At its core, out-of-network means engaging a physician or medical facility that does not have a pre-negotiated fee schedule with your insurance carrier.

Consider your insurer's network as an exclusive portfolio of trusted medical partners. Within this portfolio, services are rendered at predetermined, preferential rates. When you elect to receive care outside of this curated group, the financial framework shifts entirely.

Defining Out of Network in Your Health Plan

For our clientele with premier international private medical insurance, venturing out-of-network is seldom an oversight. It is a deliberate strategic decision to access a world-renowned specialist or a particular center of excellence. Understanding precisely how this choice impacts your financial position is paramount to managing your global healthcare strategy without incurring substantial, unexpected liabilities.

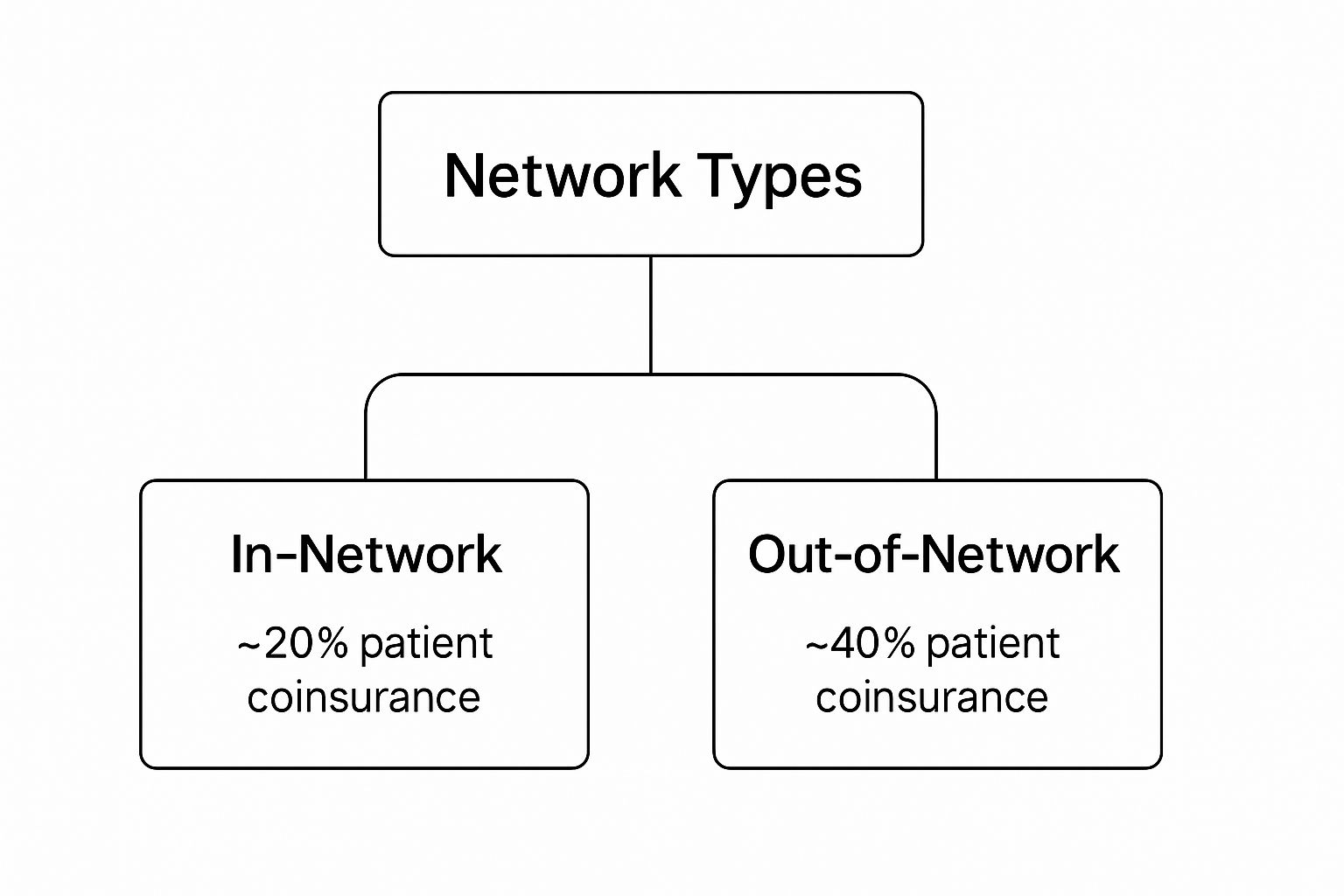

The financial variance can be considerable. The image below provides a clear illustration of how your portion of the cost can escalate significantly when you step outside the network.

