For high-net-worth individuals and expatriate finance professionals, medevac insurance isn't a luxury—it's the critical mechanism that facilitates transport to a centre of medical excellence when a crisis occurs abroad. This is not standard health coverage. It is a specialized logistical and financial safety net, designed purely to manage serious health events in locations where local medical care may not meet the highest international standards.

For global professionals, this coverage is a foundational piece of a sophisticated risk management strategy.

The Essential Safety Net for Global Professionals

International work, particularly in high-stakes finance, requires calculated risk and precise execution. A sudden medical emergency in a location without world-class healthcare introduces an unacceptable level of uncertainty, threatening both personal well-being and financial stability.

This is precisely where standard health insurance often reveals a critical, and potentially costly, gap.

Most plans will cover the cost of treatment, but they rarely address the significant expense of an emergency medical flight. The cost for these flights can readily exceed $100,000. Medevac insurance is engineered specifically to fill this void. It is not an optional add-on; it's an essential asset for any individual whose career demands global mobility.

A Foundational Component of Global Risk Management

Consider this coverage a strategic imperative, a tool that ensures you maintain control even in the most unpredictable circumstances. Its primary function is to provide a lifeline, guaranteeing that your health is not compromised by your geographical location. This becomes especially relevant for professionals operating in emerging markets or remote locales.

This growing necessity is reflected in the market itself. The global travel insurance market, which includes medical evacuation services, was valued at USD 17.6 billion in 2022, a testament to its rising importance for executives and expatriates in financial hubs like Singapore, Hong Kong, and London. For professionals in banking and private wealth management, robust medevac insurance is simply a core part of a complete global health strategy.

Integrating Health and Safety Strategies

This protection is a key piece of a much larger puzzle. While medevac insurance provides the financial backstop for a medical transport, immediate personal safety measures are just as vital.

For global professionals often working alone in unfamiliar territories, understanding the strategies from a comprehensive guide to lone worker safety devices can provide crucial insights into being proactive about your own safety.

Ultimately, medevac coverage works in concert with your primary health plan. To fully appreciate its role, it is vital to understand the benefits of International Private Medical Insurance and see how the two policies integrate to provide true end-to-end protection. This guide will give you the clarity needed to make a confident, informed decision.

Breaking Down Medevac Insurance: What It Is and Why It Matters

Let's be precise. Medevac insurance is not designed to pay for a doctor's visit or a hospital stay. It is a specialized financial and logistical lifeline designed for one critical purpose: arranging and funding your transport from a location with inadequate medical care to a hospital that can provide the necessary treatment for your condition.

Think of it as the logistical solution to a medical crisis. When you are facing a serious emergency far from home, this is the coverage that arranges and pays for the complex, and often very expensive, process of moving you to the right facility. It is the bridge from the point of crisis to the point of care, and it is a non-negotiable component of any serious international health plan.

Getting the Language Right: Evacuation vs. Repatriation

In the world of insurance, imprecise language can be a liability. The terms "evacuation" and "repatriation" are often used interchangeably, but they refer to distinct services. Confusing them can lead to significant misunderstandings about your coverage.

Knowing the difference determines where you are taken in an emergency and why. There are three key terms you need to master:

- Medical Evacuation: This is the urgent transport from the location of illness or injury to the nearest appropriate medical facility. Note the wording: "nearest appropriate." The goal is stabilization and access to a high standard of care quickly. If you have a serious accident in a remote area, you would be flown to a world-class hospital in a major regional hub like Bangkok or Singapore, not necessarily your home country.

- Medical Repatriation: This typically occurs after initial stabilization. Once you are deemed fit for a long-haul flight, this service transports you back to your home country to continue your recovery. This is for longer-term care within your familiar healthcare system, often after an initial evacuation.

- Repatriation of Remains: In the unfortunate event of a death abroad, this provision manages the sensitive and costly logistics of returning the deceased's body to their home country, handling all the complex legal and administrative requirements.

Why You Can't Afford to Ignore This

Grasping these distinctions highlights the significant financial risk of traveling without proper medevac coverage. The travel insurance market is expanding for a reason—it is projected to reach USD 107.8 billion by 2032.

