Accidental Death & Dismemberment (AD&D) insurance is a highly specific policy instrument. It is engineered to provide a substantial, tax-free capital injection should you die or suffer a catastrophic injury from a covered accident. For high-net-worth individuals, its principal value lies in insulating your estate from the immediate financial shockwave of such an event, preserving capital when it is most vulnerable.

Understanding Accidental Death Insurance as a Strategic Asset

For a global finance professional, AD&D should not be viewed as just another insurance policy; it is a targeted financial tool. Its sole purpose is to inject immediate, substantial liquidity into your estate following an unforeseen, tragic accident. This is fundamentally different from traditional life insurance, which provides a benefit for death from a wide array of causes, including illness and natural expiration.

The core function of an AD&D policy is to protect your family and your estate from the immediate financial consequences of an accident. It ensures capital is available to cover estate taxes, fund a business succession plan, or simply maintain your family's standard of living. This liquidity prevents the forced sale of other assets, such as real estate or private equity holdings, at a potentially disadvantageous time.

The Role in a High-Stakes Environment

For professionals whose careers demand frequent international travel, AD&D provides a crucial financial safety net. This coverage is particularly relevant in global financial hubs like Hong Kong, Singapore, and London, where high-pressure lifestyles can inadvertently increase exposure to certain risks. The global AD&D insurance market was valued at approximately USD 27.24 billion in 2022 and is projected to reach USD 51.52 billion by 2032, reflecting its growing importance in sophisticated financial planning. Further details on this expansion can be found in the analysis of AD&D insurance market growth on marketresearch.com.

At its core, AD&D is a capital preservation strategy. It is designed to deliver a high-leverage payout for a narrow, but potentially devastating, set of circumstances, ensuring that an accident does not derail a lifetime of strategic wealth creation.

This specialized policy provides a lump-sum payment, known as the principal sum, to your beneficiaries if you die as a direct result of an unexpected accident. It is critical to understand that this specifically excludes death from natural causes or underlying illness. This distinction makes it a unique, yet complementary, component of a comprehensive insurance portfolio.

To provide a clear framework, here is a breakdown of the key components of an AD&D policy.

Accidental Death Insurance at a Glance

| Component | Description for High-Net-Worth Individuals |

|---|---|

| Principal Sum | The maximum lump sum paid for accidental death. This sum should be calibrated to cover immediate estate liabilities or fund specific financial objectives. |

| Capital Sum | A percentage of the principal sum paid for specific catastrophic injuries (e.g., loss of a limb or sight), providing liquidity for medical costs and significant lifestyle adjustments. |

| Covered Accidents | Typically includes events such as traffic collisions, falls, and other unforeseen incidents. The precise language of the policy is paramount. |

| Exclusions | Deaths due to illness, suicide, or specified high-risk activities are almost universally excluded. A thorough review of these exclusions is non-negotiable. |

| Beneficiary | The designated individual, trust, or entity that receives the payout. This designation must align precisely with your overall estate plan. |

This table outlines the core mechanics. The true value is realized by understanding how these components operate in concert to protect your assets when an unthinkable event occurs.

Diving into Policy Coverage and Payout Structures

To fully appreciate the strategic utility of accidental death insurance, one must look beyond the marketing and analyze the mechanics of the policy. Its power is not in its breadth of coverage, but in its capacity to deliver a substantial, predictable payout for a very specific list of worst-case scenarios.

Typically, coverage extends to fatalities resulting from events such as major vehicular collisions, severe falls, drowning, or fires. For executives and professionals who travel frequently, many AD&D policies offer enhanced benefits—often doubling the payout—for accidents occurring on commercial flights or other forms of public transportation.

The Dismemberment Benefit: More Than Just a Payout

A critical, and often misunderstood, component is the dismemberment benefit. This is not medical insurance designed to reimburse hospital bills. It should be viewed as a direct capital injection following a catastrophic, but non-fatal, injury.

The payout is governed by a clear schedule of losses detailed in your policy documents. It is not ambiguous. For example:

- Loss of a hand or foot may trigger a 50% payout of the principal sum.

- Loss of sight in one eye could also result in a 50% payout.

- A more severe injury, such as the loss of two limbs, would typically command the full 100% of the policy’s face value.

