Here is a fundamental truth about travel insurance.

The standard policy you procure for a journey has a significant, and often unexamined, gap in its coverage.

It will not protect you if a pre-existing health condition suddenly requires medical attention while you are abroad.

This vulnerability can transform a meticulously planned itinerary into a significant financial liability. To mitigate this risk, you require a specific provision, known as a pre-existing condition exclusion waiver. This is not an automatic inclusion; it is a benefit for which one must qualify.

Securing Your Journeys With Elite Travel Protection

For the discerning global traveler, international exploration is an integral part of life. However, a pre-existing health condition introduces a layer of complexity and considerable financial exposure.

Many individuals operate under the assumption that their travel insurance provides comprehensive coverage for any medical emergency. This misconception is often corrected at the most inopportune moment—within a foreign medical facility, facing a substantial invoice for a known condition that has unexpectedly escalated.

This guide moves beyond generic advice to provide you with actionable strategies for securing elite travel protection. We will demystify how insurers define pre-existing conditions and detail the precise steps required to obtain the appropriate coverage.

Consider a standard policy as a basic home security system. It provides a baseline of protection, but it will not address a known vulnerability—such as a compromised window lock—unless a specific sensor is added. The same principle applies here.

The Importance of Specialized Coverage

Without a properly structured policy, the financial consequences can be severe.

An emergency medical evacuation can readily exceed $100,000, and the cost of sophisticated medical treatment in many countries can escalate into six figures with alarming speed. Proper coverage ensures these potential liabilities are strategically managed, not overlooked.

Navigating the nuances of travel insurance is not merely about purchasing a policy; it is about executing a precise risk management strategy. For individuals with pre-existing conditions, securing a waiver is the most critical step toward achieving true peace of mind.

What You Will Learn

This guide will equip you with the knowledge to make an informed, strategic decision. We will deconstruct the key elements of a superior travel insurance plan, ensuring your protection aligns with your lifestyle and assets.

We will cover three core topics:

- Understanding Insurer Definitions: We will clarify what "pre-existing condition" means from an underwriting perspective. An insurer's definition is the only one that carries legal weight.

- Securing a Coverage Waiver: We will outline the time-sensitive steps required to have your medical history covered. Missing the procurement window means forfeiting the coverage.

- Evaluating Premium Policies: You will learn the hallmarks of a truly robust insurance plan designed to safeguard your financial well-being, not just your health.

My objective is to provide you with the clarity needed to select coverage that acts as a silent, steadfast guardian. This allows you to focus on the journey ahead, not on contingent liabilities.

To begin, it is essential to understand the key terms insurers employ. This table outlines the core concepts you will encounter when sourcing the right coverage.

Pre-Existing Condition Coverage At a Glance

| Concept | Its Importance for Your Protection |

|---|---|

| Pre-Existing Condition | Any health issue for which you received medical advice, diagnosis, care, or treatment prior to your policy's effective date. Insurers use specific "look-back periods" (typically 60-180 days) to define this. |

| Look-Back Period | The precise timeframe an insurer examines your medical history to identify pre-existing conditions. Any relevant medical event within this window is material. |

| Exclusion Waiver | The critical policy provision that negates the pre-existing condition exclusion, thereby providing coverage for acute episodes of a known, stable health issue. |

| Time-Sensitive Purchase | You must procure your policy and the associated waiver within a narrow window following your initial trip payment (typically 14-21 days). |

| Medically Stable | A primary requirement for the waiver. Your condition must be controlled, with no recent changes in medication, new symptoms, or required treatments. |

Understanding these concepts is the first step. This is the language of the insurance contract, and fluency enables you to ask incisive questions and identify potential gaps in a standard policy before they become a material problem.

What Insurers Consider a Pre-Existing Condition

To secure the correct travel insurance, you must first think like an underwriter.

Their definition of a "pre-existing condition" is the sole definition of consequence—it is contractual and determines what they will and will not cover. This is not an abstract concept; it is a specific, legally binding term.

Insurers utilize a straightforward mechanism to determine what qualifies: the "look-back period."

This is a defined window of time, typically between 60 and 180 days, immediately preceding your policy purchase. Consider it a snapshot of your recent health. Any relevant medical event that occurs within that window will be noted.

