Navigating the intricacies of a premium health insurance portfolio requires a precise understanding of its core financial components. Two of the most pivotal terms you will encounter are coinsurance and copay. In essence, a copay is a predetermined, fixed fee paid for a specific service, akin to a retainer. Coinsurance, conversely, represents a percentage of the total cost of care for which you are responsible after your annual deductible has been satisfied.

This distinction is not merely semantic; it is fundamental to your financial strategy, directly influencing your out-of-pocket expenditure for all medical services, from a routine consultation to a complex surgical procedure.

Demystifying Your Core Health Plan Costs

A sophisticated command of your health insurance financials is essential for prudent wealth management and the avoidance of unforeseen liabilities. Although both copays and coinsurance represent your portion of cost-sharing, their mechanisms are fundamentally different. Mastering these concepts is the first step toward making informed, strategic healthcare decisions.

For a more comprehensive lexicon, you may explore our guide to expat medical insurance policy terms.

To illustrate, consider a copay as a fixed access fee for an exclusive service. You pay a set amount—for instance, €50—for a consultation, irrespective of the visit's ultimate complexity or duration. The cost is transparent and known in advance.

Coinsurance, however, functions more like a partnership in a significant investment. After you have personally covered the initial threshold—your deductible, say €1,000—you then agree to be liable for a specified portion, perhaps 20%, of all subsequent costs. For minor follow-up care, this 20% share might be nominal. For an extensive course of treatment, however, that same percentage could translate into a substantial financial commitment.

Coinsurance vs Copay At a Glance

This structural difference carries significant financial weight. In the United States, for example, a 2023 analysis by the Kaiser Family Foundation found the average coinsurance rate for inpatient hospital care was approximately 19% across benchmark marketplace plans. This demonstrates how percentage-based costs become a primary financial consideration once a deductible is met.

For absolute clarity, the following table delineates the essential distinctions between these two cost-sharing frameworks.

Coinsurance vs Copay Key Differentiators

| Attribute | Coinsurance | Copay (Copayment) |

|---|---|---|

| Payment Structure | A percentage of the total negotiated cost of care. | A fixed-euro amount per service. |

| When It Applies | Typically after your annual deductible has been satisfied. | Usually paid at the time of service, often before the deductible is met. |

| Cost Predictability | Variable; your financial responsibility is directly proportional to the total cost of service. | Highly predictable; the amount is fixed and known beforehand, facilitating precise budgeting. |

| Common Application | Significant procedures, inpatient hospital stays, advanced diagnostics, and specialty pharmaceuticals. | Routine physician appointments, specialist consultations, and standard prescriptions. |

Ultimately, a copay offers predictability for routine medical services, whereas coinsurance applies to more substantial, and often more costly, healthcare events. A clear understanding of which mechanism is active and when is critical for effective management of your out-of-pocket exposure.

The Financial Mechanics of Coinsurance

While a copay is a straightforward, fixed fee, coinsurance operates within a more complex financial framework. It is a cost-sharing model that activates only after you have fulfilled your policy's annual deductible. The deductible functions as the initial capital you must contribute; you are responsible for 100% of your medical costs until this threshold is met.

Once the deductible is satisfied, the financial dynamic shifts. Your insurer begins to cover the majority of expenses, while you become responsible for a pre-agreed percentage of the costs—your coinsurance. This rate is typically between 10% and 30% of the approved amount for all covered services for the remainder of the policy year. This structure is engineered to manage substantial medical costs, not routine consultations.

How Coinsurance Is Calculated

A crucial detail often overlooked is that your coinsurance percentage is not calculated from the provider's initial, undiscounted billing rate. Instead, it is applied to the preferential, negotiated rate that your insurer has secured with the medical facility or practitioner.

This is a significant financial advantage. The insurer-negotiated rate is often substantially lower than the list price, meaning your percentage is calculated from a much more favorable baseline.

Coinsurance introduces a layer of cost variability that is absent with fixed copayments. Your financial responsibility is directly proportional to the cost of the care you receive, making it a key factor in planning for major medical expenses.

