A simple oversight can have profound financial consequences, even for the most sophisticated global traveler. Arriving in Canada without dedicated health insurance is a fundamental misstep. While the nation is lauded for its majestic landscapes and cosmopolitan centers, its esteemed universal healthcare system is a benefit reserved solely for its residents. For visitors, this creates a significant, and often underestimated, vulnerability.

Securing appropriate coverage is not a mere formality on your travel agenda; it is an indispensable component of a well-executed itinerary.

The Financial Imperative of Visitor Health Insurance in Canada

Canada’s world-class provincial healthcare system is a pillar of its national identity, but let us be unequivocally clear: it does not extend to tourists, business travelers, or individuals visiting family. This critical distinction means every interaction with the medical system—from a consultation for a minor ailment to a life-altering emergency—carries a direct, out-of-pocket cost.

Disregarding this reality can transform a minor incident into a financial crisis. The costs are not hypothetical; they are immediate and substantial.

A standard walk-in clinic consultation may cost between $100 to $600, yet an ambulance transport, an emergency room visit, or an unplanned hospital admission can escalate to as much as $6,000 per day. Bespoke medical insurance is the only effective shield against such financial exposure.

The Financial Reality of Uninsured Medical Care

To provide a clear perspective, consider the potential costs for an uninsured visitor. These are not abstract figures; they represent real-world expenses that can deplete significant assets with alarming speed.

Potential Medical Costs for Uninsured Visitors in Canada

| Medical Service | Estimated Cost (CAD) |

|---|---|

| Walk-in Clinic Consultation | $100 – $600 |

| Emergency Room Visit | $1,000 – $2,500+ |

| Ambulance Service (Ground) | $250 – $500 |

| Ambulance Service (Air) | $3,000 – $25,000+ |

| Hospital Stay (Standard Ward) | $3,000 – $6,000 per day |

| Hospital Stay (ICU) | $7,000 – $10,000+ per day |

| Surgical Repair of a Major Fracture | $10,000 – $20,000+ |

| Appendectomy | $8,000 – $15,000+ |

| Diagnostic Imaging (MRI) | $800 – $2,500 |

As illustrated, even a seemingly straightforward medical issue can rapidly accumulate costs into the tens of thousands of dollars. This financial exposure is precisely what a well-structured travel policy is engineered to mitigate.

The necessity for robust coverage is underscored by Canada's global appeal. In the third quarter of 2024 alone, the country welcomed over 2.4 million international visitors, a 3.5% increase from the previous year. For this expanding cohort of discerning travelers, dedicated health insurance is not a discretionary expense—it is essential for accessing quality care without incurring ruinous debt or bureaucratic delays.

It is also vital to distinguish this form of temporary protection from the long-term solutions required for residency. If you are planning a permanent move, our guide on health insurance for expatriates in Canada delineates the distinct set of requirements you will face.

Preparing for a Seamless Entry

Prudent travel planning extends beyond medical preparedness. Before departure, it is imperative to ensure all administrative arrangements are in order. Beyond insurance, take the time to understand the comprehensive entry requirements for Canada to guarantee your arrival is as seamless as the remainder of your visit.

Ultimately, superior health insurance for travelers to Canada transcends financial considerations. It affords peace of mind, enabling you to focus on your primary objective—be it closing a significant business deal or exploring the Canadian Rockies—with the assurance that you are comprehensively protected against any eventuality.

Deconstructing Your Coverage and Policy Details

Selecting the right health insurance for travelers to Canada is not a commodity purchase. It is analogous to commissioning a bespoke suit—a generic, off-the-rack solution is inadequate when circumstances become serious. One must look beyond the premium to dissect the substance of the policy. Therein lies its true value.

Two plans may appear superficially identical yet perform vastly differently during a medical crisis. The key is to comprehend the policy's architecture: the coverage components, their alignment with your personal health profile, your planned activities, and the duration of your stay in Canada.

The Anatomy of a Superior Policy

The substantive difference between a basic emergency plan and a robust, comprehensive one resides in the fine print. A rudimentary plan may suffice for a sudden illness, but a top-tier policy provides a formidable safety net engineered for a range of adverse scenarios. The three areas demanding your absolute clarity are the policy's definitions, its limits, and its exclusions.

