When navigating the complexities of your health insurance portfolio, "coinsurance" is a term that requires precise understanding. It is a fundamental component that dictates a significant portion of your out-of-pocket medical expenditures.

In essence, coinsurance is the percentage of your healthcare costs for which you are responsible after you have met your annual deductible. It is a cost-sharing agreement between you and your insurer. They cover the majority of the approved costs, and you cover a smaller, predetermined percentage.

Demystifying Coinsurance in Your Health Plan

Mastering the mechanics of your health plan is essential for effective financial management and personal risk mitigation. Coinsurance is a key lever that directly impacts your expenditures once your deductible has been satisfied.

Consider it a joint financial undertaking for your health expenses. After you have paid your deductible from your own funds, you enter a new phase of cost-sharing. From that point forward, you and your insurer divide the costs of covered services. This mechanism determines your actual healthcare spending for the remainder of the plan year.

The Cost-Sharing Partnership

Coinsurance is always expressed as a percentage split. A common arrangement is 80/20. In this scenario, your insurance carrier pays 80% of the approved medical costs, and you are responsible for the remaining 20%.

This arrangement continues until you reach another critical financial threshold: your out-of-pocket maximum.

Coinsurance is not a flat fee. It is a variable cost contingent on the total approved bill for your medical care. This distinguishes it from a copayment, which is a fixed dollar amount you pay for a specific service, such as a physician's consultation.

Understanding this distinction is vital for accurately forecasting potential healthcare expenses. For a more detailed breakdown of these terms, you can review our guide on expat medical insurance policy terms.

To gain a broader perspective on essential health insurance definitions and their interplay, this resource can be exceptionally useful.

How Coinsurance Actually Works

To effectively manage your healthcare expenditures, you must understand the sequence of payment obligations. Coinsurance is not your initial payment; it is activated only after your annual deductible has been paid in full. This creates a clear financial pathway for your plan year.

At the beginning of your plan year, you are responsible for 100% of the allowed costs for any covered medical care received. This continues until your cumulative out-of-pocket payments reach your deductible amount. Only then does your insurance carrier begin to contribute to the costs.

Once your deductible is met, the coinsurance phase begins. From this point, you and your insurer share the cost of approved medical services based on your plan’s specific ratio, such as a standard 80/20 split. This cost-sharing continues until you reach the final financial backstop.

