Navigating the complexities of a health insurance plan can be a formidable task. However, clarity begins with understanding one pivotal role: the policyholder.

In precise terms, the policyholder is the individual or legal entity that owns the insurance contract. This party is solely responsible for remitting the premiums and is the only one vested with the authority to modify the plan's terms. This distinction is critical, as the owner of the policy is not always the direct recipient of medical services.

Understanding Your Position in a Health Insurance Structure

Consider your health insurance plan as a significant asset, akin to a property. The policyholder is the legal owner of this asset. They hold the title, manage the financial obligations, and determine who is granted access to its benefits. They are responsible for all executive decisions.

Other individuals, such as a spouse or children, may benefit from the protection this asset provides. In insurance parlance, these individuals are the insured members or dependents. They receive the full scope of medical benefits offered by the plan, but they possess no authority to alter its structure or terms. Their access to healthcare is entirely contingent upon the policyholder's management of the contract.

This hierarchy is unambiguous. The policyholder owns and administers the legal agreement that confers benefits upon all other covered individuals.

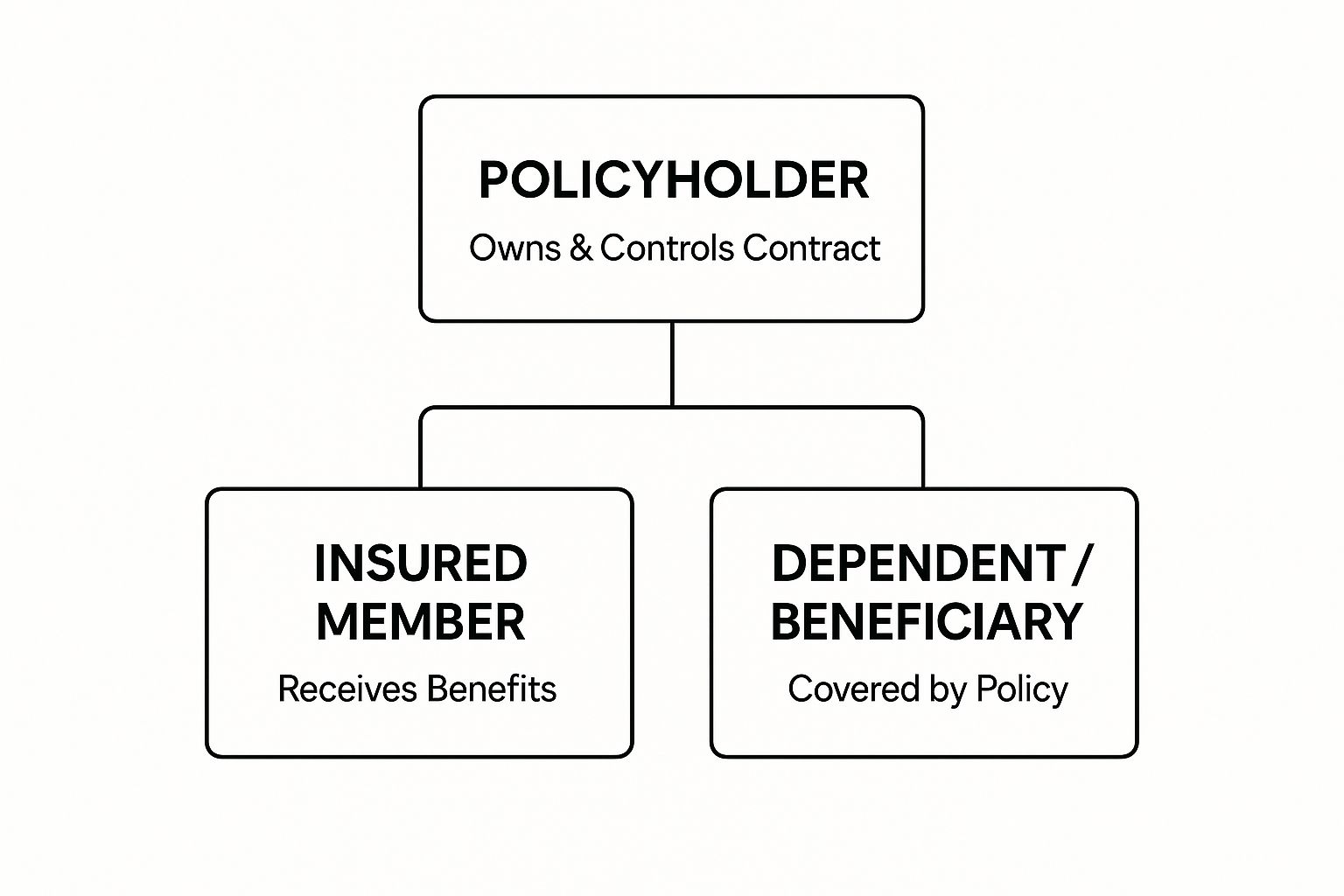

As the infographic illustrates, while numerous individuals may be covered, a single person or entity retains ultimate control. Because an insurance policy is a binding legal document, it is imperative to understand how to review a contract to ensure you are fully aware of your rights and obligations from the outset.

The Key Roles Defined

To eliminate any ambiguity, let us delineate the principal roles within any health insurance policy. Each position carries a distinct set of responsibilities.

For absolute clarity, here is a concise summary of the different functions individuals can hold within a single health insurance plan.

Key Roles Within Your Health Insurance Policy

| Role | Definition | Primary Responsibility |

|---|---|---|

| Policyholder | The individual or entity who owns the insurance contract. | Remits premiums and makes all administrative decisions regarding the plan. |

| Insured Member | Any person covered by the health insurance policy. | Receives medical benefits and adheres to the plan's terms of use. |

| Dependent | A specific type of insured member, typically a spouse or child. | Is covered under the policyholder's plan, relying on them for coverage. |

| Beneficiary | An individual designated to receive benefits, often in life or disability riders. | Receives a specified payout upon a triggering event defined in the policy. |

