Even in a robust global economy, distinguished careers can encounter unforeseen disruption. For high-net-worth individuals and expatriate professionals, insurance for layoff serves as a critical financial instrument, designed to safeguard a significant portion of your income—far beyond what standard government benefits can provide. This specialized coverage is engineered to ensure financial continuity following an unexpected job loss, delivering stability precisely when it is most needed.

Securing Your Income in a Volatile Market

Navigating an involuntary career transition necessitates financial strength, not the pressure of liquidating assets to maintain liquidity. While government unemployment programs offer a baseline safety net, their weekly disbursements are capped at levels that are insufficient for a high earner's financial commitments. This is the exact gap that private layoff insurance is structured to fill.

Consider it a bespoke financial buffer. Instead of a uniform government provision, you secure a policy that aligns with your income and lifestyle. This ensures your major obligations—from mortgages and private school fees to investment commitments—are met without interruption. For expatriates, this protection is even more essential, creating a reliable income bridge that functions across borders, independent of complex local regulations.

Bridging the Financial Gap

The fundamental distinction lies in the level of protection. State benefits may cover basic necessities, but private layoff insurance is designed to maintain your established standard of living. This distinction is pivotal. It allows you to negotiate your next career move from a position of strength, not exigency.

A private policy is not merely about replacing a lost salary; it is a tool for strategic career management. It affords you the financial runway to secure a role that truly aligns with your expertise and ambition, rather than accepting the first available offer.

Beyond the financial safety net, securing your income also involves proactive planning. This is where resources like developing a comprehensive job search plan become valuable, helping you to re-establish your career trajectory more efficiently. When a robust insurance policy is combined with an intelligent job search strategy, you construct a powerful defense against market volatility, empowering you to manage your career with confidence, regardless of external circumstances.

How Layoff Insurance Actually Works

Think of layoff insurance as a personal financial backstop. It is not designed to prevent a career transition—as that is often beyond one's control—but to ensure a stable and controlled financial state after an unexpected layoff. This is not analogous to a government unemployment benefit, which provides a rudimentary safety net. This is a private, specialized instrument engineered to replace a substantial portion of your income, keeping your most important financial commitments secure.

The mechanism is refreshingly straightforward. You procure a policy while employed and pay regular premiums. In the event of an involuntary layoff, the policy activates after a predetermined waiting period, referred to in the industry as an elimination period. This functions as a time-based deductible, typically lasting between 30 and 90 days, which must pass before benefits are disbursed.

Once this waiting period concludes, the payments commence. It is at this point that the true value of the policy becomes evident.

Understanding Your Benefit Structure

The funds you receive are not a token amount; they represent a significant percentage of your former salary, often between 50% and 70%. These payments continue for a defined duration specified in your policy, known as the benefit period, which typically ranges from six to 24 months. The objective is to establish a solid financial bridge, providing the necessary time to identify your next senior role without allowing financial pressure to compromise your decision-making.

The core function of layoff insurance is to provide the financial runway needed to make a thoughtful, strategic next move. It prevents the pressure to accept a lesser role simply to cover immediate expenses, thereby preserving your career trajectory and long-term earning potential.

For a more detailed examination of how these policies are structured, this guide on income protection and redundancy cover offers valuable insights.

