In essence, indemnity insurance is a sophisticated financial instrument designed to restore you to the precise financial position you were in prior to a covered event.

Think of it as your personal financial safeguard. Following a covered medical treatment or professional liability claim, this type of insurance provides reimbursement, ensuring your financial standing remains intact.

Understanding Indemnity Insurance in Precise Terms

Indemnity insurance is engineered around two core principles: robust financial protection and complete freedom of choice. It stands in stark contrast to managed care plans, which confine you to a restrictive network of approved medical providers.

With an indemnity plan, you retain full autonomy. You select any qualified physician, specialist, or medical facility you deem appropriate, anywhere in the world. This unencumbered access is its defining feature.

The mechanism is direct: you settle the costs for the service directly, submit the requisite claim documentation to your insurer, and they reimburse you for the covered expenses. This reimbursement model is the foundation of indemnity coverage.

The Principle of Financial Restoration

The core objective is to indemnify you—to shield you from financial loss. This is not an instrument for profit; it is designed for precise financial recovery. If a covered medical procedure has a cost of $10,000, the plan is structured to reimburse that exact $10,000, less any applicable deductible.

This principle extends beyond healthcare into the professional realm. Professional indemnity insurance protects businesses and individuals from the significant financial consequences of litigation arising from alleged negligence or errors. In 2023, the global market for this protection was valued at an estimated $121.2 billion, a figure that underscores its critical importance in modern commerce. You can review further data on the global professional indemnity insurance market to appreciate its scale.

The ultimate promise of an indemnity policy is control. It grants you the authority to make critical decisions regarding your health or professional defence without the constraint of an insurer's pre-approved network.

Key Characteristics of Indemnity Plans

For high-net-worth individuals and expatriates, several key features of indemnity plans are particularly advantageous. Understanding these will inform your decision on whether this structure aligns with your international lifestyle.

- Unrestricted Provider Choice: You have the absolute freedom to consult a leading specialist in Geneva or seek treatment at a renowned clinic in Singapore. There are no network constraints.

- Reimbursement-Based Model: Be prepared to manage upfront payments for services rendered. The system is predicated on reimbursement, making effective cash flow management essential.

- Protection Against Liability: In a professional capacity, this insurance acts as a formidable shield, protecting your personal and business assets from the substantial costs associated with lawsuits and settlements.

This synthesis of autonomy and robust financial protection is why indemnity insurance is a cornerstone for those managing significant assets and a global presence. The power to select the optimal medical care or legal defence, without seeking an insurer's permission, is a distinct strategic advantage.

To clarify, let's distill the core principles of indemnity insurance into a reference table.

Indemnity Insurance at a Glance

This table summarises how indemnity insurance operates and its implications for you as the policyholder.

| Core Principle | What It Means for You |

|---|---|

| Financial Restoration | The objective is to return you to your pre-loss financial state, not for you to derive a profit. |

| Freedom of Choice | You may select any qualified provider or facility, globally, without network restrictions. |

| Reimbursement Model | You typically pay for services upfront and then submit a claim for reimbursement. |

| Shared Responsibility | Policies often incorporate deductibles and coinsurance, meaning you bear a portion of the cost. |

| Broad Protection | Covers a wide array of losses, from medical expenses to professional liability claims. |

Ultimately, these principles converge to provide a flexible yet powerful financial safeguard, giving you control over your choices while protecting your financial stability.

