When you're travelling with a pre existing medical condition, selecting a standard travel insurance policy is an unacceptable risk. For discerning executives and high-net-worth individuals on global assignments, a generic plan is not merely a risk; it is a potential financial catastrophe. True peace of mind is not derived from a checkbox solution—it is achieved through a sophisticated insurance strategy, meticulously designed around your specific health profile and international lifestyle.

Protecting Global Assignments with Specialized Insurance

For professionals operating on the world stage, your health is your most critical asset. Yet, standard travel insurance policies are engineered for tourists on a two-week holiday, not for individuals whose global mobility is integral to their professional success.

These off-the-shelf products are designed for unexpected, acute emergencies. They invariably contain restrictive and ambiguous clauses concerning pre-existing conditions. This creates a significant vulnerability for any individual managing their health, whether it be controlled hypertension, diabetes, or a past cardiac event.

A minor health complication abroad can rapidly escalate into a major financial and logistical crisis if your coverage is inadequate. The financial risks are substantial. According to a 2024 analysis by Allied Market Research, medical expenses constitute the largest segment of travel insurance claims, accounting for over 41% of the market. This data underscores where the true financial exposure lies for international travellers in a market projected to reach $107.8 billion by 2032.

The Shortcomings of Standard Coverage

Standard travel policies are simply not constructed to manage the complexities of a sophisticated health profile. Their limitations become glaringly apparent at the precise moment you require their support.

These are the typical deficiencies I observe:

- Strict Exclusions: Most basic plans will categorically deny any claim even tangentially related to a known medical condition.

- Vague Definitions: Insurers often employ an exceptionally broad definition of "pre-existing," sometimes reviewing years of your medical history to identify a basis for claim denial.

- No Continuity of Care: These policies are intended for emergencies only. They will not cover routine consultations, prescription renewals, or the ongoing management vital for maintaining your condition's stability.

Relying on a standard travel policy is analogous to using a family saloon for commercial haulage—it is the incorrect instrument for the task and is certain to fail under duress.

Why Bespoke IPMI is the Superior Solution

For extended assignments or frequent international business travel, a far more robust solution is required. This is where International Private Medical Insurance (IPMI) becomes absolutely indispensable.

Unlike a temporary travel policy that terminates upon your return, IPMI provides comprehensive, continuous medical coverage that accompanies you across borders. It is specifically designed to accommodate and manage pre-existing conditions through rigorous, upfront underwriting.

This ensures you have reliable access to premier medical care without facing crippling out-of-pocket expenditures. Our complete guide on International Private Medical Insurance delineates these critical differences in granular detail.

This strategic approach not only safeguards your health; it protects your capacity to perform at an optimal level, irrespective of your global location.

Standard Travel Insurance vs Specialized IPMI at a Glance

To appreciate the distinction, a side-by-side comparison is illuminating. The table below illustrates the profound limitations of a standard travel policy when compared to the robust protection afforded by IPMI, particularly for an individual with a considered health history.

| Feature | Standard Travel Insurance | Specialized IPMI |

|---|---|---|

| Purpose | Short-term, emergency medical events for holiday travel. | Long-term, comprehensive health coverage for living and working abroad. |

| Pre-Existing Conditions | Almost universally excluded, or covered with severe restrictions. | Can be covered through medical underwriting, often with tailored terms or premium loading. |

| Coverage Scope | Emergency treatment, medical evacuation, trip cancellation. | In-patient, out-patient, wellness, dental, vision, and chronic condition management. |

| Continuity of Care | No coverage for routine check-ups or ongoing treatment. | Designed for continuity, covering regular consultations, prescriptions, and monitoring. |

| Geographic Area | Limited to the specific trip destination and duration. | Provides continuous coverage across multiple countries, often worldwide. |

| Renewability | Purchased on a per-trip basis. | Annually renewable, providing long-term security without recurring underwriting. |

As is evident, for any individual with a pre-existing condition who travels or resides abroad for professional reasons, reliance on standard travel insurance creates dangerous gaps in coverage. IPMI is engineered to fill those gaps, delivering the reliable, comprehensive protection that a global career demands.

