For discerning global individuals, the standard of healthcare is not a mere convenience but a critical component of a strategic international lifestyle. Making an informed decision requires moving beyond generic rankings to a nuanced understanding of how each system operates, its financial underpinnings, and its suitability for your specific needs. This analysis provides a meticulously researched overview of the world's most lauded healthcare systems.

We will dissect the structures that deliver the best healthcare in the world, from Switzerland's regulated private model to Norway's single-payer public services, offering specific metrics and insights tailored to the unique requirements of expatriates, high-net-worth individuals, and their families. This guide is designed to be a strategic resource, offering clarity on what to expect in terms of access, quality of care, and patient experience in top-tier countries.

Understanding these elite systems is the first step; the second is ensuring seamless access. Throughout this guide, we will also illuminate how a premier International Private Medical Insurance (IPMI) plan provides the essential layer of security, flexibility, and convenience. This transforms excellent local care into a truly global, white-glove health solution, ensuring continuity and peace of mind no matter where your personal or professional life takes you. You will gain a clear, actionable perspective on how to navigate these premier health environments effectively, safeguarding your most valuable asset: your well-being.

1. Switzerland – Regulated Private Insurance System

Switzerland's healthcare system consistently ranks among the best in the world, built on a unique model of universal coverage through mandatory private insurance. Known as L'assurance-maladie obligatoire (LAMal), this system requires every resident to purchase a basic health insurance plan from a non-profit, government-regulated private insurer. This approach successfully blends market competition with robust social protections, ensuring universal access to high-quality care.

How the Swiss Model Works

The core of the system is individual responsibility coupled with collective solidarity. Insurers are legally obligated to accept all applicants for the basic plan, regardless of age or pre-existing conditions. Premiums are community-rated, meaning everyone in a specific region pays the same price for the same plan from a given insurer. To ensure affordability, the government provides income-based subsidies to help lower-income households manage their premium costs.

This structure fosters a competitive marketplace where dozens of insurers, such as major players like CSS Insurance and Helsana, compete on service quality and optional supplementary coverage rather than by excluding high-risk individuals. This balance between private enterprise and stringent regulation is a key reason Switzerland achieves such outstanding health outcomes.

