Securing private health insurance for visitors to Canada is not merely a prudent measure—it is an essential component of sound financial planning for your stay. Canada's respected universal healthcare system is a privilege reserved exclusively for its residents. For visitors, every medical service is billed directly, requiring out-of-pocket settlement. Procuring the appropriate coverage is your primary strategy for mitigating unforeseen and often substantial healthcare expenditures.

Why Visitor Health Insurance is a Financial Imperative in Canada

A critical miscalculation many visitors make is assuming Canada's public healthcare system provides a universal safety net. This is unequivocally false. As a visitor, you are personally liable for the full cost of any medical care required, irrespective of your country of origin or the purpose of your visit.

The financial risk is considerable. A simple accident or a sudden illness can escalate into a significant liability. Costs for an emergency room visit, diagnostic imaging, or a hospital admission can accumulate with alarming speed. Without adequate insurance, these expenses can jeopardize personal assets and compromise the objectives of your trip.

A Matter of Prudence and Policy

For individuals accustomed to meticulous financial management, visitor health insurance is a non-negotiable element of risk mitigation. It functions as a financial backstop, ensuring a medical emergency does not devolve into a financial catastrophe.

Beyond being a strategic financial decision, it is sometimes a legal prerequisite. Unlike Canadian citizens and permanent residents, visitors have no eligibility for provincial health plans. The Canadian government stipulates that certain visitors, such as those applying for a Super Visa, must provide proof of at least $100,000 in medical coverage from a Canadian insurer. This regulation exists to ensure visitors can manage emergency medical costs without issue. You can learn more about the misconceptions of visitor coverage in Canada here.

"Treating visitor insurance as an afterthought is a significant strategic error. It is the foundational layer of protection that preserves both your health and your wealth while in Canada."

Securing a robust policy prior to your arrival provides more than financial protection—it delivers peace of mind. It allows you and your family to focus on business, family, or leisure, with the assurance that a comprehensive support system is in place if needed. This guide offers a clear framework for selecting a policy that meets your exacting standards.

Understanding the Financial Exposure of Canadian Medical Costs

To fully appreciate why premium health insurance for visitors to Canada is an indispensable asset, one must comprehend the scale of the financial risk involved. Without private coverage, out-of-pocket costs are not merely an inconvenience; they can be substantial enough to erode personal wealth and disrupt long-term financial plans.

There is a pervasive misconception that Canadian medical care is affordable for all. While the public system is a cornerstone for residents, it creates an entirely different financial reality for non-residents. A sudden illness or a minor accident can trigger a cascade of invoices that accumulate with disconcerting velocity. A straightforward incident can swiftly become a major financial event.

The Real Price of Uninsured Medical Care

The potential liabilities extend far beyond a simple physician's consultation. A true medical emergency involves a sequence of services: ambulance transport, emergency room fees, specialist consultations, diagnostic imaging such as MRIs or CT scans, and potentially surgery or a multi-day hospital stay. Each of these services is billed independently, creating a confluence of costs that can readily escalate into the tens of thousands of dollars.

Consider a scenario where a visiting parent slips on ice and fractures a limb. This single event could necessitate an ambulance, emergency room treatment, orthopedic surgery, and several days of hospitalization for recovery. Without insurance, the final invoice could easily be equivalent to the cost of a luxury vehicle. This is precisely the type of catastrophic financial exposure that a well-structured insurance policy is designed to eliminate.

For professionals relocating to the country for work, a firm grasp of these details is essential. Our in-depth analysis on health insurance for expatriates in Canada provides further context for a secure transition.

Viewing visitor insurance as a simple travel expense is a strategic miscalculation. It is more accurately defined as a high-leverage financial instrument designed to protect significant assets from unpredictable, high-impact risk.