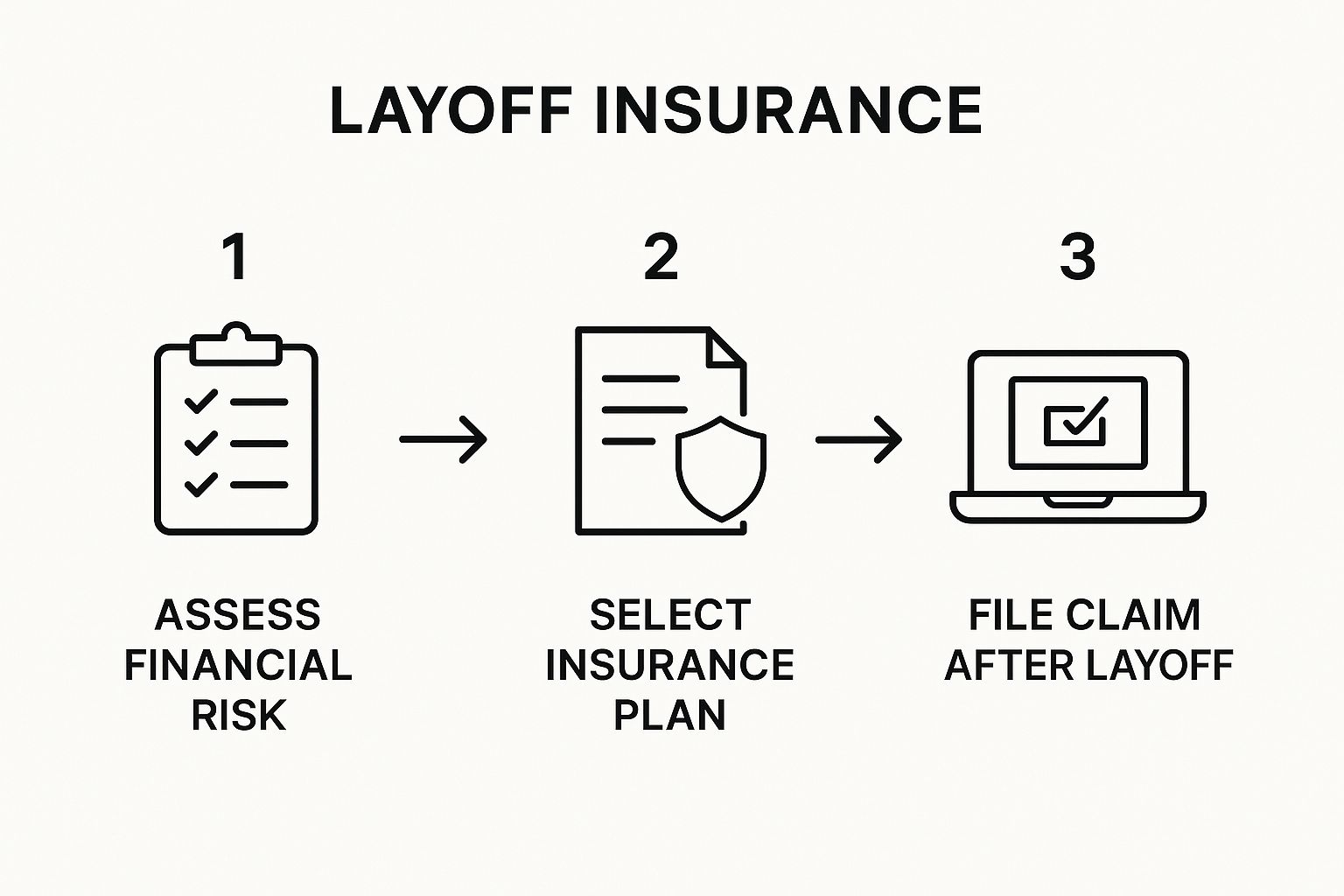

This graphic illustrates the clear steps involved in utilizing your layoff insurance, from policy acquisition to claim submission.

As illustrated, the process is designed for clarity and efficiency, allowing you to remain focused on your job search rather than on navigating a complex administrative system.

What Your Policy Will and Will Not Cover

When considering layoff insurance, it is imperative to conduct a forensic analysis of the policy terms. These policies are not standardized; the critical details reside within the fine print. A thorough understanding of these specifics is the only way to ensure the policy will perform as a reliable asset when you need it most.

At its core, layoff insurance is designed to replace a portion of your income if you are involuntarily terminated. The primary benefit is a monthly payment, typically calculated as a percentage of your previous base salary, with figures commonly ranging from 50% to 70%.

However, every policy has a maximum benefit cap—a hard ceiling on the monthly disbursement. For high earners, this is a critical figure to verify. These payments then continue for a defined "benefit period," which can range from six to 24 months.

Defining Inclusions and Exclusions

The most important section of any insurance for layoff policy outlines what it will not cover. These exclusions are not hidden traps but fundamental rules designed to mitigate the insurer's risk from predictable events or voluntary actions. It is essential to review this section with meticulous attention.

Here is what is almost certainly excluded from coverage:

- Termination for Cause: If you are dismissed for misconduct, violation of company policy, or documented poor performance, your policy will not pay out. This insurance is for involuntary, no-fault layoffs.

- Voluntary Resignation: Choosing to leave your position, regardless of the reason, is not a covered event.