This growth is fueled by a stark reality: the substantial cost of an emergency. Air ambulances can be billed at rates of $20,000 per hour or more. In response, insurers are enhancing their policies, with a significant number now offering coverage limits of $250,000 or more. If you wish to examine the data further, you can discover more insights into these travel insurance market trends.

A common and dangerous misconception is the assumption that standard travel or health insurance automatically includes a robust medevac plan. It almost never does. That policy might cover your hospital bills once you arrive, but it could leave you with the six-figure invoice for the flight that got you there.

This is exactly where sophisticated, high-net-worth professionals can be caught off guard. They may have a premium health plan or a high-end credit card and assume they're covered. When a crisis strikes, they discover the logistical challenge and immense cost of an air ambulance falls squarely on them.

Medevac insurance isn't a replacement for your medical plan; it's the essential link that makes it functional in an emergency. Without it, the best health insurance in the world is of little use if you cannot physically reach the hospital with the tools and expertise to save your life.

A quick comparison makes the distinction crystal clear.

Medical Evacuation Versus Standard Travel Medical Insurance

This table breaks down the crucial differences between a dedicated medevac service and the medical benefits found in a standard travel insurance policy. Understanding this is key to avoiding catastrophic coverage gaps.

| Feature | Medevac Insurance | Standard Travel Medical Insurance |

|---|---|---|

| Primary Purpose | Transportation and logistics to get you to adequate medical care. | Reimburses medical expenses for treatment received at a hospital. |

| Core Function | "Getting you there." Arranges and pays for emergency transport. | "Paying for it there." Covers doctor bills, hospital stays, surgery. |

| Typical Trigger | Medical necessity when local facilities are deemed inadequate for your condition. | Any covered illness or injury that requires medical treatment. |

| Cost Structure | Covers high-cost items like air ambulances, medical escorts, and flight crews. | Covers costs like consultations, prescriptions, and inpatient room charges. |

| Coverage Limits | Often $500,000 to $2,000,000+ specifically for transport. | Medical expense limits can range from $50,000 to $1,000,000+. |

| Example Scenario | A severe head injury in a remote area triggers a helicopter and private jet transfer to a major trauma center. | A broken leg from a skiing accident is treated at a local hospital; the policy covers X-rays, casting, and follow-up visits. |

Ultimately, these two types of insurance perform completely different jobs. One is a logistics and transport solution, the other is a healthcare payment solution. For comprehensive protection, both are essential. Relying on just one is like owning a high-performance race car without having any way to get it to the racetrack.

The Financial Reality of a Medical Evacuation

If you manage multi-million-dollar portfolios, you live and breathe catastrophic risk management. A medical evacuation is exactly that—a sudden, unbudgeted, six-figure event that can require the liquidation of a significant amount of capital in just a few hours.

The figures here are not meant to be alarming; they are the reality of a high-stakes logistical operation. An air ambulance is not merely a private jet with a paramedic on board. It is a flying intensive care unit, staffed with specialist physicians and nurses and equipped with advanced life-support technology. It is an ICU that must operate under immense pressure, thousands of feet in the air.

That level of service comes with a commensurate price tag. A single flight can range from $25,000 to over $250,000. These figures represent a direct, immediate, and personal financial liability for anyone traveling without the right kind of coverage. Viewing this through the lens of pure risk mitigation is the only sensible approach.

Deconstructing the Cost of an Air Ambulance

Why are the costs so substantial? The final invoice for a medical flight is not a single line item; it is an aggregation of several high-stakes variables. Each component adds another layer of expense, demonstrating how quickly the costs can escalate.

Here are the primary drivers that make up the final invoice:

- Flight Distance and Duration: It is a matter of physics and economics. A long-haul flight from Asia to Europe consumes exponentially more fuel and requires more crew hours than a short flight from the Caribbean to Miami.

- Aircraft Type and Capabilities: A long-range jet capable of a transatlantic flight has a much higher operating cost than a smaller turboprop designed for regional transfers. The specific aircraft required for the mission dictates the base cost.