One of the most critical elements to scrutinize is the insurer's definition of a medical 'emergency'. This single term is the trigger for your coverage. If the definition is ambiguous or restrictive, you are left exposed. The insurer could contend that your situation failed to meet their specific criteria, resulting in a denied claim and a substantial bill.

A premier policy eschews ambiguous language. It explicitly states that if you require immediate medical intervention to alleviate acute, unforeseen pain or to prevent a serious deterioration of your health, you are covered. No ambiguity.

Next, focus on the benefit maximum. This is the absolute ceiling on the aggregate amount the insurer will pay for your medical expenses. A $100,000 limit may seem substantial, but a major accident or several days in a Canadian ICU can exhaust that sum with alarming speed. For genuine peace of mind, a high benefit maximum—ideally $500,000 CAD or more—is not merely desirable; it is a necessity.

Core Policy Features to Mandate

To accurately assess a policy's strength, you must evaluate these specific components. Each represents a layer of protection that can prove decisive in a challenging situation.

-

Hospitalization and Medical Services: Your policy must explicitly cover a semi-private or private hospital room, the formidable costs of an intensive care unit (ICU), physicians' fees, and all associated diagnostic tests, such as X-rays and MRIs.

-

Outpatient and Emergency Room Care: Coverage cannot be confined to inpatient services. It must include emergency room fees and any necessary follow-up consultations with a physician post-incident.

-

Prescription Medications: A sound policy will reimburse you for medications prescribed by a physician as part of your emergency treatment.

-

Emergency Dental Care: Accidents involving dental trauma are common. Look for coverage that addresses sudden, painful dental injuries and verify the maximum payable amount.

-

Medical Evacuation and Repatriation: This is the cornerstone of any truly elite policy. If the local medical facility cannot provide the requisite level of care, this feature covers the cost of transporting you to a more appropriately equipped facility or back to your home country. These costs can easily exceed $50,000, making this feature non-negotiable.

Scrutinize Exclusions and Clauses

Finally, what a policy excludes is as important as what it covers. Every policy contains a list of exclusions—specific situations or conditions for which it will not provide payment. Common examples include high-risk activities like skiing or mountain climbing, which typically require a specialized add-on, or "rider," for coverage.

However, the most critical clause pertains to pre-existing medical conditions. How an insurer defines this term and the "stability period" they mandate can render your policy invalid if you fail to comprehend and adhere to the rules precisely. This area is sufficiently complex to warrant its own detailed examination, ensuring your policy will perform as expected when it matters most. By meticulously reviewing these details, you transition from merely buying insurance to making a strategic investment in your health and security.

Navigating Pre-Existing Conditions and Stability Clauses

For any traveler, particularly one managing an ongoing health concern, this is the single most critical section of an insurance policy. An error here is the primary reason for claim denials.

The fine print in health insurance for travelers to Canada concerning pre-existing conditions demands rigorous attention. A simple misinterpretation can render an otherwise robust policy useless at the moment of need.

Insurers define a pre-existing condition with considerable breadth. It encompasses any illness, injury, or medical issue for which you have experienced symptoms—or received advice, diagnosis, or treatment—prior to your policy's effective date. This includes everything from chronic conditions like hypertension to a seemingly minor sprain that has not fully resolved.

The Stability Clause: The Linchpin of Your Coverage

This is where the details become paramount. Insurers employ a stability clause as a qualifying period for your health status. Before they agree to cover your pre-existing conditions, they require that condition to have been "stable" for a specified duration.

This stability period can range from 90 to 365 days preceding your trip, depending on the policy and your age.

But what does "stable" mean from an underwriting perspective? It is not merely a subjective feeling of well-being. Your condition is considered unstable if there have been any changes during that look-back period, including:

- New or Worsening Symptoms: Any change in the manifestation of your condition.

- Medication Changes: A critical point. Any adjustment—an increase, decrease, or new prescription—restarts the stability clock.

- New Treatments: Commencing a new therapy or receiving a referral to a specialist.

- Ongoing Investigations: Awaiting test results or having follow-up tests scheduled.

Even a minor, preventative adjustment, such as a physician slightly increasing a blood pressure medication dosage, can be sufficient to render that condition "unstable" and therefore ineligible for coverage.

