Life is rarely static. You marry, change professional roles, relocate across continents, or welcome a new child. These major milestones are transformative, but they also have a profound impact on one of your most critical assets: your health insurance.

So, what happens when a significant life change occurs outside the designated "open enrollment" window? This is where a Qualifying Life Event (QLE) becomes paramount.

A qualifying event is a specific, significant change in your personal circumstances that creates a special window, allowing you to enroll in or modify your health plan. This window is officially known as a Special Enrollment Period (SEP). It is a crucial mechanism designed to ensure you and your family are not left without premier coverage during life’s most pivotal moments.

Navigating Health Coverage During Major Life Transitions

For high-net-worth individuals, particularly those leading an international lifestyle, a dynamic career should never compromise your health coverage. Consider a Qualifying Life Event not as a bureaucratic formality, but as a strategic opportunity—a private window to realign your health plan with your new reality.

This is about ensuring your health assets are managed with the same diligence as your financial portfolio. Whether you are navigating a U.S.-based plan or a sophisticated International Private Medical Insurance (IPMI) policy, understanding what constitutes a life event is fundamental to proactive wellness management.

Why QLEs Are So Important for Global Professionals

A Qualifying Life Event unlocks the critical Special Enrollment Period. This is absolutely essential for professionals who may find themselves relocating between global hubs such as Singapore, London, or Dubai.

In the U.S., where the health insurance market is a significant part of the global landscape, QLEs are the primary safety net preventing coverage gaps during career moves or family changes. The framework is designed so that a change in employment or an international move does not leave you exposed.

This is especially true for expatriates. Your career may involve complex, cross-border moves that a standard, domestic insurance policy is simply not structured to handle. A move from New York to Singapore, for example, is a classic QLE that necessitates an immediate review and update of your health coverage.

What Triggers a Special Enrollment Period?

While the specifics can vary between plans and countries, a few major life changes almost always serve as qualifying events. Knowing what they are allows you to act decisively and maintain control of your healthcare strategy.

Here are the most common triggers:

- A Change in Your Household: This includes marriage, the birth of a baby, or the adoption of a child.

- Losing Your Existing Coverage: This could mean leaving a job, or a child "aging out" of a parent's plan at age 26. The key here is that the loss of coverage must be involuntary.

- A Change in Residence: Moving to a new ZIP code, county, or, most importantly for expatriates, a new country where your current plan does not provide coverage.

A QLE is more than just an administrative requirement. It is a pivotal moment to reassess and optimize your health coverage. For high-net-worth individuals, this means ensuring your plan’s benefits, network, and service levels continue to meet your exacting standards, regardless of where life or your career takes you.

To provide a clearer picture, here is a quick-reference table summarizing the most common qualifying events.

Key Qualifying Life Events at a Glance

| Qualifying Life Event Category | Common Examples | Typical Special Enrollment Window |

|---|---|---|

| Loss of Health Coverage | Losing job-based insurance, COBRA expiration, aging off a parent's plan. | 60 days from the event. |

| Changes in Household | Getting married, divorced, having a baby, or adopting a child. | 60 days from the event. |

| Changes in Residence | Moving to a new country, state, or ZIP code with different plan options. | 60 days from the event. |

| Other Qualifying Events | Becoming a citizen, leaving incarceration, changes in income affecting subsidy eligibility. | Varies, typically 60 days. |

This table provides a solid starting point, but always remember to verify the specifics of your plan, as deadlines and documentation requirements can differ.

Understanding these concepts is the first step toward building a truly resilient health strategy. For a deeper dive into how these events intersect with your insurance options, this guide to Life Event Health Insurance is an excellent resource. It provides more context that will empower you to make the right decision when life changes occur.

Understanding Loss of Coverage as a Critical QLE

Of all the events that can trigger a Special Enrollment Period, the involuntary loss of health coverage is perhaps the most common—and the most urgent. This is not merely an administrative detail; it is a critical moment that requires swift action to protect your health and your financial stability.

