For any high-net-worth individual coming to the United States, whether for business, investment, or relocation, addressing the American healthcare system is a non-negotiable financial imperative. Attempting to rely on a standard insurance policy from your home country is a strategic error. It will almost certainly prove inadequate, leaving your personal assets exposed to staggering costs from even a minor medical event.

Securing Your Health in the US Healthcare System

Navigating healthcare in the US is a unique challenge, primarily due to its exceptional expense. For global professionals and their families, selecting the right medical insurance is not merely a prudent measure—it is an essential strategy for asset protection and personal well-being. A plan designed for another country's healthcare model is simply not structured to handle the financial realities here.

The optimal choice is determined by your specific circumstances. We will delineate how to align a plan with your visa status, duration of stay, and the standard of care you require. The objective is clear: to secure a plan that delivers both comprehensive coverage and complete peace of mind.

The High Cost of American Healthcare

The financial exposure within the US medical system is exceptionally high. This is a reality driven by decades of escalating costs. It is the primary reason that travel or home-country insurance policies are typically insufficient.

Data from the U.S. Bureau of Labor Statistics shows that between January 2000 and December 2022, the price index for hospital and related services in the U.S. increased by 227.2%. For context, the overall Consumer Price Index for all items rose by 76.1% during the same period. This significant disparity means a routine emergency room visit or a minor procedure can generate invoices in the tens or even hundreds of thousands of dollars, far exceeding the limits of most standard international policies.

Securing a policy with a high coverage limit is not a luxury—it is a fundamental necessity. It acts as a financial firewall, protecting your wealth from the potentially catastrophic costs of an unexpected medical event in the United States.

Planning Beyond the Policy

A complete health security plan extends beyond the insurance card in your wallet. It requires an understanding of the entire healthcare ecosystem, including how physician and hospital networks operate and the legal instruments that become vital in a crisis.

For instance, beyond insurance, it is wise to understand critical legal designations, like the meaning of POA in a medical context, which is crucial for decision-making if you become incapacitated.

Making informed choices on these fronts is key. Knowing the difference between an HMO and a PPO network, for example, can dramatically affect your access to top-tier specialists. You can gain further insight into this with our guide on how medical provider networks function. Consider this your primer for making a truly strategic decision.

Before we delve into specific insurance types, let's outline the primary decision points to consider. This framework will help you structure your evaluation and ask the pertinent questions when assessing different plans.

Key Decision Factors for US Medical Insurance

| Key Factor | Questions to Ask Yourself | Why It Matters |

|---|---|---|

| Visa & Immigration Status | What visa do I hold? Am I a tourist, student, temporary worker, or green card holder? How long can I legally stay? | Eligibility for different types of plans is tied directly to your legal status. A tourist plan is unsuitable for a long-term resident. |

| Duration of Stay | Is this a short trip (under a year) or a long-term relocation? | Short-term travel medical plans are fundamentally different from long-term expatriate health plans in terms of coverage and cost. |

| Coverage Needs | Do I need only emergency coverage, or comprehensive care including wellness checks, specialists, and prescriptions? | The level of coverage dictates the plan's cost and utility. Mismatched coverage can lead to significant out-of-pocket expenses. |

| Pre-existing Conditions | Do I or my family members have any ongoing health issues (e.g., diabetes, heart conditions, asthma)? | This is a critical factor. Many plans exclude pre-existing conditions or have waiting periods, which could leave you unprotected. |

| Network Access | How important is it to choose my own doctors and hospitals? Do I require access to top specialists? | Plans with broad "PPO" networks offer flexibility but cost more. "HMO" networks are more restrictive but can be less expensive. |

| Financial Exposure | What is the maximum I am willing to pay out-of-pocket (deductible)? What is the highest total bill I can handle (coverage limit)? | A high deductible lowers your monthly premium but increases your risk. A low coverage limit is a major financial gamble in the US. |

A thorough consideration of these factors is the foundational step. It compels you to define your precise needs, preventing the acquisition of a plan that appears adequate on paper but fails in a real medical situation.

Matching Your Insurance to Your Visa Status

Your immigration status is the single most important factor in determining the appropriate medical insurance for your time in the USA. The plan you can obtain—and the one that will effectively protect you financially—is directly linked to the visa in your passport and your intended length of stay. An error in this selection presents a significant risk. Choosing the wrong type of insurance can create massive gaps in your coverage, leaving you dangerously exposed to the high costs of American healthcare.

