Group dental plans are a sophisticated financial instrument with a powerful impact. An employer leverages the collective purchasing power of their entire team to secure preferential rates and superior terms on dental insurance—terms unattainable by any single individual. It is the principle of collective bargaining, applied discerningly to executive healthcare.

This structure renders high-calibre dental care eminently affordable and accessible, transforming it into a foundational element of any competitive executive compensation package.

The Strategic Role of Executive Group Dental Plans

Within the realm of executive remuneration, a group dental plan transcends the status of a routine perquisite. For your leadership cadre, premier dental care is not a luxury; it is an indispensable component of their overall health and a direct investment in their capacity to perform at the highest level. The scope extends far beyond prophylactic cleanings and examinations. It is about guaranteeing access to the calibre of care that safeguards an organisation's most valuable asset—its key human capital.

A meticulously designed group dental plan serves as a potent instrument for attracting and retaining elite talent. It is frequently a decisive component of essential employee benefit packages. For discerning executives evaluating multiple offers, a robust benefits package communicates a clear, compelling message: this company invests substantively in the well-being of its people. That message can profoundly influence their decision to join—or remain with—the firm.

Aligning Corporate and Executive Interests

The most effective plans are predicated on a precise alignment of interests among the company, the insurer, and the executives themselves.

- For the Company: It confers a competitive advantage in a fiercely contested talent market and underpins the health of key decision-makers, translating into reduced downtime and enhanced strategic focus.

- For the Executive: It guarantees access to high-quality, and often complex, dental procedures without the burden of significant out-of-pocket expenditure.

This strategic alignment elevates dental insurance from a simple line-item expense to a high-value component of an executive's total rewards. Market data corroborates this, indicating a substantial increase in demand driven by employer-sponsored plans.

According to a July 2024 GlobeNewswire report citing Grand View Research, the global dental insurance market was valued at USD 253.72 billion in 2024. It is projected to more than double, reaching approximately USD 566.34 billion by 2034, propelled largely by the expansion of these group plans. You can discover more insights about the dental insurance market on GlobeNewswire.

This context underscores why such plans require evaluation with rigorous strategic diligence. The objective is to ensure they meet the sophisticated expectations of the talent that truly drives an organisation forward.

Analyzing the Core Group Dental Plan Models

Selecting the appropriate group dental plan is not a perfunctory exercise. It is a strategic decision that balances two critical priorities: furnishing your executives with robust, flexible access to premier care, and prudently managing corporate expenditure. To achieve this equilibrium, one must look beyond promotional materials and comprehend the operational mechanics of each plan model.

The three primary structures—Dental Preferred Provider Organization (DPPO), Dental Health Maintenance Organization (DHMO), and Indemnity plans—are more than mere administrative classifications. Each fosters a distinct experience for your key personnel, dictating everything from their choice of specialist to their ultimate out-of-pocket liability. A judicious choice is fundamental to constructing a benefits package that reflects the high expectations of your top talent.