- Medical Crew Specialization: The patient’s condition determines the composition of the medical team. A stable orthopedic injury might only require a paramedic, but a critical cardiac patient will necessitate a full team, including a specialist physician and a critical care nurse, dramatically increasing the cost.

- Landing Fees and Overflight Permits: International flights require permission to cross multiple countries' airspace and involve paying significant fees to land at airports, especially for emergency, after-hours arrivals.

Real-World Cost Scenarios

Let's move from the theoretical to the practical. These scenarios illustrate how geography and medical needs create vastly different financial outcomes. They also reinforce why having a plan in place is not just prudent—it is essential.

Scenario 1: Caribbean Emergency

An executive suffers a major heart attack while on a remote Caribbean island. The local clinic is not equipped to provide advanced cardiac care.

- Evacuation Route: A short-haul flight from the island directly to a top-tier cardiac center in Miami.

- Estimated Cost Without Insurance: $25,000 – $50,000. This invoice covers the specialized flight crew, the aircraft, and the urgent landing clearances required to enter the U.S. quickly.

Scenario 2: Southeast Asia Crisis

A private wealth manager is in a serious road accident in a rural part of Southeast Asia, suffering multiple fractures and internal injuries. The local hospital cannot perform the complex surgery required.

- Evacuation Route: An air ambulance transfer to a state-of-the-art trauma facility in Singapore.

- Estimated Cost Without Insurance: $80,000 – $120,000. This higher cost reflects the longer flight, the need for a full trauma team on board, and the complex coordination with Singaporean medical authorities.

It is a fundamental miscalculation to assume a standard health plan or a premium credit card benefit will absorb these costs. Those are designed to cover your treatment after you arrive at the hospital, not the six-figure bill for the flight that transports you there.

This is the critical gap where many financially astute individuals find themselves dangerously exposed. They have excellent medical insurance but no mechanism to actually get to the care it promises to cover.

A comprehensive medevac travel insurance policy is the only instrument built specifically to close this gap. It converts an unpredictable, financially devastating expense into a fixed, manageable premium. For a high-net-worth individual, this is not just another insurance product; it is a core component of a sound financial strategy, preserving capital by neutralizing a very real and plausible threat.

Navigating Policy Exclusions and Fine Print

An exceptional insurance policy is defined not by its marketing promises, but by the specific details contained within its terms and conditions. For discerning professionals, scrutinizing the exclusions of a medevac travel insurance plan is not merely administrative work—it is a critical part of managing risk. A single oversight in this area could be the difference between a seamless rescue and a financial catastrophe.

You must understand what is not covered with the same clarity as you understand what is. Insurers are methodical in defining the boundaries of their liability, and it is incumbent upon you to be just as methodical in your review. Those clauses, often located deep within a policy document, are where the true value of your coverage is revealed.

Decoding Common Policy Exclusions

Every medevac policy will have a list of exclusions—specific events or conditions that will void coverage. While the exact wording differs between insurers, a few common themes are consistently present. Pay close attention to these to avoid unexpected issues when you can least afford them.

Here is what is commonly excluded:

- Certain Pre-existing Conditions: This is a critical point. Many policies will not cover an evacuation if it is related to an unstable pre-existing condition, especially following recent treatment or a change in medication. You must understand the "look-back" period and the insurer's definition of "stable." For a deeper dive, learn how to navigate medical conditions and policy exclusions in our detailed guide.

- High-Risk Adventure Activities: Activities like mountaineering, scuba diving beyond specified depths, or backcountry skiing are almost always excluded unless an additional premium has been paid for a specific rider or a specialized policy has been purchased. Always verify that your planned activities are explicitly covered.

- Travel to High-Risk Destinations: If you are traveling to a country for which your government has issued a "do not travel" advisory, your policy may be void. Insurers constantly assess geopolitical risk and may not operate in certain unstable regions.

The Critical Concept of Medical Necessity

The trigger for any medevac flight is what is termed medical necessity. This is not a decision you or your family makes. It is a professional judgment made by the insurer's medical team, in consultation with your local attending physician, determining that the facility you are in is not equipped to treat your condition appropriately.