Consider it analogous to selecting the right tool for a specific task. A tourist on a two-week holiday has entirely different requirements than an executive relocating their family for a multi-year assignment. The insurance market is structured around this reality, offering two principal pathways. Understanding this distinction is the first step toward a sound, secure decision.

Short-Term Travel Medical Insurance for Temporary Visitors

If you are coming to the United States for a limited duration—such as for tourism, a short business trip, or visiting family—then short-term travel medical insurance is the appropriate solution. These plans are designed specifically for non-U.S. citizens who are in the country temporarily and maintain their primary residence elsewhere.

This type of policy functions as an emergency safety net. Its sole purpose is to cover unforeseen events: a sudden illness, an accidental injury, or a medical emergency requiring hospitalization. It is not intended for routine check-ups, preventative care, or managing a chronic health condition.

This is the correct fit for common visa types such as:

- B-1/B-2 Visas: For individuals traveling for conferences, business meetings, or tourism.

- Visa Waiver Program (ESTA): For citizens of eligible countries visiting for 90 days or less.

- Other Temporary Visas: Includes a variety of short-term work or exchange visitor statuses that do not necessitate a full-scale health plan.

Think of this plan as emergency roadside assistance for your health. You would not use it for routine maintenance, but it is absolutely critical for a sudden breakdown. It is designed to protect you from a massive, unexpected financial liability.

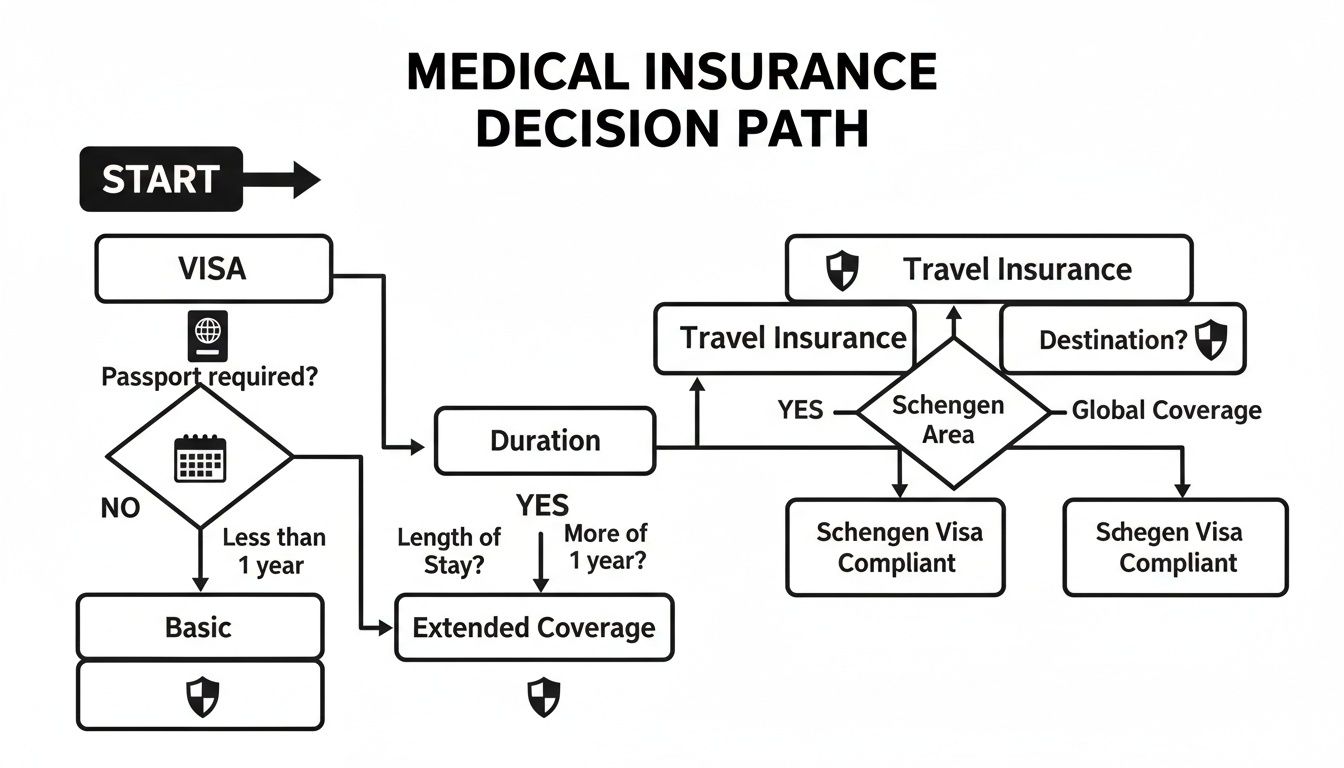

This flowchart can help you visualize which path corresponds to your visa, stay, and coverage needs.

