For high-net-worth professionals whose lives and work span continents, medical insurance international isn’t just a travel amenity. It’s a core component of a sophisticated financial strategy.

This calibre of plan provides comprehensive, long-term health coverage across borders, guaranteeing you access to world-class medical care wherever you are—without the frustrating limitations of a domestic policy. It's an elite level of protection designed to shield you from staggering overseas medical costs, an absolute necessity for the modern global citizen.

Why Elite Medical Insurance International Matters

A global lifestyle introduces complexities that your standard health plan back home was never built to handle. Think of your domestic insurance as a key that only unlocks hospital doors in your home country. An international plan is the master key, granting you access to centres of medical excellence worldwide.

For anyone whose personal and professional life plays out on a global stage, that distinction is paramount.

The necessity of this specialised coverage becomes clear when you consider the profound financial exposure one faces without it. Relying on a local policy while abroad often leads to unwelcome discoveries, such as denied claims for anything that isn't a life-or-death emergency, or finding there's no direct billing, forcing you to pay substantial sums out-of-pocket for treatment.

Securing Your Global Financial Strategy

For a high-net-worth individual, a medical emergency abroad isn’t just a health crisis—it's a direct threat to your financial stability. A premier international medical insurance plan is a powerful asset protection tool.

It effectively neutralises the risk of catastrophic medical bills that can easily climb into the hundreds of thousands, or even millions, for complex surgeries or long hospital stays in countries with high healthcare costs. This proactive health security ensures your wealth is preserved for its intended purpose, not depleted by an unpredictable medical event. Understanding the many international private medical insurance benefits is the first step toward building this vital layer of financial defence.

The demand for this robust coverage is a global trend. The global health and medical insurance market was valued at approximately USD 2.22 trillion in 2023 and is projected to grow significantly. This reflects a clear shift in awareness—more discerning individuals understand the need for dependable health security in our interconnected world.

To help clarify the fundamental differences, here's a direct comparison:

Domestic Health Plan vs International Medical Insurance

| Feature | Typical Domestic Health Plan | Medical Insurance International |

|---|---|---|

| Geographic Scope | Restricted to one country, with limited or no overseas emergency coverage. | Global coverage, often with options to include or exclude specific high-cost regions like the USA. |

| Portability | Coverage ends when you establish residency outside the country. | Fully portable. Your policy moves with you as you relocate. |

| Provider Network | Limited to a network of domestic hospitals and clinics. | Access to a worldwide network of top-tier medical facilities and specialists. |

| Coverage Depth | Designed for the local healthcare system's costs and standards. | Comprehensive benefits designed for global medical costs, including evacuation and repatriation. |

| Suitability | Best for individuals living and working exclusively in their home country. | Essential for expatriates, global executives, and frequent international travellers. |

Ultimately, a domestic plan keeps you secure at home, while an international plan protects your health and wealth on a global scale.

A well-structured international health policy isn't just another expense. It's a strategic investment in your well-being and financial resilience. It gives you the freedom and confidence to operate anywhere in the world, knowing you have a superior safety net protecting both your health and your assets, no matter where your journey takes you.

The Critical Gaps in Standard Health Coverage

A dangerous assumption many successful professionals make is that their high-quality domestic health insurance or a standard travel policy will provide adequate protection abroad. This is a significant financial gamble. These plans were simply not built for the realities of a global life and career, leaving you exposed to enormous out-of-pocket costs and concerning gaps in care precisely when you need it most.

Think of your domestic plan as a perfectly cut key to an excellent network of hospitals, but only within your home country's borders. The moment you are overseas, that key is ineffective for anything beyond the most basic, narrowly defined emergencies. This leaves you vulnerable when you require absolute certainty and seamless access to world-class medical facilities.

Territorial Restrictions and The Fine Print

The most immediate and impactful gap in standard coverage is its strict territorial limit. Domestic policies are bound by national borders. As soon as you establish residency or even spend significant time in another country, your eligibility can evaporate, often without warning. You could be uninsured and entirely unaware.