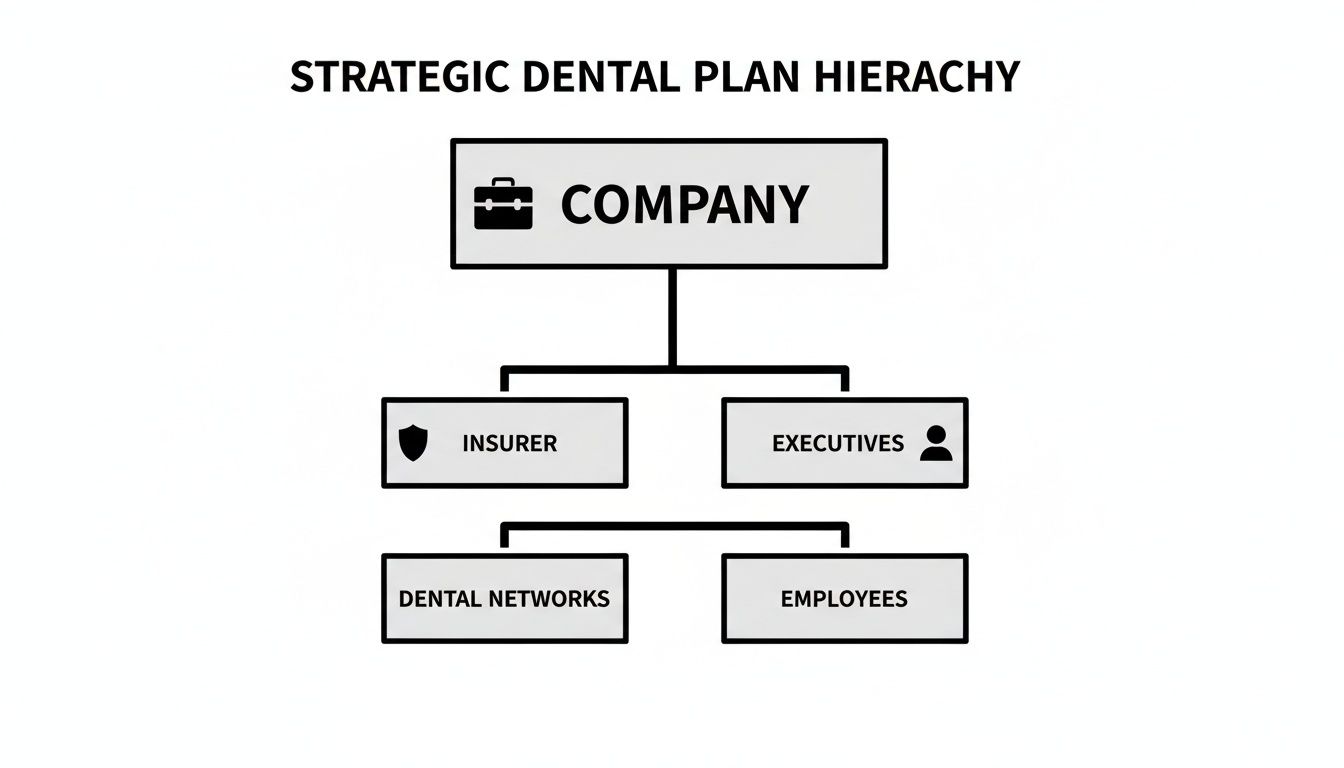

This diagram illustrates the typical flow, from the company's investment down to the executive's access to care.

Essentially, the company partners with an insurer, which in turn provides executives with access to a curated network of dental professionals. The model you select dictates the rules of that engagement.

The DPPO Model: Discretion and Flexibility

The Dental Preferred Provider Organization (DPPO) is unequivocally the most favoured model for executive benefits, for one principal reason: flexibility. A DPPO establishes a network of dentists who have agreed to provide services at pre-negotiated, discounted rates. Executives may consult any dentist they wish, but they secure the most advantageous terms—and lowest out-of-pocket costs—by remaining within this "preferred" network.

This freedom of choice is a significant advantage for high-net-worth individuals who often maintain long-standing relationships with trusted specialists.

- In-Network Care: Visiting a DPPO dentist translates to lower costs. The negotiated fees are reduced, and the plan covers a higher percentage of the invoice. It is a straightforward value proposition.

- Out-of-Network Care: An executive is at liberty to consult a specialist outside the network. The plan will still contribute, but it will cover a smaller portion of the bill. The member is responsible for the difference between the plan's allowable amount and the dentist's actual charges.

This hybrid approach permits executives to base their care decisions on professional preference, not merely on a network directory. For retaining elite talent, that is a crucial distinction.

The DHMO Model: Cost Containment and Structure

The Dental Health Maintenance Organization (DHMO) operates on a different paradigm. It is engineered entirely around cost control and a highly structured approach to care. When an employee enrols in a DHMO, they must select a primary care dentist from the plan's network. That dentist functions as a gatekeeper, managing all their dental needs and providing referrals to specialists—but exclusively to specialists within the same network.

This rigid structure typically results in lower premiums and often eliminates deductibles or copayments for preventive care.

For an organisation focused intently on predictable, low-cost benefits, the DHMO may appear attractive. However, its restrictive nature is a challenging proposition for executive-level employees who expect autonomy in their healthcare choices and wish to see any specialist they choose without requiring a referral.

The trade-off is unambiguous: lower costs are achieved at the expense of provider choice. If an executive consults an out-of-network dentist (outside of a genuine emergency), the plan provides zero reimbursement.

