For U.S. citizens operating in global financial markets, overseas health insurance is a non-negotiable component of a sound financial strategy. Let's be clear: standard domestic health plans, including Medicare, offer virtually no coverage once you step outside the United States. This leaves a significant, often underestimated, gap in your personal and financial protection when working in hubs like Singapore, London, or Hong Kong.

Why US Health Insurance Fails You Abroad

Here’s a prevalent and costly assumption: a premium domestic health policy provides a safety net anywhere in the world. It does not. In reality, your US-based insurance is geographically constrained, built for a healthcare system that operates entirely differently from those overseas. Relying on it is like bringing the wrong currency to a foreign country—it simply isn’t accepted.

This creates significant personal and financial exposure. Imagine needing medical attention for a sudden illness in Dubai or a minor injury in Zurich. Without the right coverage, you’re facing the full, immediate cost of treatment at top-tier private facilities. That could mean tens of thousands of dollars out-of-pocket for even routine procedures.

The Medicare Coverage Myth

For those approaching retirement or already retired abroad, the gap is even more pronounced. A common, dangerous misconception is that Medicare travels with you. It doesn't. Medicare provides zero coverage outside the United States, except for a few very specific, rare scenarios on a cruise ship or near the border. Retired Americans in markets like Hong Kong or Singapore are effectively uninsured. You can learn more about how the US healthcare system compares to other nations on pgpf.org.

This reality makes it crystal clear: you require a completely different approach for any substantial time spent outside the U.S.

The Definitive Solution: International Private Medical Insurance

The solution isn’t a basic travel insurance policy, which is only designed for short-term emergencies. The answer is a dedicated International Private Medical Insurance (IPMI) plan. An IPMI is specifically built for individuals residing abroad long-term.

Think of IPMI not as an expense, but as an essential asset. It functions as your global healthcare portfolio, ensuring seamless access to high-quality medical care without you having to liquidate assets or disrupt your financial strategy.

An IPMI policy is structured for the realities of an international lifestyle, offering benefits that domestic plans simply cannot provide:

- Global Network Access: Freedom to choose from top-tier hospitals and specialists in virtually any country.

- Comprehensive Care: Coverage that extends far beyond emergencies to include wellness checks, chronic condition management, and elective procedures.

- Direct Billing: The insurer settles costs directly with medical facilities, eliminating the need for you to make substantial out-of-pocket payments and wait for reimbursement.

Ultimately, securing proper overseas health insurance for US citizens is a fundamental act of wealth preservation. It ensures a medical event doesn’t become a financial crisis, allowing you to focus on your professional and personal ambitions with absolute peace of mind.

Understanding Your Global Coverage Options

When structuring health insurance for life abroad, it’s easy to get tangled in the options. Precision is critical. The choice you make isn't just about ticking a box; it directly impacts your access to quality healthcare and your financial stability far from home. You need to know the fundamental difference between a temporary patch and a real, long-term solution.

Let's use an analogy. Travel insurance is like a roadside assistance plan for your vehicle. It’s excellent for emergencies—a flat tire, a sudden breakdown—designed purely to get you patched up and back on your way. It is absolutely not a substitute for a comprehensive maintenance contract that covers everything from routine servicing to a full engine rebuild.

In the same way, travel insurance is built for short-term trips and acute medical emergencies. Its function is to get you stabilized in a crisis and, if necessary, transport you back to the United States for proper care. It’s a short-term product for a short-term problem.

The Superiority of IPMI for Long-Term Residency

Relying on travel insurance when you are living overseas is a significant, and potentially catastrophic, miscalculation. For that, you need the equivalent of the full maintenance contract: International Private Medical Insurance (IPMI). This isn’t a temporary bandage; it’s a robust, long-term health plan designed specifically for a global lifestyle.

An IPMI policy gives you the kind of comprehensive coverage you'd expect from a top-tier plan back home, but with a worldwide network. It’s designed to cover the full spectrum of your health needs—from annual check-ups and specialist visits to managing chronic conditions and even major elective surgeries at world-class international hospitals. You can dig deeper in our complete guide on international private medical insurance.

