Medical evacuation insurance is not a standard health plan. It is a sophisticated logistical and financial instrument. This specialized policy is engineered for a singular, critical purpose: to underwrite the considerable cost of extracting you from a precarious medical situation and transporting you to a superior medical facility.

When local medical services are insufficient, this is the coverage that orchestrates and finances your emergency transport. For discerning professionals whose commitments span the globe, it is an indispensable component of a comprehensive risk management strategy.

Protecting Your Health and Assets Across Borders

For a high-net-worth professional operating on the global stage, a sudden medical emergency in a foreign country represents more than a health concern—it is a dual threat. It compromises your physical well-being while directly endangering your financial stability and professional momentum.

The quality of medical care can vary dramatically between a financial hub like London or Singapore and a more remote or developing region. This guide treats medical evacuation travel insurance not as a travel add-on, but as a core component of a sound personal risk management strategy. It ensures a controlled, seamless resolution during a crisis, allowing you to circumvent a logistical catastrophe and focus entirely on recovery.

The Financial Stakes of a Medical Crisis Abroad

The financial repercussions of an overseas medical event can be profound. Without the appropriate coverage, you are personally liable for arranging and funding an exceedingly complex logistical operation, all while under immense personal duress.

Emergency medical evacuations represent a significant financial liability for the unprepared. Costs for an international airlift can readily exceed $250,000. For high-net-worth individuals requiring repatriation to highly specialized facilities, these costs can escalate into the millions. You may review recent market analyses covering global travel risks for further data.

A medical crisis is a suboptimal time to be negotiating with air ambulance charters or arranging urgent wire transfers to foreign hospitals. Premier medical evacuation coverage assumes this responsibility, acting as your dedicated crisis management team.

At its core, this type of insurance is about maintaining control. It ensures that in your most vulnerable moment, decisions regarding your health are guided by world-class medical expertise, not by the proximity of the nearest, potentially substandard, clinic.

Why Standard Insurance Falls Short

A common and critical error is relying on a domestic health plan or a basic travel insurance policy for this level of protection. Many of these policies offer severely limited, if any, coverage for international emergencies. They almost invariably do not cover the substantial costs of a medical airlift.

Medical evacuation coverage is specifically designed to address this dangerous gap. Here is what it provides:

- Access to a Global Network: Providers operate 24/7 assistance centers staffed by medical professionals. They coordinate with local physicians and manage every detail of your transport.

- Financial Security: It removes the burden of astronomical out-of-pocket costs for air ambulances, medical escorts, and associated logistical fees.

- Assured Quality of Care: The primary mission is to transport you from a location of inadequate care to a center of medical excellence—whether that is the best hospital in the region or one in your home country.

Ultimately, this coverage affords you the confidence to pursue global opportunities, secure in the knowledge that a robust safety net is firmly in place.

Deconstructing Medical Evacuation Coverage

Consider your medical evacuation policy less an insurance document and more an operational manual for your personal emergency response team. A thorough review of its contents is not merely an academic exercise—it determines the difference between a controlled, successful extraction and a logistical ordeal thousands of miles from home.

Every clause, limit, and exclusion is a critical component. Understanding their interplay is the only way to ascertain what your plan is truly capable of when a situation deteriorates. The global medical evacuation insurance market, valued at approximately $5.2 billion in 2022, is projected to expand significantly. This is unsurprising when a single air ambulance flight can easily cost upwards of $100,000. You can see a deeper analysis of this expanding market and its drivers on marketintelo.com.

This growth signifies that in an increasingly interconnected world, the risks—and the costs of mitigating them—are escalating.

Core Components of Elite Coverage

A high-caliber policy is not just a document; it is a suite of integrated services ready for immediate deployment. These are the non-negotiable elements that form the bedrock of genuine protection.

- Air Ambulance Services: This is the core of the operation. It involves a private, medically configured aircraft—effectively a mobile ICU—staffed by a specialized clinical team. It is utilized when ground transport is unfeasible or when critical care is required en route.

- Medical Escort Services: For serious but less critical situations, the policy will arrange for a physician, nurse, or paramedic to accompany you on a commercial flight. They serve as your dedicated medical professional, monitoring your condition and providing care throughout the journey.

