Here is a hard truth about international medical insurance: misunderstanding two key figures can have significant financial consequences. Those figures are your annual deductible and your out-of-pocket maximum. They sound similar, but confusing them is a classic, expensive mistake.

Think of it this way: your deductible is the starting line, and your out-of-pocket maximum is the finish line for your healthcare spending in a given year. The deductible is what you pay first, before your insurer contributes. The out-of-pocket maximum is the absolute final dollar amount you will pay for covered services, period.

Your Core Financial Protections Defined

For high-net-worth individuals living abroad, these two figures are not merely jargon; they are the pillars of your financial defence. They determine when your insurance begins paying its share and, critically, where your own financial responsibility ends. Mastering this sequence is non-negotiable for selecting a plan that protects both your health and your wealth, no matter where you are in the world.

To fully grasp your financial protections, it helps to understand where the industry is heading, including topics like the future of healthcare and modern patient care.

Key Distinctions at a Glance

Though they work in tandem, these terms have very different functions. One initiates your policy's cost-sharing, while the other acts as your ultimate financial safety net. To delve deeper, our guide explaining expat medical insurance policy terms breaks down more of this crucial language.

For now, let us place these two core concepts side-by-side.

Deductible vs Out of Pocket Maximum at a Glance

This table provides a direct comparison of how each term functions and what it means for your finances.

| Attribute | Annual Deductible | Out of Pocket Maximum |

|---|---|---|

| Primary Function | The fixed amount you pay before your insurance starts contributing to costs. | The absolute most you will pay for covered services in a policy year. |

| Financial Impact | It is your initial out-of-pocket spending on most medical services. | Acts as a financial safety net against high-cost or catastrophic medical events. |

| What's Included | Only includes payments for services subject to the deductible (e.g., hospital stays, diagnostics). | Includes your deductible, plus all subsequent copayments and coinsurance amounts for covered services. |

| When It Applies | At the beginning of your policy year, until the amount is fully met. | After the deductible is met and continues until the cap is reached for the year. |

In short, you meet your deductible first. After that, you share costs with your insurer (through copayments and coinsurance) until you reach the out-of-pocket maximum. Once you have reached that maximum, the insurance company covers 100% of your eligible, in-network medical bills for the rest of the policy year.

How Your Annual Deductible Actually Works

Consider your annual deductible as the first financial hurdle you must clear in your policy year. It is the specific amount you must pay out-of-pocket for medical care before your international health insurance activates and begins sharing the costs. This represents your initial share of the financial responsibility.

This does not pertain to minor, routine costs. The expenses that typically count toward meeting this deductible are significant ones: specialist consultations, hospital stays, surgical procedures, and advanced diagnostic scans like MRIs. It is worth noting, however, that many preventative services are often covered from day one, without requiring you to meet your deductible.

A Practical Scenario for an Expat Professional

Let us place this into a real-world context. Imagine an executive residing in Singapore. Her plan has a $5,000 annual deductible. A few months into her policy year, she requires a non-emergency surgical procedure that costs $18,000.

Here is how the funds are allocated:

- Initial Payment: The executive pays the first $5,000 of the hospital bill herself. This payment satisfies her deductible for the year.

- Insurer's Role Activates: Now that the deductible is met, the insurer's cost-sharing—typically coinsurance—is triggered.

- Remaining Balance: The insurance company then contributes its share of the remaining $13,000, based on the specific terms of her policy.

This example illustrates the deductible's primary function: it is a gateway. Once you pass through it, your insurer begins to take on the heavy financial lifting. For a more detailed breakdown, you can learn more about excesses and deductibles in our dedicated guide.

The core purpose of the deductible is to initiate your plan's cost-sharing benefits. It is the key that unlocks your insurer's financial contribution for significant medical care during the policy year.

The Strategy Behind High Deductible Health Plans

Opting for a high-deductible health plan (HDHP) is a calculated financial decision. These plans almost always have lower monthly premiums, which can be an intelligent way to manage costs if you are generally healthy and do not anticipate significant medical needs. The trade-off is higher upfront exposure, but the savings on premiums over the year can be substantial.

