Consider your primary health insurance the foundational structure of your financial estate. It is engineered to withstand significant events—major surgeries, critical illnesses, and extended hospital stays. It provides the essential, broad-spectrum protection required for catastrophic medical expenses.

However, even the most robust financial structures can have vulnerabilities. Consider the unanticipated costs: high deductibles required before your plan initiates payment, the co-payments for each specialist consultation, or the non-medical expenses that accumulate during a period of illness, such as global travel for premier treatment or significant loss of income.

This is the precise domain of supplemental insurance. It is not a replacement for your primary coverage. Instead, it is a highly specialized policy designed to address these specific financial exposures, functioning as a dedicated security detail that shields your assets from threats your primary plan does not cover.

What Exactly Is Supplemental Insurance?

Supplemental insurance is a secondary policy that operates in tandem with your primary health insurance. Its function is to cover the out-of-pocket costs that your main plan does not, thereby preserving your capital.

These policies are structured to ensure that an unexpected medical event does not necessitate the liquidation of assets or disrupt your investment portfolio. To fully grasp its role, it is beneficial to first understand how private healthcare works and the nuances of different medical systems. Supplemental plans are specifically designed to manage the substantial out-of-pocket expenses often associated with premier medical care.

Preserving Your Financial Health

At its core, this coverage is about asset preservation. A significant health crisis generates more than just hospital invoices. You may face an abrupt loss of income, the need to travel for specialized treatment, or even require bespoke modifications to your residence.

Many supplemental policies provide direct cash benefits to address these exact needs, affording you control and liquidity at the most critical time. This financial shield is essential for maintaining your lifestyle and meeting your obligations without interruption. For a more detailed examination of policy specifics, our guide explaining expat medical insurance policy terms offers valuable clarity.