- Repatriation of Remains: While a sensitive subject, this is a crucial benefit. In the event of a death abroad, this provision manages the complex and delicate process of returning the deceased home, handling all logistical and legal formalities.

The true measure of a medical evacuation policy lies not in what it covers, but in the level of control it affords you during a crisis. It shifts the burden of life-or-death logistics from your shoulders to a team of dedicated global experts.

The Decisive Clause: Hospital of Choice

Here, the distinction between a good policy and an exceptional one becomes clear. It hinges on the destination clause. Most standard policies will only transport you to the "nearest adequate facility."

While preferable to no transport, "adequate" is a dangerously subjective term. An adequate facility in a developing nation may not align with your standard of care.

For discerning professionals and high-net-worth individuals, a "hospital of choice" clause is paramount. This single provision grants you the authority to dictate your destination. Whether you wish to be flown to your trusted specialist in your home country or to a world-renowned center of excellence in London or Singapore, this clause facilitates it, ensuring you receive care within a familiar system from physicians you trust.

The difference in coverage limits is directly correlated to this level of service. As illustrated in the following table, what may appear as a minor difference between policy tiers can translate to a world of difference in your actual care options.

Comparing Medical Evacuation Policy Tiers

The table below illustrates how these crucial features evolve as you move from a standard plan to one designed for high-net-worth individuals. Note how coverage limits directly impact the destination and quality of transport you can expect.

| Feature | Standard Plan | Premium Plan | Elite (HNWI-Focused) Plan |

|---|---|---|---|

| Coverage Limit | $100,000 – $250,000 | $500,000 – $1,000,000 | $2,000,000 to Unlimited |

| Destination | Nearest Adequate Facility | Nearest Facility or Home Country | Hospital of Choice (Worldwide) |

| Medical Team | Paramedic or Nurse Escort | Critical Care Nurse or Doctor | Specialized Medical Team (e.g., Cardiac, Neurological) |

| Transport | Commercial w/ Escort, Shared Air Ambulance | Private Air Ambulance | Dedicated, State-of-the-Art Private Air Ambulance |

As you can see, an elite plan is not merely about a higher monetary value; it is about securing ultimate control and access to the best possible resources when it matters most.

Navigating Common Policy Exclusions

Even the most comprehensive medevac policies have limitations. Understanding what is not covered is as important as knowing what is. Consider it part of your due diligence to ensure there are no vulnerabilities in your safety net.

Common exclusions often involve incidents arising from:

- Pre-Existing Conditions: Most policies have stipulations regarding conditions present before coverage began. You must scrutinize the "look-back" period and any requirements for how long a condition must be stable.

- High-Risk Activities: Activities such as scuba diving, mountaineering, or motorsports are typically excluded by default. If your travels involve such pursuits, a specific rider or a specialized policy is essential.

- Traveling Against Medical Advice: This is straightforward. If your physician advises against travel and you proceed, any resulting medical event will almost certainly be denied coverage.

Understanding these details from the outset allows you to align a plan precisely with your lifestyle and risk profile, leaving no dangerous gaps in your global protection.

Medevac Insurance vs. International Health Insurance

A costly miscalculation often made by global professionals is assuming that medical evacuation travel insurance is synonymous with a comprehensive health plan. It is not.

These two policies serve distinct but complementary functions. Misunderstanding this distinction can leave you dangerously exposed to massive financial and medical risks at your most vulnerable moment.

By way of analogy, consider medevac as the specialized air ambulance that extracts you from a crisis zone. International Private Medical Insurance (IPMI) represents the world-class hospital care you receive upon arrival. One manages the emergency transport; the other finances the treatment.

Medevac: The Emergency Transport

A standalone medical evacuation policy has a single, critical mission: transportation.

Its sole purpose is to move you from a location with substandard medical facilities to a center of excellence equipped to treat your condition. It functions less like traditional insurance and more like a crisis management and logistics service.

It is structured to cover the significant costs associated with:

- Deploying an air ambulance or a medical escort team.

- Coordinating with physicians on the ground and at your destination.

- Navigating the complexities of aviation and customs for a medical flight.

