At its core, insurance underwriting is the meticulous process insurers use to evaluate risk before they agree to issue a policy. For high-net-worth individuals seeking premier International Private Medical Insurance (IPMI), this is the single most critical step that determines eligibility, the scope of coverage, and the final premium.

The Role of Underwriting in Elite Health Insurance

Consider a master jeweler carefully assessing a rare diamond. An underwriter performs a similar function, examining your unique health and lifestyle profile to craft a policy that is both comprehensive for you and sustainable for the insurer.

This process is not a barrier. It is the very foundation of a reliable, long-term healthcare partnership built for your global needs. Understanding what underwriting means is the first step to securing the best possible terms for your policy.

Underwriting is the gatekeeper of the entire insurance industry. It determines who is offered a policy and at what premium. This risk assessment becomes even more critical during challenging economic times. In what the industry calls "hard markets," insurers may face investment losses and a surge in claims, compelling them to tighten coverage terms and adjust premiums.

For instance, following the 2008 financial crisis, global hard markets reportedly led to commercial insurance rate increases of 15-30% by 2011, affecting expatriates in key financial hubs. You can explore the dynamics of these insurance market cycles in a paper from the University of Michigan.

The Purpose of Underwriting

The primary objective of underwriting is to ensure the insurer collects sufficient premiums to cover its policyholders' claims while remaining a viable enterprise. It achieves this by carefully selecting applicants whose risk profiles align with the insurer's standards.

This careful evaluation allows insurers to:

- Prevent adverse selection: This is a key industry term. It describes a situation where individuals with a higher-than-average risk are more likely to purchase insurance, which could lead to an unsustainable volume of claims for the insurer.

- Maintain fair pricing: By accurately assessing risk, underwriters ensure that your premium reflects the potential cost of your coverage. This creates a more equitable system for all members of the insurance pool.

- Ensure financial stability: Prudent risk assessment is vital for the long-term solvency of the insurance company. It guarantees they have the funds to pay your claim when you need them most.

Underwriting is both an art and a science. It is the disciplined process of sorting applicants into appropriate groups based on their likely health outcomes. This ensures the integrity and sustainability of the entire insurance system.

For a global professional, every detail is material. Your health history, profession, and even travel patterns are all considered—not just to assess risk, but to construct a policy that genuinely protects your worldwide lifestyle.

Deconstructing the IPMI Underwriting Process

Your International Private Medical Insurance (IPMI) application is more than a form. It initiates a deep-dive investigation, a process designed to build a complete and accurate picture of your health and lifestyle risks. This is the essence of underwriting, where an insurer determines the precise implications of covering an individual with your unique global footprint.

The process commences the moment you submit your application, which contains your medical history and lifestyle details. For a global professional, this analysis extends well beyond health. Underwriters will scrutinize your countries of residence and most frequent travel destinations, as these locations directly impact potential healthcare costs and risks.

Honesty and detail are paramount. An underwriter’s role is to assemble a puzzle. The more complete and transparent the pieces you provide, the clearer the final picture—and the smoother your path to securing a policy that serves your needs effectively.

