The high deductible health plan vs PPO debate is fundamentally a decision about capital allocation and risk management.

An HDHP is structured to minimize fixed monthly costs (premiums), thereby preserving your cash flow. However, this efficiency comes with the responsibility of covering higher out-of-pocket costs when medical services are required. This model is strategically sound for individuals who are in excellent health, possess substantial liquid assets to cover a significant deductible, and prioritize lower recurring expenses.

Conversely, a PPO offers cost predictability and immediate access. The higher monthly premium is an investment in financial certainty, providing direct access to specialists and a clear, manageable cost structure for medical consultations and procedures. This is the preferred choice for those who value budgetary stability and wish to mitigate the impact of unforeseen health-related expenditures.

Navigating Your Global Health Insurance Decision

For professionals managing global careers, selecting the appropriate health insurance is not a mere administrative task—it is a foundational component of a sound financial strategy. This decision dictates not only the mechanism for accessing medical care but also the approach to managing financial risk across diverse international jurisdictions. The optimal choice is not about identifying a universally "better" plan, but about aligning the plan's structure with your personal financial architecture and lifestyle.

Consider the financial models: an HDHP operates on a principle of lower fixed costs (premiums) but higher variable costs (out-of-pocket payments). This structure is naturally suited to individuals in good health with sufficient liquidity to absorb a sudden, substantial expense, and who prefer to minimize their monthly financial commitments. A PPO functions conversely, with higher fixed costs engineered to cap unpredictable variable expenses, ensuring a smoother, more predictable financial trajectory.

The Fundamental Trade-Off

The decision fundamentally boils down to a trade-off between the timing of cash flows and the allocation of risk. This is particularly evident in the U.S. market, which often serves as a blueprint for international plan designs.

For instance, the IRS defines a 2024 HDHP as having a minimum individual deductible of $1,600. For 2025, this figure rises to $1,650. Many PPO deductibles are substantially lower. Consider a $5,000 medical bill. An HDHP member with a $3,000 deductible would be required to pay that entire $3,000 before the insurance coverage activates. A PPO member with a $1,500 deductible, by contrast, would only be liable for half that amount before their insurer begins to contribute. You can explore more detailed comparisons in MetLife's analysis of HDHP vs. PPO scenarios.

This choice fundamentally determines who holds the initial financial risk for healthcare events. With an HDHP, you retain more risk in exchange for premium savings; with a PPO, you transfer more of that immediate risk to the insurer for a higher fixed price.

This guide is designed to dissect these differences with the precision required for high-stakes financial planning. As experts in this domain, we bring clarity to how these plans perform under real-world conditions. You can learn more about our methodology in our guide to selecting the right international private medical insurance.

HDHP vs PPO At a Glance Key Strategic Differences

For a concise, executive-level view, this table distills the core strategic differences between these two plan types. It is designed to enable discerning professionals to grasp the fundamental trade-offs instantly.

| Attribute | High Deductible Health Plan (HDHP) | Preferred Provider Organization (PPO) |

|---|---|---|

| Monthly Premium | Typically lower, preserving monthly cash flow. | Typically higher, securing cost predictability. |

| Deductible | Significantly higher; must be met before most coverage initiates. | Lower, allowing insurance to contribute sooner. |

| Best For | Healthy individuals with high liquidity and minimal medical needs. | Individuals or families desiring predictable costs and frequent care. |

| Financial Strategy | Lower fixed costs, higher potential variable costs. | Higher fixed costs, capped and predictable variable costs. |

| Risk Profile | Assumes more initial financial risk for medical events. | Transfers more initial financial risk to the insurer. |

Ultimately, the table highlights the core philosophy of each plan: an HDHP is a calculated position on your continued good health, while a PPO is an investment in financial predictability, irrespective of the health challenges that may arise.

Analyzing the Financial Architecture of Each Plan

To make an informed decision in the high deductible health plan vs PPO debate, one must look beyond marketing materials and scrutinize the underlying financial mechanics. The most effective framework for this analysis is to consider fixed vs. variable costs—a familiar concept to any finance professional. This choice is not merely about insurance; it is a strategic decision on capital allocation for your healthcare over the course of a year.

A PPO represents a high fixed-cost model. You commit to substantial monthly premiums, and in return, you secure predictability. The objective is to dramatically reduce or eliminate unexpected, event-driven costs.

An HDHP, conversely, is a low fixed-cost model. The minimal premiums are advantageous for monthly cash flow, but they leave you exposed to significantly higher variable costs if and when medical services are utilized.