This strategy is not suitable for everyone and requires a thorough review of your finances. In 2023, the average single-coverage deductible for an employer-sponsored plan in the U.S. was $1,735, but HDHPs can easily feature deductibles exceeding $7,500. Research has shown that a significant percentage of individuals with these plans report financial strain from their healthcare costs. It is a critical factor to weigh when balancing lower premiums against a much higher initial bill. This makes the annual deductible vs out of pocket maximum decision a central component of your personal risk management strategy.

Understanding Your Out-of-Pocket Safety Net

Once you have paid your annual deductible, your insurance plan begins sharing the medical bills. However, that cost-sharing is not indefinite. This is where your out-of-pocket maximum comes into play, acting as the ultimate financial shield for your assets.

This number is the absolute most you will pay for covered medical care within your plan's network during a policy year. Think of it as the hard ceiling on your financial liability. It is your critical line of defence against the staggering costs of a major medical event or the ongoing expenses of managing a chronic illness.

When your combined payments for your deductible, copayments, and coinsurance reach this limit, your insurer covers 100% of all eligible costs from that point forward.

How Costs Add Up to Hit Your Limit

Let us return to our executive in Singapore with the $18,000 surgery. Her policy has a $5,000 deductible, 20% coinsurance, and a $9,000 out-of-pocket maximum.

Here is how the math plays out after she meets her initial deductible:

- Deductible Paid: First, she pays the $5,000 from her own funds.

- Coinsurance Phase: The remaining bill is $13,000. Her 20% share comes to $2,600.

- Total Contribution: Her deductible ($5,000) plus her coinsurance ($2,600) adds up to $7,600. That is her total expenditure for this single procedure.

She has now contributed $7,600 toward her $9,000 out-of-pocket limit. For any other covered medical services that year, she will only have to pay another $1,400 before her plan takes over completely, covering everything at 100%.

Your out-of-pocket maximum is your definitive financial backstop. It transforms potentially limitless medical expenses into a predictable, manageable figure, providing absolute clarity on your maximum annual financial exposure.

What Doesn't Count Toward This Cap

It is absolutely vital to understand what your out-of-pocket maximum does not cover. These costs are completely separate from your direct medical care and are crucial to comprehend when you are comparing an annual deductible vs out-of-pocket maximum.

These expenses typically fall outside the cap:

- Monthly Premiums: Your regular payments to maintain the policy.

- Out-of-Network Care: Any services you receive from doctors or hospitals outside your plan's approved network.

- Non-Covered Services: Treatments or procedures that your policy explicitly excludes.

Knowing these exclusions prevents unwelcome surprises in your annual healthcare budget. Regulations like the U.S. Affordable Care Act have made these protective spending caps mandatory for compliant plans. For 2025, the U.S. federal government has proposed out-of-pocket limits of $9,200 for individuals and $18,400 for families—a detail that underscores their importance in any modern insurance plan. You can find more valuable insights by reading about the deductible vs out of pocket maximum at MetLife.

Comparing Your Financial Responsibilities

To truly command your understanding of international medical insurance, you must move beyond dictionary definitions. The moment of clarity comes when you understand the sequence of your financial responsibilities—how the annual deductible and out-of-pocket maximum work together as part of a single financial journey through your policy year.

They are not competing concepts. One directly leads to the other.

This progression defines your total financial exposure in a worst-case scenario. You begin by paying for everything yourself until you meet your deductible. Only then does the insurer start contributing, and you continue to pay your share (your coinsurance or copayments) until you finally reach the out-of-pocket maximum.