As depicted, out-of-network care can easily double your out-of-pocket expenditure. This occurs because your insurer has no pricing agreement with that provider, leaving you accountable for the difference between the provider's full charge and the amount your plan designates as "reasonable and customary."

To place these distinctions in perspective, here is a concise side-by-side comparison of the two options.

In-Network vs. Out-of-Network At a Glance

| Aspect | In-Network | Out-of-Network |

|---|---|---|

| Costs | Lower, predictable out-of-pocket expenses due to pre-negotiated rates. | Higher, unpredictable costs. You may be responsible for the full, non-discounted bill. |

| Payments | The insurer typically remits payment directly to the provider after your copayment/deductible. | You often must pay the full amount upfront and file a claim for reimbursement. |

| Paperwork | Minimal. The provider manages the majority of the claims process with the insurer. | Substantial. You bear the responsibility for all claim submissions and documentation. |

| Provider Choice | Limited to physicians and facilities within your insurer's approved list. | Complete freedom to select any physician or facility, globally. |

| Financial Risk | Low. Your maximum out-of-pocket exposure is clearly defined and capped. | High. You are exposed to "balance billing" for costs exceeding what your plan covers. |

This table clarifies the trade-off: the price of complete freedom of choice is a significantly heavier administrative and financial responsibility.

Why This Distinction Is Critical

A firm grasp of these financial mechanics is vital because out-of-network charges are more prevalent than one might assume. It is possible to follow all protocols—selecting an in-network hospital—and still receive an unexpected bill from an out-of-network anesthesiologist or radiologist practicing there.

According to a study published by the Kaiser Family Foundation, 1 in 5 emergency room visits and 1 in 6 inpatient stays at in-network hospitals resulted in a surprise medical bill from an out-of-network clinician. This analysis underscores a common vulnerability in many standard health plans.

This hidden risk is precisely why a meticulously designed insurance plan is so crucial. For clients who demand the highest standards, a global policy with robust out-of-network benefits is not a luxury; it is a strategic necessity. It provides the latitude to choose premier care without being financially penalized.

Of course, leveraging these benefits effectively requires an intimate knowledge of your policy's specific terms. For a more detailed understanding of policy language, we recommend our guide on explaining policy terms for expatriates. This knowledge is what empowers you to make calculated decisions, ensuring both your health and your financial well-being are protected.

The Real Cost of Out of Network Care

Stepping outside your insurance network is akin to entering a different financial environment. It is a world with distinct rules, almost invariably designed to increase your personal financial outlay.

The primary driver of these higher costs is a practice known as balance billing. This occurs when a provider bills you for the deficit between their full, undiscounted fee and what your insurer has agreed to pay. Your insurer has pre-negotiated rates with its in-network partners. When you go outside that circle, no such agreement exists. You are left responsible for the difference, which can be substantial.

Understanding Your Financial Exposure

To mitigate their risk, insurers cap what they will pay for care outside their network. This limit is often referred to as the Usual, Customary, and Reasonable (UCR) amount. Should a specialist charge more than this UCR figure, you are liable for every dollar of the difference.

The structure is often more complex. Most high-end insurance plans operate two entirely separate financial tracks: one for in-network care and another for out-of-network.

This means you will likely face:

- A separate, higher deductible that you must satisfy before your out-of-network benefits become active.

- A different, much higher out-of-pocket maximum, which dramatically elevates your total potential financial exposure for the year.

This dual system makes navigating your finances complex and can lead to unforeseen liabilities. It is an increasing concern; the rate of inpatient admissions involving at least one out-of-network bill has risen in recent years, often linked to the business models of certain hospital systems and physician groups.

The key takeaway is this: going out-of-network is not merely about paying a higher percentage. It involves entering a less predictable payment system where your financial safety nets are significantly weaker.