Any illness or injury for which you sought medical advice, diagnosis, care, or treatment within this period is formally classified as a pre-existing condition.

The Stability Factor Is Key

The analysis, however, goes deeper than just medical appointments.

The definition also encompasses any condition that presented symptoms—symptoms that would have compelled a "reasonably prudent person" to seek medical counsel. It also includes any changes to your medication regimen. Whether a dosage was increased, decreased, or a new medication was introduced, all such events are material.

This is a critical point for any individual managing a chronic illness.

The core principle for any insurer is stability. A condition that has been managed with the same, consistent medication dosage throughout the look-back period is viewed very differently from one that required a recent adjustment or medical consultation. Stability signals lower immediate risk.

For example, an individual may have had hypertension for years, controlled by a consistent prescription. This is likely considered stable. However, if a physician adjusted that same prescription last month, during the look-back period, the condition is now flagged as unstable. That single change completely alters an insurer's risk assessment.

You can learn more about how medical conditions and coverage interact by exploring common policy exclusions.

Unpacking the Insurer's Definition

Let us be precise. A health issue becomes "pre-existing" if, during the look-back period, you did any of the following:

- Sought Medical Advice: You consulted a physician, received a diagnosis, or obtained any professional medical care.

- Received Treatment: This is broad—it encompasses everything from a surgical procedure to a recommended course of physical therapy.

- Changed Prescriptions: A new medication was prescribed, or the dosage or type of an existing one was altered.

- Experienced Symptoms: You manifested symptoms that should have prompted a medical consultation, even if one was not sought.

Understanding this framework is the foundational step to successfully navigating travel insurance for pre-existing health conditions. It cuts through the industry jargon and empowers you to accurately represent your health status.

When you understand exactly how insurers define and measure risk, you can select a policy that provides genuine financial protection and, equally important, peace of mind during your travels.

Understanding the Pre-Existing Condition Waiver

A standard travel policy contains a significant blind spot: it excludes claims arising from your medical history. This is where a crucial benefit known as the Pre-Existing Condition Exclusion Waiver becomes indispensable.

Think of this waiver not as a separate policy, but as a vital upgrade to your core coverage. It is the mechanism that elevates your policy from standard to genuinely protective by closing that critical gap.

Obtaining this waiver is not automatic. It is a time-sensitive benefit with strict, non-negotiable requirements. When you successfully secure it, the policy's standard exclusion for your known health issues is nullified. This means an unexpected flare-up of a stable, pre-existing condition can be covered, affording you real financial security.

To qualify, you must act with precision and meet every requirement. This is not a negotiation; it is a matter of executing specific steps within a very tight timeframe.

Securing Your Waiver: A Tactical Guide

Meeting the waiver requirements is an exercise in strategic planning. The criteria are straightforward but absolute—failure to meet even one will result in the denial of the benefit.

You must:

- Purchase Early: This is the most critical factor. You are required to purchase your policy within a specific, narrow window—typically 14 to 21 days—after making your first trip payment or deposit.

- Insure Your Full Trip Cost: You must insure the full, non-refundable cost of your entire journey. Attempting to reduce premiums by under-insuring your trip will invalidate the waiver.

- Be Medically Fit to Travel: At the time you purchase the policy, you must be medically stable and have a physician's clearance to undertake the planned trip.