Estimated Out-of-Pocket Medical Costs for Visitors in Canada

The financial data is unambiguous. The significant cost of uninsured medical care in Canada is a primary driver behind comprehensive visitor insurance becoming a non-negotiable component of financial planning for anyone hosting family or visiting the country. The following provides a snapshot of potential costs.

| Medical Service or Event | Estimated Cost Range (CAD) | Notes |

|---|---|---|

| Ambulance Service | $250 – $1,200+ | Varies by province; air ambulance is substantially more expensive. |

| Emergency Room Visit | $1,000 – $6,000+ | Base fee, exclusive of physician's fees or diagnostic tests. |

| Hospital Inpatient Stay | $3,000 – $8,000 per day | Standard ward. Intensive Care Unit (ICU) costs can be double or triple this amount. |

| Diagnostic Imaging (MRI) | $800 – $2,500 | Per scan, contingent on complexity and anatomical region. |

| Specialist Consultation | $300 – $800+ | Initial consultation fee; subsequent follow-ups are additional. |

| Minor Surgery (e.g., bone fracture) | $10,000 – $30,000+ | Includes surgeon, anesthesiologist, and facility fees. |

| Major Surgery (e.g., cardiac event) | $50,000 – $200,000+ | Can easily exceed this range with complications or extended stays. |

These figures clearly demonstrate that even a "minor" incident can quickly escalate into a five-figure liability. A serious medical event can generate invoices that would otherwise be allocated to a retirement portfolio or an education fund. This is the precise risk you transfer to an insurer.

This cost structure highlights a critical point: robust visitor insurance is not about covering a walk-in clinic fee. It is about constructing a financial firewall to protect your wealth from the six-figure liabilities a serious medical event can create. It ensures a health crisis does not become a lasting financial one. The right policy effectively transfers this unpredictable, high-stakes risk from your personal balance sheet to the insurance company, allowing you to manage the situation with clarity and control—not from a position of financial distress.

When Visitor Insurance Isn't Just Prudent—It's Mandatory

While astute financial planning makes visitor insurance an obvious choice, for some individuals, it is a strict legal requirement for entry into Canada.

The Canadian government's insurance mandates for certain visas are not bureaucratic formalities. They are specific regulations designed to protect the integrity of the national healthcare system and ensure visitors can manage a medical crisis without becoming a public liability. This is not a suggestion; it is a critical component of the application process.

Failure to comply will result in an immediate visa denial or refusal of entry at the border. The rationale is straightforward: to prevent the financial burden of a visitor’s medical emergency from falling on Canadian taxpayers.

The Super Visa: A Higher Standard of Proof

The most prominent example of mandatory health insurance for visitors to Canada applies to the Parent and Grandparent Super Visa. This is a long-term, multi-entry visa that permits parents and grandparents of Canadian citizens and permanent residents to stay for up to five years at a time.

Given the extended duration of these visits, the government imposes stringent insurance requirements. To qualify for a Super Visa, applicants must present concrete proof of a policy that meets several non-negotiable criteria:

- Minimum Coverage: The policy must provide at least $100,000 CAD in emergency medical expense coverage.

- Canadian Insurer: The policy must be purchased from a Canadian insurance company. There are no exceptions.

- Duration of Validity: The coverage must be valid for a full 365 days from the intended date of entry into Canada.

- Proof of Payment: The applicant must prove the policy is fully paid. A quote or reservation is insufficient.

These rules are definitive. The government's objective is to ensure a robust financial safety net is in place for the entire first year, guaranteeing that Super Visa holders can access necessary care without financial complications.

A Super Visa insurance policy is more than a document. It is a binding agreement with the Canadian government, confirming the visitor's financial self-sufficiency and their inability to burden the public health system.

What About Other Types of Visitors?

For individuals entering on a standard visitor visa (Temporary Resident Visa), an international student permit, or a temporary work permit, the insurance requirements are more nuanced. While private coverage may not be a mandatory item on the visa application itself, the practical necessity for it is just as acute.

For example, many temporary workers and international students arrive in Canada to discover a mandatory waiting period before they are eligible for provincial health coverage. This gap can be as long as three months—a high-risk period to be without protection against Canada’s significant medical costs. Private visitor insurance is the only responsible way to bridge this gap.