A common pitfall: assuming "stability" simply because one feels well. If a physician's appointment is scheduled to monitor an unresolved issue, your condition is not stable. You must be completely transparent about your medical history. This is not merely advice; it is a contractual obligation for your policy's validity.

Real-World Scenarios and Their Implications

Consider how these clauses function in practice.

Scenario One: The Minor Medication Adjustment

An executive is traveling to Toronto for a two-week business engagement. During a routine check-up six weeks prior to departure, her physician adjusts the dosage of her cholesterol medication. Should she experience a cardiac-related event in Canada, the insurance company would almost certainly deny the claim. The reason: the recent medication change is evidence that the condition was not stable.

Scenario Two: The Lingering Injury

A traveler sprains his ankle one month before a trip to Vancouver. He follows his physician's advice for rest, but it remains intermittently sore. If he slips and re-injures that same ankle, a claim for medical care could be denied because the original injury was not fully resolved, thereby classifying it as an unstable pre-existing condition.

Full Disclosure Is Your Only Safeguard

The medical questionnaire you complete is not a formality—it is a legal declaration. Honesty and precision are your most effective defense. Do not estimate dates or understate symptoms. If you are uncertain about any detail, contact your physician to confirm the facts before submitting the application.

Providing incomplete or inaccurate information, even if unintentional, can be deemed misrepresentation. This grants the insurer the right to void your entire policy, leaving you liable for 100% of your medical expenses. It is crucial to understand how your medical history impacts your coverage, which includes a thorough review of exclusions. For a more detailed examination, you can read our analysis of common policy exclusions to identify other potential pitfalls.

Ultimately, the only policy that provides genuine protection is one that accurately reflects your health status. It is the only way to ensure you can focus on your trip, confident that your safety net is built on a foundation of clarity and truth.

How to Select the Right Insurance Provider and Plan

In the sphere of international travel, the caliber of your insurance provider is as crucial as the policy itself. A superior policy from an inferior provider is a recipe for failure. What you are seeking is a strategic partner—an insurer with impeccable service and financial stability who will perform when a medical crisis occurs.

Choosing the right health insurance for travelers to Canada is more than a price comparison. It is a strategic assessment of the provider’s capabilities and the plan’s construction. A provider with a sterling reputation does not simply pay claims; they deliver critical support during what can be an exceptionally stressful time.

Evaluating the Insurance Provider

Before examining policy specifics, you must vet the insurer. A low premium is worthless if the company is unresponsive or erects bureaucratic hurdles during an emergency. Your focus should be on providers known for their efficiency and client-centric approach.

Key evaluation criteria include:

- 24/7 Multilingual Emergency Assistance: Medical emergencies do not adhere to business hours. Insist on a provider with a dedicated, round-the-clock assistance team. These should be multilingual professionals capable of coordinating care, providing medical advice, and managing logistics on your behalf.

- Direct Billing Network: Seek providers with a robust direct billing network in Canada. This is a pivotal feature. It means the insurer settles payment directly with the hospital or clinic, so you are not compelled to cover a massive bill upfront and seek reimbursement later.

- Claims Processing Reputation: Investigate the provider’s track record. A history of prompt, fair, and transparent claims handling is non-negotiable. Review independent online reviews and industry ratings for an objective assessment.

The drive for proper travel protection is a global trend. A 2025 study revealed that 90% of Canadians intend to secure travel insurance for their own journeys, demonstrating the perceived necessity of this safeguard. This same principle applies to anyone visiting Canada; a dependable partner is essential. You can read more about these travel insurance trends and projections at Insurance Business Magazine.

Comparing and Selecting the Optimal Plan

Once you have a shortlist of reputable providers, it is time to analyze the plans themselves. The objective is to identify a policy that is perfectly aligned with your personal and travel profile. Consider it a bespoke commission—it must be precisely right.

A policy is not merely a document; it is a promise. The optimal plan is one with unambiguous language, high coverage limits, and a manageable deductible. It should remove financial anxiety from the equation, allowing you to focus on recovery.

Here is a systematic approach to comparing your options:

-

Assess Coverage Limits: A single day in a Canadian ICU can exceed $7,000 CAD. Given such costs, a low coverage limit represents a significant risk. We strongly recommend a minimum benefit of $500,000 CAD. For longer stays or for individuals with pre-existing health concerns, a limit of $1 million CAD or more offers superior peace of mind.