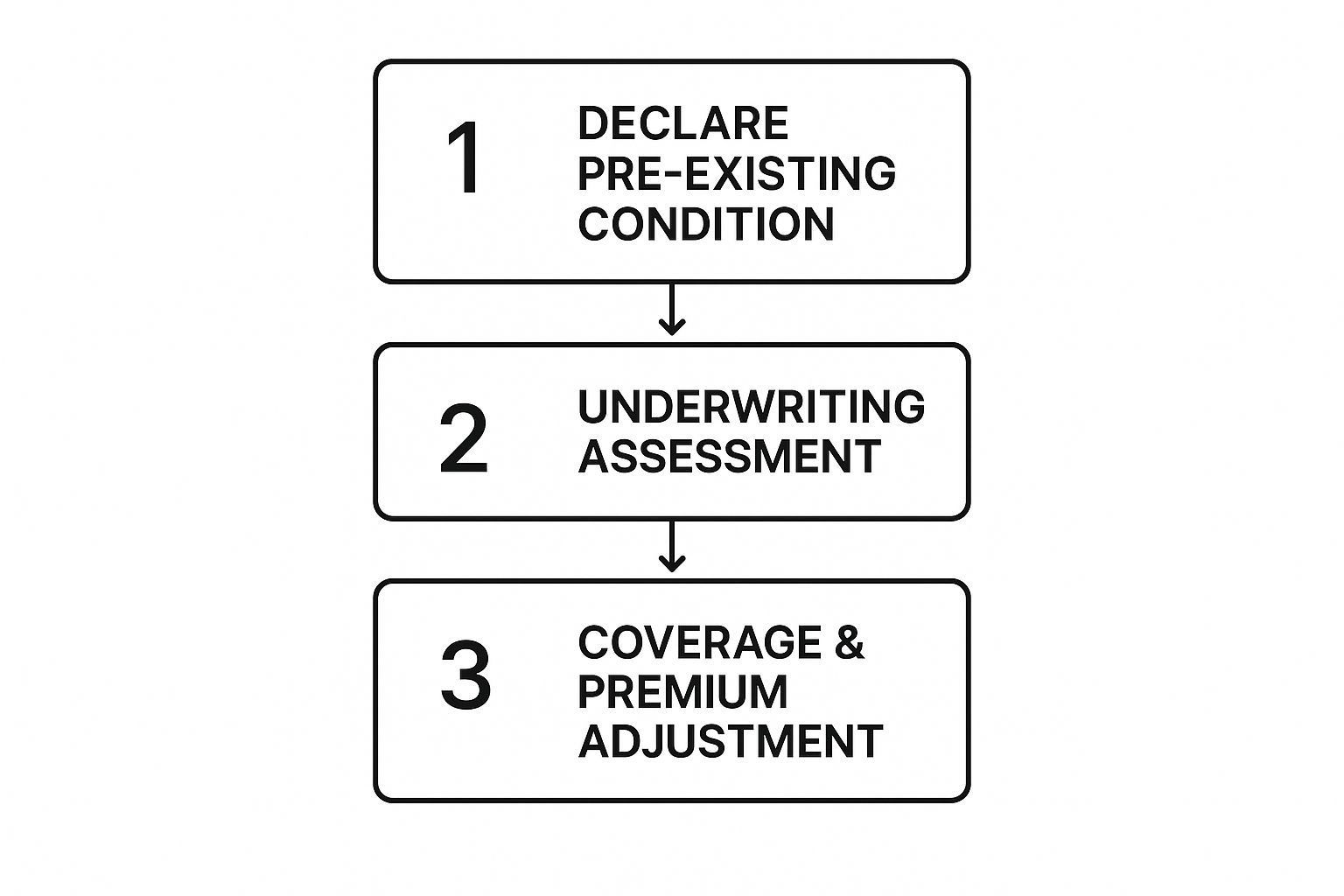

The process for declaring your condition and having it assessed is a core part of securing this protection. This workflow illustrates how insurers typically manage this process.

As the diagram illustrates, it is a structured process that begins with you. Clear, transparent communication regarding your health history is the first—and most vital—step.

The Critical Purchase Window

The importance of the purchase window cannot be overstated. Leading insurers structure their policies this way to encourage early planning, which allows them to manage their underwriting risks effectively.

The difference between complete coverage and a denied claim often comes down to a matter of days. Missing this deadline is the single most common reason travelers fail to secure this essential protection.

For example, when examining premier plans, a provider like Travel Insured International requires travelers to purchase their insurance within 14 to 21 days of the initial trip payment to qualify for the waiver. Their premium Platinum plan provides a 21-day window, while other plans mandate a 14-day timeframe. These are not suggestions; they are rigid deadlines.

For those planning extended stays abroad, the principles of early planning are equally critical. If you are interested in more permanent protection, you may find value in our guide on international private medical insurance. You can also view the specific purchase windows for various plans directly on Travel Insured's website.

Coverage for Sudden and Unforeseen Medical Events

Suppose you have missed the narrow window to secure a pre-existing condition waiver. You are not left completely exposed.