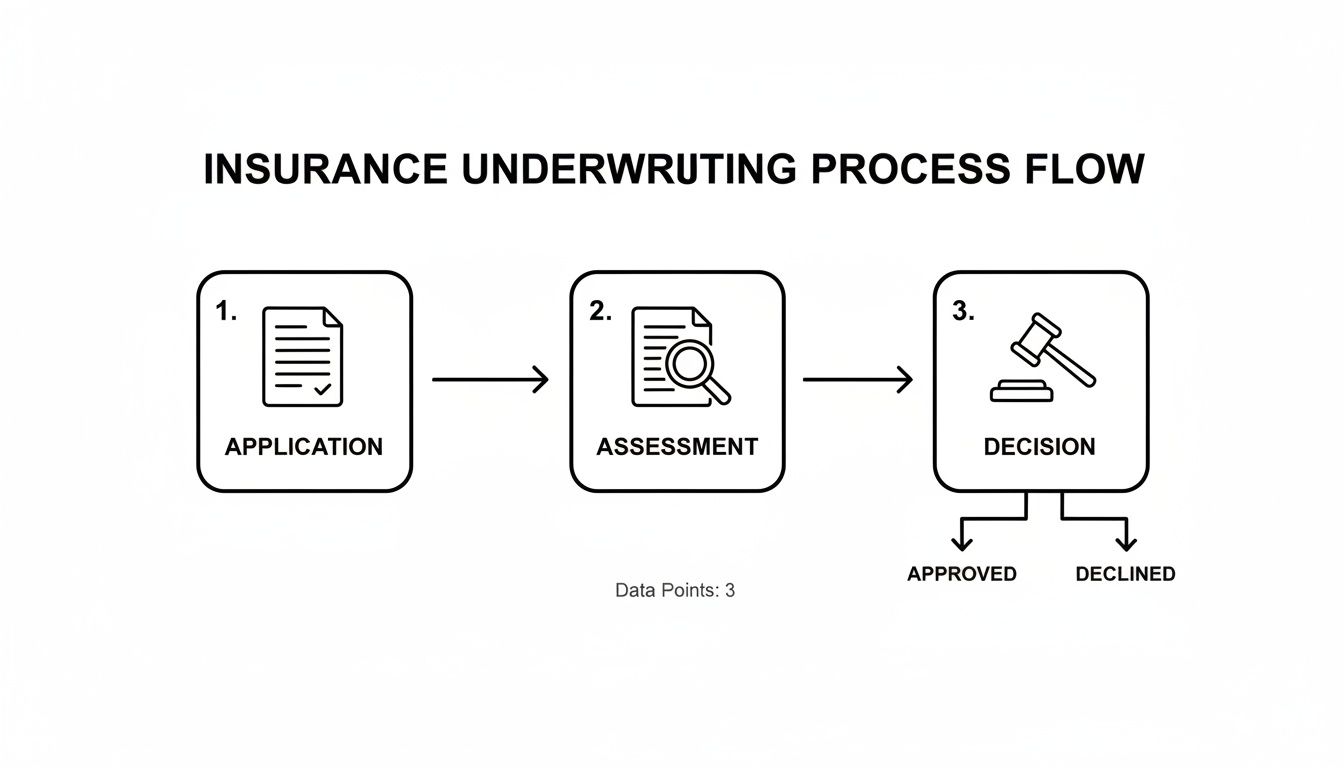

This flow chart breaks down the core stages of this assessment, from the initial application right through to the final decision.

As you can see, it’s a structured, methodical journey with three key phases. It is not an opaque system generating arbitrary decisions.

The Stages of Assessment

Once your information is submitted, the risk classification begins. While a standard policy might undergo a quick automated review, bespoke policies for high-net-worth individuals are handled by a senior underwriter. This is where human expertise converges with powerful analytical tools.

The process often involves gathering data beyond your application, such as results from medical examinations or reports from past insurance claims. Insurers are also leveraging new technology to increase efficiency. For instance, AI can reportedly reduce processing times by 50-70% and analyze massive datasets, such as real-time health insights from wearable technology. This is especially useful for expatriate families who face different health challenges in various parts of the world.

The purpose of this deep analysis is not to find reasons for declinature. It is to arrive at a clear, mutual understanding of the risk involved. For the insurer, it ensures business sustainability. For you, it means your policy’s terms are solid and dependable when you need to use them.

Ultimately, every piece of information helps shape the final underwriting decision. This detailed approach ensures your coverage is not a generic, one-size-fits-all product. Instead, it is a carefully constructed financial shield designed to protect your health and assets, no matter where you are in the world. It is crucial to understand these stages, and you can delve into the specifics by reading our guide on how key expat medical insurance policy terms are explained. The entire process is built around achieving clarity and confidence before your policy is finalised.