Even for shorter trips, the "emergency" coverage they offer is often an illusion, constrained by restrictive definitions. Any care that is necessary but not a life-or-death emergency—such as consulting a specialist for a recurring issue or obtaining an advanced scan—is almost always excluded.

Furthermore, these plans rarely have direct billing agreements with international hospitals. This means you are forced to pay substantial sums upfront for treatment and then navigate a complex reimbursement process. A serious medical event could necessitate the immediate liquidation of assets.

Your entire financial strategy is built on managing risk and protecting your assets. Relying on a domestic plan while abroad introduces a massive, uncalculated risk that undermines the very foundation of that strategy.

Inadequate Coverage for Complex Care

Another critical failure point is how quickly coverage limits are exhausted. Domestic plans are designed around local healthcare costs. They are completely unprepared for the considerable expense of premier private medical care in global hubs like Singapore, Dubai, or Switzerland, where costs can be several times higher.

Consider a few common scenarios where standard coverage proves insufficient:

- Complex Procedures: A cardiac surgery or advanced cancer treatment at a leading international hospital can easily exceed USD 250,000. A domestic plan’s annual or lifetime maximum could be depleted by a single event.

- Medical Evacuation: If you need to be transported to a centre of excellence for specialised care, a private air ambulance can cost from USD 50,000 to over USD 200,000. This is a service that domestic policies almost never include.

- Chronic Condition Management: Managing a pre-existing condition while abroad is often unfeasible with standard plans. They typically will not cover it, forcing you to choose between interrupting your treatment or funding it entirely yourself.

The Travel Insurance Illusion

Basic travel insurance policies are an even greater misapprehension. These are built for lost luggage, cancelled flights, and minor medical incidents on a short vacation. They are absolutely not a substitute for proper medical insurance international.

Their limitations are severe:

- Low Medical Limits: The coverage caps are so low they are often insufficient for anything more serious than a minor illness or a simple fracture.

- Exclusion of Pre-existing Conditions: Nearly every standard travel policy will automatically deny any claim related to a condition you had before your trip.

- Short-Term Focus: They are designed for tourists, not for professionals living or working abroad for any significant length of time.

These are not minor details in the fine print; they are fundamental flaws that create immense financial and personal risk. For anyone with global commitments, a dedicated international solution isn't just advisable—it's an essential component of responsible health and wealth management.

Core Components of a Premier International Health Plan

When evaluating a top-tier international health plan, the focus should not be on a long list of confusing benefits. It's about a handful of non-negotiable pillars that form a fortress around your health and your wealth, no matter where you are in the world.

Think of it as architectural design. You do not start with cosmetic details; you begin with a rock-solid foundation. For global professionals, these core components are that foundation. They represent the difference between a policy that looks good on paper and one that performs flawlessly during a serious, high-cost medical crisis.

Comprehensive Inpatient and Outpatient Care

First and foremost, any plan worthy of consideration must cover you both inside and outside the hospital. These are two sides of the same coin, and one is incomplete without the other.

Inpatient care is what most people consider "hospital insurance." It activates the moment you are formally admitted and covers the large-ticket items: surgery, diagnostic tests, medications during your stay, and your room—ideally a private one at a world-class facility in Zurich or Singapore.

Outpatient care, conversely, covers everything else. This is your day-to-day health management: consulting a specialist, getting an MRI, obtaining prescription drugs, or attending physical therapy. A premier plan provides seamless access to this care without restrictive sub-limits, so you can manage your health proactively and recover properly after a hospital stay.

Substantial Annual Limits

A hard truth: a plan's value is directly tied to its annual coverage limit. For a high-net-worth individual, a low limit is not just an inconvenience; it is an unacceptable financial risk. One complex cardiac surgery or an extended ICU stay can easily surpass seven figures in regions with high healthcare costs.

