Navigating health insurance in France requires a sophisticated understanding of its unique dual-system, where state coverage works in tandem with private insurance. For high-net-worth professionals relocating to France, mastering this system is not a mere formality. It is the key to securing the premier level of healthcare, immediate specialist access, and seamless global coverage you expect, from day one.

Understanding the French Healthcare Philosophy

France's healthcare system is world-renowned for its intelligent model that merges state-funded coverage with private top-ups. For any individual accustomed to a superior standard of service, it is crucial to understand how these two components integrate to deliver the exemplary care you require. This dual structure is the bedrock of health security in France.

Consider the state system your robust safety net, providing universal access. Private insurance, however, is your key to an elevated experience—granting immediate access to top specialists, private hospital suites, and covering costs that exceed standard state tariffs. It is a powerful combination offering both security and unparalleled choice.

State and Private Systems: A Symbiotic Relationship

The brilliance of the French approach lies in how the public and private systems mutually support each other. The state guarantees universal access for all legal residents, while private plans are designed to fill specific gaps and enhance the entire healthcare journey.

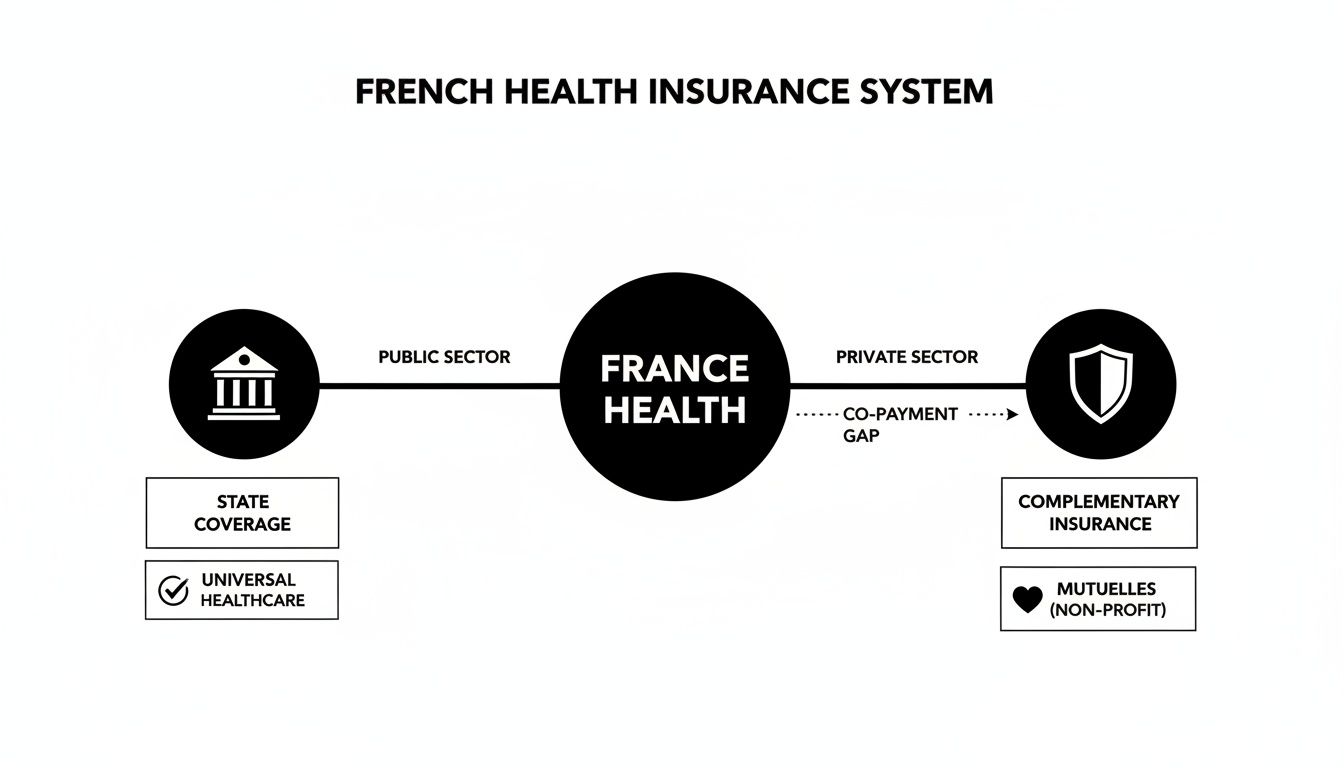

This diagram illustrates how France’s health system is architected around these two essential pillars.