This distinction is everything. A high-net-worth professional living in Singapore or London isn’t looking for a quick fix for a sprained ankle; they require continuous, high-quality care for their family and themselves.

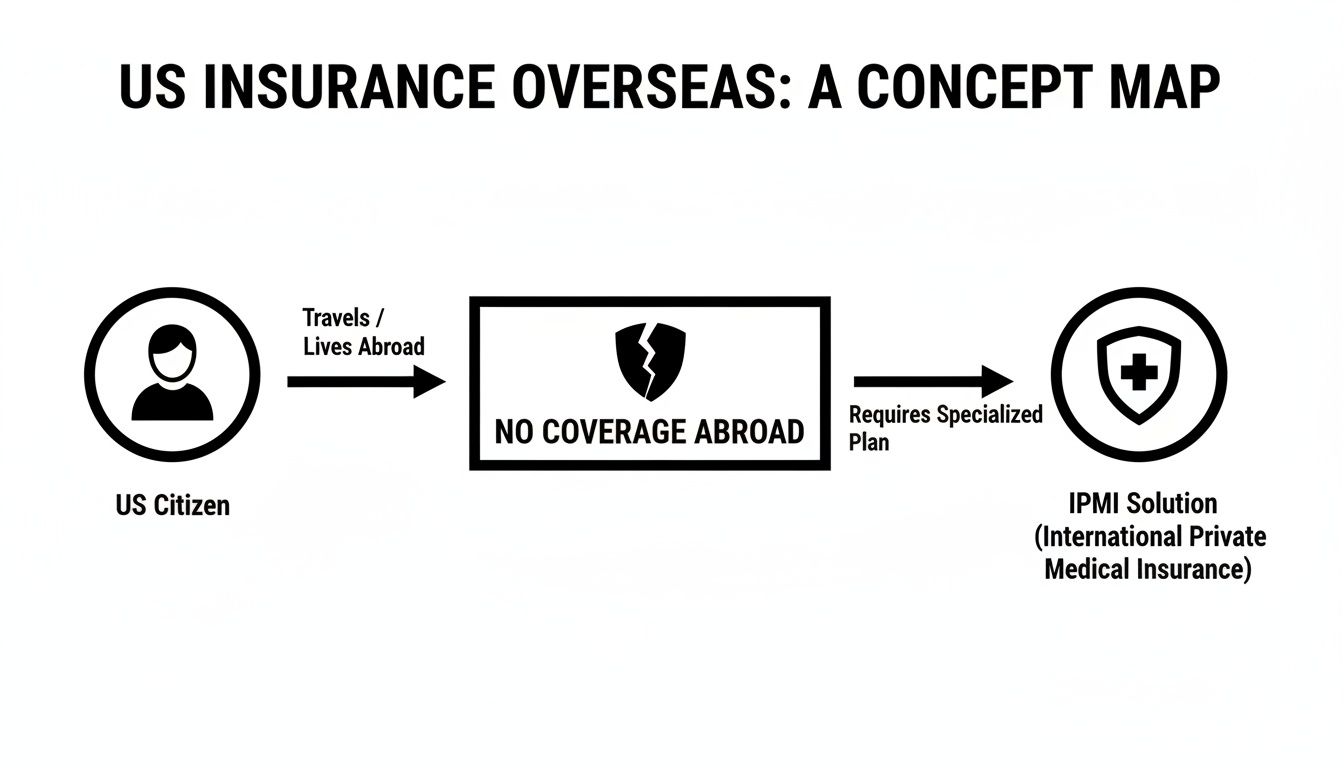

The graphic below perfectly illustrates the journey. A US citizen realizes their domestic plan is useless abroad, quickly seeing that IPMI is the only path to genuine security.

As you can see, the path from being a US citizen to being uninsured overseas leads directly to one logical conclusion: a dedicated IPMI plan is a necessity, not a luxury.

