For the discerning global citizen, your country of residence is far more than a mere address—it is the jurisdiction that legally recognizes you as an inhabitant. This status serves as your strategic anchor in the world, dictating where you file taxes, secure premium health insurance, and establish your primary legal ties.

Consider it the country where you have established your primary home and your center of life.

Understanding Your Country of Residence

Your country of residence is the nation where you physically live and have established significant personal and economic roots. This concept is distinct from citizenship, which is tied to your passport and nationality. Residency is a matter of fact, based on where you conduct your day-to-day life.

It is the primary determinant used by governments and financial institutions to define their legal and fiscal relationship with you.

Mastering this concept is critical for managing your international affairs, from tax obligations to securing comprehensive health coverage. The distinction has become paramount as the number of global professionals continues to grow. The worldwide expatriate population is estimated to be between 60 to 70 million, with jurisdictions like the UAE and Switzerland being popular hubs for high-net-worth individuals.

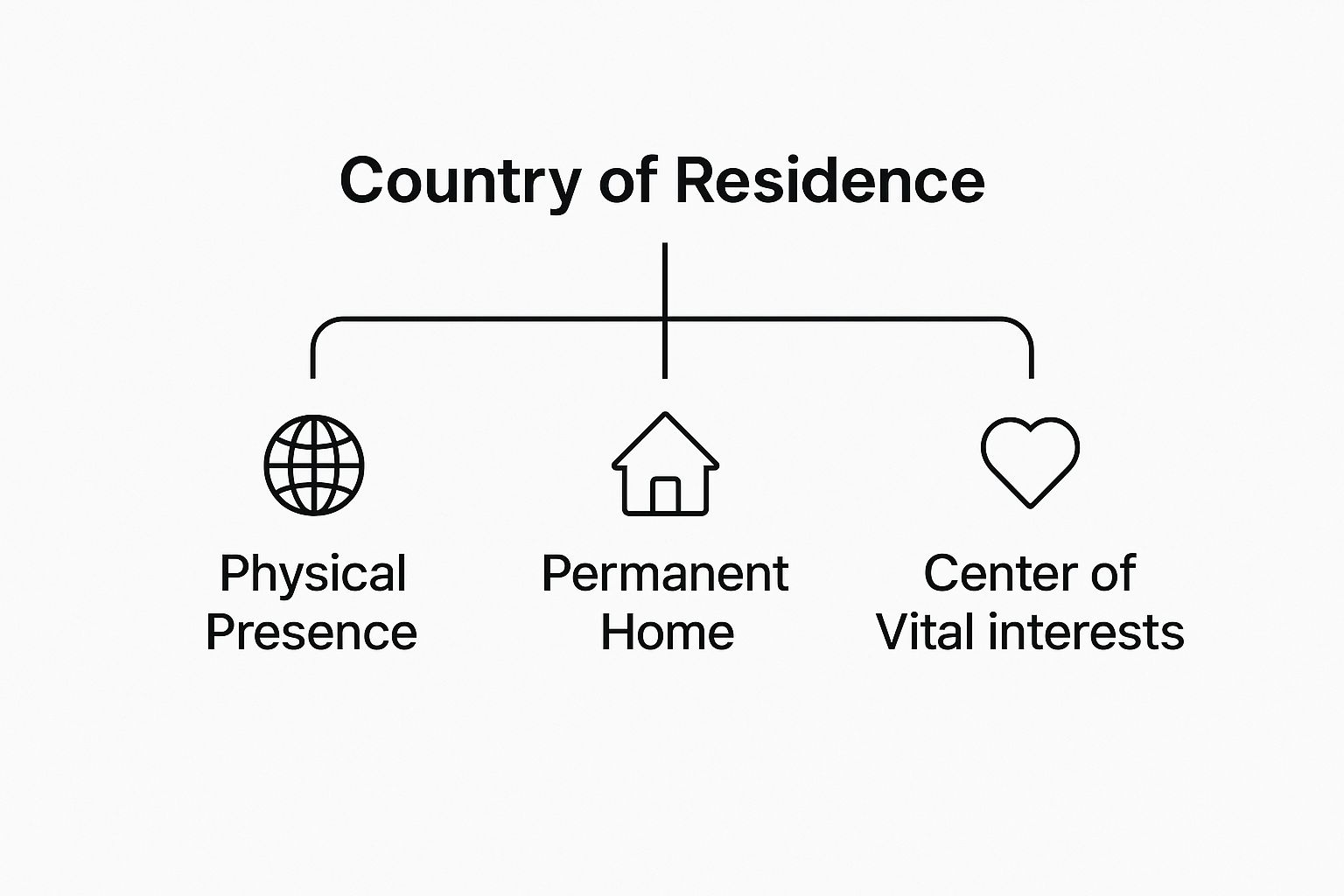

Key Pillars of Residency

Determining residency is not as simple as examining a visa. Authorities look beyond a single data point and assess the substance of your life through several core criteria.

