For global professionals, even the most robust International Private Medical Insurance (IPMI) can leave behind specific and often substantial financial gaps. A hospital indemnity plan should be viewed as a strategic financial instrument—a bespoke backstop that provides a fixed, predetermined cash benefit for each day of a qualifying hospital confinement.

This is not a substitute for medical insurance. It is a sophisticated tool engineered specifically to address the ancillary costs and financial disruptions that a primary insurance policy is not designed to cover.

Securing Financial Control with a Hospital Indemnity Plan

In the realm of international finance and high-stakes enterprise, astute risk management is fundamental. Your health coverage strategy demands the same level of precision. While a premium IPMI policy is indispensable for covering major medical procedures, it is not structured to mitigate the financial ripple effects of a serious hospital stay.

This is the specific scenario where a hospital indemnity plan demonstrates its value. The principle is elegantly simple: upon admission to a hospital for a covered reason, the policy disburses a set cash amount to you, per day. This payment is entirely independent of your primary medical insurance, and the funds are delivered directly to you, for your unrestricted use.

Protecting Assets and Preserving Liquidity

The core function of this plan is to safeguard your financial stability and provide immediate liquidity at a time when your focus must be on recovery. The cash benefit places you in complete control, allowing you to address the various financial pressures that arise during a hospital confinement.

These often-underestimated costs can accumulate rapidly:

- High Deductibles and Copayments: Addressing the initial out-of-pocket expenses your IPMI policy mandates before its coverage activates.

- Lost Professional Income: Compensating for cancelled contracts, deferred business opportunities, or the inability to manage your enterprise.

- Family and Travel Expenses: Facilitating travel and accommodation for family members, a critical consideration for expatriates located far from their support networks.

- Private Care Surcharges: Covering the premium for a private room or other specialised non-medical services that enhance comfort and privacy.

A hospital indemnity plan is not a replacement for comprehensive medical insurance. It is a sophisticated financial instrument that functions in parallel with your primary coverage, ensuring a health crisis does not precipitate a financial one.

A Strategic Tool for Global Professionals

For a high-net-worth individual operating between global financial centres such as Singapore, Hong Kong, or London, financial predictability is a requirement, not a preference. An unexpected hospitalisation can introduce significant uncertainty, impacting both personal assets and business operations.

By delivering a reliable stream of cash when it is most needed, a hospital indemnity plan enables you to maintain firm control over your finances. It ensures that unforeseen medical-related expenses are managed without necessitating the liquidation of investments or the derailment of your long-term financial strategy.

Consider it a specialised contingency fund that activates automatically, providing invaluable peace of mind and reinforcing your financial resilience.

How Does a Hospital Indemnity Plan Actually Work?

At its core, a hospital indemnity plan is engineered for direct financial intervention. It is a ‘fixed-benefit’ policy, meaning its function is not to negotiate with medical providers or cover specific procedures. Instead, its sole purpose is to provide a cash payment when you are admitted to a hospital.

Unlike your primary health insurance, which interfaces with the hospital’s billing department, this plan disburses funds directly to you. It is best understood not as traditional insurance, but as a financial safeguard that deploys capital precisely when a health crisis disrupts your professional and personal life.

The payment structure is exceptionally straightforward. You receive a predetermined amount for each day of hospitalisation, allowing you to calculate the exact financial support you will receive based on the duration of your stay. There are no variable calculations or surprises.

The Mechanics of Benefit Triggers

The strategic advantage of a hospital indemnity plan is its capacity to "stack" benefits. Various events during a hospital stay can trigger separate payments, often concurrently, creating a significant capital injection when you require it most.

The most common triggers include:

- General Hospital Admission: The foundational benefit. You receive a fixed daily cash payment for every 24-hour period of hospital confinement.

- Intensive Care Unit (ICU) Stay: As critical care entails heightened costs and stress, these policies provide a significantly higher daily benefit for any time spent in the ICU.

- Specific Surgical Procedures: Many plans feature a lump-sum payment for a covered surgery performed during your stay, entirely separate from the per-diem benefits.

- Emergency Room Visits: Certain policies will also disburse a fixed amount if your hospitalisation originates with a visit to an emergency room.

To illustrate with specific figures: a plan might provide $1,000 per day for a standard hospital stay but an additional $1,000 per day for an ICU stay. A five-day confinement in intensive care would result in a $10,000 cash payment transferred directly to your account.

This direct-to-you payment model is fundamentally different from standard medical insurance, which often involves a complex process of pre-authorisation and direct settlement uncovered.