-

Understand the Deductible: The deductible is the amount you pay out-of-pocket before insurance benefits are initiated. A higher deductible will reduce your premium, but ensure it is an amount you could comfortably pay without hesitation during an emergency.

-

Review Core Benefits: Confirm that the plan covers all essential components. This includes emergency medical evacuation, repatriation of remains, prescription drugs, and emergency dental care. Each adds a critical layer of protection.

The distinctions between various types of medical insurance can be nuanced, particularly when weighing a short-term trip against a more extended stay. To clarify these differences, you may find our guide on which expat medical insurance policy type is right for you to be informative. This methodical approach ensures you select not just any plan, but the right plan—one that facilitates worry-free travel.

Mastering the Claims Process: From Incident to Reimbursement

This is the fundamental truth of insurance: one does not purchase a policy, but rather a promise. The ultimate test of that promise is not the premium paid; it is the grace and efficiency with which your provider performs during a crisis.

When you require medical attention in Canada, the claims process can seem daunting. However, understanding a few key steps from the outset makes a significant difference. It allows you to concentrate on your well-being, not on administrative burdens.

The immediate action in any medical situation is to contact your insurer’s 24/7 emergency assistance line. This is not a mere suggestion—it is the critical first step. Unless the situation is life-threatening, make this call before receiving treatment.

Consider this as activating your personal support team. That single call connects you with professionals who can direct you to an appropriate clinic or hospital, pre-authorize your care, and initiate the entire support mechanism on your behalf.

Understanding Payment and Reimbursement

When it comes time for payment, your health insurance for travelers to Canada will function in one of two ways. The optimal scenario is direct billing, where the insurance company pays the hospital directly. This is the gold standard, as it obviates the need for you to manage large, unexpected out-of-pocket expenses.

The alternative is paying for all services yourself and then filing a claim for reimbursement. This is more common for smaller expenses, such as a physician's consultation or a prescription. Your success in this process hinges on one discipline: fanatical record-keeping.

Your policy is a financial instrument designed for your protection. The claims process is the mechanism that unlocks that protection. A well-documented claim is a successful claim—one that proceeds smoothly, without disputes or frustrating delays, delivering the peace of mind you paid for.

To ensure your reimbursement claim is processed efficiently, you must become a master archivist of your medical event.

The Art of Meticulous Documentation

Every single document, regardless of its apparent significance, is a crucial piece of your claim's evidentiary puzzle. Insurance providers require a complete, transparent record to approve the costs you have incurred. Without this paper trail, you are inviting delays or even a denial.

Your documentation file must include:

- Original Itemized Invoices and Receipts: This means everything. Hospital admission forms, the detailed breakdown of services, and receipts for every prescription or medical supply. A credit card statement is insufficient; you need the detailed invoices.

- Complete Medical Reports: Obtain a copy of the physician’s report, all diagnostic results (such as X-rays or laboratory work), and the hospital’s final discharge summary. These documents constitute the medical proof that justifies the care you received.

- Proof of Payment: If you paid upfront, retain every record demonstrating that you settled the bill. This includes credit card slips or bank statements that correspond perfectly with the invoices.

Taking the time for proper organizing your medical records can make a profound difference. By consolidating these documents in a single, secure location—whether a physical file or a digital one—you transform a stressful, chaotic task into a straightforward process. This disciplined approach is your best guarantee of a smooth claim settlement.

Common Insurance Myths That Create Financial Risk

Even the most diligent travelers can be compromised by pervasive myths about medical insurance. These are not minor misconceptions; they are significant financial risks that can entirely undermine an otherwise well-planned trip to Canada. Establishing the facts is the only way to ensure you are genuinely protected.

One of the most persistent—and dangerous—myths is the belief that your domestic health insurance provides coverage abroad. It almost certainly does not. For instance, U.S. Medicare offers virtually no coverage for medical emergencies or evacuations during international travel. Apart from a few rare exceptions, such as an emergency directly on the U.S. border where a Canadian hospital is closer, you are financially exposed. It is a massive coverage gap that many travelers discover only when it is far too late.