- Physical Presence: The amount of time you spend in a country is a significant indicator, though the specific day-count rules vary considerably between jurisdictions.

- Permanent Home: Having a permanent, accessible home available to you establishes a very strong tie that is difficult to dispute.

- Center of Vital Interests: This qualitative assessment examines where your life's core activities occur—where your closest personal relationships, social circles, and primary business activities are based.

This infographic breaks down the core components that come together to establish a country of residence.

As you can see, residency is not about a single factor. It is a holistic concept built on a combination of your physical, personal, and economic ties. For anyone looking to establish a new base of operations, understanding the practical steps, such as how to obtain a UAE residence visa, offers a real-world perspective on how the process is initiated.

Residence vs. Citizenship vs. Domicile At a Glance

For individuals living a global life, these terms can be easily confused. While they sound similar, in the eyes of the law and tax authorities, they have very different meanings. The table below delineates these foundational concepts.

| Concept | Definition | Primary Implication |

|---|---|---|

| Residence | The country where you currently live and have your primary home. | Determines your tax obligations, access to local services, and insurance requirements. |

| Citizenship | Your legal nationality, granting you the rights of a citizen (e.g., passport, voting). | Grants you a passport, diplomatic protection, and the right to live/work in that country. |

| Domicile | Your permanent, "forever" home; the country you consider your ultimate legal base. | Affects inheritance, estate taxes, and certain legal rights, even if you live elsewhere. |

Understanding these distinctions is the first step toward building a solid legal and financial foundation for your life abroad. Each status carries its own set of rules and responsibilities that one cannot afford to overlook.

How Residence Shapes Your International Health Plan

Here is a detail many globally mobile professionals overlook: your country of residence is not just a line on an application form. It is the absolute cornerstone of your international health insurance policy. For an insurer, it is the primary piece of data used to construct your entire plan, and it is a non-negotiable factor.

An off-the-shelf travel policy is wholly inadequate for this lifestyle. Your declared residence dictates your entire risk profile. Insurers conduct a deep analysis of the local healthcare costs, the quality of care available, the regulatory landscape, and even the specific health risks common to that region. This meticulous evaluation, known as underwriting, is the engine that calculates your premium.

The Impact on Premiums and Coverage

Here is where the financial implications become clear. Two individuals could have identical, world-class medical plans, yet pay vastly different premiums. The reason? Their country of residence. A plan based in a country with high private healthcare costs will invariably command a higher premium than the exact same plan in a location with more affordable medical care. It is a direct reflection of the potential claims the insurer might have to cover.

For example, a comprehensive global health plan for someone residing in Switzerland—renowned for its exceptional but expensive healthcare system—will carry a much higher premium than the same policy for an expatriate based in Dubai.

An insurer’s primary function is to price risk accurately. Your country of residence provides the foundational data for that calculation, influencing everything from your access to local specialists to the logistics of an emergency medical evacuation.

Defining Your Area of Cover

Your residence also sets the boundaries for your primary area of cover. While most top-tier international plans offer worldwide coverage, your home base always acts as the anchor point. It determines the insurer's legal obligations and ensures your plan is fully compliant with local laws and regulations.

Ultimately, choosing your country of residence is far from a casual decision. It is the central pillar supporting your access to elite medical care, wherever you are in the world. It is absolutely crucial to select a policy that aligns perfectly with this key designation.

For more on this, you may find our guide on choosing the right type of health insurance policy for expatriates useful.

Navigating the Complexities of Tax Residency

Here is a critical distinction that ensnares countless global professionals: where you live is not necessarily where you owe taxes. While your country of residence is your physical home, your tax residency is what determines which government has a claim on your income.

Assuming these two are always the same is a formula for costly compliance issues. For anyone working or living internationally, understanding this difference is not just good financial practice—it is essential for protecting your assets.