For high-net-worth professionals in dynamic sectors like investment banking or technology, this often happens when moving between roles and losing an employer's plan. However, the situations that qualify as a "loss of coverage" are much broader than just changing employers.

This specific what is a qualifying event for health insurance is designed to prevent you from falling through the cracks. It is a built-in safety net that acknowledges that life and careers shift, giving you a way to secure new coverage without being penalized for events often outside your control.

Common Scenarios Triggering a Loss of Coverage QLE

It is crucial to know precisely what qualifies, as proactive planning is essential. The key determinant is that the loss must be involuntary. Simply deciding to cancel your plan will not open the door to a Special Enrollment Period.

Several specific situations fall under this umbrella. Each has its own circumstances, but they all lead to the same result: a 60-day window to secure new insurance.

Here are the most frequent examples of an involuntary loss of coverage:

- Termination of Employment: This is the classic case—losing your job, whether from a layoff or your own resignation, and your health benefits along with it.

- Reduction in Work Hours: Your employer reduces your hours, and you no longer meet the threshold to qualify for their health plan.

- Aging Off a Parent's Plan: A dependent turning 26 is a milestone that automatically triggers the loss of their coverage under a parent's plan. This is a very clear qualifying event.

- Expiration of COBRA Benefits: The Consolidated Omnibus Budget Reconciliation Act (COBRA) offers a temporary continuation of your group health benefits. When that coverage period expires, you have a new qualifying event to find a permanent plan.

The entire framework is built to ensure you can move from one plan to another without a dangerous gap in your protection.

The Global Perspective for Expatriates

For expatriates and global professionals, losing coverage often has an international dimension. Imagine an executive completing a multi-year assignment in Hong Kong and moving back to the United States. The moment they leave, their corporate International Private Medical Insurance (IPMI) terminates. That termination is a textbook QLE.

The reverse is also true. Relocating from the U.S. to another country where your domestic plan offers no service is also considered a loss of coverage. This creates both the need and the opportunity to secure a proper, globally recognized IPMI policy that befits an international career.

The core principle is clear: If your geographical or employment circumstances change in a way that terminates your existing, creditable health coverage, you are granted a special opportunity to enroll in a new plan. This prevents a situation where a career move inadvertently exposes your assets to massive medical liabilities.

Why Timely Action is Non-Negotiable

The window to act after losing coverage is strict. You generally have 60 days from the date your old plan officially ends to choose and enroll in a new one. If you miss that deadline, you will be unable to enroll until the next annual Open Enrollment Period, which could leave you uninsured for months.

Documentation is equally important. You will need to provide proof, such as a formal letter from your previous employer or insurance provider, that verifies the date and the reason your coverage ended. Securing this paperwork immediately is key to a smooth transition.

The goal is to move seamlessly from one premier plan to another, ensuring no gap ever leaves your health and financial security vulnerable.

How Household Changes Impact Your Health Insurance

While losing a job is a common trigger for changing health insurance, major life milestones often require more forethought. These significant family moments are powerful qualifying life events that not only permit you to change your plan—they demand you reassess your entire healthcare strategy.

Your health insurance should grow and adapt with your family. Events like getting married or welcoming a new child create a specific, limited-time opportunity to ensure your policy is adequate for your new circumstances. This is not just about paperwork; it is a critical financial move to protect the people most important to you.

Marriage as a Qualifying Life Event

Marriage is more than a personal milestone; it is a financial merger. Your health insurance is a significant piece of that new financial picture. The good news is that marriage qualifies you for a Special Enrollment Period, giving you a window to combine, change, or upgrade your health plans.

This is your opportunity to add your new spouse to your employer's plan, or for you to join theirs. It is also the ideal time to compare both policies side-by-side and decide if a new family plan makes more sense for your shared future.

However, you must act promptly. The clock starts ticking on your wedding day, not upon your return from the honeymoon.

