For a global professional operating between financial hubs like Hong Kong, Singapore, and London, an unexpected health issue is not merely a medical event—it is a significant financial risk. At the nucleus of that risk lies one critical concept: qualified medical expenses. This is not esoteric insurance terminology; it is the gatekeeper that determines whether your International Private Medical Insurance (IPMI) settles the liability or if you are left to absorb it.

Defining Qualified Medical Expenses

Consider qualified medical expenses as the definitive, pre-approved schedule of services for which your health plan has contractually agreed to provide payment. These are costs directly related to the diagnosis, treatment, cure, or prevention of a disease. A precise understanding of this concept is essential to protect your wealth from the escalating medical costs observed globally. It is what separates a fully covered invoice from a detrimental financial liability.

This distinction has never been more vital. Consider a scenario: you are a principal in a private equity firm, travelling between Hong Kong and London, when you experience a cardiovascular event—a primary driver of escalating medical inflation. It is well-documented that global medical costs are accelerating, with a recent projection from WTW's 2024 Global Medical Trends Survey forecasting a net increase of 9.9% for insurers. In the Asia Pacific region specifically, the gross increase is projected at 11.2%.

Core Components of Eligibility

What precisely renders a cost "qualified"? As a general principle, the expense must be medically necessary and fall within one of your policy's defined benefit categories. This framework ensures your coverage is directed at legitimate health needs, not elective or non-essential services. It is the rule that differentiates a covered surgeon's fee from an uncovered cosmetic procedure.

To gain a comprehensive understanding, one must grasp the definitions for items such as what is considered durable medical equipment. This category often includes physician-prescribed assets like hospital beds or oxygen concentrators, which are crucial for treatment but may not be immediately recognised as a "medical expense."

Why This Matters for Global Professionals

For an executive or investor operating across multiple jurisdictions, a crystal-clear knowledge of what constitutes a qualified medical expense is non-negotiable. A service that is covered without question in Singapore might require extensive pre-authorisation documentation in the United Kingdom.

A qualified medical expense is not merely a line item on an invoice; it is the fundamental unit of your health insurance coverage. Understanding its boundaries provides the control and confidence needed to make sound healthcare decisions anywhere in the world.

This understanding is your first step to ensuring your IPMI works to your advantage. You can explore the specific coverages available by reviewing our guide to international private medical insurance benefits uncovered. In the sections that follow, we will detail precisely what is included, what is excluded, and how to manage these costs with professional diligence.

The Three Pillars of Covered Expenses

To effectively command your International Private Medical Insurance (IPMI), it is advantageous to cease viewing qualified medical expenses as a disjointed list of procedures. A more strategic approach is to see them as a structured portfolio.

Insurers typically group covered costs into three distinct pillars that mirror the logical sequence of healthcare delivery. This simple framework brings necessary clarity to a seemingly complex landscape, allowing you to anticipate what is covered with far greater certainty.

The entire healthcare journey—from proactive health screenings to complex surgical interventions—falls neatly into one of these categories. Once you understand the pillars of Prevention, Diagnosis, and Treatment, you can demystify how any medical service aligns with your policy. This approach transforms a dense legal document into a practical financial instrument.

Prevention: Proactive Health Management

The first pillar, Prevention, is centred on proactive health capital management. It is the foundation of long-term health and a hallmark of the premium IPMI plans designed for discerning international professionals. These are the proactive services you utilise to identify potential health issues before they escalate into serious, and costly, problems.

For a high-net-worth individual managing a demanding schedule across Hong Kong, Singapore, or London, this pillar is about maintaining peak performance, not merely avoiding illness.

Examples of preventive care often covered include:

- Executive Health Screenings: These are comprehensive, head-to-toe physical assessments that far exceed a standard check-up. They are designed to evaluate cardiovascular health, metabolic function, and cancer risk in meticulous detail.

- Advanced Vaccinations: This includes immunisations required for frequent business travel to specific regions in Southeast Asia or other territories.

- Wellness Consultations: These are sessions with top-tier nutritionists or physiotherapists aimed at mitigating lifestyle-related health risks before they materialise.

This focus on prevention is not a wellness trend; it is a strategic investment in your health that leading insurers recognise as a critical component of modern medical care.

