Comprehensive medical insurance is your passport to premier healthcare, anywhere in the world. It is not merely an insurance policy, but rather a sophisticated financial instrument engineered to protect your health and preserve your wealth.

Unlike standard plans designed for basic emergencies, a comprehensive policy is tailored for a global lifestyle. It provides the freedom to access the world's leading medical experts and facilities without financial hesitation.

Defining Your Health and Financial Security

View comprehensive medical insurance as a cornerstone of your personal and financial strategy. For globally mobile individuals and high-net-worth families, this calibre of protection is not a luxury—it is an absolute necessity. It ensures that your health is never compromised, regardless of where your professional or personal life may lead.

This class of insurance delivers exceptionally broad coverage across an extensive range of services. The demand for such robust protection is reflected in the market's significant growth; the global health insurance market was valued at USD 2.7 trillion in 2023 and is projected to reach approximately USD 4.4 trillion by 2032. This expansion is a direct response to evolving global health requirements. You can find more insights on the booming health insurance industry at coinlaw.io.

A Clear Distinction in Coverage

The difference between a basic plan and a comprehensive one is stark. A basic plan provides a minimal safety net, primarily for catastrophic events like a major hospitalization. Its function is purely reactive.

In contrast, comprehensive medical insurance is a proactive tool for managing your health portfolio. It encompasses:

- Routine and Preventive Care: This includes annual physicals, essential screenings, and consultations with specialists, enabling you to identify and address potential health issues before they escalate.

- Broad Medical Services: From inpatient hospital stays and outpatient procedures to prescription pharmaceuticals and mental health support, all facets of your care are typically included.

- Financial Predictability: You benefit from substantially higher benefit limits and lower out-of-pocket costs, effectively insulating your assets from the volatility of unexpected medical expenses.

A comprehensive policy is structured to provide security against the full spectrum of medical events, from minor health concerns to major crises. It shifts the entire paradigm from reacting to emergencies to proactively managing your long-term well-being.

To fully appreciate the distinction, a side-by-side comparison is instructive. This table outlines what you can typically expect from each type of plan.

Comprehensive vs Standard Insurance At a Glance

| Coverage Area | Standard Health Insurance | Comprehensive Medical Insurance |

|---|---|---|

| Inpatient Hospitalization | Covered, but with lower annual limits and potential caps. | Fully covered, with very high or unlimited annual benefits. |

| Outpatient Care | Often limited or excluded entirely. | Fully covered, including specialist visits and diagnostics. |

| Preventive Care | Usually not covered (e.g., check-ups, screenings). | Covered, encouraging proactive health management. |

| Prescription Drugs | Limited coverage, often only for inpatient use. | Broad coverage for both inpatient and outpatient meds. |

| Mental Health | Minimal coverage, if any. | Comprehensive coverage for therapy and psychiatric care. |

| Dental & Vision | Almost always excluded. | Often available as an optional add-on. |

| Geographic Coverage | Limited to a single country. | Global or wide regional coverage, designed for expats. |

As illustrated, the capability gap is significant. A standard plan might prevent complete financial ruin, but a comprehensive plan empowers you to actively maintain your health without financial constraint.

