Let's be clear: true 'insurance for visitors' isn't a souped-up version of the travel coverage you get with your credit card. For senior executives and high-net-worth individuals operating in global financial hubs, it’s a critical financial instrument.

Think of it this way. Basic travel insurance is like having a spare tire—great for small, predictable problems. But specialized visitor insurance? That’s a comprehensive vehicle replacement and roadside assistance plan, engineered for the significant, complex scenarios you might actually face.

Understanding Insurance for Visitors in Global Mobility

For the globally mobile professional, crossing borders for business deals, board meetings, or even family visits is a routine matter. What cannot be routine, however, is your approach to protecting your health and wealth while abroad.

Standard travel policies, often an afterthought bundled with a flight booking, are designed for the mass market. They fall critically short when you’re dealing with the realities of premium healthcare systems in major international cities.

This is precisely where insurance for visitors fills the gap. Its sole purpose is to provide robust, high-limit medical and emergency coverage for non-residents during their stay. We're not discussing coverage for a lost suitcase or a cancelled flight; we’re talking about securing immediate access to world-class medical care without facing catastrophic financial repercussions.

The Financial Imperative for Specialized Coverage

In premier financial centers like Singapore, London, or Hong Kong, the cost of top-tier medical care is substantial. A minor incident requiring a one- or two-day stay in a private hospital can easily result in a five-figure bill. A more serious medical event could surpass six figures without difficulty.

Proper visitor insurance acts as a financial firewall. It ensures that an unexpected health crisis does not derail your personal financial strategy or your company's balance sheet.

The market data confirms the importance of this protection. The global travel insurance market, which includes this specialized insurance for visitors, was valued at USD 21.1 billion in 2022. It is projected to expand significantly. Single-trip policies, the type often utilized by short-stay business travelers, accounted for over 60% of the market share. You can read the full research about the travel insurance market to grasp its scale.

For the discerning professional, visitor insurance is not merely a travel accessory but a non-negotiable component of international risk management. It provides the confidence to operate globally, knowing that a premier standard of care is accessible and financially secured, no matter where your business takes you.

This type of coverage is indispensable for several key reasons:

- Access to Premier Healthcare: It facilitates entry into the best private hospitals and clinics without administrative or financial delays.

- Financial Protection: It shields your personal and business assets from the significant cost of overseas medical bills.

- Peace of Mind: It allows you to focus on your objectives, whether closing a deal or visiting family, knowing a robust safety net is firmly in place.

Ultimately, this specialized insurance provides what every global professional needs most: control and certainty in an unpredictable environment.

Visitor Insurance Compared to Other Coverage Types

To quickly see where visitor insurance fits, it helps to compare it against the other types of plans you've likely encountered. Each is designed for a very different purpose.

| Coverage Type | Primary Purpose | Typical Duration | Ideal User Profile |

|---|---|---|---|

| Visitor Insurance | High-limit medical & emergency coverage in a single foreign country. | Days to several months. | Business travelers, family visitors, tourists on extended trips. |

| Standard Travel Insurance | Trip cancellation, lost luggage, and basic emergency medical. | Duration of a single trip. | Vacationers and casual travelers. |

| International Health Insurance (IPMI) | Comprehensive, long-term health coverage across multiple countries. | 1 year or more. | Expatriates, long-term assignees, global nomads. |

This table makes the distinction clear. While travel insurance handles trip logistics and IPMI provides long-term health benefits, visitor insurance is laser-focused on providing serious medical protection for the duration of your stay in a specific country.

Core Medical Protections in a Premium Policy

When evaluating a premium insurance for visitors plan, the entire mindset must shift. This is not about covering a lost suitcase; it's about securing a financial and logistical safety net that guarantees access to world-class medical care, no matter what happens.

For a discerning individual, the policy is not just a travel document. It is the non-negotiable guarantee that your health is the priority.

The fundamental promise of any truly elite policy is straightforward: to cover emergency medical treatments without compromise. This means everything from the initial consultation with a top specialist to a comprehensive stay in a private hospital. Your care should be dictated by medical necessity, not cost.