Premiums and Deductibles: The Upfront Commitment

The premium is the most conspicuous point of divergence. An HDHP's primary appeal is its low premium, which immediately reduces your fixed monthly expenses. This is highly attractive if you are young, healthy, and do not anticipate significant use of your insurance, thereby freeing up capital for investment or other financial objectives.

A PPO's higher premium secures an entirely different value proposition: immediate access to the insurer's capital. You are paying more upfront to guarantee that when care is needed, the insurance company contributes much sooner. That premium is the price for transferring a significant portion of the initial financial risk to the carrier from day one.

The deductible acts as the gatekeeper. It is the financial threshold you must cross—by paying out-of-pocket—before your insurer begins to share costs. A serious evaluation requires a precise understanding of these mechanics. For a detailed examination, reviewing the fine print on excesses and deductibles is indispensable.

- HDHP Deductible: This is a substantial figure, often amounting to several thousand dollars. Until this threshold is met, you are effectively self-insuring for most services, covering 100% of the costs yourself.

- PPO Deductible: This is a much lower, more manageable figure. Reaching this threshold is far more feasible, meaning the insurer's financial participation begins much earlier in the policy year.

Coinsurance and Out-of-Pocket Maximums: The Safety Net

Once you have satisfied your deductible, you enter the coinsurance phase, where you and the insurer share the cost of subsequent bills. A common arrangement is for you to pay 20% while the insurer covers the remaining 80%. This is where the variable cost structure becomes apparent, as your spending is now directly correlated with the services you use.

However, this cost-sharing is not indefinite. The out-of-pocket maximum is arguably the most critical figure in any health plan. It represents the absolute ceiling on your financial liability for covered, in-network services within a policy year. This amount includes your deductible, copayments, and all payments made during the coinsurance phase.

Think of the out-of-pocket maximum as your ultimate financial backstop. Once you reach this limit, the plan covers 100% of all eligible, in-network medical costs for the remainder of the year. It transforms a plan's potential for unlimited variable costs into a predictable, capped annual exposure.

Let’s model the financials for a global finance professional. Imagine an unexpected skiing accident in the Alps results in surgery and physical therapy, with a total bill of $20,000.

Financial Impact Modeling

| Cost Component | High Deductible Health Plan (HDHP) | Preferred Provider Organization (PPO) |

|---|---|---|

| Annual Premium | $4,000 | $8,000 |

| Deductible | $5,000 | $1,500 |

| Coinsurance | 20% | 20% |

| Out-of-Pocket Max | $7,000 | $5,000 |

| Member Pays (Deductible) | $5,000 | $1,500 |

| Remaining Bill | $15,000 | $18,500 |

| Member Pays (Coinsurance) | $2,000 (reaches $7,000 max) | $3,500 (reaches $5,000 max) |

| Total Out-of-Pocket Cost | $7,000 | $5,000 |

| Total Annual Cost | $11,000 | $13,000 |

In this scenario, the HDHP results in a lower total annual cost, saving $2,000. However, a closer examination reveals it required a $7,000 out-of-pocket expenditure, whereas the PPO capped the liability at $5,000.

For an individual who prioritizes predictable spending and wishes to avoid large, unexpected bills, the PPO's structure may be preferable, even at a higher total annual cost. This demonstrates that the "best" plan is not determined by a spreadsheet alone, but by your personal financial situation and tolerance for risk.

Gauging Care Access and Your Likely Behavior

For professionals in demanding global roles, time is a non-recoverable asset. Delays in accessing medical care are not merely an inconvenience; they can disrupt critical projects and personal commitments. The choice between a high deductible health plan vs PPO extends beyond financial modeling—it directly influences behavior and the propensity to seek timely care.

A plan's structure can create what I term 'financial friction'—a moment of hesitation to seek care due to the immediate financial impact. Even for an individual with ample liquidity, the prospect of paying thousands of dollars out-of-pocket before insurance benefits apply is sufficient to cause a pause.

This is the central behavioral consideration of an HDHP. The knowledge that a diagnostic scan or a consultation with a leading specialist will trigger a significant direct expense can foster a "wait and see" approach. Such delays, however minor they may seem, can have serious consequences for conditions where early intervention is paramount.

The PPO Approach: Removing the Friction

By contrast, a PPO is engineered to remove this friction and encourage proactive health management. Its design, featuring predictable copayments and significantly lower deductibles, dismantles the immediate financial barrier at the point of care. One is simply more inclined to address a health concern when the direct cost is a nominal fee rather than the full, undiscounted rate.

