For a high-net-worth individual living and working in a global hub like Singapore or Dubai, a standard health insurance plan is more than just inadequate—it's a significant liability. The financial and personal risks of having insufficient medical coverage abroad are substantial. This is precisely where international private medical insurance, or IPMI, shifts from being a simple benefit to an essential instrument for protecting both your health and your wealth.

Protecting Your Health and Wealth Across Borders

When your career portfolio spans multiple countries, your healthcare strategy must evolve in sophistication. Relying on local health plans or a basic travel policy creates profound gaps in your coverage. A sudden medical event in a foreign country can spiral into a logistical and financial challenge without the appropriate protection in place.

For an individual in your position, this is not merely about possessing an insurance card. It is about securing guaranteed access, choice, and absolute peace of mind. A well-designed international health insurance expat plan is engineered from the ground up to deliver seamless medical care, irrespective of your global location. Consider it a global key that unlocks access to the world's premier hospitals and specialists, free from the typical constraints of local network restrictions and bureaucratic delays.

A Growing Market for Global Citizens

The demand for this caliber of protection is surging. The global market for international health insurance is projected to reach USD 44.29 billion by 2029, expanding at a compound annual growth rate of 8.7%. This growth is a direct consequence of the increasing mobility of discerning professionals who require sophisticated, borderless healthcare solutions. You can explore these trends in the full report from Research and Markets.

This guide will provide the clarity necessary to make an informed decision. We will define IPMI, contrast it with other types of insurance, and articulate precisely why it is a non-negotiable component of maintaining your lifestyle and protecting your assets.

IPMI is more than a safety net; it's a strategic component of a well-managed global life, ensuring continuity of care and financial predictability no matter where your ambitions take you.

What Is International Private Medical Insurance?

At its core, International Private Medical Insurance (IPMI) is superior-grade health coverage architected specifically for individuals living and working outside their country of origin. It is designed for the realities of an expatriate life, breaking free from the borders and limitations that constrain domestic health plans.

Conceptualize it as your global medical passport. A standard local health plan effectively tethers you to a single country’s healthcare system, with its specific provider networks and often variable quality of care. IPMI achieves the opposite. It grants you the freedom to choose the best doctors and hospitals, often anywhere in the world, on your own terms.

This Is Not Standard Travel Insurance

It is imperative to distinguish IPMI from travel insurance. Confusing the two is a fundamental error that can lead to adverse consequences.

Travel insurance is designed for short-term trips and unforeseen emergencies. Its sole function is to provide acute care sufficient to stabilize your condition before repatriating you, where your substantive medical care begins. It will not cover routine check-ups, ongoing treatment for chronic conditions, or any form of elective care.

An international health insurance expat plan, conversely, is structured for a life lived abroad, not a brief holiday. It represents comprehensive, long-term health management. This means it covers the full spectrum of care, from annual physicals and specialist consultations to major surgery and oncology treatment, ensuring your health is managed proactively, not just reactively.

The Core Pillars of a Premier IPMI Plan

A truly robust IPMI policy is engineered to provide a seamless, high-quality healthcare experience, regardless of your location. Its value is built on a few non-negotiable features that are absent in other types of insurance.

- True Worldwide Coverage: You gain access to medical care across an expansive geographical area. Most premier plans offer worldwide coverage (sometimes excluding the high-cost USA to manage premiums), ensuring your policy is as mobile as your lifestyle.

- Direct Settlement Networks: The best IPMI providers maintain extensive global networks of top-tier hospitals and clinics. This is crucial as it allows for direct billing—the insurer settles payment directly with the hospital, saving you from significant out-of-pocket expenditure and subsequent reimbursement claims.

- Medical Evacuation and Repatriation: Should you face a serious medical emergency in a location with inadequate healthcare infrastructure, your plan covers the cost of transporting you to the nearest center of medical excellence. Repatriation, which is transport back to your home country, is also a standard, essential feature.

This level of sophisticated, portable coverage is precisely why demand is accelerating. The expat insurance market is on a trajectory to grow from USD 331 million in 2024 to USD 532 million by 2031, according to a detailed analysis from Intel Market Research. This growth is fueled by professionals who cannot obtain the robust, flexible protection they require from local systems.

An IPMI policy isn’t just another expense. It's a strategic investment in your continuity of care. It ensures your health receives the same exceptional standard of attention you give to your career and finances.

Ultimately, selecting the right IPMI plan is about exercising control over your healthcare. It allows you to select your preferred physician, hospital, and even the country where you receive treatment, guaranteeing that every medical decision aligns perfectly with your own high standards. To explore the full depth of these advantages, read our guide on the uncovered benefits of international private medical insurance.

