For the high-net-worth professional leading a global life, standard health insurance is not merely insufficient; it is a significant liability. Such plans are not engineered for the complexities of an international career. True expats health insurance, known professionally as International Private Medical Insurance (IPMI), is a distinct class of protection. It is designed from the ground up to deliver seamless, premium medical care across borders, serving as a financial and logistical fortress that local or travel plans cannot replicate.

Understanding Expats Health Insurance And IPMI

As a senior professional operating in a hub like Singapore or Dubai, your healthcare requirements transcend the capabilities of a local policy. Local plans are geographically tethered; the moment you cross a border for a board meeting or a family holiday, your coverage effectively vanishes. Travel insurance is a temporary solution for acute emergencies, not a strategic framework for comprehensive, ongoing medical care.

IPMI operates on an entirely different echelon. Consider it less a standard policy and more a global access key to elite medical care. It is constructed for a life in motion, providing consistent, high-level coverage whether you are at your primary residence in Asia, visiting headquarters in London, or taking a well-deserved sabbatical.

Why IPMI Is A Strategic Asset

For expatriates, particularly those in senior roles, navigating foreign healthcare systems presents a landscape of variables. In many global hubs:

- Public systems may be inaccessible or highly restrictive for non-citizens.

- The quality of care can vary dramatically between public and private institutions.

- Elite private hospitals, while offering exceptional care, command commensurately high costs. A major surgical procedure in a leading Hong Kong hospital can readily generate a six-figure invoice.

This is where the strategic value of IPMI becomes unequivocally clear. It is not merely a safety net; it is an essential component of your personal and financial infrastructure, ensuring a medical event does not derail your career or erode your wealth. You can explore the specifics of international private medical insurance in our detailed guide.

An IPMI policy is engineered to eliminate uncertainty. It provides the assurance that you and your family can access premier medical care, with direct billing arrangements, wherever your life and career take you—without facing prohibitive out-of-pocket expenses.

The demand for this level of protection is accelerating. The global population of international migrants reached an estimated 281 million in 2020. The need for robust IPMI is surging, especially in key financial centers across the Asia-Pacific region and the Middle East, driven by the growing number of professionals and high-net-worth individuals relocating for strategic opportunities.

Decoding Your Core Coverage and Essential Benefits

Insurance documentation is often dense and opaque. To truly assess a premium expat health insurance plan, one must cut through the abstract terminology and evaluate its real-world application. A well-designed International Private Medical Insurance (IPMI) policy is not a mere checklist of benefits; it is a bespoke shield crafted for a demanding, global lifestyle. The integrity of that shield begins with its core coverages, which must function flawlessly, irrespective of your location.

The absolute bedrock of any policy is inpatient care. This encompasses any treatment requiring hospital admission. Imagine you are on a business trip in Hong Kong and require an emergency appendectomy. A top-tier IPMI plan ensures you are not directed to the nearest public ward. Instead, you are admitted to a leading private facility, with the insurer directly managing the costs of surgery, accommodation, and specialist fees. Your focus remains on recovery, not on the substantial six-figure bill being generated.

Next is outpatient services—any medical care that does not necessitate an overnight hospital stay. For a professional residing in London and managing a chronic condition, this could mean regular consultations with a specialist on Harley Street, advanced diagnostic imaging, and prescription medications. These costs accumulate rapidly, but a robust outpatient benefit addresses them seamlessly.

Essential Add-Ons for Comprehensive Protection

While inpatient and outpatient care form the policy's foundation, true security comes from incorporating specialised benefits that address the unique risks of an international life. These are not optional luxuries. For high-net-worth individuals and their families, they are non-negotiable components of a complete protection strategy.

Two of the most critical add-ons are medical evacuation and comprehensive maternity benefits.

-

Medical Evacuation and Repatriation: This covers the expense of transporting you to the nearest centre of medical excellence or back to your home country if local facilities are inadequate. The logistics are complex, often involving private air ambulances and dedicated medical teams. An evacuation can easily exceed $100,000, rendering this coverage indispensable.