Most premium policies contain a critical safety net known as coverage for the "acute onset of a pre-existing condition."

Consider this your final line of defense. It is designed for a true, unforeseen emergency—a sudden medical crisis stemming from a known health issue that demands immediate intervention. It is not a substitute for a full waiver, but it provides essential protection against a catastrophic event.

This coverage addresses the difference between managing a chronic condition and reacting to a sudden, life-threatening flare-up. Routine check-ups or planned treatments are not covered. This is for the unexpected cardiac event, not the scheduled cardiologist appointment.

What Exactly Is an Acute Onset Event?

For an event to qualify, it must be sudden, unexpected, and necessitate urgent medical care. The classic example is a traveler with a history of stable heart disease who suffers a sudden myocardial infarction on vacation. Another is an individual whose diabetes has been well-managed for years suddenly experiencing severe diabetic shock.

The operative word is unforeseen. The event must be a new, acute episode, not a gradual worsening of symptoms that were present before your departure.

This coverage is your financial backstop for the truly unpredictable. It recognizes that even a well-managed condition can suddenly escalate into a crisis, and it provides a mechanism to cover the immediate, high-cost care required to achieve stability.

Understanding this distinction is vital, particularly if you are traveling to a jurisdiction where a single hospital admission can lead to significant financial consequences.

What’s In and What’s Out?

Clarity on what qualifies is the only way to align your expectations with the policy's deliverables. To avoid unwelcome surprises during a claim, let us delineate the specifics.

What typically qualifies as an acute onset event:

- A sudden stroke for an individual with managed hypertension.

- An unexpected and severe asthma attack requiring hospitalization for a person with a stable respiratory condition.

- A seizure for an individual with a known but controlled seizure disorder.

What is almost always excluded:

- Any scheduled treatments or routine check-ups for your condition.

- Medical care for a condition that was showing signs of worsening before your trip.

- Adjustments to your regular medication or any non-emergency consultations.

Travel insurance policies that address pre-existing health conditions have evolved, especially for travel to countries like the United States where medical costs are exceptionally high. Many US-based travel insurance plans now include this acute onset coverage, providing benefits for hospital stays and physician services for conditions like diabetes or heart disease.

This coverage often includes medical evacuation or repatriation if you must be moved to a more suitable facility for treatment.

How to Evaluate Premium Travel Insurance Policies

For a seasoned traveler, selecting the right insurance is not about finding the lowest cost. It is about securing the most robust, comprehensive protection available. When evaluating premium policies, especially with pre-existing health conditions as a factor, the hallmarks of a superior plan are evident in the policy details.

The first element to examine is the coverage limits. Elite plans offer substantial financial backing for worst-case scenarios. You should be looking for policies with emergency medical expense coverage of at least $100,000 and medical evacuation benefits of $500,000 or more. These figures are not arbitrary; they reflect the real-world cost of a major medical event in a foreign country.

Primary Versus Secondary Medical Coverage

Here is a critical detail that many overlook: whether a policy offers 'primary' or 'secondary' medical coverage. This distinction fundamentally changes how a claim is administered.

- Secondary Coverage: Most standard plans are secondary. This means they pay only after your domestic health insurance has paid its portion, creating a complex, multi-step claims process at a time of stress.

- Primary Coverage: A premium policy offers primary coverage. It pays first, handling your medical bills directly without involving your domestic insurer. It simplifies the entire process.

Opting for a primary plan ensures faster, more direct financial assistance when it is most needed. To better understand how insurers structure these benefits, you can explore our guide that explains expat medical insurance policy terms.

The strategic value of primary coverage cannot be overstated. It transforms your travel insurance from a reimbursement tool into a frontline financial guardian, eliminating bureaucratic delays during a medical emergency.

Analyzing Elite Provider Offerings

Leading insurance providers design their elite plans for travelers who require higher limits and greater flexibility. These top-tier policies often feature exceptionally high trip cost limits and, most importantly, inclusive medical coverage that is not restricted by age.

