Expat health insurance is your personal health passport for a life without borders. It is not the disposable travel insurance acquired for a short holiday; this is comprehensive, long-term medical coverage meticulously designed for individuals living and working abroad.

It ensures you have uninterrupted access to premier healthcare regardless of your location, bridging the significant gaps your domestic plan cannot cover once you relocate. Whether you are in Singapore for an extended assignment or dividing your time between London and New York, this is the strategic asset that protects both your health and your financial portfolio.

Securing Your Health Across Borders

For the discerning global citizen, access to top-tier healthcare is not a luxury—it is a non-negotiable component of a well-managed international life. When navigating a global career, the last variable you should contend with is uncertainty regarding your medical care. It should be a source of stability, not another challenge to overcome.

A premier expat health insurance plan is more than a medical policy; it is a cornerstone of a robust asset protection strategy. It is engineered to address the primary concern for high-net-worth individuals: obtaining seamless, elite-level medical attention anywhere in the world, without friction. A routine consultation in Geneva or an emergency procedure in Dubai should be handled with the same efficiency, without a moment's hesitation over logistics or cost.

A Foundation for Global Living

This level of coverage provides a key to a curated global network of the finest hospitals, clinics, and specialists. Domestic plans are inherently constrained by geography; an international policy is architected for a life in motion.

This guide is designed to provide a clear, strategic path. We will begin with the fundamentals and progress to the finer points of selecting a policy that safeguards both your health and your wealth. The objective is to provide you with the confidence to focus on your ventures, secure in the knowledge that your well-being is comprehensively managed.

A well-structured expat health insurance policy is more than a safety net; it is a strategic tool that enables a truly international lifestyle, providing peace of mind and protecting your most valuable asset—your health.

Key Pillars of Expat Medical Security

So, what does a superior plan deliver? It executes on several critical fronts that are simply non-negotiable for a global professional.

- Continuity of Care: It ensures long-term treatments or the management of chronic conditions proceed without interruption as you move between countries.

- Access to Excellence: It grants you privileged access to leading medical institutions and specialists worldwide, allowing you to bypass local wait times and administrative hurdles.

- Financial Protection: It shields your assets from the formidable costs of international medical care. In high-cost hubs like Hong Kong, average annual premiums can readily exceed USD 12,000.

Of course, for many global citizens, securing health across borders extends beyond family. If you have animal companions joining your journey, engaging reliable International Pet Relocation services is another crucial element of a seamless transition.

What Defines Premier Expat Health Insurance

To fully appreciate what constitutes premier expat health insurance, one must first understand what it is not. It is not a low-cost travel policy purchased for a two-week holiday. Nor is it a standard domestic plan that becomes irrelevant the moment you cross a border. Both of these options leave vast, financially precarious gaps for anyone living an international life.

Consider the analogy. A travel plan is a single-use ticket, valuable only for an acute emergency on a short trip. Your home country’s health plan is a local club membership—its utility is confined to one location. A true expat policy, however, is an all-access pass. It is a universal key that opens doors to the world's finest medical care, irrespective of your current location.

This distinction is paramount for high-level professionals whose lives and careers do not conform to the boundaries of a single country. It is about creating a seamless healthcare experience that mirrors a global lifestyle, eliminating the friction and guesswork of navigating foreign medical systems.

The Core Differentiators of Elite Coverage

True international private medical insurance is built upon a few core principles that set it profoundly apart from standard offerings. These are not merely ancillary benefits; they are the fundamental pillars of the policy, engineered for the realities of living and working abroad. The primary objective is to ensure your health is managed to the highest standard, without compromise.

This means the policy must guarantee your care is continuous. If you are receiving treatment for a chronic condition such as diabetes or hypertension, that care must move with you—flawlessly—from your specialist in London to a new one in Singapore. There can be no "pauses" or "resets" in your treatment regimen simply because you have relocated.

The true worth of an expat health insurance plan is not measured solely by its coverage limits. It is measured by its capacity to provide uninterrupted, high-quality medical support across borders, ensuring your health strategy is as mobile as you are.

