For global citizens, a cancer diagnosis presents a unique set of challenges. It is not merely a medical battle; it is a direct threat to your financial security and the sophisticated lifestyle you have established abroad. The unfortunate reality is that standard health insurance policies often contain significant gaps, failing to provide for world-class care and the freedom to choose it precisely when you need it most.

This guide will demonstrate why specialized cancer treatment insurance coverage is not simply another line item in your budget. It is an essential component of a robust strategy to shield your assets and guarantee access to the world's preeminent medical minds and facilities.

Protecting Your Health and Legacy Abroad

As a high-net-worth professional living and working internationally, you understand that a sophisticated financial plan is the bedrock of your lifestyle. It protects your investments, grows your wealth, and secures your family's future. However, a critical component is often overlooked: a health strategy resilient enough to withstand the immense pressure of a serious illness like cancer.

Your standard domestic or even a basic international health plan can prove dangerously inadequate when confronting a complex diagnosis. These policies are notorious for restrictive sub-limits on cancer care, outright exclusions for groundbreaking (and costly) treatments, and virtually no support for the significant non-medical costs associated with seeking premier care, wherever that may be.

This discrepancy between what your standard policy covers and what premier cancer care actually costs is where your personal wealth becomes exposed. A purpose-built cancer insurance policy acts as a financial firewall. It is engineered to shoulder the extraordinary costs of treatment so your life's savings and investments remain intact.

Ultimately, this dedicated coverage restores control and choice. It ensures your medical decisions are driven by what is best for your health, not by the limitations of your policy.

The Growing Need for Specialized Coverage

The demand for this caliber of specialized cancer insurance is not speculative; it is a clear global trend. We are witnessing a convergence of skyrocketing healthcare costs and rising cancer incidence rates, which is driving significant growth in the market.

The global cancer insurance market, valued at approximately USD 82.01 billion in 2023, is projected to reach nearly USD 159.27 billion by 2033. This reflects a compound annual growth rate of 6.86%, highlighting how many discerning individuals are recognizing this financial necessity.

This growth illustrates a crucial point: relying on a conventional insurance plan is an increasingly precarious strategy, especially for those who will not compromise on achieving the best possible outcome without financial devastation.

Securing Your Financial Future

A truly comprehensive protection plan must look beyond immediate healthcare needs. The same astute foresight you apply to your investment portfolio must be directed toward safeguarding your health and legacy against unforeseen events. It is about creating a financial structure that can weather any challenge.

While a robust insurance plan manages the immediate costs, protecting your family’s future security requires a broader financial strategy. For a deeper analysis of protecting your assets for the long term, our guide on Estate Planning 101 is an excellent starting point. Ensuring your entire financial house is in order provides the confidence to focus entirely on your health.

Understanding Premium Cancer Insurance Policies

Before you can select the right cancer insurance, you must understand what distinguishes a truly premium policy from a standard one. This is not about basic health insurance. We are discussing a highly specialized financial instrument engineered for a worst-case scenario.

Consider it less like a simple health plan and more like a private security detail for your well-being. A superior policy extends far beyond vague promises. Its true value is measured by its ability to eliminate the financial barriers between you and the absolute best medical outcome, regardless of its global location.

This requires cutting through dense policy jargon to identify the practical, real-world benefits that will protect both your health and your wealth.

The Foundation: High Lifetime Limits

The bedrock of any elite cancer policy is its lifetime limit, or benefit cap. A standard plan might offer a limit that seems substantial at first glance, but the staggering cost of advanced oncology can exhaust it with alarming speed. For instance, a USD 1 million limit can be easily depleted by a multi-year treatment protocol at a top cancer center in the U.S. or Europe.

This is why executive-level policies commence with much higher limits, often USD 5 million or more. Some premier policies even offer completely unlimited coverage. This is not a luxury; it is a non-negotiable feature that ensures your treatment strategy is never dictated by financial constraints.

An exceptionally high or unlimited benefit cap is the defining feature that separates adequate coverage from executive-level protection. It provides the certainty that no matter how complex or protracted your treatment becomes, your financial resources are secure.

Coverage for Advanced and Experimental Treatments

The field of cancer therapy is advancing at an incredible pace. Treatments that were theoretical a few years ago are now becoming the new standard of care, and a premium insurance policy must keep pace. This is where the fine print of your cancer treatment insurance coverage truly matters.

