When procuring a new health insurance policy, it is crucial to understand that certain benefits are not immediately accessible. This deliberate delay is known as a waiting period, a standard and essential feature in sophisticated insurance contracts. It represents a specified duration you must be enrolled in the plan before particular types of coverage are activated.

This is not an arbitrary rule but a fundamental mechanism that protects the insurance provider—and by extension, all of its members—from financially unsustainable liabilities.

Decoding the Health Insurance Waiting Period

Consider a waiting period less as a delay and more as a sophisticated instrument for risk management. Its primary function is to mitigate adverse selection. This phenomenon occurs when an individual procures insurance with the foreknowledge of an immediate, high-cost medical need, such as a scheduled surgery.

Were this practice widespread, the insurance system would rapidly destabilize. The premium pool would be depleted by high-cost claims from new members, compelling insurers to implement dramatic premium increases for the entire portfolio.

By instituting a waiting period, insurers cultivate a more balanced and equitable system. The contributions from healthy members underwrite the costs of those requiring care, which is the foundational principle that ensures the long-term sustainability of any private health plan.

The Purpose Behind the Pause

The waiting period is not designed to deny care, but rather to manage it with fiduciary responsibility. For high-net-worth individuals and globally mobile professionals, a clear understanding of this concept is the first step toward architecting a resilient healthcare strategy. It enables you to plan for potential coverage gaps, ensuring you and your family are never exposed to unnecessary risk.

Distinct types of coverage typically have their own specific waiting periods. Insurers apply them to services that are predictable and can be scheduled in advance, such as:

- Maternity Care: This ensures the policy is active well before conception, not acquired solely to cover an existing pregnancy.

- Major Dental Procedures: Services like crowns, bridges, and orthodontics often have a waiting period.

- Specific Elective Surgeries: Non-urgent, planned medical treatments fall into this category.

A waiting period is the insurance equivalent of a vesting period for executive stock options. It is a standard contractual element that ensures commitment and manages long-term risk for all parties involved.

A meticulous review of policy details is paramount. For an in-depth analysis of specific plan clauses, especially waiting periods, an AI Healthcare Policy Analyzer can be a formidable tool. Similarly, as you assess your options, understanding how different plans are structured is key. Our guide on choosing the right expat medical insurance policy can provide essential clarity.

This foundational knowledge empowers you to look beyond headline benefits. It facilitates more intelligent decision-making, ensuring your global health coverage aligns perfectly with your life and financial objectives, without unforeseen interruptions.

Quick Guide to Common Waiting Periods

To provide a clear overview, we have compiled a summary of typical waiting periods. Remember, these durations can vary between insurers and policies, so it is imperative to consult the specific terms of your plan.

| Coverage Type | Typical Waiting Period Duration | Primary Rationale |

|---|---|---|

| Maternity Care | 10 to 24 months | To prevent individuals from procuring a policy only after becoming pregnant. |

| Major Dental Work | 6 to 12 months | To discourage enrollment solely to cover expensive, non-urgent dental procedures. |

| Elective Surgeries | 3 to 12 months | To ensure coverage is for future, unforeseen needs, not pre-planned surgeries. |

| Pre-existing Conditions | Varies (often 24 months) | To manage the financial risk associated with known health issues at the time of enrollment. |

This table offers a general framework, but the definitive terms are always located within your policy documentation. Investing the time to understand these waiting periods before care is needed is a prudent and strategic action.

Navigating Employer-Sponsored Plan Waiting Periods

For executives and other globally mobile professionals, transitioning to a new senior role often involves enrolling in a new employer-sponsored health plan. While these packages can be comprehensive, a critical detail often overlooked is the waiting period for health insurance.

This is a mandatory interval, frequently lasting 30 to 90 days, between your start date and the activation of your health benefits.

This delay is a matter of administrative efficiency and risk management for the employer. It streamlines the benefits enrollment process and often aligns with probationary periods, ensuring administrative resources are invested in long-term employees. This standard practice also helps manage the insurer's risk by preventing a concentration of high-cost claims from short-term staff, which contributes to premium stability for the entire group.

Understanding the Corporate Rationale

The waiting period is a standard feature in most corporate benefits packages. It allows HR and benefits teams to process new hires in predictable cohorts, which is more efficient and less error-prone than individual processing. For the company, it also functions as a financial safeguard.