Beyond Emergency Care

Herein lies another key differentiator: a top-tier plan covers the full spectrum of your health needs. While basic travel insurance focuses narrowly on unforeseen emergencies, a proper expat policy is designed for your entire life.

This includes components such as:

- Routine and Preventive Care: This encompasses annual physicals, wellness screenings, and consultations that proactively maintain your health.

- Chronic Condition Management: This provides ongoing, long-term support for existing conditions, without being restricted by geography.

- Specialized Treatments: This grants access to advanced medical procedures, from oncology to elective surgeries, at world-class facilities.

These plans are architected for a lifetime, not just a trip. They provide a solid framework for managing every aspect of your well-being, from prevention to complex interventions. For a deeper analysis, you can explore the specific international private medical insurance benefits uncovered in our detailed guide.

Privileged Access to a Global Network

Finally, the defining feature of premier expat health insurance is the quality and scale of its medical network. Insurers catering to a high-net-worth clientele do not simply aggregate providers; they cultivate curated partnerships with the leading hospitals, clinics, and specialists across the globe. This is not just a list of providers—it is a vetted ecosystem of medical excellence.

This curated access yields tangible advantages. It often facilitates direct billing arrangements, so you are not compelled to pay substantial medical bills out-of-pocket and await reimbursement. More importantly, it ensures you are treated in facilities renowned for their high standards of care, advanced technology, and expertise with international patients. This transforms the policy from a mere financial safety net into a long-term strategic instrument for protecting your health throughout your global career.

Anatomy of an Elite Health Insurance Policy

Consider a premier expat health insurance policy less as a simple safety net and more as a sophisticated financial instrument. Each component is engineered to function in concert, delivering robust protection and effortless access to top-tier care, no matter your global position. Understanding these components is what distinguishes a standard plan from a truly exceptional one.

The entire structure is built upon two foundational pillars: inpatient and outpatient care. These form the absolute bedrock of your medical security while living abroad.

Inpatient care encompasses any treatment requiring hospital admission, from a planned surgery to a medical emergency. Outpatient care covers all other services—specialist consultations, diagnostic tests, prescriptions, and physiotherapy sessions that do not require an overnight stay. A genuinely elite policy will not just cover these; it will offer generous, often unlimited, coverage for both.

Core Coverage Beyond the Basics

True global protection, however, extends far deeper than these fundamentals. For a high-achieving professional, a policy's value is revealed in its specialized benefits—the elements designed specifically for the unique demands of an international life. These are not optional extras; they are non-negotiable necessities.

Consider maternity care. An elite plan provides comprehensive international coverage for every stage of pregnancy, from prenatal consultations to delivery and postnatal support. This guarantees access to the best obstetric facilities anywhere, providing complete peace of mind for your growing family.

Likewise, robust dental and vision coverage is a clear indicator of a premier plan. It should extend well beyond routine cleanings and eye examinations to include major dental work, such as crowns and orthodontics, as well as high-quality optical wear. It is about covering every facet of your well-being, not just critical emergencies.

Specialized Benefits for a Global Lifestyle

A modern expat health policy must also address the unique pressures associated with a high-stakes international career. This is where benefits such as executive mental wellness programs become absolutely essential.

These services provide confidential access to top psychologists, therapists, and wellness coaches, offering discreet and immediate support whether you are in London or Singapore. This focus on mental resilience is a clear indication that a policy is designed for today's global leader.

The anatomy of a superior policy is defined by its proactive and specialized provisions. It anticipates the needs of a global life—from chronic condition management to emergency evacuation—and provides elegant, effective solutions.

Another critical component is how a policy manages chronic conditions. It must offer unwavering support for ongoing treatments, ensuring you can manage your health consistently across different countries and healthcare systems without interruptions or bureaucratic complexities. To understand these policy terms with confidence requires familiarity with the specific language of insurance.

Services Delivering Unparalleled Security

The true test of an elite policy is found in the services that provide security and convenience when you need them most. These are the features that remove friction and stress from the healthcare experience, allowing you to focus on what matters: your recovery.