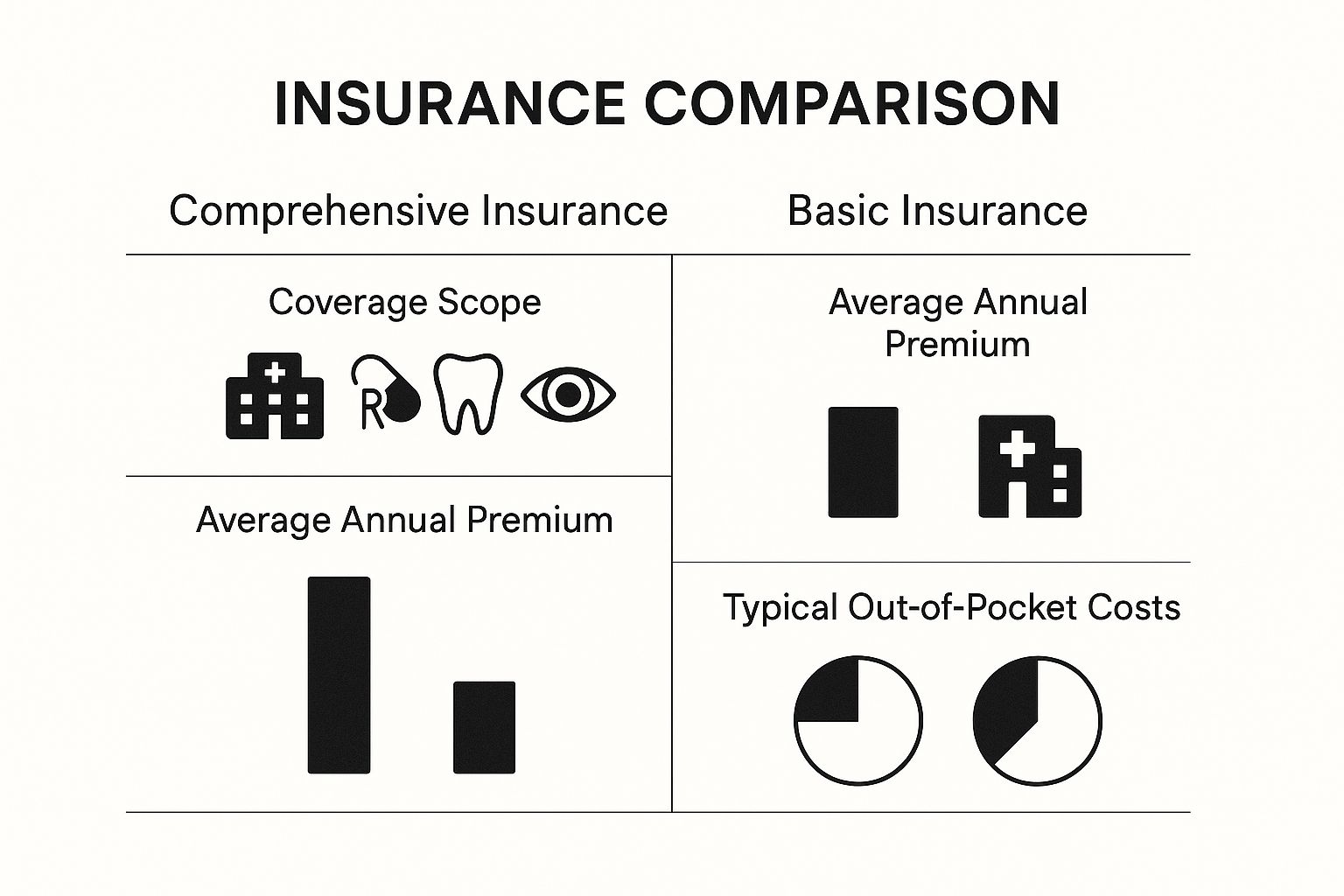

The infographic below provides a clear visual representation of how premiums, coverage scope, and potential out-of-pocket costs compare.

It is evident that the higher investment in a comprehensive plan yields returns in the form of dramatically broader coverage and mitigated financial risk when care is required.

The Pillars of Elite Health Protection

A genuinely robust health plan is not a mere collection of benefits—it is a meticulously constructed framework built upon several core pillars of coverage. These elements function in concert, not just as a safety net, but as a strategic shield for your most valuable asset: your health.

Consider these pillars as the foundational supports of a well-engineered structure. If one is weak or absent, the integrity of the entire edifice is compromised. For this reason, elite protection extends far beyond basic emergency coverage to offer a complete, interlocking defense.

Inpatient and Surgical Care

The most widely recognized pillar is inpatient care, which activates for major medical events necessitating a hospital admission. This covers the full spectrum of services, from complex surgical procedures and intensive care to the provision of a private room in a top-tier medical facility.

For a global professional, this translates to the confidence of entering a premier hospital in London, Singapore, or New York without concern for the financial repercussions. It is your frontline defense against catastrophic health events, ensuring the substantial costs of major surgery or prolonged hospitalization are effectively managed.

Outpatient and Specialist Services

While inpatient care is reactive, outpatient care is fundamentally proactive. This pillar forms the foundation of your day-to-day health management, covering consultations with leading specialists, advanced diagnostic tests such as MRIs, and minor procedures not requiring an overnight stay.