Adding a New Member to Your Family

Bringing a new child into your family, whether through birth, adoption, or foster care, is another key qualifying life event. The system is designed to recognize the urgency of this, opening a special enrollment window to get your newest family member covered from their very first day.

Changes in household size are one of the most common reasons for a special enrollment. Marriage, for instance, typically provides a 60-day window to make changes. Birth or adoption also provides a 60-day period, but with a crucial advantage: you can obtain retroactive coverage back to the date of birth or adoption. This is essential for covering a newborn immediately. You can find more insights about Special Enrollment Periods to understand these timelines better.

The ability to secure retroactive coverage for a newborn is a significant advantage. It means every check-up, test, and procedure from the moment of birth can be covered by your updated family plan. You are not left exposed to substantial out-of-pocket costs during those first critical days.

This is precisely why you must act quickly. To add your child, you will need documents such as a birth certificate or adoption records. Having these ready will ensure a smooth process and prevent any dangerous gaps in your family's protection.

Navigating Separation and Other Disruptive Events

Life is not always about celebratory milestones. Difficult events can also trigger a qualifying life event, and for good reason. A divorce or legal separation is a major one, giving an individual who lost coverage from a spouse's plan the necessary opportunity to obtain their own policy.

This ensures a difficult personal transition does not evolve into a healthcare crisis. Similarly, the death of the person holding the policy is a qualifying event for the surviving spouse and dependents. It gives them a vital window to enroll in new coverage and maintain continuity of care during an incredibly challenging time.

These qualifying life events for health insurance are safety nets. They provide a clear path to securing the right coverage when life is unpredictable, protecting both your health and your financial stability. Knowing what these triggers are allows you to be proactive, turning a potential coverage gap into a strategic opportunity.

Navigating Relocation as a Qualifying Life Event

For globally mobile professionals, a move is not just a change of address—it is a critical moment that can completely redefine your health insurance. Relocation is a powerful qualifying life event, opening a brief but essential window to overhaul your coverage. However, the implications of a domestic move versus an international one are vastly different. Each demands a distinct strategy.

A simple domestic move, even just to a new county, can trigger a Special Enrollment Period. The reason is that moving to a new ZIP code often means your old health plan is no longer available or suitable. A move from Manhattan to a suburb in Connecticut, for example, could place you in a new network with different providers and insurance carriers. This change makes your old plan obsolete and gives you the right to choose a new one that is functional where you now reside.

The Higher Stakes of International Relocation

For expatriates, the stakes are exponentially higher. A transfer from New York to London is not just a move; it marks the end of your U.S.-based health plan's viability. Domestic insurance policies are geographically restricted and were never designed to provide effective coverage overseas. This termination is a textbook "loss of coverage" QLE, instantly creating the need for a new insurance solution.

This is where planning is paramount. An international move is the definitive moment to transition from a domestic plan to a proper International Private Medical Insurance (IPMI) policy. IPMI plans are engineered for the expatriate lifestyle, offering seamless, high-level coverage across borders without the constraints of a local network.

For the globally-minded professional, an international move should be viewed as an opportunity to upgrade and align health coverage with a borderless career. It is the moment you trade a geographically limited policy for a plan that is as mobile and sophisticated as you are.

Understanding Your Options as an Expatriate

When you relocate abroad, you are stepping into an entirely new healthcare landscape. Every country has its own regulations, quality standards, and insurance mandates. For some, specific local plans like Australia's Overseas Visitors Health Cover (OVHC) might be required to ensure you are protected according to local laws.

This transition requires careful forethought. Your move is the qualifying event, but the choices you make during the Special Enrollment Period will define your health security for your entire assignment. This is your chance to secure an IPMI plan with robust benefits—such as global medical evacuation, your choice of top-tier hospitals worldwide, and multilingual support. For a deeper dive into the logistics, our guide on preparing for your move abroad offers crucial context.