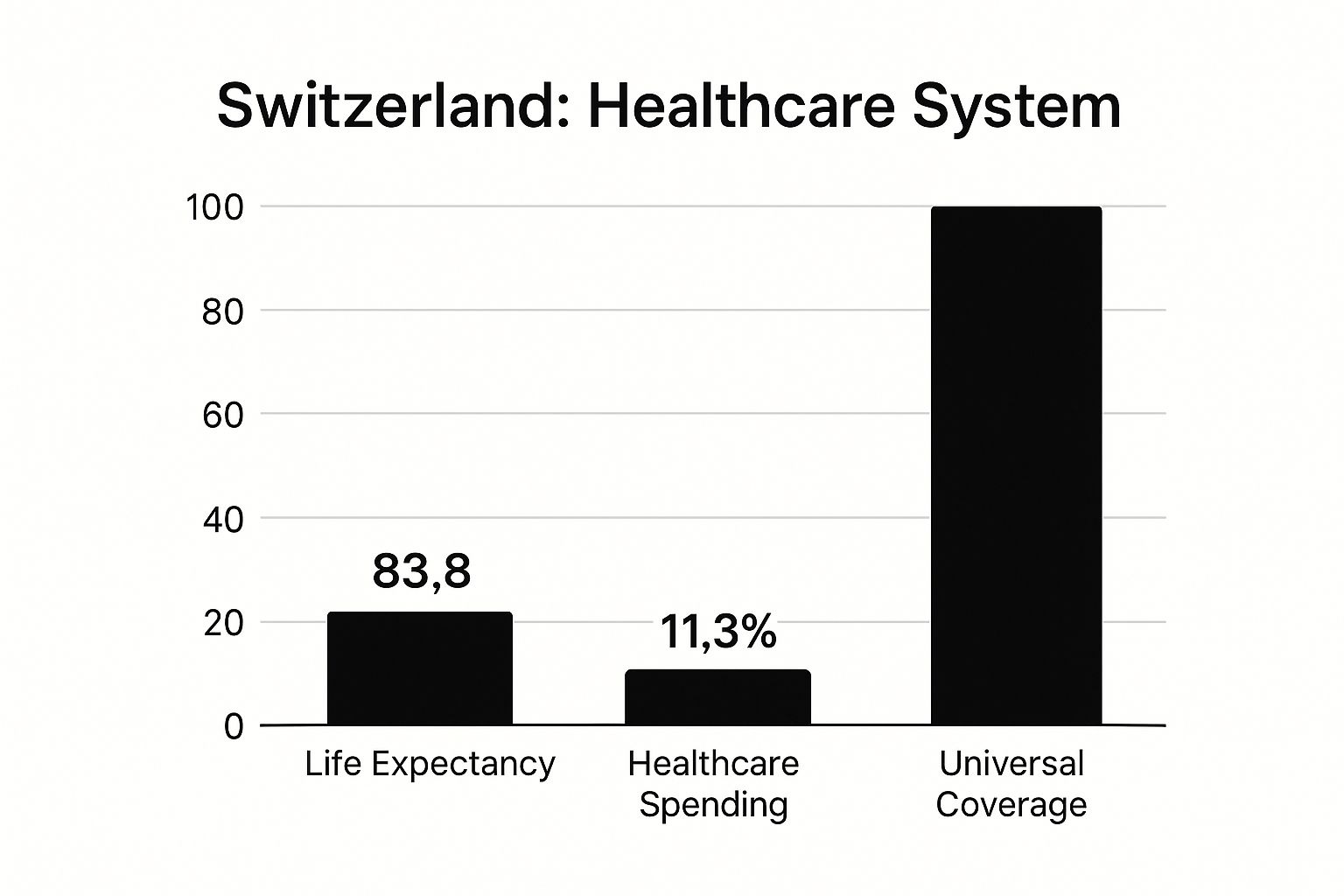

The following chart illustrates the impressive results of this system.

This data clearly demonstrates Switzerland's success in achieving a high life expectancy and complete coverage, albeit with a significant financial investment as a percentage of its GDP.

Considerations for Expatriates and High-Net-Worth Individuals

For expatriates and high-net-worth individuals relocating to Switzerland, compliance is non-negotiable. You must secure a compliant health insurance policy within three months of arrival. While the basic coverage is comprehensive, many opt for supplementary private insurance to gain access to benefits like private hospital rooms, broader choice of physicians, and enhanced dental or alternative medicine coverage. Navigating the cantonal systems and insurer options can be complex. For a deeper understanding of the specific insurance requirements for expatriates, you can learn more about Swiss health insurance solutions for expats on riviera-expat.com. This system provides peace of mind, ensuring access to some of the best healthcare in the world from day one of residency.

2. Norway – Single-Payer National Health Service

Norway’s healthcare system is a prime example of a publicly funded, single-payer model that provides universal coverage to all residents. Financed primarily through taxation, the system is administered by the national government and managed through four Regional Health Authorities (helseregioner). This highly centralized yet regionally executed approach ensures equitable access to comprehensive services, from primary care to specialized hospital treatments, reinforcing its reputation for providing some of the best healthcare in the world.

How the Norwegian Model Works

The foundation of Norwegian healthcare is the principle of universal access funded by collective contributions. Every resident is automatically enrolled in the National Insurance Scheme. A cornerstone of the system is the fastlege (regular GP) scheme, where each resident is assigned a dedicated general practitioner who acts as a gatekeeper, coordinating all aspects of their patient's care, including referrals to specialists and hospitals. This focus on primary care ensures continuity and efficiency.

The system is managed by four Regional Health Authorities: Helse Sør-Øst, Helse Vest, Helse Midt-Norge, and Helse Nord. These bodies are responsible for operating hospitals and specialized healthcare services within their geographic areas, ensuring national standards are met locally. While services are largely free at the point of use, there are modest co-payments for certain services, capped annually to protect individuals from significant out-of-pocket expenses.