This is a widespread industry practice. In the United States, a 2023 KFF survey revealed that 65% of covered workers are subject to a waiting period before their employer’s health insurance commences. Among those who wait, the average duration is approximately two months. While more prevalent in smaller firms, it is a common practice in large corporations as well. You can read the full KFF report on employer health benefits to review the data yourself.

For a senior executive or professional relocating internationally, this waiting period is more than an inconvenience—it represents a significant financial risk. During this gap, you and your family could be uninsured, creating exposure to substantial medical expenses should an unexpected health crisis occur.

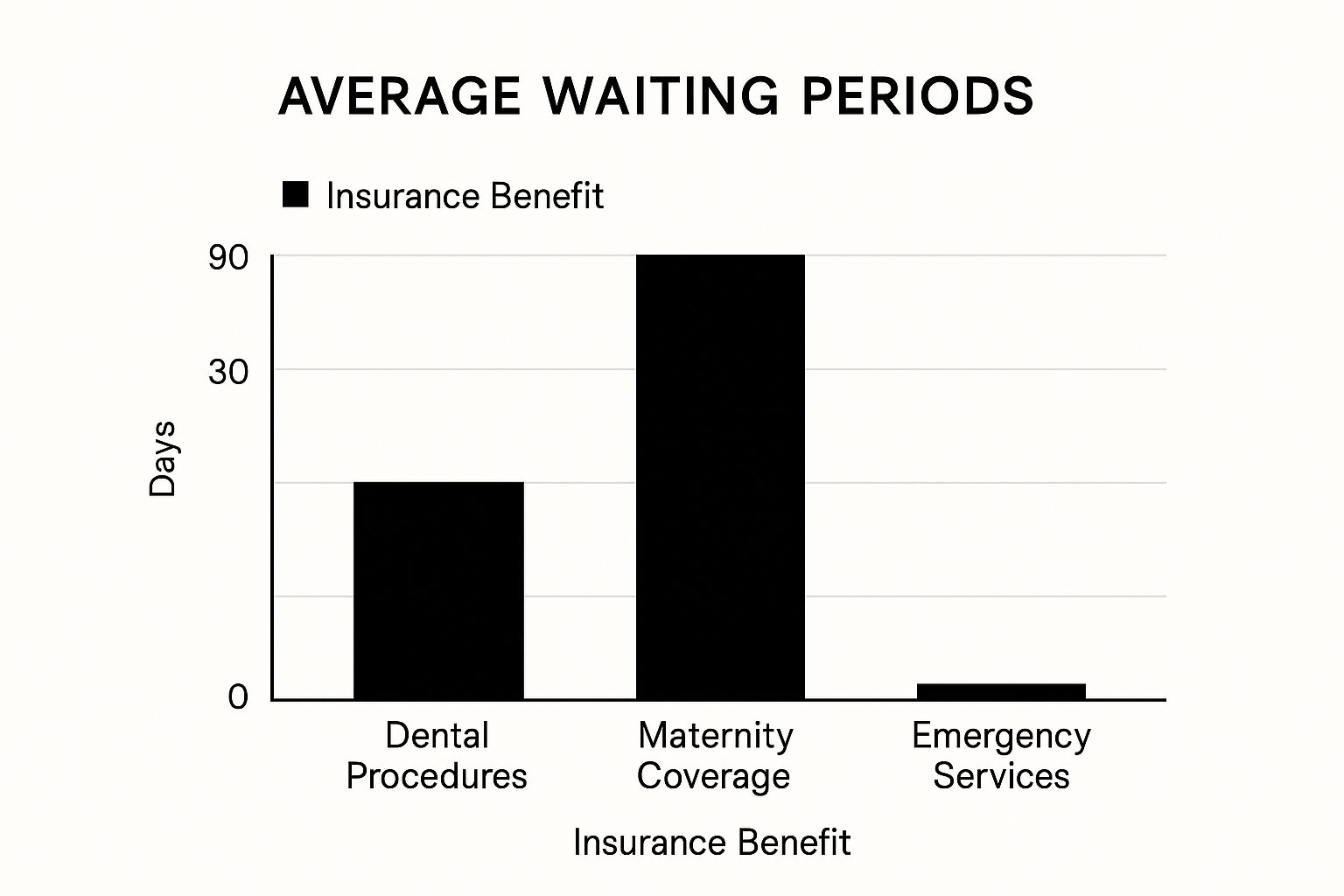

The chart below illustrates how these waiting periods often function, with emergency care typically covered immediately while other crucial services are delayed.