For an expatriate, this structure is transformative. It facilitates seamless access to premier specialists in different countries without the administrative burden of referrals or the psychological weight of a large upfront payment. For individuals whose professional performance depends on maintaining peak health, this level of immediate access is non-negotiable.

Here's the core difference in how you'll behave: an HDHP pushes you to be a sharp consumer of healthcare, often after a problem has already started. A PPO encourages you to be a proactive manager of your health, with far fewer financial hurdles in your way.

Network Flexibility for the Global Professional

Network access is another critical determinant. If you operate in global hubs such as Singapore, London, or Hong Kong, the ability to consult a preferred specialist without delay is vital. PPOs generally feature broader, more established networks, which constitutes a significant advantage.

Accessing care should be straightforward, particularly in an unfamiliar country. Our expertise in evaluating the strength of international medical networks is key to ensuring your plan provides the high-level, direct access you require. A robust network means less time spent on administrative concerns and more time focused on your health and professional responsibilities.

Empirical data confirms that plan design significantly alters healthcare utilization. A 2023 KFF survey found that 27% of adults with deductibles of $3,000 or more reported delaying or forgoing care due to cost. This demonstrates that a plan's financial structure, not just personal wealth, is a powerful driver in decision-making.

Ultimately, you must be candid about your own likely behavior. Will the high deductible of an HDHP cause you to hesitate, even subconsciously? If there is any possibility the answer is yes, the PPO's higher premium may be one of the soundest investments you can make in your long-term well-being.

Modeling Scenarios for High-Net-Worth Expats

Abstract comparisons of an HDHP vs. a PPO are of limited utility. To make a definitive decision, you must model the financial outcomes against realistic life scenarios. Concepts like premiums and deductibles gain clarity when translated into specific monetary figures tied to actual health events.

The optimal choice is never universal; it is intensely personal, contingent upon your health status, family structure, and financial strategy. Let's analyze three distinct profiles of global professionals to demonstrate how these plans perform under real-world conditions. These are not mere hypotheticals; they represent the data-driven frameworks we employ to guide our clients toward intelligent choices.

Scenario 1: The Young, Healthy Trader in Hong Kong

Consider a 30-year-old finance professional based in Hong Kong. She is in excellent health, has no chronic conditions, and anticipates only an annual physical and perhaps one minor specialist visit per year. Her primary financial objective is to minimize fixed monthly costs to maximize capital allocation to her investment portfolio.

Let's model her total annual cost:

- HDHP Premiums: $3,500 per year.

- PPO Premiums: $7,000 per year.

- Medical Usage: One annual check-up (typically covered as preventive care) and one specialist visit for a minor issue, costing $500.

With the HDHP, she pays the full $500 out-of-pocket, as this is well below her deductible. Her total cost for the year is $3,500 (premiums) + $500 (medical care) = $4,000.

Under the PPO, that specialist visit might require only a $50 copay. Her total annual cost becomes $7,000 (premiums) + $50 (copay) = $7,050.

For this profile, the HDHP is the clear winner, delivering an annual savings of $3,050. She can deploy that capital into her investment portfolio, effectively self-insuring for minor events while retaining catastrophic coverage.

Scenario 2: The Expat Family in Singapore with Young Children

Now, consider a family of four in Singapore: two executives in their early 40s with a six-year-old and a four-year-old. Young children are prone to frequent minor illnesses, necessitating regular visits to the pediatrician. For this family, cost predictability and ease of access to care are paramount.

Here’s what a typical year might look like for them:

- HDHP Premiums: $10,000 per year with a $7,000 family deductible.

- PPO Premiums: $18,000 per year with a $2,500 family deductible.

- Medical Usage: Multiple pediatric visits, a few urgent care trips, and prescriptions, totaling $4,000 in billed services.

Under the HDHP, the family pays the full $4,000 for their medical care, as they have not met their high family deductible. Their total annual cost is $10,000 (premiums) + $4,000 (medical care) = $14,000. Each doctor visit represents a direct and significant cash outflow.

With the PPO, these visits are managed with predictable copayments. Assuming ten visits at a $40 copay each and $200 in prescription costs, their out-of-pocket spend is just $600. Their total annual cost is $18,000 (premiums) + $600 (copays) = $18,600.