The Direct-to-You Payment Advantage

The single most powerful feature is the autonomy it provides. The cash benefit is yours to allocate as you see fit. There are no provider networks to consider or line-item approvals to obtain. You retain complete control over the deployment of the funds.

The express purpose of an indemnity payment is to fill the financial gaps your primary health insurance leaves. It exists so you can cover a high deductible, replace lost income during recovery, fund travel for family, or even engage a private nurse—all without liquidating assets or disrupting your long-term financial plan.

Naturally, data privacy is paramount when managing health events and insurance claims, a principle underscored by regulations like HIPAA compliance for health-related documents. The discreet, direct nature of this plan’s payout aligns perfectly with this requirement.

This is not a niche product. The global market for hospital indemnity insurance is substantial, which indicates its value to HNW individuals and seasoned professionals. We observe particularly strong demand in major expatriate hubs like Hong Kong and Singapore, where executives often face significant out-of-pocket costs even with premier IPMI policies. The data confirms that this is an established tool for building a truly resilient financial defence.

Comparing Hospital Indemnity And Other Supplemental Plans

Constructing an effective financial safety net requires a precise understanding of the designated purpose for each tool in your portfolio. A hospital indemnity plan occupies a very specific niche, one often conflated with other supplemental policies like critical illness cover or disability insurance. Misunderstanding these distinctions can leave dangerous vulnerabilities in your financial armour.

A hospital indemnity plan is defined by its simplicity. It is triggered by a single event: a qualifying hospital admission. Its function is to deliver cash to you, rapidly, to manage the multitude of costs—both direct and indirect—that arise from the moment of hospitalisation.

In contrast, other supplemental plans are designed to respond to entirely different triggers and solve different financial problems. They are not interchangeable. They are best viewed as complementary components of a comprehensive financial plan, each with a distinct mission.

Clarifying The Triggers And Payouts

To fully appreciate the unique role a hospital indemnity plan performs, it must be analysed alongside its counterparts in the insurance landscape. Each policy is structured to activate under specific circumstances and deliver a different form of financial relief.

-

Critical Illness Insurance: This policy provides a single, tax-free lump-sum payment upon the diagnosis of a specific, life-altering illness such as a heart attack, stroke, or cancer. The trigger is the diagnosis, not the hospitalisation. The lump sum is designed for large-scale financial challenges: home modifications, funding experimental treatments, or eliminating mortgage debt.

-

Disability Insurance: This serves as your income protection. If an injury or illness prevents you from working, this coverage replaces a significant portion of your monthly income. The trigger is your inability to perform your occupation, and its purpose is long-term income replacement, not addressing the immediate financial impact of a hospital stay.

The essential differentiator is the trigger. A hospital indemnity plan pays for the event of being hospitalised. It is agnostic to the diagnosis. Critical illness pays for the diagnosis itself, and disability insurance pays for the inability to earn an income.