As you can see, comprehensive protection is not an either-or decision. It is a deliberate and strategic blend of both.

This dual-system approach is so fundamental that a remarkable 96% of the French population holds a form of complementary private health insurance. They utilize it primarily to cover co-payments (ticket modérateur) and services such as high-end dental and optical care, where public reimbursement is intentionally limited.

For a high-net-worth individual, relying solely on the state system is not a viable option. A premium private plan is not an optional extra; it is an essential component for maintaining your standard of living and ensuring seamless access to top-tier care.

One of the first instances where this becomes apparent is in the official France retirement visa requirements. The regulations explicitly mandate comprehensive health coverage from the outset, highlighting how fundamental securing proper insurance is to establishing residency.

French Health Insurance At a Glance

To fully comprehend the two systems, a side-by-side comparison is instructive. Here is a precise breakdown of what each part of the system is designed to deliver.

| Feature | State System (PUMA) | Private Insurance (Mutuelle & IPMI) |

|---|---|---|

| Primary Role | Provides foundational, universal healthcare access for all legal residents. | Supplements state coverage, fills reimbursement gaps, and adds premium services and global reach. |

| Funding | Primarily funded through social security contributions (cotisations sociales). | Funded by monthly or annual premiums paid by individuals or employers. |

| Typical Coverage | Reimburses a percentage (e.g., 70%) of standard doctor visits and hospital stays. | Covers the remaining co-payment (e.g., 30%), plus costs for private rooms, dental, and optical. |

| Choice of Doctor | Complete freedom to choose your primary doctor and specialists (médecin traitant). | Unrestricted. IPMI plans include vast global networks of elite providers. |

| Best For | Basic, essential medical needs and emergency care for all residents. | HNWIs and global citizens seeking comprehensive coverage, immediate specialist access, and premium comfort. |

| International Scope | Coverage is generally limited to France and emergency care within the EU (EHIC). | International Private Medical Insurance (IPMI) offers seamless global coverage, including medical evacuation. |

Ultimately, the state system provides a solid foundation, but for the level of flexibility, comfort, and comprehensive protection most high-net-worth individuals demand, a robust private plan is indispensable.

Navigating the State System: PUMA and Your Carte Vitale

To truly integrate into French life, you must understand the state health system. It is not merely beneficial; it is fundamental. The entire structure is built on a framework known as Protection Universelle Maladie (PUMA), which is designed to grant every legal resident healthcare access after three months of stable, legal residency. Consider it less a bureaucratic requirement and more the first major step to securing your position in France.

PUMA is the government-backed system providing your core medical coverage. Once you are registered, you gain access to one of the most respected healthcare systems in the world, covering everything from a routine physician visit to a hospital stay.

Gaining Access: The Social Security Number and S1 Form

Your entry into the state system begins with obtaining a provisional social security number, the 'numéro de sécurité sociale'. This number is your unique identifier for the entire French social security system, not just healthcare. It is the first official sign of your true integration.

If you are relocating from another EU/EEA country, Switzerland, or the UK, a significant accelerator exists: the S1 form. This document is obtained from your home country's social security administration before you move. When presented to the French authorities (CPAM, or Caisse Primaire d'Assurance Maladie), it effectively ports your existing healthcare rights, which can dramatically expedite your entry into PUMA.

For any individual who values an efficient transition, this is a game-changer. The S1 form acts as a bridge, connecting your prior coverage to the French system without interruption, ensuring you are protected from day one.

The S1 form is not just paperwork; it is a strategic asset for a seamless relocation. It allows you to bypass potential delays, affording you and your family immediate peace of mind and faster access to state-reimbursed care.