This percentage-based model means your personal liability can fluctuate significantly. A 20% coinsurance on a standard blood analysis might be negligible. However, that same 20% applied to a complex surgical procedure can amount to several thousand euros. This is the core distinction when comparing coinsurance vs. copay; one offers certainty, the other, variability managed by a ceiling.

The Role of the Out-of-Pocket Maximum

Every euro you contribute towards coinsurance serves a dual purpose. It satisfies your immediate portion of the bill while concurrently reducing the remaining balance on your annual out-of-pocket maximum. This figure represents the absolute ceiling on your financial liability for covered healthcare within a given policy year—it is your ultimate financial safeguard.

Consider this scenario: you require a major surgical procedure with an insurer-negotiated cost of €50,000. You have already met your €5,000 deductible, and your coinsurance is 20%. Your calculated share would be €10,000 (20% of €50,000).

However, if your policy's out-of-pocket maximum is €8,000, your total liability for the year—encompassing your deductible and all subsequent coinsurance payments—is capped at that €8,000 limit. You would pay no more.

Once this maximum is reached, your plan covers 100% of all eligible, in-network costs for the rest of the year. This mechanism provides robust protection against the potentially ruinous costs of major medical events, ensuring your financial exposure remains finite and predictable.

Understanding the Role of the Copayment

Whereas coinsurance is a variable percentage applied after your deductible, the copayment—or copay—serves an entirely different function. It is best understood as a predictable, fixed fee for a specific service, much like a cover charge for access to a professional consultation or a pharmaceutical.

This fixed amount is paid directly at the time of service, providing immediate clarity on your cost. Whether you are consulting with your primary care physician, seeing a specialist, or acquiring a prescription, you know the precise amount you owe upfront. This predictability is the cornerstone of budgeting for routine medical care.

Crucially, copayments often apply before the annual deductible has been met. This is a strategic design feature; it ensures access to essential care without requiring a substantial initial outlay, making it a vital component for proactive health management throughout the year.

The Strategic Design of Tiered Copay Structures

Insurance providers do not assign copay amounts arbitrarily. They are meticulously designed with tiered structures to incentivise cost-effective healthcare decisions.

A well-structured plan might arrange its copays as follows:

- Primary Care Physician Visit: A low copay, such as €30, to encourage proactive, foundational care.

- Specialist Consultation: A higher copay, perhaps €60, reflecting the increased cost of specialized expertise.

- Emergency Room Visit: A significantly higher copay, often €250 or more, to discourage the use of high-cost emergency facilities for non-urgent issues.

This financial architecture subtly directs policyholders toward more efficient and affordable care pathways. Prescription medications are frequently tiered in a similar fashion, with lower copays for generic drugs and progressively higher amounts for preferred and non-preferred brand-name pharmaceuticals.

The primary value of the copay model lies in its predictability. The fixed cost eliminates the financial ambiguity inherent in percentage-based fees, enabling you to budget with precision for anticipated healthcare needs.

This is precisely why copays are the standard cost-sharing method for routine office visits. Data from ACA marketplace plans in the U.S. shows that average primary care copays for 2023 ranged from approximately $17 for platinum-level plans to $43 for bronze plans. For further analysis, you can explore detailed data on changes in consumer cost-sharing in health plans to observe these trends.

A firm command of the copayment vs coinsurance dynamic is paramount to anticipating your financial responsibility for both routine care and significant medical events.

A Strategic Comparison of Your Financial Exposure

Let us move beyond basic definitions and into the realm of strategic financial planning. The core distinction between copay and coinsurance is one of predictability versus variability. Your perspective on this trade-off will dictate your approach to managing healthcare expenditures for the year.

Copayments provide a clear, fixed-cost framework, forming the bedrock of predictable budgeting for routine services. For individuals anticipating regular but relatively low-cost interactions with the healthcare system, this structure offers exceptional financial clarity.

Coinsurance, conversely, introduces a percentage-based variable that activates only after your deductible has been met. This model is designed for significant medical events where costs can escalate. While the percentage introduces uncertainty for any single event, your ultimate financial liability is contained by your plan’s out-of-pocket maximum.