The Critical Role of High Coverage Limits

Let us be direct. In high-cost healthcare markets like Singapore, the UK, or Switzerland, standard coverage limits are dangerously inadequate. A policy with a $100,000 USD cap might sound substantial, but that can be exhausted by a single complex surgery or a few days in an intensive care unit.

This is why premium visitor insurance plans must offer coverage limits of $1 million USD or more. That figure is not arbitrary. It is a calculated safeguard designed to handle a worst-case scenario—a complex, multi-stage medical event—without putting your personal wealth at catastrophic risk.

The market for this specific protection is growing, and for good reason. A recent analysis valued the global travel medical insurance sector at approximately USD 5.24 billion, projecting it to climb past USD 10.21 billion by 2034. These products are engineered to cover the exact exposures—emergency treatment, hospitalization, and evacuation—that concern visitors entering expensive medical environments. You can discover more insights about this growing market and what’s driving it.

A superior policy recognizes that the true cost of a medical emergency isn't just the treatment itself. It's the seamless coordination, the immediate access to the best specialists, and the financial peace of mind that allows you to focus solely on recovery.

Medical Evacuation and Repatriation Explained

This might be the most critical—and most misunderstood—benefit of a high-end policy. Medical evacuation is not just an ambulance ride. It is the incredibly complex, logistically intensive process of moving you from a location with inadequate medical facilities to a center of excellence. That could be across the country or across a continent.

Consider the components of a private air ambulance transfer:

- Specialized Aircraft: A medically configured jet staffed with a flight-certified clinical team.

- Clinical Coordination: Physicians at both ends orchestrating the transfer of care to ensure a seamless handover.

- Logistical Management: Handling all ground transport, flight clearances, and international protocols.

The cost for such an operation can easily range from $100,000 to $250,000 USD, or even more. A premium policy does not just cover this expense; it manages the entire process for you. Repatriation, a related benefit, covers the cost of transporting you back to your home country for ongoing treatment once you are medically stable.

Managing Pre-Existing Conditions with Acute Onset Coverage

A major point of concern for any traveler is how a pre-existing condition will be treated. Standard policies almost universally exclude them. High-caliber insurance for visitors policies, however, address this with a specific provision known as acute onset coverage.

To be precise, this is not a provision for routine care for a chronic illness abroad. It is a safety net. It provides coverage for a sudden, unexpected flare-up or complication of a stable pre-existing condition that requires immediate medical attention.

For instance, if a visitor with well-managed hypertension experiences a sudden, unforeseen cardiac event, the acute onset benefit would activate to cover the emergency treatment required to stabilize their condition. This single feature is a vital distinction, preventing a manageable condition from becoming an unprotected, financially devastating event.

Navigating Visa Insurance Requirements in Key Hubs

For any global professional, a smooth entry into a key financial hub is not just a matter of convenience—it is about operational readiness. Many countries, particularly those with top-tier healthcare systems, have implemented specific insurance regulations. This is not mere bureaucracy; it is a practical measure to protect both visitors and their public health systems. Adherence is non-negotiable.

Understanding these local mandates is the first step. Each country's rules reflect its own healthcare and regulatory environment, which means a one-size-fits-all insurance plan is an inadequate strategy. If your work takes you across multiple borders, you must verify the requirements for each destination to avoid complications at immigration.

United Kingdom Requirements

The UK operates the publicly funded National Health Service (NHS). While visitors can typically receive emergency treatment, you will likely be billed for it. For certain visas, especially for longer-term stays, providing proof of adequate private medical insurance is a mandatory requirement.

For the typical short-term business visitor, there is not a strict "you must buy this policy" rule at the border. However, the UK government strongly recommends that all visitors have comprehensive medical insurance. Consider it a practical necessity. Relying on the NHS for an emergency can become expensive, and any non-emergency care will be entirely at your own expense without a solid policy.

Singapore Mandates

Singapore is known for its world-class private healthcare, which comes with a commensurate price tag. The government has set clear insurance requirements for certain visa holders. While a short-term tourist may not be asked for proof of insurance, anyone on a longer-term pass will be required to have it.