Although the PPO has a higher total cost in this model, its value is evident. The family avoids large, unpredictable bills. They secure peace of mind, knowing that care for their children comes with a small, fixed cost. The higher premium purchases budget certainty and removes any financial hesitation when a child falls ill.

Scenario 3: The Senior Executive with a Pre-Existing Condition

Finally, let’s consider a 55-year-old senior executive managing a chronic condition such as hypertension. This requires regular specialist consultations, ongoing medication, and annual diagnostic tests. For this individual, financial protection and seamless access to a specific network of premier physicians are non-negotiable.

Let's model the financial impact for his year:

- HDHP Premiums: $6,000 per year with a $5,000 deductible and an $8,000 out-of-pocket maximum.

- PPO Premiums: $11,000 per year with a $1,000 deductible and a $4,000 out-of-pocket maximum.

- Medical Usage: Four specialist visits, advanced imaging, and brand-name prescriptions, generating $12,000 in medical claims.

With the HDHP, the executive first pays his $5,000 deductible. On the remaining $7,000, he might owe 20% coinsurance ($1,400). His total out-of-pocket cost is $6,400. Add the premium, and his total annual cost is $6,000 + $6,400 = $12,400.

Under the PPO, he meets his $1,000 deductible first. On the remaining $11,000, his 20% coinsurance is $2,200. His total out-of-pocket is $3,200. Add the premium, and the total comes to $11,000 + $3,200 = $14,200.

At first glance, the HDHP appears slightly more cost-effective. However, the critical detail lies in the out-of-pocket maximum. The PPO’s lower cap ($4,000) provides a much stronger financial safety net. If a complication caused his medical costs to escalate, his spending on the PPO would be capped far sooner, offering superior protection against a worst-case scenario. For an executive managing a known health risk, that predictable ceiling is often well worth the higher premium.

These scenarios illustrate how personal the HDHP vs. PPO decision is. To consolidate these findings, the table below summarizes the financial outcomes, clarifying which plan is optimal under different levels of healthcare utilization.

Annual Cost Projection: HDHP vs. PPO Scenarios

| Client Profile & Scenario | Estimated HDHP Annual Cost | Estimated PPO Annual Cost | Optimal Plan |

|---|---|---|---|

| Young Trader (Low Usage) | $4,000 | $7,050 | HDHP |

| Expat Family (Medium Usage) | $14,000 | $18,600* | PPO* |

| Senior Exec (High Usage) | $12,400 | $14,200** | PPO** |

*The PPO's higher cost is offset by predictable copays and budget certainty, making it optimal for families.

**The PPO provides a stronger financial safety net with a much lower out-of-pocket maximum, which is critical for managing chronic conditions.

Ultimately, the best plan is not the one with the lowest premium, but the one that aligns with your anticipated needs and financial risk tolerance. Low users benefit from the HDHP's savings, while those expecting higher or more unpredictable medical needs find value and security in the PPO's structure.

Making the Optimal Choice for Your Situation

After modeling financial outcomes and analyzing different scenarios, the choice between a high deductible health plan vs PPO distills to a few key strategic questions. This is not merely about selecting the lowest premium. It is about deliberately aligning your insurance policy with your risk appetite, your family’s needs, and the value you place on direct, uncomplicated access to care.

For a high-net-worth professional focused on minimizing fixed costs, an HDHP offers a compelling, efficient structure. However, for a growing family or an executive managing a chronic condition, the financial predictability and seamless care coordination of a PPO are essential.