A top-tier policy will explicitly cover the types of treatments that basic plans almost invariably exclude. This includes:

- Immunotherapies: These revolutionary therapies utilize the body's own immune system to attack cancer. They are incredibly effective but can cost hundreds of thousands of dollars annually.

- Gene Therapies and CAR T-cell Therapy: These are genuine game-changers, genetically modifying cells to target cancer. Their complexity is matched by their price tag.

- Proton Therapy: A far more precise form of radiation that spares healthy tissue. It is often the preferred method but is frequently denied by standard insurers due to its higher cost.

- Clinical Trials: Access to a clinical trial can be a lifeline. The best policies provide coverage for approved trials that offer access to the next generation of promising treatments.

These policies are not just designed to pay for established procedures. They are built to fund medical progress.

Beyond Medical Bills: Essential Non-Medical Provisions

A cancer diagnosis creates a ripple effect of costs that extend far beyond hospital bills. The logistical and personal expenses of seeking world-class care can be immense, especially for an expatriate. A truly premium policy understands this reality.

These vital, non-medical benefits are what make a policy genuinely comprehensive. They often include:

- International Travel and Accommodation: This covers the cost of flights and lodging for both you and a companion when your optimal treatment is in another country.

- Private Nursing Care: This ensures you have professional, discreet support in the comfort of your own home during recovery.

- Medical Evacuation: If you are diagnosed in a location lacking top-tier oncology facilities, this covers the cost of transporting you to a recognized center of excellence.

These provisions are designed to eliminate logistical friction and stress. They allow you to focus 100% of your energy on recovery, without disrupting the life you have worked so diligently to build.

Comparing Insurance Models for Global Lifestyles

When you are accustomed to making strategic financial decisions, selecting the appropriate insurance framework for your health should be no different. The market for cancer coverage is not a one-size-fits-all affair; it is divided into distinct models, and your choice has significant implications for your global lifestyle, your finances, and your peace of mind. Making the correct choice is about maintaining control and confidence, regardless of circumstance.

Your primary choice boils down to two paths: a dedicated, standalone cancer plan or a comprehensive international health insurance policy that includes a high limit for cancer care. Each is built on a different philosophy. One is a specialized tool for a specific, catastrophic event. The other is a broad, all-encompassing shield for your general health.

The Standalone Critical Illness Plan

A standalone cancer plan, typically a form of critical illness policy, operates on a very straightforward premise. Upon a confirmed diagnosis for a cancer covered by the policy, it pays you a pre-determined, tax-free lump sum of cash. The strength of this model lies in its speed and flexibility.

Consider it a private liquidity event triggered by a health crisis. The funds are yours to use without restriction. You can allocate them for any purpose—not just direct medical bills. This could include:

- Replacing lost income while you undergo treatment and are unable to work.

- Making lifestyle adjustments, such as engaging a caregiver or adapting your residence.

- Traveling for a second opinion or to be closer to family for support.

- Paying down debt to alleviate financial pressure during a stressful period.

This approach provides a powerful cash infusion precisely when you need financial latitude the most. However, it has a clear limitation: the benefit is finite. Once the lump sum is disbursed, the policy has fulfilled its purpose, even if your total treatment costs far exceed the payout.