-

Comprehensive Maternity Benefits: If you are planning to start or expand your family abroad, this is essential. It covers everything from prenatal consultations and scans to delivery in a premium private hospital and postnatal care. Considering a private delivery in a city like Singapore can cost upwards of $20,000, this benefit provides significant financial security and peace of mind.

Differentiating between standard benefits and crucial add-ons is the first step toward crafting a truly effective policy. The objective is to eliminate any potential gaps in your coverage, ensuring every plausible scenario—from a sudden emergency to planned family growth—is accounted for, protecting both your health and your assets.

What 'Comprehensive' Truly Means

The term 'comprehensive' is frequently used, but its genuine value lies in the policy's fine print. A truly comprehensive IPMI plan provides high annual limits, often in the millions of dollars, ensuring even the most expensive treatments are fully covered. It also offers broad geographic reach, allowing you to seek treatment in any country within your chosen area of cover without penalties or administrative hurdles.

This level of detail is what separates an adequate plan from an exceptional one. It is the difference between possessing basic cover and wielding a powerful tool that guarantees access to the world's best medical care. For a deeper analysis, you can explore our complete guide to understand international private medical insurance benefits in more detail. By deconstructing each component, you can precisely align a policy with your life, ensuring your protection is absolute.

How IPMI Policies Actually Work

A premium expats health insurance policy is more than a glossy brochure; its true value is demonstrated in its flawless execution during a time of need. The efficacy of any International Private Medical Insurance (IPMI) plan depends on three critical mechanics: how it assesses your medical history, its method for settling payments, and the quality of its network of medical providers.

Mastering these details is the difference between a seamless healthcare experience and a logistical nightmare of paperwork and unexpected financial liabilities.

The Underwriting Process: Defining Your Coverage

Underwriting is the foundational step where the insurer evaluates your health history to determine the terms of your policy, particularly concerning pre-existing conditions. For a discerning professional, this is a detail that must be managed with precision.

There are two primary approaches:

-

Full Medical Underwriting (FMU): This is a comprehensive evaluation. You provide your complete medical history upfront, and the insurer decides whether to cover existing conditions, exclude them, or apply a surcharge. The principal advantage is clarity. You know precisely what is covered from day one, before any premium is paid.

-

Moratorium Underwriting: This is an expedited, deferred approach. It forgoes an initial detailed medical questionnaire. However, any condition for which you have experienced symptoms or sought treatment in the recent past (typically the last five years) is automatically excluded. This exclusion is only lifted after a continuous "trouble-free" period (typically 24 months) without symptoms, treatment, or advice for that condition. It offers speed at the cost of certainty.

For high-net-worth individuals who cannot afford ambiguity, Full Medical Underwriting is almost invariably the superior choice. It eliminates conjecture, ensuring no unwelcome discoveries arise when a claim is made.

The Claims Process: Direct Billing vs. Pay-and-Claim

The method by which your medical bills are paid is a key indicator of a premium IPMI plan. A world-class policy should be operationally invisible at the point of care, shielding you completely from the financial transaction.

The gold standard is direct billing, often referred to as a "cashless system." You present your credentials at a hospital within the insurer’s network, receive treatment, and depart. The hospital invoices the insurer directly. This is non-negotiable for major inpatient procedures, where costs can escalate into tens or hundreds of thousands of dollars rapidly.

The alternative is a "pay-and-claim" model. This requires you to settle the entire medical bill out-of-pocket and subsequently submit receipts for reimbursement. This process can be slow, create significant cash flow challenges, and add a layer of financial stress when your focus should be on recovery. For a minor consultation, it may be manageable. for anything serious, it is an unacceptable burden.

A seamless claims process is a primary indicator of a policy's quality. For high-cost treatments, direct billing is not a luxury—it is an essential mechanism that protects your liquidity and allows you to focus solely on your health.

The Provider Network: Your Global Access to Quality Care

The final, and arguably most critical, element is the insurer's provider network. This is the curated list of hospitals, clinics, and specialists worldwide that have established a direct billing relationship with your insurance company. The size, quality, and global distribution of this network determine your real-world access to premier medical care.