This is why a top-tier policy must have a substantial annual maximum, typically from USD 2 million up to unlimited coverage. This is not a luxury; it's a strategic necessity. It is the guarantee that should the worst happen, your treatment options are decided by medical professionals, not by accountants checking your policy balance.

A high annual limit is your ultimate financial backstop. It ensures that even the most expensive, life-saving treatments are fully covered, protecting your personal assets from the devastating impact of a catastrophic medical event.

This calibre of robust financial protection is more critical than ever. The global insurance market's gross written premiums recently surpassed USD 6.5 trillion, with health coverage representing a significant portion of this growth. Individuals are increasingly aware of the escalating costs of healthcare and the real security a powerful international plan provides.

Extensive Geographic Coverage

A truly global lifestyle demands a policy that travels with you, without borders. The best plans allow you to select a defined area of coverage based on your specific living and travel patterns. The two primary options are straightforward:

- Worldwide: This is the gold standard, providing unrestricted access to medical care literally anywhere on the planet for maximum flexibility.

- Worldwide Excluding the USA: This is a smart, strategic option. It still provides global coverage but carves out the United States, which has the most expensive healthcare system in the world. If you do not anticipate needing care in the U.S., this choice can significantly reduce your premiums.

It is about aligning your policy with your actual footprint. At the same time, it is prudent to understand cost-sharing tools like excesses and deductibles, which also play a major role in your overall costs. We break all that down in our guide on understanding excesses and deductibles.

Robust Medical Evacuation and Repatriation

For anyone living, working, or travelling in locations where top-tier medical care is not a given, this may be the single most important element of your policy. It is your lifeline when local hospitals are not equipped to handle a serious illness or injury.

Medical Evacuation is the emergency service that transports you from your location to the nearest centre of medical excellence. This could mean chartering a fully-equipped air ambulance to fly you from a remote project site to a world-renowned cardiac centre in another country for life-saving surgery.

Repatriation of Remains is a difficult but essential benefit. It covers the costs and handles the complex logistics of returning a deceased person’s body to their home country, lifting a tremendous burden from their family during an incredibly challenging time.

These four pillars are the bedrock of any superior medical insurance international plan. Secure these, and you will have the security and flexibility required to live a truly global life.

Sculpting Your Policy to Fit Your World

A generic, off-the-shelf insurance policy is ill-suited for a life built on global mobility. It is like trying to navigate the Swiss Alps with a tourist map of Paris. The real power of a premier medical insurance international plan lies not in its standard features, but in its ability to be precisely sculpted to fit your world.

This is not simply about buying insurance; it is about policy architecture. You are transforming a standard expense into a powerful strategic asset.

The first step is to discard the one-size-fits-all mindset. Your travel patterns, your family's needs, and your professional commitments create a unique risk profile. A bespoke solution is the only way to build a cost-efficient yet formidable financial safety net, no matter where your ambitions take you.

Choosing Your Geographical Area of Cover

One of the most significant levers you can pull when structuring your plan is defining its geographic scope. This decision directly impacts both the utility of your policy and its cost. Insurers typically provide two primary options, allowing you to match coverage to your actual movements.

-

Worldwide Coverage: This is the go-anywhere, do-anything option. It gives you unrestricted access to medical care across the globe. If your professional or personal life frequently takes you to the United States, this is not just a good choice—it is the only choice.

-

Worldwide Coverage Excluding the USA: This is an incredibly smart, cost-effective alternative. Since U.S. healthcare costs are the highest on the planet, simply removing that one country can reduce your premiums, often by a significant 30-50%. It is the perfect solution if you never travel to the U.S. or if you already have separate domestic coverage for your time there.

This is not just about saving money; it is about smart resource allocation. Paying a premium for coverage in a high-cost region you rarely, if ever, visit is inefficient. That capital is far better allocated to other policy enhancements that you will actually use.

Using Deductibles to Master Your Premiums

A deductible, sometimes called an excess, is the amount you agree to pay out-of-pocket before your insurer begins to cover costs. Do not view this as a mere cost-sharing gimmick. A well-chosen deductible is a sophisticated tool for controlling your annual premium.