Understanding these mechanics is the first step toward managing them. It also highlights why your choice of insurance plan is so critical, as these financial structures are directly related to the reasons why do medical insurance premiums rise year after year. A well-designed global plan is constructed with these scenarios in mind, providing a buffer against such financial shocks.

Using Out of Network Benefits for Global Healthcare

For many, the phrase “out of network” is a warning, signaling higher costs and administrative complexity. For individuals possessing premier international private medical insurance (IPMI), however, the context is entirely different.

In fact, the opposite is true. For you, what does out of network mean is an opportunity. Your top-tier plan was specifically engineered with this flexibility as a core feature. The insurer understands that the world's best medical care is not always found within a pre-approved list of facilities.

This fundamentally changes the perspective. Out-of-network access transforms from a financial trap into a powerful tool for managing your global health. It grants you the freedom to consult that world-renowned specialist in Geneva, receive treatment at your preferred clinic in Singapore, or access life-altering care wherever your professional and personal life may take you.

Mastering Global Access

Effectively utilizing these benefits requires more than simply scheduling an appointment. It demands a proactive and organized approach to ensure a smooth, seamless international healthcare experience.

Consider it a coordinated mission with several key steps:

- Secure Pre-Authorization: This is non-negotiable. Before committing to any significant treatment, you must obtain formal pre-approval from your insurer. This single step confirms your coverage is in place and provides clarity on the financial arrangements.

- Navigate Currency and Claims: You will almost certainly remit payment for services in the local currency. This is where meticulous record-keeping is your greatest asset. Retain every receipt and document for submission for reimbursement, which will then be processed according to your policy's terms.

- Coordinate International Care: Leverage your insurer's concierge or member assistance services. This can be an invaluable partner for managing complex logistics, from transferring medical records to liaising with overseas hospital administrators on your behalf.

With a robust IPMI plan, going out-of-network is not a compromise. It is a deliberate strategy for securing the best possible health outcomes, on your terms, anywhere on the planet.

This mindset—seeking the best available care, regardless of network affiliations—is increasingly common. For some, it might mean exploring options like dental treatment abroad to access specialized procedures or bypass long waiting lists. This is the essence of a premium global health strategy: prioritizing superior outcomes over network restrictions.

Why You Might Choose an Out of Network Provider

To be clear, selecting an out-of-network provider is rarely accidental. It is almost always a deliberate, strategic decision.

For discerning individuals, the calculus is not about marginal cost savings. It is about prioritizing the absolute best quality and specificity of care available, irrespective of its global location.

The most compelling reason is to secure an appointment with a world-leading expert. When faced with a complex diagnosis, the objective is not to find just any physician—it is to find the preeminent physician. You want the foremost authority in that specific medical niche, and their network status is a secondary consideration. Their unique expertise can mean the difference between a standard treatment protocol and a groundbreaking one.

Similarly, certain specialized treatment centers are globally renowned for their exceptional outcomes in fields like oncology or cardiology. Accessing these centers of excellence often necessitates stepping outside a traditional insurance network. It is a calculated choice made by those who demand the highest possible probability of a successful outcome.

Maintaining Continuity and Pursuing Innovation

Continuity of care is another significant factor. What happens when the trusted physician you have relied on for years, the one with comprehensive knowledge of your medical history, ceases to be part of your insurer’s network? For many, the answer is straightforward: you follow the expert. Maintaining that established trust and personalized care is non-negotiable.

This choice becomes a strategic investment in your health. With proper planning and a robust international insurance plan, the decision is not about cost, but about securing the absolute best care available.

Finally, the pursuit of medical innovation often leads across borders. A novel surgical technique available only in Germany or a cutting-edge clinical trial in Japan may represent the single best option. In these moments, the question of what does out of network mean transforms completely. It is no longer a barrier but a gateway to accessing global medical breakthroughs.

The freedom to make this choice, unconstrained by a pre-approved list of doctors, is one of the most powerful advantages of a premier health plan. It places you in control, allowing you to prioritize your health above all else.

How to Manage and Minimize Out of Network Costs

When you go out of network, you are operating outside the framework of pre-negotiated rates. This requires a sharp, proactive financial strategy to maintain control.

With the right approach, you can access top-tier providers outside your plan’s formal structure without being exposed to staggering, unexpected financial liabilities. The key is to actively manage the entire process—before, during, and after your care.

