Consider supplemental health insurance a bespoke financial instrument working in concert with your primary health policy. It is not a replacement for your core coverage. Rather, it is a strategic tool meticulously designed to address the financial exposures your main plan leaves behind—such as significant deductibles, coinsurance liabilities, and the often-overlooked non-medical costs associated with recovery.

In essence, it serves as a sophisticated second line of defense for your financial well-being.

Securing Your Financial Health Beyond Primary Insurance

Even the most robust primary health insurance plans contain inherent gaps. These gaps manifest as substantial out-of-pocket costs that can disrupt your financial equilibrium precisely when you are most vulnerable. Just as discerning investors practice Mastering Risk Management in Investing, supplemental coverage is a method of applying that same precise risk management to your health.

To offer an analogy: your primary health insurance is the formidable outer wall of a fortress, engineered to withstand major assaults. Supplemental health insurance is the elite, specialized force within that wall, poised to neutralize the specific financial threats that breach the primary defenses.

To clarify the distinct roles these two forms of insurance play, here is a direct comparison.

Primary vs Supplemental Insurance At A Glance

| Coverage Aspect | Primary Health Insurance | Supplemental Health Insurance |

|---|---|---|

| Main Role | Covers the majority of medical costs (physician visits, hospital stays, surgery). | Covers out-of-pocket liabilities and specific costs left by the primary plan. |

| Scope | Broad, comprehensive medical coverage. | Narrow, specific coverage for defined costs or triggering events. |

| Benefit Payout | Pays directly to medical providers. | Typically pays a predetermined cash benefit directly to you, the policyholder. |

| Example Use | Pays for a major surgical procedure. | Provides the capital to cover the deductible for that surgical procedure. |

This table illustrates how supplemental plans are not intended to perform the heavy lifting of your primary policy, but rather to fill the very specific—and often substantial—financial gaps.

Plugging Critical Financial Gaps

These plans are engineered to address precise financial vulnerabilities. They provide a predictable mechanism for managing unpredictable costs, ensuring a single medical event does not compromise your long-term financial objectives. The most common of these costs are excesses and deductibles, which we detail in our guide on understanding the fine print of your policy.

Here is what supplemental coverage is specifically designed to accomplish:

- Covering Deductibles and Coinsurance: It helps satisfy those initial costs and the percentage-based share for which you are responsible under your primary plan before it provides its full benefit.

- Addressing Non-Medical Expenses: Many policies provide tax-free cash benefits that can be used for any purpose, from replacing lost income and funding travel for treatment to engaging household assistance during recovery.

- Providing Specific Protections: You can secure policies targeted for specific events like a critical illness, a significant accident, or a prolonged hospital stay, giving you tailored security where you perceive the greatest risk.

This additional layer of protection is not merely about settling invoices. It is about preserving your asset base and maintaining financial control during a period of vulnerability. A well-structured supplemental plan ensures you can focus on recovery, not on liquidating investments to cover unforeseen medical costs.

It is clear that a growing number of individuals are seeking this financial security. The global supplemental health insurance market was valued at USD 287.97 billion in 2023 and is projected to reach approximately USD 537.47 billion by 2032. This is not merely an industry trend; it reflects a significant shift as individuals seek complete financial insulation from healthcare-related costs.

How Supplemental Policies Complement Your Primary Plan

To fully appreciate the value of supplemental health insurance, one must cease to view it as a replacement for a primary medical plan. It is not a competitor; it is a strategic partner. Consider it a coordinated effort where each policy has a specific role to execute when you require it most.

When a major medical event occurs—for example, an unexpected hospitalization—your primary insurance responds first. It addresses the high-cost items like surgeon’s fees, hospital room charges, and prescribed treatments, all according to its contractual terms. However, even after it pays its share, you are almost invariably left with a significant out-of-pocket liability.

Those remaining costs are precisely where your primary plan's responsibility concludes and your personal financial burden commences.

The Claims Process Unpacked

Let us examine how this partnership functions in a practical scenario. Imagine you undergo an emergency surgery with a total bill of $80,000.

-

Primary Insurer Pays First: Your primary health plan processes the claim. Assume you have a $5,000 deductible and 20% coinsurance. After applying these terms, your primary plan might cover $59,000 of the total bill. This leaves a $21,000 gap for which you are now responsible.