As illustrated, the duration and purpose of your stay are the key drivers that direct you toward either a short-term emergency plan or a more comprehensive, long-term solution.

International Private Medical Insurance for Expatriates

Conversely, if you are relocating to the United States for an extended period, a simple travel policy is entirely inadequate. For expatriates, long-term workers, and international students, International Private Medical Insurance (IPMI) is the only viable choice. These are comprehensive health plans designed for individuals living and working outside their home country for a year or more.

An IPMI plan functions similarly to a domestic American health insurance policy. It extends far beyond emergencies to cover a wide spectrum of healthcare needs, including:

- Routine physician visits and wellness checks.

- Consultations with specialists and diagnostic tests.

- Coverage for prescription medications.

- Management of chronic and pre-existing conditions.

- Hospitalizations for both emergencies and planned surgeries.

This is the level of coverage required when you are residing in the US, not merely visiting. Understanding your visa is critical, as different statuses have distinct requirements; for instance, there is specific guidance for navigating Canadian visa and work requirements. IPMI plans are generally the standard for visa holders who are effectively US residents, such as:

- L-1 Visas: For intracompany executive transferees.

- H-1B Visas: For professionals in specialty occupations.

- F-1 Visas: For academic students.

- E-Visas: For treaty traders and investors.

Attempting to manage without this level of coverage means paying for every non-emergency medical expense out-of-pocket, which can accumulate to tens of thousands of dollars rapidly. For a more detailed analysis of these plans, you can gain valuable insights by exploring which expat medical insurance policy type is right for you. This will help you align your personal and professional needs with the appropriate long-term plan.

Understanding Your Policy's Core Components

Selecting the right type of medical insurance for foreigners in the USA is only the initial step. To truly protect yourself financially, you must examine the mechanics of the policy. Breaking down the core components allows you to evaluate a plan not just on its monthly premium, but on the real-world financial shield it provides when needed.

An insurance policy is a financial partnership. You pay a predictable, regular premium, and in exchange, the insurance company agrees to cover unpredictable and often substantial medical bills. This partnership is governed by specific rules that define who pays what, and when. A firm grasp of these terms—deductibles, coinsurance, and out-of-pocket maximums—is non-negotiable.

Demystifying Your Financial Obligations

The fine print of any policy details your share of the costs. These are not hidden fees; they are the structured components of the agreement that determine your financial exposure in the event of illness or injury. Understanding them is the only way to avoid unwelcome financial surprises.

-

Deductible: This is the initial amount you must pay out-of-pocket before your insurance company begins to contribute. A $1,000 deductible means you are responsible for the first $1,000 of covered medical expenses.

-

Coinsurance: Once you have met your full deductible, you enter a cost-sharing phase. Coinsurance is the percentage of the medical bill you are responsible for after the deductible is satisfied. With a common 80/20 plan, the insurer pays 80%, and you are responsible for the remaining 20%.

-

Out-of-Pocket Maximum: This is your financial safety net. It is the absolute most you will have to pay for covered medical care in a single policy year. Once your payments for deductibles and coinsurance reach this limit, the insurance company assumes 100% of all subsequent eligible costs.

Navigating Provider Networks: PPO vs. HMO

A policy's value is directly tied to the physicians and hospitals it allows you to access. This access is controlled by the plan’s provider network. For any international professional who values flexibility and requires access to top specialists, the distinction between a PPO and an HMO is critical.

A Health Maintenance Organization (HMO) is a restrictive network. You must use doctors, hospitals, and specialists within its specific network to be covered, except in a life-threatening emergency. You are also typically required to select a Primary Care Physician (PCP) who acts as a gatekeeper, necessitating a referral from them before you can consult a specialist. This model prioritizes cost control over choice.