The Mechanics of a Relocation QLE

To use your move as a qualifying life event, you will need to provide clear, indisputable proof. Insurers are vigilant about preventing fraud, so your documentation must be solid.

Here’s what you will typically need to provide:

- Proof of Prior Coverage: You must prove you had qualifying health coverage for at least one day in the 60 days before your move. This is to prevent individuals from waiting until they are sick to obtain insurance.

- Proof of New Residence: This is non-negotiable. You can verify it with documents like a new lease or mortgage, utility bills in your name at the new address, or an official employment contract detailing your international assignment.

Precision is key. The 60-day window to enroll in a new plan begins on the day you move. Missing it can leave you dangerously exposed. We specialize in these complex cross-border transitions, ensuring your healthcare portfolio is flawlessly managed so you can focus on your professional goals with total peace of mind.

Mastering Special Enrollment Periods and Documentation

Recognizing a qualifying event is just the first step. The true test is executing the enrollment change with precision. This occurs during what is known as a Special Enrollment Period (SEP)—a strict, non-negotiable window to update your health coverage.

For most plans, you have 60 days following your life event to act. Miss this deadline, and you must wait for the next annual open enrollment. That delay can create a dangerous—and potentially ruinous—gap in your protection.

The Protocol for Proof

Consider this part as building an airtight case for your eligibility. Your insurance provider will not simply take your word for it; they require specific, verifiable proof of your qualifying life event to prevent fraud and confirm your eligibility to make changes. There is no room for ambiguity.

This is not a process where you can afford delays or incomplete paperwork. The required documents are straightforward, but they are absolutely essential. Gathering them should be your first priority the moment a qualifying event occurs.