A Proactive Financial Strategy

Your first action should always be direct communication. Before agreeing to any procedure, have a frank discussion with the provider's billing department regarding the costs. Many are open to negotiating rates, particularly for clients who can pay directly and promptly.

Concurrently, you must insist on a detailed Good Faith Estimate. This is not merely a suggestion; it is a critical document that itemizes all anticipated charges. It becomes your financial baseline and your strongest defense against surprise billing later.

Here are the essential tactics to deploy:

- Master the Pre-Authorization Process: Act preemptively. Contact your insurer well in advance to secure formal approval. This step confirms the treatment is a covered benefit and forces clarity on your exact financial responsibility.

- Document Everything: Maintain a meticulous record of every phone call, email, and document. Note the names, dates, and specific details discussed with both your provider's office and your insurance company. This paper trail is invaluable.

- Scrutinize Every Statement: When you receive the Explanation of Benefits (EOB) from your insurer, do not just glance at it. Compare it line-by-line against your Good Faith Estimate. This is how you identify billing errors and construct your case for an appeal if necessary.

Mastering these steps provides the tools to transform a potentially chaotic and expensive experience into a manageable, predictable investment in your health.

This level of vigilance is more critical than ever. According to data from the Peterson-KFF Health System Tracker, out-of-network billing is particularly prevalent in certain specialties, such as anesthesiology and pathology, even within in-network hospitals. This highlights the need for clients to be prepared.

Ultimately, your power to control these costs is directly linked to the quality of your insurance policy. To ensure your coverage is structured for these realities, review our guide on choosing the right expat medical insurance policy type for you.

Frequently Asked Questions About Out of Network Care

When managing complex health and financial matters across borders, you require precise answers, not ambiguous policy language.

This is where insurance theory meets practical application. Here are the questions we most frequently encounter regarding out-of-network care, with the direct, specific answers you need.

Plan Types and Provider Status

One of the most significant points of confusion—and potential financial exposure—is how your specific plan type manages care outside its official network. This is not a minor detail; it is the core determinant of your freedom to choose.

-

PPO vs. HMO Plans: A Preferred Provider Organization (PPO) plan is engineered for flexibility. It is designed to allow you to consult out-of-network providers, although you will bear a higher portion of the cost. In stark contrast, a Health Maintenance Organization (HMO) plan is a closed system. It generally provides no coverage for out-of-network care except in a verified, life-threatening medical emergency. For any individual who values access to top specialists worldwide, a PPO or a comparable international policy is almost always the appropriate choice.

-

Confirming Network Status: Never assume a physician or hospital is in-network. The most reliable initial step is to consult the provider directory on your insurer's website or, preferably, to call your dedicated member services line. However, the definitive step is to always re-confirm network status directly with the provider’s office when scheduling an appointment. Provider affiliations can and do change, sometimes with little notice.

A critical point on emergencies: In a true medical emergency, federal regulations like the No Surprises Act in the U.S. require insurers to cover your care at in-network rates, regardless of the hospital's network status. Be aware, the definition of an "emergency" can be very strict. You must notify your insurer as soon as is reasonably possible after receiving emergency care to ensure the claim is processed correctly.

Managing Bills and Negotiations

Even with meticulous planning, the financial aspect can become complex once invoices are issued. Understanding your rights and how to manage these costs is a crucial skill that puts you in control.

A question we are frequently asked is, "Can I actually negotiate a bill from an out-of-network provider?"

The answer is a firm yes.

Negotiation is almost always an option, especially if you are paying directly. Even before receiving care, you can often arrange a discounted "self-pay" rate. After you receive a bill—particularly a surprise balance bill—do not simply remit payment. Contact the provider’s billing department to open a discussion about a reduction.

Your leverage increases significantly if you are prepared with data on what local, in-network providers charge for the same service. This shifts the conversation from a simple request to a fact-based negotiation, helping you manage the true financial impact of going out of network.

At Riviera Expat, we specialize in providing the clarity and control you need to make these important healthcare decisions with complete confidence. Our expertise lies in sourcing and structuring premier international health insurance plans that are built for the flexibility and global access our clients demand. To explore how we can secure a policy that aligns with your unique needs, please visit us at https://riviera-expat.com.