Effective outpatient coverage is the key differentiator between a basic policy and a truly protective one. It empowers you to address health concerns at their earliest stages and to seek expert medical opinions whenever necessary. For a detailed examination of these benefits, you can explore our full guide to international private medical insurance benefits uncovered.

Prescription Drug and Medication Coverage

High-level medical treatment invariably involves sophisticated pharmaceuticals. The prescription drug pillar is designed to manage the costs of these necessary medications, from routine prescriptions to exceptionally expensive specialty drugs required for chronic conditions.

This ensures that the course of treatment recommended by your physician is always financially viable, removing cost as a variable in your healthcare decisions.

This pillar is absolutely vital for long-term health management. It provides financial stability and guarantees uninterrupted access to critical treatments that can profoundly impact your quality of life.

Preventive Wellness and Health Screenings

The final, and most forward-thinking, pillar is preventive wellness. This is centered on maintaining your health through annual physicals, comprehensive health screenings, and vaccinations.

Top-tier plans increasingly support proactive health through initiatives like corporate wellness programs, recognizing them as a vital component of elite protection. This proactive approach is no longer a luxury; it is essential. A truly comprehensive plan must cover mental health, hospital stays, physician visits, and prescription drugs—all services that sophisticated clients now demand.

Globally, Europe’s significant health insurance expenditure, which stood at EUR 1.15 trillion in 2021, reflects this trend, with high urban insurance penetration providing broad access to these comprehensive services.

Tailoring Your Coverage Beyond the Essentials

A truly elite comprehensive plan does more than cover core medical needs. It is engineered for a sophisticated, global lifestyle, offering premium benefits that extend far beyond standard hospital care. The intrinsic power of these plans lies in their customisability. Consider it less a rigid policy and more a precise financial instrument that can be fine-tuned to your personal risk tolerance and health priorities.

This is where you transcend the one-size-fits-all model. By adjusting deductibles, co-insurance percentages, and overall coverage limits, you can construct a policy that perfectly mirrors your unique circumstances. It is a process of calibration, identifying the optimal balance between your monthly premium and potential out-of-pocket exposure to ensure your health protection and financial strategy are fully synchronised.

High-Value Benefits for Global Citizens

For individuals who live, work, or travel across borders, certain benefits are not luxuries—they are operational necessities. A premium plan anticipates the unique challenges of a global life, offering specialized coverage that provides a critical safety net in urgent situations, no matter where you are in the world.

Here are two of the most crucial high-value benefits to specify in a policy:

- Global Medical Evacuation: This is your assurance that if you are in a location with inadequate medical facilities, you can be transported to the nearest centre of excellence equipped to manage your specific condition.

- Repatriation of Remains: While a sensitive topic, this benefit ensures the organised and respectful transport of remains to a home country should a death occur abroad.

These features provide an essential layer of security. They ensure that geography will never be a barrier between you and the highest standard of care or the dignified management of a crisis.

A policy without robust evacuation coverage represents a significant liability for any global citizen. It is the ultimate assurance that you can access world-class medical expertise during a critical emergency, irrespective of your immediate location.

Integrating Complete Wellness into Your Plan

True well-being extends beyond reacting to illness or planning for surgery. A modern, high-calibre medical insurance plan understands this. It integrates benefits that support your entire health profile, from routine dental care to mental fitness and proactive health management. This holistic perspective is crucial for maintaining peak performance in all aspects of your life.

Look for plans that offer strong optional riders for:

- Comprehensive Dental and Vision Care: These benefits cover everything from routine hygiene appointments to major procedures like crowns or corrective eye surgery, which are almost universally excluded from standard policies.

- Robust Maternity Benefits: Essential for growing families, this covers prenatal care, delivery, and postnatal support, ensuring access to premier obstetric care anywhere in the world.

- Mental and Behavioral Health Services: This has become a non-negotiable component of total wellness. Demand is significant, with some reports noting that 48% of insurers cite mental health as their fastest-growing claims category. This underscores the criticality of policies providing strong support for therapy and other mental wellness services. You can find more insights on these evolving insurance industry trends on deloitte.com.

Ensuring Your Health Coverage Travels with You

For a global citizen, health insurance tethered to a single country is a profound liability. Your medical coverage must be as mobile as you are, acting as a seamless shield whether you are finalising a deal in Hong Kong, vacationing in the Maldives, or visiting family. This global portability is what distinguishes a truly comprehensive medical plan.

