For the global professional or high-net-worth individual based in Greece, selecting travel insurance is not a perfunctory task—it is a critical component of a comprehensive risk management strategy. A superior policy is not a mere formality but a sophisticated financial instrument, engineered to protect significant travel investments and guarantee access to elite medical care, anywhere in the world.

It is about securing the peace of mind required to focus on your primary business and personal objectives.

Your Guide to Global Protection

Operating globally from a base in Greece necessitates more than a passport and an airline ticket. It demands a strategic defense for your personal and financial well-being. For discerning individuals, travel is often an extension of business ventures or a well-deserved respite, frequently involving complex itineraries and substantial financial outlays. A generic, off-the-shelf insurance policy is simply inadequate for this purpose.

Consider this guide your strategic brief on premium travel insurance. We will bypass rudimentary definitions and proceed directly to the critical components that constitute superior, reliable coverage. This is not about merely purchasing insurance; it is about investing in a global support network that accompanies you wherever your ambitions lead.

Why Premium Coverage is Non-Negotiable

The selection of an appropriate policy hinges on one fundamental principle: aligning its capabilities with your actual lifestyle. While standard plans might cover a basic flight cancellation, premium coverage is engineered for life’s more intricate and high-stakes eventualities.

It is specifically designed to manage high-value trip costs, provide access to an exclusive global network of premier medical providers, and ensure a 24/7 assistance team is on standby—one genuinely experienced in managing complex international emergencies. This level of support allows you to maintain control and composure when unforeseen circumstances arise.

A superior travel insurance policy is the ultimate safeguard for your mobility and assets. It transforms uncertainty into managed risk, allowing you to operate with confidence on the global stage.

The Market Context for Travel Insurance From Greece

To contextualize, travel insurance from Greece is an integral part of a formidable European market. According to recent market analysis, Europe led the global market, which was valued at approximately USD 21 billion in 2023. As Greece is a major international travel hub, the demand for robust protection is not merely strong; it is escalating.

Projections indicate significant market growth, driven by an increased awareness of the complex realities and risks associated with global travel.

Of course, a crucial aspect of global protection involves safeguarding personal assets. While insurance serves as your financial backstop, it is also prudent to familiarize yourself with practical lost luggage tips to minimize potential disruptions. We will delve into specific policy types shortly, but you may also find value in our broader overview on https://www.riviera-expat.com/the-insurance-cover/.

Understanding Global Visa Insurance Mandates

For the seasoned global professional, international travel may seem routine. However, one detail where the slightest oversight can derail an entire agenda is visa compliance. Many nations do not merely recommend travel insurance; they legally mandate it as a condition of entry.

An error in coverage can result in a visa denial or significant complications at border control, jeopardizing meticulously planned business engagements.

These regulations are a country's mechanism for ensuring visitors are self-sufficient and will not become a burden on their public health systems. For anyone based in Greece, a firm command of these mandates is the non-negotiable first step to seamless international transit.

Schengen Area Requirements

As a resident of Greece, you possess freedom of movement within the Schengen Area. However, if you are a non-EU national residing in Greece, or are hosting international colleagues, the Schengen Visa insurance regulations are the definitive standard. They are precise and rigorously enforced.

Any compliant policy must provide a minimum of €30,000 in medical coverage. This is not a suggestion; it is a strict, unalterable rule.

This coverage cannot be limited to your primary destination—it must be valid across all 29 Schengen member states. The policy documentation must explicitly state that it covers:

- Emergency medical expenses: For any sudden illness or accident requiring immediate medical attention.

- Medical repatriation: The cost of transporting you back to your home country if medically necessary.

A critical detail often overlooked: the policy must have a €0 deductible for these specific benefits. Insurers accustomed to issuing Schengen-compliant policies are aware of this, but the ultimate responsibility for verifying the fine print rests with you. Do not risk a visa rejection over this detail.

Beyond the Schengen Zone

While Schengen regulations are clear-cut, the requirements for other global business hubs vary significantly. Assuming a single policy is suitable for all destinations is a fundamental error with potentially costly consequences. Each country's mandates are predicated on its unique healthcare infrastructure and legal framework.