An insurer's definition of "medically necessary" is the gatekeeper to your benefits. A vaguely worded clause can grant the provider excessive discretion to deny a claim. Look for clear, objective criteria that define what constitutes inadequate care.

This concept is the absolute core of the medevac process. If a local hospital can achieve stabilization—even if it is not the world-class facility you would choose at home—the insurer might argue an evacuation is not strictly necessary. This is one area where a premium policy often proves its worth by offering greater flexibility.

Why Policy Limits Matter Immensely

Finally, let us discuss the financial limits. A basic plan with a coverage cap of $50,000 is dangerously inadequate. As we have discussed, a single air ambulance flight from a remote part of Asia to Europe can easily exceed $150,000. For a high-net-worth individual, a low coverage limit presents an unacceptable financial gamble.

The medical travel insurance market is substantial—valued at USD 13.6 billion in 2022 and projected to reach USD 50.8 billion by 2032—precisely because individuals are recognizing these staggering costs. For finance professionals, whose work can take them to less-developed regions, the medevac component is non-negotiable, as repatriation alone can cost anywhere from $50,000 to over $100,000 per incident. Learn more about medical travel insurance market growth.

You should be looking for plans with limits of at least $1 million, if not more. This ensures that even the most complex, long-distance evacuation—the kind that requires a specialized jet and a full medical team—is covered without you having to liquidate assets. It is a simple calculation of risk versus reward.

Integrating Medevac with Your Private Medical Insurance

Viewing medevac coverage as a standalone product is a fundamental miscalculation. For the globally mobile professional, it is not an optional add-on but a critical component that must integrate perfectly with a robust International Private Medical Insurance (IPMI) plan. The two policies play distinct, sequential roles, and understanding their synergy is the only way to build a truly seamless financial and medical safety net.

Without this integration, you are left with a dangerous gap. A standalone medevac policy, or the basic benefit included with a premium credit card, might get you to the hospital door. But it provides absolutely no mechanism to pay for the world-class treatment you require upon arrival. Relying on such a fragmented approach introduces staggering financial risk at the worst possible time.

The Two Pillars of Global Health Security

Think of your global health strategy in two distinct stages: the crisis response, and the medical treatment and recovery. Medevac insurance and IPMI are the respective funding mechanisms for each stage, and they must work in perfect concert.

This structure creates a clean, clear division of responsibility:

- Medevac Travel Insurance: This is your logistics and transportation engine. Its sole purpose is to arrange and fund the complex, high-cost operation of moving you from a location with inadequate medical care to a center of excellence. It covers the air ambulance, the specialized medical crew, and all associated flight and coordination fees.

- International Private Medical Insurance (IPMI): This is your healthcare payment solution. It takes over the moment you are admitted to the hospital, covering the costs of surgeons, specialists, inpatient care, diagnostics, and your entire recovery process.

An integrated plan ensures there is no dispute or delay between the transport phase and the treatment phase. The medevac provider knows your IPMI will handle the massive medical bills, and the IPMI provider is assured you will arrive at an in-network facility, ready for immediate care.

A Seamless Handover from Evacuation to Treatment

Imagine a medical emergency in a developing nation. Your medevac provider dispatches a jet and crew to fly you to a premier hospital in a major hub like Singapore. Upon landing, the logistical phase concludes and the medical phase begins. Your IPMI must be structured for a completely frictionless transition.

This is where features like direct settlement become invaluable. A well-designed IPMI plan will have arrangements with top-tier international hospitals to pay them directly, eliminating the need for you to cover enormous upfront costs out-of-pocket. To ensure this handover is smooth, it is absolutely essential that the processes for pre-authorisation and direct settlement are understood and confirmed with your insurance broker long before you travel.

A properly structured, integrated plan provides true end-to-end protection. It creates a continuous chain of coverage from the point of emergency, through the air ambulance transport, and all the way to your final recovery, delivering the peace of mind essential for a demanding global career.

Ultimately, this integration is about control. For a high-net-worth individual, the goal is not just to survive a medical crisis—it is to manage it with precision and absolute financial certainty. By ensuring your medevac and IPMI plans are designed to work together, you replace logistical chaos and financial shocks with a clear, pre-arranged process. This is the hallmark of a sophisticated approach to global risk management.