However, once you are admitted to the hospital, the medevac policy's function is largely complete. It is not designed to pay for surgery, hospitalization, medications, or subsequent care. Relying solely on medevac is akin to chartering a helicopter but having no means to pay the hospital that provides life-saving treatment.

IPMI: The Hospital Care

This is where International Private Medical Insurance (IPMI) becomes essential. IPMI is your long-term, comprehensive health plan designed for individuals living and working abroad. It operates like a high-end domestic health insurance plan, but on a global scale, covering everything from routine physician visits to major surgeries and ongoing treatment.

A word of caution: Many IPMI plans include a medical evacuation benefit, but it is often a less robust version of a dedicated plan. These integrated benefits are frequently capped at a low amount or restrict you to the "nearest adequate facility," which may not be the world-class hospital you would select for yourself.

A solid IPMI policy provides access to the best medical care globally without incurring financial ruin. However, without a separate, high-limit medevac plan, you may have no way to physically reach the elite hospitals to which your IPMI plan grants access. To explore this further, you can learn more about how international private medical insurance is structured for the unique needs of expatriates.

The only sound strategy for complete protection is to pair a dedicated, high-limit medical evacuation policy with a top-tier IPMI plan. This combination ensures there are no weak links in your safety net, covering you from the moment a crisis occurs until you are fully recovered.

Simply put: Medevac gets you there. IPMI pays for your care.

The Anatomy of a Medical Evacuation Mission

To truly appreciate the value of a top-tier medical evacuation travel insurance plan, one must look beyond the policy language to its real-world application. It is a complex orchestration of logistics, medicine, and communication, executed under immense pressure. This is a service that cannot be assembled ad hoc when a crisis unfolds.

Consider a realistic scenario: a financial professional on assignment in a developing country experiences severe chest pains—a potential cardiac event. The local clinic, though well-intentioned, lacks the cardiac specialists and advanced equipment required for life-threatening situations. At this moment, an abstract insurance policy transforms into a tangible lifeline.