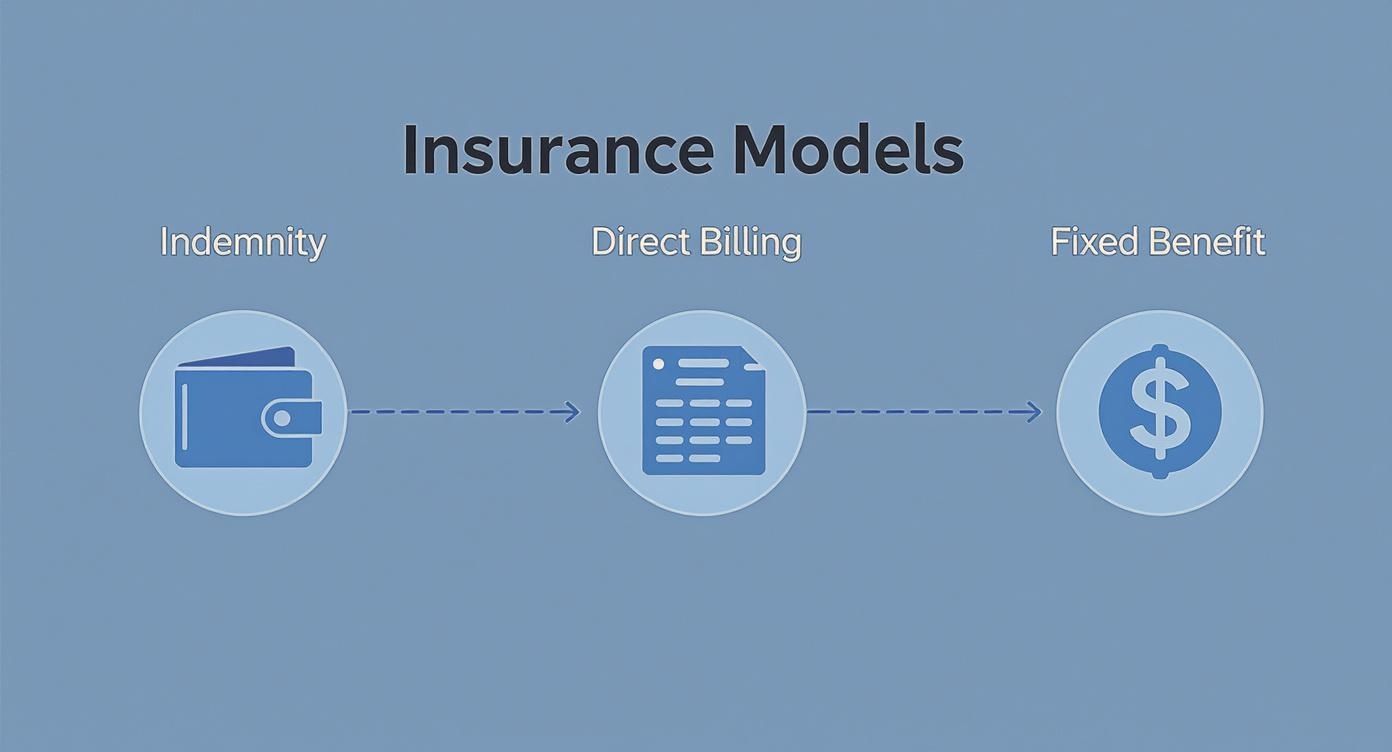

Comparing The Three Core Insurance Models

The mechanism by which your insurance policy disburses funds for your care is a fundamental, yet often overlooked, aspect of managing your health and wealth on a global scale. For a globally mobile professional, the structure of your coverage directly dictates your freedom of action when it matters most.

Let's dissect the three primary payout structures. This is not merely an administrative detail; it represents a strategic choice between absolute autonomy and structured convenience. Each model entails distinct trade-offs that can materially affect your access to care and your out-of-pocket expenditure.

The Indemnity Model: Absolute Flexibility

The indemnity model is the very definition of healthcare autonomy. It operates on a simple reimbursement principle: you pay for medical services upfront, directly to any provider you choose, and your insurer subsequently repays you for the covered expenses.

In practice, this confers complete control. You are not bound by any pre-approved network of physicians or hospitals. Should you require the expertise of a top specialist in Zurich or a procedure at a world-renowned clinic in Singapore, the decision is entirely yours. This model is engineered for individuals who refuse to compromise on access to the highest calibre of care, anywhere in the world.

The Direct Billing Model: Structured Convenience

In stark contrast, the direct billing model—often termed "cashless" or "managed care"—is built around a curated network of providers. Under this arrangement, the insurer has pre-negotiated terms and settles payment directly with the hospital or clinic for your treatment.