As a specific example, certain travelers entering Singapore may be required to have a policy with a minimum coverage of SGD 30,000 (approximately $22,000 USD). This is designed to cover potential hospitalization costs. Given the high cost of medical care in Singapore, treating this as a mere compliance exercise is a mistake. A prudent professional will secure a policy with limits far exceeding this minimum.

Hong Kong Guidelines

Hong Kong, another major financial centre with an excellent but costly healthcare system, does not enforce a universal insurance mandate for short-term visitors. For many nationalities, entering for business or tourism is generally straightforward without needing to present an insurance card.

However, do not mistake a lack of a mandate for a lack of need. The cost of treatment in Hong Kong’s private hospitals is among the highest in the world. Arriving without substantial insurance for visitors is a significant financial risk. For specific visa types, such as those for work or study, authorities will absolutely expect you to have your healthcare coverage in order.

Think of compliant insurance not as a bureaucratic hurdle, but as a strategic asset. It shows foresight and guarantees that if you need medical care, your access to the best facilities is immediate and unquestioned—protecting both your health and your wealth.

Thailand and Malaysia Regulations

As major business and travel destinations in Southeast Asia, both Thailand and Malaysia have entry requirements that can change, often in response to global health situations. It is essential to stay informed.

- Thailand: The country has, at times, required visitors to show proof of medical insurance covering amounts ranging from $10,000 to $50,000 USD. These rules are fluid, so verifying the latest official requirements before you book your flight is critical.

- Malaysia: Similar to its neighbors, Malaysia does not have a blanket insurance requirement for all tourists. However, for specific visa programs, like the Malaysia My Second Home (MM2H) or other long-term passes, medical insurance is a mandatory component of the application.

For the most current and detailed information on the specific rules for these and other destinations, take a look at our in-depth country guides for expatriates and global professionals. This resource provides the clarity you need.

Ultimately, regardless of the legal minimums, arriving with a high-limit visitor insurance plan is not just prudent—it is the mark of a well-prepared global operator.

Choosing Between Visitor Insurance and IPMI

Differentiating between short-term visitor insurance and a long-term expatriate plan is one of the most important decisions you will make. This choice dictates your entire approach to healthcare abroad, directly shaping your financial security and access to quality medical care. Making the correct choice comes down to your residency status, the planned duration of your stay, and the level of protection required.

A useful analogy for insurance for visitors is renting a high-performance vehicle for a specific road trip. It is engineered to provide excellent performance and safety for a limited time, focusing on handling unexpected, sudden problems like an accident or a medical emergency. It is the ideal tool for trips lasting up to 12 months.

Conversely, International Private Medical Insurance (IPMI) is like owning a luxury vehicle with a full, global maintenance plan included. This is not for a brief trip; it is for when you have made a new country your primary residence.

Defining Your Need: Residency and Duration

The fundamental distinction boils down to your intent and duration. Visitor insurance is designed specifically for non-residents. Its benefits, structure, and pricing are all tailored for temporary stays, with a singular focus on emergency medical treatment, hospitalization, and evacuation. It is a tactical solution for a specific purpose, whether that is a three-month business project in London or a six-month family visit in Singapore.

IPMI is for expatriates—individuals who have officially moved and established residency outside their home country. It is designed to provide continuous, comprehensive healthcare on par with, or superior to, a top-tier domestic plan. This covers everything from routine check-ups and preventative care to managing chronic conditions and elective surgeries. For a closer look at these robust plans, you can learn more about International Private Medical Insurance (IPMI) and how it supports global professionals.