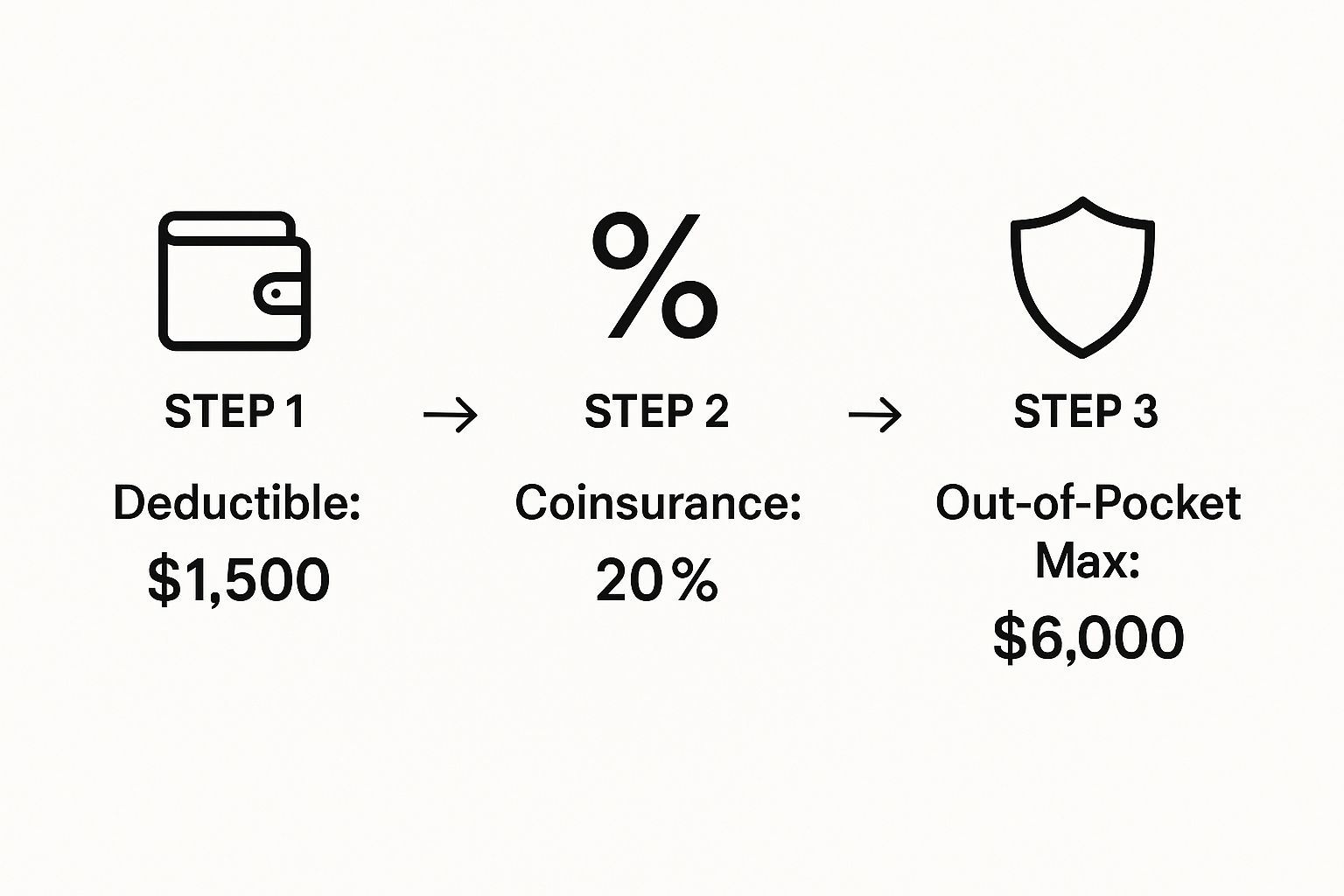

This visual breaks down that step-by-step flow, from your first medical bill to the point where your insurer takes over completely.

As you can see, your deductible is just the first piece of your total spending. It is followed by a cost-sharing phase before you reach that final cap.

The Sequence of Payment Responsibility

The relationship between your annual deductible and your out-of-pocket maximum is purely sequential. Consider it a three-stage process that plays out over your policy year, spelling out precisely who pays for what, and when.