A superior network means you can enter a leading hospital in Singapore, London, or Dubai and receive treatment without administrative friction. This is increasingly vital as healthcare costs continue to climb. For example, according to Allianz’s 2023 Global Wealth Report, private wealth is growing robustly, particularly in Asia, fuelling demand for premium services, including private healthcare. You can read more about these global insurance market insights from Allianz to understand the broader economic forces.

Ultimately, a powerful network allows you to bypass local queues and systemic limitations, granting you immediate access to the high-calibre private care you expect.

Navigating Policy Costs and Common Exclusions

A premium International Private Medical Insurance (IPMI) policy is a strategic investment in your well-being. By understanding the factors that drive its cost, you can architect a plan that provides uncompromising protection without allocating funds to unnecessary coverage. The pricing of expat health insurance is not arbitrary; it is governed by a few logical, transparent factors.

Your personal profile and the choices you make during policy configuration are what shape the final premium. Insurers utilize clear variables that correlate directly with potential healthcare expenditures.

Key Drivers of Your IPMI Premium

Three core factors determine the cost of your policy:

-

Your Age and Medical History: This is the foundation of any premium calculation. As one ages, the statistical probability of requiring medical care increases, and premiums reflect this reality. Your medical history, especially when evaluated through Full Medical Underwriting, is also a significant component.

-

Geographic Area of Coverage: Your required area of coverage is a major cost driver. A policy that includes the USA will be substantially more expensive—often by 50% or more. This is a direct reflection of the exceptionally high cost of healthcare in the United States. If you do not anticipate spending significant time there, excluding the US is the single most effective lever for managing your premium.

-

Deductibles and Excess: A deductible (or excess) is the predetermined amount you agree to pay out-of-pocket before the insurance coverage activates. Electing a higher deductible signals to the insurer that you will manage minor claims yourself, which directly translates to a lower annual premium.

This transparent structure empowers you. By fine-tuning your geographic coverage and deductible, you can achieve the optimal balance between comprehensive protection and cost-efficiency.

Understanding Common Policy Exclusions

Knowing what your policy does not cover is as critical as knowing what it does. Exclusions are not hidden clauses intended to mislead; they are standard conditions that enable insurers to manage risk and maintain viable premium levels. Familiarizing yourself with them upfront prevents unwelcome surprises.

A well-structured IPMI policy is a fortress of protection, but every fortress has defined boundaries. Recognizing these limitations is fundamental to making an informed decision and ensuring your expectations are aligned with the reality of the coverage.

Common exclusions typically fall into logical categories. High-risk avocations like professional sports or piloting private aircraft are generally not covered under a standard plan. Elective or cosmetic procedures are also usually excluded unless medically necessary, such as for reconstruction following an accident.

Crucially, pre-existing conditions are a major consideration, handled according to your chosen underwriting method. Complete transparency regarding your medical history is vital to eliminate any ambiguity about coverage. For a more detailed examination of this topic, you can read our guide on medical conditions and policy exclusions.

This awareness is more critical than ever, as the global insurance market faces new challenges and opportunities. According to EY’s 2024 Global Insurance Outlook, insurers are navigating a complex risk environment. For an executive in Singapore or Hong Kong, this underscores the risk of relying solely on local systems, which can be strained. It elevates a robust IPMI policy with solid evacuation benefits from a luxury to an essential safeguard. Discover more insights about the global insurance outlook from EY.

A Decision Framework for Global Financial Hubs

Selecting the right expats health insurance is a strategic decision, not a simple price comparison. For a finance professional, a miscalculation can lead to significant financial exposure and logistical burdens you cannot afford.

Your decision must be anchored in the realities of your location. Every major financial centre—whether Hong Kong, Singapore, London, or Dubai—presents a unique set of healthcare challenges and opportunities.

Assessing the Healthcare Environment

In hubs like Hong Kong and Singapore, you have access to some of the world's finest private medical care. This world-class quality, however, comes with a commensurate price tag, with private care costs ranking among the highest globally. Without a robust IPMI plan, a single hospitalisation can quickly escalate into a major financial event.