- Probationary Periods: If your employment is terminated within the first few months, coverage will likely not apply. Most policies include a qualification period, typically the first 90 to 180 days of employment, during which you are not eligible for benefits.

- Anticipated Events: If your company announced impending layoffs before you purchased the policy, you cannot subsequently enroll and expect coverage. Any job loss that was a known or foreseeable event is excluded.

Understanding policy exclusions is as critical as understanding the limits of your medical insurance. For a deeper analysis of how insurers frame these conditions, review our guide on navigating medical policy exclusions.

Enhancing Coverage for Executive Compensation

For senior executives, base salary is only one component of total compensation. A significant portion of your income likely derives from performance bonuses, commissions, or equity. A standard layoff insurance policy will almost certainly disregard these variable components.

This is where policy riders become indispensable. A rider is an addendum to your core policy that expands its scope. It allows you to insure a percentage of variable compensation, such as anticipated bonuses or commissions.

For example, if you are a sales director whose commissions constitute 40% of your total earnings, a standard policy would base its payout on your much lower base salary, creating a substantial financial shortfall. By adding a commission protection rider, your benefit payments would more accurately reflect your true lost income. For high-level professionals, investigating these options is not merely advisable—it is essential for constructing a safety net that aligns with your complete financial reality.

A Global Career Demands a Global Safety Net

For professionals building an international career, relying on local government unemployment benefits is an untenable strategy. The social safety net in one country can be robust, while in another, it is minimal. This creates an inconsistent patchwork of protection that is unsuitable for high-earning global professionals.

This is not a minor detail; it is a fundamental flaw for executives operating on a global scale. The efficacy of government programs is directly tied to the economic health of the country where a layoff occurs. European systems, for instance, may appear generous but can come under significant strain during a recession. This means the support you receive is not correlated to your career level or financial needs but is entirely dependent on your geographic location at that moment.

Economic Headwinds and Their Impact

Global economic shifts directly threaten the stability of national unemployment funds. When a major economy slows, it creates ripple effects worldwide, increasing unemployment and straining the very systems designed to provide support. This exposes the vulnerability of relying solely on state-run benefits.

Consider France, where the national unemployment insurance system, managed by Unédic, is projected to run a deficit in 2025 and 2026 as the economic climate cools. With economic growth forecast to slow to just +0.6% in 2025, a net loss of 91,000 jobs is anticipated, placing immense pressure on the system's finances. You can review the complete analysis in this economic impact report from Unédic.

Why Private Layoff Insurance is Non-Negotiable

This is precisely why a private insurance for layoff policy becomes essential. It is the one component of your financial plan that is decoupled from the fluctuations of local economies or shifting national politics. It is a consistent, reliable layer of protection that moves with you, offering a predictable benefit regardless of where your career takes you.

A personal layoff insurance plan transcends geography. It provides a stable financial foundation, giving you the confidence to build an international career without being subject to wildly divergent—and often inadequate—government support systems.

Ultimately, a private policy ensures your income protection is based on your needs and your career, not your current location. That consistency is paramount. It allows you to maintain control during a difficult transition and focus on securing your next senior role from a position of financial strength.

How to Choose the Right Layoff Insurance Policy

Selecting the right layoff insurance is a strategic investment in your financial stability. Making an informed decision requires a clear framework for evaluating policies, understanding cost drivers, and ensuring the coverage aligns with your career path. The objective is not to find the lowest premium, but to secure the most effective financial protection for your unique circumstances.

The premium for a policy is determined by several key variables. Your industry, income level, and geographic location are significant factors in an insurer's risk assessment. A senior executive in a volatile sector like technology will face different rates than a partner in a stable law firm. Furthermore, the desired benefit amount and duration will directly influence the cost.

Running a Strategic Cost-Benefit Analysis

Before comparing providers, conduct a personal cost-benefit analysis. Calculate your essential monthly expenditures—mortgage payments, school tuition, investment contributions, and other non-negotiable lifestyle costs.

Then, weigh the monthly premium against the potential financial damage of a six-month income gap. This exercise reframes the premium not as an expense, but as a strategic hedge against the potential erosion of significant assets.

When you begin evaluating insurers, your focus must extend beyond the price. The true value of an insurance for layoff policy is revealed in the provider's financial stability and claims handling process.

A policy is only as sound as the company that underwrites it. Your due diligence should prioritize an insurer's financial health and claims-paying history above all else, ensuring they will be there when you need them most.