As illustrated, while a true medical emergency may be covered, planned but essential care, such as maternity services or major dental work, requires significant advance planning.

Strategic Solutions for Coverage Gaps

Proactively addressing this waiting period is a core component of professional career management. A temporary gap in health coverage is an unnecessary risk that, with the right strategy, is entirely avoidable. Fortunately, several intelligent options exist to ensure seamless protection for you and your family.

Consider these two primary strategies:

-

Negotiate Your Benefits Start Date: As a high-value executive, your negotiating power is considerable. During contract discussions, make a point to request a waiver of the health insurance waiting period. Insist on coverage commencing on your first day of employment and ensure this is explicitly stated in your signed agreement.

-

Secure a High-Quality Short-Term Plan: If negotiation is not feasible or successful, the most reliable course of action is to purchase a private, high-quality short-term medical plan. These policies are specifically designed to bridge coverage gaps, such as the one created by an employer's waiting period.

A temporary health insurance plan, often termed gap coverage, functions as a crucial safety net during these transitional periods. It guarantees access to medical care for emergencies and unexpected illnesses while you await the activation of your permanent, employer-sponsored benefits.

This approach is particularly vital for individuals relocating with family or moving to a new country. A robust short-term plan provides invaluable peace of mind, ensuring an unforeseen accident or illness does not escalate into a financial catastrophe during your initial months in a new role. By planning for the waiting period, you maintain complete control over your family’s health and financial security.

Condition-Specific Waiting Periods You Must Know

Beyond the initial delay after enrollment, many insurance policies contain a second layer of time-based restrictions known as condition-specific waiting periods.

This is not about when your plan becomes active in general, but when it begins to cover costs for specific categories of medical care. Consider it a set of distinct timelines for particular health needs.

Understanding these clauses is not merely advisable; it is a critical component of due diligence. They directly affect when you can access treatment for certain issues and are fundamental to how insurers manage financial risk, thereby maintaining the stability of the policy pool for all members.

Pre-Existing Conditions Waiting Periods

This is the most common and often most significant waiting period. A pre-existing condition is any health issue—illness, injury, or chronic problem—for which you exhibited symptoms, received treatment, or were diagnosed before your new policy's start date.

To manage the high costs associated with treating known health problems, insurers almost universally apply a waiting period, frequently 24 months, before they will cover services related to that condition. This prevents an individual from purchasing a policy today to cover an expensive surgery they already know is required tomorrow. Such immediate, high-cost claims would render insurance unaffordable for the collective.

For instance, if you have a history of chronic back pain, your new plan would likely not cover specialist consultations, physical therapy, or surgery for your back for the initial two years. It would, however, cover an entirely unrelated issue like a fractured arm or influenza (once your initial plan waiting period has passed).

The core principle is fairness to all policyholders. By delaying coverage for known conditions, insurers ensure that premiums are predicated on future, unforeseen risks rather than immediate, certain costs.

This is a crucial detail for anyone managing an ongoing health concern. It is also vital to know that some pre-existing conditions may not only be subject to a waiting period but could be permanently excluded from your policy. For a more detailed examination of this topic, our article on medical conditions and coverage exclusions is essential reading.

Maternity and Newborn Care Delays

If you are planning to expand your family, your insurance strategy must be planned well in advance. Nearly every individual and family international health insurance plan includes a maternity waiting period, typically ranging from 10 to 24 months.

The logic is straightforward. Insurers need to ensure that clients purchase policies with future family planning in mind, not simply because a pregnancy has already been confirmed.

This means you must have the policy active for the entire waiting period before any costs for prenatal care, delivery, and postnatal care become eligible for reimbursement. If conception occurs before that waiting period is fulfilled, all associated medical expenses will be your personal responsibility.