Central to this concept is the area of coverage. This is a critical policy detail that dictates precisely where in the world your insurance is valid. Misaligning this with your lifestyle is a fundamental and potentially costly error. Your coverage area must be congruent with your travel patterns, business interests, and residency plans.

Decoding Your Geographic Coverage Options

True international health plans are not monolithic. They offer distinct geographic boundaries that directly impact two variables: where you can receive care and the premium you will pay for that access. Insurers typically structure these into clear tiers.

Here are the primary models you will encounter:

- Worldwide Coverage: This is the premier option, providing unrestricted access to medical care anywhere on the planet. For those whose lives are truly without borders, this offers the ultimate peace of mind.

- Worldwide Excluding the USA: This is an exceptionally popular and more cost-effective choice. It provides global coverage everywhere except the United States, which is carved out due to its uniquely high healthcare costs.

- Regional Plans: These policies are designed for specific geographic zones, such as Europe, Southeast Asia, or the Middle East. They are an excellent option if your life and travel are largely concentrated within a single region.

The decision to include or exclude the United States has the single greatest impact on your premium. The cost of medical services in the US is so significantly higher that adding this coverage can dramatically increase your policy's price. A careful analysis of whether you genuinely require US-based care is essential before incorporating it into your plan.

Your area of coverage is not merely a line item; it is the blueprint for your global health security. Aligning it precisely with your lifestyle prevents dangerous gaps in protection and ensures your investment is deployed where it matters most.

Essential Logistics for Seamless Global Care

Beyond geography, the practical mechanics of a policy determine its real-world utility when you are ill or injured abroad. A first-class plan is defined by features that eliminate friction and uncertainty when you require care.

A key feature is access to extensive direct billing networks. These are contractual agreements between your insurer and medical facilities worldwide. They permit the hospital or clinic to bill the insurer directly, so you are not required to pay a substantial bill out-of-pocket and seek reimbursement later. You can learn more about how these medical networks function and why they are vital for a stress-free experience.

Furthermore, elite plans often provide access to second medical opinions from world-renowned experts. This ensures you can confirm a complex diagnosis or treatment plan with leading specialists, regardless of your location. When combined with provisions for continuity of care as you move between countries, your health management is never disrupted by a change of address.

Understanding the Fine Print on Exclusions

While a premier medical plan offers a formidable shield, any credible advisor will stress the importance of understanding its precise boundaries. Knowing what a policy does not cover is as critical as knowing what it does. This is not about creating apprehension—it is about empowerment. Full transparency prevents unwelcome surprises and aligns your expectations with the reality of your coverage.

Every insurance policy contains exclusions—specific conditions or treatments for which the insurer will not provide payment. This is standard industry practice, designed to manage risk and maintain premium stability. Common examples include elective treatments that are not medically necessary, such as purely cosmetic procedures. You will also find that experimental treatments, those lacking a proven record of safety and efficacy, are almost always excluded.

How Pre-Existing Conditions Are Handled

This is one of the most important areas to address with precision. A pre-existing condition is any health issue for which you had symptoms, medication, or advice prior to your policy's inception date. Insurers have two primary methods for addressing these, and the distinction has a significant impact on your financial security and access to care.

The two underwriting methods you will encounter are:

- Moratorium Underwriting: This is a "wait and see" approach. The insurer does not request a full medical history at the outset. Instead, a waiting period (typically two years) is applied to any condition for which you have experienced symptoms or received treatment in a recent period (often the last five years). If you remain free of symptoms, treatment, or advice for that specific condition throughout the entire waiting period, it may become eligible for coverage.

- Full Medical Underwriting (FMU): This is a comprehensive upfront assessment. You provide a detailed health declaration at the time of application. Based on your disclosures, the insurer makes a definitive decision. They might permanently exclude a condition, apply a premium surcharge to cover it, or agree to cover it fully. While it requires more initial effort, it provides absolute certainty from day one.

Understanding this distinction is fundamental. FMU provides clarity and eliminates ambiguity. A moratorium offers a potential pathway to future coverage for past issues. The optimal choice depends entirely on your personal circumstances and your requirement for certainty.

