When evaluating a premier health insurance plan, the premium is the initial figure you consider. However, the deductible is an equally critical component of your financial strategy—and often, a point of confusion.

So, what is it precisely? A health insurance deductible is the specific amount of money you are responsible for paying out-of-pocket for covered medical care before your insurance provider begins to contribute its share.

Consider it your initial financial commitment for the policy year. Once you have met this amount through approved medical services, your insurer intervenes to cover subsequent costs according to your plan’s terms. This is a fundamental element of the financial agreement between you and your insurer.

Your Health Insurance Deductible Explained

Mastering your policy begins with a firm grasp of the deductible’s function. It is not an arbitrary fee; it is a critical lever you can adjust when selecting a plan to align with your financial portfolio.

The size of your deductible directly influences both your monthly premium and your out-of-pocket exposure when you require care. This is a significant detail. For instance, in the United States, the average annual deductible for a single individual under an employer-sponsored plan was $1,745 in 2023. This represents a substantial increase from approximately $379 in 2006, according to data from the Kaiser Family Foundation.

The Role of a Deductible

At its core, the deductible establishes the threshold for your insurer’s financial responsibility. It is the point where your direct spending concludes and their coverage commences. This cost-sharing mechanism is central to nearly every sophisticated health plan available.

The deductible is the financial hurdle you must clear each policy year. Until you have paid this amount for covered services, you are essentially self-funding your medical care (with the common exception of certain preventive services).

Understanding this concept is key to managing your financial exposure, particularly for expatriates with international assets. It is prudent to view the deductible as a potential, planned expense rather than an unforeseen penalty.

While the term is universal, its application can differ, especially within international private medical insurance (IPMI). To become more familiar with the specific language used in these policies, you may find our guide on explaining expat health insurance policy terms beneficial.

Your deductible does not operate in isolation. It functions in concert with other key financial terms in your policy. Let’s dissect how these components integrate.

Key Financial Terms in Your Health Policy

This table clarifies the core financial terms you will encounter alongside your deductible, providing a clear reference for understanding your policy’s structure.

| Term | Definition | How It Interacts with Your Deductible |

|---|---|---|

| Premium | The fixed monthly or annual amount you pay to maintain your insurance policy’s active status. | This is a separate, ongoing cost. Your premium payments do not count toward your deductible. |

| Copayment (Copay) | A fixed amount you pay for a specific covered service, such as a specialist consultation, after your deductible has been met. | Copayments for services subject to the deductible typically begin only after you have fully satisfied your deductible. |

| Coinsurance | The percentage of costs you are responsible for paying for covered health services after you have met your deductible. | This is your cost-sharing phase. For example, with 20% coinsurance, you pay 20% of the bill and your insurer pays 80%—but only after your deductible is met. |

| Out-of-Pocket Maximum | The absolute limit on what you will have to pay for covered services in a policy year. | Once you reach this ceiling (through deductibles, copays, and coinsurance), your insurer pays 100% of covered costs for the remainder of the year. Your deductible constitutes the first portion of this total. |

Once you understand how the deductible, premium, and other terms function together, you are in a superior position to make strategic decisions regarding your health coverage.

How Your Deductible Works in Practice

While the theory is straightforward, observing how a deductible functions with actual expenditures is what truly matters. Let’s walk through a realistic scenario to see how your payments accumulate and, critically, when your insurer ultimately intervenes.

Imagine you require a series of specialist visits and advanced imaging over several months. Your international health insurance plan has a $5,000 annual deductible.

