At its core, the choice between an HMO and a PPO comes down to a fundamental trade-off: structured cost control versus premium flexibility.

A Health Maintenance Organization (HMO) operates with precision, centralizing your care within a defined network of providers. Accessing specialist care requires coordination through your primary physician first. In contrast, a Preferred Provider Organization (PPO) grants you the freedom to consult nearly any provider you choose—in or out of network—without requiring a referral, though this autonomy commands a higher premium.

HMO vs PPO a Strategic Overview for Global Executives

For global executives and high-net-worth individuals, this is not merely a choice of health plan. It is a critical financial and logistical decision. Whether you are based in Singapore, London, or Hong Kong, your selection directly impacts your access to premier medical care, the predictability of your expenses, and the degree of administrative complexity you encounter. This decision is an integral component of your wealth management and global mobility strategy.

To make an informed choice, one must first understand the operational philosophies underpinning these two models. One prioritizes streamlined, predictable costs through a tightly managed network. The other provides expansive access and autonomy, for which you pay a premium for that privilege.

Core Differentiators

The optimal framework for you hinges on a few key factors. An HMO can be conceptualized as a coordinated system designed for maximum efficiency and cost containment. A PPO, in contrast, functions more like an open market, affording you broad access but placing more of the responsibility for managing care and costs squarely on your shoulders.

This distinction is of paramount importance for anyone who travels frequently or demands immediate access to specific specialists without navigating administrative hurdles.

The core trade-off is clear: HMOs offer financial certainty and coordinated care within a fixed system, while PPOs provide unparalleled freedom of choice, which is essential for a mobile, executive lifestyle.

To make these differences tangible, let's deconstruct how each plan handles provider access, referrals, and costs. This high-level overview provides a clear framework for determining which model aligns with your lifestyle before we delve into the finer details.

HMO vs PPO at a Glance Core Differentiators

This table provides a concise comparison, highlighting the crucial differences that matter most to expatriates and global professionals.

| Feature | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) |

|---|---|---|

| Provider Network | Restricted to a specific network of contracted doctors and hospitals. | A broad network of "preferred" providers, with options to see non-network providers. |

| Primary Care Physician (PCP) | Required. Your PCP is the gatekeeper, managing all aspects of your care. | Not required. You can self-direct your care and see specialists without a PCP. |

| Specialist Referrals | Required. You must obtain a referral from your PCP to see a specialist. | Not required. Direct access to specialists is a key feature of the PPO model. |

| Out-of-Network Coverage | None, except in documented medical emergencies. | Covered, but at a higher out-of-pocket cost (higher deductibles and coinsurance). |

| Cost Structure | Generally lower monthly premiums and predictable, fixed co-payments. | Higher monthly premiums with variable costs depending on in-network or out-of-network usage. |

| Ideal User Profile | An individual or family seeking cost predictability and residing long-term in one location. | A global professional or frequent traveler who values provider choice and direct specialist access. |

Ultimately, the right plan is the one that aligns with your lifestyle, financial strategy, and personal approach to managing your healthcare.

Deconstructing the HMO and PPO Operational Models

To fully grasp the strategic difference between an HMO and a PPO, one must look beyond the acronyms to their fundamental architecture. Each model delivers healthcare through a distinctly different mechanism, and that design directly impacts your access to physicians, your out-of-pocket costs, and the administrative burden you assume.

An HMO is built around a core principle: coordinated, managed care. It is a closed system, deliberately structured to contain costs while promoting preventive health.

A PPO, conversely, is engineered for flexibility and choice. It offers a much less rigid experience, placing you in control of your healthcare journey—though that freedom is accompanied by a different financial structure. Understanding these mechanics is the key to selecting a plan that genuinely serves your needs.

The HMO Model: Centralized Coordination and Cost Control

The heart of the HMO model is the Primary Care Physician (PCP). This physician is not merely a contact for minor ailments; they act as the central coordinator—the "gatekeeper"—for all of your healthcare needs. They are the architect of your entire care plan within the HMO’s network.