- Stage One: Your Initial Outlay. You are responsible for 100% of your eligible medical costs until you meet your annual deductible.

- Stage Two: The Partnership Phase. Once the deductible is met, you enter the cost-sharing phase. Now, you and your insurer split the bills according to your plan's coinsurance or copayment structure.

- Stage Three: The Insurer's Full Responsibility. The moment your total payments (deductible + coinsurance + copayments) reach the out-of-pocket maximum, your financial obligation for covered, in-network care for the year is complete. Your insurer then pays 100% of all subsequent eligible bills.

This clear progression provides a framework for calculating your absolute worst-case scenario for healthcare spending in any given year—an essential figure for sound financial planning.

The core distinction is one of function: your deductible activates your insurer's financial participation, while your out-of-pocket maximum concludes your personal financial liability for the year.

Rising Limits and Your Financial Exposure

Understanding this sequence is more critical now than ever, as the financial goalposts are constantly moving. Regulatory limits on out-of-pocket maximums have been rising steadily, which directly increases the total financial risk you must be prepared to shoulder.

For example, between 2014 and 2023, the maximum out-of-pocket limit for ACA-compliant private health plans in the U.S. increased by 43%, climbing from $6,350 to $9,100. This growth has significantly outpaced the rise in wages over the same period, placing a heavier burden on policyholders.

For 2024, those maximums are set at $9,450 for individual plans and $18,900 for family plans. It is a trend worth monitoring for any professional managing global health coverage, and you can read more about how these limits have grown faster than wages.

Choosing a Plan for Your Global Lifestyle

Selecting the right international private medical insurance is not about finding the cheapest premium. It is a strategic decision based on a clear-eyed assessment of your personal circumstances. The optimal balance between an annual deductible and an out-of-pocket maximum is deeply individual—shaped by your health, your risk tolerance, and your financial strategy.

A plan that is perfect for one globally mobile professional might be an unsuitable fit for another.

The entire decision comes down to anticipating how often you will actually utilize your medical insurance. When you align your plan's cost structure with your life stage and health profile, you secure robust protection without overpaying for benefits you are unlikely to use.

Let us walk through two very different scenarios to see how this plays out in the real world.

Scenario One: The Healthy Global Professional

Picture a young, healthy investment banker who divides her time between London and Hong Kong. She rarely visits a doctor, perhaps only for an annual check-up. Her primary concern is not routine care; it is comprehensive protection against a catastrophic health event. Her goal is to maintain low fixed costs while knowing she has a powerful financial safety net.

For someone like her, a high-deductible health plan (HDHP) is an excellent solution. Here is why:

- Lower Premiums: The most apparent benefit is a much lower monthly premium. This frees up her capital for investments or other lifestyle priorities instead of allocating it to insurance costs.

- Cost-Efficient Coverage: Since she anticipates using healthcare sparingly, it is highly unlikely she will meet a high deductible in most years. This makes the lower premium a pure financial gain.

- Catastrophic Protection: Crucially, the out-of-pocket maximum still places a hard ceiling on her financial exposure in a worst-case scenario. Her assets remain shielded.

This structure is a perfect match for her low-usage profile. It provides the essential protection she needs without the drag of unnecessary ongoing expenses. It is a calculated decision based on a favourable risk assessment.

Scenario Two: The Expat Family or Individual with Ongoing Needs

Now, let us imagine a private wealth manager relocating to Singapore with his family, including two young children. Or, consider an individual managing a chronic condition that requires regular specialist visits and prescription refills.

For them, the priority shifts. It is no longer about minimising fixed costs; it is about achieving predictable medical spending. A low-deductible health plan (LDHP) is the only sensible choice here.

For anyone with predictable and recurring medical expenses, a lower deductible transforms a health plan from a simple safety net into a functional budgeting tool. It delivers financial stability and, just as importantly, peace of mind.

While the monthly premiums are higher, the lower deductible and out-of-pocket maximum bring significant advantages. This family will meet their deductible quickly through routine paediatric visits, specialist appointments, or ongoing prescriptions.

