For the discerning global professional, International Private Medical Insurance (IPMI) is not merely a safety net; it is a critical component of a sophisticated international lifestyle. Yet, the term ‘pre-existing condition’ often introduces a layer of complexity that can compromise the very security you seek.

In precise terms, a pre-existing condition is any medical ailment, injury, or symptom for which you have sought advice, diagnosis, care, or treatment prior to the inception of your new health insurance policy. This encompasses everything from a managed chronic illness to a resolved historic injury.

Defining Your Medical Starting Point

Consider your medical history the unique blueprint of your health. When you apply for IPMI, the insurer’s task is to interpret that blueprint. This is not an intrusive search for reasons to deny coverage. Rather, it is a meticulous risk assessment designed to construct a policy that is both equitable for you and financially sustainable for the insurer.

This is where the concept of a "pre-existing condition" becomes paramount. It is a broad classification. It covers well-managed chronic conditions like hypertension or diabetes, but it also includes acute injuries such as a fractured bone from a decade ago. It even extends to symptoms for which you may have sought medical advice, irrespective of whether a formal diagnosis was made.

Why Insurers Scrutinise Medical History

The financial stakes are substantial for both you and the insurer. An error in this initial stage can lead to a catastrophic outcome later: a rejected claim precisely when you require support most.

The travel insurance sector offers a cautionary tale. According to data from the Association of British Insurers (ABI) for 2018, non-disclosure of pre-existing medical conditions was a leading factor in denied travel insurance claims. This statistic alone underscores why insurers conduct such a rigorous assessment.

Your complete medical history is the foundation of your policy. Full disclosure is not a mere formality; it is the strategic imperative that guarantees your coverage will perform without fail when it is needed.

The following table provides an overview of how insurers typically assess common conditions. These are general guidelines, not immutable rules, but they offer a valuable perspective on the underwriting landscape.

How Common Conditions Are Viewed by Insurers

| Condition Category | Examples | Typical Insurer Consideration |

|---|---|---|

| Chronic Conditions | Diabetes, Hypertension, Asthma, Heart Disease | Often results in specific exclusions or premium loadings. Insurers evaluate control, stability, and treatment history. |

| Musculoskeletal | Past back injuries, joint replacements, arthritis | May lead to exclusions for the specific body part or condition. Recent surgeries or ongoing physiotherapy are key assessment factors. |

| Mental Health | Anxiety, Depression, Bipolar Disorder | Highly variable. May be excluded or subject to limits on therapy or medication. Recent hospitalisations are a significant factor. |

| Cancer History | Any form of cancer, including those in full remission | Typically results in a permanent exclusion for cancer and related conditions. Securing coverage is exceptionally challenging. |

| Acute/Resolved Issues | Fractured bones, past infections, minor surgery | Usually accepted without issue if fully resolved with no expectation of recurrence and documented as such. |

Each insurer possesses its own risk appetite and underwriting criteria, meaning outcomes can vary significantly between providers.

How It Shapes Your Application

This forensic examination of your medical past is known as underwriting, and it directly determines the final terms of your insurance policy. Understanding this process is the foundational step toward applying with confidence.

As you evaluate your options, leveraging a detailed private healthcare comparison UK can provide valuable context on how different firms approach underwriting. By adopting a transparent and strategic stance from the outset, you can transform a potentially complex application into a clear path toward securing your health and peace of mind, anywhere in the world.

The Four Outcomes of Medical Underwriting

When you submit an application for international health insurance with a declared medical history, you are initiating a sophisticated risk assessment. The underwriter evaluates your health profile to determine the terms of the engagement.

This process, known as medical underwriting, almost invariably culminates in one of four distinct outcomes. Familiarity with these possibilities is not merely a technicality; it is a strategic necessity. It allows you to anticipate the insurer's decision and formulate your response, ensuring no surprises when the formal offer is presented.