For instance, when arranging travel insurance from Greece for a trip to the United States, one must consider the financial scale. While U.S. authorities do not mandate insurance for most visitors, it is strongly recommended for a clear reason: the absence of universal healthcare and the astronomical cost of medical services. A single medical evacuation within the U.S. can easily exceed $100,000.

Other key destinations have their own specific requirements:

- United Arab Emirates (UAE): For many nationalities, entry into Dubai and Abu Dhabi requires proof of medical insurance that explicitly covers potential COVID-19 expenses.

- Singapore: The government strongly advises travel insurance due to high healthcare costs. Depending on the global health climate, it has been, at times, a mandatory requirement for entry.

Ensuring your policy meets these diverse, country-specific regulations is not merely about compliance. It is a strategic measure to protect your health and finances, ensuring your focus remains on your business objectives, not bureaucratic impediments.

Choosing Your Provider: Local Insurers vs. Global Specialists

Selecting the right travel insurance provider from Greece is a strategic decision, not an administrative one. When a critical incident occurs thousands of miles from home, the quality and efficacy of the support you receive are paramount. For the global professional, this choice distills to a fundamental question: do you opt for the perceived convenience of a local Greek insurer or the proven infrastructure of a global specialist?

A local provider might appear to be a straightforward choice, particularly for simple domestic travel. However, their operational capabilities can be severely tested by a serious international incident. Their networks are often most robust within the EU, which can create significant friction when you require urgent, high-level medical care in a location like Singapore, New York, or Dubai. Can a local entity truly facilitate seamless, cashless treatment at a world-class hospital on the other side of the planet? This is a critical question to address.

The Global Network Advantage

This is the arena where international insurance specialists operate on an entirely different level. Their entire business model is constructed around a vast, pre-vetted global network of top-tier hospitals, clinics, and emergency assistance partners. This is not a mere directory; it is a deeply integrated system engineered for one primary function: direct billing.

The implication for you? In a medical emergency, the insurer settles the bill directly with the hospital. You are not compelled to present a personal credit card for a bill that could easily amount to tens or even hundreds of thousands of dollars, then engage in a protracted reimbursement process. This single benefit is a definitive advantage when you are in a vulnerable position.

The true value of a global specialist is their ability to make borders irrelevant in a crisis. Their infrastructure is engineered to deliver a consistent standard of excellence, whether you are in Athens or Tokyo, ensuring your focus remains on recovery, not administration.

Furthermore, 24/7 multi-lingual assistance is a standard feature with these providers. When attempting to convey complex medical symptoms in a foreign country, communicating in your native language is not a luxury—it is essential for receiving accurate care and maintaining composure.

Expertise in Complex Claims and High-Value Scenarios

Another significant differentiator is institutional experience. Global providers manage a high volume of complex international claims daily. They are masters of the logistics behind everything from medical evacuations across continents to settling substantial trip cancellation claims for intricate, multi-leg business itineraries.

This experience cultivates unparalleled efficiency and expertise. They possess an intimate understanding of the local regulations and logistical hurdles that can escalate an emergency into a catastrophe.

A local Greek insurer may process thousands of domestic car insurance claims annually but handle only a handful of complex international evacuations. In contrast, a global specialist manages these high-stakes situations as their core business. This deep institutional knowledge ensures every step, from dispatching an air ambulance to coordinating with local physicians, is executed with precision and alacrity.

Consider these key distinctions:

- Network Access: A local insurer's network may be strong within the EU. A global specialist provides direct-billing access to elite medical facilities across Asia, the Americas, and the Middle East.

- Assistance Services: Global teams are not mere call center agents. They are staffed by medical professionals and logistics experts capable of arranging everything from air ambulances to securing a second opinion from a world-renowned surgeon.

- Financial Capacity: International insurers are structured to handle exceptionally high-cost events without hesitation, whether it's a prolonged ICU stay or a sensitive evacuation from an unstable region.

For any individual whose lifestyle involves extended periods living or working abroad, these differences are critical. It is also vital to understand where travel insurance concludes and long-term health coverage begins. For greater clarity, you can explore the key benefits of international private medical insurance and see how it integrates into a comprehensive risk management plan.

