Indemnity health insurance represents a premier class of private medical coverage, structured around the principle of ultimate freedom. Consider it a fee-for-service plan—the foundational model of sophisticated health coverage. It provides you with complete control over your healthcare decisions, empowering you to consult any licensed doctor, specialist, or hospital you choose, anywhere in the world.

Unlike managed care plans that confine you to a pre-approved network, this model is defined by its autonomy. You procure and pay for medical services directly, then submit the invoice to your insurer for reimbursement. They, in turn, reimburse you for a substantial portion of the cost. For high-net-worth individuals who value absolute discretion and require unrestricted access to premier global healthcare, this is often the most strategic and logical choice.

What Is Indemnity Health Insurance?

At its core, an indemnity health insurance plan operates on two fundamental principles: freedom and reimbursement. It is a direct financial agreement between you and your insurer, unencumbered by the network restrictions common to other plans. You do not require a primary care physician to act as a gatekeeper, nor do you need a referral to consult with a specialist.

The process is refreshingly straightforward. You receive the medical care you deem necessary, settle the account with the provider directly, and then file a claim with your insurer. Your insurance company then reimburses you a pre-agreed percentage of the covered charges, typically after your annual deductible has been met. This structure is fundamentally different from the more prevalent HMOs or PPOs.

The Power of Unrestricted Choice

The single most compelling advantage of an indemnity plan is the absolute liberty it affords. You have the flexibility to seek a second opinion from a leading cardiologist in Geneva, continue your care with a trusted family physician in London, or schedule a procedure at a world-renowned clinic in Singapore—all under a single, cohesive policy.

This level of flexibility is indispensable for expatriates and global citizens, particularly those who:

- Travel frequently between countries for business or personal reasons.

- Wish to maintain relationships with long-term, trusted physicians in their home country.

- Require access to highly specialized treatments available only in specific global medical hubs.

When navigating a complex international lifestyle, selecting the appropriate policy is paramount. A critical consideration is how a plan addresses insurance coverage for pre-existing conditions, as this can significantly impact the cost and accessibility of your care. To compare how different models perform, we invite you to review our guide on choosing the right expat medical insurance policy.

An indemnity plan is less about managing costs through networks and more about providing financial protection and absolute control over your healthcare journey, no matter where you are in the world.

These fee-for-service plans were once the standard in private health insurance. While managed care has since gained significant market share, indemnity plans remain a vital option, particularly for a discerning clientele that prioritizes choice and borderless coverage above all else.

In a global health insurance market valued at over USD 2.3 trillion in 2023, indemnity insurance remains a key product for sophisticated individuals who refuse to compromise on their healthcare.

Indemnity Insurance at a Glance

To distill the concept, here is a summary of what defines an indemnity plan.

| Feature | Description |

|---|---|

| Provider Choice | Absolute freedom to choose any licensed doctor or hospital globally. |

| Payment Model | Pay upfront for services, then submit a claim for reimbursement. |

| Referrals | Not required. You can consult any specialist directly. |

| Deductibles & Coinsurance | You typically pay a deductible and a percentage of the cost (coinsurance). |

| Premiums | Generally higher to reflect the extensive flexibility and lack of network discounts. |

| Best For | Expats and global citizens who prioritize choice and require specialized or cross-border care. |

Ultimately, this model is engineered for individuals who demand to be in full command of their medical decisions, with the robust financial backing of a premier insurance plan.

How an Indemnity Plan Works in Practice

The most effective way to comprehend the mechanics of indemnity health insurance is to walk through a practical scenario. The experience is fundamentally different from managed care, as it positions you in control and establishes a direct financial relationship between you, your provider, and your insurer.

At its heart, the process is simple: you select your physician, you pay their invoice, and you are then reimbursed by your insurance company. This model liberates you from the constraints of approved provider lists and referral gatekeepers. The power of choice is returned to you.

