When structuring a comprehensive financial portfolio, understanding the nuances of your international private medical insurance is paramount. Two central terms, copay and deductible, frequently appear. While both represent out-of-pocket expenditures, their functions are fundamentally distinct. A misinterpretation of these terms can lead to unforeseen financial exposure.

To be precise, a copay (or copayment) is a fixed, predetermined fee paid for a specific medical service at the time it is rendered. Consider it a set access fee for a consultation or prescription. Conversely, a deductible is the total sum you are required to pay out-of-pocket for specific covered medical services within your policy year before your insurance plan begins to contribute to the cost.

Understanding the Core Financial Difference

While it is easy to view copays and deductibles as mere administrative costs, it is more financially astute to consider them as strategic levers for managing your healthcare expenditures. A clear understanding of their mechanics allows you to select a plan that is precisely aligned with your financial objectives and health profile, granting you greater command over your annual budget.

A copay is engineered for predictability. It is a set amount, for instance $75 for a specialist consultation, paid directly at the point of service. This fee remains constant, irrespective of the total cost billed by the provider. This structure provides transparent, upfront costs for routine care. On many sophisticated plans, copayments for certain services apply even if the annual deductible has not yet been met.

A deductible operates on a broader, typically annual, basis. It represents a financial threshold that must be met before the insurer assumes its share of the cost for significant medical expenses, such as hospital admissions or surgical procedures. For example, if your plan stipulates a $5,000 deductible, you are liable for the first $5,000 of those covered costs.

Key Distinctions for Financial Planning

To make an informed decision for your financial portfolio, it is essential to comprehend how these two cost-sharing mechanisms operate in practical terms.

- Timing of Payment: Copays are transactional, paid at the time a service is utilized. Deductibles are cumulative, an aggregate total that you satisfy over the course of your policy year.

- Predictability: A copay offers absolute cost certainty for a specific service. A deductible represents a potential, variable liability; you may or may not incur expenses that require you to meet it.

- Application: Copays are typically applied to high-frequency, routine services (e.g., physician visits, standard prescriptions). Deductibles are associated with more substantial, less frequent medical events.

From a financial planning perspective, a copay functions as a predictable operating expense within your budget. A deductible, in contrast, is a form of managed risk you agree to assume. Your comfort level with this risk should directly inform your choice of insurance plan.

This table provides a side-by-side analysis of their strategic roles.

Copay vs Deductible A Strategic Comparison

This table offers a concise financial breakdown of how copayments and deductibles function within a private medical insurance plan.

| Financial Attribute | Copayment (Copay) | Deductible |

|---|---|---|

| Payment Structure | A fixed, predetermined fee per service. | An annual cumulative amount paid by the insured. |

| When It Applies | Usually at the point of service (e.g., doctor visit). | Before the insurer begins paying for certain services. |

| Example Cost | $75 for a specialist consultation. | $5,000 annual threshold for major medical costs. |

| Financial Impact | Provides predictable costs for routine care. | Influences premium costs and potential out-of-pocket exposure. |

Mastering these details is the foundational step in gaining full command of your policy. For a more exhaustive review of these and other key terms, we recommend our guide on how to read your expat medical insurance policy terms. Ultimately, your copay and deductible are designed to be balanced against your premium, enabling you to tailor your coverage to your unique health profile and financial strategy.

How Your Deductible Shapes Your Financial Game Plan

A deductible is more than a figure on a policy document; it is the cornerstone of your financial strategy for managing healthcare costs. It is the precise amount you agree to pay out-of-pocket for medical services each year before your insurance plan begins cost-sharing.

This structure represents a risk-sharing agreement between you and your insurer. By assuming a greater portion of the initial financial risk, you can often secure a significantly lower monthly premium, thereby improving cash flow for other investments. The strategic challenge lies in selecting a deductible that aligns with both your anticipated medical requirements and your personal risk tolerance.

How You Actually Meet Your Deductible

Meeting your deductible is not a single transaction but a cumulative process throughout your policy year. Each time you pay for a covered medical service that is subject to the deductible, that expenditure is recorded, bringing you closer to satisfying the threshold.