The Indemnity Plan: Absolute Choice

Finally, there is the traditional Indemnity plan, also known as a fee-for-service plan. This model represents the apex of choice and flexibility. Members can see any licensed dentist, anywhere, without network restrictions. The insurance carrier simply reimburses a set percentage of the "usual, customary, and reasonable" (UCR) fee for any given service, and the member covers the remainder.

While Indemnity plans afford total freedom, they typically command higher premiums. They may also necessitate that members pay the dentist upfront and subsequently file a claim for reimbursement—an administrative burden that busy professionals do not always value.

The structure of these employer-sponsored group dental plans has a powerful effect on behaviour. When individuals have robust coverage, they utilise it. Research indicates that individuals with group dental plans are significantly more likely to seek preventive care, with a 2018 study from the National Association of Dental Plans showing 83% of enrollees visit a dentist annually. This contrasts sharply with the figures for uninsured adults. This demonstrates that the right plan not only manages costs—it actively encourages your team to maintain their health. You can learn more about dental industry insights from Curve Dental.

To clarify these distinctions, a high-level comparison is instructive.

Strategic Comparison of Group Dental Plan Models

This table provides a high-level overview of the primary group dental plan types, comparing core features to inform executive decision-making.

| Feature | DPPO (Dental Preferred Provider Organization) | DHMO (Dental Health Maintenance Organization) | Indemnity (Fee-for-Service) |

|---|---|---|---|

| Provider Choice | High. Can see any dentist, but financial benefits are greatest in-network. | Restricted. Must use dentists within the plan's network and requires a primary care dentist. | Absolute. Can see any licensed dentist without network restrictions. |

| Cost Structure | Moderate premiums. Involves deductibles, copayments, and coinsurance. | Low premiums. Often has no deductibles or copayments for preventive in-network care. | High premiums. Involves deductibles and coinsurance based on UCR fees. |

| Out-of-Network | Covered, but at a lower percentage, leading to higher out-of-pocket costs. | Not covered, except in specified emergency situations. | Fully covered. All providers are effectively "out-of-network" with no financial penalty. |

| Referrals | Not required. Members can see specialists directly. | Required. The primary care dentist must refer to in-network specialists. | Not required. Complete freedom to see any specialist. |

| Best For | Executives who value choice and flexibility but want some cost-control benefits. | Organizations prioritizing predictable, low-cost benefits over provider choice. | Executives who demand complete freedom and are willing to accept higher costs and admin. |

Ultimately, the optimal model is contingent upon your company's culture, budget, and the expectations of the executives you aim to attract and retain. The DPPO offers a balanced compromise, the DHMO prioritises cost efficiency, and the Indemnity plan offers unparalleled freedom at a premium price.

Understanding Coverage Tiers and Financial Thresholds

Beyond the plan’s fundamental structure—be it a DPPO, DHMO, or an alternative model—lies the financial core of the policy. This is where the true value for an executive is revealed. The coverage is not a monolithic, one-size-fits-all benefit; it is meticulously tiered, with explicit financial limits that define the precise extent of the insurer's liability. For a discerning executive, understanding these tiers is paramount to determining whether a plan offers genuine protection or merely superficial perks.

The most prevalent framework is the 100-80-50 structure. This is industry nomenclature for the percentage of costs the insurer typically covers for services within each category.

This system is designed to incentivise proactive health management while sharing the financial risk for more complex and costly procedures. Let us dissect what each tier signifies in practice.

The Three Tiers of Dental Coverage

1. Preventive Care (Typically 100% Coverage)

This tier forms the bedrock of any sound dental plan. These services are focused on pre-empting problems before they arise. Because routine care is the most effective means of avoiding expensive treatments later, insurers almost invariably cover these services in full, often without application of a deductible.

- Routine Cleanings and Examinations: Typically covered biannually.

- Standard Radiographs: Includes bitewings and full-mouth series to detect decay at an early stage.

- Fluoride Treatments and Sealants: Often included for paediatric dependents to prevent caries.

2. Basic Services (Typically 80% Coverage)

When preventive measures are insufficient, this next tier covers common restorative procedures. Consider this the category for routine repairs. The plan will typically pay 80% of the cost, but only after the annual deductible has been met.

- Fillings: The standard treatment for dental caries.