Here are the key services you should demand:

- Medical Evacuation: This is non-negotiable. It covers the cost of transporting you to the nearest center of medical excellence if local care is inadequate. For anyone operating in diverse global markets, this is an absolute lifeline.

- Repatriation: In the event of a death abroad, this benefit covers the cost of returning remains to a home country. It is a difficult subject, but this service lifts a significant burden from your family during an incredibly stressful time.

- Direct Billing Networks: Premium insurers establish relationships with leading hospitals worldwide, enabling them to settle your bills directly. This means you do not have to pay large sums out-of-pocket and then navigate a complicated reimbursement process.

- Second Medical Opinions: Gaining access to a network of world-renowned specialists for a second opinion on a diagnosis or treatment plan is invaluable. It empowers you to make critical health decisions with complete confidence.

Recent market analysis confirms that flexible, customizable plans are what expatriates value most. Top-tier providers like Cigna Global and Allianz International are constantly expanding their global hospital networks to offer these advanced benefits alongside their core inpatient and outpatient coverage.

When evaluating a premier expat health insurance plan, a detailed review of the policy wording is paramount. To confidently interpret complex terms, it is worth learning how to read contracts effectively. This checklist of core and specialized benefits provides the framework to select a policy that delivers genuine, unwavering global protection.

Aligning Coverage with Your Global Footprint

Let’s discuss one of the most fundamental aspects of an expat health insurance plan: its geographical scope. A policy's utility is defined by where it provides coverage, so mapping its boundaries to your actual lifestyle—both personal and professional—is a non-negotiable first step. Your plan's area of coverage is the single largest factor driving its effectiveness and, critically, its cost.

You will almost immediately encounter a major decision point: ‘Worldwide’ versus ‘Worldwide excluding the USA.’ This is not a minor detail; it is a significant cost driver. Including the United States in your coverage can increase your premium by a substantial 40% to 60%. The reason is a direct reflection of the U.S. possessing the most expensive healthcare system on the planet. For any individual who does not anticipate needing medical care in the States, excluding it is one of the most prudent financial decisions you can make.

Navigating Key Expatriate Hubs

Healthcare systems vary dramatically from one country to the next. A truly premium policy must integrate smoothly with both public and private systems in major expat hubs, ensuring you receive top-tier care without bureaucratic entanglement.

Let's examine three distinct regions:

- Europe: In nations like France or Spain, you may have access to the public system. The challenge? Extended wait times for specialists or elective procedures are common. A private international plan acts as your express pass, granting immediate access to private clinics and bypassing these queues.

- The Middle East: In a hub like Dubai, private health insurance is typically mandatory for residency. The best policies provide access to world-class private hospitals that operate with the service levels of five-star hotels, guaranteeing a premium experience from start to finish.

- Asia: The continent presents a diverse healthcare landscape. In Singapore, your plan must accommodate one of the world's best—and most expensive—healthcare systems. In Thailand, a solid policy ensures you are treated at internationally accredited hospitals that have established it as a global hub for medical tourism.