The types of costs that typically apply toward the deductible are significant expenses:

- Hospital Stays & Surgeries: These major events will rapidly contribute to meeting your deductible.

- Diagnostic Imaging: Advanced scans such as MRIs and CTs are substantial costs that are almost always applied to the deductible.

- Specialist Visits: While some plans feature a copay for specialists, many apply the full fee to the deductible until it is met.

- Prescription Drugs: For high-cost or specialty medications, you will often be responsible for the full cost until the deductible is satisfied.

Once your aggregate spending on these services reaches your deductible amount—for instance, $5,000—the plan's primary benefits, such as coinsurance, are activated. From that point forward, your insurer will pay a significant percentage of your covered medical bills for the remainder of the policy year.

Your deductible is the gateway to your plan's most substantial benefits. An intelligent financial strategy involves planning for the possibility of meeting this deductible each year and ensuring sufficient liquidity to do so if required.

The Ever-Rising Deductible Trend

For years, a clear trend in the health insurance market has been the increase in average deductibles. This is a strategic measure employed by insurers to keep monthly premiums from escalating at an accelerated rate. For instance, in the U.S. employer-sponsored insurance market, data from the Kaiser Family Foundation shows a significant shift.

Between 2013 and 2023, the average annual single-coverage deductible for workers with a deductible increased by 61%. This trend has been driven in part by the proliferation of High-Deductible Health Plans (HDHPs), which pair lower premiums with higher out-of-pocket thresholds.

This market dynamic directly impacts your financial planning. A higher deductible translates to a lower premium, which improves monthly cash flow. However, it also signifies a greater potential out-of-pocket liability in a year with significant medical needs. This makes it absolutely critical to conduct a candid assessment of your risk tolerance and ensure you maintain adequate liquid savings to cover the deductible without disrupting your primary financial objectives.

Finding Your Balance: Premiums vs. Potential Costs

Selecting your deductible level is a precise balancing act. It is a direct trade-off between your fixed monthly cost (the premium) and your potential variable costs (out-of-pocket spending). The optimal choice is entirely dependent on your individual circumstances.

There are two primary strategic approaches:

- Lower Deductible, Higher Premium: This is the conservative strategy. You accept a higher fixed monthly cost in exchange for greater predictability. Should a major medical event occur, your immediate out-of-pocket liability is smaller and more manageable. This is an ideal fit for individuals with known health conditions or those who prioritize financial certainty.

- Higher Deductible, Lower Premium: This is a more assertive financial strategy. It is designed to minimize fixed monthly costs and is well-suited for healthy individuals who do not anticipate significant medical needs. The premium savings can be substantial, but this approach demands the financial discipline to allocate those savings to an accessible fund, ready to cover the full deductible in the event of an accident or unexpected illness.

A firm grasp of these cost-sharing mechanisms is essential. For a more detailed analysis, review our guide that puts a spotlight on excesses and deductibles in the fine print. Ultimately, your deductible is a powerful tool you can use to precisely align your insurance coverage with your financial style and health outlook.

Using Copayments for More Predictable Healthcare Costs

While a deductible serves as your broad, annual financial backstop, a copayment—or copay—is designed to manage your routine, day-to-day healthcare expenditures. It is a fixed, predictable fee paid for a specific medical service. This brings a crucial element of clarity to routine care, which is fundamental to accurate budgeting, particularly for those living and working abroad.

The key distinction to grasp is this: unlike payments that count toward your deductible, copays are often effective from the first day of your policy. This means you gain immediate access to certain essential services for a set fee, without first having to meet a large out-of-pocket threshold. It is this immediate accessibility that makes understanding copays so vital for your financial planning.

At its core, a copayment is designed to make common medical services financially predictable. Whether you are consulting a specialist or filling a routine prescription, the fixed fee structure ensures you know the exact cost upfront. This removes the ambiguity that often accompanies medical billing.

