At its core, group insurance is a single insurance policy that provides coverage to a defined group of individuals—most often, the employees of a single company or members of a professional association. This collective approach allows organizations to offer high-value health and life benefits, making it a powerful component of any competitive compensation package. The key advantage is that the premium per person is often substantially lower than what an individual could secure on their own.

Understanding Group Insurance as a Strategic Asset

Consider group insurance as a wholesale acquisition of benefits. Rather than each individual negotiating a separate policy, the organization secures a single master contract with an insurer. This structure pools the risk of all members, which is the precise mechanism that makes it so cost-effective for both the company and its team members.

This model originated in the United States in the early 20th century. Employers quickly recognized it as an effective tool to attract and retain skilled professionals by offering something invaluable: security for their health and their family's financial future. This philosophy has evolved, but the core principle remains unchanged. You can explore the industry's evolution in Deloitte's detailed analysis.

A Cornerstone of Executive Compensation

For high-net-worth individuals and senior executives, a benefits package is not a mere perk—it is a critical component of their comprehensive financial strategy. Group insurance serves as the foundation of that security, and it comes with distinct advantages:

- Substantial Cost Efficiencies: By spreading risk across a large group, the cost per person drops dramatically compared to an individual policy.

- Simplified Access to Coverage: Members often gain coverage with minimal or no medical underwriting, bypassing the invasive health screenings typical of individual plans.

- Superior Benefit Structures: Group plans frequently provide access to premium healthcare networks and richer coverage options that would be prohibitively expensive, if not unavailable, on an individual basis.

To fully appreciate its power, one must view group insurance as part of a broader organizational strategy. It is not merely an expense; it is a direct investment in attracting and retaining top-tier talent, making it an essential element of modern corporate finance.

Group Insurance Core Principles

The table below outlines the fundamental concepts behind group insurance and their strategic importance.

| Principle | Strategic Implication |

|---|---|

| Risk Pooling | Spreads financial risk across a diverse group, lowering individual premiums and making comprehensive coverage affordable. |

| Master Contract | A single policy simplifies administration for the employer and streamlines processes for all participants. |

| Reduced Underwriting | Members often gain coverage without extensive medical examinations, ensuring broader eligibility and immediate access. |

| Group Negotiation | The collective bargaining power of the group secures more favorable terms, benefits, and rates than individuals could achieve alone. |

Ultimately, these principles operate in concert to create a system that delivers significant value to both the organization sponsoring the plan and the individuals it covers.

How Group Insurance Policies Are Structured

To truly comprehend group insurance, it is essential to understand how the policies are constructed. The entire framework is built around a single core document: the master policy.

This is the overarching contract between the organization (the policyholder) and the insurance provider. This singular document defines all the parameters—the terms, conditions, coverage levels, and premium rates for every individual within the group.

The organization, as the policyholder, collaborates with the insurer to finalize these terms. They select plan designs that are appropriate for their workforce and align with the company's financial strategy. Once this master agreement is executed, it governs the entire insurance program, ensuring efficient and straightforward administration.

While the company holds the master policy, each covered member receives a certificate of insurance. This document serves as personal proof of coverage, summarizing the specific benefits, limitations, and claim procedures that apply to the member and their dependents under the group plan.

Eligibility and Enrollment Dynamics

Participation in the plan is governed by specific rules. To be included, an executive or team member must meet clear-cut eligibility criteria stipulated in the master policy. These requirements are uniform and consistently applied.

- Employment Status: Coverage is typically reserved for full-time, permanent employees to maintain a stable and predictable risk pool for the insurer.

- Waiting Period: New employees almost always observe a waiting period, typically between 30 to 90 days, before their insurance benefits become active. This is a standard administrative protocol.

- Enrollment Windows: Enrollment is restricted to specific periods, such as immediately following the date of hire or during an annual "open enrollment" window.

The entire structure of a group policy is engineered for efficiency. By utilizing one central contract and standardized eligibility, insurers significantly reduce their administrative costs. This efficiency is a primary driver of the lower premiums associated with group plans.

Contribution Models and Management

The premium cost is typically shared between the employer and the employee.

In a contributory plan—the most prevalent model—both the member and the employer fund a portion of the premium. In a non-contributory plan, the employer covers 100% of the premium cost. The latter is a significant benefit, often used as a strategic tool to attract and retain senior-level talent.

Understanding these details is critical. For those seeking to interpret the finer points of a policy, our guide to expat medical insurance policy terms explained offers valuable insights. This clear delineation of financial and administrative responsibilities is what enables the system to function seamlessly.

What’s In It For Everyone?