The principal advantage is convenience. You avoid substantial out-of-pocket payments at the point of service, which simplifies the process, particularly for major inpatient procedures. However, this convenience comes at a cost: your choice is restricted to providers within the insurer's network. Seeking care outside this network will likely result in significant out-of-pocket expenses or a denial of coverage.

This model presents a direct trade-off: you exchange the universal freedom of the indemnity model for the administrative ease of direct settlement within a defined ecosystem of healthcare providers.

The Fixed-Benefit Model: Predictable But Limited Payouts

The third structure, the fixed-benefit model, is not designed to cover the actual cost of your medical care. Instead, it pays a predetermined, fixed cash amount for specific medical events, such as a set per-diem payout for a hospital stay or a lump sum for a specified diagnosis.

This model functions more as a financial supplement than a primary insurance plan. The payout is predictable but is entirely disconnected from your actual medical bill. A policy might pay $500 per day of hospitalization; if the actual cost is $5,000 per day, you are responsible for the considerable shortfall. It offers a financial cushion but is not a comprehensive solution for the high costs of premium international healthcare.

For a deeper analysis of how these models integrate into different policy types, you can explore which expat medical insurance is right for you.

Understanding how indemnity operates in other insurance domains can also be instructive. For instance, learning about what liability insurance covers demonstrates how the principle of protecting against financial loss is applied to third-party claims.

Comparing Insurance Payment Models

To make the distinctions unequivocally clear, here is a side-by-side comparison of the three primary insurance payment structures. This will assist you in determining which model best aligns with your personal risk strategy and international lifestyle.

| Feature | Indemnity (Reimbursement) | Direct Billing (Cashless) | Fixed Benefit |

|---|---|---|---|

| Provider Choice | Unlimited. Access any licensed provider globally. | Limited. Restricted to a pre-approved network. | Unlimited. Choice of provider is irrelevant to the payout. |

| Payment Process | Pay upfront, then claim. Requires managing initial costs. | Insurer pays provider directly. Minimal out-of-pocket costs. | Lump-sum paid to you. Independent of actual medical costs. |

| Coverage Basis | Based on actual eligible costs incurred. | Based on negotiated rates within the network. | Based on a pre-set schedule of fixed amounts. |

| Best For | Maximum control and access to top-tier global specialists. | Convenience and predictable costs within a defined network. | Supplementing primary insurance or covering incidental costs. |

Choosing the appropriate model is a critical decision. Your selection will define your interaction with healthcare services worldwide—whether you prioritise ultimate freedom, streamlined convenience, or a straightforward financial backstop.

Mastering the Indemnity Claims Process

The value of any insurance policy is realised at the point of claim. For an indemnity plan, this moment of truth is the claims process. It is predicated on efficient and seamless reimbursement.

Consider this process not as an administrative burden, but as a financial recovery operation. Executing it correctly allows you to concentrate on your health, not your finances.

Success begins with meticulous preparation. A claim is a formal request for reimbursement, a request that requires substantiation. Organised and complete documentation is paramount for expedited payment. For high-net-worth individuals who value their time, this is non-negotiable.

Essential Documentation for a Seamless Claim

You are effectively compiling a case file for your insurer. Each document must contribute to a clear and consistent narrative of the medical care received and the costs incurred. Insurers require specific documentation to validate the claim and authorise payment.

The following items are almost universally required:

- Completed Claim Form: This is your official request. It must be filled out completely and accurately. Any omissions or errors will delay the process.

- Itemised Invoices: A simple credit card receipt is insufficient. A detailed bill from the provider is necessary, breaking down every service, procedure, and medication.

- Proof of Payment: This confirms you have settled the bill. It can be a receipted invoice, a credit card statement, or a bank transfer confirmation.

- Medical Reports: For complex cases, a report from the attending physician provides the necessary medical context for the insurer to understand the necessity of the treatment.

A best practice is to digitise all documents from the outset. Create a dedicated digital folder for each claim, scan every document immediately, and use a logical naming convention (e.g., "Invoice_Dr.Schmidt_15-Oct-2024.pdf"). This digital discipline ensures no documents are misplaced and allows for swift submission.

The visual below contextualises the indemnity model against other common insurance structures, illustrating why this reimbursement-based process is distinct.