-

Supplemental Plan Kicks In: This is the critical juncture. Once you provide proof of the triggering event (such as a hospital admission or a qualifying diagnosis, depending on the policy), your supplemental plan activates its benefit. It does not pay the hospital. Instead, it pays a pre-determined, lump-sum cash amount—let's say $25,000 in this case—directly to you.

This direct, tax-free cash payment is a defining feature of most supplemental policies, and it is a strategic advantage.

The Power of Unrestricted Cash Benefits

This direct cash infusion provides a level of financial flexibility that primary insurance cannot match. The funds are yours to deploy as you see fit. You can use them to manage both the medical bills and the non-medical costs that inevitably accumulate during recovery.

A health crisis rarely confines its impact to hospital bills, and this is a critical distinction to comprehend.

The true power of a supplemental policy lies in its flexibility. It provides liquid capital precisely when your cash flow may be compromised, allowing you to protect your long-term investments from short-term crises.

With that cash benefit in hand, you can decide exactly how to allocate it. For instance:

- Covering Medical Gaps: You could immediately settle the $21,000 in deductibles and coinsurance without depleting your savings or liquidating investments.

- Replacing Lost Income: If you are unable to work for several weeks during recovery, the funds can serve as a temporary salary to maintain your household's financial stability.

- Managing Household Expenses: Life’s obligations do not pause. The cash can cover anything from childcare and mortgage payments to transportation for follow-up appointments.

This structure helps ensure that a health issue remains a health issue, rather than escalating into a financial crisis that derails your entire financial strategy. To see the full range of options available, you can explore the different types of benefits in our detailed guide on international private medical insurance benefits.

By providing this crucial liquidity, supplemental insurance acts as an essential firewall, preserving your financial stability when it is most needed.