Tax authorities are far more interested in the substance of your economic life than the stamp in your passport. They employ a series of tests, both quantitative and qualitative, to determine where your true financial center of gravity lies. This is precisely why expert corporate relocation services are so valuable; they help navigate these intricate international tax rules from the outset.

Beyond the 183-Day Rule

Many believe tax residency is governed solely by the "183-day rule," but that is merely scratching the surface. It is a common starting point, but sophisticated tax systems dig much deeper.

Most modern tax authorities now focus on a more holistic concept known as the center of vital interests. It is a qualitative test designed to pinpoint where your personal and economic ties are strongest.

They will examine a host of factors, including:

- Where is your permanent family home located?

- Where are your primary business and professional connections based?

- Where are your most significant assets held and managed?

- What about your social clubs, community ties, and personal affiliations?

An error in this assessment can inadvertently make you a dual tax resident, a complex scenario where your entire worldwide income could be taxed by two different countries.

For high-net-worth individuals, mastering the difference between physical presence and tax residency is not just good practice—it is an essential component of a sound global financial strategy. It ensures cross-border obligations are met without unnecessary financial exposure.

How countries approach these tests often depends on their legal traditions. Common law and civil law countries, for instance, tend to emphasize different aspects of a person's life when determining tax residency.

Common Tax Residency Tests by Jurisdiction Type

| Test Type | Common Law Countries (e.g., UK, USA) | Civil Law Countries (e.g., France, Germany) |

|---|---|---|

| Physical Presence | Often a primary test, using strict day counts (like the 183-day rule) as a starting point. | A significant factor, but often secondary to other ties. Day counts are part of a broader assessment. |

| Permanent Home | The availability of a permanent home is a strong indicator, but not always the deciding factor on its own. | The location of the "habitual abode" or primary family home is often the most critical test. |

| Economic Ties | Heavily weighted. The source of income, business interests, and location of assets are crucial. | Also important, but often viewed in conjunction with personal and family ties as part of the "center of vital interests." |

| Personal Ties | Social connections and family location are considered, but may carry less weight than economic factors. | Family and social life are central to the "center of vital interests" concept and are weighed heavily. |

Ultimately, these tests all aim to answer the same question: where does your life truly take place? The answer directly impacts national tax revenues and resource planning.

For context, consider population data. In 2024, India's population is approximately 1.44 billion. Compare that to smaller, high-net-worth hubs like Monaco (around 37,000) or Luxembourg (around 670,000). These vast differences, shaped by global migration and residency choices, have a profound effect on a country's tax base and economic strategy.

Using Residency as a Strategic Tool

For the strategic global professional, selecting a country of residence is no longer a passive event. It is a calculated move on the international chessboard. Consider it less a mailing address and more a dynamic tool—a key component of a well-planned international life designed to enhance mobility, diversify assets, and build a stable foundation for family and business.

This mindset completely reframes the concept of residency. It is not just a label; it is a powerful asset. The most common way to leverage this strategy is through Residency by Investment (RBI) programs, which offer a clear and legitimate path to legal residence in countries with highly favorable economic climates.

Unlocking Global Mobility and Opportunity

The rewards for choosing a strategic residence are both immediate and significant. For instance, establishing residency in a jurisdiction like Malta or Portugal can unlock visa-free travel across the entire Schengen Area—a substantial advantage for anyone conducting business or traveling for leisure. This benefit alone is a significant driver behind the popularity of these programs.

Residency is not just about where you live. It is about constructing a framework that supports your global ambitions, providing both freedom of movement and a secure legal foundation for your wealth.

In our interconnected world, this strategic approach has become vital for both individuals and the nations offering these programs. A growing number of countries, currently around 37, now offer Residency and Citizenship by Investment (RCBI) schemes. This is not a coincidence; it is a clear indication that residency is now deeply linked with economic strategy and sophisticated wealth management.

Once you have secured your country of residence, the next step is to implement smart tax planning strategies to truly optimize your financial structure. If you are contemplating such a major life change, our guide on preparing for your move abroad is an excellent place to start mapping out the practical next steps.

Costly Misconceptions to Avoid

When navigating the world of international finance and planning, what you think you know can be more detrimental than what you do not. Misunderstanding the concept of "country of residence" is not a minor academic error—it presents a significant risk. Several dangerous myths persist that can expose you to staggering financial and legal liabilities.