The demand for such insurance has grown significantly. With record numbers of immigrants, students, and tourists arriving in Canada, many find themselves requiring a temporary health plan before qualifying for provincial care. This growth is driven by both the volume of visitors and an increasing awareness of the financially devastating consequences of a medical issue without proper protection. You can discover more insights about the Canadian health insurance market and its trends.

Ultimately, whether required by your visa or by prudent financial strategy, private insurance is the key to a secure and financially sound visit to Canada. It ensures compliance, manages risk, and provides the peace of mind to focus on the purpose of your time here.

What's Actually Covered? Analyzing Your Policy's Core & Exclusions

An insurance policy is a detailed contract. For discerning individuals, understanding the distinction between what is covered and what is excluded is fundamental risk management. A high-quality health insurance plan for visitors to Canada is engineered to be a formidable shield against the significant financial impact of an unexpected medical crisis.

When this complex legal document is translated into practical terms, a core set of protections emerges. These are the pillars of your coverage, designed to handle emergencies efficiently and decisively, minimizing your out-of-pocket expenses and administrative burden during an already stressful time.

What a Premium Policy Typically Includes

A well-structured visitor insurance plan covers much more than the initial emergency room visit. It is designed to anticipate the cascade of costs associated with a serious medical event, from the first diagnostic test through to recovery. This ensures your focus remains on recuperation, not on a portfolio of mounting invoices.

Your policy's core benefits should always include:

- Emergency Medical Services: This is the bedrock of the policy. It covers sudden illnesses or accidental injuries requiring immediate medical attention, including physician's fees, specialist consultations, and emergency room charges.

- Hospitalization Costs: If admission is required, your policy covers hospital expenses. Premium plans often include semi-private or private room accommodations, offering enhanced comfort and privacy during recovery.

- Diagnostic Testing: Coverage for essential tests such as X-rays, MRIs, CT scans, and laboratory work is standard. This ensures your medical team can obtain an accurate diagnosis without delay.

- Prescription Medications: Drugs prescribed as part of an emergency treatment and administered during a hospital stay are typically covered up to a specified limit.

- Ambulance Services: This includes ground ambulance and, when medically necessary, air ambulance transport to the nearest appropriate medical facility.

- Essential Dental Care: Policies generally cover emergency dental services required as the result of an accident—for instance, repairing a fractured tooth—not routine examinations or cleanings.

Why Exclusions Are More Important Than Inclusions

While understanding what is covered provides assurance, it is arguably more critical to comprehend what is excluded. These are the specific conditions, treatments, and situations for which your policy will not provide payment. Overlooking this section can lead to a denied claim and a substantial, unexpected liability. Every policy contains exclusions, but their definitions can vary dramatically.

Common exclusions include:

- Non-emergency or elective procedures.

- Injuries from high-risk sports, unless a specific rider has been added.

- Mental health conditions, unless explicitly included.

- Maternity care and childbirth.

However, the single most important exclusion to master relates to pre-existing medical conditions. This is where the policy's fine print holds the most power.

An insurance policy's true value is found not just in what it covers, but in the clarity and fairness of its exclusions. A misunderstanding here can render a policy worthless precisely when you need it most.

A pre-existing condition is any medical issue, illness, or injury known to you before your policy's effective date. The key factor determining coverage for it often hinges on one word: stability. For a deeper analysis, you can learn more about how to watch out for policy exclusions that can impact your medical cover.

Stable vs. Unstable Pre-Existing Conditions

Insurers use the concept of "stability" to manage their risk. A claim related to a pre-existing condition may be covered, but only if that condition was considered "stable" for a specific period—often 90, 120, or even 180 days—before your coverage commenced.

- A Stable Condition is one that has not worsened. There have been no new symptoms, no changes in medication (either dosage or the drug itself), no new treatments prescribed, and no pending tests or specialist referrals. For example, hypertension that has been perfectly managed with the same medication for the past year would likely be deemed stable.