The Payment Progression at a Glance

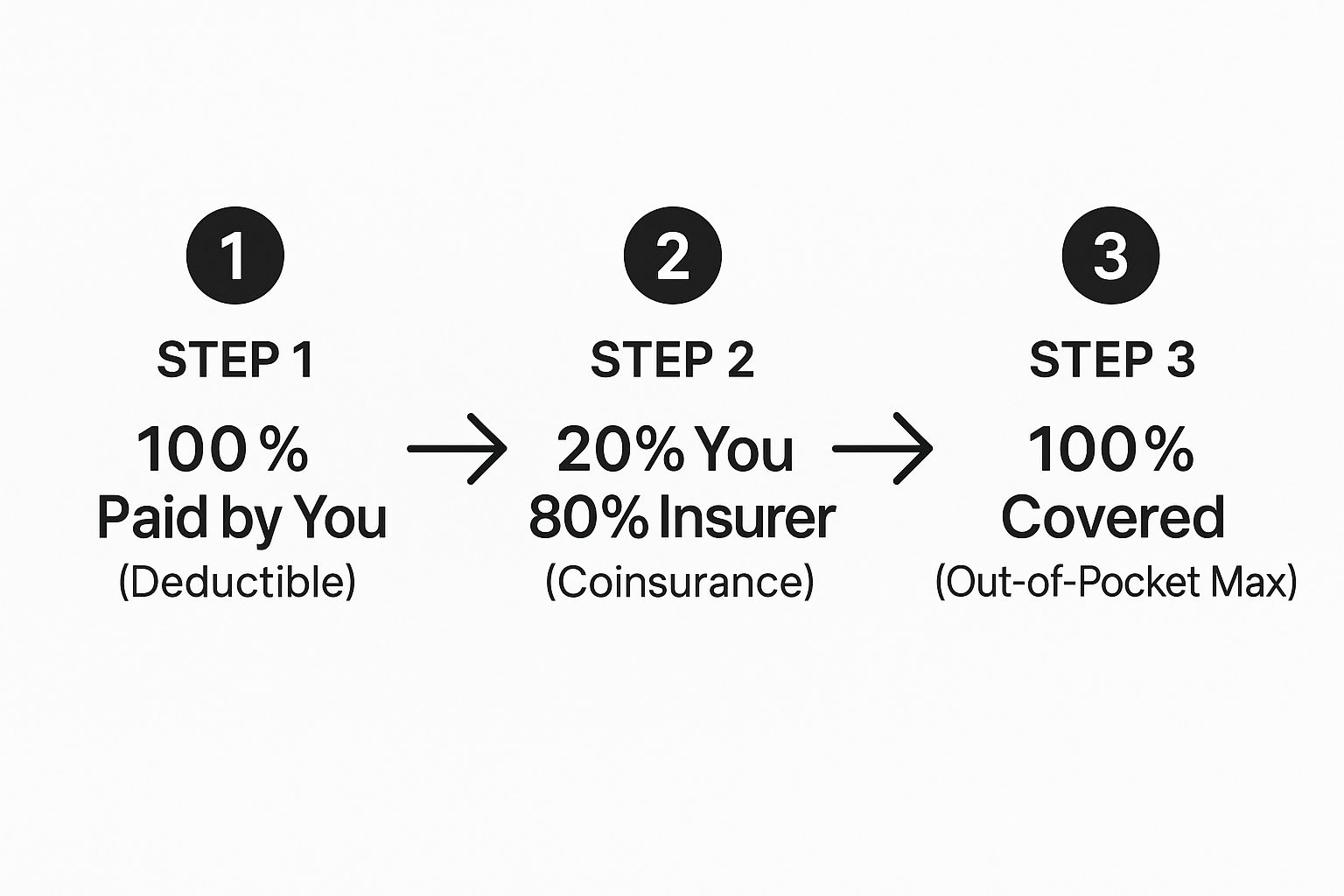

The process follows a distinct three-step progression, moving from your sole financial responsibility to your plan eventually assuming all costs.

This flow illustrates precisely how your financial responsibility shifts. You begin by bearing the full burden, then you share it, and finally, you are fully covered for eligible services within your network.

That final step is reaching your out-of-pocket maximum. This figure represents the absolute limit you will have to pay for covered services within a single plan year. Upon reaching this limit, your insurance plan covers 100% of all subsequent eligible costs. It is a critical financial safeguard designed to protect your assets from exceptionally high medical expenses.

Coinsurance vs Copay vs Deductible

Deciphering your health plan's cost structure requires a clear understanding of three key terms: deductible, copay, and coinsurance. While they all represent your portion of a medical bill, they function quite differently. Conflating them can lead to unexpected invoices and financial strain.

The deductible is the initial financial threshold. It is a fixed dollar amount you must pay out-of-pocket for your medical care before your insurance carrier's contributions begin. Until this amount is satisfied, you are responsible for 100% of the allowed costs.

Once the deductible is met, your other cost-sharing mechanisms—copays and coinsurance—are activated.

Clarifying Your Payment Responsibilities

A copay (or copayment) is a fixed, predictable fee you pay for a specific service, irrespective of the total cost billed by the provider. For instance, you might have a $50 copay for a specialist consultation or a $25 copay for a visit to your primary care physician. This is a straightforward payment typically made at the time of service.

Coinsurance, conversely, involves calculation. It is not a flat fee but a percentage of the total allowed cost for a service that you pay after your deductible is met. This means your financial share varies with the cost of the care received. For a more detailed comparison of these two terms, this analysis of coinsurance vs copay is an excellent resource.

The sequence is paramount. First, you satisfy your full deductible. Subsequently, you begin sharing costs with your insurer through either fixed copays or percentage-based coinsurance. Every dollar you spend on these obligations contributes toward your out-of-pocket maximum—the absolute ceiling on your annual healthcare spending.

Cost-Sharing Terms at a Glance

To clarify these concepts, a side-by-side comparison illustrates their distinct roles within your health plan.

| Term | What It Is | When You Pay It | Example |

|---|---|---|---|

| Deductible | A fixed amount you pay first. | Before the insurer begins paying. | You pay the first $2,000 of medical bills. |

| Copay | A flat fee for a specific service. | Typically at the time of service. | A $50 fee for consulting a specialist. |

| Coinsurance | A percentage of costs you pay. | After your deductible is met. | You pay 20% of a $10,000 surgery bill. |

A firm grasp of these concepts is the foundation of understanding your policy. When you comprehend the details of excesses and deductibles, you can anticipate costs and make informed healthcare decisions, avoiding unforeseen financial liabilities.

Let's Run the Numbers: A Real-World Coinsurance Example

Abstract concepts become clear when applied to a practical scenario. Let us examine a common medical event to translate percentages into precise monetary figures.

Assume your health plan specifies a $1,000 deductible and 20% coinsurance for surgeries. You require a procedure, and the hospital's initial bill is $15,000.

The first critical detail is that the $15,000 list price is not the basis for your costs. The relevant figure is the pre-negotiated rate your insurance carrier has with the hospital, known as the "allowed amount." For this surgery, let's assume the allowed amount is $10,000. All your cost-sharing will be calculated from this number.

How the Bill Gets Broken Down

Your share of the costs is paid in a specific order. Coinsurance is only applied after your deductible is fully paid.

- Satisfy Your Deductible: You are responsible for the first $1,000 of the $10,000 allowed amount. Once paid, your deductible is met for the year.

- Determine the Remainder: With the deductible satisfied, $9,000 remains on the bill. This is the amount to which your coinsurance applies.