Ultimately, your choice of provider should align with your expectation of seamless, expert support, regardless of where your work or life takes you.

Unpacking Medical Evacuation and Repatriation Coverage

When evaluating premium travel insurance, the true measure of a policy is not how it handles lost luggage, but how it performs in a genuine, high-stakes crisis. For any serious traveler departing from Greece, two of the most critical—and frequently misunderstood—benefits are medical evacuation and repatriation.

These are not ancillary features; they are the absolute core of what protects your health and financial interests when a severe incident occurs far from home. It is crucial to understand the distinction. Consider them as two separate but connected emergency services, managed by your insurer's expert team. When a medical emergency arises in a location lacking adequate medical facilities, these benefits are activated to transport you to a higher standard of care swiftly.

The Anatomy of a Medical Evacuation

A medical evacuation is the urgent, medically necessary transport from a location that cannot provide adequate treatment to the nearest facility that can. This is not a matter of convenience or choice of hospital. It is a critical decision made by medical professionals when the local clinic is ill-equipped to manage your condition.

The cost associated with such transport is staggering. An air ambulance, staffed with a medical crew and specialized equipment, can easily exceed $100,000, contingent on your location and the complexity of the situation.

A top-tier policy manages this entire, high-stress process:

- Medical Assessment: The insurer's 24/7 assistance team—often staffed by physicians and nurses—liaises directly with your local doctor to confirm that an evacuation is the only medically sound course of action.

- Logistical Coordination: They manage all logistics, from chartering the air ambulance and securing flight clearances to arranging ground transport and ensuring your admission to the destination hospital.

- Direct Payment: This is a crucial element. A premium provider pays these substantial bills directly. The last thing you or your family should face during an emergency is a six-figure invoice.