- An Unstable Condition is the opposite. Any change in treatment, worsening of symptoms, recent hospitalization, or a new diagnosis related to the condition renders it unstable. For instance, if a visitor with a known heart condition had their medication adjusted one month prior to their trip, that condition would be classified as unstable. Any related claim would almost certainly be denied.

This is not a minor detail; it is the primary mechanism insurers use to adjudicate major claims. Complete transparency regarding your medical history on the application is not just advisable—it is essential. Omissions can be construed as misrepresentation, which could void your entire policy.

A Framework for Selecting Your Optimal Plan

Choosing the right health insurance for visitors to Canada is more than a visa formality; it is a critical financial decision. The process should be viewed not as a box-ticking exercise, but as the construction of a tailored financial safeguard that aligns with your family’s specific needs and risk tolerance. The objective is to move beyond minimum requirements to establish a layer of protection that provides genuine confidence.

The initial step is to determine an appropriate coverage amount. While visas like the Super Visa mandate a minimum of $100,000, this figure should be considered the starting point, not the destination. A single serious medical event, particularly one involving surgery and an ICU stay, can exhaust this limit with surprising speed. For this reason, a more prudent and realistic coverage level often begins in the $250,000 to $500,000 range. This higher ceiling ensures that even a worst-case scenario does not precipitate a financial crisis.

Balancing Premiums With Deductibles

With a coverage target established, the next decision involves the classic trade-off between the upfront premium and the policy’s deductible. The deductible is the amount you are required to pay out-of-pocket before the insurer's contribution begins.

- Higher Deductible: Selecting a higher deductible—for example, $1,000 or $2,500—will result in a lower monthly premium. This is a sound strategy if your primary objective is to protect against a major, high-cost event and you are comfortable self-insuring for smaller medical expenses.

- Lower or Zero Deductible: Conversely, a policy with a minimal or zero deductible will have a higher premium but provides coverage almost immediately. This is the optimal choice for those who wish to avoid any unexpected out-of-pocket costs and value maximum financial predictability.