Waiting Periods for Major Dental and Vision Care

While your plan might cover routine dental cleanings and eye examinations relatively quickly, more significant procedures almost invariably come with a waiting period. This is especially true for treatments that are often schedulable and can be deferred.

- Major Dental Work: This includes root canals, crowns, bridges, and implants. These typically have a waiting period of 6 to 12 months.

- Orthodontics: Braces and other teeth-alignment treatments often have the longest dental waiting period, sometimes up to 24 months.

- Major Vision Procedures: While a standard eye test may be covered early, specific surgeries or more advanced treatments could also have an attached waiting period.

Consider a practical example. If you anticipate that your child will require orthodontic braces in the next few years, you must select and activate a policy with appropriate coverage well in advance. If you wait until the orthodontist recommends treatment, you will almost certainly be within the waiting period, leaving you to bear the full cost. This foresight transforms your insurance from a reactive safety net into a proactive financial planning instrument.

Waiting Periods in International Health Insurance

For globally mobile families, International Private Medical Insurance (IPMI) fundamentally alters the conversation around waiting periods. This is not the standard waiting game associated with a new employer's domestic plan. Premium IPMI policies are engineered for a world of continuous, borderless protection.

They are designed to be the seamless bridge when transitioning between national healthcare systems or corporate benefit packages, closing the dangerous coverage gaps that can otherwise emerge.

This is a critical distinction. With IPMI, the focus shifts from waiting for a plan to activate to understanding and navigating delays in accessing care once you are established in a new country. Even with a top-tier policy offering immediate financial coverage, the local healthcare system itself can present its own queues.

Policy Waits Versus System Waits

It is imperative to differentiate between a policy-based waiting period health insurance clause and a system-based delay. They are not synonymous. A policy wait is a contractual rule imposed by your insurer. A system wait is an external constraint, reflecting a country's healthcare capacity.

A superior IPMI plan can eliminate policy-based waiting periods. What it cannot do is alter the local healthcare reality. If a country has long queues for specialist appointments or non-urgent surgeries, your insurance can approve the cost in minutes, but you will still have to wait your turn. This is a crucial detail for architecting a truly resilient global health strategy.

An effective global health plan addresses both types of delays. It secures a policy that eliminates internal waiting periods while providing the flexibility to seek faster care in another country if local system-based waits are unacceptable.

Understanding this dynamic allows you to plan strategically, ensuring that neither policy fine print nor local queues impede your family's access to timely medical care.

The Global Reality of Waiting for Care

While employer-mandated waiting periods present a challenge in some countries, the more significant issue for insured expatriates is often the delay in actually seeing a specialist. This wait time varies dramatically between nations, underscoring the value of a flexible, geographically unrestricted insurance plan.

A recent global survey highlights this disparity. It found that Canada has one of the highest rates of patients waiting a month or more for a specialist appointment, at a notable 61%. Switzerland, in contrast, has the lowest rate at just 23%, with the United States at 27%.

Interestingly, while fewer U.S. adults report long waits for specialists, 28% state they rarely receive same-day answers from their primary care physician, compared to only 12% in Switzerland. "Waiting" can have different meanings—waiting for insurance to commence versus waiting for an appointment—and both are critical factors in your planning.

This is where the power of IPMI becomes self-evident. If you face a six-week wait for an MRI in one country, a robust international policy could enable you to fly to a neighboring country and have it completed in two days. The benefits of international private medical insurance frequently include this precise type of cross-border care.

This feature transforms your policy from a simple payment mechanism into a powerful logistical tool for managing your family's health. It is the hallmark of a truly international plan, providing control and confidence, no matter where you reside.

Actionable Strategies to Reduce Waiting Periods

While waiting periods are a standard component of health insurance, they are not always immutable.

With foresight and a strategic approach, you can often shorten or even eliminate them. This is not about exploiting loopholes, but about understanding the mechanics of the system and leveraging them to your advantage.

For discerning individuals and families, taking control is paramount. The objective is to demonstrate to an insurer that you are not a high-risk applicant seeking to cover an immediate need. This shifts the dynamic from passively accepting terms to actively negotiating from a position of strength, based on your history of responsible coverage.

The single most effective instrument at your disposal is proof of continuous, comparable health insurance.