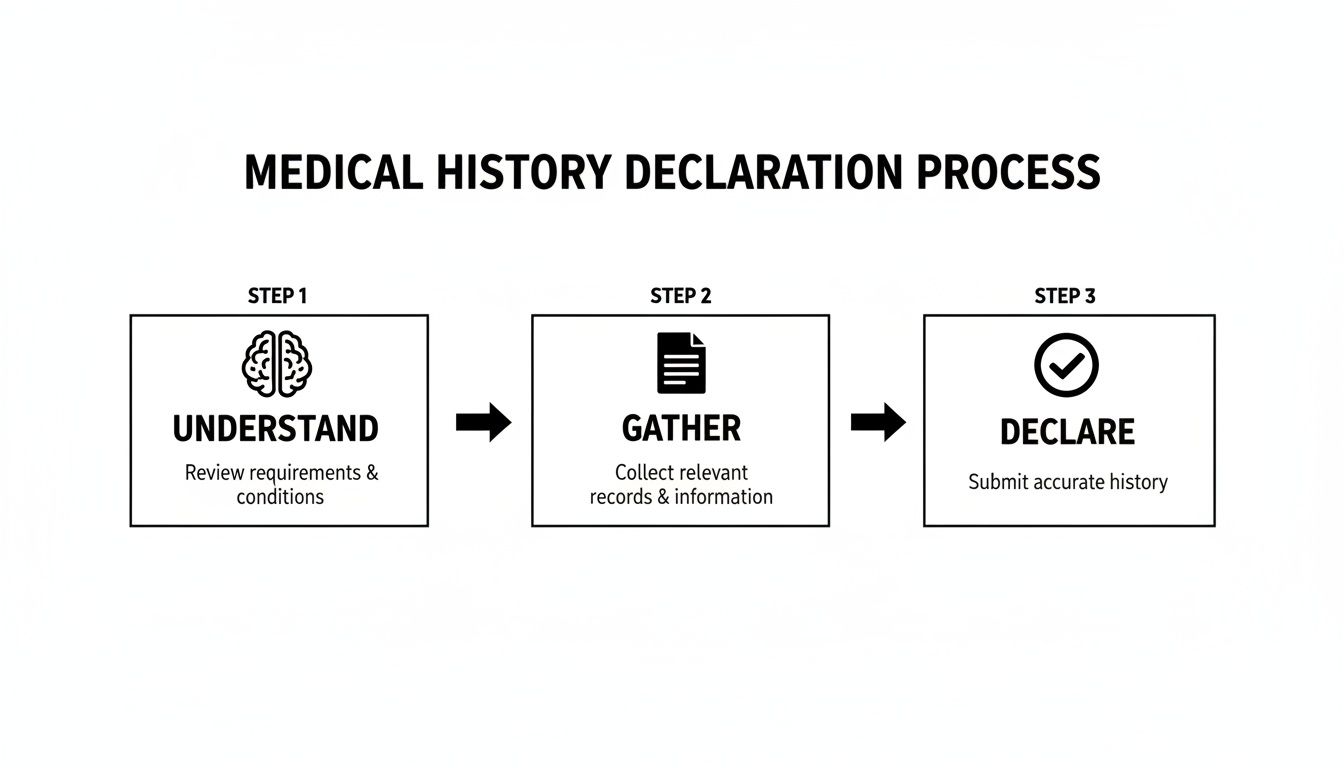

Defining and Declaring Your Medical History with Precision

Securing the right pre existing medical condition travel insurance does not begin with purchasing a policy. It commences with a forensic and objective analysis of your medical history from an underwriter's perspective. Vague notions about your health are insufficient. Precision is paramount.

What, precisely, is a pre-existing condition? In broad terms, it is any illness, injury, or disease for which you have received medical advice, diagnosis, care, or treatment. Insurers will examine a defined "look-back period"—ranging from 60 days to several years—to construct a comprehensive health profile. This includes conditions you might consider minor or fully controlled.