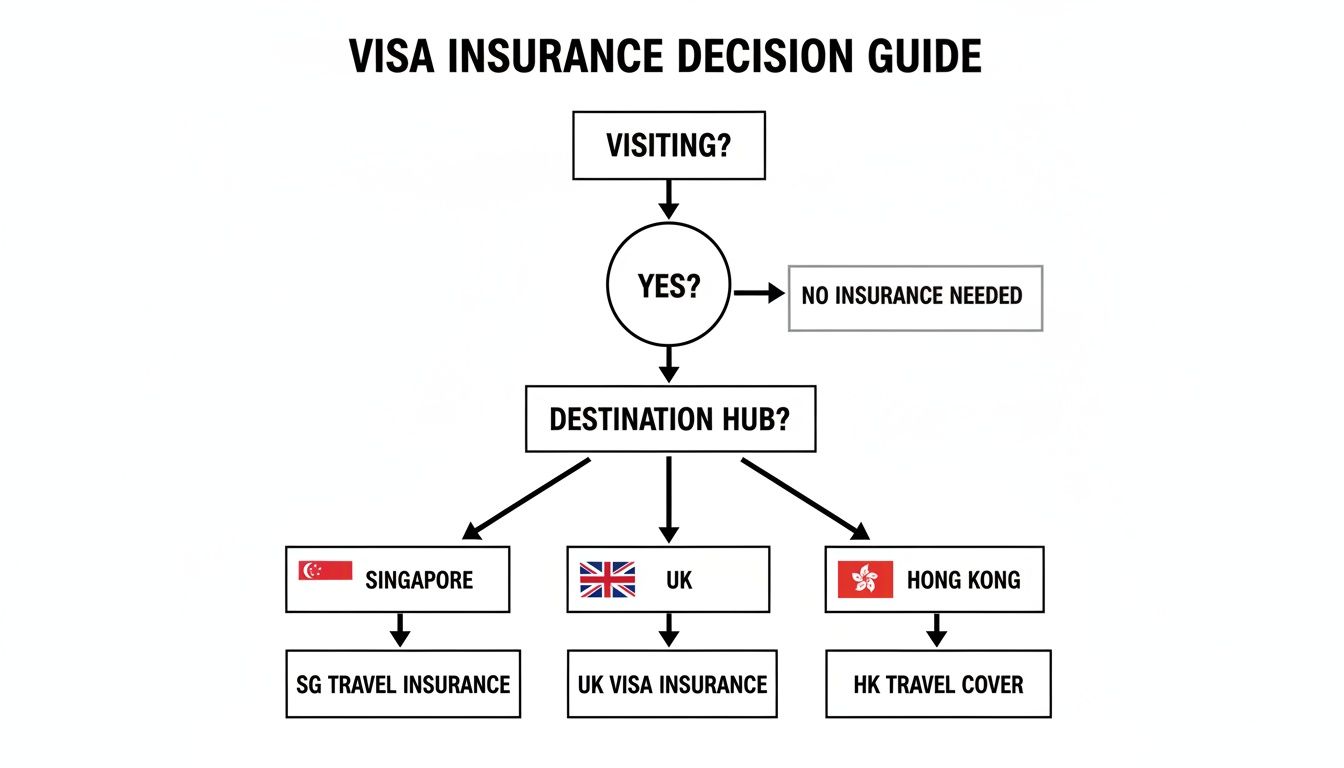

This chart can help you visualize the decision process for key international hubs.

As the flowchart shows, the first and most critical step is to determine your status—visitor or resident. That single piece of information will direct you toward the appropriate insurance strategy for your destination.

A Clear Comparison of Key Features

To make a truly informed decision, you must compare the core features of each plan side-by-side. The philosophical differences are stark and immediately reveal their distinct purposes. A visitor plan is focused on immediate, urgent care. An IPMI plan is designed for your long-term health and well-being.

The core question is simple: Are you visiting or are you residing? Answering this with clarity is the first and most important step in securing the correct level of protection. Visitor insurance is your shield for the journey; IPMI is your healthcare foundation for a new home.

Here is a direct comparison of how each plan handles critical healthcare features. This breakdown makes it clear which solution aligns with your specific circumstances.