The Carte Vitale: Your Key to Reimbursements

After you are registered with CPAM and your social security number is finalized, you will receive your Carte Vitale. This iconic green-and-yellow smart card is used for nearly all day-to-day healthcare interactions. It is not proof of insurance itself, but the tool that unlocks your benefits.

When you present your Carte Vitale at a doctor's office, pharmacy, or hospital, it communicates directly with the state insurance system. This automates your reimbursements, typically depositing the funds directly into your linked French bank account within five to seven business days. This eliminates tedious paperwork for most standard medical services.

Understanding PUMA's Coverage Limits

While PUMA provides an excellent foundation, it is critical to understand its precise limitations. The state system is structured to reimburse a percentage of standard healthcare costs, not 100%.

Here is a practical look at what this means:

- GP Visit: The state sets a standard fee, currently €26.50 for a GP consultation. PUMA reimburses 70% of that amount, less a €2 flat fee, leaving you with a co-payment.

- Hospital Stays: In a public hospital, PUMA covers approximately 80% of the costs. The remaining 20%, plus a daily flat fee and any charges for a private room, are your responsibility.

- Prescriptions: Reimbursement rates vary significantly from 15% to 100%, depending on the medical necessity of the medication as determined by the state.

- Specialist Consultations: For specialists adhering to state tariffs (secteur 1), the 70% rule applies. However, many top-tier specialists are in secteur 2, where they are free to set their own fees. PUMA will still only reimburse 70% of the official state tariff, not the specialist's significantly higher fee.

This reimbursement structure makes one thing unequivocally clear: relying solely on PUMA will result in significant out-of-pocket expenses, particularly if you seek premium care. The gap between what the state pays and the actual cost of private rooms, leading specialists, and high-quality dental or vision care is precisely where private insurance becomes not just a luxury, but an absolute necessity.

The Essential Role of Private Top-Up Insurance

Let us be perfectly clear: while France's state health system, PUMA, provides a commendable foundation, it is not designed for the exhaustive coverage that discerning professionals require. Relying solely on the state system will unequivocally lead to significant out-of-pocket expenses. This is where supplementary private insurance, known locally as a 'mutuelle' or 'complémentaire santé', ceases to be an option and becomes an indispensable part of your financial and personal well-being.

Think of the state system as standard business class travel—it is comfortable and gets you there safely. A premium private plan, however, is your upgrade to a private jet. It elevates the entire experience by covering the financial shortfalls left by the state, ensuring you receive premier care without financial surprises. It is telling that over 95% of the French population has a mutuelle. This is a clear signal that even for locals, state coverage alone is insufficient.

Decoding Reimbursement Levels and the BRSS

To understand how a mutuelle truly functions, you must grasp one key concept: the Base de Remboursement de la Sécurité Sociale (BRSS). This is the official tariff set by the government for any given medical procedure or consultation. PUMA typically reimburses approximately 70% of this official tariff. The remaining 30% co-payment, known as the 'ticket modérateur', is your responsibility.

You will see basic mutuelle policies advertised as covering '100% BRSS'. This is a common point of confusion. It does not mean the policy covers 100% of your total medical bill. It means the policy will cover up to 100% of the state-defined tariff—essentially paying the 30% co-payment left after the state's 70% reimbursement. For routine care with a state-registered doctor (secteur 1) who adheres to the official tariff, this is adequate. But for high-net-worth individuals seeking top-tier specialists, it is dangerously insufficient.

Why Premium Coverage Is Non-Negotiable

Many of France's leading medical experts, surgeons, and specialists operate in what is known as 'secteur 2'. These practitioners are free to set their own fees, which often far exceed the official BRSS tariff. This is where a basic '100% BRSS' plan becomes practically irrelevant.

For instance, a consultation with a renowned specialist in Paris might cost €150. The BRSS for this service could be just €30. PUMA will reimburse 70% of that €30 (€21), and a '100% BRSS' mutuelle will cover the remaining 30% (€9). You are still left with a €120 bill to pay out-of-pocket.