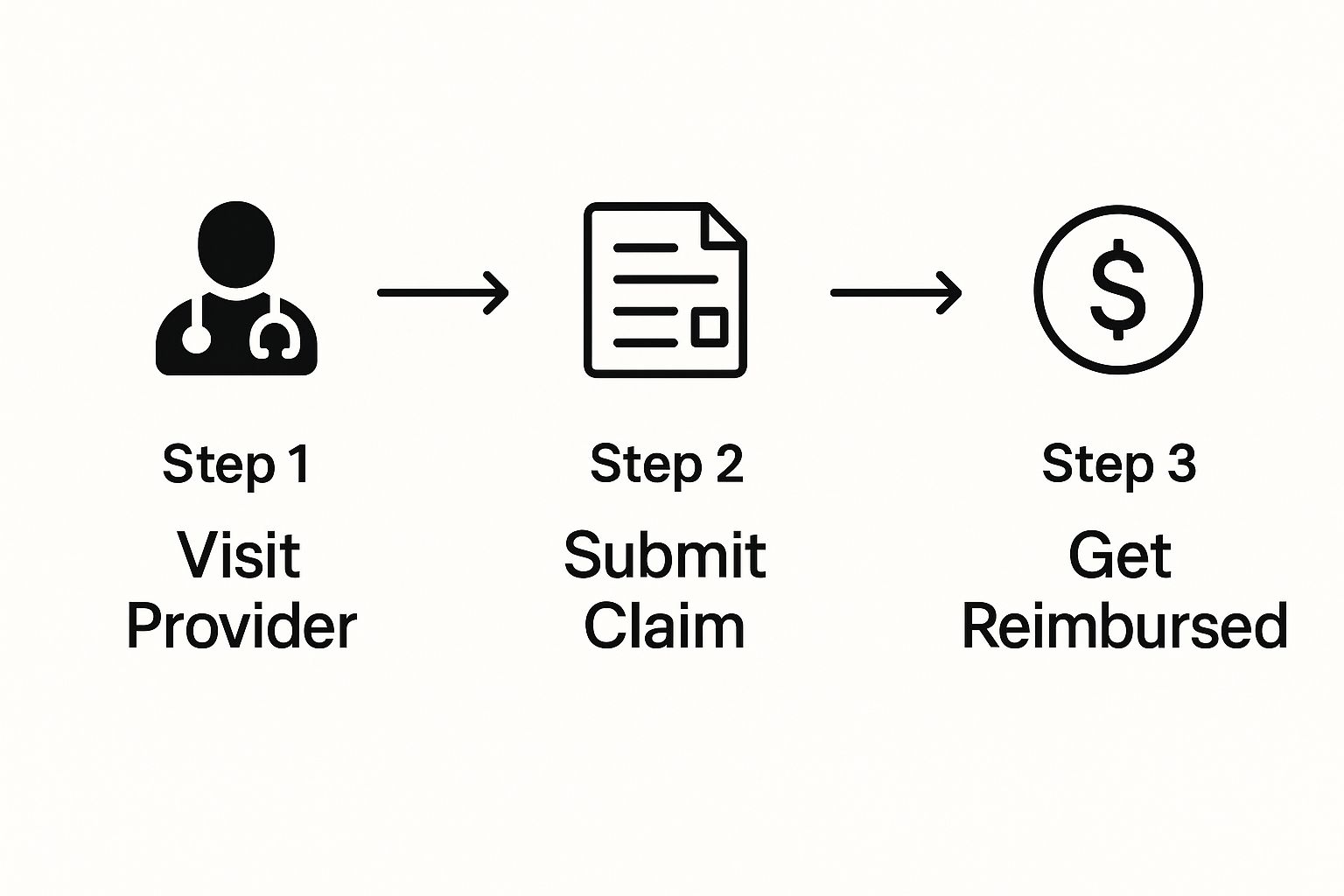

This infographic illustrates the reimbursement flow in its most essential steps.

As you can see, the process condenses into three direct actions, highlighting the linear and user-driven nature of the claims cycle.

A Practical Example in Geneva

Imagine you require a consultation with a top cardiologist. After conducting your due diligence, you identify a highly respected specialist in Geneva known for their pioneering work. With an indemnity plan, you simply contact their office and schedule an appointment. There is no need to consult an insurer's network directory or obtain pre-approval for a standard consultation.

You attend the appointment, receive world-class care, and are subsequently presented with an invoice for €1,500. You settle this bill directly with the clinic. This direct payment is the cornerstone of the indemnity plan's operational model.

