When you hear the term ultra high net worth, what comes to mind? For those in the financial world, it signifies a specific benchmark: $30 million in investable assets.

This is not simply the cash held in a bank account. It represents the sum of your liquid assets, excluding personal treasures such as your primary residence or curated art collection. This figure signals more than wealth; it indicates a new echelon of financial complexity and personal planning.

Your world operates on a different plane. It demands a sophisticated, global approach to managing assets, structuring your legacy, and, most critically, safeguarding your personal well-being.

Understanding the Ultra High Net Worth Individual

Being an ultra high net worth individual (UHNWI) is less about a precise dollar amount and more about the intricate global landscape you navigate. Your financial life is not confined by borders. It is a complex tapestry of multi-jurisdictional assets, sophisticated tax strategies, and, often, significant philanthropic missions. You are part of an exclusive global peer group.

This elevated status brings a unique set of responsibilities and challenges. The aggressive strategies that built your wealth are seldom the same ones required to preserve it for future generations. Protecting your principal, cultivating steady portfolio growth, and establishing a lasting legacy become the cornerstones of your financial life.

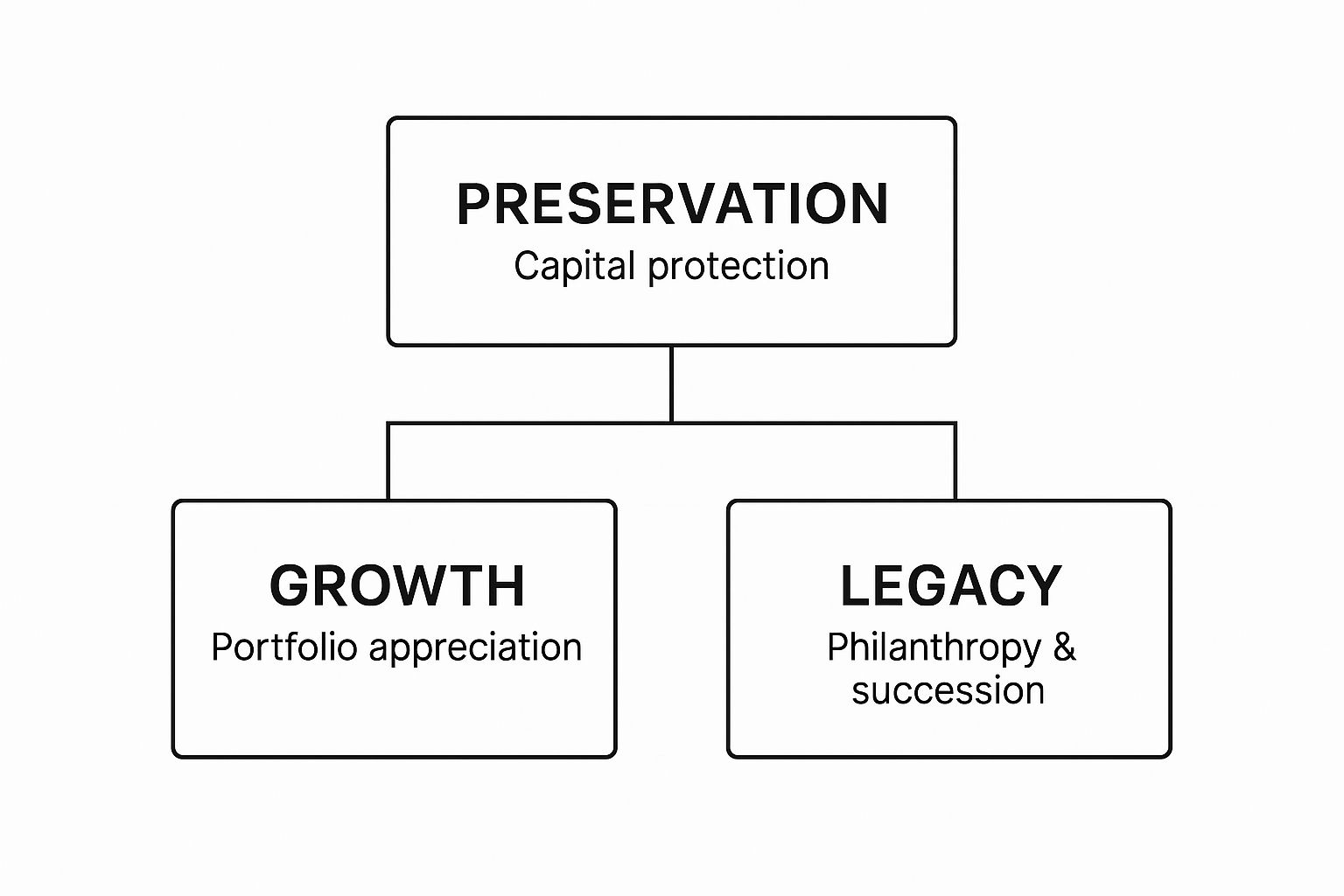

This diagram illustrates the core priorities that guide most UHNWI financial strategies.

As you can see, capital preservation forms the bedrock. Strategic, sustainable growth is the next layer, all built upon the foundational objective of creating a lasting family legacy.

Getting the Tiers Straight

To fully appreciate what makes the "ultra high net worth" designation unique, it is useful to see where it fits within the broader spectrum of wealth. The distinctions between these categories are defined by investable assets, which directly correlate to the complexity of financial management required.

Here is a concise breakdown to put the $30 million UHNWI threshold into perspective.

Understanding Tiers of Global Wealth

| Wealth Tier | Minimum Investable Assets | Typical Characteristics |

|---|---|---|

| Mass Affluent | $100,000 | Focus on retirement planning and basic investment portfolios. |

| High Net Worth (HNW) | $1 million | Often involves professional wealth managers, more diverse investments. |

| Very High Net Worth (VHNW) | $5 million | Requires more complex tax planning and estate strategies. |

| Ultra High Net Worth (UHNW) | $30 million | Navigates global assets, family offices, and legacy planning. |

This table clearly shows that ascending to the UHNW tier represents a quantum leap in financial complexity, not merely an incremental increase in assets.