In stark contrast, a Preferred Provider Organization (PPO) offers significant freedom. While staying with "in-network" providers maximizes your savings, you retain the option to go "out-of-network" to see any doctor or visit any hospital and still receive partial coverage. Crucially, PPOs do not require referrals. You can directly access the medical experts of your choice.

For a high-net-worth individual, a PPO is almost always the superior choice. The ability to directly access leading medical centers and specialists nationwide aligns with the expectation of receiving the highest standard of care without administrative delays.

Essential Benefits Beyond Standard Medical Care

A top-tier insurance plan for foreigners must include benefits that extend beyond routine physician visits. These features are designed to manage catastrophic and logistically complex situations, providing a layer of protection that is indispensable.

-

Medical Evacuation: This covers the substantial cost of transporting you to the nearest high-quality medical facility if you are seriously ill or injured in a location without adequate care. In some cases, it can cover transportation back to your home country.

-

Repatriation of Remains: In the unfortunate event of a death, this benefit manages the significant costs and complex logistics of returning the deceased's remains to their home country, alleviating a heavy financial and emotional burden from the family.

-

Acute Onset of Pre-existing Conditions: Many short-term plans provide limited coverage for a sudden, unexpected flare-up of a chronic condition. It is vital to understand the plan's precise definition and the monetary cap for this benefit—it is not the same as comprehensive coverage for a known health issue.

The necessity of these benefits cannot be overstated. A 2022 report from the U.S. Travel Insurance Association (UStiA) noted that 86.97 million people were protected by travel insurance plans from its members. With emergency medical costs being a primary driver of claims and the US being a high-cost environment, the need for robust coverage is clear. Experts often recommend a minimum of $50,000 for emergency medical coverage and $100,000 for medical evacuation, underscoring the importance of these components. You can discover more about travel insurance statistics and trends to better understand the associated risks.

What Does Medical Security in the US Actually Cost?

Determining the cost of medical insurance in the US is not about finding the lowest price. It is about understanding the immense value represented by the premium. This expenditure should not be viewed as a mere travel expense, but rather as a calculated investment in asset protection.

In the high-stakes American healthcare system, a sound policy functions as a financial firewall. It stands between you and the kind of catastrophic medical bills that can materialize with shocking speed.

The final premium is not arbitrary; it is calculated based on a clear set of variables. Each factor directly influences the cost, and understanding their function allows you to appreciate why certain choices provide far greater long-term security.

Key Drivers of Your Insurance Premium

The premium calculation is a blend of your personal profile and the level of financial protection you select. Insurers assess risk based on several key factors—factors you directly control when choosing your plan.

- Your Age: This is a significant determinant. Statistically, the likelihood of needing medical care increases with age, so premiums are structured accordingly.

- Length of Your Stay: The longer the coverage period, the higher the total cost. A 10-day policy will naturally be less expensive than a 90-day plan.

- Policy Maximum: This is the total ceiling on what the insurer will pay for covered medical expenses. Choosing a $50,000 limit versus a $1,000,000 limit will create a substantial difference in your premium.

- Deductible: This is the amount you agree to pay out-of-pocket before the insurance coverage begins. A higher deductible (e.g., $2,500) signifies greater initial risk assumption on your part, which lowers your premium. A low deductible (e.g., $250) has the opposite effect.

These factors are interdependent. For instance, real-world data on travel medical insurance for foreigners visiting the USA shows just how much these metrics affect the cost. According to one 2023 analysis, children and young adults (ages 0-21) had the lowest average premium at $51, while seniors aged 70 and over faced a much higher average of $144. The trip duration is also crucial; a short 4-7 day visit averaged $54, while a 15-30 day stay climbed to approximately $90. You can discover more insights about travel medical insurance costs to see exactly how these variables interact.

To provide a clearer picture, here is an illustration of how these factors can influence the final premium for different visitor profiles.

Illustrative Premium Costs by Visitor Profile

| Visitor Profile | Trip Duration | Coverage Limit | Estimated Average Premium |

|---|---|---|---|

| Young Solo Traveler (Age 25) | 14 Days | $100,000 | $65 – $85 |

| Business Professional (Age 45) | 30 Days | $500,000 | $150 – $200 |

| Retired Couple (Ages 68 & 70) | 60 Days | $250,000 | $450 – $600 (per person) |

| Family of Four (Ages 40, 38, 10, 8) | 21 Days | $1,000,000 | $300 – $400 (total) |

As demonstrated, the cost is highly customized. It is a direct reflection of the specific risk and protection level for each traveler's unique situation.