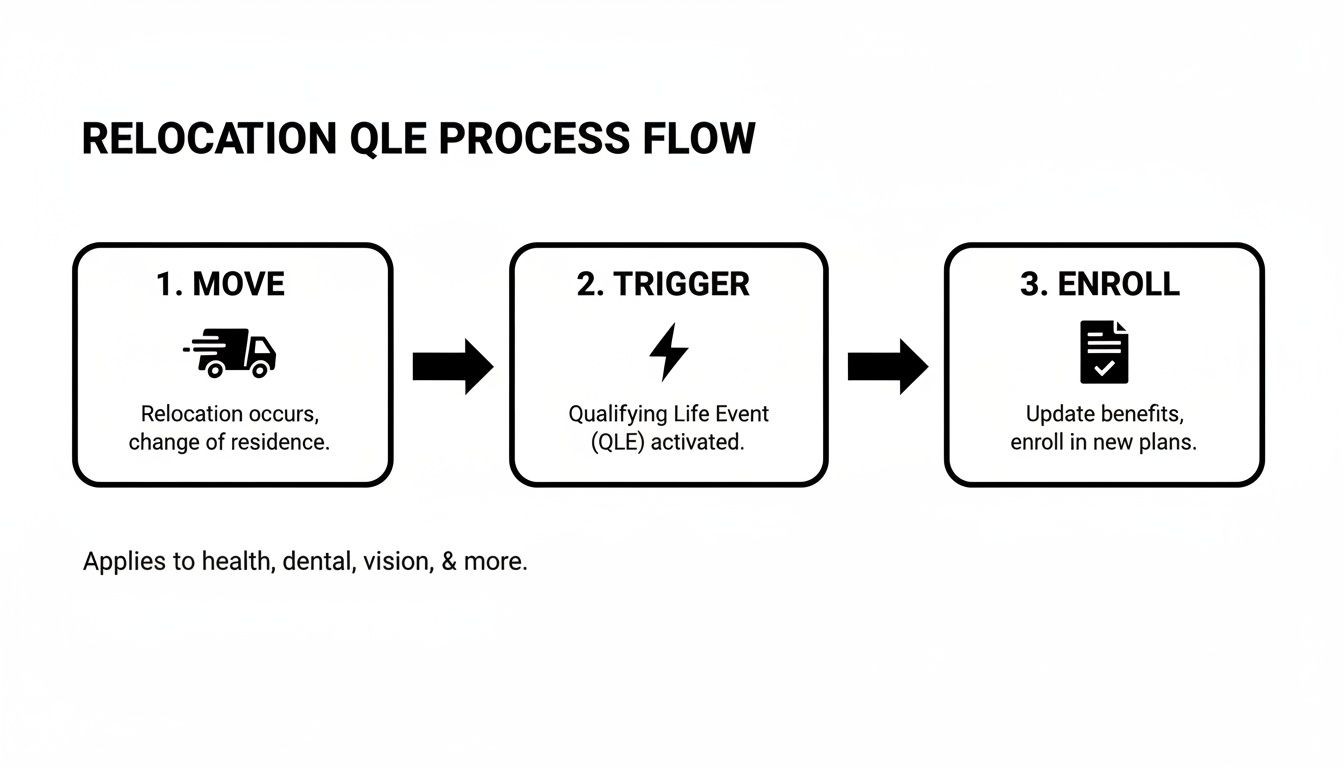

This flowchart provides a clear, step-by-step visual of how a relocation, for example, triggers the opportunity to enroll in a new plan.

As the graphic illustrates, the clock starts ticking the moment the move happens. You must have your documentation ready to secure your new coverage without issue.

Required Documentation for Common Qualifying Life Events

To help you prepare, here is a quick reference table outlining the proof you will need for the most common QLEs. Having these documents organized and ready to submit will make the entire process much smoother.

| Qualifying Life Event | Primary Documentation Required | Secondary/Supporting Documents |

|---|---|---|

| Marriage | Official Marriage Certificate | – |

| Birth of a Child | Official Birth Certificate | Hospital Record of Birth, Adoption Decree, or Court Order |

| Loss of Coverage | Letter from Former Employer or Insurer | COBRA notice, proof of previous coverage ending |

| Relocation | New Lease Agreement or Mortgage Documents | Utility bills, updated driver's license, voter registration |

| Aging Out of a Plan | Notice from the Previous Insurer | Birth Certificate (confirming age), Letter of Ineligibility |

| Employment Change | Letter of Employment Offer or Termination | Pay stubs from the new job, proof of change in hours |

This table is not exhaustive, but it covers the essentials. The key is providing official, third-party verification that the life event occurred on a specific date.

Timelines and Deadlines Are Absolute

Let us be unequivocally clear: the 60-day window for a Special Enrollment Period is unforgiving. That clock starts ticking on the date of the qualifying life event itself, not when you get around to applying. For a marriage, it starts on your wedding day. For a move, it begins the day you officially establish residency in your new home.

A Special Enrollment Period is not a suggestion; it is a firm deadline. Treating it with the same urgency as a critical financial transaction is the key to maintaining continuous, high-quality health coverage without interruption.

Waiting until the last minute invites unnecessary risk. If your documentation is rejected for any reason—a blurry scan, a missing signature—you might run out of time to rectify it. This could force you to wait months for the next open enrollment, creating an unacceptable risk for any professional managing their personal and financial well-being.

To better understand how these timelines work within the fine print of a policy, take a look at our detailed guide on expat medical insurance policy terms explained.

By preparing your documents in advance and acting decisively, you transform what could be a stressful administrative task into a controlled, strategic update to your healthcare portfolio. This proactive approach ensures you and your family are protected, no matter what life changes come your way.

Proactive Health Insurance Strategy and Next Steps

Throughout this guide, we have treated Qualifying Life Events and Special Enrollment Periods not as mere administrative hurdles, but as what they truly are: strategic tools for sophisticated life planning. Managing your health insurance proactively is every bit as critical as managing your investment portfolio. Now it is time to move from understanding these concepts to putting them into action.