Your primary responsibility in this transaction is to secure a detailed, itemized invoice. This document must list every service rendered and include the appropriate diagnostic codes. This invoice is the essential document you will submit to your insurer to initiate the reimbursement process.

Navigating the Reimbursement Journey

With the detailed invoice in hand, you will file your claim. Premier international insurers provide sophisticated online portals or mobile applications that allow you to upload your documentation efficiently. Familiarizing yourself with the specifics of your policy, especially the details of how the claims process works for international travel health insurance, is key to managing your plan effectively.

Now, let's analyze how the financial terms of your policy apply to the €1,500 cardiologist invoice. We will assume your plan has the following structure:

- Annual Deductible: €1,000 (and you have not yet made any claims this policy year)

- Coinsurance: 80/20 split (The insurer pays 80% of eligible costs after the deductible; you pay 20%)

- Annual Out-of-Pocket Maximum: €5,000

Here is the step-by-step reimbursement calculation:

- Meet the Deductible: You are first responsible for your €1,000 annual deductible. This leaves a remaining balance of €500 (€1,500 – €1,000) for coinsurance calculation.

- Apply Coinsurance: The insurer now covers its portion. They will pay 80% of the remaining €500, which amounts to €400. Your share, the coinsurance, is the remaining 20%, or €100.

- Final Reimbursement: Your insurance provider sends you a reimbursement of €400.

For this consultation, your total out-of-pocket cost is €1,100 (the €1,000 deductible + your €100 coinsurance). This entire amount is applied toward your €5,000 annual out-of-pocket maximum. Once you reach that limit within your policy year, the insurer will cover 100% of any subsequent eligible medical costs.

For significant, planned procedures, it is prudent to explore other payment arrangements. You can learn more about the pre-authorisation and direct settlement options that many top-tier international plans offer for major treatments, which can prevent the need for large upfront payments.

The Defining Features of a Premier Indemnity Policy

While the fundamental concept of an indemnity plan is straightforward, a top-tier policy designed for a global lifestyle operates on a different level of sophistication. These are not merely insurance plans; they are strategic instruments engineered for absolute control and peace of mind. The paramount feature is unrestricted freedom of choice. You can consult any licensed physician or visit any hospital on the planet, without seeking pre-approval or consulting a network list.

This is the standard of autonomy that high-net-worth individuals expect and require. A premier indemnity policy is founded on the principle that your health decisions should be governed by medical necessity, not by an insurer's network contracts. It grants you the power to assemble a global team of specialists—the best in their respective fields—ensuring you receive consistent, high-quality care regardless of your location.

High Limits and Comprehensive Scope

Beyond choice, the sheer scale of the coverage is a defining characteristic. Premier plans feature exceptionally high annual and lifetime limits, often extending into the millions of dollars. This ensures that even the most complex and costly treatments, from advanced surgical procedures to long-term therapies for critical illnesses, are fully covered.

The scope of these policies is equally expansive. They are designed to cover a vast range of medical needs, eliminating the gaps often found in standard insurance. This typically includes:

- Full Inpatient and Outpatient Care: Coverage applies whether you are admitted to a hospital for major surgery or visiting a specialist for a consultation.

- Preventative Services and Wellness: These plans encourage proactive health management by covering routine physicals, screenings, and wellness programs.

- Specialized Treatments: Gain access to alternative therapies, top-tier dental and vision care, and comprehensive maternity benefits that other plans frequently limit.

This structure functions as a financial fortress, protecting your assets from the significant costs associated with world-class medical care.

Predictable Reimbursement and White-Glove Support

Another crucial element that distinguishes a premier policy is the clarity and predictability of its reimbursement structure. Top-tier plans typically offer a high, fixed reimbursement percentage—often 80% to 100% of the actual billed amount after your deductible is met. This eliminates the ambiguity of "usual and customary" rates that can result in unexpected out-of-pocket expenses.

Furthermore, these plans are renowned for their concierge-level support. This is not a standard call center; it is a dedicated team that serves as your personal health advocate. They manage administrative complexities, assist with claims, coordinate with medical providers, and ensure the entire process is seamless.