Outcome 1: Full Coverage at Standard Rates

This is the optimal outcome. The insurer assesses your medical history, finds no areas of significant concern, and extends an offer of full coverage at standard terms. Your policy is issued without specific restrictions or additional costs related to your health history.

This is most common for minor, fully resolved issues from many years prior—for instance, a fractured arm during university that healed without complication. It may also apply to exceptionally well-managed, stable conditions where your medical reports demonstrate a long history of stability, indicating to the underwriter that you present no material additional risk.

Outcome 2: Coverage with a Premium Loading

A frequent outcome for manageable yet ongoing conditions is an offer with a premium loading. In this scenario, the insurer agrees to cover your condition but increases your premium to offset the higher anticipated risk.

This is a precise risk adjustment. For example, an executive with well-controlled hypertension may be offered a policy that covers all future cardiovascular events, but the premium could be 15% to 50% higher than the standard rate. This loading is meticulously calculated based on your condition's stability, age, and treatment history. You receive the comprehensive coverage required, but the price reflects the elevated statistical probability of a claim.

Outcome 3: Coverage with an Exclusion

Another common path is an offer that includes a specific exclusion. This means the policy will cover you for all eventualities except for costs related to your declared pre-existing condition. The insurer effectively isolates and removes that specific risk from your policy.

For instance, an individual with a history of back problems may secure a policy that excludes all treatments for their lumbar spine. While this provides broad protection against unforeseen illnesses or accidents, you remain financially responsible for any issue related to your back. Insurers often apply exclusions for conditions likely to require expensive, ongoing, or elective treatment.

This strategic segmentation of risk is increasingly critical. According to a report by Precedence Research, the global health insurance market was valued at US$2.67 trillion in 2023 and is projected to reach US$5.23 trillion by 2033, driven by escalating healthcare costs. For high-net-worth individuals, securing unambiguous terms on pre-existing conditions is vital in this expanding market. You can explore more on these market dynamics in the Global Insurance Market Report.

Outcome 4: Outright Decline

Finally, the least desirable but sometimes unavoidable outcome is a decline. This occurs when an underwriter concludes that the risk associated with your pre-existing condition is too high or unpredictable to insure under any terms.

This is typically reserved for severe, complex, or unstable conditions, or for individuals managing multiple serious health issues concurrently. A recent diagnosis for a major illness where the long-term prognosis is uncertain will often result in a decline, at least until a significant period of stability can be demonstrated.

Choosing Your Underwriting Strategy

For an individual with a pre-existing condition, securing the right international health coverage is not a passive exercise. It is a strategic decision. Success requires understanding the two primary methodologies insurers use to review your application: Moratorium Underwriting and Full Medical Underwriting (FMU).

Each approach presents a distinct trade-off between expediency, upfront certainty, and the level of disclosure required. For a high-net-worth professional, this choice is critical. It determines your application timeline and, more importantly, the long-term reliability of your health protection. Ambiguity in your coverage is a liability you cannot afford.

The Expedited Path of Moratorium Underwriting

Moratorium underwriting is the "fast track" option. It provides a quicker, less invasive route to securing a policy, often without requiring a detailed medical questionnaire. Instead of an upfront deep dive into your history, the insurer imposes a waiting period—typically 24 months—for any pre-existing conditions you have experienced in the recent past (usually a five-year lookback period).

This is effectively a "wait-and-see" arrangement. The insurer defers the underwriting decision. If you remain entirely free of symptoms, treatment, and medical advice for that specific condition throughout the moratorium period, it may become eligible for coverage thereafter.

The speed is alluring, but it is accompanied by significant uncertainty. You will not know definitively if your pre-existing condition is covered until you file a claim. At that point, the insurer conducts a retroactive review of your medical history, which can lead to unwelcome surprises when you are most vulnerable.

A moratorium policy shifts the burden of proof to the future. It is a calculated risk where you trade upfront administrative effort for a period of ambiguity. This may be acceptable for a minor, long-resolved issue, but it is an imprudent gamble for anyone with a known, chronic, or significant health concern.

