structured plan offers a suite of services designed for total peace of mind. You can explore a detailed overview of what a premier International Private Medical Insurance solution entails and how it can be structured to meet your specific requirements.

These are the elements that provide true security:

-

Choice of Medical Destination: You are not limited to the "nearest appropriate facility." You have the authority to choose a hospital renowned for its expertise in your specific condition, whether it is in London, Zurich, or your home city.

-

Coverage for a Traveling Companion: A medical emergency is an isolating experience. Quality IPMI plans often include provisions to fly a family member to your bedside, providing crucial emotional support without adding financial burden.

-

24/7 Multilingual Assistance: Your first call connects you to a dedicated, multilingual team of crisis management experts. They manage every logistical detail, from liaising with local physicians to arranging the flight and ensuring a seamless hospital admission at your destination.

-

Direct-Payment Arrangements: The IPMI provider settles the bill directly with the air ambulance service and the receiving hospital. This completely removes you from the payment process, allowing you to focus solely on your recovery.

Ultimately, an IPMI solution provides a trifecta of benefits: comprehensive medical protection, expert crisis management, and complete financial security. For the global professional whose work and life know no borders, it is the only prudent and reliable way to ensure your health is protected to the highest possible standard, anywhere in the world.

Contrasting the Claims and Assistance Process

When a medical crisis occurs overseas, the last thing your family or staff needs is a mountain of paperwork and the looming threat of a six-figure invoice. The difference between how a domestic insurer like Blue Cross Blue Shield and a dedicated IPMI provider handle an air ambulance event is profound. It is the difference between justifying your actions after the fact and having an expert team manage the crisis for you from the very first call.

With a standard BCBS air ambulance benefit, the entire process is reactive. You, or more likely a panicked family member, are left to assemble the claim after the evacuation. This requires proving, retrospectively, that the flight met the insurer's rigid definition of medical necessity. This involves securing medical records from foreign hospitals, often navigating language barriers and bureaucratic complexities.

The Standard Claims Gauntlet

The burden of proof rests entirely on you. You are expected to build a case file that validates every decision made during the most stressful moments of your life. The insurer then subjects this file to a lengthy and meticulous review process.

This retroactive system creates two massive points of financial failure:

- Claim Denial: If the insurer determines the flight did not meet their narrow criteria, they can deny the claim in its entirety. You are then personally liable for the full cost, which can easily exceed $100,000.

- Balance Billing: Even if they approve a portion of the claim, you will likely face a substantial "balance bill" from the out-of-network air ambulance company. This forces you into a protracted negotiation for which you are completely unprepared.

The Seamless IPMI Experience

In contrast, consider the IPMI approach. From the moment the emergency call is made, an expert assistance company assumes complete control. They do not just handle the medical logistics; they manage the entire financial operation. Their team coordinates everything—from dispatching the appropriate medically-equipped aircraft to ensuring a smooth hospital admission at your destination.

The most critical difference is this: the IPMI provider guarantees payment directly to the air ambulance company upfront. This proactive measure removes you from the financial chain entirely. There is no risk of a denied claim or a surprise bill arriving months later. To understand how this works in detail, you can learn more about how pre-authorisation and direct settlement processes shield you from these crippling out-of-pocket costs.

For a busy executive or high-net-worth individual, this highlights the fundamental value of specialized coverage. IPMI is not just about paying bills. It is about providing expert advocacy and stress-free crisis management precisely when you are most vulnerable, allowing you to focus on the only thing that matters: your recovery.

Common Questions About Air Ambulance Coverage

When addressing emergency medical transport, the policy details are paramount. For globally mobile individuals, obtaining clear answers is essential for protecting both personal health and substantial assets. Here are the most frequent and critical questions.

Will My High-End BCBS Plan Provide Better Evacuation Coverage?

It is a logical assumption. A premium, top-tier Blue Cross Blue Shield plan should logically provide superior protection.

While a premium plan often includes higher benefit limits, it does not fundamentally alter the mechanics of the coverage. The core limitations—the strict definition of "medical necessity" and the enormous financial risk posed by out-of-network providers—are intrinsic to the policy's structure. It is designed for the US healthcare system.

The fundamental issue is not the benefit amount, but the entire framework. A dedicated IPMI policy is engineered from the ground up for international emergencies. It is designed to transport you to a hospital of your choice, not merely the closest one that meets a minimum clinical standard.

What Happens If I Am in a Country with Substandard Hospitals?

This scenario is where the distinction between domestic insurance and a true global solution becomes starkly apparent.

In such a situation, your BCBS plan would likely approve an air ambulance—but only to the "nearest appropriate" medical facility. The critical caveat is that "appropriate" might be a local hospital that is technically adequate but falls far below the standard of care you would expect or choose for yourself.

An IPMI plan with a medical evacuation benefit is engineered for exactly this contingency. It provides the ability to bypass the nearest option and be transported to a recognized center of medical excellence, whether that is in a neighboring country or all the way back home.

The core value is choice. A domestic plan makes a choice for you based on proximity and adequacy. A global plan gives you the power to choose excellence, regardless of your location.

Should I Just Buy a Standalone Medevac Membership Instead?

On the surface, standalone medical evacuation memberships from companies like Medjet or Global Rescue appear to be a smart, cost-effective solution. They excel at one specific function: covering the staggering cost of the emergency flight itself.

However, a critical gap exists: their responsibility typically ends the moment you arrive at the destination hospital. You are then left to arrange and pay for the actual medical treatment, which can easily amount to hundreds of thousands or even millions of dollars. This strategy simply swaps one massive financial risk for another.

A comprehensive IPMI plan avoids this entirely by integrating both the evacuation and the subsequent international medical treatment into one seamless policy. For executives and their families who require absolute certainty—from the initial flight to the final hospital bill—an integrated IPMI plan is the only prudent choice.

At Riviera Expat, we specialize in the intricate details of global health security. We structure comprehensive IPMI and medevac solutions that provide the clarity and control you require, no matter where your personal or business interests take you. Secure your peace of mind by exploring your options with us.