By opting for a higher deductible, you agree to handle smaller medical events yourself. The insurer, in return for you assuming that initial risk, reduces your premium—often significantly. This is an incredibly effective strategy for high-net-worth individuals who can easily absorb minor medical costs but require absolute, ironclad protection against a catastrophic, six-figure hospital bill.

Think of it this way: you are self-insuring for minor events while transferring the risk of a major financial event to the insurer. For example, choosing a USD 5,000 annual deductible can dramatically lower your premium, making comprehensive global coverage far more efficient without compromising your protection against a major medical crisis.

Bolting On Valuable Optional Benefits

Beyond core inpatient and outpatient coverage, the best international plans offer a suite of optional benefits that allow you to build a truly holistic health solution. These are the add-ons that turn a reactive medical plan into a proactive wellness tool.

When operating globally, ensuring access to top-tier diagnostics is paramount, especially if you find yourself in a region with limited local specialists. This can even include services like remote radiological diagnoses. For those interested in how that works, this guide on Teleradiology Services and Specialists offers a great overview.

Popular enhancements often include:

- Comprehensive Dental and Vision: These modules cover everything from routine check-ups and prescription eyewear to major dental work like crowns and orthodontics.

- Wellness and Preventive Care: This is about staying ahead of health issues. It includes benefits for health screenings, vaccinations, and other measures designed to keep you at peak performance.

- Maternity Coverage: If you are planning to grow your family, this benefit provides complete coverage for prenatal care, delivery, and postnatal support.

Each addition refines your policy, transforming it from a simple contract into a personalised health management system. A well-designed plan becomes a silent partner in your global life, delivering certainty and control over both your health and your financial well-being.

How to Select the Right Provider and Plan

Choosing the right international medical plan is not an administrative chore—it's a critical strategic decision. A correct choice provides peace of mind anywhere in the world. An incorrect one could lead to dangerous coverage gaps or paying for features you will never use.

The process must be methodical, starting with a candid assessment of your own needs and ending with a policy that feels custom-built for you and your family. Let’s walk through the process.

Assess Your Personal and Family Needs

Before you even begin to look at insurers, you need to achieve absolute clarity on what you are protecting. Think of this as creating a personal blueprint for your ideal policy. This foundational step ensures every subsequent choice is based on reality, not guesswork.

Start by documenting your medical history and that of any family members who will be on the plan. Be forthright about any pre-existing conditions, ongoing treatments, or potential future needs like maternity care. This is not just paperwork; it is the key to navigating the underwriting process without any unwelcome surprises.

Next, map out where you will be living and travelling over the next few years. Will you be moving between major financial hubs like London and Singapore, or will your work take you to more remote locations? The answer directly impacts the geographic coverage and medical evacuation benefits you cannot compromise on.

Utilize Sophisticated Comparison Tools

Once you have that clear picture, it is time to separate the elite global insurers from the rest. Instead of navigating dozens of company websites, a powerful comparison engine can instantly filter the market based on the metrics that truly matter.

Here's what to focus on:

- Financial Stability Ratings: Look for top marks from agencies like S&P Global Ratings or AM Best. This is your guarantee that the insurer can pay a multi-million dollar claim without financial strain.

- Global Network Access: A premier insurer offers a sprawling, direct-billing network of world-class hospitals. This means you receive cashless treatment at the best facilities, avoiding the difficulty of fronting huge sums of money. Our deep dive into global medical networks explains why this is non-negotiable.

- Concierge-Level Customer Service: The true measure of an insurer is its performance in a crisis. You require 24/7 multilingual support, dedicated case managers for serious conditions, and seamless coordination when things go wrong.

A provider's true value is measured not just by the policy they write, but by the seamless, high-touch service they deliver when you need it most. Financial strength and a world-class network are the cornerstones of this assurance.