Considerations for Expatriates and High-Net-Worth Individuals

For expatriates residing in Norway for more than 12 months, registration in the National Insurance Scheme is mandatory and automatic upon receiving a residence permit. This grants access to the public healthcare system on the same terms as Norwegian citizens. There is no option to opt out of the public system and its associated taxes.

However, many high-net-worth individuals and executives choose to supplement their public coverage with private medical insurance. This is not for basic access but to bypass potential waiting lists for elective procedures and to secure enhanced amenities like private rooms. Private insurance can also provide more extensive coverage for services like specialized dental care, which is not fully covered under the public scheme for adults. For those seeking immediate access to specialists and a premium healthcare experience, private policies offer a valuable layer of convenience and choice on top of the robust public foundation.

3. Netherlands – Managed Competition Model

The Netherlands is frequently cited for having one of the best healthcare systems in the world, operating on a "managed competition" model that closely mirrors Switzerland's. It successfully provides universal coverage by mandating that all residents purchase a standard basic health insurance package from private, competing insurers. This system is designed to promote quality and efficiency through market forces while ensuring equitable access for all.

How the Dutch Model Works

The foundation of the Dutch system is the legal requirement for every resident to obtain a basic health insurance policy (basisverzekering). Private insurance companies, such as major providers Zilveren Kruis and VGZ, are obligated to accept all applicants for this package, irrespective of their health status. Premiums are community-rated, so everyone pays the same price for a specific policy, preventing discrimination based on risk.

To maintain affordability, the government implements a risk equalization fund, which compensates insurers for taking on higher-risk individuals. Additionally, a care allowance (zorgtoeslag) is provided as a means-tested subsidy to help lower-income individuals and families afford their monthly premiums. This framework creates a balanced environment where insurers compete on service and supplementary benefits rather than by avoiding the sick, ensuring the system remains both competitive and socially responsible.

Considerations for Expatriates and High-Net-Worth Individuals

For expatriates and high-net-worth individuals moving to the Netherlands, securing compliant health insurance is mandatory, typically within four months of registration. While the basic package is comprehensive, it is common to purchase supplementary insurance (aanvullende verzekering) for services not covered, such as extensive dental care, physiotherapy, or alternative medicine.

When selecting a plan, it is crucial to look beyond the premium price and consider the insurer's network of contracted hospitals and specialists. Some policies may restrict choice, which can be a significant factor for those accustomed to complete freedom in their healthcare decisions. Understanding the difference between basic and supplementary coverage and considering a voluntary deductible (vrijwillig eigen risico) to lower premiums are key strategies. This approach ensures you not only comply with Dutch law but also gain access to the best healthcare in the world with a plan tailored to your specific needs.

4. Australia – Mixed Public-Private System

Australia's healthcare system is a highly effective hybrid model, blending a universal public scheme with a robust private health insurance sector. This dual approach ensures all residents have access to essential medical care through Medicare while offering the option for enhanced choice and faster access through private coverage. This balance provides a comprehensive safety net and promotes a competitive healthcare market, securing its place as one of the best in the world.

How the Australian Model Works

The foundation of the system is Medicare, a publicly funded program that provides free or subsidized access to public hospital services and consultations with general practitioners (GPs) and specialists. It is financed through a general income tax levy. Alongside Medicare, a thriving private sector includes private hospitals and ancillary services, which are accessed through private health insurance from providers like Medibank and Bupa.

The government actively encourages private insurance uptake through financial incentives, such as the Private Health Insurance Rebate, and disincentives like the Medicare Levy Surcharge for high-income earners without private cover. This strategy helps alleviate pressure on the public system, particularly for elective surgeries, while giving individuals greater control over their healthcare choices, including the selection of their doctor and hospital.

Considerations for Expatriates and High-Net-Worth Individuals

For high-net-worth individuals and expatriates moving to Australia, understanding this two-tiered system is crucial for optimizing healthcare access. While many temporary visa holders are not immediately eligible for Medicare, residents from countries with a Reciprocal Health Care Agreement may have limited access. Most long-term residents and new citizens, however, will be covered.