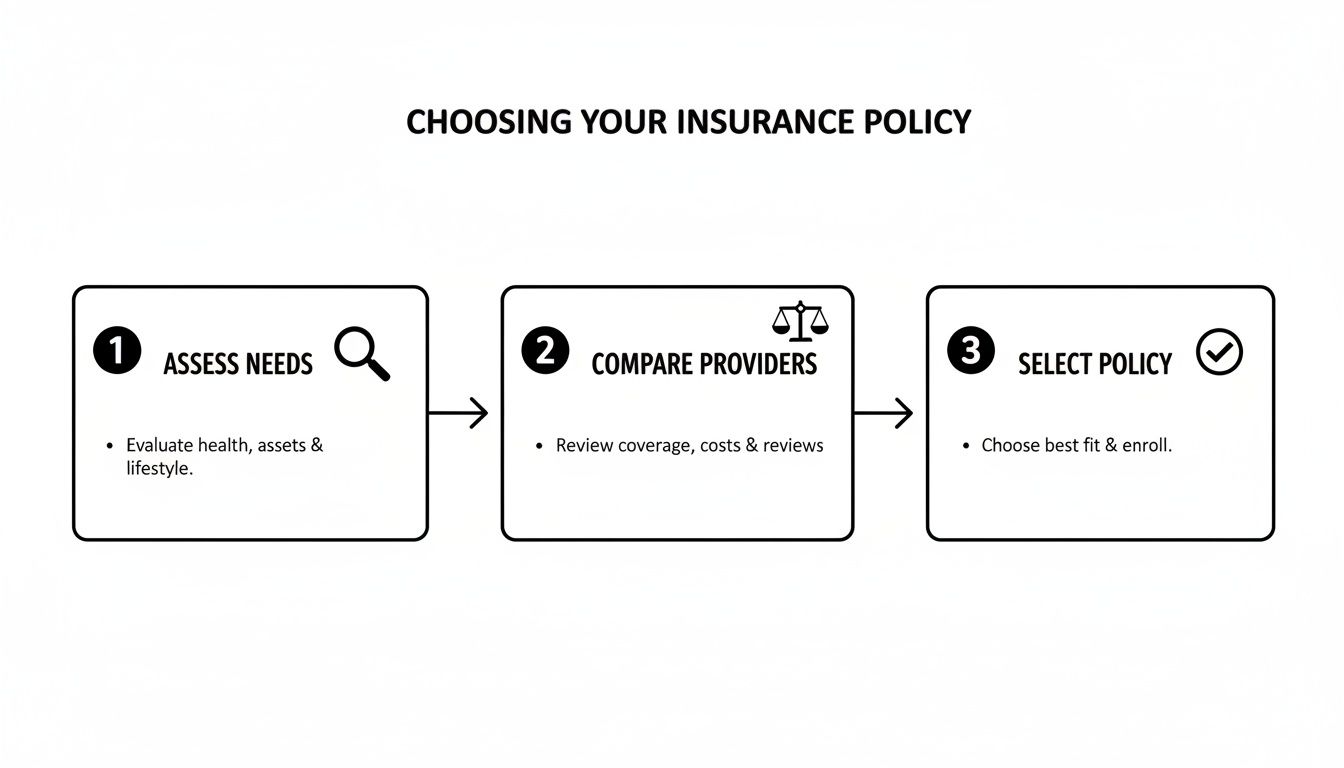

This diagram illustrates the essential steps for selecting a policy with this level of robust protection.

Following a structured process ensures you are not just purchasing a policy, but verifying its capacity to execute these critical services when it matters most.

From Evacuation to Repatriation

While medical evacuation transports you to a place of safety and competent care, repatriation is the subsequent step: returning you to your home country, Greece, once you are medically stable for travel. This is a vital distinction. Evacuation is about immediate, life-saving treatment. Repatriation is about returning you to your own physicians and support network for long-term recovery.

Similar to an evacuation, the decision to repatriate is driven by medical necessity. The insurer’s medical team will determine when it is safe for you to travel, whether on a commercial flight with a medical escort or, if required, another private air ambulance.

Consider this real-world scenario: You are on a business trip in a remote part of Southeast Asia and sustain a major injury. The local clinic cannot perform the complex surgery required. Your policy activates, evacuating you to a world-class hospital in Singapore. Following a successful operation and stabilization, the insurer then arranges and finances your repatriation back to Greece, creating a seamless continuum of care from the point of injury to your arrival home.

Why Coverage Limits Are Paramount

Regarding medical evacuation and repatriation, the coverage limits stipulated in your policy are of paramount importance. A single air ambulance flight can cost six figures, meaning a policy with a meager $100,000 limit could leave you dangerously exposed financially.

For high-net-worth individuals and serious professionals, this is not an area for compromise. You should seek policies offering at least $500,000 to $1,000,000 (or more) specifically for these benefits.

This is not a matter of luxury; it is one of pragmatism. A high limit ensures that the logistics of your care are dictated by medical necessity, not by an arbitrary financial ceiling. It represents the difference between receiving the best possible care without hesitation and facing an impossible choice in a moment of crisis. When selecting your travel insurance from Greece, verifying these limits should be your highest priority.

Travel Insurance vs International Health Insurance for Expats

For any expatriate or global professional based in Greece, confusing travel insurance with International Private Medical Insurance (IPMI) is not a minor oversight—it is a critical flaw in one's global health strategy. This misunderstanding can result in massive, and exceptionally expensive, gaps in medical protection.

The fundamental difference lies in purpose and duration.

Travel insurance is a short-term, crisis-management tool. It is designed for specific trips to handle unexpected events—a sudden illness in Dubai, a skiing accident in the Alps, or a flight cancellation that disrupts an entire itinerary. It is a temporary safety net.

IPMI, conversely, is a long-term, comprehensive health plan. It is structured for individuals who are living abroad, not merely visiting.

Defining the Scope of Your Coverage

To use a financial portfolio analogy, think of travel insurance as an on-call emergency response team for a specific mission. Its function is to manage an acute, unforeseen crisis—such as appendicitis on a business trip to Tokyo—and to stabilize and return you home. Its mission concludes upon your return to your home country.

IPMI is the equivalent of a full-service wealth management firm, but for your health. It is designed for the long term. It covers not only emergencies but also routine check-ups, specialist consultations, preventative care, and the ongoing management of chronic conditions. It functions as your primary health coverage while residing in Greece and traveling internationally, ensuring continuous, high-level healthcare access wherever you are.

