Just as one wouldn't embark on a significant financial investment without due diligence, approaching your health insurance with the same level of scrutiny is paramount. Verifying your coverage before requiring medical services is the most critical step you can take to prevent unforeseen and substantial financial liabilities.

This is not a mere administrative task; it is an essential component of managing your personal finances and healthcare strategy effectively.

Your Guide to Verifying Insurance Coverage

To confirm the specifics of your coverage, several reliable methods are at your disposal. The optimal choice depends on the level of detail and urgency your situation demands. Let's explore the primary strategies for obtaining this crucial information.

The Three Pillars of Insurance Verification

There are three dependable avenues for securing the answers you need: a meticulous review of your policy documents, direct communication with your insurer, or leveraging their digital platforms.

- Consult the Definitive Source—Your Policy Documents: Your policy is the binding legal agreement between you and your insurer. It serves as the ultimate source of truth. A comprehensive review will illuminate the intricate details of coverage limits, exclusions, and any specific prerequisites you must satisfy. While not the most engaging read, it is indispensable.

- Engage with an Expert—Speak Directly with an Advisor: At times, a direct conversation is the most efficient way to gain clarity. Speaking with a knowledgeable representative from your insurance company can demystify complex policy language and provide a definitive confirmation of coverage for a specific treatment.

- Utilize the Digital Interface—Online Portals: Most premium insurers provide secure online member portals or dedicated applications. These tools are exceptionally useful for rapid, real-time assessments of your policy status, monitoring your deductible accrual, and identifying in-network medical professionals.

For a quick confirmation of your deductible status, the online portal is highly efficient. However, if you are planning a complex international surgical procedure, you must combine a thorough review of your policy documents with a recorded telephone call to your insurer. Do not leave such significant matters to chance.

It is also beneficial to have a foundational understanding of the insurance industry's operational mechanics, including the strategic outsourcing of insurance processes, as this context can clarify why obtaining unambiguous, direct answers is so vital.

Selecting Your Insurance Verification Method

If you are uncertain which approach best suits your needs, this table provides a clear breakdown to facilitate a swift decision.

| Verification Method | Best For | Typical Timeframe | Key Requirement |

|---|---|---|---|

| Online Member Portal | Quick, straightforward checks (deductibles, network providers, claim status) | Instant | Secure login credentials, stable internet connection |

| Direct Insurer Contact | Complex inquiries, pre-authorizations, confirming specific procedure coverage | 15-60 minutes | Policy number, patience, clear questions prepared in advance |

| Policy Document Review | Understanding contractual fine print, exclusions, and detailed coverage limits | 1-3 hours | A copy of your full policy document (PDF or physical) |

Ultimately, the objective is to eliminate ambiguity and financial surprises. By employing the appropriate method for your specific requirements, you can proceed with your healthcare decisions with the full confidence of knowing your precise financial standing.

Reviewing Your Policy Documents with Precision

A lesson every high-net-worth individual and expatriate learns, often through costly experience, is that the insurance policy is the only source of truth. A telephone call to your provider offers convenience, but the written document—whether physical or digital—is the actual contract. Decisions based on verbal assurances are gambles; decisions based on the written terms are sound financial strategy.

This is not merely academic. Consider a scenario where you are scheduling an elective surgery in another country. A meticulous review of your policy might reveal specific geographic limitations or pre-authorization protocols that a casual phone call could easily overlook. The onus is on you to perform this due diligence.

Locating Your Core Coverage Details

Your initial action should be to locate the Summary of Benefits and Coverage (SBC). This document is designed to provide a clear, high-level overview of your plan—what is covered and your cost-sharing responsibilities. Consider it the executive summary before a deep dive into the contractual details.

With the SBC in hand, identify these essential data points:

- Policy Number and Group Number: These are the unique identifiers for your specific plan.

- Effective Dates: This confirms the precise period during which your coverage is active.

- Deductibles and Out-of-Pocket Maximum: You must know exactly how much you are required to pay before the insurer's liability begins and, equally important, the absolute ceiling on your annual expenditure.