This means if you require the services of a specialist, such as a cardiologist or a dermatologist, you cannot simply schedule an appointment directly. Your first point of contact is always your PCP, who will evaluate your condition and, if deemed necessary, provide a mandatory referral to a specialist within their network.

This gatekeeper system achieves two objectives very effectively:

- It ensures coordinated care. With a single physician overseeing all aspects of your health, a holistic view is maintained. This helps prevent fragmented care and redundant diagnostics that can occur when multiple specialists operate independently.

- It controls costs. By managing referrals, the model curtails unnecessary specialist visits and expensive procedures. This is the primary reason HMO premiums are often significantly lower.

This tightly integrated structure is incredibly effective at managing expenses. For perspective on the market, the global individual health insurance sector is a substantial one, and models focused on cost containment are a significant part of it. For individuals prioritizing budget predictability, this model often results in considerable savings compared to more flexible plans. You can find more insights on global insurance market trends that highlight these dynamics.

The entire HMO philosophy is built on the belief that superior health outcomes and predictable costs are best achieved through a structured, physician-led system. It represents a trade-off: you exchange a degree of autonomy for streamlined, cost-effective care.

Under this model, all your care—from routine check-ups to complex surgeries—is strictly confined to a specific list of contracted doctors and hospitals. Should you decide to seek services outside this network for anything other than a verified medical emergency, you are responsible for 100% of the cost.

The PPO Model: Autonomy and Expanded Access

The PPO model dispenses with the gatekeeper system entirely, placing you in complete control. You are not required to designate a PCP, and you have the freedom to see any specialist you wish, whenever you deem it necessary—no referral is required.

This autonomy is the PPO’s principal advantage. If you are a global executive who needs to consult a top-tier specialist in another city or even another country, you can do so directly. The model is designed for individuals who value immediate access and choice above all else.

The PPO network is also structured differently. While it features a list of "preferred" in-network providers where you receive discounted rates, its defining feature is its coverage for out-of-network care.

If you choose to see a doctor or utilize a hospital outside the preferred network, the PPO will still contribute to the cost. Your share of the expense—through higher deductibles, co-payments, and coinsurance—will be significantly larger, but you will not be left without any coverage. This flexibility is a critical safety net that HMOs do not offer, and it is the core difference between HMO and PPO plans.

A Granular Financial Comparison of Plan Costs

To accurately assess the difference between HMO and PPO plans, we must move beyond the surface and examine the total financial exposure. For high-net-worth individuals, this analysis extends beyond the monthly premium. It is about managing financial risk and ensuring cost predictability. These two models offer entirely different philosophies on structuring your healthcare investment.

The most conspicuous cost is the premium—the fixed monthly payment for your coverage. PPO plans almost invariably carry higher premiums. This is because you are paying for the administrative overhead of managing a larger network and the financial risk the insurer assumes by covering out-of-network care. In essence, you are paying for the option of flexibility, whether you exercise it or not.

Conversely, an HMO's lower premium is a direct result of its tightly controlled, efficient structure. By confining you to a specific network and routing specialist visits through a Primary Care Physician (PCP), the insurer can negotiate favorable rates and eliminate non-essential spending. This makes the HMO a powerful tool if budget certainty is a priority in your financial planning.

Dissecting Out-of-Pocket Liabilities

Beyond premiums, the true financial narrative is revealed through out-of-pocket expenses—the costs you incur when you actually utilize medical services. This is where the two plan types truly diverge and where the total cost of ownership becomes apparent.

An HMO is engineered for financial predictability. Its structure typically includes:

- Low or No Deductibles: You often do not have to pay a significant amount out-of-pocket before your insurance begins to cover costs.

- Fixed Co-payments: You will pay a set, predictable fee (for example, $50) for a physician's visit or a specialist appointment.