Comprehending these roles is the foundational step to mastering your health coverage. Knowing who holds the authority to enact changes, who merely receives benefits, and who is accountable for payments prevents significant complications in the future.

The Employer as Policyholder in Group Plans

For most executives, health coverage is an expected component of a comprehensive compensation package. This is typically facilitated through an employer-sponsored group plan, a prevalent and efficient structure.

However, a critical distinction is often overlooked: in this arrangement, your employer is the policyholder, not you. The company is the entity that executes the contract, thereby establishing the primary legal relationship with the insurance carrier.

This structure positions the employer as the master client. The company negotiates the master contract's terms, selects the specific plans offered to its employees, and retains the ultimate authority to modify or terminate the policy. While you and your colleagues receive the benefits, your role is confined to selecting from a pre-determined menu curated by your employer.

This model is exceptionally widespread. In the United States, employer-sponsored plans form the bedrock of health coverage for the non-elderly population. According to 2023 data from the Kaiser Family Foundation, 49% of the total U.S. population receives health insurance this way, with companies bearing a significant portion of the premium costs. If you wish to examine the specifics, you can learn more about these health insurance statistics and their market implications.

Fiduciary Duties of the Corporate Policyholder

Holding the policyholder position entails significant legal and ethical responsibilities. The employer assumes critical fiduciary duties, obligating them to act in the best interests of the employees enrolled in the plan. This framework is built upon trust and accountability.

Key duties include:

- Managing Enrolment: The company's human resources or benefits department manages all administrative processes for enrolling new employees and processing changes during open enrolment or following a qualifying life event, such as a marriage or birth.

- Ensuring Compliance: The employer is responsible for ensuring the health plan adheres to all relevant federal and state regulations—a complex and evolving legal landscape.

- Remitting Premiums: Your premium contribution is deducted from your compensation, combined with the company's portion, and remitted to the insurer in a timely manner. The employer is responsible for this entire financial transaction.

Understanding this corporate hierarchy is essential. It clarifies that strategic decisions about your healthcare—from the network of specialists available to annual premium adjustments—are made at the corporate level. This knowledge empowers you to better evaluate your benefits package and advocate for your needs within that established structure.