To avoid long public system waiting lists for non-urgent procedures and to ensure access to private hospitals, securing private health insurance is a standard strategy. It is also financially prudent to purchase private hospital cover before turning 31 to avoid the lifetime health cover loading, a penalty that increases premiums for each year you delay. Understanding which policy type best suits your needs is essential for comprehensive coverage. You can explore a detailed guide to different types of health insurance policies for expatriates on riviera-expat.com. This proactive approach guarantees access to Australia's excellent, multi-layered system of care.

5. Sweden – Decentralized Tax-Funded System

Sweden's healthcare system is renowned for its commitment to universal coverage, operating on a decentralized, tax-funded model. The system is managed primarily by 21 autonomous regional councils, ensuring that healthcare delivery is tailored to local needs while upholding national standards of excellence. This structure emphasizes health equity and preventive care, treating access to high-quality medical services as a fundamental right for all residents.

How the Swedish Model Works

The system is financed predominantly through regional and municipal taxes, with minimal patient co-payments for services. This public funding guarantees universal access, and responsibility for organizing and delivering care rests with the regional bodies. This decentralized approach allows for innovation and responsiveness, with primary care serving as the foundation of the system.

Patients typically register with a local primary healthcare center, known as a vårdcentral, which acts as the first point of contact for most medical needs. This model promotes continuity of care and efficient management of health resources. Sweden has also embraced digital innovation, exemplified by the national platform 1177 Vårdguiden, which provides medical advice, appointment booking, and e-prescriptions, enhancing accessibility for all. World-class institutions like the Karolinska University Hospital further underscore the country's dedication to medical research and advanced treatment.

Considerations for Expatriates and High-Net-Worth Individuals

For expatriates and high-net-worth individuals moving to Sweden, obtaining a personal identity number (personnummer) is the key to accessing the public healthcare system. Upon registration, you can choose a local vårdcentral. While the public system is comprehensive, it's important to understand the co-payment structure, which includes a high-cost protection ceiling (högkostnadsskydd) for both medical visits and prescriptions, limiting annual out-of-pocket expenses.

Many opt for supplementary international private medical insurance to bypass potential waiting times for non-urgent specialist care and to gain access to a wider choice of private providers. This ensures immediate access to the best healthcare in the world without delay and offers services often not covered by the public system, such as extensive dental care. Private coverage provides an additional layer of convenience and flexibility, aligning with the expectations of discerning global citizens.

6. Germany – Social Health Insurance (Bismarck Model)

Germany operates the world's oldest universal healthcare system, founded on the principles of social health insurance. This "Bismarck Model" ensures comprehensive coverage for its population through a multi-payer system dominated by statutory health insurance (SHI), also known as Gesetzliche Krankenversicherung (GKV). This approach successfully marries social solidarity with patient choice and competition among providers and insurers, securing its place among the best healthcare in the world.

How the German Model Works

The system is financed through mandatory contributions from employers and employees, creating a robust, self-administered network of non-profit "sickness funds." Approximately 88% of the population is enrolled in one of these funds, such as major providers like AOK or Barmer. These funds are responsible for contracting with doctors and hospitals to provide a standardized, high-quality benefits package. This decentralized structure fosters competition on service and efficiency rather than risk selection.

A key feature is the clear separation between primary and specialist care. Residents first register with a Hausarzt (general practitioner), who acts as a gatekeeper for referrals to specialists, ensuring coordinated and efficient treatment pathways. This system guarantees universal access to renowned medical institutions, including the esteemed Charité hospital system in Berlin, with minimal wait times for necessary procedures.

Considerations for Expatriates and High-Net-Worth Individuals

For expatriates and high-net-worth individuals moving to Germany, navigating the system is straightforward. Those earning below a specific income threshold (currently €69,300 per year as of 2024) must join a statutory sickness fund. Individuals earning above this threshold have the option to remain in the public system or opt for private health insurance (Private Krankenversicherung or PKV), which may offer more extensive coverage and private amenities.