Group insurance is not merely a line item in a budget; it is a strategic initiative that delivers tangible value to both the organization and its members, creating a powerful win-win scenario.

From the corporate perspective, offering a premier benefits package does more than attract talent. It solidifies a reputation as an employer that invests in its people, providing a distinct competitive advantage.

This investment yields dividends in productivity. When a team has access to excellent healthcare, they are healthier, more engaged, and less distracted by medical concerns. This fosters a more focused, resilient, and effective workforce.

The Financial and Practical Upside for Members

For a high-net-worth professional, the most immediate benefit is cost savings. By distributing risk across a large pool of individuals, insurers can offer plans at a substantially lower cost. Group insurance premiums are often significantly lower than a comparable policy purchased on the open market because administrative overhead is shared. For a clearer understanding of these cost dynamics, one can review recent global insurance market reports.

The advantages, however, extend far beyond the price. Another critical benefit is the ease of obtaining coverage. Most group plans include guaranteed issue provisions.

This means eligible members can secure excellent coverage without the invasive medical examinations and extensive health questionnaires required for individual plans. For an individual with a pre-existing condition that might otherwise render them uninsurable, this feature is invaluable.

Finally, these plans provide access to benefits and provider networks that most individuals could not secure on their own. This often includes:

- Access to Premier Networks: Group policies typically contract with leading hospitals and highly sought-after specialists, ensuring a superior standard of care.

- Enhanced Coverage Limits: Organizations can negotiate for higher payout maximums and richer benefits, such as comprehensive dental, vision, and mental health support that are rarely offered in standard individual plans.

- Zero Administrative Burden: The organization manages all administrative interactions with the insurer, freeing members from the tasks of policy management, claim submission, and premium payments.

Combined, these elements constitute a benefit that is far more than a simple perk. It is a core component of a sophisticated financial and personal wellness strategy.

Comparing Group and Individual Insurance Plans

When constructing a sound financial plan, understanding the landscape is paramount. In the insurance sector, the primary options are group plans and individual policies. While they appear similar, they operate on fundamentally different principles.

The most significant distinction lies in the underwriting process. Group plans, by virtue of spreading risk across many participants, often feature guaranteed issue coverage. This is a crucial advantage. It means one can obtain coverage without the comprehensive medical examinations that individual policies require.

For high-net-worth professionals, particularly those with pre-existing health conditions, this is a decisive factor. An individual plan will subject one's personal health history to intense scrutiny. While this may result in a more customized policy, it is a far more invasive and uncertain process.

Coverage itself is another point of divergence. Group plans are designed to offer a solid baseline for an entire organization, but customization is limited. It is common to find caps on coverage, especially for specialized treatments or robust disability insurance.

Portability and Personalization

A critical factor that is often overlooked is portability—or the lack thereof. Group insurance is tied to one's employer. Upon separation from the company, that coverage typically terminates. An individual policy, by contrast, is a personal asset. It remains with you regardless of career changes, providing a stable foundation of protection.

This is precisely why many sophisticated professionals do not rely solely on one or the other. They strategically layer their coverage, using the employer-sponsored group plan as a base and supplementing it with a private, individual policy.

This hybrid strategy is powerful because it allows you to:

- Fill Coverage Gaps: A group plan may have insufficient disability or critical illness protection. A private plan can fill these gaps, ensuring comprehensive protection against financial exposure.

- Enhance Customization: You can add specific riders and benefits that align with your family's unique circumstances and financial objectives, a level of tailoring a one-size-fits-all group plan cannot offer.

- Ensure Continuity: Regardless of employment status, you maintain a high-quality layer of coverage that is entirely under your control.