- Simple Extractions: Removal of a tooth not requiring complex surgical intervention.

- Periodontal Maintenance: Deep cleanings and treatments for gum disease.

3. Major Services (Typically 50% Coverage)

This tier is reserved for the most complex and costly dental procedures. It is also where the financial limitations of a plan become most apparent. Coverage is usually set at 50% of the cost, again, after the deductible is satisfied. For executives, robust coverage in this category is non-negotiable, as it encompasses work essential for both function and aesthetics.

- Crowns and Bridges: To restore damaged teeth or replace missing ones.

- Root Canals (Endodontics): To treat an infection within a tooth.

- Dentures and Partials: Removable prosthetics for replacing multiple teeth.

- Dental Implants: Surgically placed posts for permanent tooth replacement—a critical benefit that is often insufficiently covered.

Navigating the Financial Guardrails

The coverage percentages are only part of the equation. Several key financial limits function as the true gatekeepers to a plan's benefits.

Annual Maximums

The annual maximum is the absolute ceiling on what an insurance plan will pay for an individual's dental care within a plan year. A standard group plan might cap this at $1,500 to $2,500. This is adequate for routine care. However, for an executive requiring a single implant and crown, which can easily exceed $5,000, that limit is quickly exhausted.

For high-net-worth individuals, negotiating a higher annual maximum—ideally $5,000 or more—is a critical strategic objective. This transforms the plan from a basic benefit into a meaningful financial backstop for complex restorative and cosmetic procedures.

Deductibles

A deductible is the fixed amount you must pay out-of-pocket for Basic and Major services before the insurance company begins to contribute its share. A common deductible is approximately $50 to $100 per year. It is a modest sum, but it remains a component of the overall cost-sharing calculation.

Lifetime Maximums

Certain services, particularly orthodontia (braces and aligners), are often subject to a separate lifetime maximum. This is the total amount the plan will ever pay for that specific type of treatment for the duration of your enrolment. A typical lifetime maximum for orthodontia might be $1,500. This covers only a fraction of the total cost, making a close examination of this limit essential for executives with families.

Integrating Dental with International Private Medical Insurance

For globally mobile executives, healthcare needs do not respect borders. This is why International Private Medical Insurance (IPMI) is so critical—it provides comprehensive medical coverage almost anywhere in the world. However, a common and costly oversight is that standard IPMI plans often treat dental care as a minor, ancillary benefit.

This represents a significant deficiency for leadership teams who expect seamless, high-quality care wherever their assignments may take them. Integrating a robust group dental plan with an IPMI policy is not merely a "nice-to-have" add-on; it is a foundational component of a world-class benefits package.

This type of integration ensures an executive's complete health—both medical and dental—is managed under a single, unified, premium framework. For your personnel operating in financial hubs like Singapore, Hong Kong, or London, this means no coverage gaps and no compromises on care quality. The structure of this integration is what ultimately defines their experience.

Embedded Benefits Versus Standalone Riders

When appending dental coverage to an IPMI policy, there are generally two methods. Each has markedly different implications for cost, flexibility, and administration.

-

Embedded Dental Benefit: This can be viewed as an all-in-one package. The dental coverage is built directly into the main IPMI plan, creating a single, streamlined policy. It simplifies administration for HR as benefit levels are pre-set and there is only one plan to manage.

-

Standalone Dental Rider: This is a more à la carte approach—an optional add-on to the core medical plan. A rider provides far greater flexibility to tailor the dental coverage to the specific needs of your executive team. You can select higher annual maximums or more extensive coverage for major procedures, crafting a truly bespoke benefit.

The choice between an embedded benefit and a rider comes down to simplicity versus customisation. For an executive-level plan, a standalone rider is often the superior choice. It provides the flexibility required to secure the high coverage limits and specialist access that top talent expects.

Regardless of the structure, the objective remains the same: to guarantee absolute continuity of care for executives and their families during international assignments. You can gain a deeper understanding of these mechanics in our guide to understanding international private medical insurance.

Navigating Global Networks and Reimbursement

For an executive on assignment in Asia or Europe, the true test of a group dental plan is its international network. The gold standard of care for any busy professional is the convenience of direct billing, where the clinic settles the invoice directly with the insurer.