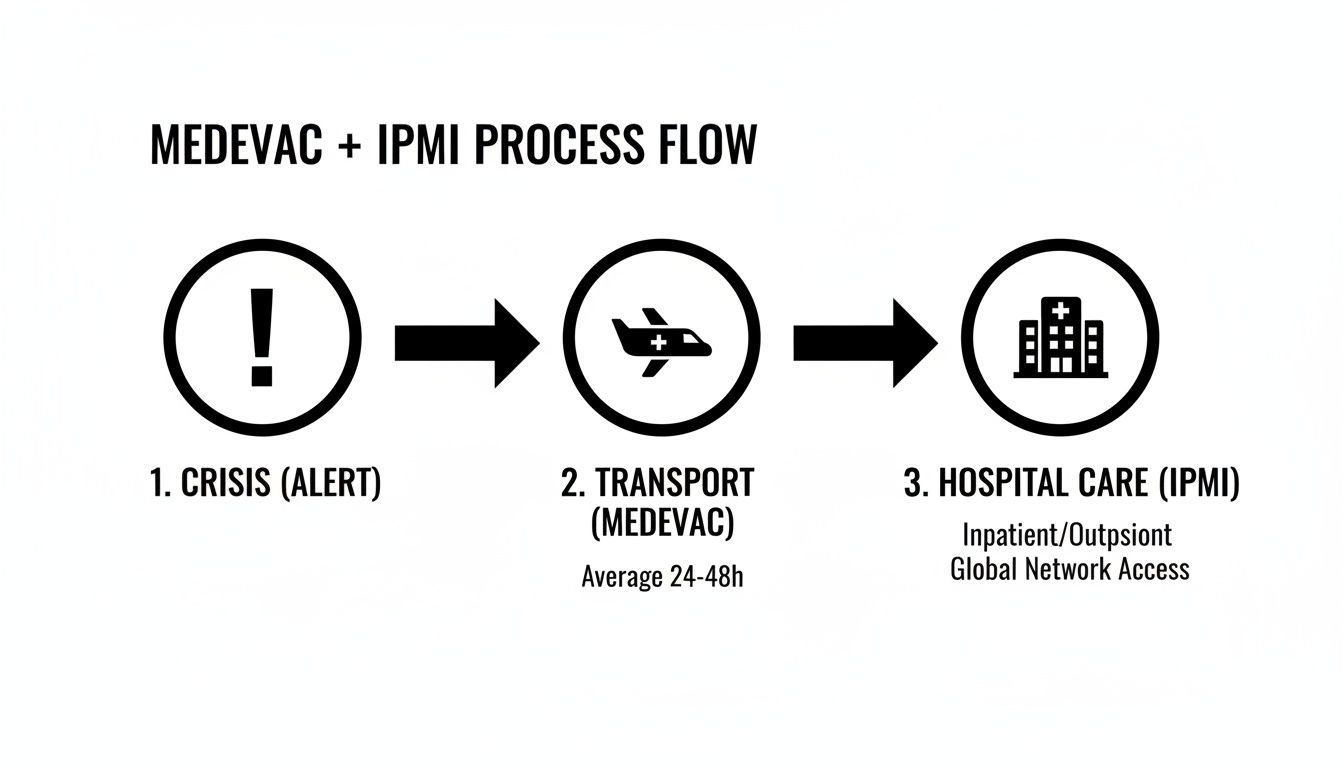

The following process illustrates the journey from the initial alert to arrival at an advanced hospital—a journey made possible only by a robust insurance plan.

This visual underscores the distinct yet complementary roles of medical evacuation insurance and International Private Medical Insurance (IPMI). One facilitates the extraction; the other finances the subsequent care.

Step 1: The Initial Call and Medical Triage

The first and most critical action is a single telephone call to the insurer's 24/7 global assistance center. This is not a standard call center but a command hub staffed by multilingual coordinators and medical professionals. You provide your location and a summary of the situation.

Immediately, the provider's medical team consults with the treating physician at the local clinic. They obtain the initial diagnosis, review medical records, and assess the local facility's capabilities. This crucial step confirms whether an evacuation is medically necessary.

Step 2: The Logistical Mobilization

Once the evacuation is authorized, a dedicated case manager assumes control. This individual becomes your single point of contact, coordinating an intricate series of simultaneous actions.

A specialized air ambulance—a mobile ICU—is dispatched. The logistics are formidable, involving flight plans, landing permits, and customs clearances across multiple countries. The entire operation is governed by strict international aviation regulations that must be navigated with precision.

Concurrently, the case manager coordinates with the destination hospital, pre-selected based on the policyholder’s “hospital of choice” clause. Admission is arranged, specialists are alerted, and a bed is secured, ensuring a seamless handover upon arrival.

The true value of an experienced provider lies in their ability to execute these complex, parallel tasks flawlessly. This is no time for a learning curve; it is a time for proven, decisive action.

This is precisely why partnering with providers who possess strong global medical networks and battle-tested protocols is non-negotiable for these high-stakes situations.

Step 3: The Execution and Handover

The air ambulance, staffed with a flight nurse and physician, arrives to retrieve the patient. They conduct a true bedside-to-bedside transfer, assuming full medical responsibility from the local clinic. Throughout the flight, the patient is under constant critical care monitoring.

Upon landing, a private ground ambulance is waiting on the tarmac for the final transfer. The patient is transported directly to the pre-approved hospital and admitted immediately, bypassing typical delays. The evacuation mission is now complete, and the patient’s International Private Medical Insurance (IPMI) policy takes over to cover the costs of treatment and recovery.

This entire process, from the initial urgent call to admission into a world-class facility, demonstrates the irreplaceable value of a premium, well-vetted plan. It transforms a potential catastrophe into a managed, controlled medical event.

This illustrates why the global travel insurance market, including medical evacuation, was valued at approximately $17.6 billion in 2022. With projections indicating significant growth, and single-trip policies comprising over 60% of the market, the risk of being inadequately covered abroad is substantial.

How to Select the Right Evacuation Provider

Choosing a medical evacuation provider is not a simple transaction; it is a critical due diligence process. The policy you select is only as strong as the company behind it. In a crisis, you are not merely purchasing an insurance product—you are retaining a global emergency management team.