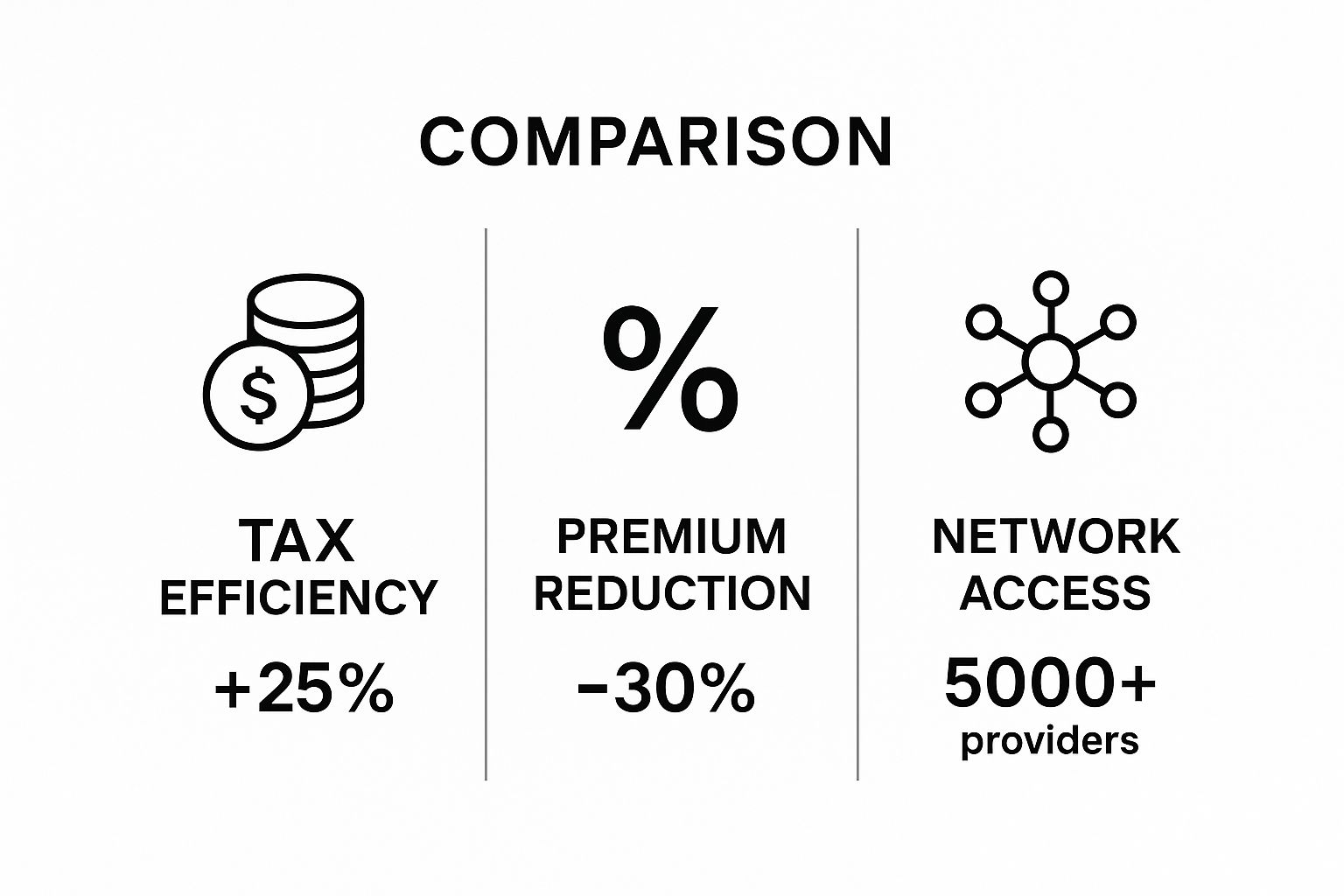

This infographic neatly summarizes some of the core advantages found in a group structure.

As you can see, the financial efficiencies are compelling. The challenge is to balance those cost savings against the need for personalized, portable protection. To help weigh these options, the following table breaks down the key differences.

Comparison of Group vs Individual Policies

| Feature | Group Insurance | Individual Insurance |

|---|---|---|

| Underwriting | Often guaranteed issue; no medical exam typically required. | Full medical underwriting based on personal health history. |

| Premiums | Generally lower due to risk pooling across a large group. | Higher, as they are based on individual risk factors (age, health). |

| Portability | Tied to the employer; coverage ends upon employment termination. | Fully portable; remains with the policyholder regardless of employment. |

| Customization | Standardized benefits; limited options for personalization. | Highly customizable with various riders and benefit levels. |

| Coverage Scope | May have lower limits, especially for disability or specific illnesses. | Can be tailored for high coverage limits to protect significant assets. |

| Enrollment | Restricted to specific enrollment periods set by the employer. | Can be purchased at any time throughout the year. |

Ultimately, the optimal choice depends on a clear assessment of your personal circumstances. You can explore this topic further in our guide on which expat medical insurance policy type is right for you. Adopting a layered approach is often the most prudent strategy for building a truly comprehensive and resilient safety net.

Navigating International Group Insurance

For an executive managing teams distributed across the globe, a group insurance plan designed for New York will be entirely insufficient in Singapore. The concept of group insurance varies dramatically between regions, and a failure to comprehend these differences can leave your team dangerously exposed.