The Certainty of Full Medical Underwriting

Full Medical Underwriting (FMU) is the antithesis of the moratorium approach. This process is founded on absolute transparency from day one, leading to a definitive and binding outcome. It requires you to provide a complete and detailed account of your medical history at the outset. The insurer will review your health records, perhaps request a report from your physician, and then render a clear decision on your coverage.

This upfront diligence results in a policy where the terms are unequivocally defined. There is no guesswork. You will know precisely which conditions are covered, which may be subject to a premium "loading," and which will be specifically excluded. For senior professionals managing global responsibilities, this level of clarity is non-negotiable.

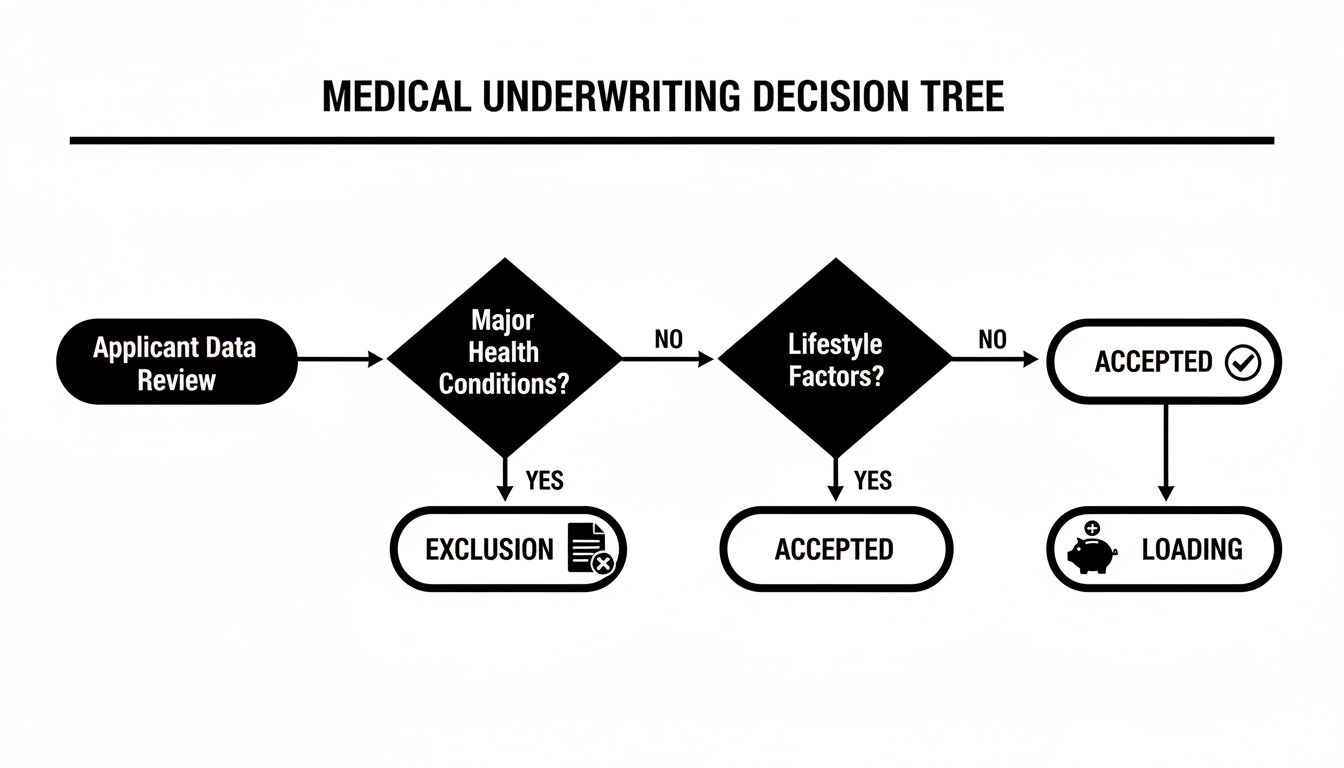

This flowchart illustrates the structured decisions an underwriter makes during the FMU process based on the health information you provide.