When choosing a statutory fund, it is wise to compare not only the base contribution rates but also the optional supplementary services they offer. Many expatriates also purchase supplementary private insurance to cover services not included in the standard package, such as private hospital rooms or extensive dental work. Understanding these options ensures you can tailor your coverage to your precise needs while benefiting from one of the world's most accessible and high-quality healthcare systems.

7. Iceland – Nordic Universal Healthcare Model

Iceland’s healthcare system is a prime example of the Nordic universal model, achieving exceptional health outcomes through a publicly funded and highly centralized structure. The system provides comprehensive, high-quality healthcare to all legal residents, regardless of socioeconomic status, financed primarily through general taxation. This state-run approach ensures that access to care is treated as a fundamental right, not a commodity.

How the Icelandic Model Works

The Icelandic system is managed by the Ministry of Health and is largely state-owned and operated. It is built on a strong foundation of primary care, with residents registering at a local healthcare center, such as the Primary Health Care of the Capital Area (Heilsugæsla höfuðborgarsvæðisins). These centers act as the first point of contact, handling general health needs and emphasizing preventive services and public health initiatives. This gatekeeper system ensures efficient resource allocation and continuity of care.

For specialized services, patients are referred to specialists or major hospitals, with Landspítali University Hospital in Reykjavík serving as the national referral and teaching hospital. The system is known for its high level of technological integration, with a nationwide Electronic Medical Record (EMR) system connecting all providers. This digital backbone facilitates seamless information sharing, enhancing both efficiency and patient safety, and is a key reason Iceland is often cited when discussing the best healthcare in the world.

Considerations for Expatriates and High-Net-Worth Individuals

For individuals relocating to Iceland, registering legal residency is the key to accessing the public healthcare system. Once registered, you must sign up with a local primary care clinic to be assigned a general practitioner. While the public system is comprehensive, co-payments for consultations and prescriptions are standard, although they are capped annually.

High-net-worth individuals and expatriates often choose to supplement their public coverage with private insurance. This can offer faster access to certain elective procedures, a broader choice of specialists, and coverage for services not fully included in the state plan, such as extensive dental work or private physiotherapy. This dual approach allows one to leverage the strength of the universal system while adding a layer of convenience and choice for non-urgent matters.

8. Japan – Universal Health Insurance with Fee Control

Japan's healthcare system is renowned for achieving exceptional health outcomes, including one of the highest life expectancies globally, through a statutory health insurance system (SHIS). This model provides universal coverage while maintaining relatively low costs, a feat accomplished by tightly controlling medical fees and utilizing a predominantly private delivery network. All residents are required to enroll in an insurance plan, either through their employer or their municipality, ensuring equitable access to high-quality medical services.

How the Japanese Model Works

The system operates on a foundation of social insurance, with costs shared between individuals, employers, and the government. There are two primary categories: employer-based plans, managed by entities like the Japan Health Insurance Association (JHIA), and residence-based plans for the self-employed, unemployed, and retirees. A separate system covers individuals aged 75 and older. The government, specifically the Ministry of Health, Labour and Welfare, sets a national fee schedule for all medical procedures and pharmaceuticals, which prevents price escalation and keeps costs predictable.

This strict government price regulation, combined with a culture of preventive care epitomized by the annual ningen dock (comprehensive health check-ups), allows Japan to deliver some of the best healthcare in the world. Patients enjoy significant freedom in choosing their providers, including world-class institutions like the University of Tokyo Hospital, without needing referrals. This combination of universal access, cost control, and patient choice is a hallmark of Japan's success.

Considerations for Expatriates and High-Net-Worth Individuals

For expatriates residing in Japan for three months or more, enrollment in the national health insurance system is mandatory. Upon registration, you will receive a health insurance card, which must be presented at every medical visit. While the statutory system covers approximately 70% of most medical costs, there are out-of-pocket expenses and some services, like certain dental procedures or private hospital rooms, are not fully covered.