This is not a matter of semantics; it has profound financial consequences. An error or omission in disclosure is a leading cause of claim denial—a costly mistake that can jeopardise your health and financial standing when you are far from home.

What Conditions Actually Need to Be Declared

Let us be unequivocal. Insurers are not solely concerned with major surgeries or life-threatening illnesses. They are interested in any recent alteration in your health status. A condition is almost always deemed pre-existing if, within the insurer's "look-back" window, you have:

- Received a diagnosis for a new issue, regardless of its perceived severity.

- Experienced symptoms that would prompt a reasonable person to seek medical consultation.

- Been prescribed medication or had a modification to an existing prescription, such as a dosage change.

- Undergone a test, consultation, or treatment recommended or performed by a physician.

For instance, a recent adjustment to your blood pressure medication for well-managed hypertension is a declarable event. A consultation with your physician about persistent knee pain before a skiing trip also qualifies. You must adopt an underwriter's mindset: any deviation from your stable health baseline is material information. To understand the practical implications, it is valuable to explore common medical conditions and policy exclusions that frequently ensnare applicants.

Why Full Disclosure is Non-Negotiable

Attempting to conceal a health issue from an insurer is a strategy destined for failure. In the event of a claim, they possess the right to access your medical records. Any discrepancy between your declaration and your records will almost certainly result in a denied claim and a voided policy.

The consequences extend beyond the forfeiture of your premium. A denied claim can leave you stranded in a foreign country, liable for the full, often exorbitant, cost of medical care. This represents a massive, unnecessary assumption of risk.

The principle is simple: when in doubt, declare. Transparency is not a sign of weakness; it is the foundation of a robust insurance contract that will perform as intended when you need it most.

In fact, errors in disclosure are a primary reason for claim rejection. A 2023 survey by consumer group Which? revealed that issues related to pre-existing medical conditions were responsible for over a quarter of all rejected travel insurance claims. This positions non-disclosure as a significant financial landmine for travellers.

How to Prepare Your Medical Documentation

A strategic declaration is substantiated by clear, professional documentation. This step transforms what an underwriter might see as a red flag into a well-documented, manageable risk. When you present a complete portrait of a stable, well-managed condition, you provide the underwriter with the confidence required to offer favourable terms.

Your documentation dossier should include:

- A Physician's Letter: A concise summary from your doctor stating your diagnosis, confirming the condition's stability, outlining your current treatment protocol, and affirming your fitness to travel.

- Treatment History: A simple timeline demonstrating consistent management of the condition, including regular consultations and adherence to medication.

- Recent Test Results: Any relevant, recent laboratory results or diagnostics that validate the condition is stable and under control.

This package demonstrates proactive health stewardship. It shifts the narrative from a list of diagnoses to a testament of responsible health management—precisely what a sophisticated insurer seeks.

Navigating the Medical Underwriting Process

To be clear: medical underwriting is not an examination to be passed. It is the insurer's methodology for understanding your health profile. For them, it is a risk assessment. For you, it is the process that ensures your policy is priced accurately and will honour its obligations.

Following your declaration, the insurer will conduct a detailed review. This typically involves a comprehensive health questionnaire regarding your specific condition, treatment history, and stability. This is your opportunity to present a clear, concise narrative of a well-managed health condition.

Securing robust pre-existing medical condition travel insurance is contingent upon executing this stage correctly. The process is far more straightforward than it appears when deconstructed.

The key takeaway is simple: superior preparation yields a superior outcome. By understanding the insurer's criteria and having your documentation in order, you position yourself for success.

Understanding Underwriting Outcomes

Once the underwriter has reviewed your file, they will present a decision. Comprehending these outcomes is crucial for your coverage and your finances. Surprises are unwelcome, particularly concerning health cover.

Here are the most common results you can expect:

- Standard Terms: The optimal outcome. If your condition is minor and exceptionally well-managed (e.g., mild asthma rarely requiring an inhaler), the insurer may offer a standard policy at the standard premium.

- Medical Loading: A very common result for more significant but stable conditions. The insurer approves coverage but adds a percentage increase, known as medical loading, to your base premium. The cost is higher, but your condition receives full coverage.