- Minimal Coinsurance: The percentage of costs you share with the insurer is typically low or zero for in-network care.

This model effectively places a ceiling on your financial exposure for any given service within the network. It creates a clear, predictable cost framework. You can gain a deeper understanding of how these costs function in our guide on excesses and deductibles.

A PPO, however, introduces layers of financial variability. Its cost structure is tiered and depends entirely on where you receive care. For in-network services, you will still have deductibles, co-payments, and coinsurance, but they are generally higher than an HMO's. The significant financial bifurcation occurs when you decide to go outside the preferred network.

With a PPO, out-of-network care is a calculated financial risk. While the plan offers coverage, it comes with a separate, often substantially higher, deductible and a greater coinsurance percentage, leaving you with significantly more financial responsibility.

The Critical Risk of Balance Billing

The most significant—and most frequently underestimated—financial risk associated with a PPO plan is balance billing. This occurs when an out-of-network provider bills you for the difference between their full charge and the amount your PPO plan agrees to pay. Since these providers have no contract with your insurer, they are not obligated to accept the insurer's rate as payment in full.

For instance, an out-of-network specialist charges $2,000 for a procedure. Your PPO’s "allowable amount" for that service is only $800. After you pay your share of the $800, the provider can legally issue you a bill for the remaining $1,200. This single factor can generate thousands of dollars in unexpected costs, compromising even the most meticulous financial plan.

Ultimately, the financial equation is clear. An HMO offers a disciplined, predictable cost structure, making it the superior choice for anyone who values budget certainty and is comfortable operating within a curated network. A PPO provides unmatched freedom but demands a higher tolerance for financial risk and the potential for large, unpredictable out-of-pocket costs—especially if you value access to providers outside its network.

Provider Networks and International Freedom: The Defining Choice

For any global professional, the substantive difference between an HMO and a PPO comes down to one element: the provider network. This is not merely a technical detail—it dictates your freedom of movement, your access to top specialists, and your ability to receive care where and when you need it. For executives operating across borders, this is a non-negotiable consideration.

An HMO network is a closed ecosystem. It consists of a curated list of doctors, specialists, and hospitals that have contracted with the insurer to provide services at pre-negotiated rates. As a member, you are strictly confined to this list. If you step outside of it for anything other than a verified medical emergency, you are personally responsible for 100% of the bill.

This highly structured approach is excellent for cost control, but it carries significant limitations. The model is perfectly suited for someone on a long-term assignment in a single, well-resourced city like Singapore, where the in-network providers are top-tier. However, its rigidity presents a substantial challenge for professionals whose lives are more fluid.

The PPO Advantage: Flexibility and Control

A PPO network, on the other hand, is built on the principle of choice. You are provided with a broad list of "preferred" in-network providers where your costs are lowest. But its defining characteristic—and the primary reason it appeals to high-net-worth individuals—is the explicit freedom to see any provider, anywhere, whether they are in-network or not.

This out-of-network capability is the decisive factor for a global professional. Consider an executive who divides their time between London and New York. With a PPO, they can consult specialists in both cities without financial penalties or administrative roadblocks. If a health issue arises while traveling, they can see a trusted expert immediately rather than attempting to locate a physician in an unfamiliar, restrictive network or waiting until they return home. You can learn more about evaluating different international medical networks in our guide.

Of course, this flexibility comes at a price. While out-of-network care is covered, it will be subject to a separate, usually higher, deductible and coinsurance. You are essentially paying more of the bill in exchange for complete control over your healthcare.

A Global Perspective on the Network Divide

The profound divide between these two models becomes even more apparent on a global scale. In major markets, there is a consistent tension between cost-containment models and those that prioritize choice. For instance, in the U.S. employer-sponsored market, which is a significant indicator of plan design trends, PPOs are a dominant model, chosen by a large percentage of covered employees precisely for their provider flexibility.

This dynamic illustrates the core challenge that an expatriate banker in London or a family office manager in Singapore must resolve: the trade-off between cost savings and global access.