The dismemberment benefit is designed to finance significant life changes. It is capital to re-engineer your home for accessibility, access cutting-edge rehabilitation, and, most importantly, compensate for the permanent loss of high-earning potential. It provides the financial resources to restructure your life and career after a catastrophic event.

How Payouts Work in Practice

Let us place this in a practical context. Consider a private wealth manager who holds a $5 million AD&D policy. If a covered accident results in the loss of a hand, the policy would pay them $2.5 million, tax-free. If that same accident had been fatal, their designated beneficiary would receive the full $5 million.

This creates a two-pronged defense against the most severe outcomes of an accident. It addresses both the ultimate financial loss from death and the massive disruption caused by a permanent, career-altering disability.

The need for this type of protection is not merely theoretical. For example, in the United States, transportation incidents accounted for 38% of all work-related fatalities in a recent year, highlighting risk even in professional contexts. Expanding the view, the Asia-Pacific region experienced USD 65 billion in economic losses from natural catastrophes in 2023, with an astonishing 91% of those losses being uninsured. This exposes the significant protection gaps that a product like AD&D is engineered to fill. To explore this further, you can read about the trends shaping the accidental death insurance market. Ultimately, this clear-cut payout mechanism provides a predictable financial backstop in an unpredictable world.

Recognizing Critical Exclusions and Policy Limitations

Understanding what a financial instrument does not cover is as crucial as understanding what it does. Accidental Death & Dismemberment (AD&D) insurance is a powerful tool, but its efficacy is derived from its specificity. To rely on it, you must be unequivocally clear on the boundaries of its protection.

The most significant exclusion is death by illness. AD&D will not provide a benefit if the proximate cause of death was a medical condition. For instance, if an individual suffers a fatal heart attack while driving, leading to a crash, the insurer would almost certainly deny the claim. The rationale is that the medical event, not the accident, was the primary cause of death.

Understanding Common Disqualifying Scenarios

Beyond illness, every policy specifies situations that are not covered. These are not hidden details; they are fundamental to the product's design.

Here are the common exclusions that require your attention:

- Self-Inflicted Harm: Any death ruled a suicide is universally excluded from AD&D coverage.

- Influence of Non-Prescribed Substances: If a fatal accident occurs while the policyholder is impaired by illegal drugs or alcohol (typically defined as being over the legal blood alcohol limit), the claim will likely be denied.

- Participation in High-Risk Activities: Standard policies generally will not cover deaths resulting from activities such as motorsports, hang gliding, or professional sports. Coverage for such activities would necessitate a special—and more expensive—policy rider.

Understanding these boundaries is critical because they directly impact whether the policy serves as a reliable safety net for your specific lifestyle. For a deeper examination of how insurers apply these limits, it is valuable to learn more about common policy exclusions and what to watch out for.

The Importance of Timing and Proximate Cause

Two final, and critical, limitations involve timing and direct causation. Insurers use a "proximate cause" clause to ensure the accident was the sole and direct reason for the death or injury. Complications can arise if, for example, post-accident medical treatment contributes to the death.

A key detail that is often overlooked is the time-limit clause. Most AD&D policies stipulate that death must occur within a specific period after the accident, typically 90 or 180 days, for the benefit to be paid.

This rule exists to create a clear and defensible link between the accident and the death, precluding claims where a prolonged period has elapsed. Acknowledging this allows for a realistic assessment of your coverage, ensuring the policy performs exactly as you expect.

Comparing AD&D with Term Life and IPMI

Constructing a robust financial defense is not about a single product; it is about layering specialized solutions. To properly situate Accidental Death & Dismemberment (AD&D) insurance within your strategy, it is essential to compare it with two other pillars of protection: Term Life Insurance and International Private Medical Insurance (IPMI).

Consider these three policies as specialized instruments in a surgeon's toolkit. Each is designed for a precise function, and understanding their distinct roles is key to creating comprehensive protection for your family and assets.

Defining Each Instrument's Role

The fundamental difference lies in the event that triggers a payout and the intended purpose of the funds. Each policy addresses a completely different contingency.

- AD&D Insurance asks: "Was the death or severe injury caused directly by a covered accident?" If yes, it pays a pre-agreed lump sum to mitigate the immense financial shock.