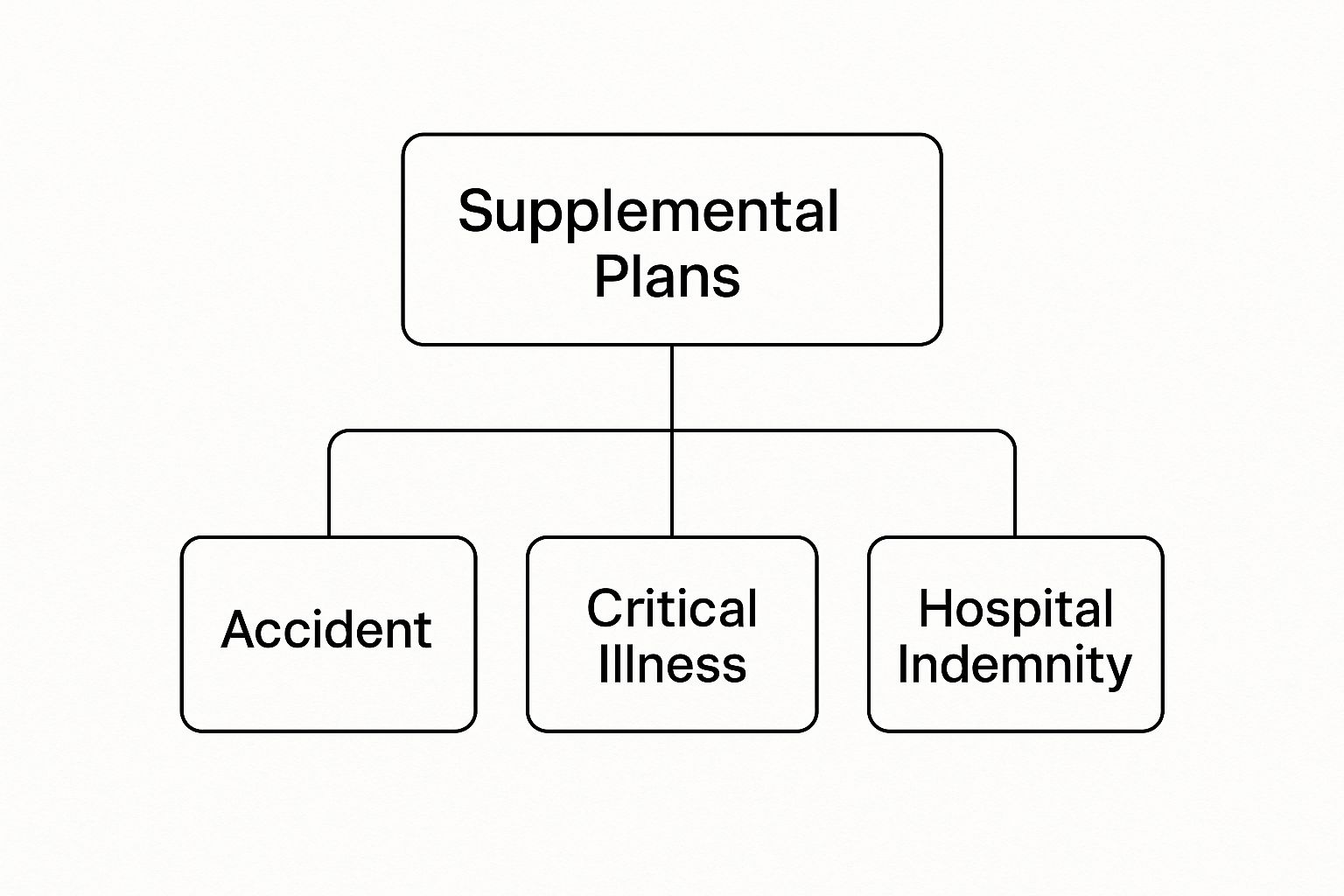

Exploring the Spectrum of Supplemental Coverage

It is more accurate to view supplemental health insurance not as a singular product, but as a suite of specialized policies. Each is engineered to close a specific financial gap that your primary health plan may leave open. The objective is not to find one comprehensive policy, but to strategically layer different types of protection that align with your unique risk profile.

The key is to see these policies as individual components of a larger financial defense system. Each is designed to activate for a specific event—such as a critical diagnosis or an accident—and deliver a set payout, allowing you to construct a safety net that is truly customized to your life.

Critical Illness Insurance

A critical illness policy is straightforward: you receive a lump-sum, tax-free cash payment if you are diagnosed with a specific, life-threatening condition listed in the policy, such as a heart attack, stroke, or cancer. The payment is triggered by the diagnosis itself, not by the subsequent medical invoices.

This coverage is a prudent measure for individuals with a family history of certain illnesses. It is also highly valuable for those who desire the financial freedom to pursue premier treatment options without liquidating assets. The capital can be used for any purpose—from funding experimental treatments or travel to a specialized clinic to simply replacing lost income during recovery.

Accident Insurance

Distinct from critical illness coverage, accident insurance pays a cash benefit if you are injured in a covered accident. Benefits are typically tied to the specific injury (such as a fracture or a severe burn) and the required treatment (an emergency room visit or physical therapy, for example).

This type of policy is particularly useful for individuals with active lifestyles or those enrolled in high-deductible health plans. It provides immediate capital to manage the out-of-pocket costs from an unexpected injury, ensuring a minor incident does not evolve into a significant financial event.

Hospital Indemnity Insurance

Hospital indemnity insurance is designed to pay you a fixed cash amount for each day you are confined to a hospital. The trigger is simple: upon admission, the plan pays for each day of your stay. The funds are delivered directly to you, regardless of hospital charges or what your primary insurance covers.

A hospital indemnity plan acts as a direct financial buffer against the ancillary costs of a hospital stay. It addresses the non-medical expenses—lost productivity, family travel, and at-home care—that primary insurance will not touch.

This coverage is a wise choice for anyone concerned about the significant indirect costs associated with hospitalization. The daily cash benefit provides a steady financial stream to maintain your household while you are unable to manage your affairs.

Disability Insurance

Finally, disability insurance is focused on protecting your most valuable financial asset: your ability to generate income. If an injury or illness prevents you from working, this policy replaces a substantial portion of your monthly income. It is structured to maintain your financial trajectory over the long term, covering everything from mortgage payments to retirement contributions.

The U.S. supplemental health market offers a wide array of benefits—including vision, dental, critical illness, and disability—all intended to fill gaps in standard health plans. As healthcare costs continue to rise, these plans are becoming less of a discretionary purchase and more of a necessity for achieving true financial security.

For expatriates, aligning the right policy with a global lifestyle is even more critical, a subject we cover in our guide on choosing the right expat medical insurance.