As specialists in International Private Medical Insurance (IPMI) for high-net-worth individuals, we provide the expert counsel needed to navigate these complexities. Our entire advisory model is built on objectivity and a deep understanding of the global insurance landscape, ensuring your choices align perfectly with your professional and personal ambitions.

Charting Your Course Forward

The clear next step is a personalized consultation. This is where abstract concepts become a concrete, actionable strategy tailored to your unique circumstances. For anyone living a global life, a proactive review is absolutely essential for maintaining control over your health and wellness portfolio.

Our process starts with a meticulous assessment to ensure your coverage is always one step ahead of your life's trajectory. We will help you:

- Review your current coverage to identify potential gaps or inefficiencies, especially regarding international assignments or frequent travel.

- Anticipate future life events that could trigger a QLE, allowing you to prepare the necessary documentation and plan your response well in advance.

- Develop a robust global health strategy that gives you clarity, control, and peace of mind, no matter where your career takes you.

Engaging with an expert is not a cost—it is an investment in certainty. It ensures that when a significant life event occurs, your focus remains on the event itself, not on scrambling to secure adequate medical protection for your family.

We are dedicated to this level of preparation. For a deeper dive into what premier global coverage entails, you can explore the many benefits of International Private Medical Insurance in our comprehensive guide. Let us help you build a health strategy that works as hard as you do.

Frequently Asked Questions

When it comes to health insurance, particularly for globally mobile professionals, the details are paramount. Obtaining direct answers to specific questions is key to protecting your health and your wealth. Here are some of the most common queries I receive about qualifying life events.

Does a Major Change in Income Count as a QLE?

This is a common point of confusion, and the answer depends entirely on the type of insurance you have.

For someone using a U.S. ACA Marketplace plan, a significant change in income that alters eligibility for subsidies can, in fact, be a qualifying event. However, this rarely applies to the high-net-worth individuals I typically advise, who do not use subsidy-based plans.

When we are discussing International Private Medical Insurance (IPMI), a change in income is not considered a qualifying event for enrollment. These premier plans do not operate on a subsidy model. That said, if your financial situation changes dramatically, it is the perfect trigger to review your existing policy. You will want to ensure its premium and coverage levels still align with your overall financial strategy.

What Are the Consequences of Missing the SEP Window?

Missing your Special Enrollment Period is a critical, and potentially devastating, financial mistake. The 60-day window you get after a qualifying event is not a suggestion; it is a hard deadline. If you do not enroll or make your changes in time, the door closes. You are locked out until the next annual Open Enrollment Period.

This is not merely an inconvenience. It can leave you and your family completely exposed for months. One unexpected medical emergency during that coverage gap could create a massive financial liability. Acting on time is not just important—it is non-negotiable. It is precisely this kind of high-stakes deadline that makes professional guidance so valuable.

Missing your SEP is not an inconvenience; it is a direct threat to your financial security. The potential out-of-pocket costs for a single major medical event during a coverage gap can be astronomical, far outweighing the cost of any insurance premium.

Are QLE Rules Universal Across All Insurance Types?

Absolutely not. The rules are highly specific to the insurance market you are in. The term "Qualifying Life Event" has a formal, regulated definition for plans in the U.S. ACA Marketplace. While many employer-sponsored plans follow these federal guidelines, they can and do have their own specific rules and deadlines.

The world of IPMI operates under a different set of rules. International insurers might not use the official "QLE" jargon for making changes mid-year, but they are structured to accommodate major life milestones. Getting married or having a baby are standard reasons to add dependents to an existing policy.

More importantly for expatriates, an international move that makes your domestic plan obsolete is the ultimate trigger. It effectively creates its own enrollment opportunity, making it the primary reason to secure a proper global health plan.

At Riviera Expat, our specialty is cutting through the complexity to give you the clarity needed for these critical decisions. We focus exclusively on IPMI for high-net-worth professionals, ensuring your global health strategy is as robust and mobile as your career. Contact us today for a personalized consultation.