The Accumulation Phase

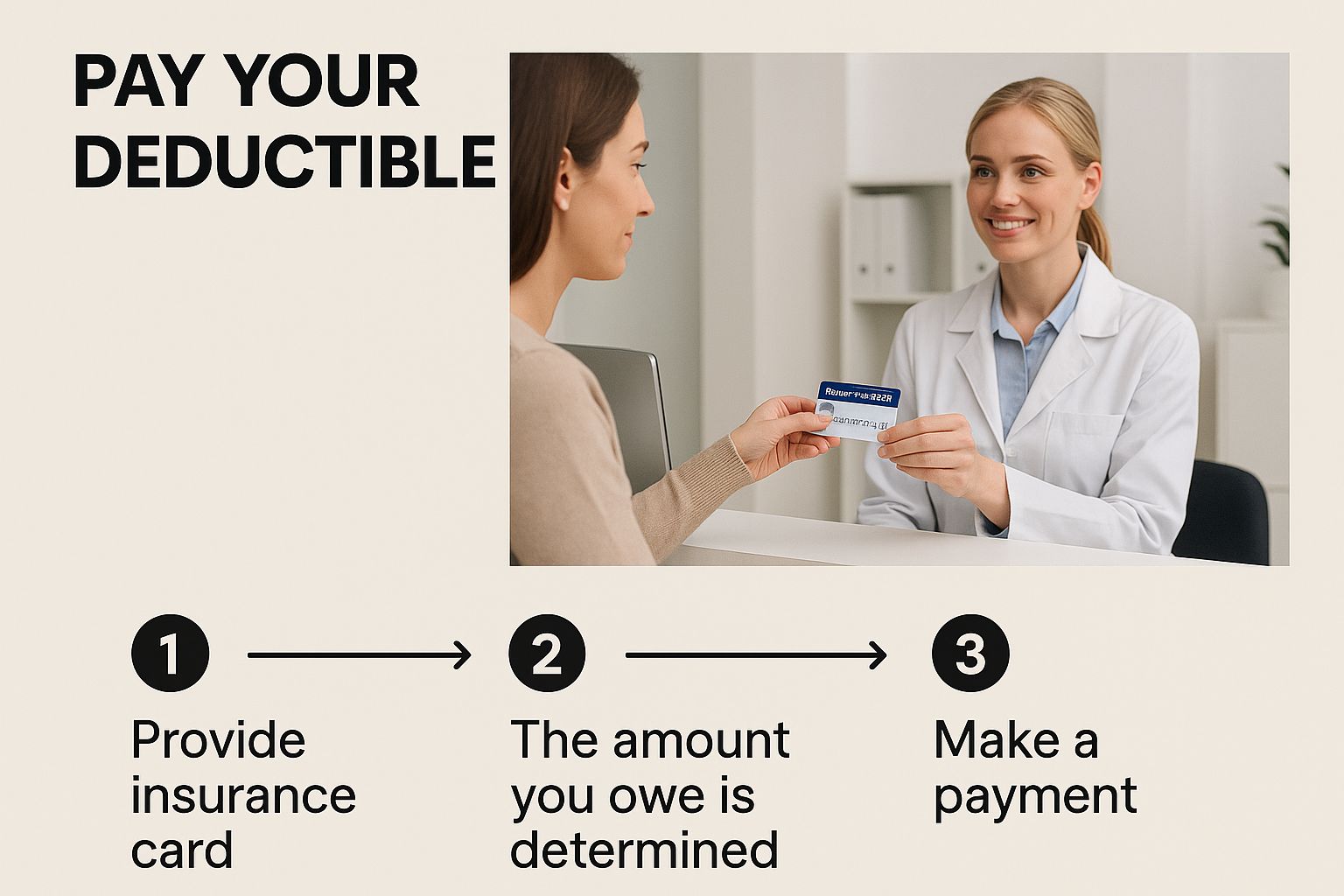

Initially, you are responsible for 100% of your medical bills. Each time you pay for a covered service, that amount is credited against your total deductible.

- Visit 1: Specialist Consultation: Your first appointment costs $500. You settle this bill in full. Your remaining deductible is now $4,500.

- Visit 2: Diagnostic Imaging: You require an MRI, which costs $2,500. This payment also comes directly from your funds. Your remaining deductible drops to $2,000.

- Visit 3: Follow-Up & Laboratory Analysis: A follow-up visit with associated lab work amounts to $1,500. You pay this as well. You now have only $500 remaining to meet on your deductible.

To date, you have paid a total of $4,500 out-of-pocket. You remain in the deductible phase, meaning your insurer has not yet contributed toward these specific costs.

This is the point where you begin shouldering the costs, initiating the process of meeting your deductible.

As the image illustrates, meeting your deductible commences the moment you make that first payment for a covered healthcare service.