- Term Life Insurance asks: "Did the policyholder pass away during the policy term?" If yes, it pays a death benefit for nearly any cause—illness or accident—providing broad financial security.

- IPMI asks: "Does the policyholder require medical treatment?" If yes, it covers the often-staggering costs of hospitalization, specialist care, and treatments, protecting your wealth from depletion by medical expenses.

AD&D is a high-leverage instrument designed for the narrow but catastrophic possibility of a severe accident. Its function is to complement the comprehensive protection of term life insurance and the immediate medical cost coverage of IPMI.

While IPMI pays the hospital, AD&D and life insurance pay your beneficiaries, preserving your estate's liquidity. You can explore the mechanics of this in our detailed guide on International Private Medical Insurance.

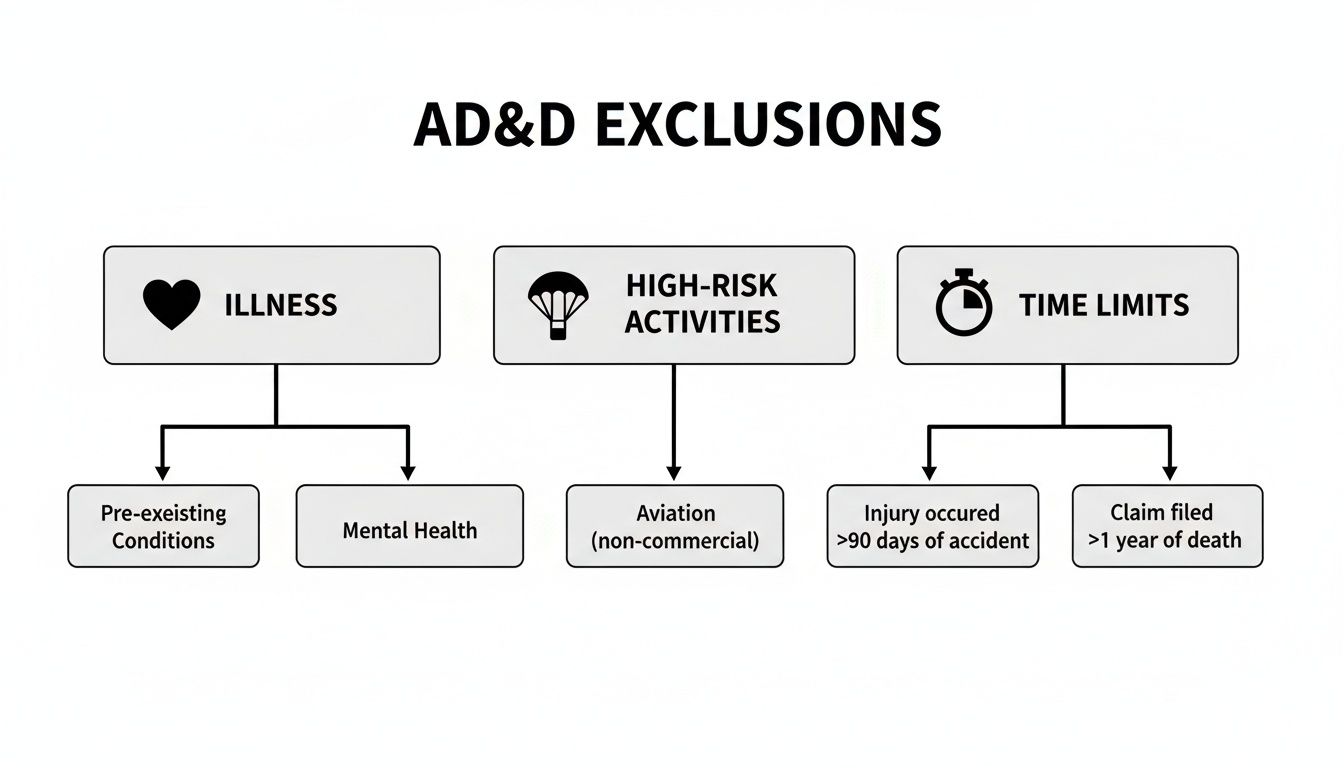

This diagram illustrates the common scenarios AD&D does not cover. Understanding this is critical to appreciating its specialized role.

As shown, death from illness, high-risk activities (without a specific rider), and events outside a strict time limit are fundamental exclusions. This is not a flaw; it is by design.

