An out-of-pocket maximum represents the absolute ceiling on your spending for covered medical services within a single policy year. Consider it a crucial financial safeguard. While not a spending target, it is the fundamental backstop protecting your assets from a significant medical event.

Once your qualifying expenditures reach this limit, your insurance carrier is obligated to cover 100% of all subsequent eligible healthcare costs for the remainder of that policy year.

Your Financial Safety Net in Health Insurance

For high-net-worth individuals and expatriates, this figure is a critical component of sophisticated financial planning. It effectively converts a potentially limitless, unpredictable medical liability into a fixed, manageable annual expense. This is indispensable for shielding your portfolio from the financial shock of a serious illness or accident.

What Counts Toward the Maximum

To be precise, only specific payments for covered medical services from in-network providers contribute to this maximum.

Your primary contributions are:

- Deductible: The initial amount you are required to pay for covered services before your plan’s cost-sharing provisions are activated.

- Copayments: The fixed fees you pay for specific services, such as a specialist consultation or a prescription medication.

- Coinsurance: The percentage of the cost you are responsible for after your deductible has been met.

These three expense categories are the exclusive building blocks that accumulate toward your annual limit.

What Does Not Count

It is equally important to understand what does not count. Your monthly premiums, for instance, are the cost of maintaining your policy and are entirely separate from your cost-sharing obligations; they do not apply toward your out-of-pocket limit.

Similarly, if you elect to consult a provider outside your plan’s network or receive a service that is not a covered benefit, those costs are your sole responsibility.

The out-of-pocket maximum is a key feature of modern health plans, representing the most a policyholder has to pay for covered services in a plan year. For 2024, U.S. federal regulations set this limit at $9,450 for an individual and $18,900 for a family on most Marketplace plans.

Mastering this financial backstop is the first step toward commanding your healthcare finances. From here, you can explore other strategies to reduce healthcare costs and ensure your wealth remains protected.