Understanding How Copay Structures Vary

International private medical insurance plans utilize sophisticated copayment structures. They are designed to guide your healthcare choices while managing costs for both you and the insurer. A tiered system is a common feature in high-quality plans.

For example, a plan might be structured as follows:

- A $30 copay for a visit to a general practitioner.

- A $75 copay for a consultation with a specialist, such as a cardiologist or dermatologist.

- A $250 copay for an emergency room visit for a non-life-threatening condition.

This tiered model incentivizes the use of the appropriate level of care, reserving high-cost emergency facilities for true medical crises. It is a prudent design that contributes to the stability of the overall insurance pool, which in turn helps to contain premium increases.

A well-designed copayment system transforms abstract healthcare costs into concrete, budgetable expenses. It shifts the paradigm from reactive spending to proactive financial management, providing the confidence to plan for routine health maintenance.

The Role of Copays in Prescription Drug Costs

Copayments are also a significant factor in managing pharmacy expenses, a major component of overall healthcare spending. Here, too, tiered systems are standard. They are built to create financial incentives for making cost-effective medication choices.

A typical prescription drug copay structure might include these tiers:

- Tier 1: A low copay (e.g., $15) for generic drugs.

- Tier 2: A moderate copay (e.g., $45) for preferred, brand-name drugs.

- Tier 3: A higher copay (e.g., $90) for non-preferred, brand-name drugs.

- Tier 4: A percentage-based cost (coinsurance) for specialty or high-cost biologic medications.

This design provides a clear financial rationale for selecting generic medications when clinically appropriate. As they are bioequivalent to their brand-name counterparts but cost significantly less, you directly reduce your out-of-pocket spending by opting for them.

Ultimately, the copayment is a powerful instrument for financial clarity. It keeps routine healthcare accessible and makes costs transparent, encouraging proactive health management. By understanding how these fixed fees function within your international plan, you can budget effectively and make more intelligent decisions for both your health and your financial well-being. This clear separation from the larger, annual deductible is a hallmark of a well-architected insurance plan.

Modeling Real-World Financial Scenarios

Definitions provide a foundation, but to truly appreciate the strategic difference between a copay and a deductible, one must see them in application. Understanding the theory is secondary to comprehending the real-world impact on your cash flow and assets. By modeling a few practical examples, we can illustrate precisely how your choice of insurance plan affects your actual out-of-pocket liability.

Let us compare two distinct plan structures. Plan A is designed for predictability, featuring a lower deductible and higher monthly premiums. Plan B is structured for individuals comfortable with greater financial risk, offering a higher deductible in exchange for lower monthly premiums.

Scenario One: A Routine Specialist Visit

Assume you require a consultation with a leading dermatologist. The negotiated cost for this visit is $350.

- Under Plan A (Low Deductible): This plan architecture typically includes a fixed copayment for specialist visits. You would pay your $75 copay at the time of your appointment. Your financial obligation is complete. The insurance plan covers the remaining $275, and this event has no impact on your annual deductible. Your cost is predictable and easily managed.

- Under Plan B (High Deductible): With this plan, the entire $350 cost of the visit is your responsibility. This payment contributes toward meeting your high annual deductible, but until that threshold is reached, you are liable for the full cost of such services.