The Strategic Value of Higher Coverage Limits

It is tempting to view a high coverage limit as excessive, but in the US, this is a critical miscalculation. A single night in an American hospital can cost thousands of dollars, and a complex surgical procedure can easily exceed $100,000. A policy with a low maximum can be exhausted with alarming speed.

Selecting a higher coverage limit—such as $500,000 or more—is not about planning for an unlikely event. It is about ensuring you are insulated from the financially devastating. It transforms your policy from a basic safety net into a comprehensive shield for your wealth.

Consider this: a $50,000 emergency medical plan might have an average premium of $90. Increasing that coverage to $250,000 might only increase the premium to $139. For a relatively small additional investment, you have multiplied your financial protection fivefold. In the American medical market, that is an incredibly sound strategic decision.

For global professionals who travel to the US frequently, an annual multi-trip plan often presents the most logical and cost-effective solution. Instead of purchasing a new policy for each visit, one annual plan provides continuous coverage. It streamlines planning and ensures you are never without protection—an indispensable tool for any modern executive.

Accessing Premium Services and Executive Care

For a discerning international professional, medical insurance in the USA must be more than a financial safety net. It must function as a complete support system, delivering premium services designed to protect your two most valuable assets: your health and your time. These features elevate a standard policy to a high-touch executive service, guaranteeing seamless, stress-free access to the best available care.

Executive-level plans are defined by convenience and responsiveness. They are designed for individuals who operate on a global scale and expect crisp efficiency in every aspect of their lives. When navigating the complexities of American healthcare, this level of service is not a luxury—it is a necessity.

The Power of Concierge Assistance

Imagine arriving in a new country and needing to find a top neurologist or cardiologist. With a premium plan, you do not have to guess. You receive immediate, expert action through 24/7 multilingual concierge assistance. This is far more than a helpline; it is your personal health logistics team.

This service is invaluable for managing critical tasks that would otherwise consume your time and energy. A dedicated concierge can:

- Secure Appointments with Top-Tier Specialists: They leverage established networks to facilitate appointments with sought-after physicians, often bypassing long public wait times.

- Coordinate Hospital Admissions: They manage all administrative requirements for a planned or emergency hospital stay, ensuring a smooth process.

- Arrange Second Medical Opinions: They can quickly organize consultations with other leading experts to confirm a diagnosis or explore alternative treatment paths.

- Navigate Administrative Hurdles: They act as your advocate, handling the complex paperwork and communication between medical departments.

This personalized support ensures your focus remains on your well-being, not on logistical challenges.

The Advantage of Direct-Billing Networks

One of the most significant challenges for foreigners in the US healthcare system is the confusing and fragmented billing process. Direct billing, a core feature of elite medical insurance, completely removes this burden. It creates a truly cashless experience at the point of care.

Direct billing means the insurance provider settles payments directly with the hospital or clinic. This feature is a game-changer, as it means you do not have to pay huge sums upfront and then seek reimbursement.

Without it, a single hospital stay could require you to pay tens—or even hundreds—of thousands of dollars out of pocket, creating a significant cash flow issue while you wait weeks or months for a claim to be processed. A strong direct-billing network provides incredible peace of mind, allowing you to access care without financial friction.

Prioritizing Privacy and Discretion

For high-profile individuals, privacy is not a preference; it is essential. Top-tier insurance providers catering to an executive clientele understand this. They operate with the utmost discretion, ensuring your sensitive medical information is handled securely and confidentially.

This commitment extends beyond digital security. It is ingrained in the service culture, from the concierge who books your appointment to the case manager overseeing your treatment. This provides the confidence to seek medical attention knowing your personal and health details are protected by strict privacy protocols. Choosing an insurer with a proven history of serving a distinguished client base is critical to maintaining the level of discretion you expect.

Managing Claims and US Medical Billing

A top-tier medical insurance policy demonstrates its true value when you need to use it. It is more than a financial safety net; it acts as your guide and advocate within the notoriously complex US healthcare system. Understanding how claims work is critical, as is preparing for the unique and often confusing nature of American medical billing. The process has a structure, but it can feel disorienting without proper assistance.