As demonstrated, full disclosure leads to a clear outcome, entirely removing the dangerous uncertainty inherent in other underwriting methods.

Moratorium vs Full Medical Underwriting: A Strategic Comparison

Selecting the appropriate strategy is contingent on your personal health history and your tolerance for risk. FMU is the gold standard for certainty, whereas a moratorium offers a faster—but far less predictable—alternative.

The table below delineates the key differences to facilitate an informed choice.

| Feature | Moratorium Underwriting | Full Medical Underwriting |

|---|---|---|

| Application Process | Fast and simple. Minimal health questions are asked at the start. | Requires a detailed medical questionnaire and full disclosure. |

| Initial Certainty | Low. Coverage for pre-existing conditions is an unknown "maybe." | High. The terms of your coverage are explicitly defined from day one. |

| Claim Process | Potentially complex. A claim triggers a retroactive review of your medical history. | Streamlined. The insurer has already made its decision on coverage. |

| Best For | Minor, fully resolved health issues where future treatment is highly unlikely. | Anyone with known, chronic, or significant pre-existing conditions. |

| Key Downside | The risk of a claim being denied for conditions that surface during the waiting period. | A longer application process due to the detailed and thorough review. |

Ultimately, for any professional whose financial and personal well-being depends on robust health protection, the deliberate and transparent path of Full Medical Underwriting is almost invariably the superior strategic choice. It transforms a potential gamble into a structured negotiation, leaving you with a policy you can rely upon with absolute confidence.

The Uncompromising Importance of Full Disclosure

In the realm of high-stakes finance, integrity is the bedrock of any successful transaction. This same principle governs premium health insurance. When applying for International Private Medical Insurance (IPMI), the full and accurate disclosure of your medical history is not a mere formality—it is the single most critical action to secure a policy that will perform as intended.

Failing to disclose a pre-existing condition is analogous to constructing an investment portfolio on flawed data. The structure may appear sound initially, but the foundation is compromised and is guaranteed to fail under pressure. In insurance, that pressure materialises the moment you file a significant claim.

The Consequences of Omission

The assumption that omitting a minor or long-resolved health issue is inconsequential is a dangerous miscalculation. Insurers conduct forensic investigations when major claims are submitted. If an undisclosed condition is discovered—regardless of its perceived insignificance—they are contractually entitled to act.

This can result in several catastrophic outcomes:

- Claim Denial: The insurer can refuse to cover your treatment, leaving you liable for substantial, unexpected medical expenses.

- Policy Rescission: In more severe cases, the insurer can rescind your policy entirely, voiding it ab initio (from the beginning), as if it never existed.

- Reputational Damage: A finding of non-disclosure or fraud can be recorded in industry-wide databases, making it exceedingly difficult to obtain coverage from other insurers in the future.

These consequences invariably manifest at the most inopportune time—when you or a family member requires urgent medical care. The financial and emotional fallout can be devastating, completely negating the security you sought to establish. For a more detailed analysis of how policy terms function, our guide on understanding medical policy exclusions provides essential context.

A Proactive Strategy for Disclosure

Approaching disclosure with diligence and absolute transparency transforms it from a procedural burden into a strategic advantage. It ensures the resulting policy is robust, reliable, and fundamentally sound. Your objective is to provide the underwriter with a complete and organised view of your health.

Here are practical steps to collate and present your medical information effectively:

- Compile a Comprehensive Timeline: Document every significant medical event, including diagnoses, treatments, surgeries, and consultations. Note the dates, the names of physicians and facilities, and the outcomes.

- Gather Supporting Documents: Obtain copies of relevant medical records, consultation notes, and laboratory results. For managed conditions like hypertension, providing recent readings that demonstrate stability is highly advantageous.