- Exclusions: An insurer may offer a policy at the standard rate but specifically exclude your pre-existing condition and any related complications. This reduces the upfront premium, but you bear the full financial responsibility should that condition require treatment abroad.

- Decline: The most challenging outcome. If a condition is unstable, recently diagnosed, or carries a high risk of requiring expensive care overseas, the insurer may decline to offer coverage.

Influencing the Underwriting Decision

While you cannot alter your medical history, you can absolutely influence an underwriter's perception of it. A proactive, well-documented application can mean the difference between an exorbitant premium with exclusions and a fair price with comprehensive coverage.

An underwriter's greatest concern is unpredictability. A serious but stable, well-managed condition often presents a more acceptable risk than a minor, untreated problem with an uncertain trajectory.

Your objective is to provide incontrovertible proof of stability. Secure a letter from your specialist confirming your fitness to travel. Demonstrate a consistent history of prescription fulfilment. Provide recent test results proving your condition is controlled. This transforms your application from a list of diagnoses into a portrait of responsible health management, giving the underwriter the confidence required to offer favourable terms.

The Best-Kept Secret: Medical History Disregarded Policies

For executives and employees covered by a corporate group plan, a superior option often exists: Medical History Disregarded (MHD) underwriting. This feature is typically available exclusively on group International Private Medical Insurance (IPMI) schemes.

Under an MHD policy, the insurer agrees to cover all eligible medical conditions—including pre-existing ones—without individual health questionnaires. This completely bypasses the detailed declarations, potential for premium loadings, or exclusions that individual applicants face.

For a senior executive with a chronic health condition, securing a position with a company that offers a group MHD plan is a significant advantage. It ensures comprehensive, uninterrupted coverage from day one, with absolute certainty regarding the security of your health and finances during a global assignment. It is the gold standard of care and a non-negotiable for professionals who cannot permit health issues to impede their global mobility.

What to Look for in a Policy for True Global Protection

When you have a pre-existing condition, selecting medical travel insurance for pre-existing conditions is not a superficial exercise. It demands a forensic examination of policy details. Not all coverage is equivalent, and for a global professional, the fine print represents the difference between seamless care and a financial crisis.

You must look beyond marketing materials and scrutinise the structural components that deliver genuine protection. A generic, low-limit plan is wholly inadequate when confronting the potential costs of high-quality international medical care. You require a policy architected for the realities of global life—one that serves as a financial shield for your health and assets.

This is a growing necessity. The global travel insurance market, which includes medical coverage, was valued at over $21 billion in 2023 and is projected to grow significantly. This expansion is driven by global professionals who demand superior coverage.

Travel Insurance vs. IPMI: Knowing the Crucial Difference

One of the most common—and hazardous—errors is confusing short-term travel insurance with long-term International Private Medical Insurance (IPMI). They are designed for entirely different scenarios, and selecting the wrong product leaves you dangerously exposed.

Short-Term Travel Insurance is designed for precisely that: short trips, typically less than 90 days. Its function is to cover sudden, unforeseen emergencies like an accident or an acute illness. It is not structured to manage the ongoing care of a chronic condition and will almost invariably exclude it.

International Private Medical Insurance (IPMI) is the definitive solution for anyone living or working abroad for an extended period. It is comprehensive health insurance covering emergencies, specialist consultations, hospital stays, and—critically—the routine care required for pre-existing conditions.

Consider the analogy: travel insurance is the emergency response team at the scene of an accident. IPMI is the full-service, premier hospital, complete with preventative care, diagnostics, and long-term treatment plans. For any engagement longer than a few weeks, IPMI is the only prudent choice.

The Non-Negotiable Policy Inclusions

When comparing plans, certain features are not merely "nice to have"—they are absolutely essential. These core components ensure your policy will perform as expected when you need it most.

- High Medical Expense Limits: Medical costs, particularly in hubs like Singapore, Zurich, or New York, can be astronomical. A policy with a low coverage ceiling is a false economy. Insist on limits of at least $1 million; premier plans will offer $5 million or more.

