For any globally mobile professional or high-net-worth individual, your country of residence is far more than just a mailing address. It's the central pillar of your entire international life, the legal and financial anchor that defines your global footprint.

Defining Your Global Financial Hub

Consider it the single most critical decision you will make when managing an international lifestyle. Establishing your country of residence is not a mere administrative task; it's the strategic move that dictates your tax liabilities, governs your investment structures, and, most importantly, determines your access to premium services like International Private Medical Insurance (IPMI).

Getting this right from the outset provides control and predictability. It creates a stable base of operations, ensuring you are compliant while positioning you to manage your wealth effectively. Without a clearly defined residency, you operate without a clear framework, exposed to unexpected tax liabilities and dangerous gaps in your healthcare coverage.

Why Precision Matters

If you operate in major hubs like Singapore, Hong Kong, or London, any ambiguity in your residency status represents a significant liability. Tax authorities in these jurisdictions are experts at scrutinizing residency to determine their right to tax your income and assets. A simple misunderstanding of the rules can quickly escalate into serious financial penalties and legal complexities. This is not an area for approximation; a precise, proactive approach is absolutely essential.

Your country of residence directly determines:

- Tax Obligations: Which jurisdiction has the primary right to tax your worldwide income.

- Legal Framework: The laws that apply to your personal and business affairs, including inheritance.

- Insurance Eligibility: Whether you qualify for specific IPMI plans and how your premiums are calculated.

Your declared country of residence is the anchor for your global financial life. It dictates the rules of engagement for everything from taxation to personal health security, making it the most important declaration for any international professional.

This is not just about bureaucracy—it is about strategy. As you move between countries, you must understand the nuances. Each nation has its own set of rules, and what establishes you as a resident in one jurisdiction may not suffice in another. To gain insight into these differences, exploring specific country guides can provide crucial context for your planning. By carefully selecting and maintaining your country of residence, you build a solid foundation for all your international endeavors.

Residence, Domicile, and Tax Residency Unpacked

Ask any globally mobile executive about residence, domicile, and tax residency, and you will often hear the terms used interchangeably. This is a common error. In the precise world of international finance and law, however, these are three distinct concepts with enormous consequences.

Confusing them is not a minor slip-up; it is a costly error that can trigger unexpected tax liabilities, legal complications, and even dangerous gaps in your international health insurance.

To manage your global affairs with professional acumen, you need absolute clarity. Think of these statuses as different layers of your international identity. Each serves a unique purpose, and each is determined by a completely different set of rules. Mastering this distinction is the bedrock of intelligent strategic planning.

Country of Residence: The Center of Your Daily Life

Your country of residence is straightforward: it reflects your reality at present. It is the place you call home, where you live day-to-day, and where you have established your primary social and economic roots.

When it comes to your insurance, this is the single most important factor. Insurers rely heavily on your country of residence to calculate risk and set your premiums. Why? Because the cost of healthcare in Singapore is worlds apart from the cost in Thailand. Your residence dictates their financial exposure.

Tax Residency: Where You Are Liable for Tax

Here, the details become more technical. While it often aligns with your country of residence, tax residency is a distinct legal status. It identifies the country that has the legal authority to tax your income, whether it is earned locally or on the other side of the planet.

Most major hubs, like the UK or Hong Kong, have clear, quantitative tests. The most well-known is the "183-day rule." Spend more than that threshold in the country, and you could automatically become a tax resident, regardless of your intent. Governments also rely on formal documentation to cement this status; for a real-world example of how this is formalized, it's worth seeing how one obtains a Tax Residency Certificate UAE.