To bridge these gaps and gain access to a wider network of multilingual medical facilities, many high-net-worth individuals secure supplementary coverage. For those requiring a more tailored approach to global medical access, you can find more information about the advantages of international private medical insurance on riviera-expat.com. This ensures comprehensive protection and peace of mind while navigating the Japanese healthcare landscape.

9. France – Social Security Healthcare System

France's healthcare system is widely recognized for its high quality and accessibility, operating on a robust social security model that provides universal coverage. The system, known as l'assurance maladie, is funded primarily through mandatory social security contributions linked to salaries and income. This approach guarantees every legal resident access to a comprehensive benefits package, regardless of their financial status or medical history, making it a cornerstone of French society.

How the French Model Works

The system is a unique blend of state funding and patient choice. Patients typically pay for medical services upfront and are then reimbursed by the state insurance fund, often within days. Most medical costs, such as doctor visits, hospital stays, and prescription medications, are covered at a high rate, usually around 70%. The process is streamlined through the Carte Vitale, an electronic health card that simplifies transactions and reimbursements between patients, providers, and the national health insurance system.

To cover the remaining co-payment, nearly all residents purchase supplementary private insurance, known as a mutuelle. This combination ensures minimal out-of-pocket expenses while preserving patient freedom to choose their own doctor and hospital. Renowned hospital networks like Assistance Publique-Hôpitaux de Paris (AP-HP) exemplify the high standard of care available within this framework.

Considerations for Expatriates and High-Net-Worth Individuals

For expatriates and high-net-worth individuals residing in France, integrating into this system is a key step. After establishing legal residency, obtaining a Carte Vitale is essential for accessing streamlined reimbursements. You are also strongly advised to select a médecin traitant (a chosen primary care physician) to ensure coordinated care and receive higher reimbursement rates.

While the state system is excellent, a high-quality mutuelle is indispensable for covering co-payments and accessing premium services like private hospital rooms and enhanced dental or vision care. This dual-layer system provides comprehensive protection and access to what is often considered among the best healthcare in the world. Navigating the registration process and selecting the right supplementary plan can be complex, so seeking professional advice is a prudent step for ensuring a seamless transition into the French healthcare landscape.

Top 9 Global Healthcare System Comparison

| System | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| Switzerland – Regulated Private Insurance | High (complex subsidies and premiums) | High (private insurers, subsidies) | Excellent health outcomes, universal coverage | Universal coverage with market competition | Freedom of choice, innovation, financial protection |

| Norway – Single-Payer National Health Service | Moderate (tax-funded, regional admin) | High (public funding, regional authorities) | High life expectancy, equitable care | Tax-funded universal care with strong primary focus | Strong primary care, no financial barriers, health equity |

| Netherlands – Managed Competition Model | High (complex regulation and risk equalization) | Moderate to high (regulated insurers and subsidies) | High-quality care, cost control | Universal coverage with competing private insurers | Balance of quality, cost control, high satisfaction |

| Australia – Mixed Public-Private System | Moderate (dual public-private system) | Moderate (Medicare + private insurance) | Good outcomes, universal access | Universal care with private options for choice | Public access plus private provider choice, subsidies |

| Sweden – Decentralized Tax-Funded System | Moderate (decentralized regional management) | High (tax funded, regional councils) | Excellent outcomes, equity | Universal tax-funded system with regional autonomy | Strong primary care, digital health, equity focus |

| Germany – Social Health Insurance (Bismarck) | High (multiple sickness funds, employer-employee funding) | High (shared employer-employee contributions) | Universal coverage, high quality | Mandatory social insurance with insurer competition | Comprehensive benefits, choice of funds and doctors |

| Iceland – Nordic Universal Healthcare Model | Low to moderate (centralized, government owned) | Moderate (government funded and owned) | Excellent health, equity | Small population, centralized tax-funded system | Advanced IT use, universal access, preventive focus |

| Japan – Universal Health Insurance with Fee Control | High (multi-scheme insurance, strict fee schedule) | Moderate (mixed public-private delivery) | Highest life expectancy, affordable care | Universal coverage with government fee control | Controlled costs, advanced technology, universal access |

| France – Social Security Healthcare System | High (complex reimbursement and insurance mix) | High (payroll taxes, government funding) | Excellent patient outcomes and satisfaction | Universal social insurance with fee-for-service | Comprehensive coverage, high quality, strong primary care |