Diagnosis: Precision in Assessment

When a health concern arises, the second pillar, Diagnosis, is activated. This category covers all the essential tests and procedures required to determine the exact nature of a medical issue.

For complex cases, achieving a precise diagnosis is paramount, and a robust IPMI plan ensures you have access to world-class diagnostic technology without financial concern. These are the services that provide clarity and define the therapeutic pathway.

A definitive diagnosis is the bedrock of any successful treatment plan. Your policy should treat advanced diagnostic services not as a luxury, but as a non-negotiable qualified medical expense.

Services under this pillar typically include:

- Advanced Imaging: This encompasses Magnetic Resonance Imaging (MRI), Computed Tomography (CT), and Positron Emission Tomography (PET) scans that provide physicians with a clear view of internal structures.

- Specialist Consultations: Securing second or even third opinions from leading global experts in fields such as oncology, cardiology, or neurology.

- Complex Laboratory Tests: This can include genetic testing and detailed blood work to uncover underlying conditions that standard tests might fail to detect.

To provide further clarity, here is a breakdown of how these services are often categorised within a high-quality IPMI plan.

Breakdown of Qualified Medical Expense Categories

This table offers a clear overview of common medical services and their classification under typical IPMI policies designed for global professionals.

| Category | Description | Examples for HNW Professionals |

|---|---|---|

| Prevention | Proactive services to maintain health and detect potential issues early. | Executive health screenings, comprehensive check-ups, travel vaccinations, wellness and nutrition consultations. |

| Diagnosis | Procedures and tests to accurately identify a medical condition or injury. | Specialist consultations (including second opinions), MRI/CT/PET scans, advanced laboratory tests, biopsies, and genetic testing. |

| Treatment | Medical care provided to cure, manage, or alleviate an illness or injury. | Inpatient hospital stays, surgeries, cancer treatments (chemotherapy, radiotherapy), prescription drugs, and physical therapy. |

| Ancillary | Supportive services and equipment necessary for treatment and recovery. | Durable medical equipment (e.g., crutches, wheelchairs), home nursing care, ambulance services, and specialised rehabilitation programs. |

| Emergency | Urgent medical care required for sudden, unexpected, and potentially life-threatening situations. | Emergency room visits, urgent surgeries following an accident, and medical evacuation to a centre of excellence. |

Understanding this structure helps you view your policy not as a list of restrictions, but as a comprehensive toolkit for managing your health anywhere in the world.

Treatment: Restoring Your Health

The final pillar is Treatment. This is the broadest and often most financially significant category of qualified medical expenses. It covers all interventions doctors undertake to cure, manage, or mitigate a diagnosed illness or injury.

This is where your IPMI policy demonstrates its true value, covering everything from minor procedures to life-saving operations. A robust plan ensures that when treatment is necessary, your sole focus is on recovery—not the escalating hospital invoices.

Crucially, this pillar also includes essential follow-up costs, such as prescription medications and specialised medical equipment, creating a complete financial shield while you return to full health.

Navigating Common Exclusions and Gray Areas

A lesson many high-net-worth professionals learn through experience is that knowing what your International Private Medical Insurance (IPMI) excludes is as critical as knowing what it covers.

It is a significant error to assume that a premium policy provides unrestricted access to any and all health-related services. Even the most comprehensive plans have defined boundaries, and it is here that one finds a minefield of exclusions and ambiguous areas. Misunderstanding these distinctions can result in unexpected six-figure liabilities.

This is where the concept of qualified medical expenses serves as your most important filter. It separates what is medically essential from what the insurance industry deems elective, experimental, or simply a luxury.

The Bright Line of Exclusions

Let us begin with the unambiguous categories. Certain services are almost universally excluded from IPMI policies. Insurers view these as falling outside the scope of treating a diagnosed medical condition. Understanding these is a fundamental aspect of sound financial planning.

Common exclusions include:

- Elective Cosmetic Procedures: Any intervention performed purely for aesthetic enhancement, such as a facelift or liposuction, is excluded. It is not a qualified medical expense.

- Experimental Treatments: If a drug or procedure has not received full regulatory approval or is still in clinical trials, your insurer will not provide coverage.

- Discretionary Wellness Therapies: Luxury spa treatments, non-prescribed alternative therapies, or wellness retreats, while beneficial, will not be covered.