How You Reach Your Out-of-Pocket Maximum

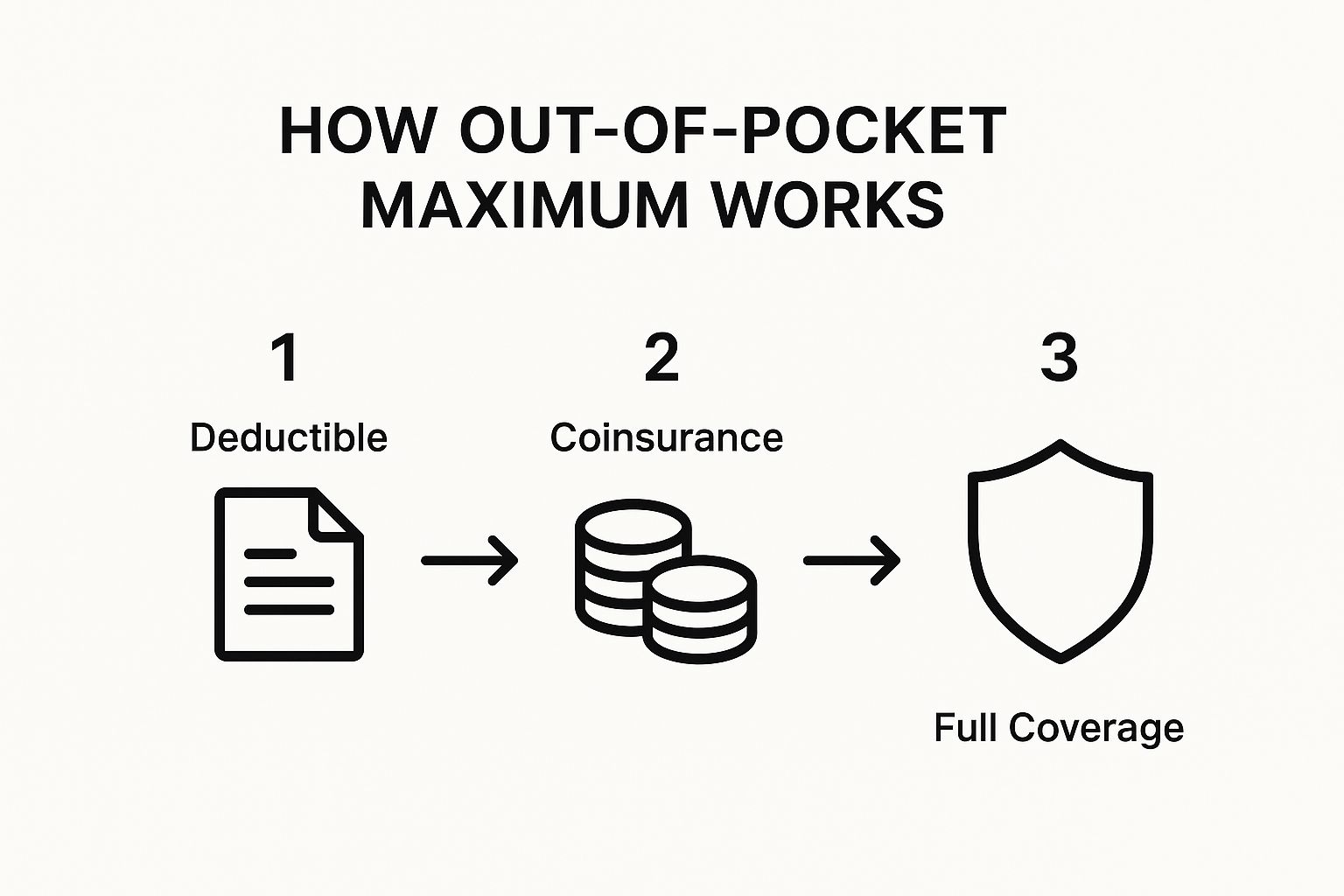

Understanding the mechanics of reaching your out-of-pocket maximum is crucial for effective capital management. Envision it as filling a container. Each dollar you spend on covered, in-network medical care incrementally fills that container.

Initially, you are solely responsible for all costs until you meet your deductible. This represents the first portion of filling the container. Once that threshold is met, your insurance carrier begins to contribute. From that point, you pay only a percentage of subsequent costs (coinsurance) or a fixed fee (copayment).

Only these three specific payment types—your deductible, copayments, and coinsurance—contribute to the total. Each payment brings you progressively closer to the annual limit.

How Your Medical Expenses Count Toward the Maximum

This table provides a precise breakdown of how your payments accumulate to reach your annual out-of-pocket maximum for covered, in-network services.

| Payment Type | What It Is | Contribution to OOP Maximum |

|---|---|---|

| Deductible | The initial amount you pay for covered services before your plan starts to pay. | Yes, every dollar is applied. |

| Copayments | A fixed amount you pay for a covered health care service after you've paid your deductible. | Yes, these amounts accumulate. |

| Coinsurance | Your share of the costs of a covered health care service, calculated as a percentage. | Yes, this is a primary component. |

| Monthly Premiums | The fixed monthly fee you pay to keep your health insurance active. | No, these payments do not count. |

| Out-of-Network Care | Costs for doctors or hospitals not in your plan’s network. | No, these are subject to separate terms. |

| Non-Covered Services | Services that your health insurance plan doesn't pay for or cover. | No, these are 100% your responsibility. |

As illustrated, only specific, pre-approved medical expenses contribute. Expenses such as monthly premiums or care from an out-of-network provider do not apply toward this total.

The Path to Full Coverage

Once the container is full—meaning your combined qualifying payments have reached the out-of-pocket maximum—your financial obligation for eligible medical care ceases for the year. At this juncture, your insurer assumes 100% of all subsequent eligible, in-network costs. It is a progressive framework that establishes a hard ceiling on your potential medical expenditures.

The diagram below illustrates this straightforward journey from your first dollar spent to achieving the full protection of your plan's limit.

This reinforces that reaching your maximum is not a single event but a cumulative process built upon your deductible and all subsequent cost-sharing payments.

Of course, the approval of these costs often requires navigating administrative processes like prior authorization. It is noteworthy that emerging technologies like AI prior authorization tools are beginning to streamline this process considerably for all parties involved.