Comparing Global IPMI and Local Health Plans

Upon relocating, a primary consideration is always healthcare. Is the local health plan sufficient? On the surface, it may appear to be the simplest, most cost-effective option. However, for a globally mobile professional, relying on a domestic insurance scheme can be a costly misjudgment, leaving you exposed to serious coverage gaps and unexpected financial liabilities.

The fundamental difference is not merely geographical; it is about the entire philosophy underpinning the plan. A local plan is built for a resident. It operates on the assumption that you will live, work, and require medical care almost exclusively within one country's borders. It is hardwired into that nation’s healthcare system, its specific network of providers, and its unique regulations. For a dynamic international career, that static design creates immediate and significant limitations.

The Portability Problem: A Plan That Moves with You

The most conspicuous flaw in a local plan is its complete lack of portability. Imagine you have just been relocated from Singapore to London for a two-year assignment. Your Singapore-based policy is now effectively void. You are forced to start anew, navigating an entirely new healthcare and insurance system while acclimatizing to a new professional role.

This is not a singular inconvenience. The entire process must be repeated with every international move. It is an administrative burden that, more critically, creates dangerous gaps in your coverage during transitional periods. An international health insurance expat plan, or IPMI, is engineered to solve exactly this problem. It is a single, continuous policy that accompanies you across the globe, providing consistent, reliable protection irrespective of your career's trajectory.

A local plan anchors your healthcare to one location. An international plan renders your healthcare as mobile as you are, ensuring seamless protection across continents and career moves.

Geographical Boundaries and Standards of Care

Local plans effectively confine your non-emergency medical treatment within national borders. If you desire a second opinion from a world-renowned specialist in another country, or prefer treatment at a top clinic abroad, a local policy will not cover it. You are restricted to the options available within that single territory.

Furthermore, the standard of medical care can vary dramatically from one country to another. What is considered a routine procedure in one nation might be a complex, private surgery with a lengthy waiting list in another. An IPMI plan affords you the freedom to choose not just your doctor and hospital, but also the country where you receive your care. This guarantees you can always access the highest global standards of medical excellence.

That freedom of choice is an incredibly powerful asset. It means you are never forced to compromise on the quality of your healthcare simply because of your current residence.

A Clear Comparison: International IPMI vs. Local Coverage

To truly appreciate the difference, a side-by-side comparison is instructive. The table below delineates the key features, illustrating precisely why a dedicated international health insurance expat plan offers far superior protection for a global lifestyle.

International IPMI vs Local Health Insurance: A Head-to-Head Comparison

This table contrasts the critical features of International Private Medical Insurance (IPMI) against standard local health insurance plans to help high-net-worth expats understand the fundamental differences in coverage and flexibility.

| Feature | International Private Medical Insurance (IPMI) | Local Health Insurance Plan |

|---|---|---|

| Geographical Coverage | Provides broad, often worldwide, coverage for treatment. | Strictly limited to the country where the policy is issued. |

| Portability | Fully portable; the same policy remains active when you move to a new country. | Not portable; a new policy is required for each international relocation. |

| Choice of Provider | Offers unrestricted choice of doctors and hospitals within a global network. | Confined to a specific, pre-approved network of local providers. |

| Medical Evacuation | Includes coverage for medical evacuation to the nearest center of excellence. | Typically does not include medical evacuation or repatriation benefits. |

| Direct Billing | Extensive global direct settlement networks mean cashless access to care. | Direct billing is only available within the local, in-country network. |

| Currency of Policy | Typically offered in major global currencies like USD, EUR, or GBP for stability. | Billed and paid in the local currency, subject to exchange rate fluctuations. |

As is evident, the two types of plans are constructed for entirely different lives. A local plan is for an individual remaining in one place, while an IPMI plan is for someone whose life and career transcend borders. For the international professional, the choice is clear.

Navigating Your Coverage Options and Exclusions

Consider a premium international health insurance expat policy as the architectural plan for a bespoke residence. Every component has a specific purpose, and the final design must perfectly align with your lifestyle. The real value lies not just in what is included, but in having absolute clarity on what is not.

A top-tier IPMI plan is structured in modules, allowing you to construct the precise level of protection you require. You begin with a solid foundation and then add specialized modules to cover every aspect of your well-being. This prevents you from paying for benefits you will not use while ensuring you are fully protected where it matters most.