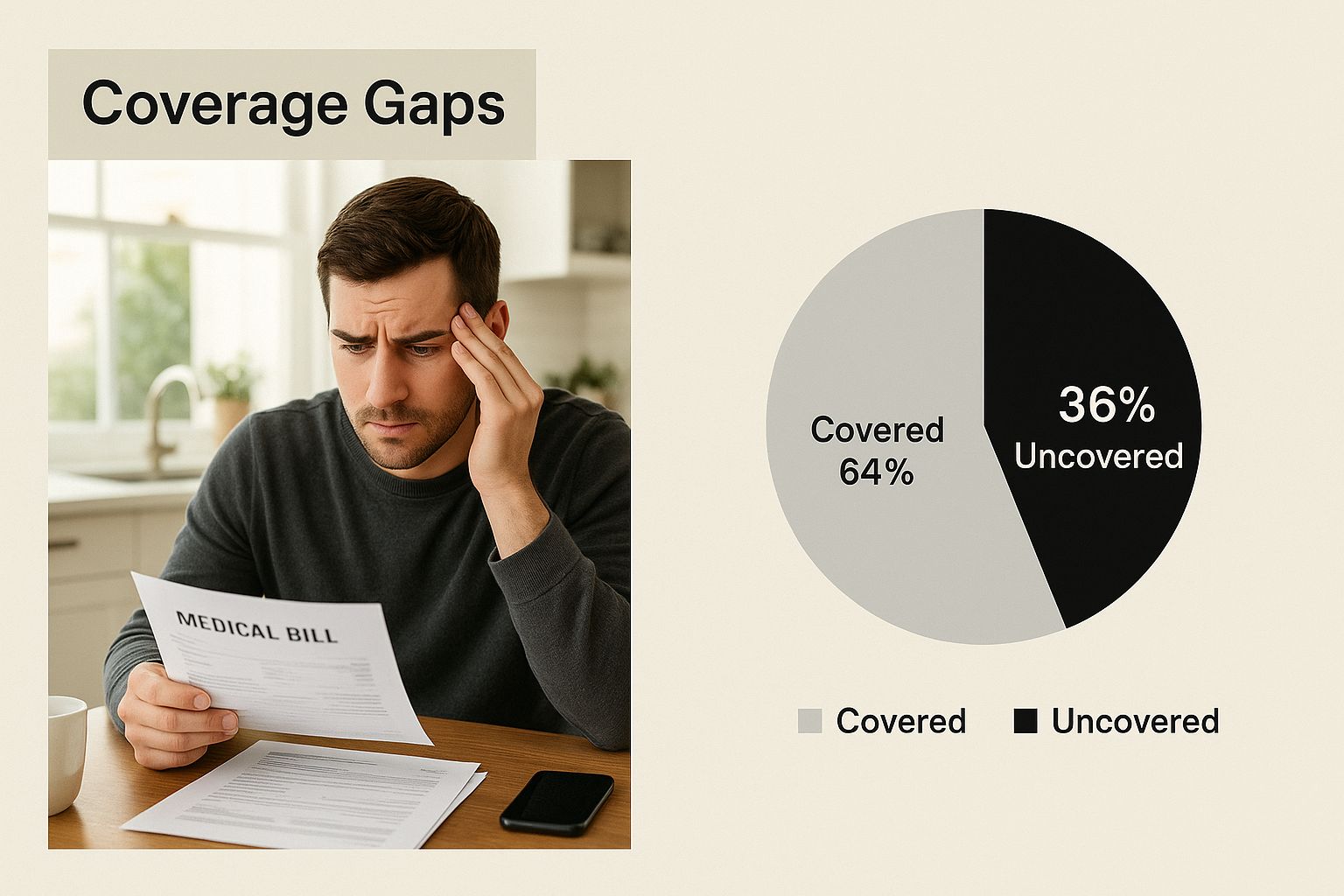

The image below starkly illustrates a common fear: discovering that your policy has massive coverage gaps just as the bills for extensive treatment begin to accumulate.

This underscores the vital importance of selecting a model where the benefits can keep pace with the potential multi-year costs of modern cancer care.

Comprehensive International Health Insurance

Conversely, a comprehensive international health insurance (IPMI) plan with a high cancer limit functions more like the insurance you are likely familiar with, but on a global scale. Instead of a single large payout, it directly pays for your approved medical services as you receive them, up to a very high annual or lifetime limit—often USD 5 million or more.

This model is designed for direct payment, granting you seamless access to a global network of premier hospitals and cancer specialists. The insurer liaises directly with the hospital on billing, removing a significant administrative burden when your focus must be on your health. Its greatest advantage is providing sustained, long-term coverage for ongoing treatments that can easily span several years and involve therapies costing hundreds of thousands annually.

The true value of a premium IPMI plan is its endurance. It is built to withstand the financial marathon of a complex cancer journey, ensuring you have continuous access to care without the fear of a one-time benefit being exhausted.

A Head-to-Head Comparison

To clarify the strategic choice, let's compare these two models side-by-side. Your personal circumstances, frequency of travel, and overall financial strategy will ultimately determine which is more suitable for you. To explore this further, our guide on choosing the right expat medical insurance is an excellent next step.