This is precisely why premium mutuelle plans—offering 200%, 300%, or even higher BRSS reimbursement rates—are essential for our clients. A 300% BRSS plan would cover up to three times the official state tariff, dramatically reducing or completely eliminating the shortfall for specialist fees.

These higher-tier plans are the mechanism that gives you unrestricted, financially worry-free access to the best practitioners. They also provide robust coverage for areas where state support is notoriously minimal:

- Dental Care: Full reimbursement for complex procedures like crowns and implants.

- Optical Needs: Generous allowances for designer frames, advanced lenses, and contact lenses.

- Hospital Comfort: Guaranteed access to private rooms and other amenities.

- Alternative Therapies: Coverage for services like osteopathy or chiropractic care.

Ultimately, a high-quality mutuelle does more than just fill financial gaps. It provides the financial predictability and peace of mind you need to maintain the standard of care you demand, making it a critical part of securing comprehensive health insurance for France.

Why IPMI Is the Premier Solution for Global Citizens

While a local mutuelle is an excellent tool for supplementing the French state system, it has one critical limitation for globally-mobile professionals and their families: its scope is exclusively French.

For anyone who travels extensively for business, manages assets across borders, or simply demands the highest tier of service and flexibility, a mutuelle is inadequate. It is analogous to using a local transit card for international travel—perfectly functional within its designated zone, but useless beyond it. This is where International Private Medical Insurance (IPMI) emerges as the definitive solution.

IPMI is not a mere top-up plan; it is a comprehensive, standalone health insurance architecture designed from the ground up for the global citizen. It provides seamless, high-level coverage not just in France but across the world, offering a continuity of care that local plans cannot match. This makes it an indispensable asset for any individual whose lifestyle is not confined to a single country.

This kind of sophisticated coverage exists within a massive and stable market. France's health insurance sector is one of Europe's largest, valued at over €45 billion in annual premiums. This robust, high-value environment enables premium providers to deliver the world-class services that high-net-worth individuals rightly expect.

The Decisive Advantages of IPMI Over a Mutuelle

For a discerning client, the difference between a local mutuelle and a premium IPMI plan is profound. The distinction extends far beyond geography; it touches on the core elements of service, access, and control that are non-negotiable for those accustomed to the best. IPMI is engineered to deliver a white-glove service experience from day one.

The advantages are clear and compelling:

- Seamless Global Coverage: An IPMI policy travels with you. Whether you are in Paris for a board meeting, vacationing in the Caribbean, or visiting family in your home country, your coverage remains consistent and powerful. No gaps, no exceptions.

- Direct Billing and Cashless Access: Top-tier IPMI providers maintain vast global networks of private hospitals and clinics. This means you can often receive treatment without any upfront payment—the insurer settles the bill directly with the facility.

- Access to Elite Medical Networks: IPMI plans unlock a curated network of the world's best specialists and medical centers, backed by multilingual support teams who coordinate appointments and care on your behalf.

- Medical Evacuation and Repatriation: This is an absolute necessity for any global citizen. If you fall ill in a location without adequate medical facilities, an IPMI plan covers the cost of emergency transport to the nearest center of excellence or back to your home country.

Think of an IPMI plan as your personal health concierge. It manages the complexities of global healthcare so you can focus on what matters. It is about ensuring your health is protected to the highest standard, no matter where in the world you happen to be.

Meeting Visa Requirements with Superior Coverage

For expatriates moving to France, securing a long-stay visa is the first critical hurdle. A key requirement is proof of comprehensive health insurance. While a basic plan might technically suffice, an IPMI policy signals a level of preparedness and financial stability that immigration authorities recognize and respect.

It effortlessly meets and almost always exceeds the minimum requirements for medical expenses, hospitalization, and repatriation. This not only streamlines the visa application process but also provides you with genuine, high-quality protection from the moment you arrive, long before you can access the state PUMA system. Choosing IPMI aligns your healthcare with the same high standards you apply to your financial and business affairs. You can learn more about the extensive benefits of international private medical insurance in our guide.