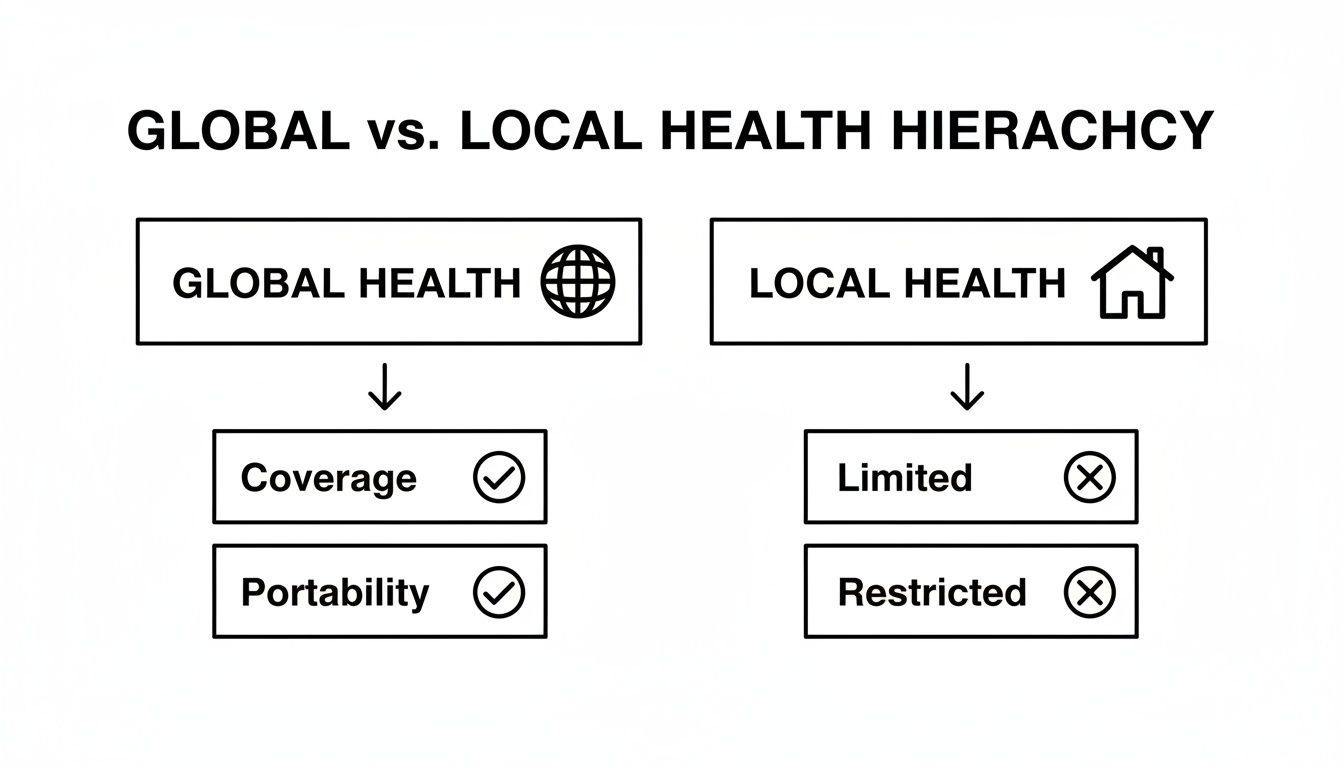

This infographic breaks down exactly how a global plan's flexible structure provides far superior coverage compared to the rigid, constrained nature of a local policy.

The image reinforces a fundamental truth for any global professional: an international plan is built for a life of mobility and choice, while a local plan is designed for stasis.

Core Components of Your Global Plan

The absolute foundation of any IPMI policy is inpatient and day-patient care. This covers all aspects of a hospital admission—the room, surgical procedures, specialist fees, and diagnostic imaging like MRIs. It is the non-negotiable safety net for any serious medical event.

From this base, you build upwards, adding further layers of protection:

- Outpatient Benefits: This module is for all medical care that does not require a hospital admission. This includes specialist appointments, prescription medications, physical therapy, or routine health checks. If you are managing any ongoing health conditions, this is an essential component.

- Dental and Vision Care: Often overlooked, these benefits can cover everything from routine cleanings and fillings to more complex procedures like crowns or laser eye surgery. For families, this provides crucial, predictable support.

- Wellness and Preventative Care: The best plans increasingly offer benefits for health screenings, vaccinations, and other proactive measures. They empower you to manage your health proactively, rather than merely reacting to problems.

A well-structured IPMI policy is a bespoke instrument. It is designed not as a one-size-fits-all product but as a tailored solution that mirrors your specific health needs and global footprint.

Understanding Common Policy Exclusions

Equally important is knowing, with complete transparency, what is typically excluded. Surprises are undesirable in both finance and healthcare. While policies differ, some exclusions are standard across the industry and demand your full attention before you commit.