Comparing Cancer Coverage Models for Global Citizens

This table contrasts the key features of standalone cancer plans versus comprehensive international health insurance to guide your selection.

| Feature | Standalone Cancer Plan | Comprehensive International Health Plan (with High Cancer Limit) |

|---|---|---|

| Payment Method | One-time, tax-free lump sum upon diagnosis. | Direct payment to medical providers for incurred costs. |

| Use of Funds | Unrestricted; can be used for any purpose. | Restricted to eligible medical and related expenses. |

| Coverage Duration | Benefit is finite; paid once per qualifying event. | Ongoing coverage for treatment, up to high policy limits. |

| Best For | Individuals seeking financial flexibility and income protection. | Individuals wanting direct, long-term payment for global medical care. |

| Global Portability | Excellent. The diagnosis triggers payment anywhere. | Excellent. Provides access to a global network of facilities. |

Ultimately, this is not just about insuring against cancer; it is about aligning your health security with the life you have diligently built. Whether you value a flexible cash infusion or sustained, direct-billed medical support, the right choice is the one that best protects your peace of mind and your financial well-being.

Navigating the Financial Realities of Advanced Cancer Care

Access to the world’s premier cancer hospitals comes with a commensurate price tag. Confronting this financial reality is a critical part of building a resilient health strategy, because the costs of premier oncology can quickly overwhelm even the most generous standard insurance plans.

When you examine the numbers, it becomes evident why specialized cancer insurance is not a luxury—it is an absolute necessity for preserving your financial integrity.

The figures are sobering. The most advanced therapies, essential for treating complex or aggressive cancers, are incredibly expensive. A single course of immunotherapy or targeted gene therapy can easily surpass USD 200,000, and many treatment protocols require multiple courses over several years. This is before factoring in all the associated expenses.

These ancillary costs, while not the treatment itself, accumulate rapidly and significantly increase the total financial burden. They typically include:

- Elite Consultation Fees: Securing an appointment with a world-renowned oncologist can cost thousands of dollars.

- Advanced Diagnostics: PET scans, genomic sequencing, and liquid biopsies are crucial for creating a personalized treatment plan, but standard insurance often provides poor coverage for them.

- Supportive Care: This encompasses everything from specialized nutrition and physiotherapy to private nursing—all vital for maintaining quality of life during a rigorous treatment regimen.

The Escalating Costs in a Real-World Scenario

To gain a tangible sense of how quickly these expenses can spiral, let's consider a realistic scenario. Imagine an executive diagnosed with a complex cancer who elects to receive treatment at a top Center of Excellence in the United States.

The initial bill might look something like this:

- Initial Consultation & Diagnostics: USD 30,000

- First Year of Immunotherapy: USD 250,000

- Supportive Care & Medications: USD 40,000

- Travel & Accommodation (for patient and companion): USD 25,000

In the first year alone, the total cost can soar past USD 345,000. If the treatment needs to continue into a second or third year—which is quite common—the total bill can easily approach or exceed USD 1 million. This is precisely why a standard insurance cap is so dangerously inadequate.

When your coverage is insufficient, you are forced to make compromises. It might mean choosing a less effective treatment, delaying care, or even liquidating assets you had designated for your family's future. A premium policy with an exceptionally high or unlimited benefit cap is designed to prevent this exact nightmare scenario.

The Data Behind High-Cost Cancer Care

This is not merely a collection of anecdotes; it is a well-documented financial pressure point in the healthcare system. The evidence is clear: the average out-of-pocket cost for cancer patients in the U.S. can exceed USD 1,000 per month, even with insurance.

Furthermore, privately insured patients are significantly more likely to receive guideline-recommended treatments compared to those with less comprehensive coverage. It is a stark reminder of how directly insurance impacts the quality of care one can access. You can see more on these unrivaled U.S. cancer care costs on americanactionforum.org.

As you navigate these financial waters, it is also vital to stay abreast of medical progress, since new therapies affect both potential outcomes and costs. For example, understanding the latest breakthroughs in breast cancer treatment options provides the context needed for productive conversations with your oncologist and insurance advisor.

Ultimately, a premium policy is built to absorb these massive costs, acting as a financial shield that allows you to focus on one thing: getting the best possible care without hesitation.

The Devil is in the Details: Policy Exclusions and Underwriting

On the surface, a premium insurance policy appears bulletproof. It is the fine print, however, that reveals its true strength. The clauses hidden within the exclusions and underwriting sections are where a top-tier plan either holds firm or crumbles under pressure. For high-net-worth individuals living abroad, scrutinizing these details is not just due diligence—it is the only way to secure protection that actually performs.