The global insurance market is far from uniform. According to 2022 data from the Insurance Information Institute, the United States holds approximately 40% of the global market share, while Europe accounts for around 22%. These regional concentrations directly influence the types of private group plans available and their scope of coverage.

Key Regional Differences

Let us examine what this means in practice.

In North America, the system is predominantly employer-centric. Private group insurance forms the backbone of healthcare for most working professionals and their families. The market is mature, competitive, and offers a vast array of plan designs and provider networks.

In Europe, the landscape is entirely different. Most European nations have robust public healthcare systems that provide a high standard of baseline care. Here, private group insurance serves a supplementary function—providing faster access to specialists, private hospitals, and enhanced amenities. The regulatory environment is complex and varies significantly from one country to another.

The Asia-Pacific region is a dynamic and rapidly evolving environment. As companies expand and the competition for talent intensifies, so does the demand for competitive group benefits. Success here requires careful attention to local laws, cultural expectations regarding employee wellness, and a constantly changing market.

For any leader managing a global team, the primary challenge is integrating these disparate systems. A single, uniform plan is rarely feasible. A sophisticated understanding of international benefits administration is what distinguishes a disjointed, ineffective policy from a seamless global strategy that properly protects your people, regardless of their location.

This global perspective is non-negotiable. To offer truly competitive benefits, your plan must accommodate these regional nuances. For those managing overseas assignments specifically, our in-depth guide to international private medical insurance provides the critical details required.

How to Properly Evaluate a Group Insurance Plan

Understanding the definition of group insurance is only the first step. The essential skill is the ability to look beyond the summary document and critically analyze any plan presented. Accepting the first offer without due diligence is a mistake; a proper evaluation is the only way to ensure the policy aligns with your actual needs.

First, set aside the premium and focus on the scope of coverage. Does the plan offer comprehensive dental, vision, and mental health services, or are these superficial add-ons with negligible limits? This distinction can mean the difference between true well-being and significant, unexpected out-of-pocket expenses.

Examining the Financials and Networks

Next, you must investigate the plan’s financial structure and network limitations. This is where the true value of a policy is either confirmed or revealed to be inadequate. A low premium often conceals a high deductible or a restrictive provider network, making it a poor value proposition in practice.

Here is what you must investigate:

- Deductibles & Out-of-Pocket Maximums: You must know your total potential financial exposure for the year, for both yourself and your family. For high-income earners, it is often more strategic to pay a higher premium for a plan with a lower out-of-pocket maximum, as it provides greater financial predictability.

- Provider Network (PPO vs. HMO): Do you require the flexibility of a Preferred Provider Organization (PPO) to see specialists without a referral? Or can you operate within the more structured framework of a Health Maintenance Organization (HMO)?

- Dependent Eligibility: Never assume your family is covered. Verify the specific rules for spousal and child coverage to ensure no one is inadvertently excluded.

For any professional working internationally, verifying global coverage is non-negotiable. You must confirm the specifics of medical evacuation and repatriation benefits. These are essential lifelines when operating far from one's home country.

By asking these targeted questions, you transition from being a passive recipient of a standard HR offering to an informed stakeholder. You ensure your group plan is a genuine asset, not simply another deduction on your pay statement.

Common Questions About Group Insurance

When seeking to understand group insurance, several questions consistently arise. Clarifying these points helps to appreciate the real-world value—and the limitations—of your coverage.

What’s The Real Advantage Of Group Insurance?

The single greatest advantage is significant cost savings, which is a direct result of risk pooling.

When an insurer covers a large group, the risk of any single individual making a substantial claim is distributed across the entire pool. This dramatically lowers the premium for everyone compared to what one would pay for an individual policy. This collective purchasing power also provides your employer with the leverage to negotiate for superior benefits than any individual could obtain independently.

Can I Keep My Group Insurance If I Quit My Job?

In almost all cases, the answer is no. Your coverage is a benefit of your employment, and it typically terminates when you leave the company.

In some jurisdictions, such as the U.S. with its COBRA regulations, you may have the option to temporarily continue your plan, but you will be responsible for paying the full, unsubsidized premium. This is usually prohibitively expensive and is intended only as a short-term solution. This reality underscores why a private, portable policy is critical for maintaining continuous protection.

The primary weakness of any employer-sponsored plan is its lack of portability. A private policy that you own and control ensures your health and financial security are never contingent upon your employment. It provides you with complete autonomy over your long-term well-being.

At Riviera Expat, our exclusive focus is securing world-class international private medical insurance for professionals like you. We ensure you have clear, continuous coverage, regardless of where your career takes you. Gain the clarity and confidence you require by exploring your options with us at https://riviera-expat.com.