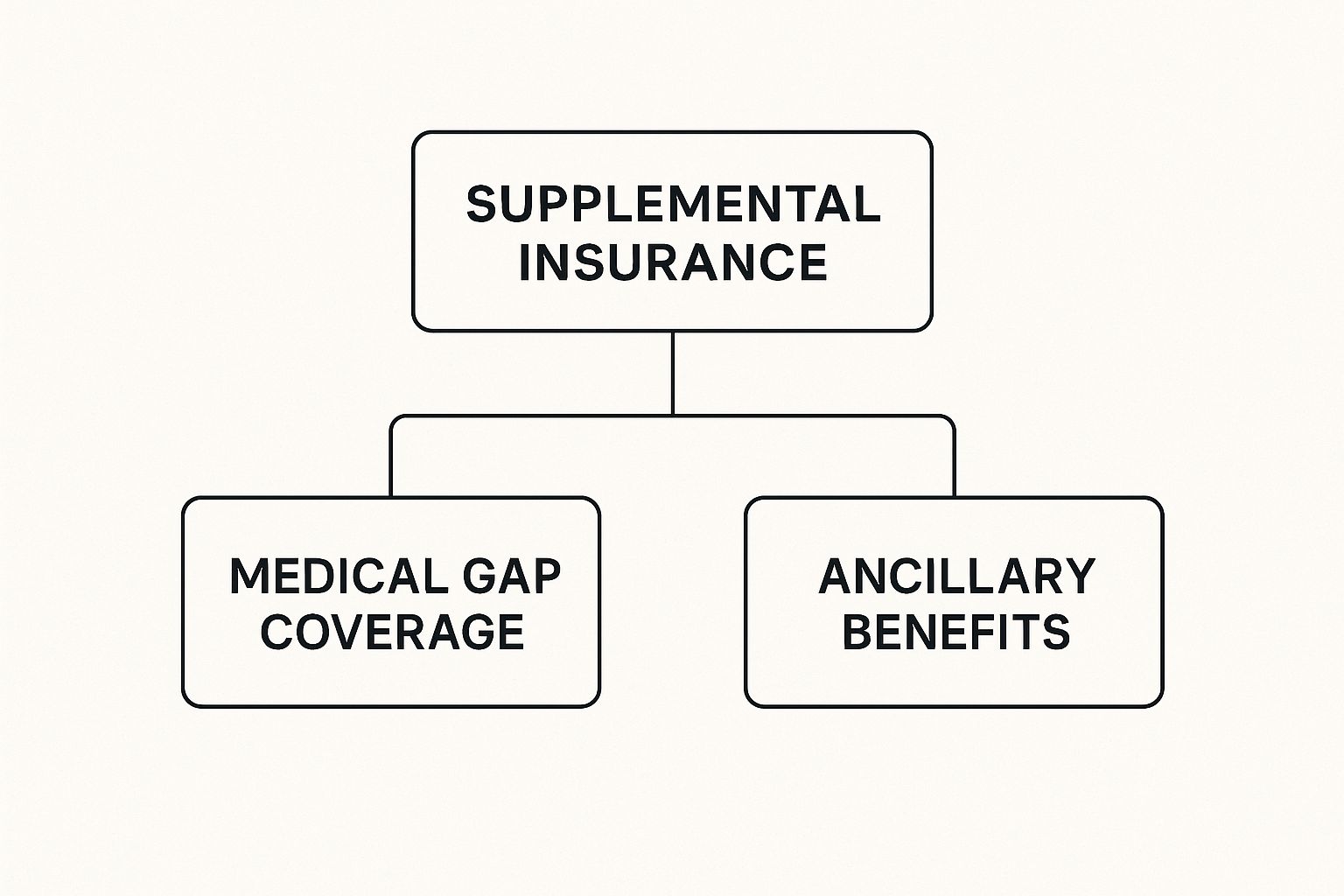

As this diagram illustrates, supplemental plans are generally classified into two primary categories:

This structure highlights how these plans can target both direct medical costs (Medical Gap Coverage) and the ancillary financial drains associated with an illness (Ancillary Benefits). It is this dual-pronged approach that makes it such a potent instrument for comprehensive financial protection.

The global supplemental health insurance market was valued at approximately USD 273.7 billion in 2022 and is projected to expand significantly. This growth is not surprising. With healthcare costs escalating globally, discerning individuals are seeking sophisticated strategies to secure their wealth against the financial shock of unexpected medical liabilities. This trend underscores the essential role this coverage plays in modern wealth management.

Primary vs Supplemental Insurance At a Glance

To make the distinction explicit, here is a high-level comparison illustrating the unique roles each type of insurance plays in a comprehensive protection strategy.

| Coverage Aspect | Primary Health Insurance | Supplemental Insurance |

|---|---|---|

| Primary Role | Broad, foundational coverage for major medical events (hospitalization, surgery). | Targeted coverage for specific gaps (deductibles, copays, non-medical costs). |

| Scope of Coverage | Comprehensive medical services (doctors, hospitals, prescriptions). | Fills specific financial holes or provides cash benefits for specific events (e.g., cancer, accident). |

| How it Pays | Pays medical providers directly after deductibles/copays are met. | Can pay cash directly to you or the provider, depending on the policy. |

| Primary Goal | Protect against catastrophic medical bills. | Protect assets from out-of-pocket costs and related expenses. |

Ultimately, primary insurance is your first line of defense against financial ruin from healthcare costs, while supplemental insurance reinforces those defenses to protect your immediate cash flow and long-term financial stability.

How Supplemental Insurance Actually Works

To appreciate the value of supplemental insurance, one must observe it in application. These policies are not abstract concepts; they are precise financial instruments designed to activate the moment your primary health plan reaches its limitations. Consider it a secondary layer of financial defense, engineered to cover specific, pre-defined costs.

For instance, imagine you require an unforeseen major surgery while residing abroad. The invoice is substantial. Your primary international health insurance covers the majority, but you are still left with a significant gap due to deductibles and coinsurance—a common occurrence.

This is precisely where supplemental insurance demonstrates its worth. A gap insurance policy would activate to cover those remaining out-of-pocket medical bills, settling the balance with the hospital. This simple mechanism prevents you from having to divest from investments or deplete cash reserves to cover a five- or six-figure expense not covered by your primary insurer.