How to Select Your Medevac Provider

Selecting the right medevac provider is not like choosing a standard insurance policy. It is more akin to vetting a high-stakes emergency logistics partner for a contingency you hope never materializes. Your decision requires precision and a crystal-clear understanding of their real-world operational capabilities.

This process boils down to asking direct, pointed questions that cut through marketing materials and get to the core of their service. A provider's quality is not found in its glossy brochures, but in its proven ability to execute a complex medical flight under immense pressure.

Critical Questions for Potential Providers

Before considering a contract, you need a checklist of non-negotiable questions. The confidence and clarity of their responses will reveal everything you need to know about their professionalism and reliability.

Your investigation should focus on four critical areas:

-

Operational Reach and Assets: What does their global network actually consist of? Crucially, do they own their aircraft or do they rely on third-party charters? In a true emergency, an owned fleet almost always translates to a faster response. Inquiring about the different types of aircraft they operate can also provide insight into their capabilities.

-

Medical Expertise and Staffing: Who exactly comprises the medical team? Are they full-time employees or contractors engaged for a specific mission? You need to clarify the qualifications of the medical directors who will be managing your case from their 24/7 operations center.

-

Evacuation Triggers and Process: What is the precise, step-by-step process for dispatching a flight? Ask them to walk you through the timeline, from the initial emergency call to the moment the aircraft is airborne. Understanding the chain of command is essential.

-

Destination Flexibility: This is a key differentiator. Does the policy mandate an evacuation to the "nearest adequate facility," or does it provide the option of being transported to your "hospital of choice"? For many individuals, the ability to return to their trusted medical team at home is the most important factor and a key feature of premium plans.

A provider's real value is in its ability to deliver a seamless, integrated response. This means their operational plan must cover every single step, from that initial emergency call all the way to a smooth handover at a top-tier hospital.