The most significant is almost always pre-existing conditions. These are health issues you had before the policy's inception. How an insurer addresses them depends entirely on the underwriting process—they might be covered for a higher premium, excluded for a set period under a moratorium, or excluded permanently.

Other common exclusions to review carefully include:

- Specific High-Risk Activities: Most standard policies will not cover injuries from professional sports or hazardous avocations like mountaineering or motorsports without a special rider and an additional premium.

- Fertility Treatments: Services such as IVF are often excluded or are only available under the highest-tier maternity plans.

- Cosmetic Procedures: Any treatment or surgery that is not medically necessary, such as elective plastic surgery, is almost universally excluded.

The global increase in chronic conditions has made comprehensive coverage more vital than ever. Health insurance premiums are rising globally, with Asia experiencing a significant surge—a key trend for expats in hubs like Singapore. This is closely linked to the need for continuous care; for instance, the number of people living with pre-diabetes in the United Kingdom reaching 3.6 million underscores why robust, cross-border coverage for long-term health management is indispensable for expatriates.

Mastering these details requires a firm grasp of policy language. To assist, you can learn more about key expat medical insurance policy terms in our article. A thorough review ensures your final policy is free of dangerous ambiguities, providing the certainty you require.

Understanding Policy Costs and Underwriting

When considering international health insurance expat coverage, it is natural to focus on the premium. But for a discerning client, cost is always a measure of value, not just price. View this policy as a critical investment in your well-being. The premium is not an arbitrary figure; it is a direct reflection of the comprehensive, global protection you are securing.

Understanding how that figure is calculated is the first step. Insurers utilize a clear set of factors to assess risk and construct a premium that corresponds to the level of coverage provided.

The Core Drivers of Your Premium

The architecture of your policy's cost rests on several fundamental pillars. Each one offers a lever for adjustment, affording you a degree of control over the final investment.

- Age and Health Profile: This is a primary determinant. As a general rule, premiums increase with age, reflecting the statistical rise in the likelihood of needing medical care. Your personal health history is equally important in the final calculation.

- Geographic Area of Coverage: The regions where you are eligible for treatment significantly impact the cost. A plan that includes exceptionally expensive healthcare systems, such as the USA, will command a much higher premium. A strategic approach is to tailor your coverage area to your specific residential and travel patterns.

- Deductibles and Cost-Sharing: The deductible, also known as an excess, is the amount you agree to pay out-of-pocket before your insurance benefits commence. By selecting a higher deductible, you assume more of the initial risk, which in turn lowers your annual premium.

- Benefit Limits and Modules: The policy's total annual limit and the optional modules you select—such as outpatient care, dental, or wellness benefits—also influence the cost. A higher benefit ceiling and more comprehensive add-ons translate to a higher premium.

While premiums are a planned investment, the potential cost of being underinsured or uninsured in a foreign country can be financially devastating. A well-structured policy is a critical component of a robust personal financial strategy.

The Underwriting Process Explained

The process an insurer uses to evaluate your health status and determine the terms of your coverage is known as underwriting. For an international health insurance expat plan, this process typically follows one of two paths, each handling pre-existing conditions very differently. Making the correct choice here is vital.

Full Medical Underwriting (FMU) is a comprehensive assessment. You provide a complete medical history via a detailed questionnaire. The insurer’s underwriting team then analyzes this information to craft a bespoke offer. They may cover your pre-existing conditions (sometimes for an additional premium), or they may apply specific exclusions. The principal advantage of FMU is absolute clarity from day one; you know precisely what is covered and what is not.

Moratorium Underwriting is the simpler, more expedited route. There is no extensive medical questionnaire upfront. Instead, the policy automatically excludes any condition for which you have experienced symptoms or sought treatment in the recent past (typically the last five years). These conditions are not necessarily excluded permanently. They can become eligible for coverage, but only after a continuous period on the policy—usually 24 months—without any symptoms, treatment, or advice related to them. Moratorium offers convenience but begins with less certainty.

The decision between these two approaches depends on your personal health profile and whether you prioritize upfront certainty over a simplified application. This single decision directly shapes the reliability of your global health protection. Premiums are also subject to wider economic pressures, and you can learn more about why medical insurance premiums rise over time.

The Value of a Specialist Insurance Broker

Attempting to secure the right international health insurance expat plan independently can be akin to navigating a complex financial market without an advisor. The sheer number of providers, intricate policy documents, and subtle underwriting nuances can be challenging for even the most sophisticated professionals. This is precisely where a specialist insurance broker becomes your most valuable asset.