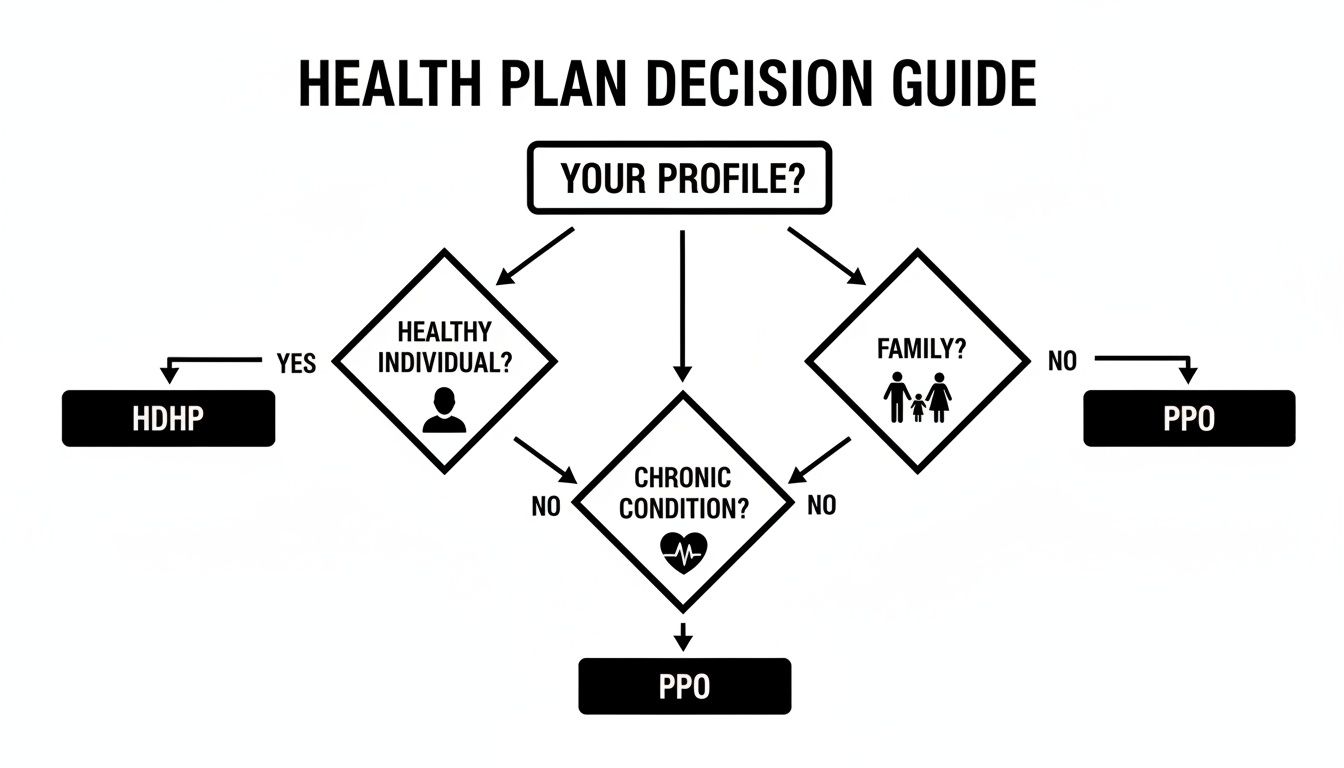

This decision guide helps visualize the pathways to the right choice for your specific profile.

As the flowchart illustrates, your personal health and family situation are the primary drivers in the HDHP vs. PPO decision, pointing you toward the plan that best manages your real-world risks.

A Decision Matrix for Discerning Professionals

For greater clarity, evaluate your personal situation against these variables. Your candid answers will indicate the most appropriate direction.

- Your Cash Flow Preference: Do you prefer to keep monthly fixed costs as low as possible to free up capital? Or do you favor the certainty of higher, predictable premiums to eliminate the shock of a large, unexpected bill?

- Your Risk Tolerance: Are you comfortable with the possibility of covering several thousand dollars in medical expenses on short notice? Or does that level of financial uncertainty create an unacceptable degree of stress?

- Your Expected Medical Needs: Based on your health history (and that of your family), do you anticipate infrequent medical consultations? Or are regular appointments, prescriptions, or procedures a normal part of your life?

- The Importance of Network Freedom: How critical is it for you to see any specialist, anywhere in the world, without requiring a referral? Is that convenience a non-negotiable component of your health management strategy?

Your best plan is the one that delivers confidence, not just coverage. It needs to work as a seamless extension of your personal financial strategy, whether that’s aggressive cost control or absolute budget certainty.

Answering these questions honestly provides a solid framework for your choice. A young, healthy professional with substantial liquid assets can confidently leverage an HDHP's savings. In contrast, an executive with dependents or a known health issue will find immense value in the PPO’s predictable, higher-touch model.

Tailoring the Plan to Your Life

Ultimately, the high deductible health plan vs ppo debate is settled by a sober assessment of the specific demands of your life.

Choose an HDHP if:

- You are in excellent health with no chronic conditions.

- You have sufficient liquid savings to cover the full out-of-pocket maximum without causing financial strain.

- Your primary financial objective is to reduce your fixed monthly overhead.

Choose a PPO if:

- You have a family, especially with young children who require frequent medical attention.

- You or a family member is managing a chronic health condition that requires regular care.

- You value predictable budgeting and wish to avoid the risk of large, sudden medical bills.

- You demand total flexibility and direct access to specialists across a global network.