- Be Explicit and Detailed: Avoid ambiguous language. Instead of stating "stomach issues," specify "diagnosed with gastritis in 2019, treated with medication, symptom-free since." Clarity eliminates ambiguity and facilitates a fair, informed underwriting decision.

Full disclosure is not an admission of weakness; it is a demonstration of integrity. It empowers the insurer to construct a policy that accurately reflects your risk profile, resulting in coverage you can trust implicitly.

By being forthright, you control the narrative. An organised, honest application builds credibility with the underwriter and often leads to more favourable terms than if the same information were discovered independently. This proactive approach is the hallmark of a professional who leaves nothing to chance, ensuring their global health protection is as secure as any other asset in their portfolio.

How Global Financial Hubs Treat Pre-Existing Conditions

An International Private Medical Insurance (IPMI) policy does not exist in a vacuum. Its practical value is profoundly influenced by the regulatory and healthcare framework of your country of residence. For global professionals, understanding how different financial hubs approach insurance pre-existing conditions is a matter of strategic importance.

The regulations in London are distinct from those in Dubai, and these variations can dramatically impact your coverage options and financial liabilities. This jurisdictional analysis is essential for making informed decisions and ensuring your health protection is robust, irrespective of your location.

London: A Mature and Flexible Market

The United Kingdom, particularly London, operates a highly developed and competitive private insurance market. For expatriates, there are no mandatory health insurance laws, affording you significant freedom of choice.

This environment has cultivated a diverse array of IPMI products with varied underwriting approaches.

In London, both Moratorium and Full Medical Underwriting are commonplace. This flexibility allows you to select a strategy that aligns perfectly with your health profile. The market's maturity also means insurers are experienced in assessing complex medical histories, often resulting in more nuanced outcomes than a simple exclusion.

Singapore: A Hybrid System of Public and Private Care

Singapore presents a far more structured system. While private health insurance is not mandatory for all visa categories, it is a practical necessity for accessing the country's world-class private medical facilities.

The government promotes personal responsibility for healthcare costs, but its programs like MediShield Life are designed primarily for citizens and permanent residents.

For expatriates, IPMI providers in Singapore are adept at navigating the intersection of public and private healthcare. Underwriting is typically rigorous, with a strong preference for Full Medical Underwriting to ensure absolute clarity from inception.

Navigating the specific regulations of each financial hub is not just about compliance; it's about optimizing your global health strategy. The right policy in one jurisdiction may be suboptimal in another, making location-specific expertise indispensable.

Dubai: Mandatory Coverage and Stricter Regulations

The United Arab Emirates, specifically Dubai, employs a different model driven by government mandate. Health insurance is compulsory for all residents, and employers are obligated to provide a basic level of coverage.

This has created a unique market where local regulations heavily influence insurer operations.

The Dubai Health Authority (DHA) establishes minimum standards for all health plans. Critically, for policies issued in Dubai to its residents, pre-existing conditions must be covered after an initial six-month waiting period. While this provides a baseline safety net, the mandated plans are often limited. For senior professionals requiring comprehensive global coverage, supplementing the local plan with a robust IPMI policy—which undergoes its own independent underwriting—is standard practice.

Hong Kong: A Laissez-Faire Private Market

Hong Kong’s insurance market mirrors its free-market economy. Similar to the UK, there is no mandatory health insurance requirement for expatriates. The market is dominated by private insurers offering an extensive range of IPMI plans, providing ample choice.

Underwriting practices are diverse, with both Moratorium and FMU readily available. However, given the exceptionally high cost of private healthcare in Hong Kong, insurers are remarkably diligent when assessing pre-existing conditions.

Full, transparent disclosure is paramount to securing a reliable policy. The absence of a robust public safety net for expatriates makes a fully underwritten, comprehensive IPMI plan a critical asset for anyone residing in this dynamic financial hub.