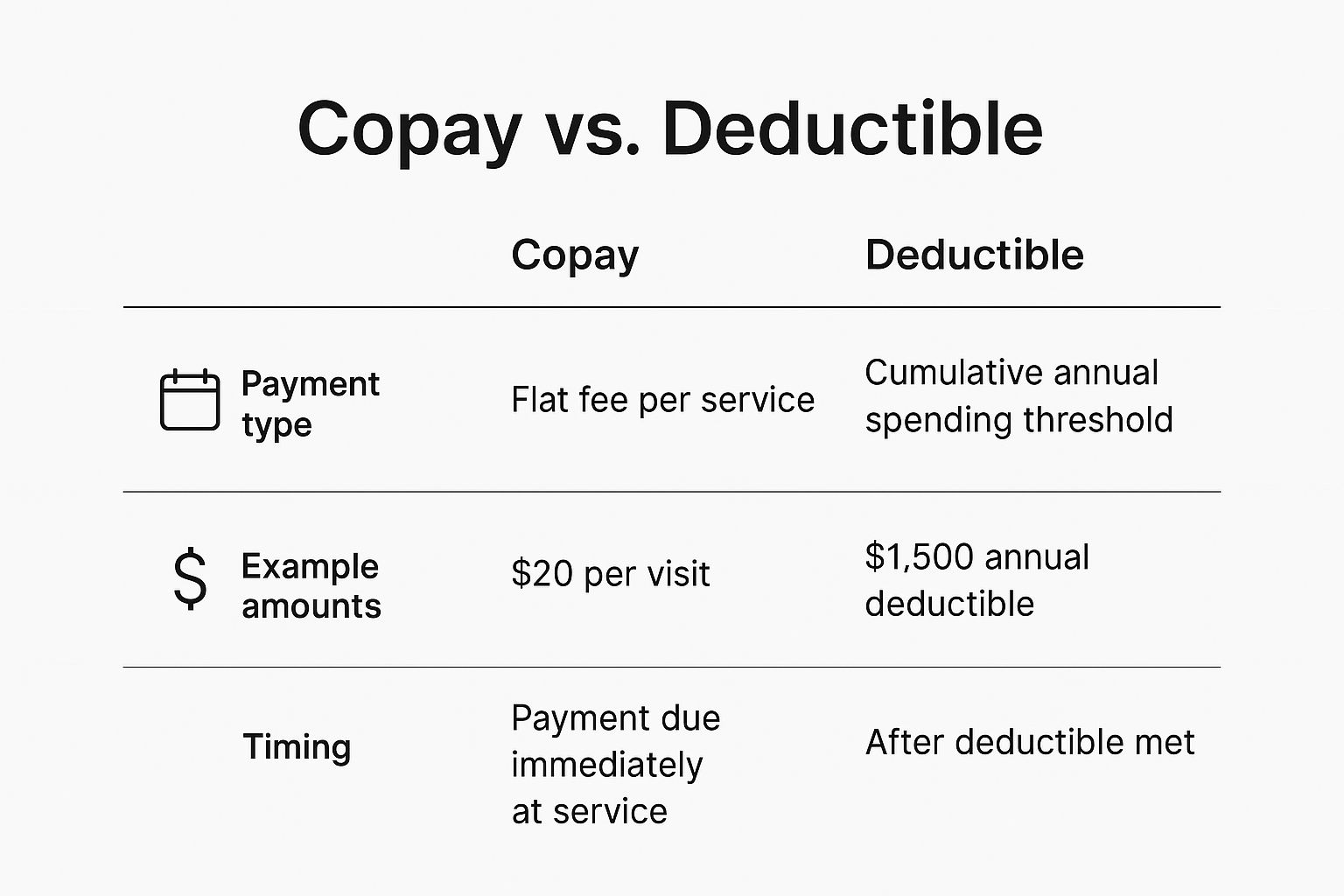

The image below illustrates the core differences between these payment types, highlighting their distinct timing, structure, and typical financial scale.

As depicted, a copay is a small, transactional fee per service. A deductible is a much larger, cumulative threshold that must be met annually.

Scenario Two: An Unexpected Minor Surgical Procedure

Now, consider a more significant, unplanned event: an outpatient procedure such as minor arthroscopic surgery. The total billed cost is $8,000. We will assume Plan A has a $2,000 deductible, while Plan B has a $7,000 deductible. Both plans have 20% coinsurance after the deductible is met.

- Under Plan A (Low Deductible): You are responsible for the first $2,000 to meet your deductible. After you have satisfied this, your plan's coinsurance applies to the remaining $6,000. With 20% coinsurance, you will owe an additional $1,200. Your total out-of-pocket cost for the surgery is $3,200.

- Under Plan B (High Deductible): You are required to pay the first $7,000 of the bill to satisfy your deductible. Once met, your 20% coinsurance applies to the remaining $1,000, meaning you owe an additional $200. Your total cost for this procedure amounts to $7,200.