This decision is a critical component of your overall financial and well-being strategy. By aligning your health plan's design with your personal and financial realities, you ensure your coverage works for you, providing security and peace of mind wherever your career may lead.

Frequently Asked Questions About HDHPs and PPOs

Even after a thorough financial analysis, practical questions often arise when choosing between a high-deductible plan and a PPO. For globally mobile professionals, these questions typically focus on the cross-border functionality of these plans, specific tax implications, and complex family situations. Addressing these details is the final step in making a well-informed decision.

These are the most common inquiries from our clients, with answers that reflect the on-the-ground complexities often overlooked in standard plan documentation.

Can I Use An HSA With An International HDHP?

This is a significant point of confusion for U.S. expatriates, and the answer is almost invariably no. Health Savings Accounts (HSAs) are a superb, tax-advantaged financial instrument, but they are intrinsically linked to the U.S. tax code. To be eligible to contribute, you must be enrolled in a specific "HSA-qualified" plan as defined by the IRS.

While many international private medical insurance (IPMI) plans may resemble HDHPs—featuring high deductibles and lower premiums—they are almost never formally HSA-qualified. Consequently, you cannot contribute pre-tax dollars to a U.S.-based HSA simply because you have a global health plan with a high deductible.

What is the alternative? Investigate the tax-efficient savings vehicles available in your current country of residence. Many nations have their own mechanisms for funding future healthcare needs, and a local financial advisor can provide appropriate guidance.

How Does Out-of-Network Coverage Differ?

Both plan types may offer some coverage for providers outside their designated network, but the structure—and your resulting cost—is dramatically different. A PPO is designed for this kind of flexibility. If you anticipate any possibility of consulting out-of-network providers, the PPO is the superior choice.

Here’s the practical difference:

- PPO Out-of-Network: A PPO will have separate (and higher) deductibles and out-of-pocket maximums specifically for out-of-network care. While you will pay more than for in-network services, the plan still covers a significant portion of the cost, and crucially, there is a firm cap on your total expenditure.

- HDHP Out-of-Network: This is where HDHPs become restrictive. The plan might reimburse a much smaller percentage of the bill, or worse, it may only cover out-of-network care for true emergencies. All other out-of-network services would be your full responsibility.

The core difference comes down to intent. A PPO is built for flexibility, treating out-of-network care as an expected choice. An HDHP is built for cost control, treating it as an expensive, and often penalized, exception.

For professionals who demand the freedom to consult any specialist, anywhere in the world, without incurring a massive financial liability, the PPO's robust out-of-network architecture is the clear winner.

Which Plan Is Better for Dependents in Different Countries?

This is a common scenario for global executives, and the answer is unequivocal. For families dispersed across different countries, a PPO with a strong international network is almost always the better choice. The entire structure is designed to manage claims and provide access across borders with predictable costs.

Attempting to use an HDHP in this situation creates significant friction. Imagine your child requires care in a high-cost city like London or New York. You could quickly find yourself paying thousands of dollars out-of-pocket merely to satisfy the high family deductible. This transforms a simple doctor's visit into a major cash-flow event.

A PPO eliminates this complexity. A dependent in another country can locate an in-network provider, pay a simple copayment, and the process is complete. This dramatically reduces both the administrative burden and the immediate financial impact on the family budget.

Does My Risk Tolerance Change Which Plan Is Financially Better?

Absolutely. In fact, your personal comfort with financial risk is arguably the single most important non-medical factor in this decision. Choosing between an HDHP and a PPO is not just about healthcare—it's a strategic decision on how you wish to manage financial uncertainty.

Consider this framework: an HDHP requires you to self-insure for every dollar up to your deductible. If you have a high risk tolerance and the liquidity to cover the full out-of-pocket maximum without hesitation, the HDHP is incredibly efficient. You can invest the premium savings, potentially growing that capital to a point where it more than covers any occasional medical expenses.

Conversely, if you are risk-averse and prioritize predictability above all else, the higher fixed cost of a PPO is a sound investment. You are purchasing peace of mind. You know your financial exposure is strictly limited from day one, which eliminates unwelcome surprises and facilitates cleaner long-term financial planning. The "better" plan is simply the one that aligns with your financial philosophy and allows for sound sleep at night.

Navigating the complexities of international health insurance requires expert guidance tailored to your unique financial and personal situation. At Riviera Expat, we provide the clarity and objective advice you need to select a plan with confidence. Schedule your complimentary consultation to see how our expertise can simplify your decision.