As depicted, the indemnity model is centered on reimbursement (the wallet), distinguishing it from the network-based direct billing model and the lump-sum payout of a fixed-benefit plan.

Navigating International and Complex Claims

For expatriates and global professionals, claims often involve an additional layer of complexity, such as multiple currencies, different jurisdictions, and varying local regulations.

Here are specific strategies to manage these situations:

- Currency Conversion: Clarify your insurer's policy on currency exchange rates. Typically, they use the rate on the date of treatment, not the date of claim submission. Maintain a record of the rate you paid.

- Submission Deadlines: This is critical. Policies impose a time limit for submitting claims, often 90 to 180 days from the date of service. Missing this deadline will almost certainly result in denial.

- Processing Timelines: Inquire about the standard processing time. A well-documented claim should be processed within 30 business days. If processing exceeds this timeframe, a polite follow-up is appropriate.

Proactive management is key. By anticipating the insurer's requirements and providing an impeccable file, you control the process and ensure a successful reimbursement.

Even with an indemnity plan, securing pre-authorisation for planned, high-cost procedures is a prudent measure. To better understand this process and its connection to direct settlement options, our guide on pre-authorisation and direct settlement uncovered provides essential information. Mastering these steps ensures that indemnity insurance translates to financial security and peace of mind, regardless of where you require medical care.

Decoding the Fine Print of Your Policy

The true value of your indemnity insurance policy resides not in marketing materials, but in the structured language of the contract itself. For individuals managing significant assets or a global career, mastering these terms is an essential component of financial due diligence. This is where the scope of coverage is defined, limited, and ultimately, enforced.

Analysing your policy should be viewed as a critical financial exercise. It is how you ascertain the true scope of your protection, identify potential gaps, and avoid unwelcome surprises at the moment you require support. A clear understanding of the fine print transforms a legal document into a predictable financial instrument.

Identifying Common Exclusions

Every insurance contract contains an "exclusions" section, which enumerates specific situations, conditions, or treatments the policy will not cover. Overlooking this section is a significant risk. For international private medical insurance, these exclusions often pertain to elective, predictable, or exceptionally high-cost areas.

Common exclusions to be aware of include:

- Pre-existing Conditions: Policies define a "look-back" period and may permanently or temporarily exclude coverage for any condition for which you received treatment prior to enrolment.

- Elective or Cosmetic Procedures: Treatments not deemed medically necessary, such as cosmetic surgery, are almost universally excluded.

- Experimental Treatments: Any procedure or therapy not yet established as standard medical practice is typically not covered.

Understanding these boundaries is fundamental. It prevents incorrect assumptions about coverage and enables more precise financial planning for your healthcare needs.

Interpreting Financial Limits and Caps

Beyond explicit exclusions, it is crucial to understand the policy's payout limits. Insurers mitigate their risk by incorporating a series of financial caps. These limits represent the absolute maximum the insurer will pay and directly influence your potential out-of-pocket exposure.

The most common limits include:

- Annual Maximum: This is the total amount the insurer will pay for all claims combined within a policy year. For high-net-worth individuals requiring access to premium care, this figure must be substantial.

- Per-Incident or Lifetime Caps: Some policies may limit benefits for a specific condition or over the entire duration of the policy. You must assess whether these caps align with your long-term health strategy.

The practical meaning of indemnity insurance is found in these details. The interplay between your freedom of choice and these contractual limits defines the true utility of your coverage.

These financial boundaries also operate in conjunction with other cost-sharing mechanisms. For a comprehensive overview of how these elements interact, it is advisable to read our detailed analysis of the fine print of excesses and deductibles.

Demystifying the Reasonable and Customary Clause

One of the most critical—and frequently misunderstood—clauses in an indemnity policy is the "Reasonable and Customary" (R&C) provision. This clause stipulates that the insurer will only reimburse costs that are consistent with the typical charges for a given service in a specific geographic location.

This is the insurer's primary mechanism for cost control within a model that affords you complete provider autonomy.

Consider this scenario: a standard specialist consultation in Singapore typically costs $400. However, you consult a provider who charges $1,000 for the same service without medical justification for the higher fee. Your insurer will likely reimburse only the "reasonable" $400, leaving you responsible for the remaining $600.