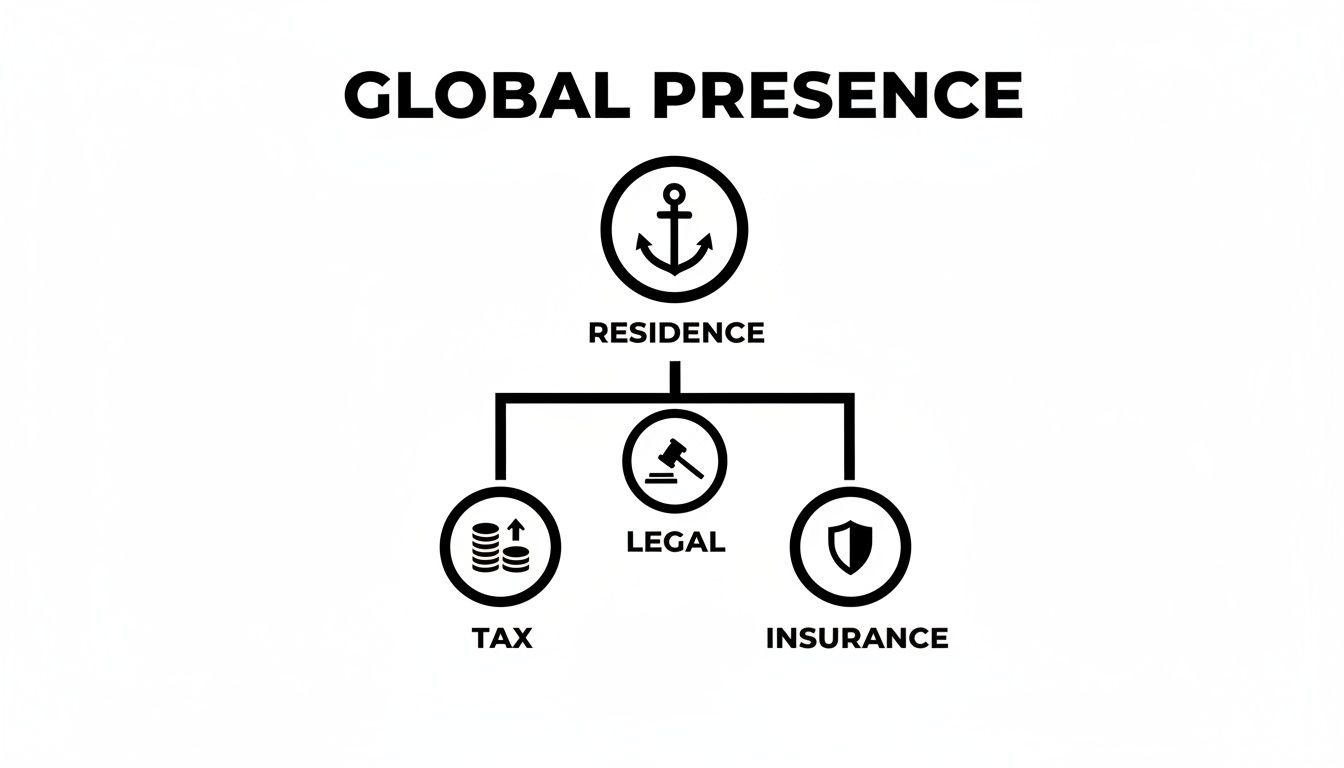

This diagram shows how your country of residence serves as the anchor for the other legal and financial pillars of your life.

As you can see, residence is the foundation, but it directly informs the separate—yet connected—frameworks for your tax and legal obligations.

Domicile: Your Ultimate Legal Home

Finally, we have domicile. This concept is more abstract and permanent. It is the country you consider your ultimate home, the place you intend to return to indefinitely. You can change your country of residence with every new assignment, but you generally only have one domicile at a time. For most people, it is acquired at birth from their father (a "domicile of origin").

While your residence can be as fluid as your travel schedule, your domicile is the legal and emotional anchor of your identity. It follows you around the world, influencing fundamental matters like inheritance and succession law, regardless of where you currently live.

Changing your domicile is not like updating your address. It is a major legal undertaking that requires you to prove an undeniable intention to sever ties with your old homeland and make a new country your permanent base. This concept is of paramount importance in areas like inheritance tax and estate planning. Given its weight and potential impact on your insurance, it’s vital to understand every term in your policy. Our guide explaining expat medical insurance policy terms offers more detail on this and other key definitions.

To provide further clarity, let's look at these three concepts side-by-side.

Residence vs Domicile vs Tax Residency Key Distinctions

This table breaks down the core differences between these critical legal statuses every international professional needs to understand.

| Concept | Primary Basis | Key Implication | Example Determinant |

|---|---|---|---|

| Country of Residence | Physical Presence & Daily Life | Insurance Premiums, Local Laws | Location of primary home, social ties |

| Tax Residency | Statutory Rules (e.g., days spent) | Income Tax Liability (Local or Worldwide) | Spending 183+ days in the country |

| Domicile | Intention & Permanent Home | Inheritance Tax, Succession Law | Place of birth, long-term intentions |

Understanding these distinctions is essential. It is the difference between a well-managed global lifestyle and one riddled with preventable risks.