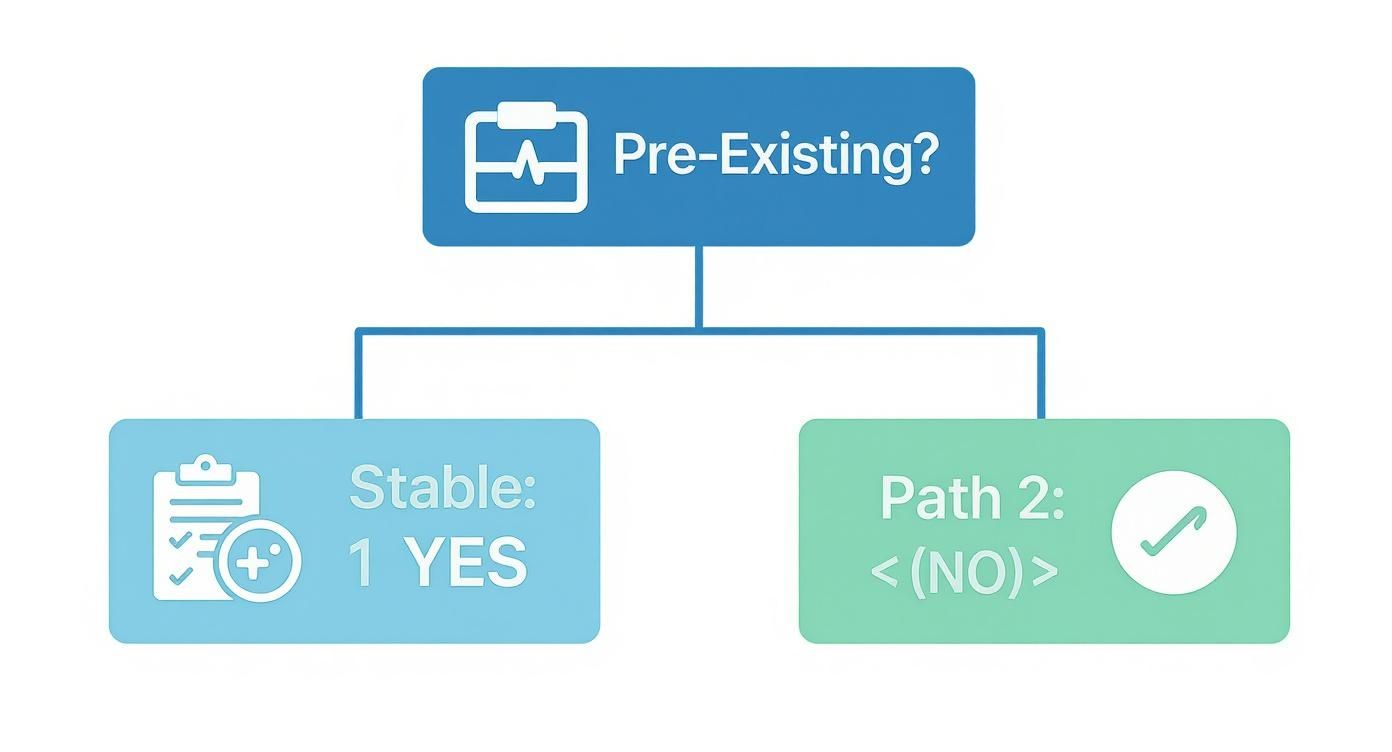

The decision rests on your personal financial philosophy: pay less now with the potential for higher costs later, or pay more now for complete cost certainty. The following visual illustrates a key aspect of this process, specifically how insurers assess your health history when calculating risk.

As the flowchart indicates, securing coverage for a pre-existing condition is almost always contingent upon one factor: documented proof that the condition was stable before the policy's inception.

Evaluating Network and Direct Billing Value

A significant differentiator among quality plans is access to a direct-billing network. This feature allows the hospital to bill the insurance company directly, meaning you are not required to pay a substantial sum upfront and then seek reimbursement. For a serious medical event, this is not merely a convenience; it is a crucial feature that protects your immediate cash flow.

Before finalizing a plan, it is wise to verify which hospitals and clinics are part of the insurer's network, particularly in the areas where your family will spend the majority of their time. A robust network ensures access to high-quality care in an emergency without encountering administrative or financial friction. To understand how these benefits are layered in premier plans, our guide on international private medical insurance benefits uncovered offers a comprehensive analysis.

An insurance policy is a legally binding contract. A plan's true strength is revealed not only in its coverage limits but in the efficiency and simplicity of its claims process during a moment of crisis.

Finally, timing is paramount. The policy must be purchased before arrival in Canada to ensure compliance with visa regulations and to avoid any dangerous gaps in coverage. Policies acquired after landing almost invariably include a waiting period for illnesses (typically 48-72 hours), leaving you completely exposed during the initial days. A structured contract review checklist can be an invaluable tool for methodically comparing options. By employing a disciplined approach, you can select a policy that offers not just coverage, but complete control.

The Advantage of Expert Guidance and White-Glove Service

For individuals who measure time in opportunity cost, navigating the complexities of the Canadian insurance market is an inefficient allocation of a valuable asset.

Securing premium health insurance for visitors to Canada involves more than an online transaction. It requires a detailed analysis of policy architecture, an assessment of the insurer's financial stability, and insight into their claims handling procedures. This is where expert guidance transitions from a luxury to a strategic necessity.

Engaging a specialized advisory service transforms the entire dynamic. A tedious procurement task becomes a streamlined, confidential consultation. Instead of personally vetting dozens of policies—each with its own arcane definitions—you receive clear, tailored recommendations from a curated portfolio of Canada’s most reputable insurers. This approach yields significant time savings and, more importantly, drastically reduces the risk of selecting a policy with hidden coverage gaps or unfavorable terms.