Choosing Your Underwriting Path

When securing an International Private Medical Insurance (IPMI) policy, you are not simply presented with a standard contract. You have a choice in how the insurer assesses your health history. Making the correct choice is a significant decision—it directly affects what is covered from day one, the speed of your application, and the degree of certainty you have going forward.

Think of these underwriting methods as different routes to the same destination: comprehensive global health coverage. Each path is designed for different circumstances and comfort levels with risk. For a global professional who cannot afford unforeseen complications, selecting the right path from the outset is a strategic move that prevents issues later.

Full Medical Underwriting (FMU)

For those who require absolute clarity and leave nothing to chance, Full Medical Underwriting (FMU) is the preferred option. It is the most thorough approach, requiring you to complete a detailed health questionnaire covering your entire medical history. An underwriter then personally reviews this information to issue a policy with crystal-clear terms from inception.

Why is this the best path for certainty?

- No Ambiguity: You know precisely what is covered and what is excluded before paying the first premium. There are no unwelcome surprises when you need to make a claim for a pre-existing condition.

- Potential for Coverage: A pre-existing condition does not lead to an automatic exclusion. The insurer may agree to cover certain conditions, sometimes for an additional premium, based on their assessment.

- Unwavering Confidence: This upfront diligence means your coverage is locked in and clearly defined, giving you a stable foundation for your health and wellbeing anywhere in the world.

While FMU requires more time initially, it is the most direct route to knowing exactly what you are purchasing.

Moratorium Underwriting

If you prefer a quicker, less paperwork-intensive process, Moratorium underwriting is a popular alternative. With this method, you generally do not have to provide your full medical history upfront. Instead, the policy excludes treatment for any medical conditions for which you have experienced symptoms or received advice in the five years prior to your policy's start date.

A Moratorium is akin to a probationary period for past health issues. The insurer is effectively stating, "We will cover this past condition, but only after you have been on our plan for two consecutive years without any symptoms, treatment, or advice for it."

This path offers speed but trades it for a degree of uncertainty. When you make a claim, the onus is on you and your physician to demonstrate that the condition is new and unrelated to anything from your past. This can sometimes lead to delays or disputes when you most need support.

Continued Personal Medical Exclusions (CPME)

Continued Personal Medical Exclusions (CPME) is a strategic option available only to individuals switching from another health plan, whether corporate or individual. This method allows you to carry over your existing underwriting terms—including any specific exclusions—to your new policy with a different insurer.

The significant advantage here is continuity. If your previous plan was already covering a managed pre-existing condition, CPME ensures that coverage rolls over without a new medical review. It is the ideal choice for maintaining uninterrupted protection when you change insurance providers, as it eliminates the risk of a new insurer suddenly excluding a known health issue.

To help you decide which path is right for you, here is a concise side-by-side comparison of these three methods.

Comparison of Medical Underwriting Types

| Underwriting Type | Best For | Key Consideration |

|---|---|---|

| Full Medical Underwriting (FMU) | Individuals who want 100% clarity on coverage for pre-existing conditions from day one. | The most thorough application process, but offers the greatest long-term certainty. |

| Moratorium Underwriting | Healthy individuals without recent pre-existing conditions who prioritize a fast and simple application. | Offers speed but creates ambiguity; the burden of proof is on you at the time of a claim. |

| Continued Personal Medical Exclusions (CPME) | Individuals switching from an existing plan who want to maintain coverage for their known medical conditions without a new assessment. | Ensures continuity but is only available when moving from a comparable health insurance policy. |

Ultimately, the optimal choice depends entirely on your personal health history and your tolerance for risk. FMU provides certainty, Moratorium offers speed with some ambiguity, and CPME delivers seamless continuity for those already insured.

What Underwriters Scrutinize: Key Factors That Influence Their Decisions

Assuming an underwriter’s decision is based merely on age and a cursory glance at your medical history is a common misconception. For a global professional, it is a deep dive into every facet of your life, piecing together a complete risk profile. This is not bureaucratic box-ticking; it is essential for determining the true cost of insuring an individual whose life and work transcend geographical boundaries.