Analyze Plan Features and Limits Side-by-Side

With a shortlist of top-tier providers, you can now examine the specifics. Compare their plans feature by feature, looking past the marketing slogans and digging into the policy details. How do the annual limits, outpatient benefits, prescription coverage, and evacuation terms stack up against your personal blueprint?

This level of detail is critical. The global health insurance market is projected to reach USD 4.47 trillion by 2030, driven by the escalating cost of specialised medical care. That figure tells you one thing: securing a plan with high, clearly defined limits is not a luxury, it's an essential financial shield.

Navigate the Underwriting Process

The final hurdle is underwriting, where the insurer officially reviews your application. There is only one rule here: complete and total transparency. Disclosing your full medical history is not a formality—it is what makes your policy an unbreakable contract.

Attempting to conceal a pre-existing condition is a catastrophic error. It can lead to denied claims or even policy cancellation when you are most vulnerable. A specialist broker can be invaluable here, helping you present your history accurately to negotiate the best possible terms, ensuring your policy is the rock-solid guarantee it is meant to be.

Key Questions on International Medical Insurance

When considering top-tier international medical insurance, a few critical questions always arise. For a global professional, obtaining clear answers is an absolute necessity. Here are the direct, no-nonsense answers to the most common questions we hear, providing the clarity you need to move forward with confidence.

How Do International Plans Manage Pre-Existing Conditions?

Elite medical insurance international policies are far more sophisticated than a simple "yes" or "no" when it comes to pre-existing conditions. The approach depends on the insurer and the specifics of your health history, but it usually results in one of three outcomes.

In some cases, you can get full coverage, but the insurer will add a "loading" to your premium to account for the higher risk. Another common route is a specific exclusion, where the policy covers you for everything except that one pre-existing condition.

A third, more nuanced path is the moratorium. With a moratorium, a pre-existing condition can become fully covered after a waiting period—usually 24 months—as long as you have not had any symptoms, treatments, or sought medical advice for it during that time.

Being completely transparent on your application is non-negotiable. It is the only way to ensure your policy is valid when you need to use it. We help our clients navigate these details to find the best possible terms, making sure their health history is handled with the care it deserves.

Can I Retain My Plan If I Return to My Home Country?

Yes, absolutely. Portability is a defining feature of a truly premium international health plan. These plans are specifically designed to travel with you, providing seamless coverage even if you move back home. This is a critical safety net, preventing dangerous gaps in your health security, especially if you have developed new health issues while living abroad.

That said, you must review the fine print on the insurer's repatriation clauses. You need to be certain the coverage level is still appropriate for your home country’s healthcare system. This is especially true if you are returning to a location with notoriously high medical costs, such as the United States. A well-chosen plan is a constant, protecting you across borders and through all of life's transitions.

What Differentiates Medical Evacuation and Repatriation?

People often use these terms interchangeably, but medical evacuation and repatriation are two very different—and equally vital—benefits. Understanding their function is key to appreciating the full safety net a good policy provides.

Think of these two services as your ultimate backup plan, especially when you are in a location where the local medical care might not meet international standards.

-

Medical Evacuation: This is the emergency function. It is an urgent transport to the nearest appropriate centre of medical excellence. This could mean an air ambulance to a hospital in a neighbouring country if the local facilities lack the necessary specialists or equipment. The decision is driven purely by medical necessity.

-

Medical Repatriation: This is about returning you home. Once you are stable enough to travel, this benefit covers your transport back to your designated home country for continued treatment or recovery. It provides the comfort and familiarity of your own healthcare system.

A serious international plan will have robust coverage for both. The cost for these private medical transports can be substantial, easily running into six figures. This makes comprehensive evacuation and repatriation benefits a non-negotiable part of any global health strategy.