Unrestricted Access and Uncompromised Control

Ultimately, the single greatest benefit of IPMI is the control it places firmly in your hands. You are not constrained by local state-set tariffs or restrictive provider lists. You have the freedom to choose the best doctors and hospitals—whether in France or abroad—ensuring you always receive the highest caliber of care.

Imagine this scenario: you require a specialized surgical procedure. With a local mutuelle, your options might be limited to doctors within France, and you would still need to navigate the reimbursement system. With a premium IPMI plan, you could consult with top surgeons in Switzerland, Germany, or the United States, with the policy covering the costs and your insurer's support team managing all the logistics.

This level of control, combined with the assurance of global protection, offers complete peace of mind. It transforms health insurance for France from a simple necessity into a powerful tool for safeguarding your health and well-being on a global scale.

What High-Net-Worth Families Must Consider

For high-net-worth families, selecting the right health insurance for France is not merely about supplementing the state system. It is a strategic decision, one that should be approached with the same diligence used to manage your wealth portfolio.

This requires looking far beyond the standard benefits of a local mutuelle and focusing on the specific, nuanced coverage that a dynamic, international lifestyle demands.

Frankly, a standard local plan is not engineered for this purpose. Premium International Private Medical Insurance (IPMI) plans, however, are. They are designed from the ground up to handle the complexities that HNW families face, offering definitive solutions for maternity care, pre-existing conditions, and global travel security.

Comprehensive Family and Maternity Planning

If you are planning to grow your family in France, comprehensive maternity cover is absolutely non-negotiable. Top-tier IPMI plans provide access to the best private obstetricians, clinics, and pediatricians without being restricted by state-set tariffs.

These plans are structured to provide:

- Full coverage for private hospital deliveries, which often includes private suites and the personalized care you expect.

- Extensive prenatal and postnatal care, covering everything from specialist consultations and advanced screenings to postnatal support.

- Newborn coverage from day one, ensuring your child is immediately protected under your policy without a new, complex underwriting process.

Navigating Pre-Existing Conditions

This is a critical consideration for many families and where premium IPMI providers truly demonstrate their value. Unlike the state system or basic private plans, they offer sophisticated underwriting options that create clear pathways to coverage, not just roadblocks.

You will generally encounter two approaches:

- Moratorium Underwriting: A condition may be covered after a set waiting period, typically 24 months, provided you have been symptom- and treatment-free for that condition. It is a "wait and see" approach.

- Full Medical Underwriting (FMU): You declare all conditions upfront. The insurer then makes a clear decision: they may offer full coverage immediately (sometimes with a higher premium), or they may place a specific exclusion on one condition. You know exactly where you stand from day one.

For HNW families, the certainty of Full Medical Underwriting is almost always the preferred route. It eliminates all ambiguity. You know precisely what is covered before you ever need to make a claim—critical for long-term financial peace of mind.

The French insurance market's stability underpins these robust offerings. Despite challenges like rising medical costs, the sector has proven adaptable and well-managed. This stability ensures that premium providers can offer reliable, well-capitalized plans you can depend on. You can see more on the resilience of France's insurance sector from S&P Global Ratings analysis.

Essential Safeguards for a Global Lifestyle

For families who travel frequently, medical evacuation and repatriation are not luxuries—they are essential safeguards.

If a medical emergency occurs while you are in a location with inadequate facilities, these benefits cover the staggering cost of transporting you to the nearest center of medical excellence or back home. It is a critical safety net for a global lifestyle.

Beyond emergencies, premium IPMI plans integrate wellness and executive health benefits. This includes coverage for preventative health screenings, mental health support, and access to exclusive networks of top-tier doctors. By making these choices, your insurance policy evolves from a simple safety net into an active component of your family's overall well-being strategy. You can explore our overview of premier medical networks to see the level of access these plans truly provide.

A Practical Roadmap to Securing Coverage in France

Arranging your health insurance in France is not just a procedural step; it is a strategic imperative. For high-net-worth individuals and their families, executing this correctly from the start means establishing a plan as robust as your financial portfolio. This is the process of moving from initial concept to a fully activated policy.