When You Are the Individual Policyholder

What occurs when a corporate plan is not an option? Many globally-minded professionals, including entrepreneurs, consultants, and retirees, find themselves in this precise scenario. In such cases, you are no longer sheltered under a corporate umbrella; you assume direct control of your health insurance. This is also the standard path for individuals purchasing specialized or supplementary private coverage.

In this configuration, you are both the policyholder and the primary insured member. This grants you absolute control over your healthcare strategy, a significant advantage for those who demand direct oversight of their coverage. The corollary is that you are responsible for every aspect of its administration.

If you are self-employed—for instance, in the process of securing a freelance visa in Dubai—you are solely responsible for procuring and managing your health plan. All administrative duties rest on your shoulders.

The Scope of Individual Responsibility

As the sole decision-maker, your responsibilities extend far beyond simple plan selection. You must personally manage all critical tasks that ensure your coverage remains active and performs as expected when needed.

Your obligations include:

- Policy Selection and Customisation: You are tasked with researching, comparing, and selecting a plan that aligns precisely with your health requirements and financial strategy.

- Premium Payments: You are directly responsible for ensuring premiums are paid on schedule. A single missed payment could result in the termination of your coverage.

- Claims Management and Renewals: You will be the one submitting claims and liaising directly with the insurer for annual policy renewals.

The primary benefit of this responsibility is autonomy. You are not constrained by limited corporate offerings. This freedom empowers you to select a premium international plan that meets your exact specifications—a considerable advantage for managing a global lifestyle on your own terms.

When you possess this level of authority, a comprehensive understanding of your policy's language is non-negotiable. To become proficient, consult our guide where key expat medical insurance policy terms are explained with precision. This knowledge is your most valuable asset for making judicious decisions about your health and finances.

Navigating International and Expat Health Plans

For expatriates and globally mobile executives, the question of "who is the policyholder?" is not merely an administrative detail; it is a critical component of an international strategy. When your life and career transcend borders, the answer determines who holds control, who bears financial liability, and ultimately, how seamlessly you can access care.

This detail is paramount because the structures vary significantly. A multinational corporation might act as the policyholder for its entire global workforce, enabling centralized control and superior negotiating power. Conversely, an entrepreneur might purchase a personal global policy, becoming the individual policyholder to maintain direct authority over their family's worldwide coverage.

Jurisdictional Nuances and Policyholder Authority

The legal framework of your country of residence profoundly impacts the policyholder's duties. Local regulations can influence everything from claims processing protocols to data privacy laws and renewal conditions. A policy held by a company in Singapore for an employee based in London operates under a vastly different set of rules than a personal plan that same executive might purchase independently.

Globally, private health insurance is a dominant force, but the policyholder structure is far from uniform. In many high-income nations, employers commonly serve as the group policyholder. In contrast, in countries with robust national health systems, individuals often become direct policyholders for their supplementary private plans. You can discover more insights about the global health insurance market outlook to better understand these regional distinctions.

Ascertaining who holds legal and financial authority over your plan is of utmost importance. It clarifies whom to contact for modifications, who is liable for payments, and which legal jurisdiction governs the contract—regardless of where your career takes you.

For anyone navigating these complexities, a firm grasp of international private medical insurance is an essential prerequisite. It provides the foundation needed to make intelligent decisions that protect both your health and your financial interests across borders. Your location should never be an impediment to receiving exceptional care.

Your Rights and Responsibilities as Policyholder

As the policyholder, you command the strategic direction of your health insurance plan. This position affords you significant control, but this authority is coupled with critical obligations necessary to maintain the integrity of your agreement with the insurer.

A comprehensive understanding of this duality—your powers and your duties—is the key to managing your healthcare coverage with precision. Your authority stems from your ownership of the policy, a status that grants you exclusive rights that other insured members of your family do not possess.

Your Exclusive Authority

Consider yourself the principal of the contract. Your rights are centred on control and access, allowing you to direct the policy in alignment with life's changes.

- Modify the Policy: You are the sole individual who can alter coverage levels, adjust deductibles, or add new benefits to the plan.