The White-Glove Service Model

Our white-glove service model is designed to reflect the standards our clients expect in all facets of their lives. It is a discreet, efficient process engineered to deliver absolute clarity and control. We manage the intricate details, allowing you to remain focused on your professional and personal priorities.

This bespoke support encompasses the entire policy lifecycle:

- Policy Analysis: We scrutinize the fine print so you are not required to. Complex insurance terminology is translated into clear, actionable business language. You will understand precisely how pre-existing conditions are defined and how the claims process functions, eliminating any ambiguity.

- Application Advocacy: We ensure your application is submitted correctly the first time, anticipating potential underwriting inquiries to facilitate a smooth and efficient approval process.

- Claims Concierge: In the event a claim is necessary, you are not navigating the process alone. You have a dedicated advocate to manage the claim, ensuring it is handled fairly and expediently by the insurer.

This level of service is not about simply purchasing a product. It is about implementing a robust risk management strategy. It is about ensuring that your family’s health and your financial assets are protected by a policy that performs precisely as promised when it matters most.

Ultimately, the advantage is clear. You gain an expert partner dedicated to securing optimal protection for your visitors, providing the confidence that comes from a well-informed decision without sacrificing your valuable time. This is how a simple insurance requirement becomes a cornerstone of a well-executed financial plan for any visit to Canada.

Frequently Asked Questions

Let's address the practical questions that arise when arranging health insurance for visitors to Canada. Here are the direct answers required to make an informed decision and ensure a secure visit.

Can I Purchase Insurance After Arriving in Canada?

While technically possible in some cases, it is a strategically flawed approach.

Insurers classify post-arrival purchases as high-risk and almost always impose a waiting period—typically 48 to 72 hours—for any illness-related claims. This means for the first few days of your visit, you are exposed and uninsured for anything other than an accident.

For Super Visa applicants, this is not an option. You are required to present proof of a valid, pre-paid policy at the port of entry. It is a non-negotiable condition. The only prudent course of action is to secure coverage before travel to ensure seamless protection from the moment of arrival.

How Do Insurers Handle Pre-Existing Conditions?

This is the most critical detail in any visitor insurance policy. Any notion of comprehensive coverage for ongoing issues should be dismissed. Insurers will only consider covering a pre-existing medical condition if it is deemed “stable.”

"Stable" is a defined term. It means that for a specified period before the policy's start date (usually 90 to 180 days), there have been no new symptoms, changes in medication, new treatments, or pending specialist appointments. It is imperative to disclose all medical history on the application with complete accuracy. Any omission, however minor, can provide the insurer with grounds to void your policy and deny a claim.

What Is the Difference Between a Deductible and Co-Insurance?

These terms define how you and the insurance company share the cost of a medical expense. The concepts are straightforward.

-

A deductible is the fixed, initial amount you pay out-of-pocket on a claim before the insurer contributes. If your policy has a $1,000 deductible and you incur a $5,000 hospital bill, you are responsible for the first $1,000. The insurer then addresses the remaining $4,000.

-

Co-insurance is a percentage-based cost-sharing arrangement that applies after your deductible has been met. An 80/20 co-insurance clause means the insurer covers 80% of the remaining costs, and you are responsible for the other 20%.

Many superior visitor insurance plans are structured with a $0 deductible and 100% coverage up to the policy limit. This is an ideal structure as it eliminates out-of-pocket surprises for approved claims.

Can I Extend My Policy If I Decide to Stay in Canada Longer?

Yes, most visitor policies are extendable, provided you adhere to the specific terms. First, the extension request must be made before your current policy expires. Second, you generally must be in good health and not have made any significant claims.

The insurance company will re-underwrite the risk and may adjust your premium for the extension period. Most importantly, your legal visitor status in Canada must remain valid for the entire duration of the extension. An expired visa will invalidate your insurance coverage.

At Riviera Expat, we eliminate the complexity of securing premier visitor insurance. We provide a clear, confidential consultation, ensuring you acquire a policy that delivers genuine peace of mind, allowing you to focus on what truly matters. https://riviera-expat.com