The fundamental difference is one of philosophy. An HMO curates a high-quality but finite ecosystem for you, while a PPO provides the tools and financial backing for you to construct your own, borderless network of care.

For a globally mobile professional, the value of this freedom is immense. The ability to see a top specialist in Zurich or obtain a second opinion in Boston without being constrained by network rules provides a level of control and confidence that is absolutely essential. The PPO model is designed for a life that is not confined to one place, making it the default choice for those who demand unrestricted access to the best medical expertise the world has to offer.

Practical Scenarios: When to Choose an HMO or PPO

Theoretical understanding has its limits. The true test of an HMO or PPO is its performance under the pressures of your actual life. The right choice is deeply personal, contingent on your career demands, family needs, and your preferred approach to health management.

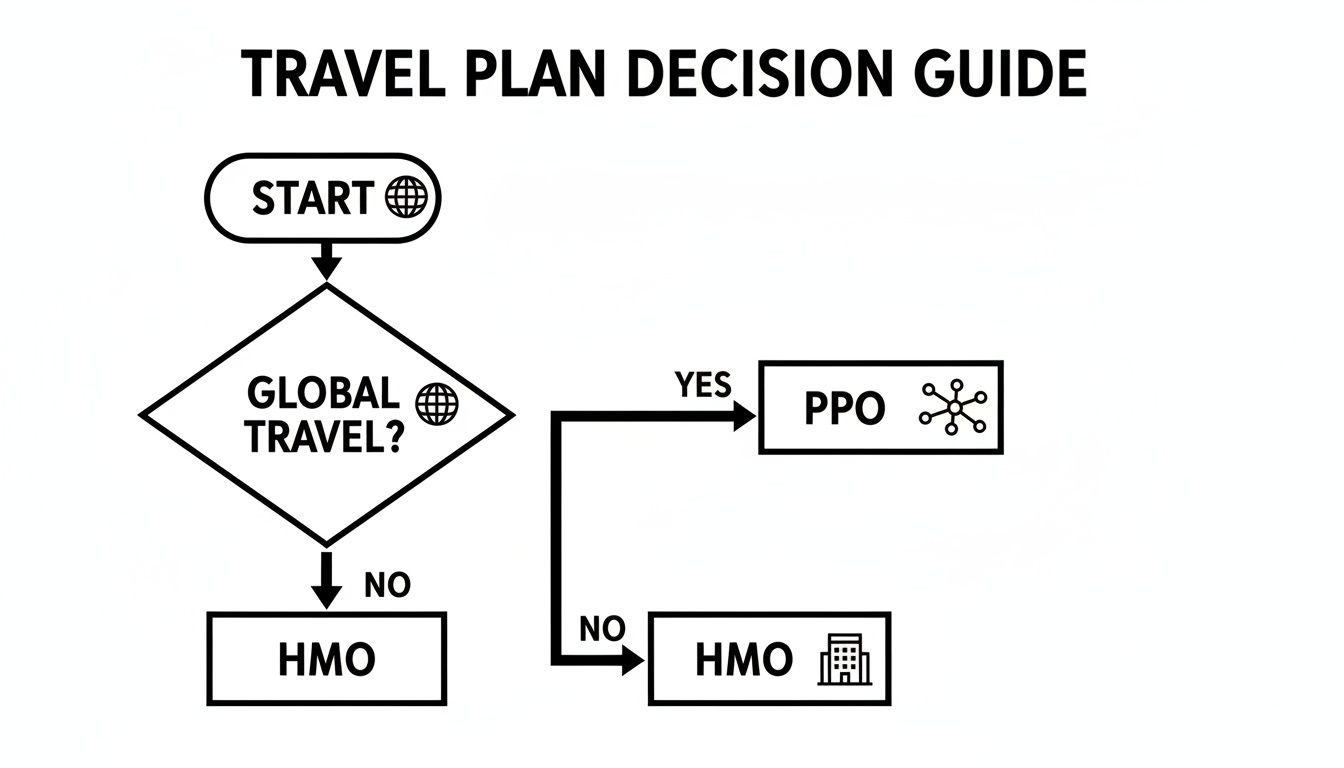

Let's examine a few real-world profiles to see how these plans function in practice. This simple decision guide helps visualize the core difference based on one of the most critical factors for any global professional.