- Comprehensive Medical Evacuation: If you require specialised care that is unavailable locally, medical evacuation is your lifeline. This benefit must cover transport to the nearest centre of medical excellence, not simply repatriation. A quality plan will cover costs that can easily exceed $100,000.

- Ongoing Maintenance and Prescriptions: A robust IPMI plan covers the routine consultations and prescription renewals required to manage your stable condition. This ensures continuity of care, which is vital for preventing a minor issue from escalating into a critical emergency.

That "Stable and Controlled" Clause Everyone Misses

This is one of the most critical—and frequently misinterpreted—clauses in any policy covering a pre-existing condition. The term "stable and controlled" has a very precise meaning to insurers, and it directly impacts whether your claim will be paid.

An insurer generally considers a condition "stable and controlled" if, within a defined period before your trip (often 60 to 180 days), you have not:

- Experienced any new or worsening symptoms.

- Required a change in your medication, including dosage.

- Been hospitalised or referred to a new specialist for the condition.

- Been awaiting any tests, investigations, or results.

Consider a real-world scenario. You have well-managed hypertension, and for years, your blood pressure has been optimal on a consistent medication dosage. This is a classic "stable and controlled" situation. However, if your physician adjusts your dosage two weeks before an international assignment, your condition is no longer considered stable. Any related claim could be justifiably denied.

This is why a final medical review well in advance of departure is so important. It ensures the health status declared on your application perfectly aligns with your medical situation at the time of travel, thereby cementing the validity of your insurance.

How to Manage Costs and Ensure a Smooth Claims Process

Acquiring a quality insurance plan for your pre-existing medical condition is a prudent decision for your financial and personal well-being. However, true peace of mind is derived from understanding how to manage that policy intelligently and knowing precisely what to do when you need to use it.

It is not merely about possessing the insurance card; it is about confidently navigating costs and mastering the claims process, especially during a stressful medical event.

Designing Your Policy for Cost-Effectiveness

While a comprehensive IPMI plan represents a greater investment than a standard travel policy, you have powerful levers at your disposal to manage the annual premium without compromising coverage quality. This is a matter of aligning the policy's financial structure with your own budget and risk tolerance.

One of the most direct methods is adjusting your deductible (also known as an excess). This is the amount you agree to pay out-of-pocket before the insurer begins to cover costs.

- Higher Deductible, Lower Premium: By selecting a higher deductible—for instance, $5,000 instead of $1,000—you agree to assume more of the initial financial risk. In return, your insurer will reduce your annual premium, often substantially. This is an effective strategy if you maintain sufficient liquidity to cover the deductible and prefer to minimise fixed annual costs.

Another instrument is a co-payment or co-insurance. This is an arrangement where you agree to pay a set percentage of every claim. A common structure is an 80/20 split, where the insurer pays 80% of the invoice and you cover the remaining 20%, up to your policy's annual limit. This risk-sharing model also lowers your premium.

For any professional on a multi-year assignment abroad, the calculus is clear. The long-term value of a single, well-architected IPMI plan far surpasses the cost and administrative burden of purchasing multiple single-trip policies. An annual plan provides seamless, continuous protection without the need to undergo medical underwriting for every journey.

Making Sure Your Claim Goes Smoothly

When a medical emergency occurs in a foreign country, clarity and a decisive action plan are paramount. Knowing whom to contact and the correct procedure can be the difference between a smooth, insurer-managed process and a chaotic scenario involving significant upfront payments.

Your immediate first step, invariably, is to contact the 24/7 emergency assistance number on your insurance card. This is your critical support line. The assistance team will direct you to an approved medical facility within their network, confirm your coverage, and—most importantly—arrange for direct billing wherever possible.

The Game-Changing Power of Direct Billing

Direct billing, also known as direct settlement, is a non-negotiable feature of any serious IPMI policy. It means the hospital invoices your insurer directly. You are not required to pay substantial sums out-of-pocket and subsequently seek reimbursement.

This is absolutely critical for in-patient hospital stays, where costs can escalate rapidly. Without direct billing, you could be required to provide a deposit of tens of thousands of dollars simply for admission.