The Misleading Comfort of Credit Card Benefits

Another trap is assuming the travel insurance included with a premium credit card is sufficient. While these benefits appear attractive, they are rarely a true substitute for a dedicated, standalone policy. In reality, credit card plans are often laden with restrictive terms and low coverage limits that a serious medical event will quickly exhaust.

These plans typically operate on a reimbursement basis for a highly specific list of incidents and often exclude coverage if you are over a certain age or have pre-existing conditions. Relying on them is akin to addressing a major crisis with an inadequate solution. A serious incident could easily surpass a credit card's $25,000 or $50,000 limit, leaving you personally liable for the remaining—often substantial—balance.

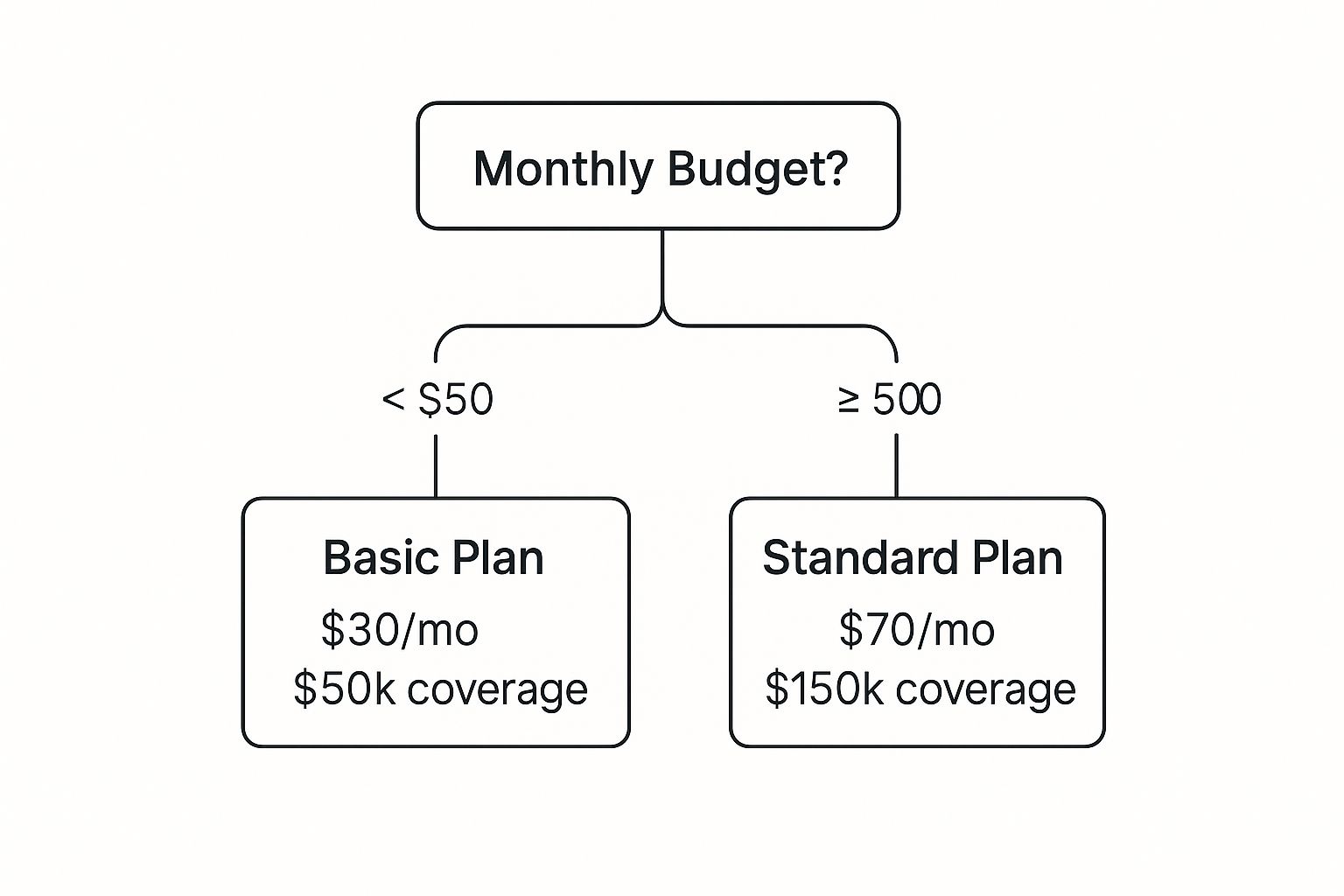

This decision tree provides a simple framework for balancing your budget against the need for genuine protection.