Consider an expatriate executive in Singapore who arranges a week at a five-star rehabilitation retreat following surgery, assuming it is fully covered. They are often shocked to discover the insurer only paid for the core medical services, classifying the luxury amenities as non-essential. The executive is now liable for the remainder of that substantial bill. You can learn more about how to identify these pitfalls in our guide on watching out for common policy exclusions.

The Crucial Concept of Medical Necessity

We now arrive at the most significant gray area in insurance: medical necessity. This is the core principle that governs nearly all coverage decisions. It stipulates that a service must be appropriate, reasonable, and essential for diagnosing or treating your condition according to accepted standards of medical practice.

Critically, it is the insurer who retains the final authority on what meets this standard, not you or even your physician.

Medical necessity is the gatekeeper of your coverage. A treatment may be recommended by a world-class physician, but if the insurer’s internal guidelines do not deem it necessary, it will not be classified as a qualified medical expense.

This is where being proactive becomes your most powerful financial tool.

For any major procedure, obtaining pre-authorisation from your insurer is not merely advisable; it is non-negotiable. This process eliminates guesswork by securing a definitive "yes" or "no" on coverage before the liability is incurred.

It is a straightforward process: your physician submits a detailed treatment plan and medical justification, and the insurer provides its official approval. By taking this single step, you transform ambiguity into financial certainty and shield your assets from a potentially devastating, unexpected expense.

How Global Tax Regimes Impact Your Bottom Line

For high-net-worth professionals, the phrase “qualified medical expense” is governed by two distinct authorities. The first is your insurance provider, which determines reimbursement based on your policy, as we have discussed.

The second, and often more financially significant, is the tax authority in your country of residence. This is where the matter becomes complex, as the definition of a deductible medical expense changes dramatically upon crossing a border.

Assuming these two definitions are identical is a costly error. An expense your IPMI plan covers without issue might be completely non-deductible from a tax perspective. Conversely, a service your insurer denies could potentially offer a tax advantage. Mastering these jurisdictional nuances is a core component of wealth preservation.

A Tale of Three Financial Hubs

Let us examine how this scenario plays out in three of the world's major expatriate destinations: the United Kingdom, Singapore, and Hong Kong. The differences are stark and illustrate how significantly your net cost for healthcare can fluctuate depending on your tax domicile.

One country might view private health insurance as a public good and offer generous tax relief for premiums. Another might consider it a personal luxury, offering no relief whatsoever. These philosophical differences have tangible financial consequences.

Here's a concise breakdown of the landscape:

United Kingdom: In the UK, if an individual personally pays for private medical insurance, there is generally no tax relief available on the premiums. If an employer provides it, it is typically considered a taxable benefit-in-kind. This means you will pay income tax on the value of the policy, increasing your overall tax liability.

Singapore: Singapore takes a more structured, though limited, approach. While reliefs for earned income exist, there is no broad, specific tax deduction for private medical insurance premiums or out-of-pocket medical costs in the manner found in other jurisdictions. The tax system is not structured to subsidise private healthcare choices.

Hong Kong: Hong Kong is the most straightforward of the three, but not favourably for deductions. The city’s simple tax regime offers no tax deductions for an individual's private medical expenses or insurance premiums. The entire cost is borne by the individual, paid with post-tax income.

The concept of a "qualified medical expense" is not a fixed global standard. For tax purposes, it is a fluid concept defined by local legislation. This creates both risks and opportunities for anyone managing their finances across borders.

The key takeaway is clear: a one-size-fits-all approach is ineffective. A strategy that maximises tax efficiency in London is entirely irrelevant in Hong Kong.

Ultimately, aligning your healthcare expenditures with local tax laws is not something that can be done retroactively. It demands proactive planning with advisors who are fluent in these cross-border complexities. This ensures your healthcare decisions not only protect your health but also support your wider financial objectives and maintain compliance in every jurisdiction you inhabit.

Mastering Documentation for Seamless Claims

In the domain of International Private Medical Insurance, your documentation serves as the key to reimbursement. Meticulous record-keeping is not a mere administrative task; it is the critical final step in managing your healthcare finances, separating a swift, successful reimbursement from a frustrating delay.

Precision and thoroughness dictate the outcome. For every single medical interaction, you must secure a core set of documents. This is non-negotiable—it is the bedrock of a successful claim. You are essentially building an unassailable case for why an expense qualifies for reimbursement.