Your Path to Securing Global Health Protection

Navigating the complexities of international health insurance with a pre-existing condition can seem daunting. However, it is a manageable challenge. Success hinges on a clear understanding of insurer perspectives, a strategic choice between underwriting methods, and an unwavering commitment to transparency.

A pre-existing condition is not an insurmountable barrier. It is simply a variable in a complex risk equation that requires careful and strategic management. With a well-defined approach, you can secure robust global coverage that protects both your health and your financial well-being.

From Complexity to Clarity

The initial step is to reframe the issue. Securing the right insurance pre existing conditions coverage is an exercise in risk management—a discipline familiar to every senior professional. By presenting your medical history with absolute clarity and integrity, you transform the dynamic from a passive application to an active negotiation. This proactive stance is what leads to favourable outcomes.

A pre-existing condition does not define your insurability; your strategy for managing and disclosing it does. The goal is to move from a position of uncertainty to one of absolute control over your global health protection.

Achieving this level of control is not a solo endeavour. Just as you would engage a wealth manager for your portfolio, you require an expert IPMI broker. A specialist understands how to translate your health profile into the language of underwriters, discreetly sound out different insurers, and structure your application for the optimal result. To understand how the components of a policy integrate, you can explore the various international private medical insurance benefits uncovered in our detailed guide.

Engaging this expertise transforms a stressful and confusing process into one of clarity and confidence. It ensures the policy you secure is not merely a document, but a reliable asset that truly supports your life and ambitions abroad.

Frequently Asked Questions

When navigating international health insurance with a complex health history, pertinent questions will arise. For high-level executives and professionals, obtaining precise answers is critical for sound financial and personal decision-making. Here are the most common queries we address for our clientele.

Will a Minor Past Condition Affect My Application?

Even a seemingly trivial event—such as a fractured bone a decade ago that healed perfectly—must be declared on your application. While it is highly unlikely to impact your premium or result in an exclusion, insurers require a complete medical history to construct an accurate risk profile.

This disclosure is a matter of establishing trust with your insurer. Full disclosure demonstrates integrity and creates a solid foundation for your policy, eliminating any potential for a future claim to be disputed based on an omission.

What if I Develop a New Condition After My Policy Starts?

This scenario is the fundamental reason for acquiring premium health insurance. Any medical issue diagnosed after your policy’s inception date is considered a new condition, not pre-existing. It will be covered under the full terms of your plan, subject only to your chosen benefit limits and any standard policy exclusions.

The purpose of the policy is to shield you from the financial impact of unforeseen health problems that may arise once your coverage is securely in place.

Can I Switch Insurers with an Existing Exclusion?

Yes, it is possible to move to a new insurer even if your current policy includes an exclusion for a pre-existing condition. However, this requires a meticulous strategic plan. You will need to complete a new application, disclose the condition again, and undergo a fresh underwriting assessment by the new provider.

The outcome is not guaranteed. Depending on the stability of the condition and your recent medical records, a new insurer might offer more favourable terms, impose the same exclusion, or present a less attractive offer. This transition should always be managed by a specialist broker to ensure there is no inadvertent gap in your coverage.

Is a Moratorium Policy a Good Option for Me?

A moratorium policy can be suitable for individuals with minor, long-resolved health issues, especially those who have been symptom-free and have not required treatment for a significant period. The primary advantage is a faster, simpler application process.

However, this expediency comes at the cost of certainty. You will not have definitive confirmation of coverage for the condition until you need to make a claim and have successfully completed the waiting period without any related issues. For senior professionals who require absolute clarity, Full Medical Underwriting (FMU) is almost always the superior choice. FMU provides a definitive decision on coverage from day one, eliminating the ambiguity that high-net-worth individuals cannot afford.

At Riviera Expat, we cut through this complexity to give you clarity and control. Our expert guidance ensures you get the precise global health protection your lifestyle demands. Contact us today for a complimentary, in-depth consultation.