London offers the exemplary NHS public system. The caveat is that waiting lists for non-urgent procedures can be extensive, making private cover the only pragmatic way to secure timely access to specialists.

Dubai mandates health insurance for all residents, but employer-provided plans are often basic. The quality and network access can be inconsistent, which is why a separate or supplementary IPMI policy is frequently necessary to access top-tier hospitals and clinics.

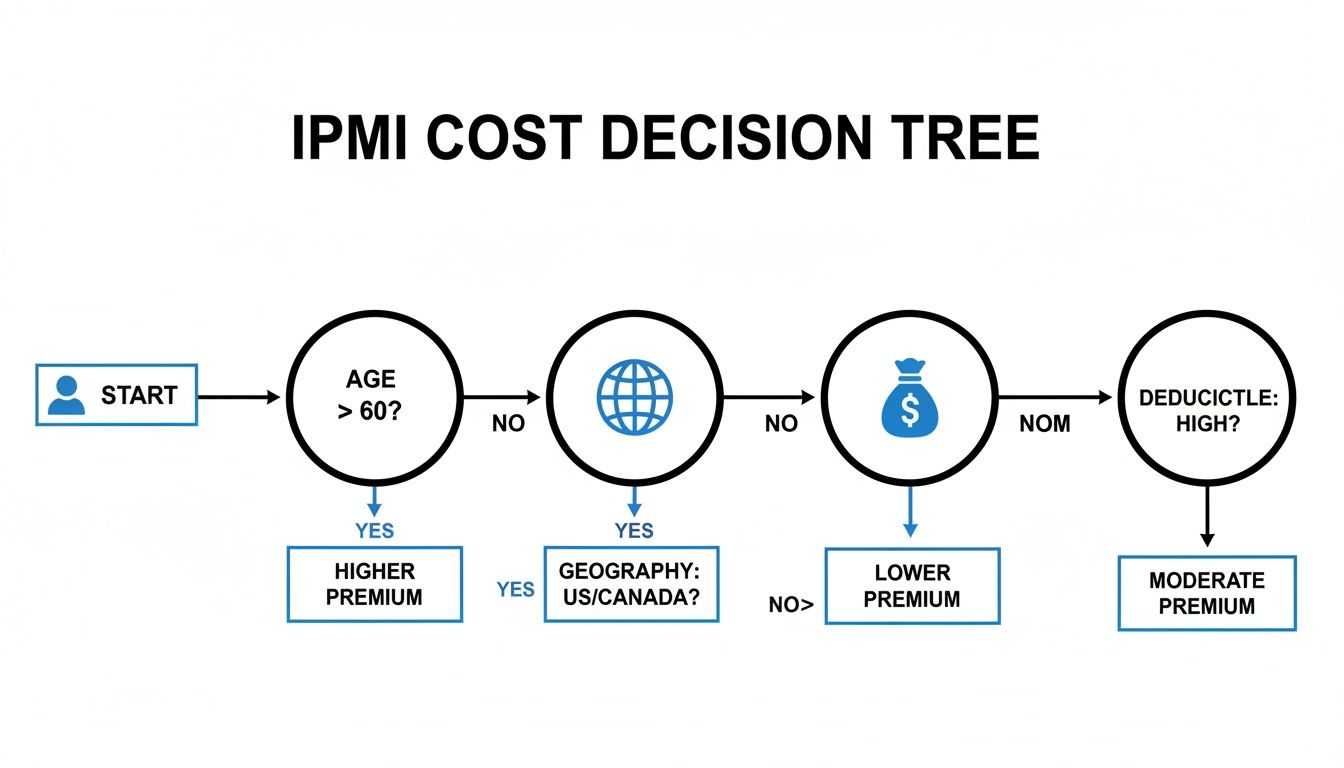

This decision tree illustrates how core factors—your age, location, and chosen deductible—directly influence your IPMI premium.