Triggering Coinsurance and Reaching the Threshold

Your very next medical bill is what carries you over the threshold. This is where your policy’s cost-sharing features finally activate.

Let’s say you have one last procedure that costs $2,000. You pay the first $500 of this bill, which officially satisfies your $5,000 annual deductible.

What becomes of the remaining $1,500 of that bill? It now falls into your plan’s coinsurance phase. If your plan specifies a 20% coinsurance, you are responsible for 20% of that $1,500 (which is $300), and your insurer finally engages, paying the other 80% ($1,200).

From this moment forward for the remainder of your policy year, your deductible is met. You have entered the cost-sharing stage. For any subsequent covered medical bills, you will only be responsible for your coinsurance percentage until you reach your out-of-pocket maximum—the ultimate cap on your spending.

Of course, this entire process hinges on precise billing and claims processing, which relies heavily on your medical providers adhering to the top medical documentation guidelines.

Individual vs. Family Deductibles

It is also absolutely critical to ascertain whether you are dealing with an individual or a family deductible structure, as they function quite differently.

- Individual Deductible: This is the amount a single person on a family plan must pay out-of-pocket before their specific costs begin to be shared by the insurer.

- Family Deductible: This is a much higher, aggregate amount. Once the total medical spending of all family members reaches this single target, the insurer begins sharing costs for every person on the plan, even those who have not met their individual deductible.

This dual system provides two pathways for coverage to activate. It offers a financial safeguard for a major health event affecting one person, as well as for a year of numerous smaller expenses distributed across the family. Always review your policy documents to confirm the exact structure of your plan.

The Relationship Between Deductibles and Premiums

The most important financial trade-off you will make when selecting a health plan is the one between your deductible and your premium.

Envision them as two ends of a seesaw. When one rises, the other must descend. This is not an arbitrary rule; it is the fundamental principle of how you align insurance with your personal financial strategy and anticipated healthcare utilization.

It is a straightforward exchange. If you select a higher deductible, you are indicating to the insurer your willingness to assume a greater portion of the initial financial risk. In return, they provide you with a lower monthly premium.

Conversely, if you opt for a lower deductible, the insurer assumes risk much sooner. That higher level of protection for you is reflected in a more predictable, yet larger, monthly premium payment.

Aligning Your Plan with Your Financial Strategy

Understanding this dynamic is paramount. It transforms your health insurance from a simple safety net into a sophisticated component of your overall financial plan. Your choice here is a direct reflection of your personal comfort with risk and your approach to managing cash flow.

For example, a healthy, young entrepreneur might gravitate towards a high-deductible plan. The lower monthly premium frees up valuable capital that can be reinvested into their business or other assets. They are making a calculated decision based on their good health, comfortable with the prospect of a larger one-time expense should an unexpected event occur.

Now consider an executive with a family, for whom budget predictability is paramount. A low-deductible plan is far more appealing. The fixed monthly premium is higher, certainly, but it dramatically mitigates the financial impact of a sudden medical crisis, making it much easier to forecast the family’s annual expenditures.

Your deductible choice is a direct reflection of your financial comfort zone. It’s about deciding whether you prefer to manage lower, fixed costs each month or are prepared to handle a larger, less frequent expense should the need arise.

This balancing act is not only about personal choice; it is also influenced by broader market forces. Financial pressures on insurers often lead them to offer plans with higher deductibles across the board. The result for policyholders can be higher out-of-pocket spending, which may unfortunately lead to a delay in seeking necessary care.

And remember, the premium itself is a complex figure, not solely determined by your chosen deductible. For a comprehensive picture, you can read our detailed explanation of why medical insurance premiums rise year after year.

By carefully weighing this trade-off, you can identify the perfect balance for your specific circumstances, turning your policy from a generic product into a financial tool that truly works for you.

Deductibles in Global Health Insurance Plans

When managing your life and assets across different countries, you require health insurance that is as mobile as you are. Standard domestic plans are often too rigid. For expatriates and global citizens, International Private Medical Insurance (IPMI) offers an entirely different level of flexibility.

A significant part of that flexibility is found in how deductibles are structured. These plans are designed differently, providing you with a way to strategically manage your costs that aligns with a global lifestyle.