The most dangerous assumption an expat can make is that a travel insurance policy can function as a primary health plan. Travel insurance is designed to stabilize and return you home; IPMI is designed to support your health and well-being wherever you are in the world.

This is why securing the correct plan is non-negotiable. For an expatriate residing in Greece for a year or more, relying on a patchwork of short-term travel policies is an untenable risk. For a more detailed analysis, understanding which expat medical insurance policy type is right for you is an essential next step.

A Practical Comparison for Global Professionals

Let’s delineate the key differences in a manner that directly informs your decision-making. The global travel insurance market is projected to grow substantially, potentially exceeding USD 100 billion by 2034. This expansion is fueled by a demand for superior, more flexible coverage. The European market is a significant component of this trend, but even the most advanced travel policies are fundamentally different from a long-term health plan. You can find more details about the global travel insurance market's growth on imarcgroup.com.

To provide absolute clarity, the following table compares what each type of plan is engineered to do.

Travel Insurance vs. IPMI Key Differences

| Feature | Travel Insurance (Short-Term Trips) | International Private Medical Insurance (Long-Term Living Abroad) |

|---|---|---|

| Primary Purpose | Emergency medical cover, trip cancellation, lost baggage for a specific trip. | Comprehensive healthcare for individuals living and working abroad. |

| Duration of Cover | Limited to the specific trip duration (e.g., 2 weeks, 30 days). | Annual, renewable policy designed for long-term residence abroad. |

| Routine Medical Care | Not covered. Excludes check-ups, preventative care, and elective treatments. | Covered. Includes specialist visits, screenings, and wellness checks. |

| Pre-Existing Conditions | Generally excluded or covered only for acute, unforeseen flare-ups. | Can be covered through medical underwriting, often with a premium loading. |

| Geographic Scope | Covers you outside your home country for a defined trip. | Provides broad, often worldwide coverage, including your country of residence. |

| Claim Philosophy | Stabilize the emergency and repatriate for further treatment. | Provide the best possible medical outcome and ongoing care, wherever you are. |

Ultimately, selecting the appropriate protection requires an honest assessment of your lifestyle and requirements.

For a two-week business trip from Athens, travel insurance is precisely the right instrument. However, for an expatriate living in Greece, a robust IPMI plan is not a luxury—it is an absolute necessity for protecting both your health and your financial well-being.

Your Pre-Purchase Checklist for the Right Policy

Procuring travel insurance can be a complex undertaking, particularly when significant financial and personal interests are at stake. To ensure you acquire a policy that provides genuine protection, a methodical approach is essential.

Consider this not as a simple to-do list, but as your critical pre-flight check. Systematically addressing these points will enable you to look beyond marketing materials, scrutinize the fine print, and confirm the insurer’s capacity to deliver in a time of need.

Nail Down the Core Financial Protections

Before examining the details, confirm that the policy’s core financial pillars are sufficiently robust for your itinerary. These three figures form the foundation of any quality policy and must be high enough to manage a worst-case scenario.

- Medical Expense Coverage: Does the policy offer a minimum of $100,000? This should be considered the absolute baseline. For travel to destinations with notoriously high healthcare costs, such as the United States, a limit of $500,000 or more is advisable.

- Emergency Evacuation & Repatriation: This is a critical component. A single medical flight can easily surpass $100,000. Your policy must have a limit of at least $500,000 to $1,000,000 for these services. This ensures that a physician's decision to transport you is based on medical necessity, not on an insurer's financial constraints.

- Trip Cancellation & Interruption: Calculate the total of all non-refundable expenses—flights, accommodations, prepaid tours, and other commitments. The policy must cover 100% of this total amount. Anything less leaves your investment partially unprotected.

Dig Into the Exclusions and Fine Print

The true value of a policy is determined not by what it covers, but by what it excludes. This is where insurers embed potential liabilities. A thorough review of the exclusions can prevent a catastrophic financial outcome.

A policy's real strength lies in its clarity. You must take the time to read the exclusions. Pay close attention to definitions and the specific circumstances that could invalidate your coverage. Do not bypass this step.