Strategic Comparison: AD&D vs. Term Life vs. IPMI

For global professionals, understanding how these policies integrate—or where they leave gaps—is essential. This table deconstructs their core functions and strategic purpose within a protection portfolio.

| Feature | Accidental Death & Dismemberment (AD&D) | Term Life Insurance | International Private Medical Insurance (IPMI) |

|---|---|---|---|

| Payout Trigger | Death or specific severe injury (dismemberment) resulting directly from a covered accident. | Death of the policyholder during the policy term from nearly any cause (illness, accident, etc.). | Need for eligible medical treatment, diagnostics, or hospitalization. |

| Recipient of Funds | The policyholder's designated beneficiaries (or the policyholder in case of dismemberment). | The policyholder's designated beneficiaries. | Medical providers (hospitals, clinics, doctors) directly, or reimbursement to the policyholder. |

| Primary Purpose | Provides a large capital sum to offset the sudden financial devastation of a catastrophic accident. | Provides broad financial security for dependents, covering lost income, debts, and future expenses. | Protects personal wealth from being eroded by high costs of medical care, especially abroad. |

| Coverage Scope | Highly specific: only accidents as defined in the policy. | Very broad: covers death from almost any cause, with few exclusions (e.g., suicide in the first 1-2 years). | Broad medical coverage: covers costs related to illness and injury, from consultations to major surgery. |

| Strategic Role | A high-leverage supplement to life insurance, providing additional capital for the most unexpected events. | The foundational layer of family financial protection. | The foundational layer of personal health and wealth protection. |

This comparison clarifies that these are not interchangeable products. AD&D is a targeted enhancement, not a substitute. Term Life is your safety net for nearly any cause of death, while IPMI is the mechanism that prevents a medical crisis from becoming a financial one.

A Strategic Financial Perspective

For high-net-worth professionals, layering these coverages through an expert broker provides a significant strategic advantage. OECD data shows accident and health insurance comprised 21.8% of global non-life premiums in 2022, underscoring its role in serious risk management.

When you factor in global trends such as growing urbanization and a corresponding increase in road traffic incidents, the value of targeted accident coverage becomes exceptionally clear. An AD&D policy is not a replacement for term life insurance; it is a powerful supplement to it.

As you construct your protection strategy, it is also crucial to scrutinize the fine print of every policy. For instance, individuals often have questions about specific end-of-life arrangements, asking, Does life insurance cover natural organic reduction? This type of inquiry highlights the necessity of ensuring policy terms align with your complete financial and personal plan.

Strategic Scenarios for Global Professionals

Understanding the mechanics of accidental death insurance is one matter. Appreciating its real-world application for high-net-worth professionals is another entirely. For our clients, this is not a theoretical exercise; it is the deployment of a precision tool for a specific, high-stakes lifestyle where the risk profile is inherently elevated.

Consider an investment banker who frequently travels between London, Dubai, and Singapore. Each segment of that journey—air travel, chauffeured transport, navigating an unfamiliar city—carries a low probability of a catastrophic event. An AD&D policy serves as a direct financial hedge against those specific travel-related risks.

Protecting Assets and Business Interests

The same logic applies to a private equity principal whose leisure pursuits include heli-skiing in the Alps or deep-sea diving in Belize. These activities, while rewarding, dramatically increase personal risk in ways a standard life insurance policy might not fully contemplate or price accordingly. This is where AD&D delivers its unique value.

Its entire purpose is to provide a substantial, tax-advantaged benefit at the precise moment of greatest need. This sudden injection of capital can be utilized to:

- Satisfy Estate Tax Liabilities: This prevents the forced, fire-sale liquidation of illiquid assets like private company shares or real estate to meet a tax obligation.

- Address Immediate Liquidity Needs: It provides your family with instant access to capital, so they do not have to disrupt long-term investment strategies to cover short-term expenses.

- Fund a Business Buy-Sell Agreement: This supplies the capital for surviving partners to acquire a deceased partner's shares, ensuring business continuity.

In essence, an AD&D policy is a financial backstop, triggered only by a sudden, unexpected event. It is designed to protect the core value of your long-term assets by solving critical, short-term financial pressures.