Key Questions to Ask When Evaluating Providers

As you assess your options, use this checklist to guide your evaluation. The answers will reveal the true quality of the policy and the integrity of the company behind it.

-

What is the insurer's financial strength rating? Seek top marks from independent rating agencies like A.M. Best or S&P. An "A" rating or higher is the standard you should look for. This grade is a direct measure of their ability to pay claims, even during a broad economic downturn.

-

What is the claims process? Obtain specific details on claim submission requirements, average processing times, and the necessary documentation. A slow, bureaucratic process is an unnecessary burden during an already stressful period.

-

Is the policy portable for international assignments? For any expatriate professional, this is a non-negotiable feature. You must confirm that your coverage is geographically portable, providing consistent protection without requiring a new policy for each relocation.

This evaluation process shares principles with selecting other critical protections. Our guide on choosing the right health insurance policy for expatriates may serve as a helpful reference. By focusing on these strategic points, you can secure a robust policy built to protect your income and career.

Navigating the Claims Process Step by Step

In the event of a layoff, the last thing you need is a complex administrative process to access the benefits for which you have paid. Filing a layoff insurance claim should be a clear, straightforward procedure that allows you to focus on securing your next senior role.

The moment you receive notification of an involuntary termination, your first action should be to contact your insurance provider. This is not a task to be deferred. Most policies have a strict deadline for initiating a claim, and a delay could jeopardize your entire benefit.

Assembling the Necessary Documentation

Prepare your documentation as you would for any formal proceeding. Your insurer requires a specific set of documents to validate your claim. Providing a complete and accurate file is the most efficient path to approval. Incomplete paperwork is the primary cause of claim delays.

You will almost certainly be required to provide:

- Official Termination Letter: This is the primary piece of evidence. It must be issued by your former employer and clearly state that the termination was involuntary and not due to performance or misconduct.

- Proof of Income: Your most recent pay stubs or tax documents will suffice. The insurer uses this to verify the salary upon which your benefit amount is calculated.

- Final Employment Details: You will need to provide your official last day of employment and the date you were given notice of termination.

Maintaining Eligibility During the Benefit Period

Once your claim is approved and payments commence, you have ongoing obligations. You must actively seek new employment. Most policies require you to submit regular progress reports on your job search, detailing activities such as networking meetings, applications submitted, and interviews conducted.

The underlying principle is that layoff insurance is a temporary bridge to your next opportunity, not a permanent income replacement. Demonstrating a consistent, documented effort to find new work is a standard requirement for maintaining benefit eligibility.

Should your claim be denied, it is not necessarily the final word. If you face a denial, understanding how to appeal an insurance denial is the critical next step. Knowing how to navigate every potential outcome allows you to manage this process with confidence.

Frequently Asked Questions About Layoff Insurance

When considering a new financial protection instrument, numerous questions naturally arise. To provide clarity, here are answers to the most common queries from senior professionals exploring this type of coverage.

Is This Different From Income Protection Insurance?

Yes, they cover entirely different risks and are not interchangeable. Consider them as two distinct tools for separate purposes.

Layoff insurance provides a financial benefit if you are terminated for reasons beyond your control, such as a corporate restructuring or position elimination.

Income protection, by contrast, is a form of disability insurance. It provides benefits only if you are unable to work due to a qualifying illness or injury. Many executives maintain both types of policies to create a comprehensive safety net against the two most common threats to their income.

Can I Buy This if I Expect a Layoff?

No, you cannot. Insurers are unequivocal on this point: these policies are designed to cover unforeseen job loss, not an event that is already anticipated. This is known as anti-selection.

To prevent this, every policy includes a "qualification period" immediately following its purchase. This waiting period typically lasts from 6 to 12 months. A layoff occurring within this window is not a covered event. This is the insurer's mechanism for ensuring the coverage is for genuine, unexpected circumstances.

Are the Benefits from Layoff Insurance Taxable?

Tax treatment of benefits varies significantly by jurisdiction.

As a general principle, in many countries, if you paid the insurance premiums yourself with after-tax income, any benefits you receive are often considered non-taxable. However, this is not a universal rule.

The most prudent course of action is to consult with a qualified tax advisor in your country of residence. They are the only professionals who can provide definitive guidance tailored to your specific financial situation. For other general questions, you may find an answer in our FAQ for expatriate professionals.