Here is the bottom line:

- Residence: Where you live now.

- Tax Residency: Where you are liable for tax.

- Domicile: Where your permanent legal home is.

Failing to separate these in your mind can completely derail even the most carefully laid financial plans, exposing you to liabilities you never anticipated.

How Major Financial Hubs Define Your Residency Status

For anyone living and working internationally, determining your official country of residence is not just an administrative formality. It is a critical component of managing your wealth, taxes, and health.

Major financial hubs like the UK, Singapore, Hong Kong, Malaysia, and Thailand do not simply take your word for it. They each have their own rigorous tests to determine where you legally reside, and these rules go far beyond simply counting the days you spend in the country. They examine the real substance of your life—your personal and economic ties.

An error here can be costly. A wrong assumption could trigger a significant tax liability you never anticipated or, just as damaging, cause serious problems with your international health insurance policy right when you need it most. Let's break down how these economic powerhouses decide where you truly belong.

The United Kingdom: The Statutory Residence Test

The UK employs one of the most detailed and methodical systems in the world: the Statutory Residence Test (SRT). This is not a vague guideline; it's a multi-step legal test designed to provide a definitive answer on your UK residence status for any given tax year.

Think of it as a flowchart that guides you through a series of questions:

- The Automatic Overseas Test: First, it checks if you are automatically a non-resident. For example, if you were a UK resident recently but spent fewer than 16 days in the UK this year, you are conclusively non-resident.

- The Automatic UK Test: If you do not meet the first test, it checks if you are automatically a resident. Did you spend 183 or more days in the UK? Is your only home located in the UK? If so, you are resident.

- The Sufficient Ties Test: If your status remains undetermined, the SRT looks at your connections, or "ties," to the UK. This includes factors like having close family, accommodation, or substantive work here. It also considers whether you spent more than 90 days in the UK in either of the last two tax years. The more days you spend in the UK, the fewer of these ties are needed to be considered a resident.

The UK's Statutory Residence Test is a clinical, step-by-step process. It is built to eliminate grey areas, forcing a clear decision based on your physical presence and the real-world connections you maintain with the country.

Asian Hubs: Hong Kong and Singapore

While often grouped together, Hong Kong and Singapore have slightly different approaches to residency. Both rely heavily on the classic 183-day rule—if you are physically present in the country for 183 days or more in a year, you are almost always considered a resident for tax purposes.

However, it is not just about counting days. Both jurisdictions also consider whether you have a "place of abode." This is a more subjective measure. Do you have a permanent home there that is consistently available for your use? Owning or renting an apartment where you regularly stay can be a powerful indicator of residency, even if you fall just short of the 183-day mark. It is their way of preventing individuals from gaming the system while maintaining a solid operational base.

Malaysia and Thailand: A Focus on Days and Visas

In prominent financial centers like Malaysia and Thailand, residency status is often directly linked to your visa and the amount of time you spend in the country.

- Malaysia: The rule here is quite specific. Spend 182 days or more in Malaysia within a calendar year, and you are considered a tax resident. This is the primary pillar of their residency test.

- Thailand: The threshold is similar, set at 180 days in a calendar year. Cross that line, and you are generally treated as a resident for tax purposes.

Beyond the calendar, your immigration status is highly informative. Holding a long-term visa, such as the Malaysia My Second Home (MM2H) permit or a Thailand Elite Visa, sends a strong signal to the authorities. These programs are designed to attract long-term residents, and tax officials view them as a clear sign of your intent to establish roots.

To see a strong European example of how formal permits solidify your legal status, the Dutch residence permit process offers a clear parallel on how residency is formally established.

Ultimately, each of these countries has built a precise system to define what "country of residence" truly means. They leave little room for ambiguity, requiring you to be strategic about where you spend your time and where you build your life. Achieving this clarity is essential for remaining compliant with tax authorities and ensuring your international health insurance remains valid.

Why Your Residence Status Governs Your International Health Insurance

When you are a globally mobile professional, your declared country of residence is the single most important factor in your International Private Medical Insurance (IPMI) policy. Consider it not as a minor detail on an application form, but as the central anchor that determines the cost, scope, and ultimately, the effectiveness of your health coverage.