Travel Insurance vs International Private Medical Insurance (IPMI)

To make the distinction crystal clear, let's break down the core differences. A quick glance at this table reveals why these two products serve completely different—and non-interchangeable—purposes for Americans living abroad.

| Feature | Travel Insurance | International Private Medical Insurance (IPMI) |

|---|---|---|

| Primary Purpose | Short-term emergency medical cover for trips. Focuses on stabilization and repatriation. | Long-term, comprehensive healthcare for people living abroad. |

| Duration | Per-trip or annual multi-trip, typically for stays up to 90 days. | Annual, renewable contracts designed for long-term residency. |

| Coverage Scope | Emergency medical, trip cancellation, lost luggage, medical evacuation. | Inpatient, outpatient, wellness, dental, vision, chronic condition management. |

| Healthcare Access | Limited to stabilizing emergencies. You're often sent home for further treatment. | Access to a global network of hospitals and doctors for routine and major care. |

| Pre-existing Conditions | Almost never covered, or only for acute, unforeseen flare-ups. | Can be covered, often through medical underwriting and sometimes with a premium loading. |

| Ideal For | Tourists, vacationers, and short-term business travelers. | Expats, digital nomads, and anyone residing outside the US for 6+ months. |

The takeaway is simple. Travel insurance protects your trip. IPMI protects your life.

Market Trends Confirm the Shift

The data supports this conclusion. More and more Americans are recognizing the risks of being unprotected abroad, which is fueling the demand for proper global coverage.

According to the U.S. Travel Insurance Association (UStiA), Americans spent $4.9 billion on all types of travel protection in 2022. Of the plans that included travel medical and evacuation benefits, these were among the most frequently utilized features.

While these numbers are for travel insurance, they point to a much larger trend: a growing awareness of the dangers of having no medical safety net outside the US. This awareness is precisely what pushes sophisticated individuals toward permanent, robust solutions like IPMI for their long-term stays. This isn't just a niche concern anymore; securing proper overseas health insurance for US citizens has become a financial imperative.

Key Policy Features for US Citizens

To make an informed decision about your overseas health insurance, you must first understand the unique legal and regulatory landscape that shapes these policies for US citizens. A premium International Private Medical Insurance (IPMI) plan operates under a completely different set of rules than the domestic coverage you're used to. Understanding this distinction is the first step toward finding a plan that genuinely protects you abroad.

Here's the most critical point to grasp: the foundational US healthcare programs you know are geographically handcuffed. They simply were not built for a global lifestyle.

Why Medicare and the ACA Don’t Apply

For Americans living overseas, two pillars of the US healthcare system become almost entirely irrelevant. Medicare offers virtually no coverage outside of the United States, save for a few unusual and rare exceptions, like being on a cruise ship within six hours of a US port. This leaves retired citizens who have moved abroad dangerously exposed without a dedicated international plan.

Likewise, the Affordable Care Act (ACA) does not apply abroad. Its marketplace plans, subsidies, and consumer protections are for residents inside the US. An ACA-compliant plan will not cover you for treatment in global hubs like Singapore, Hong Kong, or London. The good news? You will not be penalized for not having one while living as a bona fide resident of another country.

Demystifying Medical Underwriting

With domestic plans off the table, the conversation shifts to how international insurers evaluate you. This process is called medical underwriting, and it is the insurer's version of the due diligence performed in a high-stakes financial deal. It’s how they assess their risk before agreeing to cover you.

Unlike some ACA plans that are legally required to cover pre-existing conditions, IPMI providers have more freedom. They will review your medical history to decide the terms of your policy. If you want to get a better handle on the jargon, you can learn more about how to interpret expat medical insurance policy terms in our detailed guide. This underwriting process is a standard—and vital—part of securing robust international coverage.

Managing Pre-existing Conditions

A primary concern for any discerning professional is how an insurer will treat their pre-existing conditions. Top-tier IPMI providers typically offer a few possible outcomes, each with different consequences for your coverage and your premium.