Beyond the Numbers

While the $30 million figure serves as the industry benchmark, the true defining feature of a UHNWI is the complexity of managing a global footprint. This entails juggling cross-border investments, intricate family governance structures, and highly personalized risk management that extends far beyond a standard stock portfolio.

It is a remarkably exclusive group. Ultra High Net Worth Individuals constitute a minute fraction of the world’s population, yet they control a significant portion of global private wealth. As we look toward 2025, the $30 million benchmark remains, but the conversation is shifting. The focus is now on the sophisticated stewardship of cross-border assets and the execution of ambitious philanthropic goals. You can delve deeper into this data in the 2025 Wealth Report.

This reality demands a level of planning that extends beyond financial instruments to protect your most valuable asset: your health.

For the ultra wealthy, premier international health insurance is not just a benefit—it is a core asset protection strategy. It ensures immediate access to the best medical care anywhere in the world, safeguarding both personal wellbeing and the continuity of your global enterprises.

This guide will explore the specific health and security challenges you face and explain why a top-tier international private medical insurance plan is an indispensable tool in your wealth preservation toolkit. Understanding these dynamics is the first step toward securing your health, your family, and your legacy with the same diligence you apply to your financial portfolio.

Mapping the Global Footprint of the Ultra Wealthy

The concept of "ultra high net worth" is not just a number on a spreadsheet; it is a global phenomenon. Wealth at this level is incredibly fluid, flowing across borders and concentrating in specific cities—the true epicenters of capital, culture, and commerce. Understanding where these hubs are, and why they attract such significant capital, provides a clear map of global influence.

These key cities act as powerful magnets for the ultra wealthy. They are not merely places to reside; they are entire ecosystems that provide unparalleled access to financial markets, elite business networks, and world-class lifestyles. This concentration is one of the defining features of the modern ultra high net worth landscape.

As of recent data, the world’s UHNWI population is clustered in a handful of major cities. For instance, New York City, Hong Kong, and London consistently rank as top hubs. These numbers do not just show where capital resides; they demonstrate how critical certain cities have become in the global financial network. For a deeper look, you can explore more insights into high-net-worth individual demographics.