The analysis goes far beyond standard health statistics, delving into the nuanced details of your lifestyle. Your occupation, for example, is a significant factor. An executive traveling between predictable meetings in London and Hong Kong represents a completely different risk compared to an energy consultant who spends half the year in remote, high-risk regions.

Your country of residence is another critical piece of the puzzle. The cost and quality of healthcare vary dramatically between countries. An underwriter views a policyholder in Singapore, with its world-class but exceptionally expensive medical system, through a very different lens than someone based in a country with a less developed healthcare infrastructure.

Your Global Lifestyle Under the Microscope

It is not just your professional life; your personal hobbies and travel patterns are also scrutinized. Insurers must understand any factor that might increase your probability of needing medical care. It is a fundamental part of what underwriting means today.

They will focus on factors such as:

- High-Risk Hobbies: Activities like flying private aircraft, motor racing, or even frequent scuba diving are noted. These activities carry an inherent risk of serious injury, and underwriters will price that risk accordingly.

- Frequent Travel to Medically Expensive Regions: If your travel frequently includes the United States, where medical costs are the highest in the world, expect your premium to reflect that reality.

- Declared Medical Conditions: Full disclosure of any pre-existing conditions is non-negotiable. What is most important is how well a condition is managed and its stability over time. For a deeper look, review our guide on how medical conditions can lead to policy exclusions.

The entire framework is built on a simple principle: risk and cost are two sides of the same coin. The underwriter’s job is to calculate that connection with precision, ensuring the policy is fair to you but also sustainable for them.

This concept is not unique to health insurance. Consider automobile insurance—certain behaviours and events directly impact your premiums. You can learn more about how risk factors influence insurance rates to see how this principle applies elsewhere.

Ultimately, every element—your profession, your home base, your travel habits, and your hobbies—is a piece of a larger puzzle. When the underwriter assembles them, they get the detailed profile needed to make a final, informed decision on your coverage and its price. It is this meticulous approach that ensures your policy truly matches the unique realities of your life as a global professional.

How Technology Is Refining Modern Underwriting

The era of insurance underwriting being confined to dusty actuarial tables and manual risk calculations is over. Technology, particularly artificial intelligence (AI) and predictive analytics, is completely transforming how insurers assess risk, especially for sophisticated IPMI policies. The entire industry is making a significant leap from a reactive, historical model to a proactive, data-driven one.

For global professionals, this shift is a game-changer. Machine learning algorithms can now process massive, complex datasets with incredible speed, leading to pricing that is far more personalised and accurate. A significant part of modern underwriting is simply processing this data efficiently. Knowing how to automate data entry with AI is now a key component of accelerating the entire process and reducing errors, which translates to a much smoother application experience for you.

The Role of Big Data and AI

The influence of AI and Big Data on risk assessment is immense. For example, some advanced machine learning models can now interpret unstructured notes from physicians and securely analyse Electronic Health Records (EHRs). These systems can automatically approve a large percentage of low-risk cases, reducing processing costs by an estimated 30-50% and enabling insurers to create hyper-personalised IPMI policies.

This data-first approach even extends to your lifestyle. With your consent, information from wearable technology can provide underwriters with a real-time picture of your health, potentially rewarding you with better terms for actively managing your well-being. This is what modern underwriting truly means: a dynamic, personalised evaluation of you as an individual.

It is crucial to understand that for complex, high-net-worth cases, technology is there to assist, not replace, human expertise. These powerful tools provide a senior underwriter with deeper insights, but the final, nuanced decision always rests on their seasoned judgment.

Ultimately, the integration of technology results in a more precise, efficient, and client-focused underwriting experience. It ensures the policies designed for global professionals are not just comprehensive, but are also priced with a level of accuracy that was impossible just a few years ago, reflecting a genuine understanding of individual risk.