A true specialist is not merely a salesperson; they are your personal advisor and advocate in a high-stakes market. Their role is to distill complexity into clarity and deliver expert counsel, transforming a difficult purchasing decision into a straightforward, confident one.

Objective Guidance and Deep Market Knowledge

When you contact an insurance company directly, you are engaging with their sales team, whose objective is to sell their products. A specialist broker, conversely, works for you. Their fiduciary duty is to you, the client, not to any single insurer.

This independence is fundamental to their business model. Reputable brokers are remunerated via a commission from the insurance company after you have selected a policy. Crucially, your premium remains identical whether you engage directly or through a broker. They have no financial incentive to favor one insurer over another, ensuring their advice is genuinely impartial.

A specialist broker acts as your personal navigator in the global insurance market, leveraging deep industry relationships and product knowledge to secure terms and coverage that are often inaccessible to individuals.

For you, this translates to an expert's comprehensive view of the entire market, at no direct cost. They perform the due diligence of analyzing dozens of policies, saving you invaluable time while ensuring the final recommendation is optimally suited to your circumstances.

Navigating Underwriting and Claims Support

A broker’s value extends far beyond plan selection. They provide mission-critical guidance during the application phase, helping you understand the real-world implications of Full Medical Underwriting versus a Moratorium plan based on your personal health history. This advice is vital for managing pre-existing conditions appropriately and preventing future coverage disputes.

Their support continues long after the policy is active. Should you encounter a complex claim or a disagreement with the insurer, your broker acts as your advocate. They liaise directly with the insurer on your behalf to ensure a fair and efficient resolution. This level of dedicated service provides immense peace of mind when you are located far from home.

Engaging a specialist provides a distinct advantage:

- Unbiased Recommendations: You receive a curated shortlist of the market's best policies, hand-selected for your specific needs.

- Expert Negotiation: Brokers can often secure more favorable terms, particularly for clients with complex health profiles.

- Time Efficiency: They manage all research, comparisons, and administration, allowing you to focus on your professional and personal priorities.

- Ongoing Advocacy: You have a dedicated expert in your corner for renewals, policy queries, and claims support for the life of the policy.

Ultimately, a specialist broker for international health insurance expat plans delivers clarity and confidence. They provide the professional guidance needed to protect your two most important assets—your health and financial well-being—no matter where your life takes you.

Your Questions Answered: Navigating Expat Insurance

When managing a global lifestyle, pertinent questions will naturally arise. The world of international health insurance for expats can appear complex, but obtaining clear, direct answers is the first step toward securing the right protection. Here, we address some of the most common queries from our clientele.

I'm Moving to a Country with Excellent Public Healthcare. Do I Really Need a Private Plan?

Yes, and the rationale is centered on access and choice. While many countries offer high-quality public healthcare, these systems are often characterized by significant waiting lists for specialist appointments and non-urgent surgical procedures. For an individual accustomed to immediate, premium service, this can represent a material decline in your standard of care.

An international plan functions as an express route. It allows you to bypass public system queues entirely, granting direct access to the best private hospitals and clinics. More importantly, it provides the freedom to select your own physicians and specialists, ensuring you receive the precise care you desire, precisely when you need it.

What is the Precise Difference Between Medical Evacuation and Repatriation?

These terms may sound similar, but they pertain to two distinct—and equally critical—scenarios. Understanding their definitions is key to appreciating the true strength of a global policy.

- Medical Evacuation: This benefit covers your transport to the nearest center of medical excellence if your current location lacks the necessary facilities or expertise to treat your condition. This could involve a flight to a world-class hospital in a neighboring country. It is an essential provision when local care is substandard.

- Repatriation: This benefit facilitates your transport back to your designated home country for treatment. This typically occurs once you are medically stable for a longer journey, allowing you to recover in a familiar environment, supported by family.

A truly premium IPMI plan will include both, creating a robust safety net that guarantees, no matter where a medical emergency occurs, you will be moved to a location where the best possible care is available.

Can I Cover My Entire Family on One International Policy?

Certainly. One of the primary advantages of a dedicated international health insurance expat plan is the ability to consolidate your entire family's coverage under a single, comprehensive policy. Insurers are adept at constructing family plans that seamlessly cover your spouse and dependent children.

This integrated approach ensures every family member receives the same high standard of medical care, regardless of your global location. It is particularly valuable for families with children, providing uninterrupted access to pediatricians and other specialists during your international transition.

Securing the right international health insurance is not merely an administrative task; it is about designing a strategic plan that aligns perfectly with your global life. At Riviera Expat, we specialize in cutting through complexity to ensure your health and wealth are protected, without compromise. Get your free, no-obligation quote today.