Feature Comparison: Visitor Insurance vs. IPMI

| Feature | Insurance for Visitors | International Private Medical Insurance (IPMI) |

|---|---|---|

| Primary Focus | Emergency medical events, accidents, and acute illness during a trip. | Comprehensive healthcare, including routine, preventative, and emergency care. |

| Coverage Scope | Limited to urgent medical needs; excludes wellness and most pre-existing conditions. | Broad coverage including chronic condition management, wellness, dental, and maternity. |

| Typical User | Short-term business travelers, tourists, individuals visiting family abroad. | Expatriates, long-term assignees, and individuals residing abroad for a year or more. |

| Underwriting | Simplified underwriting, often purchased online with immediate coverage. | Full medical underwriting, assessing long-term health risks for annual coverage. |

This comparison highlights the strategic divide. For professionals who might begin as a long-term visitor and later transition to official residency, understanding this distinction is crucial. It ensures a seamless continuum of world-class medical care with no gaps in protection as your status evolves.

Essential Considerations for High-Net-Worth Individuals

For high-net-worth individuals, standard, off-the-shelf insurance products are fundamentally insufficient. Your requirements extend far beyond basic emergency coverage; they revolve around control, immediate access to premier care, and a service level that matches your expectations. True premium insurance for visitors is less a policy and more a personal risk management strategy, engineered for confidence and seamless execution.

This is where the conversation shifts from simple protection to sophisticated facilitation. It is about ensuring a medical issue, no matter how severe, is managed with absolute precision—preserving both your health and your wealth without compromise.

Guaranteeing Access with Exceptionally High Limits

For this clientele, coverage limits are not just a detail; they are the gateway to the world's best medical facilities. A policy with a $1 million or $2 million cap is the absolute baseline. The real objective is to have a financial instrument powerful enough to remove cost from the equation entirely, making quality of outcome the only factor driving medical decisions.

These high limits guarantee you can enter any leading private hospital—be it in London, Singapore, or Zurich—and receive immediate, top-tier care. There can be no hesitation or financial pre-authorization delays when your health is on the line. This level of coverage acts as your financial passport to the best medical minds and technologies on the planet.

The need for such robust plans is not theoretical. Data shows visitors are actively using their insurance for medical events. Recent statistics from the U.S. Travel Insurance Association (UStiA) show that the leading reasons for claims under comprehensive plans are medical or emergency situations. While leisure travelers represent a large segment, sophisticated users like business executives and expatriates form a critical cohort that often drives a higher proportion of large medical and evacuation claims. You can learn more about visitor insurance claim trends and their implications.

For the discerning global professional, visitor insurance is not about finding the cheapest option. It is about investing in a framework that guarantees control, choice, and an unwavering standard of care, reflecting the same diligence applied to managing a premier investment portfolio.

The Importance of Continuity of Care

A critical yet often overlooked aspect of visitor insurance is continuity of care. A standard policy is designed to stabilize you and send you home. For a high-net-worth individual, this is simply inadequate. A superior plan must be able to manage a condition that arises during your trip and requires ongoing follow-up, even after you return to your home country.

Imagine a complex diagnosis is made while you are on a three-month assignment in Hong Kong. A premium policy will not just cover the initial emergency; it can be structured to support the subsequent specialist consultations and treatments needed. This ensures a seamless and uninterrupted care pathway, managed by a single, accountable entity.

White-Glove Service and Concierge Support

The value of a premium plan extends far beyond its financial benefits. It lies in the white-glove service layer that handles the intricate logistics of a medical crisis. This includes:

- Dedicated Medical Concierge: A single point of contact who can arrange appointments with top specialists, secure hospital admissions, and manage all administrative burdens.

- Second Medical Opinions: Access to a global network of leading physicians to review a diagnosis or treatment plan, providing confidence and clarity.

- Cashless Arrangements: Direct billing with a vast network of premier hospitals, eliminating the need for you to pay upfront and seek reimbursement later.

This level of support transforms a stressful medical event into a managed process. It provides the logistical and administrative scaffolding that allows you to focus exclusively on your recovery. The expectation is not just coverage, but complete, hands-on crisis management delivered with precision and discretion.

Finding the Right Visitor Insurance Plan for You

Choosing the right insurance for visitors is not just a box to tick; it's a critical strategic decision that protects your health and your wealth in equal measure. For senior professionals and high-net-worth individuals, the standard, off-the-shelf plans available on public marketplaces are simply not sufficient. They are not built for the realities of premier global healthcare, leaving you dangerously exposed.