The Engines of Wealth Generation

How is capital of this magnitude accumulated? The paths are as varied as the individuals themselves, but clear patterns have emerged. The most significant trend is the rise of self-made fortunes, which now dominate the UHNWI population.

This is not a minor shift. It points to the powerful economic engines creating wealth in the 21st century. While inherited wealth still plays a role, the landscape is increasingly shaped by entrepreneurship and professional success in high-growth industries.

A significant majority of UHNWIs are self-made. This tells us that today, entrepreneurial vision and astute investing are the primary forces creating new ultra high net worth fortunes.

The industries fueling this growth are a clear indicator of where global economic power truly lies. Anyone navigating the UHNW environment—for investment, networking, or strategic planning—must understand these sectors.

- Finance and Investments: This sector remains dominant, accounting for a substantial portion of UHNWI fortunes. It encompasses everything from investment banking and asset management to hedge funds and private equity.

- Technology: A powerful engine of new wealth, the tech sector is responsible for a rapidly growing share of UHNW individuals, driven by software, e-commerce, and digital innovation.

- Real Estate: A classic and tangible asset class, real estate continues to be a significant source of UHNWI wealth, from direct ownership of trophy properties to large-scale development projects and investment trusts.

These sectors highlight a simple truth: proximity to the epicenters of finance, technology, and global trade is not just an advantage. It is often a prerequisite for building and preserving wealth at the highest levels.

Why Certain Cities Attract Capital

The allure of cities like New York, London, and Singapore extends far beyond their stock exchanges. They offer a rare combination of factors that create the ideal environment for wealth to grow and be protected—a top priority for any ultra high net worth individual.

This creates a self-perpetuating cycle. As more capital flows into these cities, they attract more top-tier talent. That talent fuels further innovation, which creates more investment opportunities, solidifying their status as essential hubs for the global elite.

Here’s a breakdown of what makes these cities so magnetic:

| Factor | Description |

|---|---|

| Financial Infrastructure | Direct access to global markets, top-tier banks, and specialized financial services. |

| Business Ecosystem | A dense concentration of corporate headquarters, venture capital, and expert legal firms. |

| Cultural Capital | World-class arts, elite education, and exclusive social networks that support a global lifestyle. |

| Political Stability | A secure and predictable regulatory environment that protects assets and investments. |

Ultimately, the global footprint of the ultra wealthy is a map of opportunity. These cities are not just addresses; they are strategic launchpads from which UHNWIs manage their portfolios, expand their businesses, and secure their legacies.

Anticipating Future Trends in Wealth Creation

Looking beyond day-to-day market fluctuations, the trajectory for global wealth is clear. It is not just growing; it is accelerating at the highest levels.

The forces driving this expansion are not temporary. They are deep, fundamental shifts in technology, finance, and emerging economies that are creating new fortunes and rewriting market dynamics. For an ultra high net worth individual, understanding these currents is not just an academic exercise—it is essential for strategic positioning.

This incredible momentum stems from a few key sources. Technological innovation—especially in artificial intelligence, biotech, and sustainable energy—is a massive engine for new wealth. Concurrently, capital is flowing into emerging markets, creating new epicenters of affluence far beyond the traditional Western hubs.

This expansion has real, tangible consequences for the markets in which you operate. As the number of UHNWIs grows, so does the demand for assets and services catering to this specific group. The impact is most evident in sectors defined by true scarcity and exceptional quality.

The Ripple Effect on High-End Markets

When more capital is concentrated at the top, it directly reshapes pricing and availability in several key sectors. This is not simple inflation. It is a structural change driven by a larger pool of sophisticated buyers competing for a finite supply of premium assets.

This trend creates a fascinating dynamic of challenge and opportunity. While competition for trophy assets intensifies, it also sparks incredible innovation in bespoke services. It pushes developers, designers, and artisans to create new offerings that meet an ever-higher standard of excellence.

Consider the impact on these specific areas:

- Luxury Real Estate: Prime properties in global cities and exclusive retreats see a surge in demand. This drives significant price appreciation and inspires new, architecturally stunning developments.