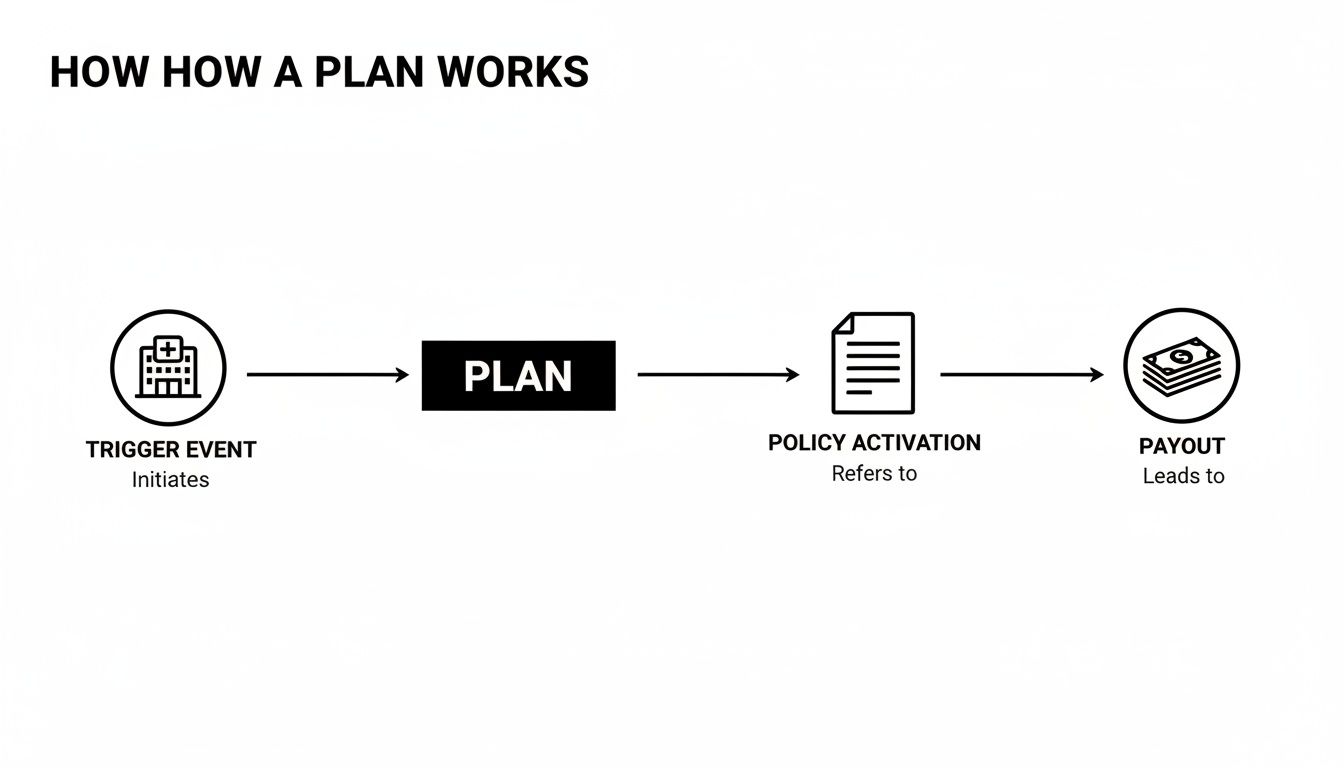

This workflow diagram illustrates the straightforward nature of a hospital indemnity plan. A qualifying event occurs, you are hospitalised, and cash is paid directly to you.

It is this direct and uncomplicated mechanism that provides immediate liquidity precisely when a qualifying hospital stay introduces chaos into your life and finances.

A Practical Scenario For A Global Professional

Let's transpose this into a real-world context. Consider an entrepreneur based in Dubai who suffers a serious skiing injury requiring surgery and a ten-day hospitalisation. Here is how the different policies would respond:

- The Hospital Indemnity Plan activates upon admission. If her policy has a $1,500 daily benefit, it disburses $15,000 directly to her. She can use these funds for any purpose—her IPMI deductible, the surcharge for a private room, or to hire a temporary manager to maintain business continuity.

- Disability Insurance does not yet activate. It will only begin payments after a predetermined waiting period (e.g., 90 days) if the injury is severe enough to prevent her from returning to her professional duties. It is designed for long-term scenarios.

- Critical Illness Cover provides no benefit. An injury, regardless of severity, is not a covered diagnosis on its specified list.

This example highlights the immediate, tactical role of a hospital indemnity plan. It is your financial first responder for costs directly associated with a hospital stay. The market for these plans is expanding, particularly for professionals in global hubs where even the best primary IPMI plans can leave an individual responsible for deductibles and coinsurance of 10-20% on a major claim. Hospital indemnity plans are perfectly designed to fill that gap.

Supplemental Insurance Comparison for Global Professionals

To make the distinction explicit, this table breaks down how these three crucial supplemental plans compare. Each is a specialist instrument, designed to protect against a different financial threat.

| Feature | Hospital Indemnity Plan | Critical Illness Cover | Disability Insurance |

|---|---|---|---|

| Primary Function | Provides immediate cash for costs associated with a hospital stay. | Provides a large, one-time lump sum for major lifestyle and medical costs following a serious diagnosis. | Replaces a portion of your monthly income if you cannot work due to illness or injury. |

| Benefit Trigger | Admission to a hospital for a qualifying stay. | Diagnosis of a specific, pre-defined critical illness (e.g., cancer, stroke). | Inability to perform your occupational duties after a waiting period. |

| Payment Structure | Fixed daily, weekly, or lump-sum cash benefit paid directly to you. | One-time, tax-free lump sum payment. | Regular monthly payments (stipend). |

As illustrated, these plans are not in competition; they are synergistic. A hospital indemnity plan covers the event, critical illness covers the diagnosis, and disability insurance covers the income-related aftermath.

Why A Hospital Indemnity Plan Is A Foundational Layer

For high-net-worth professionals and expatriates, asset protection is paramount. A hospital indemnity plan serves as a foundational layer of that protection, providing instant capital that prevents you from having to draw upon other assets during a medical emergency. It ensures the unexpected costs of a hospitalisation do not compel you into suboptimal financial decisions, such as liquidating investments at an inopportune time.