Achieving Clarity, Control, and Confidence in Your Global Healthcare Strategy

Navigating the landscape of global healthcare reveals a fundamental truth: there is no single "best" system, but rather a spectrum of high-performing models, each with distinct architectures, strengths, and inherent complexities. Our exploration of top-tier nations, from Switzerland's regulated private insurance to Norway's single-payer system and Germany's foundational Bismarck model, underscores that excellence in healthcare is achieved through varied philosophies.

For high-net-worth individuals and globally mobile professionals, understanding these differences is not an academic exercise; it is a prerequisite for safeguarding your health and financial well-being. The key takeaway is that even the best healthcare in the world often presents significant navigational challenges, including mandatory enrollment processes, language barriers, and coverage gaps that can lead to unexpected out-of-pocket expenses or delays in accessing specialized care.

Key Insights for Your Global Health Portfolio

Mastering your international health strategy requires moving beyond a surface-level appreciation of these systems. It demands a proactive approach to bridge the divide between local public provisions and the bespoke, immediate access you expect.

- Public Systems Are Not a Panacea: While countries like France and Australia offer exceptional public care, they often involve wait times for non-urgent procedures and may not cover the full cost of treatment in premier private facilities. Relying solely on the state system can mean compromising on convenience and choice.

- Mandatory vs. Optional Coverage: In nations such as the Netherlands and Switzerland, participation in the local health insurance scheme is mandatory. Failing to enroll can result in penalties. It is crucial to understand these obligations and integrate them into your broader coverage plan, rather than being caught unprepared.

- The Proactive Health Mandate: Beyond systemic structures, individuals also play a crucial role in managing their health outcomes. The modern executive and investor understands the value of preventative care and early detection. For those seeking proactive measures, exploring resources on at-home health testing for longevity offers an actionable plan for personal health management, complementing any systemic coverage.

Actionable Next Steps: From Knowledge to Implementation

Translating this understanding into a robust strategy involves several critical steps. Your objective is to engineer a seamless healthcare experience, regardless of your location.

- Audit Your Current and Future Needs: Assess your personal and family health requirements, considering any chronic conditions, planned medical procedures, and preferred standards of care. Factor in your travel patterns and potential future residencies.

- Map Coverage Gaps: For each country you frequent or reside in, identify the specific limitations of the local system. What are the typical wait times for specialists? Does the public system grant access to the top private hospitals? What are the co-pays and deductibles for advanced diagnostics or treatments?

- Deploy a Strategic IPMI Layer: This is where International Private Medical Insurance (IPMI) becomes indispensable. An expertly structured IPMI policy is not a mere travel insurance plan; it is a comprehensive global health solution designed to fill these specific gaps. It ensures you can bypass public queues, choose your preferred specialist or facility anywhere in the world, and receive care without concerns over claim approvals or network restrictions.

An IPMI policy transforms your healthcare from a geographical lottery into a globally consistent, high-quality experience. It is the mechanism that provides absolute certainty and control, ensuring your health strategy is as sophisticated and reliable as your financial portfolio.

Ultimately, identifying the nations with the best healthcare in the world is only the first step. The true mastery lies in architecting a personal healthcare strategy that leverages the strengths of these systems while insulating you from their limitations. This proactive, tailored approach is what provides true peace of mind, allowing you to focus on your professional and personal ambitions with the confidence that your health is comprehensively protected, no matter where your ventures take you.

For discerning individuals who require a seamless global healthcare strategy, Riviera Expat provides the clarity and expertise needed to navigate this complex landscape. We specialize in structuring bespoke International Private Medical Insurance plans that deliver unparalleled access and control. Secure your consultation at Riviera Expat to ensure your health coverage meets the same exacting standards as your wealth management.