The real value of your cancer treatment insurance is defined by what it does not exclude. Even the most expensive policies have limitations. Understanding them upfront is what prevents unwelcome surprises when you need to make a claim. Your most powerful tool here is complete transparency during the application process.

Common Exclusions and Waiting Periods You Cannot Ignore

Every policy has a list of situations and treatments it will not cover. Some are standard across the industry, but others can create devastating roadblocks to your care. You must identify these potential pitfalls before committing.

Common areas of exclusion or limitation include:

- Pre-Existing Conditions: This is the most significant. Any health issue you had before your policy's inception could be excluded for a set period—or even permanently. Full, honest disclosure is not just advisable; it is non-negotiable.

- Specific Waiting Periods: Many policies will not cover cancer until you have been insured for a specific duration, often 12-24 months. If you are diagnosed within that window, you are solely responsible for treatment costs.

- Experimental or "Off-Label" Therapies: This is a considerable gray area. A therapy might be the standard of care in a leading German clinic but considered "experimental" by your insurer. For example, Hyperbaric Oxygen Therapy (HBOT) is often used to heal tissue damage from radiation, but securing coverage can be a challenge unless it is for an explicitly FDA-approved, "on-label" use.

The best policies are not defined by what they cover, but by how few—and how clear—their exclusions are. The objective is to find a plan where your oncologist, not an insurance administrator, guides your treatment decisions.

Why Underwriting Is So Critical

Underwriting is the insurer's process of vetting you. They investigate your health history to evaluate their risk and determine whether to offer you a policy and at what premium. For anyone with a complex medical past or who has resided in multiple countries, this stage is paramount.

Failure to disclose something—even a minor health event from years ago—can provide an insurer with the legal grounds to cancel your policy and deny a claim. This is known as rescission, and it is a worst-case scenario. It is also why working with a specialized broker is so vital. They know precisely how to guide you through the disclosure process, ensuring your application is airtight and fortified against future challenges. For a deeper analysis of this, you can read our guide on navigating medical conditions and policy exclusions.

Securing a Policy That Actually Works

Your mission is to find a policy with maximum flexibility and minimal bureaucracy. This demands a proactive approach. Do not just glance at the summary of benefits; request the full policy wording and review the exclusion clauses with your advisor.

Pay close attention to the definitions. How does the policy define "experimental," "medically necessary," or "pre-existing"? Vague language creates loopholes that can be used to your detriment. A truly superior policy uses precise, transparent definitions that protect your access to the widest possible range of treatments, ensuring your financial shield remains impenetrable when it counts.

Selecting the Right Cancer Coverage for Your Future

Choosing your cancer treatment insurance is not merely another item on a financial checklist. It is a foundational decision for your future, a strategic move that requires the same level of diligence you would apply to a major investment. The objective is not just to purchase a policy, but to secure a powerful asset that stands ready to protect you.

Consider this: you are not just a consumer buying a product. You are a strategic partner engaging with an insurer from a position of strength and knowledge. This guide will walk you through evaluating providers, dissecting policy language, and making a choice that aligns perfectly with your life. The right plan delivers more than money; it delivers access, options, and genuine peace of mind.

A Practical Framework for Your Decision

Making the right choice demands a structured approach. You are performing due diligence on a critical component of your personal risk management strategy. This is not about finding the cheapest plan, but the most robust and reliable one for your specific needs.

Your evaluation should be based on three pillars:

-

Provider Reputation and Global Reach: How has the insurer handled high-value cancer claims in the past? Do they have a proven track record of paying without contention? Investigate their network of hospitals and specialists. Does it include the world-renowned centers of excellence you would want to access?

-

Policy Terms and Flexibility: Look far beyond the headline benefit amount. You must scrutinize the fine print. How do they define "medically necessary"? What are the waiting periods? How straightforward is it to get approval for new, advanced treatments? The best policies use clear, unambiguous language that will not bog you down in administrative hurdles.

-

Alignment with Your Lifestyle: How does the policy fit your life as a global citizen? Will it cover medical evacuation from a remote location? Does it include provisions for a companion to travel with you during treatment? These are the details that distinguish a merely good policy from a truly great one.