- Full Coverage with Premium Loading: This is the best-case scenario. The insurer agrees to cover your condition in full but adds a surcharge, or "loading," to your annual premium to offset the higher risk.

- Moratorium Underwriting: Here, the insurer excludes your pre-existing condition for a set time, usually 24 months. If you do not have symptoms or require treatment for that condition during the moratorium, they may agree to lift the exclusion after a review.

- Full Exclusion: In some situations, the insurer will offer you a policy but permanently exclude a specific pre-existing condition and any related treatments.

Understanding these underwriting outcomes is crucial. It lets you anticipate how your health history will shape your options and allows you to negotiate from a position of strength.

The Critical Importance of Policy Portability

For globally mobile executives and their families, perhaps no single feature is more valuable than portability. This means your IPMI plan moves with you as you relocate from one international post to another—from Hong Kong to London, then to Dubai—without forcing you to reapply or go through medical underwriting all over again.

This continuity is an incredibly powerful asset. It ensures that any medical issues that arise while you are covered stay covered, no matter where your career takes you next. A truly portable policy is a seamless, unbroken shield of protection, giving you the stability and peace of mind you need to thrive in a demanding global career.

How to Structure a Cost-Effective IPMI Policy

Building the right International Private Medical Insurance (IPMI) policy is analogous to calibrating a complex investment portfolio. The goal is simple: maximize your protection where it matters most, while strategically reducing costs on coverage you do not need. It’s all about striking that perfect balance—securing elite-level care without overpaying for features that will not serve you.

The single biggest lever you can pull to control your premium is how your policy treats healthcare inside the United States. That one decision changes everything.

This choice is critical because of a stark reality in global healthcare. Macro-level pressures within the U.S. system are, ironically, driving up demand for high-quality overseas health insurance among us citizens. For a hedge fund partner in Hong Kong or a family office principal splitting time between Singapore and London, it often makes more sense to build their health strategy around a global IPMI plan instead of a prohibitively expensive domestic one. You can get a sense of these global dynamics in a detailed policy brief from KFF.

Tailoring Your Geographical Coverage

The first layer of customization is defining your "area of coverage." Insurers generally give you two main options, and the price difference between them is substantial.

- Worldwide Coverage: This is the all-access pass. It provides healthcare anywhere on the planet, including the United States. This is the correct move if you know you will be spending significant time back in the U.S. and want seamless access to your American medical network.

- Worldwide Excluding the USA: Choosing this option can slash your annual premium, often by a staggering 30-50%. This structure is ideal for professionals who are truly living abroad full-time and only return to the U.S. for brief visits. For those short trips, a simple travel policy can cover any emergencies.

This decision lets you align your policy directly with your real-world footprint, avoiding the sky-high costs of U.S. healthcare if you do not actually need ongoing access to it.

Balancing Deductibles and Cost-Sharing

Once your geography is locked in, the next step is to fine-tune your out-of-pocket costs. Think of this as managing your personal cash flow against potential medical bills. The higher your deductible—the amount you pay yourself before insurance kicks in—the lower your annual premium will be.

A well-structured deductible is not about avoiding costs; it is about controlling them. It is a strategic decision to self-insure for small, manageable expenses while retaining full-force protection against a major medical event that could threaten your financial standing.

For instance, opting for a $5,000 annual deductible can make your premium far more reasonable. You would cover routine doctor visits and minor treatments out of pocket, but you are completely shielded from the crippling costs of a major surgery or hospitalization. Many high-net-worth individuals prefer this approach, choosing to handle minor expenses directly rather than paying a higher premium for first-dollar coverage.

Selecting Your Benefit Levels

Finally, premium IPMI plans offer different tiers of benefits, usually labeled something like Silver, Gold, or Platinum. These tiers dictate your annual coverage limits and the scope of what’s included, such as outpatient care, wellness check-ups, and dental.