The key to successfully navigating a claim is immediate and clear communication. Your first action, whenever possible, should be to contact your insurer before receiving any non-emergency treatment. This is known as pre-authorization or pre-certification, and it is a standard requirement for any planned procedure, from surgeries to advanced imaging like an MRI.

Failing to complete this step can lead to adverse consequences. Your insurer might reduce your benefits or deny the claim outright, leaving you responsible for the entire bill. For a more detailed examination of this vital first step, our guide breaks down the intricacies of pre-authorization and direct settlement processes.

The Intricacies of the US Billing System

One of the most bewildering experiences for foreigners in the US healthcare system is the way bills are generated. In many countries, a hospital stay results in a single, consolidated invoice. This is not the case in America. Here, the system is highly compartmentalized, and you will almost certainly receive a multitude of different bills for a single medical event.

This occurs because each professional and department involved in your care often bills independently. A relatively minor surgical procedure, for example, could generate separate invoices from:

- The hospital itself, for the room, nursing care, and equipment.

- The attending surgeon for their professional services.

- The anesthesiologist who administered and monitored anesthesia.

- The radiology department if you had X-rays or scans.

- An external laboratory that processed bloodwork.

This influx of paperwork can create significant confusion and stress. It is absolutely essential to meticulously organize every bill and piece of correspondence you receive.

Anticipating this multi-bill reality is half the battle. Maintain a detailed file for each medical incident, tracking every invoice and Explanation of Benefits (EOB) from your insurer. This diligence transforms a chaotic paper trail into a manageable process.

Effectively Managing Your Claim Documentation

To process your claim, your insurer will require specific documents. Proactive and organized record-keeping is your best strategy. Always retain copies of all paperwork and submit them to your insurance provider promptly.

Here are the key documents you will need:

- Itemized Bills: Do not accept a summary bill with a final total. Insist on a fully itemized statement from every provider that lists each service and its specific charge.

- Medical Reports: This includes the physician's notes, results from diagnostic tests, and hospital discharge summaries. These documents substantiate the medical necessity of the care you received.

- Completed Claim Form: Fill out your insurer's official claim form with complete and accurate information. Double-check that it is signed and dated before submission.

Remember, your insurance provider is your partner in this process. Leverage their expertise, especially if you receive a bill that appears incorrect or lists services you do not recognize. A high-quality insurer will assign case managers who can intervene on your behalf, challenge erroneous charges, and ensure you only pay what is contractually required under your policy. This advocacy is one of the most valuable features of a premium plan.

Answering Your Lingering Questions

Regarding the specifics of medical insurance for foreigners in the USA, several common questions consistently arise. Let's address them directly to resolve any remaining uncertainty and allow you to finalize your strategy with confidence.

Can I Just Buy Insurance After I Land in the USA?

Technically, yes, many visitor medical plans can be purchased after arrival. However, I strongly advise against this approach.

Securing your policy before you travel is the most prudent course of action. Policies purchased after arrival almost always have a waiting period before certain benefits become active. More critically, any illness or injury that occurs before your policy is effective is considered a pre-existing condition—and it will not be covered.

What About Quick Trips to Canada or Mexico? Will My US Plan Cover Me?

Many US-centric plans do provide coverage for short, incidental trips to neighboring countries, but you cannot assume this is the case. This is a detail you must verify.

Examine your policy documents for a section titled "Territorial Coverage" or "Geographical Area." It will specify exactly where you are protected. Pay close attention to any limitations, such as the maximum number of days permitted for these side trips.

A common and potentially costly error is assuming a "US plan" automatically covers all of North America. Always confirm this in writing within your policy certificate. An incorrect assumption here could result in a significant, uncovered medical bill from a weekend trip.

What if My Plans Change and I Need to Stay in the US Longer?

Plans can change unexpectedly. Most reputable short-term medical policies are designed to be extendable. Typically, you must request the extension before your current plan expires, and the insurance company may review your claims history before approving it. This is usually a straightforward process that can be handled online or by phone.

For more comprehensive, long-term IPMI plans, annual renewals are a standard feature. The key is to fully understand the specific extension and renewal process when you initially purchase the policy. Clarifying this from the outset ensures you can maintain continuous protection if your time in the US is extended.

At Riviera Expat, we specialize in providing discerning financial professionals with the clarity and control they need over their international health insurance. We deliver expert, objective guidance to help you secure the precise coverage required for your time in the United States. Secure your consultation and find the right IPMI plan today.