A premier indemnity policy is built to function as a silent partner in your global life, handling the complexities of healthcare administration so you can focus entirely on your well-being, not on paperwork.

This high-touch service is essential for individuals whose time is their most valuable asset. The wider professional indemnity insurance market was valued at over USD 50 billion in 2023 and is projected to grow, reflecting a deep reliance on indemnity products for financial protection in complex environments—a principle that applies directly to premier health indemnity plans. You can find more market analysis on this trend and its drivers.

Ultimately, it is this combination of absolute freedom, extensive coverage limits, predictable finances, and dedicated support that transforms an indemnity health plan from a simple safety net into a strategic tool for managing your global health with total confidence and control.

Indemnity Plans Versus Managed Care Plans

When selecting global health coverage, you will ultimately face a fundamental decision: a traditional indemnity plan or a managed care plan, such as a Health Maintenance Organization (HMO) or a Preferred Provider Organization (PPO). The choice hinges on a single, critical trade-off: Do you prioritize absolute freedom, or do you prefer structured costs?

Each model is designed for a different lifestyle and set of priorities. Understanding their core mechanics is the only way to align your insurance with your actual requirements.

Indemnity plans represent the pinnacle of autonomy. They operate on a simple fee-for-service model that allows you to consult any licensed medical provider, anywhere in the world. Conversely, managed care plans are built around a network of contracted doctors and hospitals, creating a more controlled and predictable environment.

The Core Philosophies: Choice Versus Control

The philosophical divide between these models is substantial. An indemnity plan is designed for the individual who does not want to be directed where to go or whom to see for medical care. It places the power squarely in your hands, trusting you to procure the best care available, whether in Zurich, Singapore, or your city of residence. You do not need a primary care physician (PCP) to act as a gatekeeper, and you certainly do not require a referral to see a specialist.

Managed care, by contrast, is engineered for cost efficiency. HMOs are the most restrictive, requiring you to use their network providers for all services (except in a true emergency) and mandating a referral from your PCP before you can see a specialist. PPOs offer more latitude, allowing you to go out-of-network if you are willing to pay a higher share of the cost, but they are still structured to incentivize staying within their network.

For a global citizen, the distinction is critical. An indemnity plan supports a life without borders, while a managed care plan operates best within a defined geographical and provider network.

This structural difference impacts everything from your out-of-pocket costs to the administrative burden. Managed care often translates to lower premiums and simpler billing, but these benefits are achieved by limiting your choices. An indemnity plan’s higher premium is the price of unrestricted, worldwide access.

Comparing Key Structural Differences

To fully appreciate how these plans function in practice, a direct comparison is necessary. They handle the fundamentals—access to providers, payment methods, and reimbursement—in distinctly different ways.

Consider how these features would integrate with your lifestyle:

- Provider Choice: With an indemnity plan, your options are global and unlimited. Any licensed professional is accessible. HMOs restrict you to their network. PPOs offer an out-of-network option, but at a higher cost to you.

- Referral Requirements: Indemnity and PPO plans allow you to consult a specialist directly at your discretion. HMOs almost always require a referral from your primary care doctor first.

- Claims Process: This is a significant differentiator. Indemnity plans are reimbursement-based. You pay the provider first, then submit the invoice to your insurer. Managed care plans typically pay the provider directly, leaving you responsible only for a small copayment.

The table below provides a clear, side-by-side comparison of the most important differences.

Indemnity vs. HMO vs. PPO: A Head-to-Head Comparison

This table isolates and compares the core features of indemnity plans against the two most common managed care models.

| Feature | Indemnity Plan | HMO Plan | PPO Plan |

|---|---|---|---|

| Provider Network | None. Complete freedom to choose any licensed provider worldwide. | Restricted. Must use doctors and hospitals within the HMO network. | Flexible. A network of "preferred" providers with an option to go out-of-network at a higher cost. |

| Primary Care Physician (PCP) | Not required. | Required. Acts as a gatekeeper for all your medical care. | Not required. |

| Specialist Referrals | Not required. You can self-refer to any specialist. | Required. You must get a referral from your PCP. | Not required. You can see specialists without a referral. |

| Out-of-Network Care | Fully covered (as there is no network). | Not covered, except in cases of a true medical emergency. | Covered, but you will pay a significantly higher coinsurance or copay. |

| Claims & Billing | You pay the provider directly and submit a claim for reimbursement. | The insurer pays the provider directly. You only handle copays. | Insurer pays in-network providers directly. You handle claims for out-of-network care. |

| Cost Structure | Higher premiums, deductibles, and coinsurance. | Lower premiums and predictable copays. | Moderate premiums with different cost structures for in-network vs. out-of-network care. |