- Exclusive Goods: Rare collectibles, from vintage automobiles to fine art and haute horlogerie, become even more sought-after. They function not just as objects of beauty, but as powerful stores of value.

- Specialized Financial Services: The need for sophisticated wealth management, family office solutions, and custom investment vehicles grows in lockstep with the UHNWI population.

This is not a forecast; it is a measurable trend with significant momentum. Projections show that the global ultra-wealthy population is set to continue its strong growth trajectory. This will only intensify demand across all high-end markets.

A telling indicator of this is the average real estate footprint of an ultra high net worth individual. They typically own multiple luxury residences, often spread across different international cities, with locations like New York, London, and Monaco remaining primary hubs.

Strategic Positioning for What Comes Next

Anticipating these shifts is the essence of strategic wealth management. As the ultra-wealthy continue to diversify their portfolios, understanding specific asset classes—like the evolving landscape of global luxury real estate market trends—is absolutely critical. It allows for much sharper investment decisions, whether in property, private equity, or other alternative assets.

The next decade will not just see more wealth. It will see smarter, more mobile capital. Being prepared means understanding where that capital will flow and what truly drives value in an increasingly competitive world.

Ultimately, the future of wealth creation is tied to global innovation and connectivity. By keeping a close watch on these trends, you can position your strategies to not only protect what you have built but also to capitalize on the opportunities that will emerge from this historic expansion.

Why Elite Health Insurance Is a Core Asset

Allow us to be direct.

For an ultra high net worth individual, your most valuable asset is not your stock portfolio. It is not your real estate empire or your private equity stakes.

It is your health.

Without it, the ability to steer your enterprises, enjoy the life you have built, and protect your legacy diminishes. Protecting this core asset demands a strategy as meticulous and sophisticated as any financial plan.

Standard health insurance, even the best corporate plans, was simply not designed for the reality of a global life. These policies are built around domestic provider networks and local regulations. They fail under the demands of someone who might be in New York one week, Singapore the next, and a remote location the week after.

This is where premier international private medical insurance (IPMI) ceases to be an expense and becomes a critical component of your personal risk management framework. It functions less like a conventional insurance policy and more like a global health security detail.

Beyond Coverage: Global Access and Control

The difference is fundamental. A standard plan asks, "Is this doctor in our network?" An elite IPMI plan asks, "Who is the world's foremost specialist for this condition, and how quickly can we secure an appointment?"

That shift—from network limitations to outcome-focused access—is everything.

Imagine a medical emergency while traveling. With a standard plan, you are often at the mercy of the local healthcare system's capabilities. An elite plan, however, triggers an immediate, high-level response designed for a global citizen.

This response is built on key pillars that guarantee peace of mind, no matter where you are.

- Rapid Medical Evacuation: This means coordinated transport to a center of excellence, often by private air ambulance. This is not merely a flight; it is a fully managed medical transfer with an expert team onboard.

- Direct Access to Top Specialists: You bypass GP referrals and lengthy waitlists to see world-renowned physicians for consultations, second opinions, or immediate treatment.

- Seamless Entry into Premier Facilities: Forget administrative burdens. You gain pre-arranged access and direct billing with the world’s leading private hospitals—from the Mayo Clinic in the U.S. to Gleneagles in Singapore—removing all hurdles during a crisis.

Privacy and Personalization Are Non-Negotiable

For an ultra high net worth individual, medical privacy is not a preference; it is a necessity. A health event can have ripple effects on business dealings, market perceptions, and family security. Premier IPMI providers operate with this as a baseline requirement.

They manage sensitive information through secure, encrypted channels and work with private clinics accustomed to serving high-profile clientele. Your health matters remain strictly confidential. This level of discretion is a built-in feature, not an add-on request.

These plans also move far beyond reacting to illness. They are increasingly structured around proactive wellness and preventative medicine. We are talking about bespoke wellness programs, comprehensive health screenings at world-class facilities, and coverage for advanced, cutting-edge treatments that standard policies will not cover. This proactive approach mirrors a core UHNWI principle: identify and neutralize risk before it escalates into a crisis. Our comprehensive guide on insurance coverage offers more insight into building these protective layers.