This structure gives them a much clearer picture of their total annual medical spending, preventing the shock of large, unexpected bills and ensuring they never hesitate to obtain the care they need. To see how this fits into a broader policy, you can explore what international private medical insurance benefits are uncovered in our detailed analysis. In this case, the higher premium is not an expense—it is a strategic investment in financial predictability.

How to Choose the Right Plan Structure

Choosing the right international health plan is not about chasing the lowest premium. It is a calculated financial decision. An intelligent choice means looking past the headline figures of the annual deductible vs out of pocket maximum and thoroughly analysing your own situation. You want a plan structure that provides solid protection without being financially wasteful.

It all begins with an honest assessment of your health and finances.

A Framework for Making a Smart Decision

To get this right, you must be methodical. A clear framework helps you weigh the variables that truly matter, ensuring your final choice aligns with your lifestyle and financial goals. This is not just purchasing insurance; it is about managing personal risk on a global scale.

Use these criteria to guide your thinking:

- Look at Your Health History: Be realistic about your personal and family medical history. If you have a history of significant medical needs or a predisposition to certain conditions, a plan with a lower deductible and out-of-pocket maximum is almost always the more prudent choice.

- Forecast Your Upcoming Needs: What does the next year look like for you? Are you planning to start a family? Considering any elective surgeries? When you can predict you will be using your insurance, paying a higher premium for a lower deductible is often a very sound investment.

- Check Your Financial Liquidity: Here is the critical question: If you had a major medical emergency tomorrow, could you comfortably write a cheque for the full out-of-pocket maximum without hesitation? Your honest answer reveals your true risk tolerance and indicates whether a lower-premium, high-deductible plan is a realistic option for you.

- Scrutinize the Provider Network: Ensure the plan’s network includes top-tier hospitals and specialists in the cities where you reside or travel frequently. For most of my clients, access to elite care is non-negotiable and should be a primary filter before you even begin looking at the numbers.

A truly optimized health plan is an extension of your overall wealth management strategy. It should protect your assets from unforeseen liabilities just as diligently as any other component of your financial portfolio.

Common Questions About Deductibles vs. Out-of-Pocket Maximums

Even with a solid grasp of the fundamentals, a few specific questions always arise when you are examining the figures on an insurance quote. Getting these details right is critical for planning your finances and ensuring there are no unwelcome surprises down the road.

One of the first points of confusion I often encounter is about monthly premiums. Do they count toward your deductible or out-of-pocket maximum? The short answer is no. Think of your premiums as the fee that keeps your policy active; they are completely separate from the costs you pay when you actually receive medical care.

How Policy Resets and Family Plans Work

Another question I frequently receive is, "What happens if I don't meet my deductible by the end of the year?" The answer is simple: the slate is wiped clean. Nothing carries over. Both your deductible and your out-of-pocket maximum reset to zero on the first day of your new policy period.

For anyone on a family plan, you must pay close attention to how the deductibles are structured. It is not a minor detail. Insurers typically use one of two models:

- Aggregate Deductible: The entire family must collectively meet one large deductible before the insurance starts paying its share for any family member. This means you could spend significantly more out-of-pocket before the plan's benefits activate for anyone.

- Embedded Deductible: This model is usually more manageable. An individual within the family only has to meet their own, smaller deductible (which is part of the larger family deductible). Once they reach that personal threshold, the plan starts paying for their care, even if the total family deductible has not been met.

The choice between an aggregate and an embedded deductible will have a direct, significant impact on your family’s cash flow. An embedded model almost always provides faster access to your cost-sharing benefits, especially if one person has higher medical needs than the rest of the family.

Getting this distinction right is fundamental. It determines how you forecast your potential spending and ensures the plan you choose actually works for your family's health and financial situation.

Navigating these complexities is what we do all day, every day. At Riviera Expat, we bring clarity to the fine print and offer the expert guidance you need to choose an international health plan that protects both your health and your wealth. Secure your financial peace of mind by exploring your options with us today.