- Calculate Your Coinsurance: Your plan requires you to pay 20% of the remaining $9,000. This amounts to $1,800. Your insurance carrier covers the other 80%, or $7,200.

Your total out-of-pocket cost for this surgery is $2,800 (your $1,000 deductible + your $1,800 coinsurance share).

The essential principle to remember is that coinsurance is always calculated based on the insurer's negotiated 'allowed amount,' not the provider's initial bill. Understanding this is fundamental to accurately projecting your financial liability.

This example demonstrates how a significant medical bill is reduced to a more manageable expense by your plan's structure. You can learn more about how premiums, deductibles, and coinsurance work together from major health providers.

Furthermore, every dollar of the $2,800 you paid contributes toward your annual out-of-pocket maximum, your ultimate financial safeguard.

How Provider Networks Impact Your Coinsurance

A critical detail that significantly impacts your healthcare budget is your choice of provider. This decision directly influences the amount of coinsurance you will pay. Insurers establish specific networks of physicians and hospitals that have agreed to provide services at lower, pre-negotiated rates.

Utilizing these "in-network" providers is the most effective strategy for controlling your costs. When you remain in-network, your coinsurance is calculated from that lower, discounted price. The moment you seek care outside this network, the financial terms change—to your disadvantage.

Opting for an out-of-network provider will almost certainly increase your coinsurance percentage. It is common to see this rate escalate from 20% for an in-network service to 40% or higher for an out-of-network equivalent. You can learn more about the structure of these medical networks to understand how these agreements are formed.

The Financial Risks of Out-of-Network Care

Seeking out-of-network care introduces a significant financial risk known as balance billing. An out-of-network provider is not bound by your insurer's negotiated rates. If their full charge for a procedure is $10,000, but your insurer’s "allowed amount" for that service is only $6,000, the provider can legally bill you for the $4,000 difference.

This $4,000 liability is in addition to your higher out-of-network coinsurance.

Your financial exposure for out-of-network care is often uncapped. Critically, payments made for balance billing typically do not count toward your annual out-of-pocket maximum, leaving your assets vulnerable to substantial medical bills.

Furthermore, coinsurance rates can vary by the type of service. You might have 20% coinsurance for an in-network specialist, but consulting an out-of-network specialist for the same condition could carry a much steeper coinsurance rate. Understanding these differentials is vital, particularly when specialized care is required.

The Out-of-Pocket Maximum: Your Financial Safety Net

Every health insurance plan includes a crucial feature designed to protect your assets from a year of high medical costs: the out-of-pocket maximum. This is the absolute ceiling on what you will spend on covered, in-network healthcare in a plan year.

Consider it the ultimate financial backstop. Every dollar you pay towards your deductible, copayments, and coinsurance is tracked and applied toward this single, critical number. It is your plan's commitment that a significant medical event will not result in financial ruin.

Reaching the Financial Threshold

Once your cumulative payments reach the out-of-pocket maximum, your financial obligation for covered medical services ceases for the remainder of the plan year.

At this point, your insurance plan begins to cover 100% of all eligible, in-network costs. This is the core purpose of the out-of-pocket limit—it transforms a potentially unlimited financial risk into a predictable, manageable annual expense.

This feature provides true peace of mind. It ensures that even a severe, unexpected medical crisis will not disrupt your overall financial strategy. For high-net-worth individuals, understanding this figure is not merely about insurance; it is a fundamental component of comprehensive asset protection.

Coinsurance Questions You’re Probably Asking

Let's address some practical questions that arise when managing coinsurance. These details can significantly impact how you navigate your healthcare spending.

Does Coinsurance Apply to Prescription Drugs

This depends entirely on your plan's structure. Many plans utilize a straightforward copayment system for generic and preferred brand-name prescriptions, where you pay a flat fee for different drug tiers.

However, coinsurance is frequently applied to high-cost specialty medications. Typically, you must first meet a separate prescription drug deductible, after which your coinsurance percentage will apply to these specific drugs. The definitive source for this information is your plan’s Summary of Benefits and Coverage (SBC).

Can My Coinsurance Percentage Change

Your coinsurance rates are fixed for the duration of your plan year and will not change mid-term.

However, the percentage you pay can vary significantly based on two factors: the type of medical service and, most importantly, whether your provider is in-network. A visit to an in-network specialist might carry a 20% coinsurance, whereas an out-of-network visit will almost invariably result in a higher percentage.

The single most important factor dictating your cost is your provider's network status. Your coinsurance is always a percentage of your insurer's negotiated "allowed amount," not the provider's list price.

If you go outside your network, you also risk exposure to "balance billing"—the difference between the provider's charge and your insurer's allowed amount. This can be a substantial, unexpected expense. Adhering to in-network providers is the most reliable strategy for controlling costs.

At Riviera Expat, we deliver the clarity and control you require to make confident healthcare decisions. We specialize in securing premium international health insurance for financial professionals, ensuring your policy aligns precisely with your global lifestyle. For expert, objective guidance, explore your options at https://riviera-expat.com.