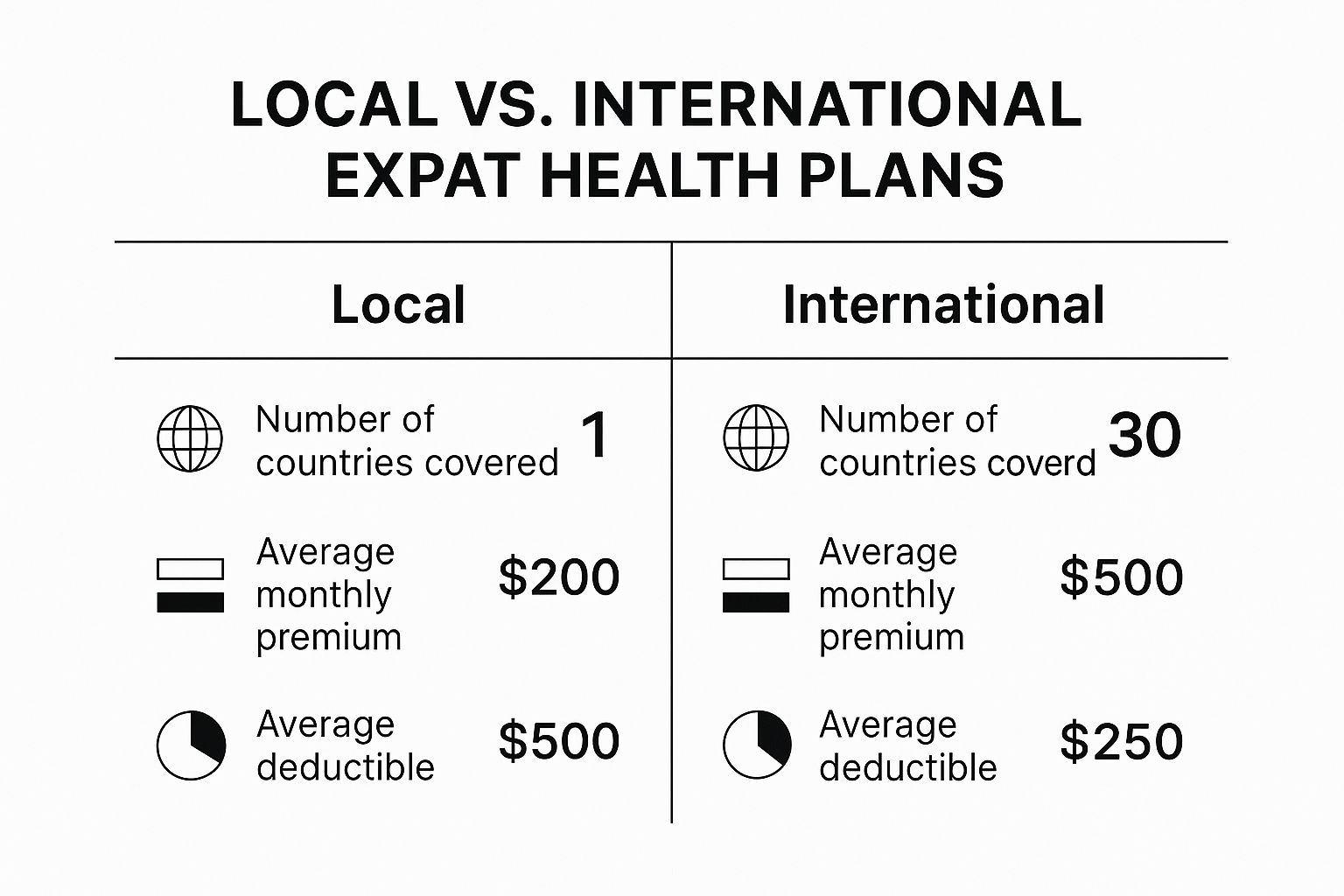

This visual breakdown highlights the difference in scope and cost between local and international plans.

As illustrated, local plans may present a lower initial cost, but their limited geographic footprint represents a significant liability for anyone living or working on a global scale.

Strategic Coverage for Your Lifestyle

Ultimately, your choice of geographic coverage must be a precise reflection of your life today and your plans for the future. Are you based in Asia but travel to London for business quarterly? Your plan must cover both regions seamlessly. Are you considering retirement in Europe but want the option for specialized treatment in your home country? Your policy requires that flexibility.

Market analysis shows health insurance growth in Asia has outpaced much of the world, fueled by growing expat communities in cities like Singapore and Hong Kong, alongside a rising local affluent class seeking superior private healthcare options.

A policy's geographic scope is not about covering the entire world; it is about covering your world. The optimal plan is one that is perfectly aligned with your travel patterns, business interests, and personal priorities.

Choosing the right coverage area is a strategic balance between comprehensive access and financial prudence. But it is not just about where you are covered—it is also about who you can see. Ensuring your plan provides access to the best facilities is critical. You can learn more about how to assess the quality of medical networks in our dedicated guide. This ensures that no matter where you are, your health is in trusted hands.