The Power of Direct Cash Benefits

Certain supplemental policies offer a particularly powerful feature: direct cash benefits. Policies for critical illness or hospital confinement operate differently. Instead of remitting payment to a hospital, they deliver a lump-sum, often tax-free, payment directly to you upon a covered event.

Imagine you are diagnosed with a serious illness covered by your policy. The plan would pay you a predetermined amount—perhaps $250,000 or more—irrespective of your actual medical bills. This provides complete financial autonomy at a critical juncture.

This direct capital injection is a strategic advantage. It means you can protect your primary income stream, travel to consult a world-renowned specialist, or simply cover household and business obligations without touching your other assets. The capital is yours to deploy as you see fit.

A Practical Walkthrough of the Financial Flow

Let us trace the sequence of events to see how these layers of protection operate in concert.

- The Medical Event: You undergo a necessary medical procedure with a total cost of $150,000.

- Primary Insurance Pays: Your primary health plan covers $135,000 after your deductible is met.

- The Coverage Gap: You are now liable for the remaining $15,000 in coinsurance and other costs. This is the type of unanticipated expense that can disrupt a financial plan. For a deeper analysis of these terms, please review our spotlight on excesses and deductibles.

- Supplemental Policy Activates: Your supplemental gap policy intervenes and pays the $15,000, either directly to the hospital or by reimbursing you. The gap is closed.

- Direct Benefit Payout (If Applicable): If your medical event also triggered a critical illness policy, you would separately receive your lump-sum cash benefit, adding another powerful layer of financial security.

This coordinated process ensures a health crisis remains a health issue—not a financial catastrophe.

Exploring Your Supplemental Insurance Options

Understanding the definition of supplemental insurance is one matter. Recognizing these policies for what they are—distinct, strategic tools for your financial portfolio—is another. Each is engineered to counter a specific threat, providing immediate capital and control when a crisis materializes.

Knowing your options allows you to construct a bespoke defense, tailored to your unique circumstances and the risks inherent in your global lifestyle.

This is not a niche market. For instance, in the United States alone, the supplemental health insurance market was valued at over USD 250 billion in 2022. The projected growth of this market indicates an increasing awareness of the need for coverage that extends beyond basic primary plans.

Policies That Provide Direct Capital Infusion

Some of the most powerful supplemental plans are valued for one reason: they deliver a direct infusion of cash, free from the restrictions of traditional insurance payouts. These policies are not designed to pay a specific hospital bill. They are about providing the capital to manage a crisis entirely on your own terms.

Two of the most impactful policies are:

- Critical Illness Insurance: This policy delivers a substantial, often tax-free, lump-sum payment immediately upon diagnosis of a covered condition such as cancer, a heart attack, or a stroke. That capital is yours, without restriction. You can utilize it for experimental treatments not covered by your primary plan, replace lost income during recovery, or simply maintain your family's lifestyle without liquidating other assets.

- Hospital Indemnity Insurance: This policy is designed to counteract the significant costs of hospital admission. It pays you a fixed, per-diem cash benefit for each day you are an inpatient. These funds can be vital for covering high deductibles, co-pays, or the myriad non-medical expenses that accumulate, ensuring your personal cash flow remains uninterrupted.

This direct-to-you payment structure is what distinguishes these plans. It offers a level of financial agility that standard health policies cannot match, making them an indispensable component of any serious asset protection strategy.

Coverage for Specific Life Events

Beyond major illnesses, other policies are structured to manage the financial fallout from accidents or the inability to work. Consider these less as health insurance and more as protection for your single most valuable asset—your earning potential.

Consider these policies as business continuity plans for your personal finances. They ensure that an unforeseen event does not derail your long-term wealth strategy by protecting your income stream when it is most vulnerable.

This category includes several non-negotiable instruments:

- Accident Insurance: This policy pays benefits for specific injuries resulting from an accident. The payouts can cover everything from emergency medical services and physical therapy to the non-medical costs associated with recovery.