This is precisely where expert guidance becomes invaluable. To delve deeper into how insurers assess different health issues, consult our detailed guide on medical conditions and how to watch out for policy exclusions. A firm grasp of these limitations is the final, crucial step in making a confident decision about your global health security.

Choosing Your Ideal Comprehensive Health Plan

Having established the principles, we now turn to execution. Selecting the right comprehensive medical plan is one of the most significant financial decisions you will make. It is about more than satisfying a requirement; it is about securing a precision instrument to protect both your health and your wealth.

The process begins with a rigorous and honest assessment of your personal and family healthcare needs. It also demands careful consideration of your lifestyle—your travel destinations, potential future residences—to ensure your coverage area perfectly aligns with your global footprint. The objective is to integrate your health coverage seamlessly into your broader financial life.

The Strategic Value of a Specialized Broker

Navigating the premium international health insurance market independently is a formidable challenge, fraught with complexity and potential pitfalls. This is why partnering with a specialized insurance broker is not a luxury; it is a strategic necessity. A reputable broker serves as your advocate and expert guide in an often-opaque marketplace.

Their value is immense and essential for securing the most favorable terms. A dedicated broker delivers several key advantages:

- Access to Elite Insurers: They maintain established relationships with top-tier global insurance carriers, providing access to plans and options not available on the open market.

- Unbiased, Expert Advice: A broker works for you, not the insurance company. They dissect dense policy language, providing clear, objective comparisons to enable an informed evaluation of each plan's merits without sales pressure.

- Streamlined Process Management: From the initial application to navigating a complex claim, a broker manages the administrative burden. This saves considerable time and helps you avoid costly errors.

Engaging a specialist broker transforms the selection process from a complex chore into a confident, informed decision. They ensure the plan you secure is not merely adequate, but perfectly optimized for your sophisticated requirements.

This partnership is ultimately the key to gaining genuine clarity and control over your health security. With an expert managing the details, you can be assured that your comprehensive medical insurance is perfectly aligned with your life, offering robust protection no matter where your journey takes you. The right guidance is what delivers true peace of mind.

Frequently Asked Questions

When considering premium health insurance, several key questions invariably arise. Here are straightforward answers to the most common queries we receive from expatriates and discerning clients.

Comprehensive vs. Critical Illness: What’s the Difference?

It is crucial to understand that these two policies serve entirely different functions. A comprehensive medical plan is your day-to-day healthcare partner. It covers the full spectrum of your needs, from routine GP visits and specialist consultations to major hospital stays and prescription drugs.

A critical illness policy, conversely, is a specialised instrument for a specific contingency. It pays out a single, tax-free lump sum upon diagnosis of a specific, life-altering condition listed in the policy, such as certain cancers or a major heart attack. This capital is not intended for ongoing medical bills; it is for addressing other financial consequences, such as lost income, mortgage payments, or home modifications.

How Do Deductibles and Co-Insurance Affect My Costs?

Both deductibles and co-insurance are cost-sharing mechanisms that directly influence your premium. A deductible is the fixed amount you pay out-of-pocket each policy year before your insurance coverage begins to pay. It is your initial contribution to your healthcare expenses.

Co-insurance applies after your deductible has been met. It is the percentage of the remaining bill that you share with the insurer. For instance, in an 80/20 arrangement, the insurance company covers 80% of the cost, and you are responsible for the remaining 20%.

By selecting a higher deductible or a larger co-insurance percentage, you agree to assume more of the initial financial risk. This reduces the insurer's potential liability, and in exchange, they offer a lower monthly premium.

What Should I Do in a Medical Emergency Abroad?

Facing a medical emergency in a foreign country can be disorienting, but a methodical approach is all that is required.

- Secure Medical Help Immediately: Your health is the absolute priority. Proceed to the nearest reputable hospital or clinic.

- Contact Your Insurer: As soon as it is feasible, call the 24/7 emergency assistance number located on your insurance card. This is your primary point of contact.

- Provide Your Details: Have your policy number ready. Explain the situation and your location. The assistance team will then coordinate directly with the medical facility to arrange payment and confirm your coverage.

Understanding these details is precisely why having an expert in your corner is so valuable. At Riviera Expat, we specialise in securing elite international health plans, ensuring our clients have total clarity and confidence in their coverage, no matter where life takes them. To explore your options, please get in touch with us at Riviera Expat.