For substantial, single-incident medical events, your deductible is the primary determinant of your immediate financial liability. A lower deductible results in a much smaller, more manageable invoice, though you pay for this protection via higher monthly premiums.

Scenario Three: Managing a Chronic Condition

Finally, let us analyze the annual costs of managing a chronic condition such as hypertension. This requires four specialist visits per year ($350 each) and monthly prescriptions for a preferred brand-name drug ($150 per month).

-

Plan A (Low Deductible):

- Specialist Visits: 4 visits x $75 copay = $300

- Prescriptions: 12 months x $45 copay = $540

- Total Annual Cost: $840 (Your deductible remains unaffected)

-

Plan B (High Deductible):

- Specialist Visits: 4 visits x $350 = $1,400 (applied toward your deductible)

- Prescriptions: 12 months x $150 = $1,800 (also applied toward your deductible)

- Total Annual Cost: $3,200 (all paid by you toward meeting the high deductible)

This long-term scenario demonstrates the clear financial advantage of a copay-centric plan for anyone with predictable, ongoing medical needs. The fixed-fee structure insulates you from high, accumulating costs. The same analytical framework applies to various medical services; for example, evaluating in-home healthcare costs and insurance requires applying these principles to determine your potential liability.

Ultimately, these examples confirm that no single plan is universally superior. The optimal choice is deeply personal, contingent upon your health profile and the degree of financial risk you are prepared to assume.

Selecting an Optimal Plan for Your Portfolio

Choosing the right international private medical insurance is not merely a healthcare decision; it is a fundamental component of your overall financial strategy. The plan you select—specifically, the balance between monthly premiums and potential out-of-pocket costs—must align with your personal risk tolerance, anticipated health needs, and broader financial architecture. The primary objective is to secure access to premier medical care without introducing undue financial volatility into your life.

This decision hinges on a calculated trade-off. A plan with a higher, fixed monthly premium typically corresponds to lower deductibles and predictable copays. This can be viewed as a conservative investment, prioritizing stability and minimizing downside risk. Conversely, a plan with a lower premium requires you to accept a higher deductible, signaling a greater tolerance for potential out-of-pocket liabilities in exchange for reduced fixed monthly overhead.

Aligning Your Plan with Your Personal Profile

Your personal health forecast is the most significant variable in this equation. If you are young, in excellent health with no chronic conditions, and do not foresee extensive medical needs, a high-deductible plan can be a strategically sound choice. The savings on monthly premiums can be redirected toward investments or held in a liquid account, ready to cover the deductible should an unexpected event occur.

However, if you are managing an ongoing medical condition or your family medical history suggests future needs, a low-deductible, copay-focused plan will offer far greater value. The higher premium becomes a predictable, budgeted expense that effectively places a ceiling on the financial impact of regular specialist consultations, therapies, and prescriptions. This approach ensures your healthcare costs do not derail your long-term financial plans.

The core principle is to match your insurance structure to your life's reality, not just its possibilities. A plan that is theoretically cost-effective but misaligned with your predictable health needs can quickly become a significant financial drain.

The Critical Role of the Out-of-Pocket Maximum

Regardless of your deductible preference, the out-of-pocket maximum is your ultimate financial safeguard. This figure represents the absolute ceiling on your annual spending for covered, in-network services. Every dollar you contribute through deductibles, copays, and coinsurance is tallied against this limit.

Once you reach this maximum, your insurer covers 100% of all eligible costs for the remainder of that policy year. This feature is what prevents a severe medical event from becoming a catastrophic financial one, thereby protecting your core assets.

A Framework for Your Decision

Making the optimal choice requires a structured, analytical approach. For those seeking to apply similar strategic thinking to other major life decisions, you may find relevant principles in guidance on understanding financial planning for future goals. A comparable logic applies here:

- Assess Your Health Trajectory: Conduct an objective review of your healthcare utilization over the past year and project your likely needs for the upcoming year. Be specific about any known consultations or treatments.