The essential file for any claim must include:

- Itemised Invoices: A detailed breakdown of every single service and charge, not merely a final bill with a total amount.

- Proof of Payment: Receipts or bank statements confirming you have settled the account.

- Physician’s Notes: A formal letter or report from your physician confirming the medical necessity of the treatment received.

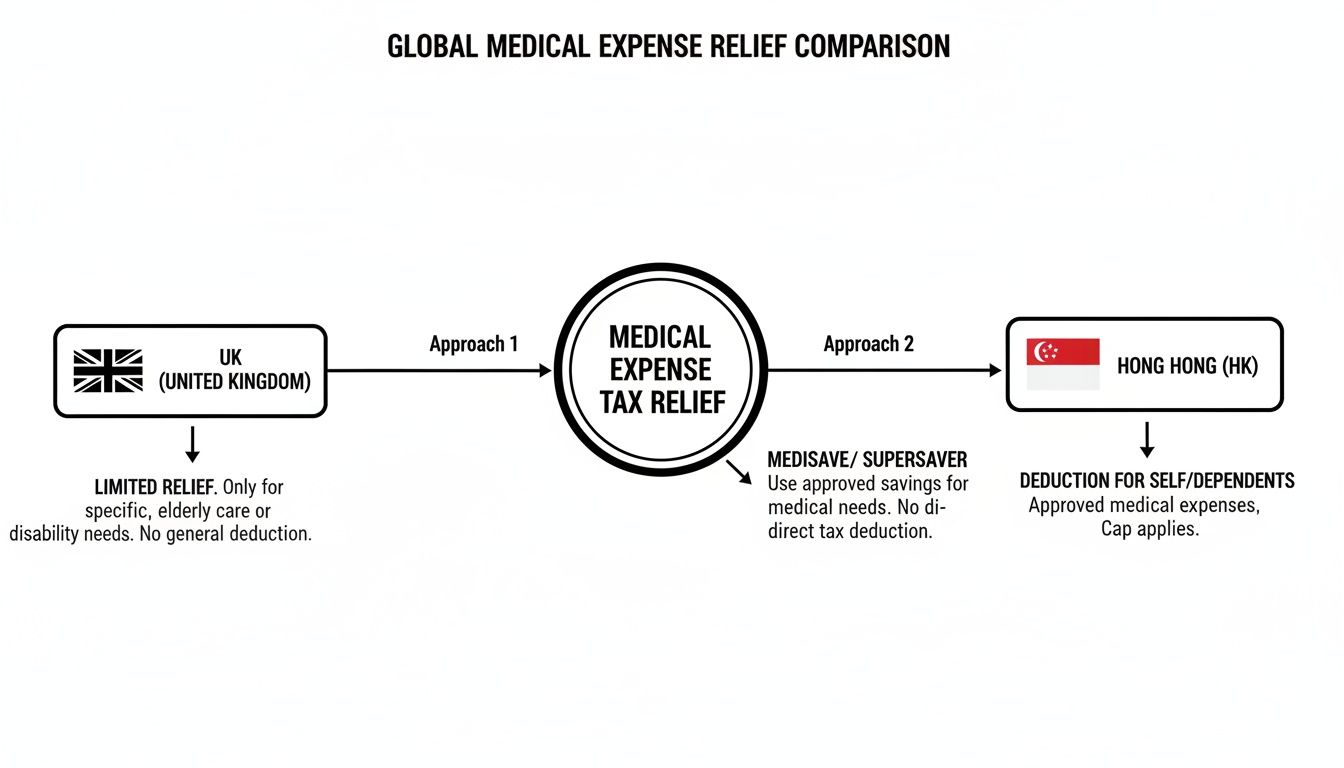

This flowchart provides a high-level view of how medical expense relief is handled across key financial hubs. It serves as an effective visual reminder of the importance of this subject.

As illustrated, the tax treatment of your medical costs varies significantly by location, which underscores the need for a region-specific financial strategy.

Proactive Record-Keeping for the Global Professional

For a busy professional operating between cities, managing this paperwork can feel like an additional burden. However, modern tools can completely transform this process. Secure digital applications allow you to scan and organise records the moment you receive them, building a complete and defensible file for any future claim. It all begins with mastering receipt capture to create clean, legible digital copies.