Take a high-caliber plan like IMG’s iTravelInsured Travel LX as an example. It provides emergency medical limits of $500,000 and medical evacuation up to $1,000,000 with no age restrictions on most benefits. Similarly, Allianz Global Assistance’s OneTrip Prime Plan offers up to $50,000 for emergency medical and $500,000 for emergency transport, ensuring your policy is sufficiently robust to protect your assets.

A Strategic Checklist for Policy Selection

Choosing the right travel insurance is not a mere purchase; it is a critical component of your overall risk management strategy. For the sophisticated traveler, this process demands precision. You must be certain that the financial safety net you have arranged will perform as expected if called upon.

The entire foundation of a valid policy rests on one simple principle: complete transparency.

You must provide a full and honest disclosure of your entire medical history. This is non-negotiable. Attempting to downplay or omit a condition—no matter how minor it may seem—provides the insurer with a valid reason to void your coverage at the moment of need.

Scrutinizing the Policy Document

To invest with confidence, you must read the policy document. Pay extremely close attention to the insurer's specific definitions of these three terms, as their interpretation is the only one that matters when a claim is filed:

- Pre-Existing Condition: How, precisely, do they define this? What specific criteria are used to classify a condition?

- Look-Back Period: Identify the exact duration—typically 60 to 180 days—that the insurer will examine your medical history prior to the policy purchase date.

- Medical Stability: What are the precise requirements for a condition to be considered "stable"? Any recent change in medication, treatment, or symptoms could easily render you ineligible.

It is also prudent to consult your physician before you finalize your travel arrangements. Obtaining a formal letter confirming that you are medically stable and fit for travel is often a standard requirement. More importantly, it serves as crucial evidence should you ever need to file a claim.

A travel insurance policy is more than a purchase; it is a contract predicated on good faith. Diligence in the selection process ensures this contract provides genuine peace of mind, allowing you to focus on the purpose of your journey, not the potential for financial disruption.

Finally, never forget the critical importance of the purchase window.

As we have discussed, securing a waiver for a pre-existing condition is almost always contingent upon purchasing your policy within 14 to 21 days of making your initial trip deposit. Meeting this deadline is the single most important action you can take to secure comprehensive travel insurance for pre-existing health conditions.

Frequently Asked Questions

When dealing with travel insurance for pre-existing health conditions, specific questions inevitably arise. Let us address the most common ones directly so you can make decisions about your coverage with complete confidence.

Does Age Affect My Coverage Eligibility

This is a significant concern, particularly for mature travelers. The short answer is: age can certainly influence the premium, but it rarely disqualifies an individual from obtaining a pre-existing condition waiver. In fact, many high-end insurance providers offer excellent plans designed specifically for seniors.

What is far more material than your age is how and when you procure the policy. The decisive factors are purchasing your plan within the required window (usually 14-21 days after your first trip payment) and being medically cleared to travel at the time of purchase. Some of the best plans available have no age limits on medical benefits.

What If I Do Not Declare a Minor Condition

This is ill-advised. It may seem tempting to omit something you consider minor, but this is a direct path to a denied claim.

Absolute, radical transparency with your insurer is non-negotiable. If you fail to disclose a health condition—regardless of your personal assessment of its severity—the insurer can use that omission to deny a related claim. In the worst-case scenario, they could rescind your entire policy, leaving you completely exposed financially.

Insurers operate based on contractual definitions, not personal assessments of a condition's severity. Their criteria are simple: Did you receive advice, treatment, or a diagnosis for it during the look-back period? If the answer is yes, you must disclose it. Full disclosure is the only way to ensure your policy will perform as intended.

Are Mental Health Conditions Covered

Yes, unequivocally. Insurers treat mental health conditions such as anxiety or depression in the same manner as physical conditions. There is no distinction from an underwriting perspective.

If you have consulted a therapist, received treatment, or taken medication for a mental health condition during the policy's look-back period, it is considered a pre-existing condition.

This means you will need to secure a pre-existing condition waiver to be covered for any unexpected, acute events related to it while you are traveling. This ensures your mental well-being is protected with the same diligence as your physical health.

At Riviera Expat, we specialize in providing elite international private medical insurance solutions for financial professionals. We offer expert, objective guidance to help you secure coverage that aligns with your exacting standards. Schedule your complimentary consultation on riviera-expat.com to ensure your global health is comprehensively protected.