As the visual illustrates, even a modest investment can dramatically enhance your financial security, elevating you from flimsy protection to a robust plan capable of managing a true crisis.

Debunking Prevailing False Assumptions

Finally, there is the critical misunderstanding surrounding Canada's renowned "free" healthcare system. It is often assumed to apply to everyone, but this is entirely incorrect. The universal system is funded by and for Canadian residents exclusively. As a visitor, you are classified as a private-pay patient, meaning you are liable for 100% of any medical bills you incur.

These myths are not merely anecdotal; they are supported by data. A 2025 survey found that only 51% of people plan to purchase any travel insurance. The primary reasons for forgoing it are based on these exact misconceptions: 44% wrongly assumed their provincial health plans would cover them, 36% believed their work benefits would suffice, and 25% were relying on their credit cards. This significant gap in understanding underscores the absolute necessity for dedicated health insurance for travelers to Canada. To delve deeper into these widespread false beliefs, you can explore the survey findings at TD Media Room.

Acknowledging these myths is the first step toward true financial preparedness. The only reliable shield against Canada's high medical costs is a standalone, comprehensive travel medical insurance policy designed specifically for your needs.

By recognizing these myths for what they are—dangerous financial shortcuts—you can make an informed decision to secure the kind of solid, dependable coverage that allows you to focus on your trip, not on a potential medical catastrophe.

Frequently Asked Questions

When arranging health insurance for a trip to Canada, specific, practical questions inevitably arise. Obtaining direct, accurate answers is the only way to make a prudent choice, complete your travel preparations, and ensure you are genuinely protected.

Here, we address the most common inquiries with the clarity you require.

How Much Health Insurance Coverage Should I Secure For Canada?

A single day in a Canadian hospital can easily cost thousands of dollars. An inadequate, low-coverage policy can be exhausted with shocking speed.

For genuine protection, you should seek a policy with a minimum of $500,000 CAD in medical coverage. This amount establishes a solid financial safeguard for the vast majority of medical emergencies one might encounter.

However, if you have pre-existing conditions, or if your itinerary includes adventure activities such as skiing or remote hiking, a policy of $1 million CAD or more is the more prudent choice. The objective is to possess coverage that is more than sufficient for a worst-case scenario. This strategy completely removes the risk of out-of-pocket payments for necessary medical care and guarantees you can access the best treatment without financial concern.

Can I Purchase Visitor Insurance After Arriving in Canada?

While some companies will technically sell a policy after you have landed in Canada, this is a high-risk strategy that we strongly advise against.

The reason is that policies purchased in-country almost invariably include a waiting period—typically 48 to 72 hours—before coverage for illnesses becomes effective.

Any health issue that arises before your policy officially commences is automatically classified as a pre-existing condition. Consequently, it will be entirely excluded from your coverage. This creates a dangerous gap in your protection at the very beginning of your trip.

The only method to ensure seamless, gap-free protection from the moment of your arrival is to secure your policy before you depart from your home country.

Does Visitor Insurance For Canada Cover Trips To The USA?

This is a critical detail to confirm. A standard "visitors to Canada" insurance policy will typically only cover medical emergencies that occur within Canada's borders.

If your travel itinerary includes any excursions to the United States or other countries, you must verify this with your insurance provider.

Many insurers offer a rider or an add-on to expand the geographic area of coverage, but this is never included automatically. As healthcare in the USA is significantly more expensive, coverage for travel there is almost always a separate, higher-priced feature.

Never assume your coverage extends beyond Canada without receiving explicit, written confirmation. To do so is to take a massive financial gamble you cannot afford to lose.

At Riviera Expat, we specialize in providing elite international private medical insurance solutions. We offer expert, objective guidance to ensure you select a policy that delivers the clarity, control, and confidence your global lifestyle demands. Learn more and get your complimentary consultation with Riviera Expat.