Ultimately, there is no single "best" option—only the best option for your specific circumstances. An indemnity plan offers unparalleled freedom, which is invaluable for a mobile expatriate. A managed care plan offers predictability and lower costs, which may be suitable for someone residing long-term in a country with a strong, established healthcare network.

Why Expats and Global Citizens Prefer Indemnity Plans

For high-net-worth expats and global citizens, health insurance is not merely a safety net—it is a critical component of a lifestyle defined by mobility and excellence. For this demographic, an indemnity plan is often the default choice, functioning less like traditional insurance and more like a strategic asset for managing their well-being across the globe.

The rationale is simple: when your life and business interests span multiple continents, your healthcare plan cannot be constrained by borders. The true value of an indemnity plan lies in its completely borderless nature. It facilitates seamless, high-quality medical care whether you are in London, Singapore, or visiting your home country.

Uncompromising Access to Global Expertise

The primary motivation for choosing an indemnity plan is the freedom to consult any specialist, anywhere, without navigating network limitations.

Consider a scenario where you need to consult with a leading oncologist in Zurich, or you require a complex surgical procedure perfected by a team in the United States. A typical managed care plan would likely present significant barriers, if not deny coverage outright. An indemnity plan removes those obstacles.

This empowers you to build your own personal advisory board of the world's best physicians. Your care is dictated by medical need and expert opinion, not an insurer's contractual arrangements. This is absolutely essential when facing a serious health condition where access to the right specialist at the right time is paramount.

Furthermore, many expatriates wish to maintain continuity of care with their trusted doctors back home. An indemnity policy facilitates this, allowing you to return for check-ups with a physician who has a comprehensive understanding of your medical history, even if you reside thousands of miles away.

The Assurance of Control and Confidentiality

For many high-net-worth individuals, privacy is a non-negotiable requirement. The structure of an indemnity plan inherently offers a higher degree of discretion. Because you pay the provider directly and are subsequently reimbursed, the financial relationship remains between you and your physician's office.

This model significantly reduces the amount of personal data shared with third parties. It provides a level of confidentiality that is nearly impossible to achieve in managed care systems, where direct billing and extensive data-sharing are standard practice. Your plan operates as a silent financial partner, enabling you to manage your health with the same discretion you apply to all other aspects of your life.

An indemnity plan is structured to serve your agenda, not an insurance network's. It provides the financial backing to pursue the best medical care on your own terms, offering a peace of mind that is essential when navigating a global career.

This control extends beyond privacy to the quality of care itself. You are not limited to pre-approved treatment protocols or standardized solutions. You and your chosen physician have complete autonomy to select the most advanced and appropriate course of action—a crucial advantage that defines premier healthcare. To gain a deeper understanding of what sets these plans apart, it is worth exploring the specific international private medical insurance benefits available.

Ultimately, an indemnity health insurance plan is perfectly aligned with the global citizen's mindset. It is a sophisticated, flexible, and powerful instrument for protecting your most valuable asset—your health—no matter where your ambitions lead.

Navigating the Financials of Your Indemnity Plan

To maximize the value of an indemnity health plan, it is essential to become comfortable with its financial mechanics. This is a different paradigm from managed care, where costs are largely defined by predictable copayments and network rates. An indemnity model places you in control, which necessitates a more hands-on approach to managing your healthcare expenditures. This is the trade-off for complete command over your medical journey.

Your financial commitment begins with the premium—the regular payment made to keep the policy active. You will observe that premiums for top-tier indemnity plans are higher. This is not merely a cost; it is an investment in unparalleled flexibility, global coverage, and white-glove service that grants you unrestricted access to world-class care, entirely on your terms.