A common misstep is assuming a procedure is fully covered simply because the facility is "in-network." Your policy document will explicitly detail cost-sharing arrangements, such as coinsurance percentages. These can result in a significant financial obligation even after your deductible has been met.

Interpreting Complex Clauses and Exclusions

Once you have mastered the fundamentals, it is time to analyze the more complex sections. Pay exceptionally close attention to any clauses detailing exclusions for specific treatments or pre-existing conditions. These are the provisions most likely to expose you to unexpected costs. For a more profound understanding of this often-convoluted language, consult our guide on how to decipher your expat medical insurance policy terms.

This level of personal review has never been more critical. The global insurance industry is a colossal market, with total life and non-life direct premiums written reaching $6.8 trillion in 2022, according to the Swiss Re Institute. As the market has expanded, insurers have implemented more rigorous verification processes to manage risk. This means the responsibility to comprehend your own policy falls squarely on your shoulders.

Engaging Directly with Your Insurer

While your policy documents establish the contractual foundation, nothing substitutes for a direct conversation with your insurer to obtain final, binding confirmation. Too many individuals have been financially compromised by assumptions. This call is not a mere formality; it is a critical measure to eliminate all doubt before you become liable for substantial medical expenses.

Approach this as a business negotiation where absolute clarity is the objective. The representative on the other end of the line possesses the definitive answers you require. Proper preparation ensures you acquire those answers efficiently and accurately.

Preparing for a Productive Conversation

Before dialing, have your policy number readily available and a single, clear objective for the call. Are you simply confirming that your plan is active, or are you seeking to verify coverage for a highly specific and potentially costly procedure?

For instance, if you are considering a new biologic drug treatment, a general inquiry about "biologics" is insufficient. You must obtain the specific CPT (Current Procedural Terminology) code from your physician to receive an accurate answer.

Arm yourself with a checklist of direct questions to maintain focus and ensure no ambiguity remains post-conversation.

- First, can you confirm my policy is active and my premiums are current?

- What are my remaining annual deductible and out-of-pocket maximum for the current plan year?

- Using CPT code [provide the specific code], can you confirm this treatment is a covered benefit?

- Does this specific physician or medical facility fall within my approved network? (You can learn more about why understanding your plan's medical networks is so crucial).

- Is pre-authorization required for this procedure, and if so, what is the exact process?

Always request a reference number for the call and the name of the representative. Follow up with a concise email summarizing your understanding and request written confirmation. This simple action creates an invaluable evidentiary trail should a dispute arise later.

Fortunately, this entire process has become more streamlined. In the US, for example, the average time to manually verify coverage has dropped significantly due to improved digital systems. Similar efficiency gains are being observed globally, with some markets reporting marked increases in customer satisfaction due to automation. You can delve deeper into these industry trends in the latest global insurance report.

Using Digital Tools for Instant Verification

Your time is your most valuable asset. Allocating it to hold times with an insurer or sifting through dense policy documents for a simple query is an inefficient use of resources. Fortunately, the era of on-demand information has permeated the insurance sector, placing direct control over your policy at your fingertips.

Your first destination should be your insurer’s secure member portal. View this not as a digital archive but as a real-time dashboard for your coverage. With a few clicks, you can instantly confirm your policy's active status, review your claims history, and ascertain your precise standing regarding your annual deductible and out-of-pocket maximum.

For expatriates and global citizens, these portals are indispensable. They offer the most rapid method for verifying in-network physicians and hospitals across different countries, which is the most effective defense against incurring exorbitant out-of-network charges.

Benchmarking and Optimizing Your Coverage

Beyond basic verification, sophisticated comparison engines provide a distinct strategic advantage. These platforms not only confirm your existing benefits but also allow you to benchmark your current plan against other premium options in the marketplace. This is critical during life transitions—such as a new international assignment or the expansion of your family.

The true power of these digital tools lies in the transparency they afford. They distill complex, jargon-laden information into an intelligible format, empowering you to make swift, informed decisions about your healthcare without the customary administrative friction.