A plan with an extensive direct billing network in cities like Bangkok or Kuala Lumpur means your executive can receive treatment and depart without managing personal payments or extensive paperwork.

However, even the most comprehensive networks have limitations. When an executive needs to consult a specialist who is not in the network, the claims process becomes absolutely crucial.

- Out-of-Network Reimbursement: The process must be exceptionally simple. The executive pays the provider upfront and submits a detailed invoice to the insurer. The best IPMI providers have streamlined this with digital claims portals and applications, ensuring reimbursement is credited to the executive's account within a few business days.

- Clear Policy Terms: The plan's documentation must be unequivocally clear about how it calculates reimbursement for out-of-network care. This is typically based on "reasonable and customary" charges for that specific city or region. This transparency is key to preventing unwelcome surprises and unexpected financial shortfalls for your executive.

Ultimately, a well-integrated dental and IPMI plan delivers more than just financial protection. It provides genuine peace of mind, assuring your key people that they have access to premier dental care no matter where their work takes them.

A Framework for Evaluating Group Dental Plans

Choosing the right group dental plan is not a matter of selecting the least expensive option from a brochure. It is a strategic decision. For the financial advisors and employers undertaking this process, the objective is to identify a plan that delivers genuine, tangible value to executive talent. This involves a deep analysis of the fine print that shapes an executive’s actual experience when they utilise their benefits.

A truly effective evaluation transcends simple cost metrics. It focuses on the quality of care, speed of access, and financial predictability that high-performing individuals demand. This is not about administrative box-ticking; it is about selecting a plan that functions as a powerful component of a competitive compensation package.

Assessing Network Quality and Specialist Access

The first point of analysis should always be the provider network. A lengthy list of dentists may appear impressive, but what truly matters is the quality and accessibility of those providers, particularly the top-tier specialists.

For executives, obtaining prompt access to a leading periodontist for gum disease, an endodontist for a complex root canal, or a prosthodontist for sophisticated procedures like implants is not a luxury—it is a necessity.

Your evaluation must include:

- Specialist Density: How many reputable in-network specialists are located where your executives live and work?

- Provider Credentials: Does the network feature practitioners from respected institutions with advanced certifications?

- Out-of-Network Penalties: For DPPO or indemnity plans, what is the real-world cost of seeing a preferred specialist who is not in-network? A plan that heavily penalises out-of-network care is not as flexible as it appears.

Scrutinizing the Schedule of Benefits

The schedule of benefits is the plan’s governing document. It requires careful review. Pay close attention to how the plan covers Major services and orthodontia, as this is where executives and their families can incur significant out-of-pocket costs.

A plan's true value is often revealed in its coverage for complex procedures. A low premium is meaningless if the plan offers minimal support for a dental implant or multi-stage crown placement, which are common requirements for this demographic.

Look specifically for waiting periods. Many group dental plans impose a waiting period of six to twelve months before covering Major services. For an executive team, such a delay can be a significant source of frustration. A key strategic goal during negotiations should be to have these waiting periods waived.

Finally, deconstruct the plan’s financial architecture. Beyond the annual maximum, you must understand the deductibles and coinsurance. For a more detailed analysis, you can learn more about excesses and deductibles in our detailed guide, which explains how these subtle details can substantially impact an executive's final bill.

Evaluating Insurer Service and Reputation

Ultimately, a dental plan is only as good as the insurer’s service. Busy professionals have zero tolerance for bureaucratic delays, cumbersome websites, or poor communication. A seamless administrative experience is non-negotiable.

Your due diligence must cover the insurer’s operational capabilities. Key factors to verify are:

- Claim Processing Time: What is the average turnaround for claims, both in- and out-of-network? The best insurers process claims in days, not weeks.

- Digital Tools: Does the insurer offer a modern, functional online portal or mobile application for locating dentists, checking benefits, and submitting claims?

- Concierge Support: For executive-level plans, is there a dedicated support line or concierge service that can handle complex queries and pre-authorisations efficiently?

By applying this structured framework, you can move beyond superficial marketing and select a group dental plan that genuinely supports the health—and meets the high expectations—of your organisation’s leaders.