The Financial Strategy Behind Your Policy

View an elite expat health insurance policy less as a recurring expense and more as a sophisticated financial instrument designed to shield your global assets. To optimize its function, you must look beyond the premium to understand how its core financial components—deductibles, co-payments, and annual limits—work in synergy. These are the levers you can adjust to perfectly align a policy with your financial strategy and risk tolerance.

When you approach your policy from this perspective, it transitions from a reactive safety net to a proactive component of your wealth management. By selecting these variables deliberately, you can fine-tune your coverage to deliver maximum security without allocating unnecessary capital to excessive premiums. It is about achieving the optimal balance between cost and ironclad protection.

Architecting Your Cost-Sharing Structure

The premium you pay is directly correlated to the amount of financial risk you are willing to assume personally. This is managed through two key mechanisms: deductibles and co-payments. Consider them as your personal stake in your healthcare costs.

A deductible is the fixed amount you pay out-of-pocket annually before your insurance coverage begins. For instance, if you select a USD 5,000 annual deductible, you are responsible for the first USD 5,000 of your medical expenses that year.

A co-payment (often termed co-insurance) is the percentage of a medical bill you cover after your deductible has been met. A common structure is an 80/20 split, where the insurer pays 80% of the approved cost, and you are responsible for the remaining 20%.

The art lies in balancing these two elements. A higher deductible can significantly reduce your annual premium, freeing up capital that could be deployed more effectively elsewhere. For individuals who are generally healthy and can comfortably absorb smaller, routine medical costs, this is a highly intelligent strategy.

By consciously opting for a higher personal cost-sharing threshold, you are essentially self-insuring for minor events while retaining bulletproof coverage for a major medical crisis. This transforms your premium from a sunk cost into a calculated investment against catastrophic financial risk.

The Critical Role of Annual Limits

The annual limit is the absolute maximum your insurer will pay for your medical care in a single policy year. For a high-net-worth individual, this is arguably the single most important figure in the entire policy. A low annual limit constitutes a massive financial vulnerability that could expose your personal assets in the event of a serious illness or accident.

It is non-negotiable: you require a plan with a very high, or ideally, an unlimited annual maximum. Here is why this is so critical:

- Protection Against Catastrophic Costs: A single major medical event, particularly in a high-cost country like the United States or Switzerland, can easily generate bills exceeding USD 1 million. A policy with an inadequate limit would leave you liable for the substantial difference.

- Access to the Best Treatments: Groundbreaking medical technologies, specialized surgeries, and long-term intensive care are exceptionally expensive. An unlimited annual benefit means you never have to compromise on the quality of care due to cost considerations.

- True Peace of Mind: Knowing your financial liability is capped allows you to focus on what truly matters—your recovery—instead of the stress of an escalating medical bill.

Imagine requiring a complex cardiac surgery and an extended ICU stay at a top Swiss hospital. The bill could rapidly surpass USD 500,000. A policy with a USD 250,000 limit would result in a crippling out-of-pocket expense. A plan with a USD 5 million or unlimited cap, however, would manage it completely. Ultimately, a high annual limit is the essential firewall that protects your wealth from the volatile and often staggering costs of global healthcare.

Selecting the Right Global Insurance Partner

Choosing an insurer is a decision that extends far beyond policy details and premiums. You are not merely purchasing a product; you are selecting a global health partner. A discerning evaluation looks past cost to strategically assess the provider's capabilities. The quality of that insurer is what imbues your expat health insurance with its true value, and it marks the difference between a seamless experience and one fraught with friction.

The first element to scrutinize is the insurer's global medical network. This is not a mere list of hospitals. It is a carefully architected ecosystem of top-tier facilities and specialists with whom the insurer has established, robust relationships. A strong network provides tangible benefits, such as direct billing, which obviates the need for you to advance thousands of dollars for care and then await reimbursement.

Next, examine their financial operations. The efficiency of the claims process is a clear indicator of an insurer's operational strength. When dealing with a medical issue, the last thing you require is administrative complexity. The best providers offer streamlined, digital methods for claim submission and process them expeditiously, demonstrating a commitment to service that aligns with executive expectations.