A Strategic Investment in Your Legacy

Viewing elite health insurance as just another line item is a strategic error.

It is a direct investment in your personal capacity, your family’s security, and the long-term stability of your entire legacy. The power to access the best medical minds and facilities on the planet, without delay or administrative friction, is one of the most effective asset protection tools at your disposal.

It ensures that a health issue—major or minor—causes the absolute minimum disruption to your life and global responsibilities. This security frees you to focus on your ventures and passions, confident that your most important asset is completely protected. It is a foundational piece of any serious wealth preservation strategy.

Essential Features of a Premier Global Health Plan

Let's be clear: a standard health insurance policy, even a top-tier corporate one, is fundamentally inadequate for the realities of an ultra high net worth lifestyle. It is like using a city map to navigate the open ocean. These plans are built on local networks and domestic rules, rendering them insufficient for someone whose life and business interests transcend borders.

A premier global health plan is engineered differently from the ground up. It is designed not just for coverage, but for absolute continuity of care and total control over your health decisions, no matter where you are in the world.

This level of assurance comes from a handful of non-negotiable features. Think of them not as luxury add-ons, but as essential pillars for protecting your health—and by extension, your global enterprises.

Unrestricted Access and Unlimited Benefits

The first principle of a truly premier plan is the complete removal of barriers. It begins with unlimited annual benefits. When facing a serious medical situation, the last thing you should be concerned about is hitting a policy limit. True peace of mind comes from knowing that whatever treatment is needed, wherever it is, it is covered without financial caps.

This philosophy extends to how you access that care. A critical feature is the ability to see specialists directly, without needing a primary care physician's referral. This eliminates frustrating and potentially critical delays, allowing you to engage immediately with the world’s leading experts in any medical field.

Whether you require a second opinion from a top oncologist in Zurich or an urgent consultation with a cardiologist in New York, the access is direct and immediate.

The Power of a Global Concierge Service

Perhaps the single most defining feature of an elite plan is the dedicated 24/7 medical concierge. This is far more than a customer service hotline; it is your personal health logistics team. Their sole function is to manage the complex, time-consuming details of your medical care, anywhere on the planet.

This service becomes indispensable during a crisis. Imagine you need urgent care while traveling. Your concierge team handles everything:

- Arranging appointments with world-renowned specialists, often within days, not months.

- Coordinating complex logistics, including medical evacuations via private air ambulance.

- Managing direct billing with a global network of premier hospitals, ensuring a cashless and seamless experience.

- Facilitating second opinions from a global panel of experts to ensure you have the best possible information.

For an ultra high net worth individual, time is a finite and invaluable resource. A medical concierge service preserves this resource by removing every administrative and logistical burden, allowing you to focus entirely on your health and recovery.

The difference in service and access is stark when you compare a standard plan with one designed for a global citizen. The gap is not just about coverage amounts; it is about the fundamental design and responsiveness of the service. You can learn more about the specifics of these policies in our guide to international private medical insurance.

A Focus on Comprehensive Wellbeing

Finally, a premier plan is proactive, not just reactive. It emphasizes comprehensive preventative care, covering extensive health screenings and wellness check-ups designed to identify potential issues early. This aligns perfectly with a core principle of effective asset management: mitigating risk before it becomes a problem.

These plans also provide robust support for mental health and wellbeing. They offer confidential access to top psychologists, therapists, and wellness experts globally, recognizing that mental resilience is as crucial as physical health for maintaining peak performance in business and life.

The table below highlights the critical differences.

Standard Health Plans Versus Premier UHNW Coverage

It is one thing to discuss the differences, but seeing them side-by-side makes the value proposition crystal clear. A standard plan offers basic protection; a premier plan delivers strategic health management.

| Feature | Standard/Corporate Insurance | Premier UHNW International Plan |

|---|---|---|

| Annual Limit | Capped, often with sub-limits | Truly unlimited |

| Specialist Access | Requires GP referral and network approval | Direct, immediate access to global experts |

| Global Network | Limited to domestic or regional providers | Expansive, direct-billing with elite global hospitals |

| Support | Standard call center | Dedicated 24/7 medical concierge |

| Mental Health | Basic coverage, often with limitations | Comprehensive, confidential global access |

| Privacy | Standard data protection | Enhanced protocols for high-profile clients |

Ultimately, the choice comes down to whether you require a basic safety net or a comprehensive global health security system. For UHNWIs, the latter is not a luxury—it is a necessity.