While a premier health plan is non-negotiable, understanding the precise function of each insurance product is what enables the creation of a truly resilient financial strategy. You can explore our analysis of what international private medical insurance benefits truly cover to see how these supplemental plans integrate into the broader picture. By pairing a hospital indemnity plan with other specialised policies, you construct a multi-layered defence that addresses distinct financial risks with precision and control.

Real-World Scenarios for High-Net-Worth Professionals

Theoretical benefits are of little consequence until they are tested against real-world pressures. For a high-net-worth professional, a medical emergency is not merely a health issue; it is a financial event with the potential to impact assets, disrupt income, and affect family stability.

This is where a hospital indemnity plan demonstrates its strategic power: delivering immediate, unrestricted capital precisely when it is most required.

Let's move beyond the abstract to examine two detailed scenarios. These are not mere hypotheticals; they employ realistic figures to demonstrate exactly how this coverage provides the tactical financial control needed to protect your primary assets and insulate you from the ancillary costs of a serious hospitalisation.

Case Study 1: The Singapore Investment Banker

An investment banker in Singapore, engaged in a critical transaction, requires unexpected abdominal surgery. To ensure the highest standard of care and a private recovery environment, he elects for a seven-day stay at a premier private hospital. His premium International Private Medical Insurance (IPMI) covers the majority of the medical bills, but not all associated expenses.

This is the exact gap his hospital indemnity plan is designed to fill.

- Daily Hospital Confinement Benefit: His policy pays a $2,000 per day cash benefit. For his seven-day stay, this amounts to $14,000 transferred directly to his bank account.

- Surgical Lump-Sum Benefit: Additionally, the plan includes a one-time $5,000 payout for a qualifying inpatient surgical procedure.

The total tax-free cash payout from his indemnity plan is $19,000. This injection of capital proves indispensable. He immediately allocates $5,000 to cover his IPMI policy's annual deductible. A further $4,500 covers the surcharge for a premium private suite—an expense not fully covered by his primary insurance but essential for his comfort and ability to remain connected to his team.

This scenario illustrates the plan's role as a financial facilitator. The direct cash payment covers immediate out-of-pocket costs without requiring him to draw from investment accounts or emergency funds.

The remaining $9,500 is his to use without restriction. He uses it to arrange a last-minute, business-class flight for his wife to join him from Hong Kong, along with her hotel accommodation near the hospital. The surplus cash provides a buffer for miscellaneous expenses, ensuring the entire event creates zero financial stress.

Case Study 2: The Kuala Lumpur Consultant

Consider a management consultant on a critical project in Kuala Lumpur who is involved in a serious road accident. Her injuries are severe, necessitating four days in the Intensive Care Unit (ICU) followed by ten days of recovery in a standard room. Her professional commitments come to an abrupt halt.

Fortunately, her financial strategy included a robust hospital indemnity plan with benefits designed to stack during catastrophic events.

- Daily Confinement Benefit: The policy pays a base rate of $1,000 for each day of hospitalisation.

- ICU Rider: Critically, her plan includes an ICU rider that adds another $1,500 per day for any time spent in intensive care.

The benefit calculation demonstrates the power of these stacked features. For the first four days in the ICU, she receives $2,500 per day ($1,000 base + $1,500 ICU rider), for a total of $10,000. For the subsequent ten days in a standard room, she receives $1,000 per day, adding another $10,000.

Her total cash benefit is $20,000, paid directly to her. This lump sum is a financial lifeline. The accident forced the cancellation of two lucrative short-term contracts, representing a significant income loss. The $20,000 payout serves as a direct replacement for that lost revenue, ensuring her financial obligations are met without interruption.

This infusion of capital allows her to focus entirely on recovery, confident that her immediate financial stability is secure. The funds arrive long before any disability insurance payments would commence, bridging a critical income gap and preventing a medical crisis from becoming a financial one.

Getting Into the Weeds: Evaluating Policy Details and Contract Nuances

For any discerning professional, the true value of a financial instrument lies not in its marketing materials, but in the fine print of its contract. Hospital indemnity plans are no exception. A thorough review of the policy document is not a formality; it is the critical due diligence required to ensure the plan will perform as expected when needed.

One must approach the policy with a specific objective. While the language can be dense, focusing on several key areas will reveal the plan's true strengths and limitations. This analysis is how one moves beyond the sales proposition to understand the precise mechanics that trigger the cash benefit.