The Lasting Value of Elite Dental Benefits

Ultimately, a thoughtfully designed group dental plan is far more than another line item on an expense report. It is a direct investment in the health, focus, and productivity of your most critical asset—your leadership team. This is not about administrative compliance. It is about deploying a strategic tool for attracting and retaining top talent in a fiercely competitive global market.

For high-net-worth individuals and senior executives, superior dental care is not a perquisite; it is a non-negotiable component of their personal health strategy. A plan that only covers basic services entirely misses the point. They expect—and require—coverage that handles complex restorative work, specialist consultations, and cosmetic procedures without encountering frustratingly low financial ceilings.

A Strategic Edge in the War for Talent

The quality of the dental benefits you offer sends a powerful message. Providing an elite plan signals that the company values its key people enough to invest in their total well-being. That is a distinction that top-tier global talent notices and weighs heavily when considering career moves. An inferior plan, conversely, creates friction and dissatisfaction, eroding the very loyalty you seek to cultivate.

An elite group dental plan is a cornerstone of executive wellness. It protects the individual's health and the company's investment in its leadership, ensuring key personnel can perform at their peak without concern over access to premier care.

For organisations developing a comprehensive wellness program, it is crucial to understand how all the pieces integrate. To gain a better sense of how these benefits fit into a broader health strategy, our article on the fundamentals of international private medical insurance benefits provides essential context.

Armed with this perspective, corporate leaders and their financial advisors can approach the selection of group dental plans with the appropriate mindset. The goal is clear: secure a plan that not only protects, but actively supports the executive teams driving the entire organisation forward.

Frequently Asked Questions

When analysing the specifics of executive-level group dental plans, the same critical questions consistently arise. Senior executives and their advisors require precise knowledge of how these plans function in practice to ensure the benefits truly align with the promise of premium care.

Let us move beyond the jargon and provide the direct answers needed to make confident decisions for your top teams, especially those operating internationally.

Can We Negotiate Higher Annual Maximums?

Absolutely. Not only is it possible, it is one of the most common and effective ways to elevate a standard dental plan into a genuinely executive-class benefit.

For larger corporate groups, or when creating a specialised "carve-out" plan exclusively for senior leadership, insurers are often quite flexible. This is a key point of leverage. The negotiation typically hinges on the group's overall risk profile and the company's willingness to accept a corresponding premium adjustment. Increasing the annual maximum from a typical $2,000 to $5,000 or more transforms the plan from a simple perquisite into a substantial financial backstop for key individuals who may require complex restorative or cosmetic procedures.

How Does Coverage for Dental Implants Typically Work?

This is a detail that must be scrutinized. Dental implants are almost always classified under "Major" dental services, but the specifics of their coverage can vary dramatically between plans.

Most plans will cover a percentage of the cost—often 50%—but only up to the plan's overall annual maximum. Others may introduce additional stipulations, such as specific exclusions, waiting periods before a claim can be made, or even a separate, lower lifetime limit exclusively for implant procedures.

The only way to achieve total clarity is to review the fine print in the plan’s "Schedule of Benefits." This document outlines the exact coverage percentage, waiting periods, and any financial caps for implantology. It is the sole method to ensure there are no costly surprises later.

What Is the Difference Between In-Network and Out-of-Network Care Abroad?

For a globally mobile executive with an integrated IPMI and dental plan, this distinction is paramount. It represents the difference between a smooth, effortless experience and an administrative burden.

The core difference relates to convenience and cash flow.

-

In-Network Care: This is the gold standard. The executive visits an international clinic that has a direct billing agreement with the insurer. The experience is cashless and seamless. The clinic invoices the insurer directly, so your executive does not need to handle payments personally.

-

Out-of-Network Care: This requires the executive to pay the full invoice at the time of service. They must then collect all receipts and documentation, complete a claim form, and await reimbursement from the insurer.

For your top talent, a plan with a strong, high-quality international direct billing network is non-negotiable. It removes financial friction and allows them to focus on their professional responsibilities, not on pursuing reimbursements while on assignment. Offering group dental plans with this feature is a clear indicator of a truly premium benefits program.

At Riviera Expat, we build premium international health and dental insurance solutions for financial services professionals in the world's top hubs. We provide the expert guidance needed to select a plan that delivers clarity, control, and confidence. To see how we can design a plan for your executive team, contact Riviera Expat for a complimentary consultation.