- Quantify Your Risk Appetite: Determine the maximum amount you could comfortably pay out-of-pocket in a single year without disrupting your investment strategy or lifestyle. This figure should guide your selection of a deductible and out-of-pocket maximum.

- Model the Scenarios: Perform the calculations. Determine the total potential annual cost (premiums plus maximum out-of-pocket spending) for both a high-deductible and a low-deductible plan based on your health assessment. Compare the best-case, worst-case, and most-likely financial outcomes for each option.

By viewing the copay versus deductible distinction through this strategic lens, you can select a plan that functions as a seamless, protective extension of your financial portfolio. For a more detailed review of the essential components of a top-tier policy, we invite you to read our guide on the core https://www.riviera-expat.com/international-private-medical-insurance-benefits-uncovered/.

Even with a firm grasp of the fundamentals, real-world situations can introduce complexity into understanding your international health insurance. Let us address some of the most common questions that arise. The following are direct, precise answers to clarify how copays and deductibles function in practice.

This is not a simple reiteration of definitions. It is an examination of the practical scenarios that inevitably occur during a policy year, enabling you to manage your plan with confidence.

Do Copayments Apply Toward My Annual Deductible?

In almost all cases, no. A copayment should be viewed as a separate, fixed access fee for a specific service, such as a physician's visit. It exists independently of your annual deductible. Your deductible is satisfied by payments for services that are subject to it—typically major expenses like hospital stays, advanced imaging, or surgical procedures.

However, copayments almost invariably count toward your annual out-of-pocket maximum. This maximum is your ultimate financial safety net, representing the absolute most you will pay for covered healthcare in a policy year. It is crucial to verify the specific terms of your policy, as some premium international plans may have unique rules, but this is the standard structure.

Which Is Better: A High-Deductible or High-Copay Plan?

Neither option is inherently "better." The optimal choice is contingent upon your specific health profile and financial strategy. The goal is to align the plan's structure with your circumstances, not to find a universal solution.

-

High-Deductible Plan: These plans are characterized by lower monthly premiums. They are an excellent strategic fit for healthy individuals who do not anticipate frequent medical care. You are accepting a higher potential out-of-pocket liability in exchange for lower fixed costs. When you remain healthy, this strategy is financially advantageous.

-

High-Copay (or Low-Deductible) Plan: Conversely, a plan with a lower deductible and predictable copays offers greater cost stability. This structure, which entails higher premiums, is often indispensable for anyone managing a chronic condition or who anticipates regular physician visits. It makes healthcare spending a more predictable component of your annual budget.

Your most astute financial move is a direct reflection of your expected healthcare utilization. One plan structure minimizes your fixed monthly costs, while the other minimizes unpredictable, variable costs when care is needed.

How Does the Out-of-Pocket Maximum Work?

The out-of-pocket maximum is your ultimate financial shield within a policy year. It is the absolute ceiling on what you will pay for covered, in-network services, preventing a medical crisis from becoming a financial one.

Every dollar you contribute to cost-sharing—your deductible payments, every copayment, and any coinsurance—is aggregated and counts toward this limit. Once you reach that maximum threshold, your insurance plan is obligated to cover 100% of all eligible costs for the remainder of that policy year. This feature is particularly critical in making high-deductible plans a safe and viable strategic option.

Is It Standard to Have Both a Copay and a Deductible?

Yes, it is entirely standard for a high-quality international plan to incorporate both. They are not mutually exclusive features; they are designed to work in concert to share costs in different ways for different services.

For example, your plan may apply your annual deductible to major events like hospitalization or specialized surgery. Concurrently, it could require a simple, fixed copay for routine care, such as visiting a general practitioner or filling a standard prescription. In many policies, these copay-based services are accessible from day one—even before the deductible has been met—to encourage preventative care without the barrier of a large initial payment. Always consult your plan's Summary of Benefits to understand precisely which services trigger a copay versus which are applied to your deductible.

Navigating the complexities of international medical insurance requires expert guidance. At Riviera Expat, we provide the clarity and control you need to make confident healthcare decisions that align perfectly with your financial portfolio. Explore our personalized consultation services at https://riviera-expat.com.