Core Contract Provisions To Examine

The ultimate utility of a hospital indemnity plan is determined by a handful of critical clauses. These terms dictate when payments begin, their maximum duration, and any prerequisite conditions. A clear understanding of these points is essential to assessing the policy's value within your financial toolkit.

-

Benefit Period: This specifies the maximum number of days the policy will pay benefits for a single hospital confinement. A superior plan should offer a substantial period, such as 365 days, providing a genuine safety net for a prolonged recovery.

-

Elimination Period: This functions as a time-based deductible. It is the number of days you must be hospitalised before benefits commence. A shorter period is always preferable—ideally a zero-day elimination period—as it ensures financial support from day one.

-

Pre-existing Condition Clause: This clause defines the waiting period before the plan will cover a hospitalisation related to a condition that existed prior to the policy's inception. It is vital to have absolute clarity on this timeline to avoid an unexpected denial of a claim. Sifting through these documents can be tedious; an AI agent for healthcare policy analysis can sometimes expedite the process of identifying key terms.

Key Questions To Ask Your Advisor

A focused discussion with your advisor is non-negotiable. Your questions must be precise and designed to eliminate any ambiguity in the policy language. This is how you confirm that the coverage you believe you are purchasing is what you actually own. For a deeper understanding of how these contractual details function, our guide on the fine print of excesses and deductibles provides a valuable starting point.

A policy's value is defined not only by its stated coverage but by the precision of its definitions. Clarity in terminology is the hallmark of a high-quality contract.

Ensure you receive concrete answers to these questions:

- What is the exact definition of 'Hospital Confinement'? Does it require a full 24-hour inpatient stay, or does it cover shorter periods of observation? This is a critical distinction, as many hospital visits begin in an observation unit prior to formal admission.

- Is the policy 'Guaranteed Renewable'? For long-term planning, this feature is essential. It ensures the insurer cannot terminate your coverage due to age or changes in health status, provided you continue to pay the premiums.

- Does the plan include 'Portability'? For a globally mobile professional, this is indispensable. Portability means your coverage remains in force when you relocate, ensuring your protection is not forfeited due to a change in country of residence.

The broader market for hospitalisation insurance, which includes these indemnity products, is experiencing significant growth. This trend underscores the increasing importance of these policies for investment bankers and HNWIs, who require robust financial backstops in an environment of evolving health risks.

Frequently Asked Questions

When investigating a specialised financial product such as this, several key questions invariably arise. Here are the most frequent inquiries from clients, with direct answers to help you ascertain where this tool fits within your personal financial architecture.

Are The Benefits From A Hospital Indemnity Plan Taxable?

In most jurisdictions, no. For a policy that you own personally and fund with after-tax income, the cash benefits received are typically not considered taxable income. This significantly enhances the real financial impact of the payout.

The primary exception is if the plan is part of an employer-sponsored arrangement funded with pre-tax dollars. In such cases, the benefits may be subject to income tax. It is always prudent to consult a qualified tax advisor in your jurisdiction for a definitive ruling based on your specific circumstances.

Can I Use The Cash Benefit For Anything I Choose?

Yes; this is the fundamental premise of the product. It is what distinguishes a hospital indemnity plan from standard health insurance. Rather than reimbursing a hospital, the plan provides a fixed cash payment directly to you.

You have complete discretion over these funds. Clients have used the proceeds to cover large IPMI deductibles, replace lost income during a period of incapacitation, fly in family members for support, or simply ensure household expenses are managed during recovery. The choice is entirely yours.

Does A Hospital Indemnity Plan Have Network Restrictions?

Absolutely not. These plans are network-agnostic. The benefit is triggered by a single, verifiable event: your admission to a hospital for a qualifying stay.

Consequently, you can seek treatment at any licensed hospital of your choosing, anywhere in the world (subject to your policy's geographical terms). This freedom from network constraints makes a hospital indemnity plan an exceptionally powerful tool for globally mobile professionals who require flexibility and decline to be limited to a prescribed list of providers.

How Does The Claims Process Typically Work?

The process is designed for simplicity and speed, as the objective is to place capital in your hands when you need it most. Following discharge, you will submit a claim form accompanied by proof of hospitalisation, such as the admission and discharge summaries.

Upon the insurer's verification that the event aligns with your policy terms, a payment is issued for the predetermined amount. Critically, this process is entirely independent of your primary health insurance. Filing a hospital indemnity claim will not delay or interfere with your IPMI claim in any manner.

At Riviera Expat, we specialise in constructing comprehensive health and financial protection strategies for professionals in global finance. To explore how a hospital indemnity plan could fortify your personal financial architecture, schedule a consultation with our expert advisors today.