Evaluating Service and Stability

An insurer’s support infrastructure is as critical as its network of physicians. If you operate across different time zones, having 24/7 multilingual concierge support is not a luxury—it is a necessity. This service acts as your personal healthcare navigator, assisting with everything from identifying a specialist in a new city to coordinating appointments. It is an essential layer of logistical support.

Another paramount consideration is the insurer's long-term financial stability. You are entering a long-term relationship and must be confident your partner will be solvent and reliable for years to come. Look for strong ratings from independent agencies like A.M. Best or Standard & Poor's. These scores provide an objective assessment of their financial health and dependability.

A truly elite insurance partner functions as an extension of your personal support team. They do not just offer financial coverage; they provide sophisticated logistical and administrative support that cuts through the complexity of global healthcare.

Digital Integration and Due Diligence

In the modern era, a premium experience is underpinned by robust digital tools. Any insurer of merit should offer integrated telehealth services, providing instant access to medical consultations regardless of your global location. A secure online member portal for managing your policy, tracking claims, and accessing network providers is now standard.

The international private medical insurance market is expanding rapidly, fueled by a growing number of affluent mobile professionals and improved access to global care. You can explore the growing global health insurance market on navigator-insurance.com. This growth makes it even more critical to select an established partner with a forward-looking strategy.

Finally, conduct your own due diligence. This process should culminate in a meticulous review of the policy documents. Pay extremely close attention to the fine print regarding exclusions and limitations. To navigate the market effectively, consider engaging a specialist broker. Their expertise can be invaluable for vetting potential partners and ensuring the policy you select is perfectly aligned with the demands of your global lifestyle.

Frequently Asked Questions

When delving into the specifics of expat health insurance, several key questions consistently arise. Let us address them directly to provide the clarity required to make an informed decision for your global life.

Is Expat Health Insurance Tax Deductible

This is one of the most frequent—and complex—inquiries. The answer is highly specific to individual circumstances. The tax deductibility of your premiums depends entirely on your home country's tax legislation and the regulations in your current country of residence. Tax codes are intricate and subject to change.

For a U.S. citizen living abroad, for instance, provisions such as the Foreign Earned Income Exclusion can directly influence the deductibility of premiums. A definitive "yes" or "no" is not possible without a personal analysis. It is imperative to consult a tax advisor who specializes in expat financial planning. They are the only professionals qualified to provide counsel specific to your financial situation.

How Is Coverage for Pre-Existing Conditions Handled

An insurer's approach to pre-existing conditions is a key differentiator between premier plans and standard policies. Top-tier international plans offer solutions where others do not, but one rule is non-negotiable: you must provide full, transparent disclosure of your medical history upon application.

Leading insurers typically follow one of two underwriting paths:

- Moratorium Underwriting: This can be viewed as a "waiting period." Your pre-existing condition will not be covered immediately. Instead, there is a defined period (typically 24 months) during which you must be entirely free of symptoms, treatment, and medical advice for that condition. After this period, it may become eligible for coverage.

- Full Medical Underwriting: This is a more detailed approach. The insurer conducts a comprehensive review of your health history. Based on this assessment, they may offer to cover the condition from day one (often for an adjusted premium), apply specific exclusions, or decline to cover the condition entirely.

Securing robust coverage for pre-existing conditions is a hallmark of a truly premium expat health plan. It demonstrates the insurer's commitment to providing continuous, uncompromising global care.

Can I Maintain My Policy If I Relocate

Yes, absolutely. In fact, this is a core function of a true expat health insurance policy. Global portability is engineered into its design. These plans are intended to move with you, whether you are relocating for a new professional engagement or a change in lifestyle.

The key is to inform your insurer of your move in advance. This is not merely a courtesy; it is a contractual obligation. Relocating can impact your premium, particularly if you are moving to a region with high healthcare costs, such as the United States. Your level of coverage and access to medical networks will travel with you, as defined by your policy’s specified area of coverage.

At Riviera Expat, we navigate the complexity to help you secure a premier international health plan that aligns with your life, wherever it may lead. Secure your expert consultation today and move forward with complete confidence in your global healthcare strategy.