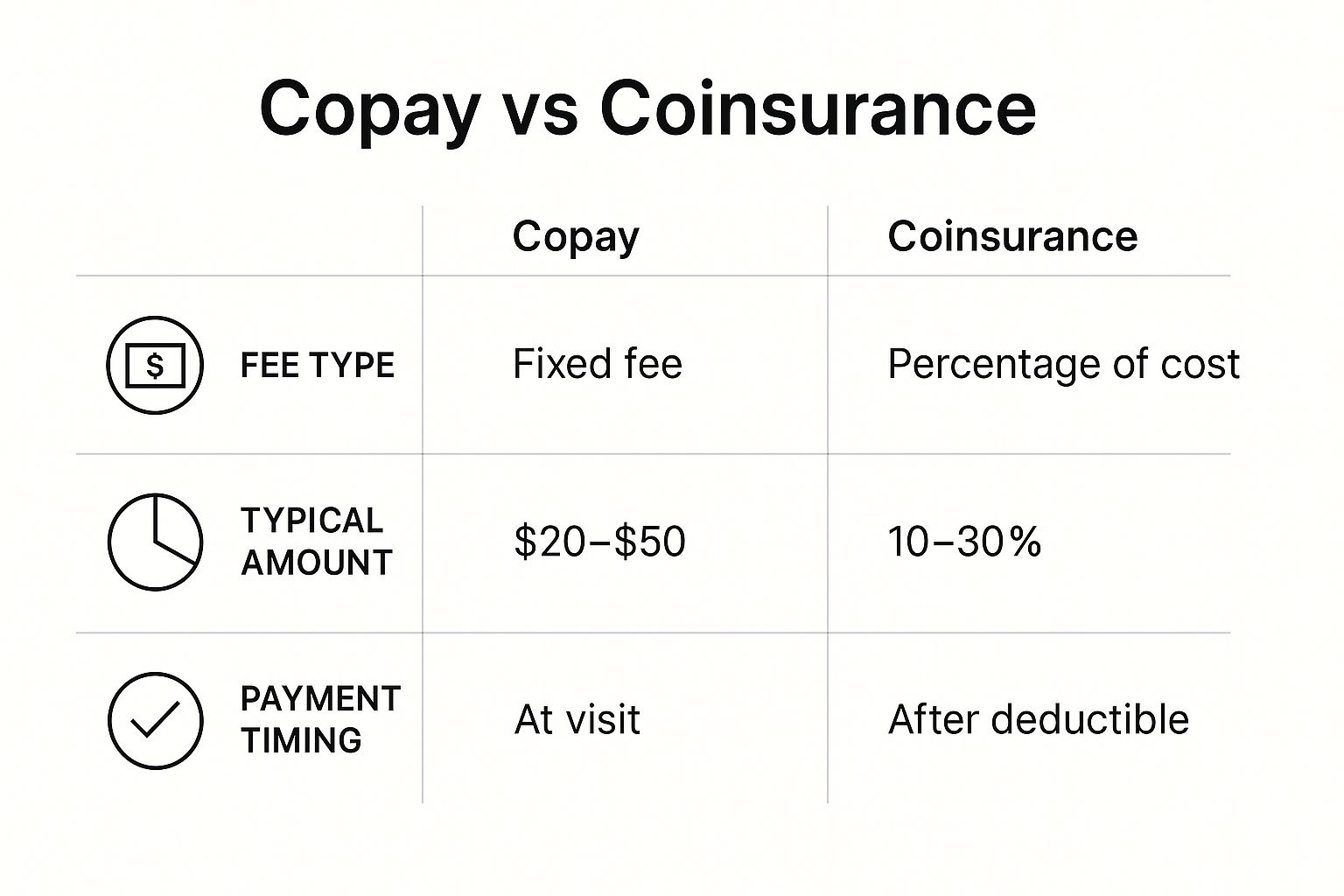

This infographic perfectly illustrates the core structural differences.

As depicted, a copay is a simple, upfront fee for which you can plan. Coinsurance is more complex—a calculated share of the final, negotiated bill that you only begin to pay once your deductible has been satisfied.

Scenario-Based Cost Analysis Coinsurance vs Copay

To truly appreciate the financial impact, we must analyse the numbers. Let us examine a few common scenarios to see how your total out-of-pocket costs can accumulate. This is where a plan that is perfectly suited for one individual could prove to be financially inefficient for another.