As illustrated, the need for borderless healthcare access is often the primary filter. If your life involves frequent global travel, the flexibility of a PPO immediately becomes more compelling.

Scenario One: The Globetrotting Investment Banker

Consider an investment banker based in London. Her role requires last-minute travel to New York, Hong Kong, and Zurich for client engagements. Her schedule is demanding, and her time is her most valuable asset. For her, obtaining immediate, high-quality medical care without administrative friction is not a luxury—it is a professional necessity.

In this situation, a PPO plan is the only logical choice. The freedom to see a specialist in any city without first securing a referral from her primary care physician (PCP) in London is mission-critical. If a health issue arises in New York, she cannot afford to wait for an appointment with her UK-based doctor.

The PPO’s out-of-network coverage serves as her safety net. It empowers her to consult a world-renowned expert, regardless of their network affiliation, ensuring she receives the absolute best care available. The higher premium is a calculated business expense, purchasing unparalleled flexibility and peace of mind. Any potential for higher out-of-pocket costs is an acceptable trade-off for maintaining control.

Scenario Two: The Family Office Manager Relocating to Singapore

Now, consider a family office manager moving to Singapore for a five-year assignment with his spouse and two young children. His priorities are stability, predictability, and ensuring his family has access to excellent, well-managed healthcare. He does not anticipate frequent international travel for work.

For this family, an HMO-style plan aligns perfectly with their objectives. Singapore possesses a world-class healthcare system, and a quality HMO network will grant them access to top-tier pediatricians, specialists, and hospitals. The mandatory PCP becomes a significant asset, acting as the central coordinator for the family's health—managing everything from routine vaccinations to specialist referrals.

The coordinated care model of an HMO is particularly beneficial for families with young children, providing a structured and holistic approach to healthcare management that simplifies decision-making and ensures continuity of care.

The financial predictability of an HMO is another major advantage. With fixed co-payments and low deductibles, the family can budget for healthcare costs with near-perfect certainty. This is vital when managing household finances in a new country. Since they will be in a single location with a robust medical infrastructure, the lack of out-of-network coverage is not a significant drawback. The difference between HMO and PPO here is stark: one offers managed stability, while the other provides a level of freedom they simply do not require.

Decision Framework: The Core Factors

Ultimately, the choice depends on how you weigh a few critical variables. Your personal situation dictates which plan structure delivers superior value.

Ask yourself these key questions:

- How often do I travel internationally for business or leisure? Frequent travel heavily favors the flexibility and out-of-network coverage of a PPO.

- Do I value direct access to specialists? If you wish to see a specialist without obtaining a referral first, a PPO is essential.

- How important is cost predictability in my financial planning? An HMO offers greater certainty with its fixed co-payments and minimal deductibles.

- Am I relocating with a family? The coordinated care and single point-of-contact (the PCP) in an HMO can simplify managing healthcare for all family members.

By applying these scenarios and questions to your own circumstances, you can move beyond abstract comparisons and make a strategic choice that supports both your professional ambitions and personal well-being.

Beyond Domestic Plans: The IPMI Solution

For any individual living a global life, the HMO versus PPO debate is a useful starting point, but it is only that—a start. These domestic plan structures were never designed for the realities of an expatriate lifestyle. The true solution for a high-net-worth individual living and working across borders is International Private Medical Insurance (IPMI).