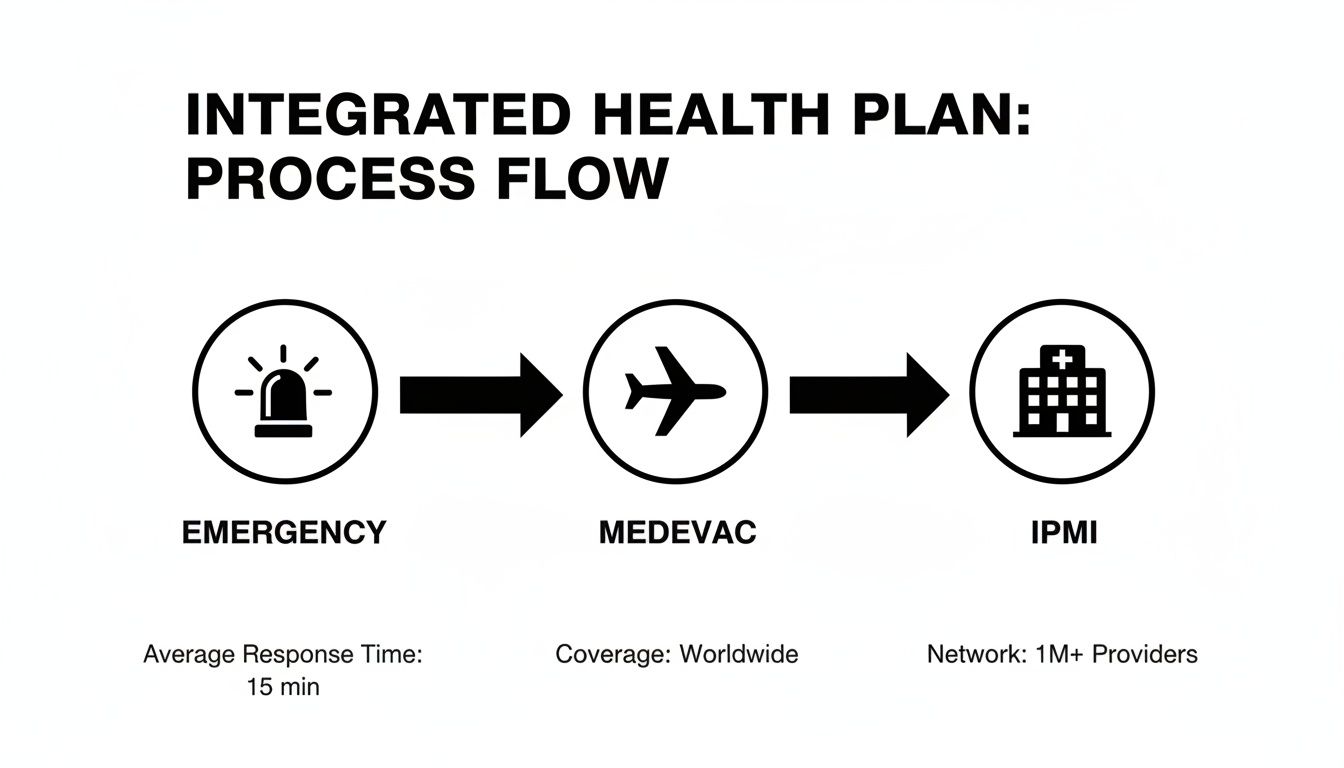

The diagram below illustrates how a medevac service fits into a complete international health strategy.

Think of it this way: your IPMI policy pays for the world-class medical care you need. But your medevac insurance is the critical logistical bridge that gets you from the site of the emergency to that care. Your choice of provider determines just how strong that bridge is.

Common Questions About Medevac Insurance

Even with the best planning, specific questions invariably arise when examining the details of medevac insurance. Here are straightforward answers to the questions most frequently posed by global professionals, designed to provide that final piece of clarity before you make a decision.

How Fast Can an Air Ambulance Realistically Reach Me?

This is a critical question, and the honest answer is: it depends. There is no fixed number. The actual timeline is a dynamic variable influenced by your precise location, weather conditions on the ground and in the air, and the complex process of securing permits to fly over different countries.

While no provider can guarantee an exact time, a top-tier service that owns its own fleet and operates a 24/7 global command center can often get a jet airborne within 2 to 4 hours of confirming the medical necessity. Their value is not just the aircraft; it is the logistical expertise and crisis-tested procedures they bring to bear.

Will My Insurance Allow a Family Member to Fly with Me During an Evacuation?

High-quality medevac policies absolutely should include a provision for a companion, such as a spouse or close family member, to fly with you. In the midst of a stressful medical event, this is a profoundly important detail that provides immense personal comfort.

However, do not assume it is a standard feature. You must check the policy wording. The best plans include this as a core benefit, while others might offer it only as a paid add-on.

Having a companion by your side is a hallmark of a truly client-focused medevac plan. It recognizes the human element of a medical crisis and, for many, should be a non-negotiable feature.

Can I Decide Which Hospital I Am Flown To?

This question is what separates a basic policy from a premium one. Many standard plans will only transport you to what they define as the "nearest adequate medical facility" that can handle your condition. It gets you to safety, but it is not on your terms.

Superior policies, designed for individuals who require more control, offer a "hospital of choice" benefit. This feature allows you, once you are medically stable, to be flown to your preferred hospital, often in your home country. This provides continuity of care from your own doctors—a significant advantage.

How Do Policies Address Pre-Existing Conditions?

This is easily the most nuanced aspect of medevac insurance. Insurers utilize a "look-back" period, typically between 60 and 180 days, to review your medical history for any pre-existing conditions.

Here is the crucial detail: if your emergency is caused by a condition that was not considered "stable" or for which you received treatment during that look-back period, the evacuation will likely be denied. This is why complete transparency about your medical history during the application is non-negotiable. You must be certain your coverage is secure. Always ask the insurer to define, in writing, what "stable" means.

At Riviera Expat, we specialize in structuring integrated health plans that combine premier medevac services with comprehensive international medical insurance, ensuring no gaps in your protection. Secure your peace of mind by exploring your options with our expert advisors at https://riviera-expat.com.