The table below outlines potential annual costs for two hypothetical plans. For simplicity, we will assume both plans feature a €3,000 deductible and an €8,500 out-of-pocket maximum.

| Healthcare Scenario | High-Copay Plan Example Cost | High-Coinsurance Plan Example Cost | Key Financial Takeaway |

|---|---|---|---|

| Routine Care Year (5 PCP visits, 2 Specialist visits) | €370 total (7 visits x ~€53 avg. copay) | €2,500 (Full cost of visits, assuming less than deductible) | For predictable, low-to-moderate healthcare needs, copay-centric plans are significantly more cost-effective. You pay nominal fees instead of the full negotiated rate. |

| Major Medical Event (€50,000 surgery) | €8,500 (Reaches out-of-pocket max after deductible) | €8,500 (Reaches out-of-pocket max after deductible) | In the event of a significant medical event, both plan types cap your liability at the out-of-pocket maximum. The path to that limit is simply different. |

| Mixed Utilization Year (Routine care + €5,000 procedure) | €3,370 (€3,000 deductible + €370 in copays) | €3,400 (€3,000 deductible + 20% of remaining €2,000) | In these middle-ground scenarios, the total costs can be remarkably similar. Here, the monthly premium becomes the decisive factor. |

This analysis highlights a critical insight in the coinsurance vs. copay debate: the optimal choice is determined entirely by your anticipated utilisation of healthcare services in the coming year.

The strategic decision is not about which model is inherently superior, but which one aligns with your personal risk tolerance and expected medical needs. Copays shield you from small-cost volatility. Coinsurance manages your exposure to massive bills through the out-of-pocket limit.

Ultimately, your choice should be an extension of your broader financial strategy. A high-net-worth individual who values budget certainty may prefer to pay a higher premium for a copay-heavy plan to eliminate financial ambiguity. In contrast, a healthy individual with a robust emergency fund might opt for a lower-premium, high-coinsurance plan, accepting the risk of higher out-of-pocket costs in exchange for immediate premium savings.

Choosing the Right Plan for Your Financial Reality

Selecting a health insurance plan is a critical financial decision, not merely a healthcare one. The choice between a predictable copay structure and a variable coinsurance model must align with your lifestyle, financial position, and risk appetite. It is a strategic balance between your fixed monthly premium and your potential out-of-pocket liability.

The optimal structure hinges upon your expected healthcare needs. A healthy professional focused on wealth accumulation has a vastly different risk profile than a family with young children requiring frequent paediatric visits or an individual managing a chronic medical condition. Examining these real-world personas illuminates the decision-making process.

Matching Your Plan to Your Life

Let us analyse how this decision plays out for different individuals, bringing the coinsurance vs. copay consideration into sharp relief.

-

The Healthy Professional: For an individual who rarely requires medical services, a high-deductible plan with significant coinsurance is often the most financially prudent choice. The lower monthly premium frees up capital for investment, and a well-funded emergency account can comfortably cover the deductible in the event of an unforeseen medical issue.

-

The Family with Young Children: A family can anticipate regular visits to the paediatrician for wellness checks, vaccinations, and occasional specialist consultations. The certainty of a copay-centric plan provides invaluable budget stability. Knowing each visit costs a fixed €40 rather than a percentage of an unknown total simplifies monthly and annual financial planning, ensuring routine care does not become a financial burden.

-

The Individual with a Chronic Condition: If you are managing an ongoing health condition, you face frequent consultations, tests, and specialty medications. In this context, a plan with a lower deductible and clear copays for prescriptions and visits is almost always the superior choice. Coinsurance on expensive specialty pharmaceuticals can create large, unpredictable costs, making the fixed-cost structure of a copay model a far more stable financial strategy. For further guidance, please consult our guide on choosing an expat health insurance policy.

Your health plan is an integral part of your overall financial portfolio. The objective is to secure a structure that provides peace of mind without unnecessarily diverting capital that could be generating returns elsewhere.