The Financial Case for Supplemental Policies

A reality many successful professionals overlook until it is too late is that a single, major health crisis can derail decades of meticulous financial planning. You construct a sophisticated portfolio to generate returns and protect principal, yet one unforeseen medical event can force you to liquidate assets at the most inopportune time.

This is precisely why supplemental health insurance is not an expense. It is a core component of any serious wealth preservation strategy. Consider these policies a financial firewall, standing between a sudden, massive medical liability and your long-term assets—your investment accounts, retirement funds, and business capital. The predictable, modest premium is a calculated decision to hedge against unpredictable and potentially catastrophic healthcare costs.

Mitigating Catastrophic Financial Exposure

Let us analyze a real-world scenario. Imagine you are diagnosed with a serious illness. Your primary health insurance plan has a $7,500 deductible and a 20% coinsurance responsibility, with your total out-of-pocket exposure capped at $15,000 annually. The total cost of treatment reaches $200,000. While your primary policy covers the vast majority, you remain liable for that $15,000.

Without a supplemental policy, that $15,000 must be sourced from somewhere. It might necessitate selling equities when the market is down or withdrawing cash from an account earmarked for a different strategic objective. It is a forced, reactive financial move made under duress.

Now consider the alternative: you hold a critical illness policy. A qualifying diagnosis could trigger a lump-sum, tax-free payout of $50,000 or more, paid directly to you.

This capital injection does not just cover the $15,000 medical shortfall; it provides a surplus of $35,000. This excess capital can be deployed to manage non-medical costs that arise, such as covering lost income during recovery or paying for travel to see a specialist. Your primary investment strategy remains completely untouched. The financial case is clear: a small, fixed premium preserves the integrity of a much larger asset base.

Supplemental insurance transforms an unpredictable, potentially ruinous liability into a manageable, fixed cost. It is a tool for maintaining financial control during a period of intense personal vulnerability, ensuring a health crisis does not evolve into a wealth crisis.

Protecting Your Legacy and Future Earnings

The financial shockwave from a serious health issue extends far beyond immediate hospital bills. A prolonged recovery can impair your ability to manage your business or perform your professional duties, directly impacting future earning potential. The cash benefits from supplemental policies provide the critical liquidity needed to maintain household operations and ensure business continuity.

This type of forward-thinking protection keeps your financial trajectory on course. Instead of being forced to liquidate assets intended for your retirement or your family’s legacy, you rely on a dedicated insurance instrument designed for this exact purpose.

This is the essence of sound financial stewardship—anticipating risks and implementing specific safeguards to neutralize them before they can inflict significant damage. The true value lies not just in the funds the policy pays out, but in the assets you never have to disturb.

Navigating Global Healthcare as an Expatriate

A fact most globally mobile professionals discover too late is that a home country's health insurance is of little use beyond its borders. Domestic plans are built for a domestic context, leaving you dangerously exposed the moment you step onto foreign soil.

This creates a significant vulnerability, particularly for expatriates living and working in major international hubs. A standard policy might cover a medical visit in your hometown, but it is not designed to handle the complexities of a medical emergency in another country. This is precisely where supplemental international health insurance becomes non-negotiable. It is the essential bridge between disparate healthcare systems.

These specialized plans are designed from the ground up to provide a layer of security that domestic policies simply cannot replicate.

Essential Coverage for Global Professionals

For the serious expatriate, certain benefits are mission-critical. This is not merely about covering invoices; it is about guaranteeing access to the best possible care, anywhere in the world, without disrupting your life or career.

When evaluating a plan, look for these core features:

- International Coverage: This ensures your policy is accepted by premier hospitals worldwide, not just within a limited, pre-approved network.

- Medical Evacuation: If you become seriously ill or injured and the local hospital cannot provide the required standard of care, this covers the cost of transporting you to the nearest superior medical facility. It is an indispensable safeguard.

- Repatriation of Remains: While an unpleasant consideration, this benefit is crucial. It covers the logistical and financial burden of returning home, sparing your family from a devastating ordeal during a difficult time.

For an expatriate, a supplemental policy is more than just insurance; it is a global support system. It provides the assurance that no matter where your career takes you, your health and financial well-being are comprehensively protected.

The demand for this protection is rising sharply. The Asia Pacific region is the fastest-growing market, with a projected CAGR of 8.6% through 2032, driven largely by rising healthcare spending in economic centers like India and China. Europe is also experiencing significant growth, with its market expected to expand from roughly USD 67 billion in 2023 to USD 124 billion by 2032. These figures tell a clear story: global professionals recognize how vital this coverage is.