Choosing the right tier comes down to your personal health profile and risk tolerance. A younger, healthy individual might find a mid-tier plan is more than sufficient. But someone managing a chronic condition or planning to start a family will likely require a top-tier plan with higher limits and comprehensive maternity benefits.

By thoughtfully combining these three elements—geographical area, deductible, and benefit tier—you can construct an IPMI policy that is a perfect match for your life. You get powerful protection exactly where you need it, without wasting capital on coverage that does not fit your international lifestyle. This is the heart of building truly cost-effective overseas health insurance for us citizens.

A Due Diligence Checklist for Selecting Your Plan

Selecting the right IPMI policy is an executive decision. It demands the same sharp-eyed rigor you would apply to a major financial investment. Forget the glossy marketing brochures; you need a methodical process to get under the hood and scrutinize the core operational strengths of each potential insurer.

This is not just about buying insurance. It is about stress-testing a provider's global infrastructure to ensure it perfectly aligns with your international footprint.

Assess the Global Provider Network

The strength of an insurer's network is everything. It is what determines whether you get frictionless access to top-tier medical care or find yourself tangled in bureaucracy during an emergency. Before you even consider signing, demand absolute clarity on these points:

- Primary Country Network: How deep and high-quality is the network in your main country of residence? Are the leading private hospitals and most respected specialists on their list?

- Secondary and Tertiary Locations: If you split your time between hubs like London and Singapore, you need to verify robust network coverage in all your key locations. Do not take their word for it.

- Direct Billing Arrangements: Scrutinize the list of facilities offering direct billing. For high-net-worth individuals, this is a non-negotiable feature. It is the mechanism that prevents you from having to front substantial out-of-pocket payments for hospital stays. You can learn more about the critical importance of established medical networks for expats.

A truly premium IPMI provider doesn’t just offer a list of hospitals; they offer seamless, cashless access to the right hospitals—the ones you would choose for yourself and your family.

Scrutinize Critical Policy Limits and Terms

Beyond the network, the fine print in the policy document dictates its real-world value in a crisis. This is where you must pay razor-sharp attention to the financial limits on high-stakes benefits, as these can vary dramatically between insurers.

The entire point is to find the best coverage for your unique situation. Many of the same risk-assessment principles apply when figuring out how to choose the right travel insurance, so that is a good place to start thinking.

For an IPMI plan, your due diligence absolutely must include these three things:

- Medical Evacuation Limits: Confirm the policy provides at least $1 million in coverage for medical evacuation. This is the amount that ensures you can be transported to the nearest center of medical excellence, no matter the cost.

- Repatriation Coverage: Check the terms for the repatriation of mortal remains. It is an uncomfortable detail to consider, but ensuring this is adequately covered prevents your family from facing immense logistical and financial burdens during an already difficult time.

- Renewal Terms and Guarantees: Dig into the insurer's policy on premium increases and renewal guarantees. You need solid assurance that your premium will not skyrocket after a high-cost claim and that the insurer guarantees your renewal regardless of your future health status.

Following this methodical checklist transforms the selection process from a guess into a calculated, strategic decision. By focusing on network quality, direct billing, critical coverage limits, and long-term stability, you can confidently choose an overseas health insurance for us citizens that truly meets your exacting standards.

A Word for Global Professionals

If you are managing a demanding career in a global financial hub like Singapore, Hong Kong, or London, navigating overseas health insurance is a high-stakes decision. The off-the-shelf plans that work for a typical expat will not suffice. They are simply not built for the unique pressures and expectations faced by traders, wealth managers, and their families.

For you, this is not about buying a product; it is about establishing a specialized advisory relationship. You require more than just a policy. You need clarity, control, and absolute confidence that a medical issue will not derail your career or your finances. It’s the difference between being a consumer and being a client.

Why an Objective Advisor Matters

A truly client-first advisory model must be built on one thing: objectivity. Unlike an insurance company that’s focused on selling its own products, a specialized brokerage works for you. Our job is to put your interests first, always.