The real test of a cancer insurance policy is its performance under pressure. Your selection process must be rigorous, focused on one objective: securing a plan that guarantees uncompromising access to the best care, irrespective of cost or location, thereby protecting both your health and your wealth.

The Growing Importance of a Strategic Choice

The need for this level of scrutiny is more critical than ever, and market trends corroborate this. The global cancer insurance market, valued at USD 82.01 billion in 2023, is on a trajectory to hit USD 159.27 billion by 2033. This growth is not just a number; it reflects a widespread understanding of the staggering financial risk that modern cancer care represents.

More options are entering the market, which presents both an opportunity and a challenge. It creates more choice but also more complexity. Making a deliberate, informed decision is your best defense against acquiring a policy that looks good on paper but fails when it truly matters.

The Long-Term Value of a Premium Policy

Investing in a premium policy is, at its core, an investment in certainty. It is about ensuring a health crisis does not spiral into a financial catastrophe, allowing you to concentrate all your energy on what is most important: recovery. The value extends far beyond simply paying medical bills; it is about maintaining control over your life, your choices, and your legacy.

To fully grasp how these specialized plans function, it helps to understand the full range of their advantages. You can uncover more details about the benefits of international private medical insurance to see how every feature is engineered to support a global lifestyle. Ultimately, the right cancer treatment insurance coverage is your guarantee that you can face any health challenge with confidence, protected by a financial shield as resilient and sophisticated as your own financial portfolio.

Frequently Asked Questions About Expat Cancer Insurance

When considering a financial instrument as specific as cancer insurance, many questions arise. For high-net-worth expatriates, obtaining precise answers is not a preference—it is essential for protecting both your health and your financial stability.

Let's cut through the jargon and address what truly matters. Here are some of the most common questions we hear about premier cancer treatment insurance coverage.

Can I Use My Policy Anywhere In The World?

Absolutely. In fact, true global portability is the core principle of a premium expat cancer plan. These policies are not merely adapted domestic plans; they are engineered from the ground up for a life without borders.

This means your coverage is as mobile as you are. A standard domestic plan is tethered to one country's network of hospitals. A top-tier international plan empowers you to seek out the best. You can consult a world-renowned specialist in Germany, a leading cancer center in the United States, or even return to your home country for care—all under the same policy. Your medical decisions should be driven by the best available care, not by lines on a map.

One critical detail to examine is the policy’s definition of "centers of excellence." The best plans do not just permit you to go to these top-tier institutions; they actively encourage and fully cover treatment there. It is a sign that the insurer is focused on outcomes, not just cost containment.

Does This Insurance Cover New AI-Driven Diagnostics or Treatments?

This is where a premium plan truly demonstrates its value. The best cancer insurance policies are designed to keep pace with medical science, not lag five years behind it. That means covering emerging therapies, including those powered by artificial intelligence, is a core feature.

AI is already transforming oncology, from predicting cancer risk with stunning accuracy to identifying minute tumor cells on a scan that a human eye might miss. Some algorithms can analyze massive patient datasets to forecast how you will respond to a certain drug or even design a personalized treatment based on your unique genetic profile. A forward-thinking policy will cover these data-driven tools.

However, this is where you must perform your due diligence. Look closely at the policy's definition of "medically necessary." You want a plan that recognizes treatments that are becoming the standard of care in top cancer centers, even if they do not yet have decades of historical data.

How Does This Policy Work With My Existing Health Insurance?

This is a key point of confusion for many. A specialized cancer plan does not replace your main international health insurance—it works in partnership with it.

Think of it as a strategic overlay. Your general health plan is for the day-to-day: check-ups, prescriptions for a common illness, or a minor injury. It is your workhorse policy.

The specialized cancer policy lies dormant until the moment of a cancer diagnosis. Then, it springs into action, covering the massive costs associated with oncology that would exhaust the annual limits of a standard health plan. This two-policy structure creates a financial firewall, ensuring you have robust coverage for everyday needs without ever compromising on the high-limit, specialized protection a serious illness demands. It's an integrated shield with no gaps in your cancer treatment insurance coverage.

At Riviera Expat, we provide the clarity and expertise needed to select the ideal international health insurance for your circumstances. We specialize in serving financial professionals in global hubs, offering a white-glove service that demystifies complex policy choices. Secure your health and financial future with confidence by exploring your options with us at https://riviera-expat.com.