Finally, it is vital to remember that costs contributing to this limit are entirely separate from your monthly premiums. Those are fixed fees for maintaining the policy. For a deeper analysis of premium dynamics, our guide on https://www.riviera-expat.com/why-do-medical-insurance-premiums-rise-year-after-year/ may prove insightful.

Seeing the Out-of-Pocket Maximum in Action

It is one thing to discuss these concepts in theory; it is another to observe how the out-of-pocket maximum performs under duress, where it demonstrates its true value.

This feature is what transforms a potentially catastrophic medical liability into a predictable, manageable expense—an essential safeguard for any individual, but particularly for high-net-worth individuals managing financial exposure.

Let us analyze a realistic scenario involving an expatriate executive with a premium international health plan.

A Surgical Scenario Breakdown

Imagine this executive requires a complex but necessary surgery while on assignment abroad. The total invoice for the procedure, hospitalization, and specialist fees amounts to $100,000.

Their insurance policy specifies the following terms:

- Deductible: $5,000

- Coinsurance: 20%

- Out-of-Pocket Maximum: $15,000

Here is the precise, step-by-step breakdown of the costs. This illustrates exactly what the out-of-pocket maximum is engineered to do.

First, the executive pays their $5,000 deductible. This is their initial capital outlay and the first payment that applies toward their annual out-of-pocket limit.

With the deductible satisfied, the remaining bill is $95,000. The 20% coinsurance is now active. However—and this is the critical distinction—it does not apply to the entire $95,000. It applies only until the executive’s total spending reaches their $15,000 maximum.

Since the executive has already paid $5,000 for the deductible, they only need to contribute another $10,000 in cost-sharing to reach their maximum. That $10,000 represents their 20% share of the next $50,000 in medical charges.

Once this occurs, the executive has paid a total of $15,000 ($5,000 deductible + $10,000 coinsurance). They have officially met their out-of-pocket maximum for the policy year.

The Insurer Takes Over Completely

The moment that $15,000 threshold is crossed, the financial dynamic shifts entirely.

The remaining balance of the medical bill—a substantial $45,000—is now covered 100% by the insurer. The executive pays nothing further.

Let us consider the alternative. Without that out-of-pocket cap, the executive’s 20% coinsurance on the $95,000 balance would have been $19,000. Their total cost would have amounted to $24,000 ($5,000 deductible + $19,000 coinsurance).

Instead, their liability was capped at a predictable $15,000. This example demonstrates precisely how this feature places a firm ceiling on your financial risk, providing absolute certainty even when confronted with significant medical expenses.

Here is a common error that can lead to thousands in unexpected healthcare costs.

Confusing your deductible with your out-of-pocket maximum.

While they sound similar, they serve entirely different functions in your financial strategy. Misunderstanding their roles is a formula for an unwelcome surprise when a major medical bill arrives.

Think of your deductible as the initial barrier you must overcome. It is the amount you are required to pay for covered medical care before your insurance carrier begins to contribute to the costs.

Once you have paid your deductible, your spending is not complete. You have simply entered the next phase, where you and your insurer share costs through copayments and coinsurance.

The Key Financial Distinction

The out-of-pocket maximum, by contrast, is the absolute financial safety net for your year. It is the total cap on your expenditures for eligible, in-network care.

This figure includes every qualifying dollar you have paid: your deductible, all your copayments, and your coinsurance contributions.

Once you reach that out-of-pocket maximum, your financial responsibility for covered care is concluded. Your insurer is legally obligated to cover 100% of all subsequent eligible costs for the remainder of the plan year.

This is a critical distinction for asset protection. The deductible initiates cost-sharing; the out-of-pocket maximum is what prevents a medical crisis from becoming a financial catastrophe.

A Look at Real-World Limits

What do these limits look like in practice? Understanding typical figures provides a clearer perspective when selecting a plan.

Let’s examine some U.S. data for context. In 2023, 67% of covered workers with single coverage had an out-of-pocket maximum exceeding $3,000. The federal limit for most individual plans was $9,450, a threshold reached by only 2% of employees with individual plans. You can explore more data on employee cost-sharing trends to see how these structures are implemented across the market.