This migration to digital verification is not a fleeting trend but a systemic industry shift. In the United States, over 90% of healthcare providers now utilize electronic eligibility verification systems. This adoption is driven by proven efficiency gains, reducing processing times by as much as 70%. These systems enable your insurer and the hospital to instantly confirm policy details, a transformative development for both patient care and claims processing. You can read more about these industry-wide advancements from The Business Research Company.

Ultimately, proficiency with these digital tools transforms how you verify insurance coverage. It evolves from a reactive chore into a proactive strategy, ensuring your policy remains perfectly aligned with your dynamic needs.

Getting the Green Light: How to Navigate the Pre-Authorization Process

Verifying your standard benefits is one level of diligence. Securing formal approval for a major medical procedure is an entirely different and more rigorous undertaking.

For specialized treatments, high-cost pharmaceuticals, or a planned surgery, a simple benefits inquiry is insufficient. This is the domain of pre-authorization—sometimes called prior authorization. Consider it a formal review process wherein your insurer must consent to the medical necessity of a service before it is rendered.

This is not a simple coverage check. That is a basic inquiry. Pre-authorization involves a clinical case that your physician submits on your behalf, complete with your medical records and a robust justification for the proposed treatment. To navigate this successfully, you must first understand what prior authorization is in healthcare.

Understanding the Approval Workflow

While your physician’s office initiates the request, your active involvement is crucial. Do not be a passive observer in a process with such significant financial implications. The procedure typically involves the submission of detailed clinical notes, laboratory results, and a formal letter explaining the medical necessity of the proposed treatment.

It is advisable to request a copy of the complete submission package from your provider's office for your records. This ensures you are aware of the exact information the insurer is reviewing.