Leverage Continuity of Coverage

The principle of continuity of coverage is your most potent strategy for having waiting periods waived, particularly for pre-existing conditions. Insurers implement these delays to protect against adverse selection. However, if you can provide official documentation of consistent, similar insurance coverage, you effectively nullify that risk from their perspective.

To execute this, you require specific, official proof from your previous insurer. This is non-negotiable; it is the evidence that substantiates your request.

Consider it analogous to a financial reference. A lender reviews your credit history before extending a loan. Similarly, a new insurer examines your coverage history before agreeing to waive a waiting period. A solid, uninterrupted record signals that you are a reliable client.

The critical document is a Certificate of Creditable Coverage. This is an official statement detailing the start and end dates of your prior policy and the benefits it included. It is your responsibility to request this from your previous insurer immediately upon the termination of your old policy.

Secure the Right Documentation

Do not delay until you are completing a new application. On the day your old plan terminates, initiate the request for this paperwork. Acquiring these documents can take time, so immediate action is crucial.

The essential documents you will typically need are:

- Certificate of Creditable Coverage: This is the gold standard, officially documenting your coverage history.

- Detailed Policy Benefits: A summary of your previous plan's benefits helps demonstrate that your new policy is a like-for-like transfer, not a sudden upgrade to cover an emergent health issue.

- Proof of Cancellation: A letter confirming the termination date of your last policy provides the new insurer with a clear timeline.

Having these documents prepared from the outset presents a powerful, comprehensive case for a waiver. This level of organization demonstrates professionalism and can significantly streamline the underwriting process.

Explore Zero Waiting Period Plans

For those who prioritize immediate certainty, a more direct option exists.

Many top-tier international health insurance providers offer plans specifically structured with zero waiting periods for most, if not all, benefits.

These premium plans carry a higher investment but deliver unparalleled peace of mind. They are designed for individuals who cannot afford any interruption in protection, such as executives relocating overseas or families with known health considerations.

Choosing a zero waiting period plan is a strategic investment in instant, comprehensive healthcare access, obviating the need for negotiation or documentation entirely. It is the most direct and effective method for eliminating concerns about waiting periods and ensuring your benefits are active from the moment your policy commences.

Frequently Asked Questions About Waiting Periods

In the realm of health insurance, nuanced details can create significant challenges. Waiting periods are one such detail. Let us clarify the most common questions to empower you to manage your policy with confidence.

How Can I Avoid a Waiting Period Entirely?

To be direct, completely circumventing a waiting period on a new policy is challenging, as it is a standard feature for most plans.

However, you can often have them waived for pre-existing conditions if you provide official proof of continuous coverage from a previous insurer.

For those requiring immediate certainty, some premium plans are offered as 'zero waiting period' policies. These command a higher premium but provide access to all benefits from day one. Your most effective strategy, however, remains meticulous advance planning before any change in employment or insurance provider.

What Is the Difference Between a Waiting Period and a Deductible?

These two terms are frequently confused, yet they serve entirely different functions within your policy.

Consider the distinction as follows:

A waiting period is a function of time. It is the specified duration you must be enrolled in the plan before certain benefits become active. You serve the time, then you access the coverage.

A deductible, conversely, is a function of money. It is the fixed amount you must pay out-of-pocket for medical care before your insurance company begins to contribute its share.

The key difference is simple. A waiting period is a function of time, while a deductible is a function of money. You must satisfy both according to your policy's terms.

Crucially, your deductible applies only to services received after any applicable waiting periods have been completed.

Does International Insurance Cover Me During a Waiting Period?

Yes, and this represents one of the most compelling reasons to maintain a high-quality International Private Medical Insurance (IPMI) plan.

A robust IPMI policy is designed to provide seamless protection during transitional phases. This includes covering you and your family while you are in a waiting period for a new employer's plan or a national health system. Its purpose is to fill these gaps.

However, due diligence is essential. You must confirm that the IPMI plan you select does not have its own waiting periods for the types of care you anticipate needing. Verifying these details is the only way to guarantee the gap-free coverage you are investing in.

At Riviera Expat, providing this level of strategic clarity is our core mission. We offer objective, expert advice to help you select a premium international health insurance plan that eliminates gaps and provides complete confidence. Explore your options with us today.