Understanding UCR and Your Reimbursement

There is a concept that can be a point of confusion for those new to indemnity plans. When you submit a claim, the insurer does not simply pay a percentage of what you were billed. They first compare the charge against their internal benchmark, known as Usual, Customary, and Reasonable (UCR) fees.

This UCR figure represents what the insurer has determined to be a fair market price for a specific service in a particular geographic area. Your reimbursement is calculated based on their UCR amount, not necessarily the full amount invoiced by your doctor.

For example, a specialist in Geneva bills you $800 for a consultation. Your insurer, however, has set the UCR for that service at $600. Your 80% reimbursement will be based on that $600 figure, not the $800 you paid. Understanding this is critical because it directly affects your out-of-pocket costs and is a major differentiator between standard and premier indemnity plans. The best plans often agree to pay based on actual charges, thereby bypassing UCR limits entirely.

The Concept of Balance Billing

This leads directly to another key term: balance billing. This occurs when there is a disparity between what your provider charges and what your insurance plan agrees to pay based on its UCR. The "balance" is the remaining amount, and it is your responsibility.

Balance billing is simply the financial gap between a provider’s invoice and the insurer’s UCR-based payment. Thinking about this potential cost ahead of time is fundamental to managing the finances of your indemnity plan.

While this may seem like a significant drawback, for many high-net-worth expatriates, it is an acceptable trade-off for the absolute freedom to see any top-tier specialist without network constraints. Furthermore, high-end indemnity policies are designed to mitigate this issue, often by offering much higher reimbursement rates or paying a percentage of actual billed charges, which significantly reduces or even eliminates the balance bill.

Effectively managing an indemnity plan comes down to three key financial habits:

- Anticipate Upfront Costs: Adopt the mindset of paying for the full cost of care at the time of service. Reimbursement is a subsequent step.

- Clarify Provider Fees: Before any significant procedure, inquire with the provider’s office about the expected costs. This allows you to forecast your out-of-pocket share.

- Maintain Meticulous Records: Retain every itemized invoice and receipt. Organization is the key to a smooth and accurate claims process.

By understanding these components—premiums, UCR, and balance billing—you can leverage your indemnity plan not just as insurance, but as a precise financial tool for directing your global healthcare strategy.

Common Questions About Indemnity Health Insurance

When exploring any type of health insurance, the high-level concepts are important, but it is the practical, day-to-day questions that truly matter. Let's address some of the most common inquiries regarding indemnity plans.

Can I Keep My Existing Doctors?

Absolutely. In fact, this is one of the primary reasons individuals select an indemnity plan.

It grants you total freedom to consult any licensed doctor, specialist, or hospital you trust, anywhere in the world. There are no restrictive networks that compel you to change providers, so you can maintain relationships with the physicians you have known for years, even after relocating abroad.

Are Premiums Tax-Deductible?

This is a complex matter, and the answer is almost always: "it depends."

Tax regulations concerning health insurance premiums vary dramatically from one country to another and often depend on your specific residency and tax status. While some jurisdictions do permit the deduction of medical expenses, it is imperative that you seek advice from a qualified financial advisor who specializes in the tax laws of the countries where you reside and file taxes.

The core value of an indemnity plan is its unmatched flexibility and global access. It’s built for people who prioritize freedom of choice over the rigid, network-based cost controls you find in plans like HMOs or PPOs. For a global lifestyle, that freedom is everything.

How Does This Differ from a "Hospital Indemnity" Plan?

This is a critical distinction, and confusing the two can be a costly error.

A true indemnity health insurance plan is comprehensive medical coverage. It is your primary insurance for a wide range of services, including doctor visits, hospital stays, surgery, and prescriptions.

A "hospital indemnity" plan, in contrast, is a supplemental product. It pays you a fixed, predetermined cash amount for each day you are hospitalized. It is not a substitute for comprehensive health insurance and will not cover the substantial costs of a serious medical event.

At Riviera Expat, our exclusive focus is on providing clarity and control for your global healthcare decisions. We specialize in matching discerning clients with premium international health insurance that is precisely tailored to their lifestyle. Allow us to help you secure your peace of mind.

Find your ideal IPMI plan at https://riviera-expat.com.