One of the most significant differences is how the deductible is applied. Many domestic plans feature a single, large annual deductible that must be met before any benefits are paid. In the international market, however, it is very common to find a per-claim deductible.

This structure means you pay a small, fixed amount for each new medical issue or claim, rather than having to exhaust a large yearly sum before your coverage activates. If you anticipate only a few, separate physician visits during the year, this model can be a distinct advantage.

This level of customization is what distinguishes premium IPMI policies. It transforms the deductible from a fixed obstacle into a financial tool that you can actively control.

Tailoring Deductibles to Specific Kinds of Care

Here is where these plans become truly powerful. Global health plans often permit you to apply deductibles selectively. You can design your policy to have a deductible for certain types of care while ensuring other, more critical services are covered from the first dollar.

A common and highly effective strategy is to choose a deductible that applies only to outpatient services. This includes services such as routine physician visits, appointments with specialists, and diagnostic tests.

By structuring your plan this way, you achieve two critical objectives:

- You lower your premiums. By agreeing to cover the initial costs for smaller, routine care yourself, you can significantly reduce your monthly policy payments.

- You secure full protection for major events. Crucially, this structure often means that major medical events requiring hospitalization (inpatient care) have no deductible at all. Your insurer provides full coverage from day one for the largest financial risks, such as a major surgery or an extended hospital stay.

This strategic split ensures your plan provides immediate, powerful protection against catastrophic costs, while you maintain control over smaller, more predictable expenses. It is a more intelligent way to manage your risk.

Making a Strategic Choice for Your Global Lifestyle

Ultimately, selecting the right deductible structure for your IPMI plan is a key strategic decision. It has a direct impact not only on your annual costs but also on your immediate access to top-tier healthcare networks around the world.

Consider your personal situation.

Are you a frequent traveler who might need a few GP visits in different countries? A per-claim deductible could be a perfect fit.

Are you a family living abroad, focused on protecting against a major medical emergency while managing day-to-day healthcare costs? An outpatient-only deductible offers an excellent balance of protection and affordability.

Your choice here defines your financial risk and ensures your coverage is perfectly aligned with the reality of your international life. It’s about creating a plan that works for you, wherever you happen to be.

Which Services Are Exempt from Your Deductible

A common misconception often leads to unnecessary expense.

Many believe that every medical service utilized contributes towards satisfying the annual deductible.

This is not how the best international health plans are designed. In fact, many high-value policies, especially those built for expatriates, are structured to encourage health maintenance, not merely to provide assistance during illness.

This means certain vital services are often covered in full from day one, completely bypassing your deductible.

The logic from the insurer’s perspective is simple and ultimately works in your favor. By covering preventive care at no initial cost to you, they provide a powerful incentive to detect health problems early. It is a calculated investment that helps prevent a minor issue from escalating into a complex and far more expensive medical crisis.

Proactive Health Measures Covered from Day One

View your policy as a tool for wellness, not just a safety net for emergencies. You can, and should, utilize a full suite of valuable services without any initial out-of-pocket expenditure.

Examples of services that often bypass the deductible include:

- Annual Physicals: Comprehensive check-ups that provide a clear baseline of your health status.

- Standard Immunizations: Routine vaccinations to protect against common, preventable illnesses.

- Preventive Screenings: Critical tests like mammograms or colonoscopies that are key to the early detection of serious diseases.

By utilizing these benefits, you are leveraging the financial incentives built directly into your policy. It is the most intelligent way to realize the maximum value from your premium payments throughout the year.

This structure is a hallmark of a well-designed health plan. It creates a win-win scenario: you maintain better health, and the insurer avoids much larger claims down the line.

Knowing which services are exempt is crucial. It empowers you to use your plan to its full potential without concern for the cost. For a more in-depth examination of how deductibles, excesses, and other financial components of your policy function, you may wish to read our article on the fine print of excesses and deductibles.

This knowledge is what empowers you to manage both your health and your finances with confidence, no matter where you are in the world.

How to Strategically Select Your Deductible

Selecting your health insurance deductible is not a perfunctory choice; it is a significant financial decision.