- Manage Dependents: Adding a newborn or a spouse, or removing an adult child who has secured their own employment, is your decision to make.

- Access Official Documents: All contractual paperwork, detailed claims histories, and official correspondence from the insurer are accessible to you.

- Appeal Decisions: If the insurance company denies a claim, you possess the legal standing to formally challenge that decision.

- Cancel the Contract: Ultimately, the power to terminate the policy rests exclusively with you.

Your Core Obligations

This authority is not absolute; it is balanced by fundamental responsibilities. These are not mere suggestions; they are requisite actions to keep the policy in force and ensure all enrolled members remain covered.

Your foremost duty is to maintain complete transparency with your insurer. This requires providing accurate information on your application and disclosing any material changes that could affect your coverage or risk profile.

Beyond this principle of good faith, you have practical duties. You are responsible for ensuring premiums are paid on time, as delinquency can lead to a policy lapse, terminating benefits for all insured members.

You must also notify the insurer of significant life events, such as relocating to a new country, which could alter the terms of your policy. Fulfilling these obligations is vital for seamless claims processing and directly impacts how features like those detailed in our guide on pre-authorisation and direct settlement procedures function in practice.

To provide further clarity, let us examine the two facets of your role as a policyholder.

A Policyholder's Core Rights and Responsibilities

This table offers a direct comparison of the powers you wield and the duties you must uphold to maintain your health coverage.

| Policyholder Rights | Policyholder Responsibilities |

|---|---|

| Control Policy Changes: Adjust benefits & coverage | Pay Premiums: Ensure timely payment to avoid policy lapse |

| Manage Members: Add or remove dependents | Provide Truthful Information: Maintain accuracy on all applications |

| Access Information: Receive all official documents | Report Changes: Notify insurer of material life events (e.g., relocation) |

| Appeal Decisions: Challenge claim denials | Understand the Contract: Be fully versed in the terms and conditions |

| Cancel the Policy: Terminate the contract | Communicate: Serve as the primary point of contact for the policy |

Understanding this balance is what distinguishes a passive policy-owner from an empowered policyholder who can strategically leverage their insurance to benefit themselves and their family.

Critical Questions Answered

When scrutinising the intricate details of health insurance, several pivotal questions invariably arise. Let us address them directly to provide you with complete clarity.

Can the Policyholder Be Different from the Person Insured?

Yes, unequivocally. This is a very common and standard arrangement.

Consider a corporate plan: the company is the policyholder responsible for the premiums, while the employee is the insured individual receiving medical care. The same principle applies to family plans, where one parent acts as the policyholder for a spouse and children, all of whom are insured members.

What Happens if the Policyholder Misses Premium Payments?

This scenario underscores the critical nature of the policyholder's financial responsibility. The consequences of missed premium payments are severe.

The policyholder is solely accountable for ensuring premiums are remitted on schedule. A missed payment initiates a grace period, after which the policy will lapse. Once lapsed, coverage is terminated for every individual on the plan, leaving all insured members without protection.

How Can the Policyholder of a Plan Be Changed?

As a general rule, one cannot simply "change" the policyholder on an active contract. An insurance policy is a legal agreement specifically tied to a particular person or entity.

The correct procedure involves cancelling the current policy. Subsequently, the individual who intends to assume responsibility must apply for a new policy in their own name. This process ensures a clean and legally sound transfer of ownership and responsibility.

The core principle is that ownership of an insurance contract is not transferable. A new agreement must be established with the new party, which necessitates a complete application and underwriting process.

How Do I Confirm Who the Policyholder Is?

Identifying the policyholder for your plan is typically a straightforward process.

If you are enrolled in a corporate plan, your Human Resources department can provide this confirmation. For any personal or family policy, the information is contained within your insurance documentation. Specifically, refer to the declaration page of your policy—it will clearly state the name of the individual or entity who is the official policyholder.

At Riviera Expat, we specialise in demystifying such complexities to provide high-net-worth professionals with unparalleled clarity. We offer expert, objective guidance to help you secure an international health insurance policy that places you firmly in control. Explore your options with us today.