Ultimately, the most effective way to conceptualize this is: your deductible is the price of admission for activating your insurance benefits. Your out-of-pocket maximum is the ultimate spending ceiling that protects your entire portfolio.

A Global Perspective for Expatriates and Investors

Here is a fact that surprises many expatriates.

The concept of an out-of-pocket maximum—the financial safeguard you may be accustomed to in the U.S.—is not a global standard. While a consumer protection mechanism, its existence and implementation vary dramatically from one country to another.

This directly affects your financial risk and your access to quality care when residing abroad.

How Cost Protection Varies Around the World

The structure of an out-of-pocket maximum differs significantly depending on geographic location.

While it became a mandated feature for most U.S. health plans in 2014 under the Affordable Care Act, other developed nations employ different methods for managing cost-sharing.

Many European countries, for instance, have far lower direct cost-sharing limits, if they utilize this specific mechanism at all. In nations like Germany or the Netherlands, the cap on patient liability is often integrated directly into their universal coverage frameworks, sometimes even indexed to income.

In other regions, these financial backstops can be ambiguous or entirely absent. This lack of clarity creates a substantial financial risk, capable of turning a medical emergency into a serious threat to your wealth.

For a globally mobile investor or executive, the absence of a predictable ceiling on medical costs within a local healthcare system constitutes an unacceptable financial variable. It contradicts every principle of sound wealth management.

The Critical Role of Premium International Insurance

This global inconsistency is precisely why a premium international health plan with a clearly defined out-of-pocket maximum becomes a non-negotiable component of your financial toolkit.

A high-quality international policy eliminates the guesswork. It establishes a predictable, standardized cap on your medical spending, regardless of your location.

It ensures that your access to world-class medical care is not compromised by the financial limitations or peculiarities of a local system.

Of course, selecting the right policy is paramount. To truly protect your assets, you must understand every detail of your coverage. For more guidance, you can read our detailed breakdown of expat medical insurance and which policy type is right for you.

Frequently Asked Questions

Even with a firm grasp of the out-of-pocket maximum, real-world questions inevitably arise. It is one thing to understand a concept; it is another to apply it when your finances and health are at stake.

For expatriates and investors, precision in these details is non-negotiable. A minor misunderstanding can create significant financial blind spots, transforming a trusted health plan into a liability. Let's address some of the most common inquiries we receive from clients.

Does My Out-of-Pocket Maximum Reset Every Year?

Yes, absolutely. This is a critical detail for financial planning. Your out-of-pocket maximum resets to zero on the first day of your new plan year.

Consider the strategic implications. If you schedule a major procedure late in your plan year, you might reach your maximum just before the policy renews. Any follow-up care in the new year will start a fresh accumulation. In certain situations, carefully timing a procedure can be a powerful financial maneuver.

How Does This Work With a Family Health Plan?

This is where many individuals encounter confusion. Family plans feature two layers of protection: an individual out-of-pocket maximum and a higher family maximum.

Here is the practical application. Once one person on the plan reaches their individual maximum, their own eligible, in-network costs are 100% covered by the insurer. However—and this is the key point—the other family members continue to pay their own cost-sharing for their care.

This continues until the combined out-of-pocket spending of all family members meets the total family maximum. Only then does the plan begin covering 100% of eligible costs for everyone on the plan for the remainder of the year.

It is essential to understand this two-tiered structure. One family member's high medical expenses will not automatically trigger full coverage for everyone else until that higher family threshold is met.

Are There Costs I Pay After Hitting My Maximum?

Yes, and overlooking this can be a costly error. The out-of-pocket maximum is a powerful shield, but it only protects you from covered, in-network services.

You will always be responsible for paying:

- Your monthly plan premiums.

- Any costs for services your plan does not cover (e.g., elective cosmetic surgery).

- All costs for care from out-of-network providers.

These expenses do not count toward your maximum, and the maximum does not limit them. For more answers to common insurance questions, you can always check out the Riviera Expat FAQ page.

Navigating the complexities of international health insurance is our specialty. At Riviera Expat, we provide expert, objective guidance to ensure your policy aligns perfectly with your financial strategy and global lifestyle. Get clarity and confidence in your coverage by visiting us at https://riviera-expat.com.