Understanding the R&C benchmarks in the jurisdictions where you anticipate receiving care is essential for managing your own financial exposure.

Indemnity Insurance in Real-World Scenarios

Policy clauses and abstract principles are only part of the equation. The true measure of an indemnity plan is its performance in practice—when your health or professional reputation is at stake. These scenarios demonstrate precisely what indemnity insurance means in tangible terms.

Let’s move beyond definitions to see how this coverage functions for globally mobile professionals facing critical challenges. These examples illustrate the practical power of financial restoration and freedom of choice.

Unrestricted Medical Access in Dubai

Consider an expatriate executive residing in Dubai who is diagnosed with a complex cardiac condition. After extensive research, she identifies a leading specialist with a private clinic, who is not affiliated with any insurance network. With a standard managed care plan, consulting this specific physician would be financially prohibitive, forcing a compromise in her choice of care.

Her indemnity insurance policy fundamentally alters the situation.

- Immediate Access: She secures an appointment with her chosen specialist directly, without requiring referrals, pre-approvals, or consulting network directories. This enables decisive action at a critical time.

- Upfront Payment: She pays for the initial consultations, advanced diagnostic imaging, and the subsequent procedure out-of-pocket, with the total amounting to approximately $45,000.

- Seamless Reimbursement: She compiles the itemised invoices and proofs of payment, submitting a single, comprehensive claim. Within weeks, the full eligible amount is transferred to her account, restoring her financial position.

This exemplifies the core value of health indemnity insurance: complete control over your medical care. It ensures access to the best available treatment, irrespective of network affiliations. For a closer examination of how insurance policies function for specific treatments across borders, it is worthwhile to review understanding dental implant insurance coverage in an international context.

Navigating a Professional Liability Claim

Let us now shift to a different category of risk. A financial consultant provides strategic advice to a client regarding a major acquisition. Months later, the deal fails, and the client initiates legal action, alleging the consultant's advice led to significant financial losses. The claim is for millions, posing an existential threat to the consultant's firm and personal assets.

In this scenario, a professional indemnity policy acts as an impenetrable shield.

The policy responds immediately, covering not only a potential settlement but also the substantial cost of mounting a legal defence. It is designed to preserve your wealth by absorbing the financial shock of litigation.

Here is how the policy activates:

- High-Calibre Legal Defence: The insurer engages a top-tier law firm specialising in financial services litigation. These legal fees alone can amount to hundreds of thousands of dollars.

- Expert Witness Fees: A robust defence often requires testimony from industry experts—another significant cost covered in full by the policy.

- Settlement Costs: After protracted negotiations, a settlement is reached to mitigate the risk of a court battle. The policy covers this payment, protecting the consultant's business and personal wealth from depletion.

This level of protection is a strategic asset, as essential as market analysis or legal counsel in high-stakes professional environments. The use of indemnity insurance is also increasing in corporate transactions. A recent survey indicated that 65% of respondents anticipate a rise in the use of specialised indemnity insurance in M&A deals, particularly in emerging financial hubs.

How to Choose the Right International Indemnity Plan

Selecting the right international indemnity plan is a significant decision that requires a methodical approach. A correct choice safeguards your health and wealth; an incorrect one can result in a policy that fails at a critical moment. This is not about finding the lowest premium, but about making a strategic financial commitment.

The process must begin with an objective assessment of your circumstances. The optimal plan for a single professional dividing their time between London and Singapore is entirely different from that required by a family residing in Dubai. The key is to align the policy's specifications with the realities of your global lifestyle.

First, Nail Down Your Personal and Geographic Profile

Before reviewing any policy options, you must define your specific requirements. This foundational step prevents distractions from superfluous benefits and focuses your attention on what is truly essential.

Consider the following questions:

- Where is my primary base? Healthcare costs in Hong Kong differ dramatically from those in Lisbon. Your primary residence establishes the baseline coverage you need.

- How often and where do I travel? Are you frequently mobile? Does your travel include high-cost jurisdictions like the United States or Switzerland? The plan’s geographic scope must precisely match your travel patterns.