For anyone considering international travel specifically for medical care, securing the correct visa is the first major hurdle. You can find detailed information on B2 Visa Requirements for Medical Treatment in the US. By securing the right supplemental coverage, expatriates are not just buying a policy—they are acquiring indispensable peace of mind.

How to Select the Optimal Supplemental Plan

Choosing the right supplemental policy is not an off-the-shelf purchase; it is a strategic decision. The process begins with a rigorous analysis of your primary health insurance to identify its specific shortcomings.

Pinpoint the precise weaknesses. Where are the significant deductibles? What are the coinsurance percentages that could expose you to thousands in liability? What is your annual out-of-pocket maximum? Acknowledging these specific vulnerabilities is the only way to construct a targeted defense. The objective is not merely to add more coverage; it is to add the right coverage that closes those exact gaps so you never have to liquidate assets to pay a medical bill.

Assess Your Personal Risk Profile

Next, you must conduct an honest review of your personal risk factors. This involves examining your family's health history for patterns of conditions like cancer or heart disease. Be realistic about your lifestyle as well. If you travel internationally frequently or engage in high-impact sports, you carry risks that a standard plan was not designed to mitigate.

Choosing the right supplemental plan is an exercise in personal risk management. It demands a clear-eyed assessment of your potential health exposures and a sophisticated strategy to neutralize them.

What to Look For in a Policy

Once you have identified the gaps you need to fill, you can begin comparing policies. Here are the critical benchmarks for evaluation:

- Benefit Payouts: Ensure the lump-sum or indemnity payment is substantial enough to cover not only medical gaps but also non-medical costs, such as lost income if you are unable to work.

- Waiting Periods and Exclusions: Gain absolute clarity on when your coverage becomes effective and, just as importantly, what specific situations or pre-existing conditions are not covered. There should be no surprises.

- Insurer Reputation: An insurance policy is only as sound as the company's ability to pay claims. Investigate their financial stability ratings and their track record for paying benefits when it matters most.

Ultimately, the most prudent course of action is to consult with a qualified, independent advisor. They can help you integrate a supplemental plan into your broader financial picture, ensuring it functions as a seamless part of your overall wealth and well-being protection strategy.

Frequently Asked Questions

Regarding supplemental health insurance, several questions consistently arise. Let's address the key inquiries of discerning professionals.

Is Supplemental Health Insurance the Same as an HSA?

Not in the slightest. They are two distinct tools within your financial portfolio.

A Health Savings Account (HSA) is a personal, tax-advantaged savings vehicle. You contribute funds and use them to pay for qualified medical costs. It is your dedicated medical fund.

Supplemental health insurance, conversely, is a contractual agreement. When a specified event occurs—such as a heart attack or a serious accident—the policy pays out a defined cash benefit directly to you. It is engineered to provide immediate capital when your primary insurance proves insufficient.

Can I Have More Than One Supplemental Policy?

Yes, and this is where sophisticated financial planning becomes paramount. You can absolutely hold multiple supplemental policies to construct a layered, bespoke defense.

For example, you might combine a critical illness policy (which pays upon a serious diagnosis) with a separate accident policy that covers unexpected physical injuries. This strategy allows you to build a powerful safety net tailored to your specific risks, ensuring no single event can compromise your financial stability.

The ability to stack policies provides an exceptional degree of control, allowing you to construct a defense that aligns perfectly with your lifestyle, family medical history, and long-term financial objectives.

Is Supplemental Insurance Necessary with a Low-Deductible Plan?

Even with a premier primary plan and a low deductible, supplemental coverage remains a prudent strategy. A low deductible does not grant immunity to significant out-of-pocket costs, particularly from coinsurance during major procedures or long-term treatments.

More importantly, your primary plan is designed to address medical invoices exclusively. Supplemental insurance is structured to manage the financial consequences that occur outside the hospital—such as lost income during recovery, travel for specialized care, or engaging domestic help. It protects your broader financial architecture, not just your medical expenses.

Navigating the complexities of international health coverage requires expert guidance. At Riviera Expat, we specialize in crafting bespoke insurance solutions for financial professionals living and working abroad. Secure your financial peace of mind by exploring your options with us at https://riviera-expat.com.