- Disability Insurance: This is arguably one of the most critical protections one can possess. It replaces a significant portion of your income if you are unable to work due to an illness or injury. For high-income earners, a long-term disability policy is absolutely essential for securing your financial foundation.

To construct a truly airtight defense, you can layer in a suite of ancillary policies. Adding coverage for dental, vision, and long-term care ensures every potential gap is sealed. By stacking these specific protections, you gain the confidence that your health and wealth are shielded, regardless of unforeseen circumstances. You can see how these layers fit together by reviewing the key components of international private medical insurance benefits.

Strategic Financial Advantages for High Net Worth Individuals

For affluent individuals and families, viewing supplemental insurance as merely another health plan is a fundamental miscalculation. Its purpose extends far beyond covering a co-payment. It is a sophisticated financial instrument, engineered specifically for asset protection. Its primary function is not just paying medical bills—it is to insulate your entire financial portfolio from the profound shock of a multi-million-dollar health crisis.

A catastrophic illness can trigger financial demands that even the most robust primary insurance plans are not designed to handle. When those gaps appear, you are forced to fill them. Without a secondary layer of protection, this may require liquidating investments, selling real estate at an inopportune time, or drawing upon other core assets to generate cash. Supplemental policies act as a financial firewall, preventing this erosion of wealth before it can begin.

Here, its strategic power becomes evident. By covering substantial out-of-pocket costs and providing direct cash infusions, these policies preserve the integrity of your long-term financial plan. Your investment portfolio remains untouched, free to compound as intended, completely insulated from the immediate need for medical capital.

Ensuring Premier Global Access and Liquidity

One of the greatest advantages for high-net-worth individuals is the ability to access the world's best medical care without financial hesitation. The world's top specialists and premier global hospitals operate at a price point that can easily exceed standard insurance limits. Supplemental coverage removes this barrier. Your focus remains where it should be: on securing the best possible treatment, not on its cost.

This immediate liquidity is the bedrock of financial stability during a crisis.

A supplemental policy delivers a critical injection of capital precisely when it is needed most, allowing you to maintain all financial commitments and uphold your lifestyle without interruption. This peace of mind is an invaluable, though often unquantified, return on investment.

This proactive approach to risk management makes supplemental insurance an indispensable part of any serious wealth management strategy. It is a calculated move of financial stewardship, ensuring a personal health crisis does not escalate into a generational financial one.

Comparing Financial Outcomes

The contrast between facing a medical crisis with and without this coverage is stark. The table below illustrates how dramatically a supplemental strategy can alter the outcome, mitigating risks that could otherwise derail a financial legacy.

Financial Risk Mitigation Scenarios

The following scenarios demonstrate the financial impact of a major health event, comparing the outcomes for a portfolio with and without robust supplemental insurance.

| Scenario | Financial Impact Without Supplemental Insurance | Financial Impact With Supplemental Insurance |

|---|---|---|

| Major Cardiac Surgery | Forced liquidation of $500,000 in securities to cover deductibles, out-of-network specialists, and six months of lost income. | Primary policy gaps are covered; a critical illness policy provides a $250,000 lump-sum payment, preserving all investments and ensuring liquidity. |

| Extended Hospitalization | Depletion of cash reserves and liquidation of a real estate asset to meet ongoing high out-of-pocket maximums and non-medical costs. | Hospital indemnity provides daily cash benefits, covering ancillary costs and protecting cash reserves. All real estate assets remain untouched. |

| Specialized Cancer Treatment | Compromising on treatment options due to primary insurance network limitations or incurring massive debt to access a leading global cancer center. | Supplemental coverage grants the freedom to choose any specialist or facility worldwide, ensuring access to premier care without financial constraint. |

As demonstrated, the right coverage does not just pay bills; it preserves options, protects assets, and maintains financial control during life's most challenging moments. It is the difference between reacting to a crisis and having a pre-emptive plan to manage it.