- Who am I covering? Is the policy for an individual, a couple, or a family? Account for any chronic conditions, planned life events such as maternity, or specific wellness needs that require consistent coverage.

Answering these questions provides a clear blueprint, transforming the abstract concept of "good coverage" into a concrete checklist of non-negotiable features tailored to your situation.

Next, Compare Policy Guts and Insurer Reputation

With your blueprint established, you can begin to compare specific policy offerings. This involves a detailed examination of the policy wording that governs its performance in a crisis. An insurer's reputation for efficient claims processing is as critical as the coverage limits they offer.

Focus on these key areas:

- Geographic Scope of Coverage: Does the plan provide true worldwide coverage? Pay close attention to whether high-cost countries like the USA are included as standard or require a substantial additional premium.

- Aggregate Policy Limits: Look for a high annual maximum. For high-net-worth individuals, a limit of $5 million or more is not excessive; it is essential protection against a catastrophic medical event that could otherwise threaten personal assets.

- Insurer's Claims Efficiency: Conduct due diligence on the insurer's service reputation. Seek out reviews, consult with other expatriates, and find data on their typical reimbursement times. An excellent plan is rendered ineffective if claims are difficult to process or reimbursement is delayed for months.

Finally, Run it Past Your Professional Advisors

An international indemnity policy is a financial instrument that intersects with tax and legal systems in every jurisdiction you operate in. Consulting with your financial and legal advisors is a crucial final step to ensure your choice is sound from all perspectives.

They can identify potential issues you might overlook, such as the tax deductibility of premiums in your country of residence or latent liabilities. This final review ensures the plan protects your wealth as effectively as it protects your health.

Frequently Asked Questions

When considering the practicalities of indemnity insurance, several key questions consistently arise. Let's address the most common inquiries from globally mobile professionals to resolve any ambiguity regarding costs, coverage strategies, and dispute resolution.

Are Indemnity Plans More Expensive?

This is often the first question, and the answer is typically yes. The premiums for a true indemnity plan can be higher than those for a network-based HMO or PPO policy.

This is a function of risk from the insurer's standpoint. With an indemnity plan, they have no control over provider costs, as they have not negotiated discounted rates with a network. They are exposed to charges from the world's most exclusive clinics and top-tier specialists. This higher risk is reflected in a higher premium.

However, what you are purchasing with that premium is unrestricted access and complete control. For high-net-worth individuals or senior executives, the ability to choose any provider, anywhere in the world, without network constraints, is a value that far outweighs the additional cost. It is an investment in certainty and peace of mind.

Can I Hold An Indemnity Policy Alongside A Local Plan?

Absolutely. For many expatriates, this dual-coverage approach is the most strategic and effective solution. It is common to maintain a local, network-based plan in your primary country of residence for routine medical needs. This is then supplemented by a robust international indemnity policy for its global reach and catastrophic coverage.

This strategy offers the best of both worlds:

- Your Local Plan: Ideal for routine check-ups, prescriptions, and consultations with a local GP, offering the convenience of direct billing within a familiar network.

- Your Indemnity Plan: This serves as your strategic reserve. It is deployed for serious medical events, when traveling, or when you need to consult a world-renowned specialist who is outside your local network.

How Are Disputes Over Charges Resolved?

While infrequent, disputes can arise, typically concerning what an insurer deems a "reasonable and customary" charge. If your chosen specialist's fee is significantly above the benchmark for that procedure in that location, there is a formal resolution process.

Your primary tool is the formal appeals process. This involves more than simply completing a form; it requires building a case. The key is to provide supplementary documentation directly from your physician.

This report must clearly justify why the higher fee was medically necessary. Reasons could include an unusually complex case, the procedure requiring unique expertise possessed only by that doctor, or the use of specialised equipment. A well-argued medical justification is almost always sufficient to prompt the insurer to reconsider and cover the full amount.

Navigating the world of international health insurance is complex, but you don't have to do it alone. For clear, objective advice on finding a plan that truly fits your life, contact Riviera Expat. Our experts can help you compare your options and secure the right protection. Get your free IPMI comparison quote today.