Getting this right is fundamental to ensuring your policy is a dependable asset, ready to protect your health no matter where your engagements take you.

The connection is all about risk and cost. At their core, insurers are underwriters of risk. In healthcare, the largest variable by a significant margin is the local cost of medical treatment. Your country of residence provides them with a clear benchmark for what it will cost to secure top-tier medical care for you.

This is not a niche concern; the number of individuals living this lifestyle is substantial. The global expat population is estimated to be around 66.2 million as of 2023, with many being high-net-worth individuals and finance professionals moving between global hubs. For this demographic, securing the correct residence arrangements is a critical piece of the relocation puzzle.

How Residence Dictates Your Premiums

The most immediate and obvious impact of your residency is on your policy's premium. Healthcare costs vary dramatically from one country to the next, and insurers price their plans to reflect that reality. A policy based in a high-cost country will always be more expensive than one based in a more affordable market.

Here is a practical example to illustrate the point:

- Singapore: A global hub known for its world-class—but exceptionally expensive—private medical facilities. Declaring Singapore as your residence will place you in a high-premium bracket.

- Thailand: While it also offers excellent private healthcare, the costs are significantly lower than in Singapore. Residency here means a substantially more affordable premium for comparable coverage.

Insurers do not guess at this; they maintain incredibly detailed data on medical costs by country, tracking everything from a routine consultation to complex cardiac surgery. This data feeds directly into the pricing models for every single policy they issue.

For an insurer, the meaning of 'country of residence' is simple: it is the primary indicator of their financial risk. Your location sets the baseline for potential claim costs, making it the most significant factor in calculating what you will pay.

Shaping Your Area of Coverage and Eligibility

Beyond just the price tag, your residence status dictates the geographic scope of your coverage and can even determine your eligibility for certain plans in the first place. Many IPMI policies are structured around specific regions to keep costs manageable for the entire portfolio of insured clients.

A classic example of this is the inclusion or exclusion of high-cost zones, with the USA being the most prominent. Because of its exceptionally high medical expenses, many international health plans offer an option that excludes coverage in the USA to keep premiums from escalating.

Your declared residence influences this in two key ways:

- Plan Availability: Certain plans, especially those that exclude US coverage, might only be offered to residents of specific countries where those plans are most relevant.

- Coverage Boundaries: Your policy will always define a primary "area of coverage." While these plans are global in nature, your country of residence acts as the home base from which your worldwide protection is constructed.

Proving Your Residence Status

Do not be surprised when insurers wish to verify that your declared country of residence is accurate. This occurs both when you first apply and, more importantly, when you file a significant claim. This is not about mistrust; it is a necessary step to ensure the policy is priced and structured correctly according to the terms to which you both agreed.

To prove your status, you will need to provide clear documentation. This simple step ensures there are no ambiguous areas that could complicate a future claim when you least need the difficulty.

You should be prepared to supply copies of documents such as:

- A valid long-term visa or residence permit.

- A formal lease agreement for a residential property.

- Recent utility bills (electricity, water, internet) with your name and address on them.

Keeping these documents in order is not just a bureaucratic chore. It is a vital part of ensuring your policy remains a robust and reliable financial shield. Ultimately, aligning your declared residence with your legal and physical reality is the key to a seamless and secure healthcare experience as a global professional.

Common Residency Challenges for Global Citizens

The highly mobile lifestyle of a successful global citizen—defined by frequent international travel, multiple properties, and complex business interests—often creates a tangled web of residency questions. These are not just administrative headaches; they are sophisticated challenges that can carry staggering financial and legal consequences. Mismanaging this is not an option.

For individuals who live and work across borders, the traditional notion of a single, fixed home simply does not apply. You might have your family home in Singapore, a summer villa in the south of France, and an apartment in London for business, spending significant time in all three. This fluid reality is precisely what blurs the lines of your legal and financial obligations.

The Problem of Multiple Jurisdictions

One of the most common traps is spending considerable time in several countries without meeting the classic 183-day threshold in any single one. This situation immediately places you into a legal grey area.

Imagine you spend 120 days in Hong Kong for business, 100 in the UK overseeing investments, and 80 in Malaysia with family. Which country has the primary right to tax you?