As you can see, your premium is not an arbitrary figure. It is the direct result of controllable variables, allowing you to engineer the right balance between cost and comprehensive coverage.

To provide a clearer perspective, here is a concise breakdown of the healthcare landscape in the key hubs where our clients are based.

Expat Healthcare Considerations in Key Financial Hubs

This table summarises the unique healthcare environment and key insurance considerations for expatriates in major global financial centres.

| Financial Hub | Healthcare System Snapshot | Key IPMI Consideration |

|---|---|---|

| Hong Kong | Excellent but extremely expensive private healthcare. Public system is high quality but overburdened. | High annual limits (e.g., $2M+ USD) are essential to cover potential costs. A strong network of private hospitals is a must. |

| Singapore | World-class public and private healthcare. Costs are very high, and Medisave is not for most expats. | Comprehensive inpatient and outpatient cover is critical. Check for direct billing with top hospitals like Mount Elizabeth. |

| London | Strong public system (NHS) with long wait times for non-emergencies. Private care is readily available. | IPMI is primarily for fast-tracking specialist access and elective procedures. Ensure the plan complements NHS access. |

| Dubai | Mandatory insurance for all residents. Private healthcare is the norm, with varying quality. | Employer plans can be basic. A top-up or primary IPMI plan is often needed for access to premium facilities and doctors. |

| New York | Highest healthcare costs in the world. Extremely complex insurance system (ACA-compliant plans needed). | IPMI must be specifically designed for the USA. Expect the highest premiums globally. Out-of-network costs are ruinous. |

This snapshot highlights why a one-size-fits-all approach to expat health insurance is ineffective. Your policy must be tailored to the city you call home.

Tailoring Coverage to Your Personal Profile

Your personal and professional circumstances dictate the precise requirements of your plan.

Are you a solo professional frequently travelling between continents? A policy with a vast global network and robust medical evacuation benefits is non-negotiable. It must function seamlessly whether you are at home or visiting a client overseas.

If, however, you are relocating with your family, the priorities shift. Comprehensive wellness checks, paediatric care, and extensive maternity coverage become paramount. Underestimating these needs is a common error that can lead to significant out-of-pocket expenses at the most inopportune times.

The most effective IPMI strategy is not about finding the cheapest plan. It's about architecting coverage that precisely mirrors your life. This demands a candid assessment of your family structure, travel patterns, and long-term health priorities.

A Practical Checklist for Evaluating IPMI Options

To cut through marketing rhetoric and compare policies systematically, use this checklist. It forces a direct comparison of the features that truly matter when you need to rely on your insurance.

- Network Depth in Your City: Does the plan have direct-billing agreements with the top three private hospitals where you reside? A limited local network is a significant deficiency.

- Annual and Lifetime Limits: Is the annual limit sufficiently high (e.g., $2 million USD or more) to cover a catastrophic medical event in a high-cost country?

- Medical Evacuation Specifics: Does the policy evacuate you to the "nearest centre of excellence" or only to your home country? The former provides far greater flexibility in a crisis.

- Outpatient Coverage Details: Are specialist consultations, advanced scans (MRI, CT), and physical therapy covered in full, or do they have low sub-limits? These costs accumulate quickly.

- Deductible and Co-payment Structure: How is the deductible applied? Is it per claim or per policy year? Understanding this is vital for predicting your actual out-of-pocket expenses.

- Customer Service and Claims Reputation: What is the market feedback from other expatriates regarding the insurer? Seek real-world reviews on their claims process and customer support.

By using this framework, you transform a confusing search into a clear-headed analysis. This disciplined approach ensures your final choice delivers not just a policy document, but genuine security and peace of mind.

How We Simplify Your IPMI Selection Process

Selecting the right International Private Medical Insurance is a complex, high-stakes process. It demands a significant investment of time you do not have and a level of specialised expertise you should not need to acquire.

Deciphering policy documents filled with industry jargon and comparing dozens of plans from global insurers is a formidable task, even for a finance professional accustomed to intricate details. This is where engaging a specialist adviser is not a luxury, but a strategic imperative.