How to Achieve the Best Possible Underwriting Outcome

Approach underwriting not as a transaction, but as a negotiation. Achieving the best possible result is not merely about completing forms—it requires a clear strategy. Success depends on proactive preparation, complete transparency with the insurer, and having an expert advocate on your side.

This is where a specialist advisor becomes your most valuable asset. Our role extends beyond submitting paperwork. We anticipate the questions underwriters will ask, assist you in compiling your complete health history, and frame your application to receive the most favourable review. This preparatory work is what ensures a smooth process.

Securing Your Best Terms

A seasoned expert ensures no detail is overlooked. We concentrate on three key areas to make your application as robust as possible:

- Anticipatory Guidance: Our experience allows us to foresee potential roadblocks or questions from the underwriting team long before they arise, addressing them preemptively.

- Meticulous Documentation: We will guide you through compiling a comprehensive and accurate health history. This presents a credible, clear-cut profile to the insurer, which builds trust and facilitates a faster decision.

- Strategic Positioning: We know how to present your case in the most professional and advantageous light, highlighting all the factors that point toward a positive outcome.

By aligning our expert guidance with your best interests, we ensure you secure a precisely tailored IPMI policy that delivers comprehensive protection and peace of mind, no matter where your ventures take you.

This structured approach gives you control over your underwriting journey. Part of this preparation also involves understanding the mechanics of how your policy will function day-to-day, such as how insurers handle payments for treatment. You can get ahead of the curve by reading our deep dive into pre-authorisation and direct settlement procedures. Taking these steps ensures you are fully prepared for every aspect of your global health coverage.

Common Questions About IPMI Underwriting

When considering International Private Medical Insurance (IPMI), a few key questions invariably arise, particularly concerning underwriting. For high-net-worth individuals, whose lives and careers are anything but standard, obtaining direct answers is the only way to make a confident decision about global health protection. Let’s address the most common inquiries.

How Long Does IPMI Underwriting Take?

For global professionals, the timeline for an underwriting decision depends on the complexity of the application. For a straightforward medical history, an insurer can often assess and approve an application within 5-7 business days.

However, if underwriters require additional information, the process can extend to 2-4 weeks. This typically occurs when they need to request specific medical records from your physicians or obtain more clarity on your lifestyle, profession, or travel habits. Our role is to prevent these delays by ensuring your application is complete and robust from the outset, which helps expedite the process with the insurer.

Will a Pre-Existing Condition Result in an Automatic Decline?

Absolutely not. In the realm of premium IPMI, a pre-existing condition is rarely a cause for automatic declinature. Instead, it initiates a detailed review of the condition itself—its stability, your treatment history, and how effectively it is managed. This is where a practical understanding of underwriting truly matters.

Following this review, the insurer will typically propose one of two outcomes:

- A premium loading: This is an increase in your premium to cover the additional risk associated with the condition.

- A specific exclusion: The policy will cover you for everything else, but treatment related to that one specific condition will not be included.

Our expertise lies in presenting your medical history to the right insurers—those comfortable with complex profiles—to find the best possible terms for your unique situation.

How Can I Secure the Best Underwriting Outcome?

Securing the best result from underwriting hinges on two elements. First, complete transparency. Being upfront and honest about your medical history is non-negotiable. It builds trust with the underwriter, and that credibility is invaluable.

Second, work with a specialist broker. We know how to frame your application professionally, anticipate an underwriter's questions before they are asked, and match you with the insurer whose risk appetite best fits your profile. It also helps immensely to demonstrate proactive health management—for example, by providing recent check-up records for any chronic conditions. Underwriters view such proactive management very favourably, and it can positively influence the final decision.

At Riviera Expat, we demystify IPMI underwriting and transform it into a clear, strategic process designed for you. Our expert guidance and proprietary comparison engine ensure you secure a policy that provides total confidence and control over your global healthcare. To start a confidential consultation, explore your IPMI options with Riviera Expat.