For international professionals, the deductible is one of the most powerful instruments for controlling healthcare costs and managing personal finances. A correct choice can result in substantial savings. An incorrect one could lead to an unwelcome financial liability.

The optimal choice depends on a clear-eyed assessment of three factors: your health profile, your cash flow, and your personal risk tolerance. These factors are interconnected, and a change in one alters the entire equation.

Assessing Your Key Decision Drivers

Before evaluating insurance plans, you must conduct an honest assessment of your own situation. A young, healthy entrepreneur with a robust investment portfolio will approach this decision very differently than a family requiring predictable monthly expenses.

Consider these two classic scenarios:

- The Young Professional: With few health concerns and a primary goal of maximizing capital for investment, a high-deductible health plan (HDHP) is typically the most logical choice. The significantly lower monthly premium frees up cash, and they possess the financial liquidity to cover the higher deductible should an unexpected medical expense arise.

- The Established Family: For a family with children or individuals with known health conditions, predictability is paramount. A low-deductible health plan (LDHP), despite its higher premium, secures peace of mind. It smooths budgetary fluctuations and prevents the financial shock of frequent physician visits or an emergency room admission.

The essential question to ask yourself is this: are you seeking to lower your fixed monthly costs (premiums) or your variable out-of-pocket costs? Your answer will point directly to the appropriate deductible for your circumstances.

Financial Liquidity and Risk Tolerance

This is the critical juncture. A high deductible is a prudent financial strategy only if you can comfortably settle it without causing financial strain.

If paying a $5,000 or greater sum would create financial stress or necessitate the premature liquidation of assets, a lower deductible represents the safer, more intelligent choice.

This is directly tied to your personal risk tolerance. Are you comfortable with the possibility of a large, single expense in exchange for monthly premium savings? Or do you operate more effectively knowing your major expenses are fixed, insulating you from financial surprises?

There is no single correct answer. There is only the answer that aligns with your financial philosophy and provides complete confidence that your health and assets are protected, regardless of what occurs.

Frequently Asked Questions

When mastering the intricacies of a health insurance policy, a few key questions invariably arise. Let’s address the most common ones directly to provide you with clear, practical answers.

Does My Monthly Premium Count Towards My Deductible?

No, it absolutely does not.

Your monthly premium should be viewed as a retainer fee. It is the fixed amount you pay simply to keep the insurance plan active. Your premium does not cover any medical care itself; it merely guarantees your access to the policy’s benefits when required.

Your deductible, in contrast, is only reduced when you actually utilize medical services. It is the amount you pay out-of-pocket for covered treatments before your insurer begins to share in the costs.

What Is the Difference Between a Deductible and an Out-of-Pocket Maximum?

These two figures define the start and end points of your financial responsibility for medical costs within a given year. They work in tandem but serve very different functions.

The deductible is the first financial threshold you must cross. It’s the amount you must pay for covered care before your plan’s cost-sharing features, such as coinsurance, are activated.

The out-of-pocket maximum is your ultimate financial safety net. It’s the absolute most you will be required to pay for your share of covered services in a policy year, encompassing your deductible, copayments, and coinsurance. Once you reach this ceiling, your insurer pays 100% of all subsequent eligible costs for the remainder of the year.

The deductible is the first part of your financial journey toward the out-of-pocket maximum. The maximum is the finish line that caps your annual healthcare spending.

How Do Deductibles Work on a Family Plan?

Family plans introduce a layer of complexity with a dual-deductible system. You will typically see two key figures: an individual deductible for each person and a higher, aggregate family deductible.

Here is how it functions. Once one person on the plan meets their own individual deductible, the insurance company begins sharing the costs for that person’s medical care.

However, if the combined medical spending of everyone on the plan reaches the total family deductible, cost-sharing will then commence for every single person covered by the plan—even for those who have not yet met their individual deductible. It is crucial to review your policy documents to understand exactly how your specific plan is structured.

At Riviera Expat, we specialize in providing precisely this kind of clarity for high-net-worth professionals navigating the global insurance market. We offer expert, impartial guidance to help you select a policy that aligns perfectly with your financial strategy and lifestyle. To ensure your health coverage is as sophisticated as your portfolio, explore our services.