Consider this: you would not use a generic key for a custom-built safe. Securing a proper plan should not feel like a quick online purchase. It is a consultation. It requires a genuine understanding of your travel patterns, specific health needs, and your expectations regarding service and access. An off-the-shelf policy cannot grasp these nuances, creating a false sense of security that shatters the moment a real crisis hits.

Why Partnering with a Specialist Broker Makes All the Difference

The single most effective way to obtain a policy that meets your standards is to work with a specialized brokerage. Unlike going directly to an insurer, who can only offer their own products, a specialist broker acts as your advocate in the market. Their entire role is to analyze the options on your behalf, identifying the plans with the high limits, continuity of care, and concierge-level service you require.

This approach delivers several key advantages:

- Objective Advice: A reputable broker works for you, not the insurance company. Their recommendations are based entirely on what is best for your situation, not on sales quotas.

- Market Access: They have access to premium policies that are not publicly listed, plans designed specifically for a discerning global clientele.

- True Customization: They can help structure a plan that covers your specific concerns, whether that is coverage for an acute onset of a pre-existing condition or arranging for a non-medical evacuation.

By leveraging their specialized knowledge, you cut through the noise and uncertainty of navigating this complex landscape alone.

Taking the Next Step with Confidence

Your international health arrangements demand clarity, control, and absolute confidence. A specialized brokerage provides the framework to achieve this, turning a potentially confusing task into a straightforward, managed process. This ensures the policy you ultimately select is not just compliant—it is a powerful tool for managing your global risk.

Securing the right visitor insurance is the final, crucial step in preparing for international travel. It ensures your focus remains on your objectives, not on potential medical or financial disasters. It is an investment in certainty.

Ready to secure a plan that meets your exacting standards? The first step is to consult with experts who understand your world. For a clear, objective assessment of your needs, you can start by requesting a quick quote for your international medical insurance to see what options are available. This puts you in a position of control, ready to move forward with a policy that delivers complete peace of mind.

Frequently Asked Questions

When it comes to insurance for visitors, several key questions invariably arise. Here are the straightforward answers globally mobile professionals like you need to make an informed decision.

Is My Premium Credit Card Insurance Sufficient?

This is a common and potentially costly misconception. While your premium credit card is excellent for a cancelled flight or lost luggage, its medical coverage is dangerously insufficient for a real emergency.

These policies almost always have low benefit limits and extensive lists of exclusions. If you are hospitalized or require a medical evacuation in a high-cost city like Singapore or London, relying solely on that card could leave you with a staggering out-of-pocket expense. It is simply not designed for serious medical events.

Can I Buy Insurance After My Trip Starts?

This is a complex matter, and the answer is sometimes. A handful of insurers may permit you to purchase a plan after you have already departed from your home country, but there is a caveat. They will almost certainly impose a mandatory waiting period before key benefits become active, leaving you exposed.

The only prudent course of action is to secure your insurance for visitors before you travel. That way, you are protected from the moment you arrive at your destination.

One of the most critical differences between a standard visitor plan and a premium one is how it handles pre-existing conditions. A misunderstanding in this area can lead to significant, unexpected gaps in your medical protection.

How Are Pre-Existing Conditions Handled?

Standard, off-the-shelf visitor insurance plans will explicitly exclude anything related to a pre-existing condition.

However, superior plans designed for professionals often include a vital provision for the "acute onset" of a pre-existing condition. This means if you have a sudden, unexpected flare-up of a stable condition that requires immediate medical help, you are covered. It is crucial to read the policy wording carefully, as the definition of "acute onset" is a key differentiator that separates a basic plan from truly robust coverage. Consider it a critical safety net for the unexpected.

For expert guidance in selecting a plan that aligns with your specific travel and medical requirements, consult with Riviera Expat. Our specialists provide objective advice to ensure your healthcare arrangements offer complete clarity and control. Learn more at Riviera Expat.