We do this by digging deep into the market, using our own comparison tools to dissect what every top-tier global insurer is offering. The goal is not to find a "good" plan; it is to find the precise policy structure that maps perfectly to your professional footprint and your family's health needs.

This advisory process is specifically designed to solve the real-world problems you face:

- Complex Moves: We manage your coverage so it moves with you seamlessly between international assignments, eliminating gaps and the difficulty of having to re-qualify for insurance.

- Family First: We ensure your spouse and children have comprehensive protection, including access to the best pediatric specialists or educational support if needed.

- Absolute Privacy: Your sensitive medical and financial details are handled with the discretion and security you'd expect in your own industry.

A Partnership Built on Understanding

Ultimately, choosing the right overseas health insurance for us citizens in senior finance roles is a strategic decision. It is about protecting both your health and your wealth. This requires a partner who genuinely understands your world—the need for frictionless access to elite medical care, the critical importance of robust evacuation coverage, and the non-negotiable expectation of impeccable service.

An expert partner is more than a broker. They are a dedicated advisor, a manager for the well-being of globally mobile individuals and families who expect—and deserve—the very best. This partnership ensures that a medical problem never becomes a financial crisis, freeing you to focus on what you do best.

If you’re ready to move past generic solutions and build a healthcare strategy that’s as sophisticated as your career, I invite you to schedule a complimentary consultation. Let’s review your unique situation and provide the expert, objective guidance required to protect your most valuable asset—your health.

Your Top Questions Answered

When you are sorting out the details of international health insurance, many practical questions arise. Let's tackle some of the most common ones I hear from high-net-worth professionals and their families as they plan a life across borders.

As a US Citizen, Am I Legally Required to Have Health Insurance While Living Abroad?

Here is a detail that trips up many people. While the U.S. government will not penalize you for not having health insurance overseas, that is not the real question you should be asking. The only thing that matters is the law in your host country.

Many of the world's financial hubs, like Singapore, are incredibly strict about this. They often demand proof of valid private health insurance as a non-negotiable condition for obtaining or renewing your residency visa. If you do not have it, you could put your legal status—and your family's ability to stay in the country—at serious risk. It's a completely avoidable problem.

How Do These Plans Handle Maternity Coverage and Newborns?

Top-tier International Private Medical Insurance (IPMI) is built for growing families and almost always includes excellent maternity benefits. This includes prenatal check-ups, delivery at the best private hospitals, and crucial postnatal care for both mother and baby.

But there is one critical detail: the waiting period. Most quality insurers require you to have the policy for 10 to 12 months before maternity benefits kick in. This means you must plan ahead. Once your baby arrives, they can typically be added to your policy from day one, often without new medical underwriting, ensuring they are protected immediately.

Can I Keep My Plan If I Eventually Move Back to the US?

Yes, and this is one of the most powerful reasons to choose a premium IPMI policy. The best plans offering worldwide coverage are fully portable. This means you can keep the exact same coverage when you return to the United States, giving you a seamless health safety net without any gaps.

This portability is an absolute game-changer, especially for anyone who develops a health condition while living abroad. It completely removes the stress and uncertainty of trying to find a new domestic plan that will accept a pre-existing condition.

This feature offers incredible long-term security and should be a major factor in your decision if you ever plan to move back.

What’s the Process for Making a Claim for Treatment Overseas?

The claims process with a top-tier IPMI provider is designed to be painless and keep your cash flow intact. The best insurers run on a direct billing model and have massive global networks of high-end hospitals and clinics.

For any major inpatient treatment within their network, the hospital bills the insurance company directly. You simply show your insurance card and focus on getting better—no need to pay a substantial bill out of pocket and wait for reimbursement.

What about smaller, out-of-network costs, such as a visit to a local GP? That is simple, too. You will pay the doctor yourself, then just snap a photo of the invoice and upload it with a quick claim form through their online portal or app. Reimbursement is usually fast.

At Riviera Expat, our job is to provide this kind of clarity and expert guidance. Schedule a complimentary consultation to build a healthcare strategy that meets your exacting standards.