Imagine this: you are a private wealth manager in Singapore and have just received a significant hospital invoice. Consider that recent data from the IQVIA Institute shows global spending on medicines is projected to reach approximately $2.3 trillion by 2028. This trend, driven partly by high-cost specialty drugs, is reshaping what we consider qualified medical expenses on a global scale. It is a stark reminder of why documenting every single prescription and service is absolutely critical for reimbursement.

A well-documented claim is a claim that is paid promptly. By treating record-keeping with the same rigour you apply to your professional life, you protect your time, your finances, and your peace of mind.

This disciplined approach ensures you are always prepared, whether for a routine check-up claim or a complex, multi-stage treatment. It also places you in a much stronger position when dealing with processes that require advance approval. To gain a better understanding of how this works in practice, you may find our deep dive on pre-authorisation and direct settlement helpful. Taking these small steps provides a significant degree of clarity and control over your healthcare finances.

Frequently Asked Questions

When navigating International Private Medical Insurance (IPMI), numerous detailed questions arise. For professionals operating across borders, obtaining clear, direct answers is essential. Let's address some of the most common queries to reinforce how you can manage your global healthcare finances effectively.

Are Preventative Screenings Considered Qualified Medical Expenses?

Yes, they are. For most high-quality IPMI plans, preventative care is not an ancillary benefit but a core feature. This typically covers executive health check-ups, comprehensive annual physicals, important cancer screenings (such as mammograms or colonoscopies), and necessary vaccinations for travel and general health.

Insurers catering to global professionals understand that proactive health management is a sound risk-mitigation strategy. The key detail to monitor, however, is policy limits—some plans may cap the frequency or total cost of these screenings. Always review your specific policy documents to see precisely what is covered and ensure your proactive health measures are fully considered qualified medical expenses.

How Does Pre-Authorization Impact A Claim Status?

Consider pre-authorisation as the financial clearance from your insurer. It is a critical step that officially confirms an upcoming procedure is a qualified medical expense before the service is rendered. For any significant, non-emergency treatment—such as elective surgery, an MRI, or a planned hospital stay—the vast majority of insurers will mandate their approval in advance.

Failing to complete this step can have serious financial consequences. It could lead to an outright claim denial, even for a service that would have otherwise been fully covered. Obtaining pre-authorisation transforms financial uncertainty into a guarantee, protecting you from an unwelcome liability following a major medical event.

Can Dental And Vision Care Be Claimed As Qualified Expenses?

This depends entirely on the structure of your specific IPMI policy. Most standard or basic plans will treat routine dental and vision care—such as cleanings, fillings, or regular eye examinations—as separate from core medical coverage, meaning they are not included.

However, many high-net-worth individuals opt for premium policies that offer comprehensive dental and vision benefits as a rider. If you have this add-on, services like check-ups, restorative dental work, and prescription eyewear become qualified medical expenses. It is also important to note that medically necessary procedures, such as dental surgery following an accident, are more likely to be covered under the main policy. As always, the most prudent course of action is to verify coverage first.

What Is The Recourse For A Denied Claim?

A claim denial is not necessarily the final outcome. Your first step should be to carefully review the insurer's explanation of benefits, which will state the precise reason for the denial. Frequently, the issue is a simple administrative error, such as missing documentation, a typographical error, or an incorrect billing code submitted by the physician’s office.

If you are certain the service should be considered a qualified medical expense under your policy, you have the right to file a formal appeal. This involves submitting a letter to your insurer that clearly outlines your case, accompanied by all supporting medical records and documentation you can assemble.

An initial claim denial can often be overturned with a well-prepared appeal. The key is to provide clear, compelling evidence that demonstrates the medical necessity and contractual eligibility of the service.

This is where having an experienced insurance broker as your advocate can be invaluable. A dedicated professional can help you navigate the complex appeals process, working to ensure your covered expenses are reimbursed as they should be. That expert guidance can make all the difference in achieving the correct outcome.

For high-net-worth professionals, managing global health requires more than just a policy—it demands an expert partnership. At Riviera Expat, we provide the clarity and control you need to make confident healthcare decisions. Explore our specialized IPMI solutions and secure your peace of mind by visiting https://riviera-expat.com.