The optimal starting point is a detailed consultation with a specialized brokerage. This is not a sales call. It is a critical diagnostic step to map out your precise requirements—do you travel globally? Do you have family members with specific medical needs? Do you have preferences for certain hospitals or clinics? An expert can quickly determine whether a premium local mutuelle or a comprehensive IPMI plan is the most sensible solution for your lifestyle.

Preparing Your Documentation

Once you have a clear strategy, it is time to assemble your documents. While the exact list can vary slightly between insurers, having a standard dossier prepared accelerates the underwriting and approval process significantly.

Here is what you will almost always need:

- Proof of Identity: A clear, high-resolution copy of your passport or national ID card for all applicants.

- Proof of French Address: A recent utility bill (facture d'électricité), your rental agreement (bail de location), or property title (titre de propriété).

- Residency Status: A copy of your long-stay visa or residency permit (titre de séjour).

- Bank Details: A French bank account RIB (Relevé d'Identité Bancaire) is essential for seamless premium payments and reimbursements.

As you compile these documents, you may find that some require official translation. Engaging professional French document translation services is advisable to ensure perfect clarity for local authorities and insurance companies.

How Your Premium Is Calculated

No one appreciates financial surprises. For top-tier IPMI plans, your premium is not an arbitrary figure; it is calculated based on several key factors. Understanding these helps you appreciate the investment you are making in your health.

Your premium is primarily driven by your age, the geographical area of cover required (e.g., worldwide excluding the USA), the deductible you select, and the underwriting method. Opting for Full Medical Underwriting may seem more intensive upfront, but it provides absolute certainty about your coverage from day one.

The most efficient way to secure the best terms is to work with a specialist who navigates the international insurance market daily. They can manage complex negotiations on your behalf, ensuring your policy is perfectly tailored to your actual needs.

For a straightforward, objective review of the leading IPMI plans, the next logical step is to request a personalized quote through our platform. It is the simplest way to obtain expert guidance and secure complete peace of mind.

Frequently Asked Questions

When navigating the intricacies of French health insurance, several key questions consistently arise, particularly for those accustomed to a different standard of care. Here are direct answers to the queries we hear most often from professionals and high-net-worth individuals relocating to France.

Is Private Insurance Necessary if I Have State Coverage?

Yes, it is not just recommended—it is essential. The French state system, PUMA, should be viewed as a foundational safety net. It is designed to reimburse a significant portion of standard healthcare costs, typically around 70%.

That leaves a considerable gap. Private insurance is what covers the remainder: the co-payment, specialist fees that exceed state tariffs, private hospital rooms, and any significant dental or vision care. For our clients, a top-tier private plan is not a luxury; it is a non-negotiable instrument for ensuring zero financial exposure and complete freedom in choosing the best doctors and clinics.

Can I Use an International Plan for My French Visa Application?

Absolutely. In fact, a high-quality International Private Medical Insurance (IPMI) policy not only meets the visa requirements but often significantly exceeds them.

The critical factor is that the policy must provide robust, comprehensive coverage in France for medical expenses, hospitalization, and repatriation. French immigration officials often view a strong IPMI plan as a significant positive attribute—it demonstrates financial preparedness with globally recognized coverage, providing you with superior benefits from the day you arrive.

How Does French Health Insurance Address Pre-Existing Conditions?

This is where the public and private systems diverge sharply. The state system (PUMA) is universal; it accepts all legal residents regardless of their medical history.

Private insurance operates differently. Local French top-ups, or mutuelles, may impose waiting periods or outright exclusions for pre-existing conditions.

This is where premium IPMI plans demonstrate their superior sophistication. They offer advanced solutions. Some will cover pre-existing conditions after a waiting period (moratorium underwriting), while others provide full, immediate coverage, sometimes for a higher premium (full medical underwriting). The key is complete transparency and accurate declaration from the outset.

At Riviera Expat, our exclusive focus is securing world-class international health insurance for discerning professionals like you. We eliminate complexity, ensuring you receive a policy that grants you complete control and confidence in your family's healthcare. Contact us for a personalized consultation and let's ensure your health is protected to the highest standard.