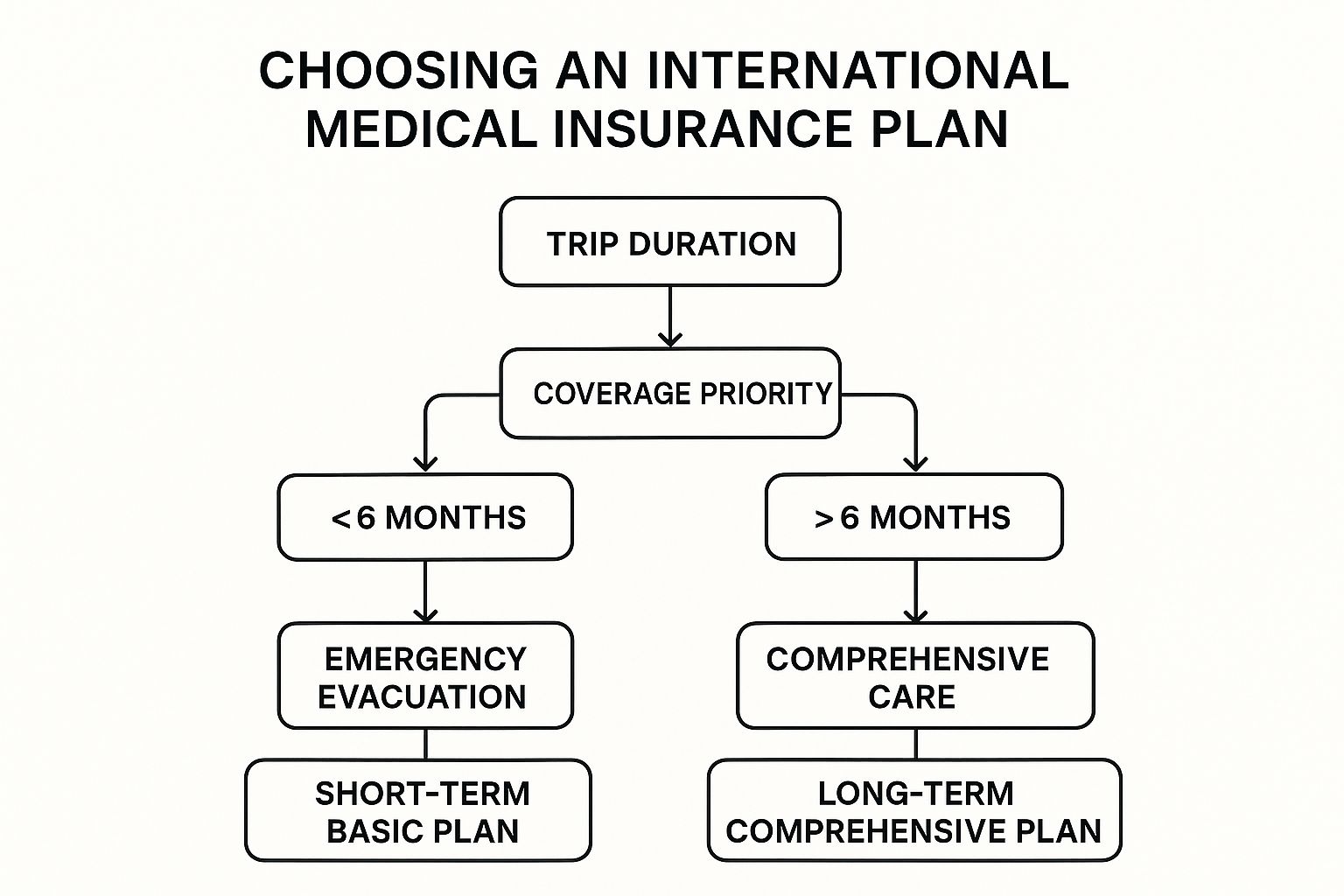

This decision tree helps visualize the first few choices you'll make when picking the right medical insurance international plan.

As the graphic shows, basic factors like the duration of your time away and your main priorities will point you toward the right kind of policy structure for your needs.

Before you proceed, it is smart to determine what you might already have. Checking your eligibility for healthcare coverage while traveling abroad through existing plans or reciprocal agreements can provide a valuable baseline. Knowing this ensures you are not paying for duplicate benefits and are making the most informed choice for your global health security.