Be vigilant for these common pitfalls:

- Pre-Existing Medical Conditions: How does the insurer define a "stable" condition? Is the required stability period 30, 60, or 180 days prior to your trip? You must ascertain if you need to declare your conditions and whether this requires an additional premium for coverage.

- Adventure and Sporting Activities: A standard policy will almost certainly exclude activities it deems "high-risk," such as scuba diving, skiing, or climbing. If your plans include any activity more strenuous than walking, you will need to add a specific rider or purchase a specialized policy that explicitly enumerates and covers those activities.

Check Out the Provider's Real-World Capabilities

Finally, remember that a policy is merely a document. The operational capacity of the company behind it is what matters in a crisis. Before committing, you must verify that they possess the infrastructure to fulfill their promises.

- Confirm 24/7 Global Assistance: This must be a genuine, medically-staffed, multi-lingual assistance line, not simply a call center that records messages. If possible, place a test call to the number to assess their responsiveness.

- Understand the Claims Process: Is it a modern, digital process, or will you be required to mail physical paperwork from a hospital bed? Research reviews on the company’s claims handling—are they known for being fair and efficient, or for seeking reasons to deny payment?

- Check for Direct Billing Networks: This is a hallmark of a top-tier provider. The ability to pay a hospital directly spares you from placing tens of thousands of dollars on a personal credit card during a medical emergency. Confirm they have an established network of hospitals at your destination that can bill them directly.

Common Questions, Answered

When it comes to travel insurance, especially for professionals who value precision, the details are paramount. Let's address the most common questions we receive from clients traveling from Greece, providing the clarity needed to make an informed decision about your global protection.

Domestic vs. International Coverage

Does my Greek public or private health insurance cover me abroad?

The unequivocal answer is: almost certainly not in any meaningful capacity. Your domestic Greek insurance, whether public or private, provides minimal to zero coverage once you depart from Greece, particularly outside the European Union.

You may be considering your European Health Insurance Card (EHIC). While the EHIC is useful, it is a common and dangerous misconception to view it as travel insurance. It only grants you access to state-provided healthcare in another EU/EEA country on the same terms as a local resident. It provides absolutely no coverage for private medical care, medical repatriation to Greece, or any travel-related disruptions such as lost baggage or cancelled flights.

For genuine protection against the significant financial risks that can derail a business trip or holiday, a dedicated travel insurance policy is non-negotiable.

Policy Structure and Duration

Should I choose an annual multi-trip or a single-trip policy?

This is a straightforward cost-benefit analysis. If you travel internationally from Greece more than two or three times per year, an annual multi-trip policy is almost always the more prudent financial choice.

It provides a blanket of seamless coverage for the entire year, eliminating the administrative burden of purchasing a new policy for each trip. A spontaneous weekend trip to London or a last-minute business meeting in Dubai would be covered automatically. A brief review of your travel calendar will indicate which option is the most logical and efficient for your needs.

Asset and Equipment Protection

How can I insure my high-value electronics and business equipment?

This is a critical detail that many travelers overlook until it is too late. Standard travel insurance policies impose surprisingly low per-item limits for personal belongings. Your €2,000 laptop or specialized camera equipment might only be reimbursed for a few hundred euros.

To adequately protect your valuable technology, you must select a policy with a specific high-value electronics rider or a dedicated gadget insurance add-on. Do not merely glance at the total baggage limit.

You must verify two key figures: the per-item limit and the maximum total claim amount. This simple step is the difference between being fully reimbursed for a stolen laptop and receiving a payment that barely covers the sales tax on its replacement.

What should I look for regarding pre-existing medical conditions?

This is where the fine print is most critical, as policies vary dramatically. The paramount rule is absolute transparency. You must declare every condition during your application, regardless of how minor it may seem.

Many premium insurers will cover stable, well-managed conditions, but this may require a medical screening or an additional premium. You must scrutinize the policy wording for the definition of "stable," the required look-back period for your condition, and any specific exclusions related to your health history. An error in this area is one of the most common reasons for a claim denial.

At Riviera Expat, we cut through the complexity. We specialize in providing the expert guidance needed to secure premier international health insurance that actually aligns with your global lifestyle. Contact us for a complimentary consultation.