Therefore, one must look beyond premium costs and coverage limits. A meticulous examination of the provider's operational capabilities, the expertise of their medical team, and the precise wording of the policy is required. This is the only way to ensure the plan you secure will perform under pressure and meet the high standards you rightfully expect.

Assessing the Provider's Operational Strength

First, let us examine the provider’s infrastructure. A glossy brochure is meaningless without the assets and personnel to execute a complex international evacuation. Not all providers are created equal, and their operational models can differ significantly.

Here is what you need to investigate:

- Global Reach and Network: Scrutinize their actual presence in the regions where you travel or reside. Do they have their own personnel on the ground, or do they subcontract to the lowest bidder? A premier provider has a robust, vetted global network of air ambulance partners, top-tier medical facilities, and assistance personnel.

- Asset Ownership vs. Third-Party Contracting: This is a crucial distinction. Does the provider own and operate its own fleet of medically equipped aircraft, or do they rely entirely on chartering from others? While many use a hybrid model, those with proprietary assets often have far greater control over quality, speed of deployment, and medical protocols.

- In-House Medical Expertise: Inquire about the depth of their internal medical team. A top-tier provider employs a staff of full-time emergency physicians, critical care nurses, and aviation medical specialists. These are the experts who will consult with the local doctor for the initial triage and manage your care until you are safely repatriated.

Scrutinizing Critical Policy Clauses

Once you have assessed their operational capabilities, the next step is a granular review of the policy document. The language in these contracts is incredibly precise and has massive real-world implications. Overlooking a single clause can be the difference between a seamless evacuation and a denied claim.

The most important test of any medical evacuation travel insurance policy is its clarity and fairness under stress. Vague definitions or restrictive terms are red flags that indicate potential conflicts when you can least afford them.

Pay exceptionally close attention to the definitions and conditions surrounding these key terms:

- "Medically Necessary": This is the gatekeeper clause for nearly all benefits. The provider’s medical director, not your personal physician, typically has the final authority on whether an evacuation is warranted. Demand a clear, objective definition of this term. You need to understand the criteria they use to make this critical decision.

- "Pre-Existing Condition" Waiting Periods: Every policy has rules regarding conditions present before your coverage began. You must understand the "look-back" period—typically 60 to 180 days—and the stability requirements. If you have a managed chronic condition, ensure you meet their definition of "stable" to avoid any ambiguity.

- "Hospital of Choice": As discussed, this is a non-negotiable clause for many high-net-worth individuals. Confirm that the policy explicitly grants you the right to be transported to a facility of your choosing, not just the "nearest adequate" one. This clause provides the ultimate control over the quality of your care.

Understanding Claim and Payout Logistics

Finally, investigate the provider’s process for handling claims and payments. In a true emergency, financial complexities are an unwelcome burden. You require a provider that manages the logistics directly, shielding you from the need for upfront payment.

This is where understanding the system of direct settlement is vital. A premier provider will issue a guarantee of payment to the air ambulance company and the receiving hospital, managing the entire financial transaction behind the scenes. For a deeper dive into how this works, our guide on pre-authorisation and direct settlement provides a clear explanation.

Before committing, confirm that your chosen provider has a proven track record of swift, direct payments to its global partners. This is your assurance that financial negotiations will never delay your medical care. By performing this multi-layered analysis, you move from simply buying a policy to making a strategic investment in your health and security.

Your Strategic Checklist for Global Travel

Securing the right medical evacuation travel insurance is not a last-minute travel purchase; it is an exercise in strategic foresight. The only way to ensure your coverage aligns perfectly with your global lifestyle is to perform a precise evaluation of your personal risk profile.

This checklist is a practical tool designed for you and your advisors to methodically assess your needs. Use this framework to move beyond generic policies and build a protective strategy that performs under pressure. It's a structured approach to identifying potential gaps and defining your absolute non-negotiables.

Assessing Your Exposure and Risk

Before comparing policies, you must quantify your personal risk. The answers to these questions will form the basis of your coverage requirements, ensuring the plan you select is fit for purpose.

- Geographic Footprint: Where are your primary and secondary travel destinations? A risk assessment for operating in a financial hub like Singapore is vastly different from one for a remote project location.