For this system to function, you must adhere to the insurer's protocols. Many planned procedures and hospital admissions require pre-authorisation. If you neglect this step and fail to obtain prior approval, your insurer could deny the claim in its entirety. To understand its importance, you can learn more about the critical nature of pre-authorisation and direct settlement in our guide.

Finally, become a meticulous record-keeper. Even with direct billing, obtain copies of all documentation: medical reports, invoices, receipts. This paperwork is your substantiation and is essential for an undisputed claims process.

Got Questions? We’ve Got Answers.

Even with the most strategic planning, travelling with a pre-existing condition raises numerous specific questions. For the senior executives and global professionals we advise, the details are paramount. Here are some of the most frequent inquiries, with the direct, practical answers required.

Will My Routine Medication and Check-Ups Be Covered Abroad?

This question strikes at the core of a significant misunderstanding between basic travel insurance and a true International Private Medical Insurance (IPMI) plan.

Standard travel insurance is designed purely for unforeseen emergencies. It will almost certainly exclude any routine care for a pre-existing condition. A prescription renewal, a scheduled follow-up with a specialist, or a regular blood test to monitor your condition will not be covered.

For an executive on a six-month assignment, this is untenable. This is precisely where an IPMI plan differs. It is designed to function as your primary health insurance, but with a global remit. It covers both acute emergencies and the essential, ongoing maintenance care required to manage a chronic condition.

What if My Stable Condition Changes Before I Travel?

This is a critical point that many overlook. Assume you have declared your condition, secured your policy, and are prepared for departure. Then, one week before your flight, your health status changes. You have an obligation to inform your insurer immediately. In industry parlance, this is a 'material change in risk'.

What constitutes a material change?

- Your physician alters your medication or adjusts the dosage.

- You develop new symptoms, or existing ones worsen.

- You have an unexpected hospital visit or are referred to a new specialist.

- You receive a new diagnosis related to your existing condition.

Failure to report this could void your entire policy. The insurer must be given the opportunity to reassess your file, which could result in a revised premium or a new exclusion. While it may seem inconvenient, it is absolutely essential to ensure your policy remains valid and will perform if needed.

Should I Choose a Higher Premium or an Exclusion for My Condition?

This choice reduces to a fundamental question: who will bear the financial risk for your condition—you or the insurance company?

When an insurer offers a lower premium in exchange for excluding your condition, they are transferring that risk directly to you.

Accepting an exclusion on your policy is a direct transfer of financial risk from the insurer to you. For any condition with the potential for costly complications, this is a significant gamble.

Paying a higher premium (a 'medical loading') to secure full coverage provides financial certainty. For conditions like heart disease or diabetes, which can precipitate six-figure medical emergencies, this is almost always the prudent course of action. Accepting the exclusion might save a few thousand dollars on the premium, but it exposes your personal assets to a potentially catastrophic liability. Full coverage is the superior strategy for asset protection.

How Does a Specialist IPMI Broker Add Value?

Navigating this complex market independently is a formidable challenge. Engaging a specialist broker provides three advantages unattainable on your own: deep expertise, exclusive market access, and a powerful advocate.

Here is how we deliver value:

- Deep Market Knowledge: We are immersed in this sector. We know which insurers are receptive to specific health profiles and which are likely to decline. This prevents you from wasting weeks on applications destined for rejection.

- Exclusive Access: We maintain established relationships with senior underwriters, which provides access to policies and terms not available on the public market or through direct channels.

- Strategic Positioning and Advocacy: We understand how to present your medical history in the clearest, most favourable light, supported by the correct documentation. Should a claim become complex, we act as your advocate, interfacing with the insurer to ensure a fair and efficient resolution. It is about engaging a professional to manage your health and financial interests, allowing you to focus on your professional responsibilities.

At Riviera Expat, we specialize in securing world-class international health insurance for professionals with pre-existing conditions. Our expertise ensures you receive the precise coverage needed to protect your health and wealth, no matter where your work takes you. Contact us for a confidential consultation at https://riviera-expat.com.