Choosing the Right Supplemental Coverage for Your Portfolio

Selecting the right supplemental insurance is not a consumer purchase; it is a strategic financial decision. The objective is to construct a seamless, impenetrable layer of financial defense that aligns perfectly with your personal risk profile, your lifestyle, and—most critically—the specific gaps in your primary health plan.

This requires a rigorous and objective analysis of your unique situation.

Begin with your personal and family health profile. Analyze your family’s medical history. Are there genetic predispositions that would indicate a higher need for critical illness coverage? Furthermore, what are the demands of your lifestyle? For those who frequently cross borders for business or leisure, a plan with robust global coverage is non-negotiable. A policy with geographic limitations is an unacceptable liability.

A Framework for Strategic Selection

A haphazard approach is a recipe for creating dangerous gaps in your financial armor. The first step is a forensic analysis of your primary health insurance policy. Pinpoint its exact out-of-pocket maximums, deductible requirements, and, crucially, its exclusions. These gaps are the vulnerabilities your supplemental plan is designed to eliminate.

The ability to conduct a thorough risk assessment is key to making informed decisions. This framework allows you to methodically identify and analyze potential financial threats. As you evaluate policies, your checklist must include:

- Policy Limitations and Exclusions: Scrutinize what is not covered. Are there waiting periods for pre-existing conditions? Are there geographic restrictions that conflict with your travel patterns?

- Benefit Triggers: Understand the precise event that activates a payout. For a critical illness policy, which specific diagnoses qualify, and at what stage of severity? The policy language is paramount.

- Financial Strength of the Insurer: This is a critical point of due diligence. You must verify the financial stability and ratings of the underwriting company. An A-rated carrier is not merely a preference; it is your assurance that the company has the capacity to pay substantial claims when required.

The Role of Specialized Consultation

Attempting to navigate the complexities of supplemental insurance independently, especially with a significant asset base at stake, is ill-advised. A specialist is required.

Engaging a financial advisor who possesses a deep understanding of the high-net-worth landscape is paramount. Such an advisor can assess your entire financial picture and help architect a bespoke portfolio of policies that work in concert to achieve your objectives.

A well-chosen supplemental plan is the final, impenetrable layer of your financial defense. It transforms your health coverage from a simple safety net into a proactive asset protection tool, guaranteeing that your health and your wealth are equally and comprehensively shielded.

Frequently Asked Questions

Let us address some common inquiries regarding supplemental insurance, particularly when viewed through the lens of a significant financial portfolio. Clarifying these details is essential to understanding the practical application of this coverage.

Is Supplemental Insurance Necessary with a High-Limit Primary Plan?

Yes, it remains a strategic necessity. Even the most comprehensive primary health plans have defined limitations, such as stated out-of-pocket maximums, deductibles, and significant coverage exclusions.

These gaps become particularly evident when considering non-medical costs like loss of income or international travel for specialized care. Supplemental insurance is engineered specifically to fill these financial voids. Its primary purpose is not to pay routine medical bills, but to protect your liquidity and assets from unexpected, high-magnitude drains.

How Do Payouts from a Critical Illness Policy Work?

The mechanism is exceptionally straightforward. Upon a confirmed diagnosis of a major condition specified in your policy—such as a heart attack or specific cancers—the policy pays a lump-sum, often tax-free, cash benefit directly to you.

This payment is entirely independent of your actual medical expenses. The capital is yours to deploy at your complete discretion: replace lost income, fund experimental treatments not covered by your primary plan, or manage household and business expenses without liquidating investments.

Can I Use Supplemental Insurance Internationally?

This is entirely contingent on the specific policy selected. Many supplemental plans, particularly those designed for expatriates and global citizens, incorporate worldwide coverage.

However, it is absolutely imperative to verify the geographic scope and any potential limitations with your advisor before committing to a policy. Always obtain written confirmation that the plan under consideration provides the robust global protection your international lifestyle demands. This is a non-negotiable point of due diligence.

At Riviera Expat, we specialize in sourcing premier international private medical insurance for financial professionals. We provide the clarity and control you need to protect your health and your wealth. Schedule your complimentary consultation.