Tax authorities are experts at dissecting these scenarios. They have moved far beyond simply counting days on a calendar and now apply qualitative tests to determine where you truly belong. The most critical concept here is the "center of vital interests." This test cuts through the complexity to determine where your personal and economic ties are strongest.

To make this determination, authorities will ask questions like:

- Where is your primary family home? The one to which you always return?

- Which country is the hub for your most significant business and financial assets?

- Where do you keep your most important personal belongings?

- Where are your club memberships, and where does your primary social life take place?

A poorly defined residency status can lead to disastrous outcomes, most notably dual taxation, where two or more countries claim the right to tax your entire worldwide income. It can also completely invalidate an IPMI claim if your declared country of residence does not match the reality of your lifestyle.

When your life spans multiple countries, ambiguity is your greatest financial risk. Proactive management of your residency status, supported by expert counsel, is not a luxury—it is an absolute necessity for legal certainty and wealth preservation.

Navigating Complex Scenarios

The scale of this issue is enormous. Consider the United States as an example. As of 2024, it is estimated that millions of American expats are living overseas. Furthermore, a recent survey found that a significant percentage of Americans are actively considering moving abroad to places like Canada, Italy, and England. These numbers indicate a massive trend towards global mobility, which inevitably creates complex residency questions. You can explore more about these trends to understand American expat movements.

Let’s consider a discreet but all-too-common scenario to see the risks in action. An investment banker officially resides in low-tax Singapore. However, he spends over 150 days a year in London for business and maintains a serviced apartment there. The UK’s tax authority, HMRC, could easily argue that his economic ties to London are substantial enough to establish UK tax residency. Suddenly, he is facing an unexpected—and massive—tax liability on his global earnings.

The Imperative of Proactive Management

These examples all point to one critical truth: defining your country of residence is not something you can afford to leave to chance. It requires careful, strategic planning to ensure your legal, tax, and insurance frameworks are perfectly aligned and watertight.

The focus must always be on proactive risk management. This involves:

- Meticulous Record-Keeping: Documenting every single travel day and the time you spend in each jurisdiction is non-negotiable.

- Strategic Structuring: Purposefully aligning your personal and business affairs to establish one clear, primary center of interest.

- Expert Consultation: Engaging legal and tax advisors who specialize in international residency for high-net-worth individuals.

Ultimately, structuring your life with this level of precision provides the legal and financial certainty you require. It allows you to enjoy the incredible benefits of a global lifestyle without the hidden, and potentially devastating, risks.

Your Top Questions on Residency and IPMI, Answered

To conclude, let's address the most common questions our clients ask when aligning their international health insurance with a life lived across borders.

What Happens to My IPMI Policy if I Relocate?

Think of a premium IPMI policy as a mobile asset—it is designed to move with you. However, you have a contractual obligation to inform your insurer of your new country of residence before you relocate.

Once you notify them, they will reassess your premium. This is a simple adjustment based on the healthcare costs in your new home base, ensuring your coverage is priced correctly for the local environment. You will then receive an updated certificate of insurance reflecting the change.

Allow me to be direct: failing to inform your insurer that you have moved is a critical error. They may view it as non-disclosure, which could give them the right to deny a claim or, in a worst-case scenario, void your entire policy.

How Is My Residence Determined if I Split Time Between Countries?

Living between two or more countries is common, but for insurance purposes, you must establish a primary base. You must declare one location as your primary country of residence, and this cannot be an arbitrary choice—it needs to be the place where you have the most significant ties.

This usually comes down to practical factors like where your main home is located, where your business is registered, or where your family primarily lives. Your entire premium and the terms of your coverage are based on this declaration, so it is vital to ensure it aligns with your tax and legal status. Consistency is paramount.

What Proof of Residence Do Insurers Require?

Do not be surprised if your insurer requests proof of where you live. This is a standard verification, especially when you first apply or if you file a particularly large claim. It is simply their way of performing due diligence to prevent fraud and confirm the policy terms are being met.

You should be prepared to provide clear, current documents. The most commonly requested items include:

- A valid long-term visa or a residence permit.

- A formal rental agreement or property deed in your name.

- Recent utility bills addressed to you at your declared residence.

Keeping these records organized is a simple habit that can save you significant complications and ensure the claims process runs smoothly.

At Riviera Expat, we provide the expert guidance needed to perfectly align your international health insurance with your residency status, ensuring seamless and reliable global coverage. Get a free IPMI quote and consultation today.