The Growing Importance for Mobile Professionals

This is not merely anecdotal; market data reflects a growing awareness of these risks. The market for business travel accident insurance—a related product vital for executives moving between financial hubs—is projected to grow significantly from USD 4.73 billion in 2023 to USD 12.23 billion by 2033.

This trend underscores a clear recognition of the unique risks faced by international executives. You can find more data on the growth in the accidental death insurance market.

Therefore, for the global professional, what is accidental death insurance? It is a targeted instrument for preserving wealth against the distinct risks that accompany a life in motion.

Does AD&D Merit a Place in Your Financial Toolkit?

Let us now address the ultimate question: does accidental death insurance genuinely warrant inclusion in your financial strategy? This is not a universal product; its suitability depends on a candid assessment of your lifestyle, profession, travel frequency, and—most critically—the existing gaps in your current insurance portfolio. You must honestly evaluate your personal risk profile to determine if this highly specialized policy adds material value.

There are several ways to acquire this type of coverage, each with distinct advantages and disadvantages. You can secure a standalone policy for maximum control and customization, add it as a cost-effective "rider" to an existing life insurance policy, or obtain a basic level of cover through a group plan at your firm.

Making an Informed Decision

For high-net-worth individuals, AD&D can be a surprisingly effective component of strategic legacy planning, ensuring your family’s financial stability remains intact irrespective of circumstance. The key is to perceive it for what it is: a powerful but highly specific tool for a precise function.

AD&D is not a substitute for comprehensive life or medical insurance. It is a strategic supplement. Its role is to inject a significant sum of capital precisely when an unexpected accident could cause maximum disruption to your family and your estate.

This is especially true for globally mobile professionals, such as investment bankers or consultants, who are constantly in transit. AD&D is particularly effective at covering the exact types of risks they face, such as serious vehicular collisions or other travel-related incidents. The market is expanding for a reason; the global industry was valued at approximately USD 27.24 billion in 2022 and is projected to reach USD 51.52 billion by 2032 as more individuals recognize its niche benefits.

Ultimately, the objective is to ensure all components of your protection plan work in harmony. Consulting with an objective advisor is the optimal way to ensure any new policy integrates seamlessly with your existing international health insurance and your broader estate plan. This approach provides control and, more importantly, confidence in your long-term financial security.

If you are currently evaluating your insurance options, our guide on which expat medical insurance policy type is right for you may prove beneficial.

Frequently Asked Questions

A detailed understanding is what transforms a generic financial product into a powerful instrument in your specific strategy. Here are answers to the most common questions our clients pose about accidental death insurance.

Is the Payout from an AD&D Policy Taxable?

In most jurisdictions, including the US and the UK, the lump-sum payout from an AD&D policy to a named beneficiary is typically received free from income tax. It is a direct transfer of capital.

However, for high-net-worth individuals, a crucial consideration is estate tax. If the payout becomes part of the deceased's taxable estate, it could be subject to estate or inheritance taxes. Proper structuring—often through the use of irrevocable trusts—is essential to ensure the proceeds are distributed according to your intentions without being diminished by tax liabilities.

How Do Insurers Define an "Accident"?

This is where the policy's specific language is paramount. Insurers are precise. An "accident" is generally defined as a sudden, unforeseen, and external event that results in an injury or death, independent of any and all other causes like illness.

The central principle is that the cause itself must be accidental.

For example, if a heart attack leads to a fatal car crash, it would generally not be covered as an accidental death. The reason is that the event initiating the chain of causation was medical, not accidental. Your policy documents will provide the exact definition, and a thorough review of that language is not merely advisable—it is essential.

Can I Hold Multiple AD&D Policies?

Yes, it is permissible to hold several AD&D policies from different insurance carriers. In the event of a covered death, your beneficiaries can file claims with each insurer and, provided all conditions are met, receive the full benefit from each policy.

Some individuals, particularly those in high-risk professions or with demanding international travel schedules, use this strategy to "layer" their coverage. The critical factor is ensuring your total coverage amount aligns with your actual financial needs. Each premium represents a recurring cost and must serve a clear strategic purpose within your overall financial plan.

At Riviera Expat, we provide the clarity and control you need to make confident decisions about your international health and protection portfolio. Secure your financial peace of mind by exploring our specialized IPMI solutions today at https://riviera-expat.com.