At Riviera Expat, our entire focus is on eliminating this complexity. We provide IPMI brokerage services designed specifically for high-net-worth professionals in the world's financial hubs. We understand your standards are non-negotiable; you require absolute certainty in your expats health insurance plan.

A True White-Glove Service

Our approach is founded on a white-glove service model. It is not a marketing term for us; it is our operational standard.

We combine deep, one-on-one expert consultation with our proprietary comparison engine. This synergy allows us to survey the entire market on your behalf, matching world-class insurance products to your specific personal, professional, and family requirements. We perform the due diligence so you do not have to.

Your time is your most valuable asset. Our function is to protect it. We transform a frustrating, time-intensive process into a clear, intelligent, and conclusive decision, providing the control you need to secure premier health protection.

We also operate with complete transparency. Our expert advice and end-to-end support come at no direct cost to you. We are compensated by a commission from the insurance provider you select, and only after your policy is in place.

This model ensures our advice remains objective and singularly focused on one goal: identifying the optimal policy for your unique circumstances.

Our mission is to provide you with the confidence that your health, and that of your family, is protected by a plan architected for your global life. That peace of mind allows you to focus on what you do best, without reservation.

Frequently Asked Questions About Expats Health Insurance

When navigating the world of expats health insurance, several key questions invariably arise. For a high-net-worth professional, obtaining clear, precise answers is essential for protecting your health, time, and financial assets. Here are the direct answers to the questions we encounter most frequently.

Do I Need International Health Insurance If My Host Country Has Public Healthcare?

This is a logical question. Many countries offer excellent public healthcare systems, but relying on them exclusively can be a significant strategic error.

Even in premier cities like London, public systems often involve extensive waiting periods for specialist appointments and non-emergency procedures. As an executive, your time is a critical asset; waiting months for an MRI or a consultation is not a viable option.

Furthermore, access to these public systems is not always immediate or guaranteed for non-citizens. An International Private Medical Insurance (IPMI) plan circumvents these issues. It provides immediate access to the private sector, ensuring you receive premium care precisely when you need it, without bureaucratic delays.

Can I Use My Domestic Health Insurance While Living Abroad?

In short: no. Your domestic health insurance policy was designed for a different legal and regulatory environment. It is geographically constrained and almost never provides meaningful coverage once you reside overseas.

These plans are not engineered for the realities of an expatriate lifestyle. Attempting to use one abroad is a flawed strategy that will expose you to significant coverage gaps and potentially catastrophic expenses for everything from a routine consultation to a medical emergency.

On a related note, as an expatriate, safeguarding your digital security is also paramount. It is prudent to understand fundamentals like hotel WiFi safety to protect your personal and financial data.

How Much Should I Expect to Pay for Expat Health Insurance?

The cost of a robust IPMI plan varies significantly based on several critical factors:

- Your Age: Premiums are directly correlated with age, reflecting the statistical increase in health risks over time.

- Geographic Coverage: This is a major determinant. A plan including the USA will be substantially more expensive due to the exceptionally high cost of healthcare in that country.

- Level of Coverage: The breadth and depth of benefits, including annual limits and optional add-ons, will influence the premium.

- Deductible: Your deductible is the amount you agree to pay out-of-pocket before insurance coverage begins. Selecting a higher deductible is a direct method for reducing your annual premium.

To provide a real-world example, in a major hub like Hong Kong, a comprehensive plan for an individual can exceed $8,000 USD per year. For a family, that figure can surpass $23,000 USD.

The objective is not to find the cheapest plan, but the one that delivers the correct value and robust protection for your circumstances. A low premium is meaningless if the policy fails to perform during a serious medical event.

Making this choice without a clear understanding of the trade-offs is a considerable gamble. A well-designed IPMI plan is not merely an expense; it is a strategic investment in your security and peace of mind.

Navigating these decisions demands genuine expertise and a comprehensive view of the global market. Riviera Expat delivers the specialised guidance you need, supported by powerful comparison tools, to help you select the right IPMI plan with total confidence. Contact us today to secure your world-class health protection.