These fallacies typically arise from attempts to oversimplify incredibly complex legal rules. Let us deconstruct these myths, one by one, so you can identify any weaknesses in your own arrangements and ensure your global affairs are built on a solid foundation.

Myth 1: My Citizenship Dictates My Residence

This is perhaps the most common—and most dangerous—misunderstanding. Individuals often believe their passport serves as a definitive shield against residency rules. However, your citizenship and your residency are two entirely separate legal concepts. Your passport grants you certain rights from your home nation, but your country of residence is determined by where you actually live your life.

Tax authorities and regulators are not concerned with your passport's country of origin. They are concerned with substance. Where do you reside for most of the year? Where are your children enrolled in school? Where do you conduct your daily affairs?

A Swiss citizen who spends the entire year living and working in Singapore is, for all practical purposes, a resident of Singapore. That is where their life is centered, and that is almost certainly where their primary tax obligations will lie, regardless of what their passport indicates.

This is a core principle of international law: your lifestyle and real-world ties define your residence, not your nationality. Believing otherwise is the first step toward a major compliance issue.

Myth 2: Spending Less Than 183 Days Somewhere Means I'm Not a Resident

The infamous "183-day rule" is the most widely quoted and thoroughly misunderstood concept in the expatriate world. It is often treated as a magic number that makes tax obligations disappear. It does not.

While counting days is part of the equation, it is never the only part. Relying solely on a calendar is a deeply flawed strategy because tax authorities have become far more sophisticated. They have moved on to more qualitative tests.

They are now laser-focused on your "center of vital interests." They will investigate where your permanent home is, where your spouse and children live, and where your strongest financial and social connections are. You could spend less than six months in a country, but if your primary home, your family, and your entire social life are there, you can be certain they will view you as a tax resident.

Myth 3: Owning Multiple Homes Lets Me Pick and Choose

Owning properties in London, Dubai, and Monaco provides wonderful flexibility, but it does not grant you the authority to simply point at a map and declare, "That is where I am resident this year." Authorities are not interested in your preference; they are interested in objective facts.

They will analyze all of your ties to each location to determine which one is your true home base.

They will examine factors such as the size and use of each property. Is it a sprawling family estate where you spend holidays, or is it a small city apartment used for occasional business trips? The location where you have deeper roots will almost always carry more weight. The decision is based on evidence, not on your choice.

A Few Common Questions

Delving into the world of international residency, tax, and insurance can feel like solving a puzzle with pieces from different boxes. Let's clarify some of the most common points of confusion for global professionals.

Can I Have More Than One Country of Residence?

Yes, it is quite possible to be considered a legal resident in multiple countries simultaneously, especially for tax purposes. This scenario is often called dual residency, and while it is perfectly legal, it creates a complex web of tax obligations that must be managed with extreme care.

When this occurs, you could find yourself liable for taxes on your worldwide income in both jurisdictions. The key to navigating this is typically found in Double Taxation Treaties, but this is not an area for self-navigation. Securing professional tax advice is non-negotiable to maintain compliance and avoid severe financial penalties.

How Do I Officially Change My Country of Residence?

Changing your country of residence is not as simple as packing your bags and updating your mailing address. It is a formal process that involves methodically severing significant ties with your former country while establishing substantial new roots in your new one.

Consider it less a move and more a legal declaration. The key steps usually involve:

- Obtaining the correct visa or residence permit.

- Securing a permanent home that is available for your use at any time.

- Moving the center of your financial and business life to the new country.

- Formally notifying the tax authorities in both countries of your change in status.

Changing your residence is a legal act with serious financial consequences. You must prove a clear and definitive shift in your "center of vital interests" to satisfy the authorities in both your old and new home countries.

What Is the Difference Between Residence and Domicile?

These terms are often used interchangeably, but in the eyes of the law, they are worlds apart. Residence is relatively straightforward—it is where you currently live and have an established home. It can change with relative ease.

Domicile is a much more permanent and fundamental concept. It is your legal "permanent home," the country to which you are fundamentally connected and intend to return. You typically acquire your domicile at birth, and it is far more difficult to change than your residence. This distinction becomes critical for matters such as inheritance and estate taxes, as your domicile often dictates which country's laws apply to your worldwide assets upon your death.

For a deeper look at these topics and many others, you can explore our full list of frequently asked questions.

For expert, objective guidance in selecting an international health plan that aligns with your country of residence, contact Riviera Expat for a complimentary consultation at https://riviera-expat.com.