IPMI can be understood as an evolution that incorporates the best principles from both models—the cost management of an HMO and the provider choice of a PPO—and applies them on a global scale. These plans are not constrained by national borders or restrictive local networks. Instead, they deliver a higher level of customization, true worldwide coverage, and a service designed for individuals who require absolute certainty in their healthcare, regardless of their location.

Translating Needs into Global Coverage

An IPMI plan is less a product one buys off the shelf and more a healthcare strategy one builds. An expert advisor assists in translating your specific professional and personal requirements into a plan that functions seamlessly. It is about achieving the right balance—obtaining the cost controls you might appreciate in an HMO while retaining the complete freedom characteristic of a PPO.

This hybrid model allows for smart, strategic decisions:

- Geographic Sculpting: You can design a worldwide plan that specifically excludes high-cost countries like the USA to manage premiums, or you can opt for total global access if your needs require it.

- Benefit Customization: Your plan can be built from the ground up to cover specialized services that domestic insurance would not contemplate.

- Deductible Structuring: You can fine-tune deductibles to align with your personal risk tolerance and overall financial strategy.

For global executives who require bespoke healthcare or are managing their family’s care from afar, this level of detail is paramount. It is even possible to complement a plan with specialized private medical nurse services, demonstrating the profound degree of customization available.

IPMI effectively delivers the best of both worlds—cost control where needed and premier access where it matters most. It moves beyond the binary choice of HMO versus PPO into a realm of true strategic healthcare planning.

Navigating these sophisticated options requires expertise. The role of an advisor is to cut through the complexity and ensure your final plan is a perfect match for your career, family, and financial objectives. This process transforms health insurance from a necessary expense into a powerful asset that actively supports your life abroad. You can learn more about the significant benefits of international private medical insurance in our detailed guide.

Answering Your Questions About Global Health Plans

When evaluating global health plans, a few key questions invariably arise. For high-net-worth individuals and successful expatriates, receiving clear, direct answers is non-negotiable. You must understand precisely how international PPO- and HMO-style plans operate to make a sound financial decision.

Clarifying these details ensures your coverage genuinely fits your life, rather than forcing your life to conform to your coverage. The answers highlight the fundamental difference in philosophy between the two plan types: one is built around structured cost control, while the other is designed for premium flexibility.

Are International PPO-Equivalent Plans Always More Expensive?

Not necessarily, although plans with broad provider choice do tend to have higher base premiums than their more restrictive counterparts. The true determinant of cost is the level of customization.

You have several levers to adjust the cost. For instance, selecting a higher deductible, choosing regional over worldwide coverage, or excluding high-cost countries like the USA can reduce the premium significantly. A knowledgeable advisor can help structure a plan that provides comprehensive access without being cost-prohibitive.

How Is Emergency Care Handled Differently?

In a true, life-threatening emergency, both plan types will cover you at the nearest capable facility, regardless of its network status. You receive the necessary care without delay.

The divergence occurs in post-stabilization or follow-up care. An HMO-style plan will require you to transfer to an in-network hospital as soon as you are medically stable. A PPO-equivalent, conversely, affords you the freedom to remain with the out-of-network provider, although your out-of-pocket costs will be higher. To fully grasp the available options, understanding What Is International Health Insurance is an excellent place to start.

A major life event, such as moving to another country, typically creates a Special Enrollment Period. This is a critical opportunity to re-evaluate your healthcare needs and switch plan types outside the standard annual renewal window.

Can I Change Between Plan Types Mid-Year?

Generally, no. You are typically committed to your plan until the annual open enrollment period.

However, significant life events—such as an international relocation—can trigger a Special Enrollment Period, which provides a window to make a change. Most private international medical policies operate on an annual renewal cycle, which presents the ideal time to consult with an advisor, reassess your situation, and ensure your coverage remains perfectly aligned with your needs.

At Riviera Expat, we excel at transforming your specific requirements into a perfectly tailored international health plan. Our purpose is to find you the ideal balance between global access and financial efficiency. Schedule a consultation today to gain confidence in your global healthcare strategy.