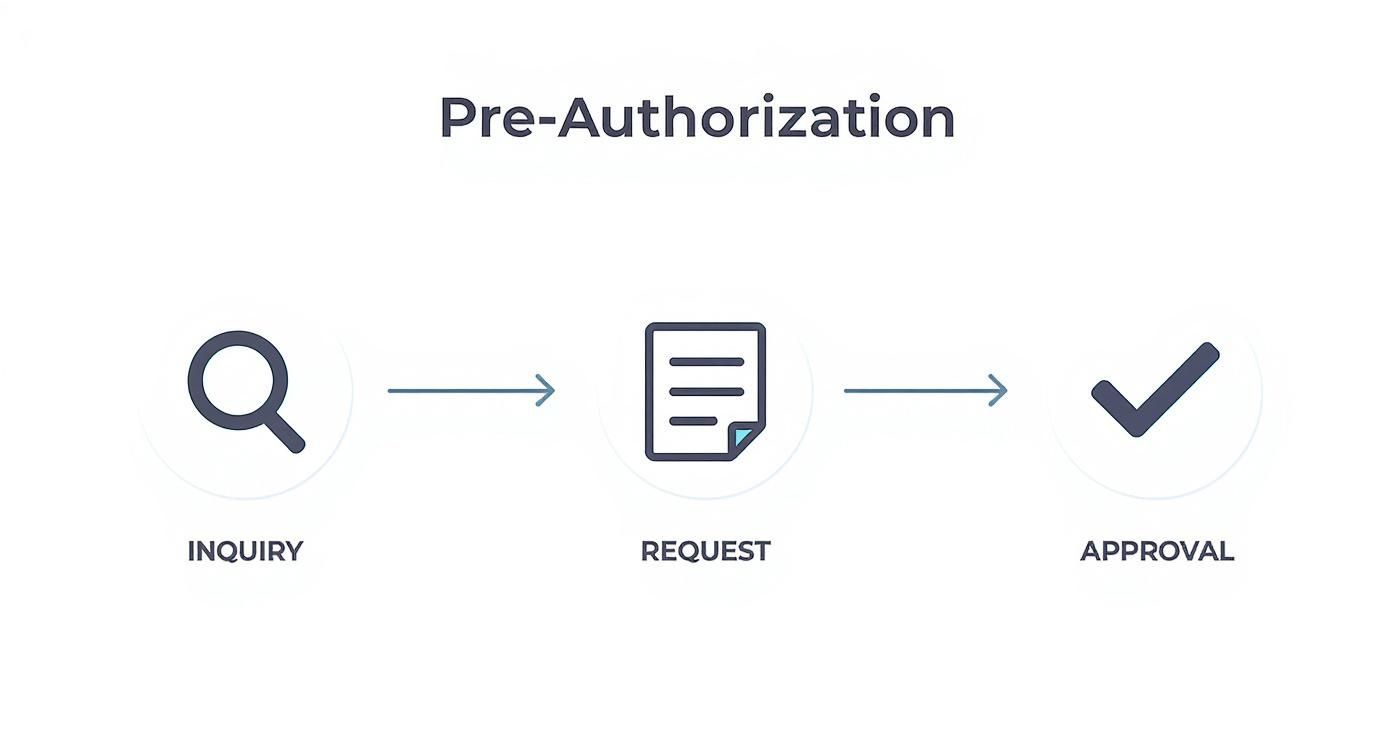

The pathway from submission to a final decision is well-defined.

This visual delineates the key stages, from your physician’s initial request to the insurance company's final approval or denial.

The duration of this process can range from a few business days to several weeks, depending on the complexity of your case. For insights into how this connects with direct payment to the hospital, we offer a detailed guide on pre-authorisation and direct settlement.

Consider a real-world example: a planned knee replacement surgery. Proceeding without an approved pre-authorization constitutes a massive financial risk. If the insurer later determines the procedure was not medically necessary according to their clinical guidelines, they will deny the claim. This would leave you personally liable for the entire bill—a cost that can easily amount to tens of thousands of dollars. Always await written confirmation of approval before proceeding.

Common Sticking Points in Insurance Verification

Even with meticulous preparation, you may encounter obstacles when verifying your insurance. Knowing how to navigate these situations is what truly distinguishes a savvy consumer. Let's address some of the most common questions and complex scenarios.

What Should I Do If My Insurance Is Denied at a Provider's Office?

The moment of being informed at a provider's front desk that your insurance has been denied can be unsettling. The first step is to remain composed. Frequently, the issue stems from a simple clerical error—a mistyped policy number or an incorrect date of birth.

Your immediate course of action is to call the member services number on the back of your insurance card. Explain the situation to the representative and ask them to confirm your policy's active status. If they can, request that they speak directly with the provider’s administrative staff to resolve the discrepancy on the spot.

If an immediate resolution is not possible, you must decide whether to pay for the visit out-of-pocket. Should you choose to do so, insist on a detailed, itemized receipt. This document is essential for filing a claim for reimbursement once the coverage issue is rectified with your insurer.

How Often Should I Verify My Insurance Coverage?

Proactive verification is the key to preventing last-minute complications. At a minimum, a comprehensive review should be conducted at the start of each new plan year. Insurers can and do alter benefits, provider networks, and cost-sharing structures annually.

Beyond this annual check-in, it is prudent to re-verify your coverage prior to any significant medical event. This includes planned surgeries, the initiation of a new high-cost treatment regimen, or a first-time consultation with a new specialist. A brief verification call before even a routine appointment is a sound practice, particularly if you have recently changed employment or insurance plans.

Can a Healthcare Provider Verify My Coverage?

Yes, and this is a standard part of their intake process. The administrative staff at any clinic or hospital will conduct an electronic eligibility check before your appointment. This is their method for confirming you have an active policy and determining your co-payment and deductible status.

However, and this is a critical distinction: their verification is for their billing purposes, not a guarantee of your benefits. It confirms the existence of a policy but does not certify that the specific service you are about to receive is a covered benefit under your plan. The ultimate responsibility for understanding your benefits and securing any required pre-authorizations always rests with you. Never rely solely on the provider’s check as a guarantee of payment.

Navigating the world of international health insurance demands a sharp eye and real expertise. At Riviera Expat, we give you the tools and clarity you need to make healthcare decisions with confidence. Check out our proprietary comparison engine to find the right IPMI policy for your life abroad at https://riviera-expat.com.