- Travel Frequency and Duration: How many days a year are you abroad? Are these short business trips or extended stays? The cumulative exposure from frequent travel demands far more robust coverage.

- Local Healthcare Infrastructure: What is the verified quality of medical care in the locations you frequent? An honest, unvarnished evaluation of available trauma centers, cardiac units, and specialist care is critical.

- Personal Health Baseline: Do you have any managed, pre-existing health conditions? It’s wise to get a clear picture of your starting point. As part of your preparation, consider incorporating some easy tips for checking your heart health at home to better understand your baseline before and during your journey.

Defining Your Non-Negotiable Coverage

With a clear picture of your risk, you can now define the essential, must-have elements of your policy. This is where the conversation shifts from cost to capability.

Your insurance portfolio should be a direct reflection of your standards. The goal is to secure a policy that guarantees control, access, and excellence—eliminating uncertainty during a critical medical event.

Your list of essential requirements should specify:

- Transport Destination: Is repatriation to your home country non-negotiable? Do you require a "hospital of choice" clause to ensure transport to a specific, world-class facility? This is a critical point of control.

- Coverage Limits: Given the high cost of private air ambulances, what is your minimum acceptable coverage limit? For most high-net-worth individuals, policies starting at $2,000,000 or higher are the standard. Anything less introduces unnecessary financial risk.

Frequently Asked Questions

Even with a detailed understanding of medical evacuation insurance, specific questions often arise. Here are the most common inquiries from discerning professionals, with direct answers to help you refine your global risk strategy.

Is My Credit Card Travel Insurance Sufficient?

This is a critical and common point of confusion. While premium credit cards often promote travel protection as a key benefit, their medical evacuation coverage is almost always a secondary feature with significant limitations. You will often find their coverage caps are quite low, typically in the $50,000 to $100,000 range—a figure that is insufficient to cover a complex international airlift.

More importantly, they rarely include the essential "hospital of choice" provision. Instead, they default to transporting you to the "nearest adequate" facility, which may be thousands of miles from your trusted physicians and family. A dedicated medical evacuation travel insurance policy should be viewed as a strategic asset for crisis management, not merely an ancillary benefit of a credit card.

How Much Does Medical Evacuation Coverage Cost?

The premium is determined by several key variables: the total coverage limit, your age, the policy duration (single trip or annual), and your travel destinations. For a comprehensive annual plan with a $2,000,000 benefit and worldwide reach, one might expect to invest from several hundred to a few thousand dollars per year.

While this represents a real investment, it is a fraction of the cost of a single, uninsured medevac, which can easily exceed $250,000 out-of-pocket. The premium is not just for insurance; it secures access to a global crisis response network that would be impossible to arrange independently during an emergency.

Do not view the premium as merely an expense. Consider it a retainer for a world-class emergency team. The real value is their proven ability to execute a flawless medical transport under immense pressure—a service that is truly priceless in a crisis.

Can My Family Be Covered Under the Same Plan?

Yes. Premier providers offer family plans that extend the same robust coverage to your spouse and dependent children. This is the most efficient method to ensure your entire family is protected under one consistent, high-quality plan, particularly if you reside or travel abroad together.

One crucial detail to verify when considering family coverage: ensure the policy limits apply per person, not as a combined total for the family. This ensures that in an unfortunate situation involving multiple family members, the coverage is not diluted.

What Is the Difference Between Evacuation and Repatriation?

These two terms are often used interchangeably, but they have distinct meanings in the context of insurance.

- Medical Evacuation: This is the process of moving you from a location with substandard medical care to the nearest facility that can provide the necessary treatment, regardless of its location.

- Medical Repatriation: This specifically means transporting you back to your home country for medical care, which typically occurs after you have been stabilized at an initial hospital.

A truly elite policy with a "hospital of choice" clause effectively merges these two concepts. It grants you the authority to choose repatriation to your home hospital from the outset, provided it is medically prudent to do so.

At Riviera Expat, we focus on structuring insurance portfolios that give high-net-worth professionals clarity and control over their global risks. We invite you to see how our expert guidance can align your health and evacuation coverage with your demanding standards. Learn more at https://riviera-expat.com.