It is also noteworthy how these models operate from an administrative standpoint. Copays are simpler to process. Analysis of claims data indicates that copayments are measured with high accuracy—approaching 90%—whereas coinsurance values are less precise. This discrepancy arises because coinsurance is a percentage of a negotiated rate that can vary, making it more complex to track than a simple, fixed copay. You can find more insights on how cost-sharing is measured in health claims.

Ultimately, the right plan is the one that allows you to manage both your health and your wealth with confidence and clarity.

How All Your Health Plan Costs Work Together

Understanding the distinction between copay and coinsurance is an excellent foundation, but it is only one component of your policy's financial architecture. To truly master your healthcare finances, you must understand how these elements function in concert with your plan's deductible and out-of-pocket maximum. These four components constitute the financial DNA of your policy, dictating the precise ceiling of your potential expenditure in a given year.

Conceptualize it as a sequence of financial thresholds you cross as you utilise your insurance. Each component activates at a specific point, transferring the cost-sharing responsibility to the next stage in a process designed to manage and ultimately cap your financial exposure.

The Journey of a Medical Claim

Let us trace the path of a medical bill through your plan, from the first euro spent to the point at which the insurer assumes full responsibility. Understanding this progression is the key to comprehending when and why you pay what you pay.

-

Initial Payments and the Deductible: At the start of your plan year, you are liable for 100% of most medical expenses until your payments meet your deductible. While some routine services, such as a standard physician's visit, may only require a flat copay from the outset, you will pay the full negotiated rate for more significant costs like hospital stays or advanced imaging. For a deeper analysis, review our guide on understanding excesses and deductibles.

-

Activating Coinsurance: The moment your eligible spending reaches your deductible, the dynamic changes. You cease paying 100% of the bill. Your plan’s primary cost-sharing mechanism now engages, and you begin paying only your coinsurance percentage—typically 10-30% of the approved cost for any subsequent care.

-

Reaching the Financial Safety Net: Every euro you pay toward your deductible and for coinsurance is aggregated and counts toward your out-of-pocket maximum. In virtually all modern plans, your fixed copayments also contribute to this critical limit.

Your out-of-pocket maximum is the absolute most you will pay for covered, in-network medical care in a year. It is your financial backstop. Once you reach this number, your insurance company covers 100% of all eligible costs for the remainder of the plan year.

This sequence allows you to calculate your worst-case financial risk with precision. Once you see how satisfying the deductible unlocks your coinsurance, and how all your spending contributes toward the out-of-pocket maximum, you are no longer speculating. You are in command of your healthcare finances.

Common Questions Answered

When navigating the complexities of health insurance, several key questions consistently arise regarding the interplay of copays and coinsurance. Let us address the most common areas of uncertainty.

Can a Health Plan Have Both Copay and Coinsurance?

Yes, and it is the standard for virtually all modern health plans.

A policy will typically use a simple, flat copay for a routine specialist visit. However, if that consultation leads to a more complex service, such as an MRI or a surgical procedure, your coinsurance percentage will apply to those larger costs. This hybrid approach provides predictability for everyday care while sharing the financial load for more significant medical events.

The most effective health plans strategically blend copays and coinsurance. This structure keeps routine care affordable while managing the financial risk of expensive, less frequent treatments.

Do My Copayments Count Toward My Annual Deductible?

This is a critical point, and the answer is determined by the specific design of your plan. In the majority of cases, the answer is no—routine copayments for physician visits or prescriptions do not typically reduce your annual deductible.

However, they almost always count toward your out-of-pocket maximum, which is your ultimate financial safeguard for the year. The only way to be certain is to consult your plan's official Summary of Benefits and Coverage document.

Which Is Better for Expensive Prescription Drugs?

For high-cost specialty pharmaceuticals, insurers are increasingly utilising coinsurance rather than copays. This can have a significant financial impact, as your liability becomes a percentage of a drug that may cost thousands of euros per month.

In contrast, tiered copay systems offer far more predictable, fixed costs for generic and preferred brand-name medications. If you have known prescription requirements, it is imperative to review your plan’s formulary (its list of covered drugs) to understand your precise payment obligations.

At Riviera Expat, we provide the clarity and expertise necessary to select an international health plan that aligns with your lifestyle and financial objectives. Secure your financial well-being with a complimentary expert consultation today.