When you think about wealth preservation, your mind likely goes straight to financial metrics. For an ultra high net worth individual, that is only half the equation. The real objective is not just accumulating assets; it is ensuring your family is secure and your legacy will endure for generations.

A premier global health plan is the unsung hero of this strategy. It is the bedrock that provides stability when everything else is in motion.

Think of it as a protective layer around everything you have built. It ensures that a sudden medical crisis—whether it affects you or a family member—does not derail your business ventures, philanthropic work, or personal passions. It is a proactive investment in continuity. It provides peace of mind.

This becomes absolutely critical when your family members are located across the globe.

Unifying Your Family’s Health Under One Roof

The modern UHNWI family is often a global one. Your children might be studying at universities in different countries, pursuing careers in international cities, or simply traveling frequently. Attempting to manage their health and safety with a patchwork of separate, domestic insurance policies is a logistical challenge.

Worse, it creates dangerous gaps in their safety net.

A single, high-caliber international medical plan cuts through all that complexity. It brings every family member under one cohesive umbrella, ensuring that no matter where they are, they receive the same elite standard of care and immediate access to the best medical facilities.

This single-policy approach delivers:

- Consistent Quality of Care: No more worrying if the care in one country matches the care in another. Everyone receives the same high standard.

- Simplified Administration: One policy, one point of contact. The administrative burden of juggling multiple plans and providers vanishes.

- Guaranteed Global Access: Your dependents are covered for everything from a routine check-up to a serious emergency, anywhere in the world.

A unified health strategy is a core part of modern family governance. It is a powerful statement of your commitment to the wellbeing of every family member, giving them the security they need to thrive on their own terms.

Of course, securing your legacy extends beyond health. It requires sharp financial planning, including effective investment risk management. When you pair that financial diligence with a world-class health strategy, you create a foundation that is truly resilient for generations to come.

Ultimately, protecting your family’s health with the same intensity you apply to your investment portfolio is the final, crucial piece of the legacy puzzle. It ensures the people you care about most are secure, freeing you to focus on the future with complete confidence.

Frequently Asked Questions

When you operate at the level of an ultra high net worth individual, your questions are often highly specific. Here, we address some of the most common inquiries.

Why Is a Single International Plan Superior to Multiple Domestic Policies?

Imagine juggling different insurance policies for residences in London, Singapore, and New York. Different rules, different contacts, different renewal dates—a logistical complication.

Now apply that same scenario to your family's health.

A premier international plan eliminates this complexity. It offers one policy, one point of contact, and one consistent, high standard of care regardless of location. You avoid the dangerous gaps that can appear when traveling between countries and the administrative burden of managing multiple domestic plans. It provides seamless, comprehensive protection.

What Is the Role of a Medical Concierge in a UHNW Health Plan?

Think of a medical concierge less as a customer service agent and more as a personal health logistics manager for your family. This is not about calling an 800 number; it is about having a dedicated expert who handles everything, so you do not have to.

Their sole purpose is to make your healthcare experience frictionless.

- Need an urgent appointment with a world-renowned cardiologist in Zurich? They will arrange it.

- Facing a medical emergency requiring a private evacuation? They coordinate every detail.

- Dealing with billing from an elite clinic? They manage all administration behind the scenes.

It is about removing every obstacle between you and the best possible care, instantly.

How Does a Premier Health Plan Ensure Medical Privacy?

For any ultra high net worth individual, privacy is not a perk; it is a fundamental requirement. Standard insurance plans are not built for this level of discretion, but premier plans are designed around it.

They achieve this by working exclusively with a network of private hospitals and clinics that specialize in treating high-profile clients. These facilities—along with the insurer and the concierge team—operate under stringent confidentiality agreements. Every communication, every medical record, and every invoice is handled with the utmost discretion, shielding your personal health information from public and media attention.

For more answers to common questions, you can also check out our general FAQ page.

At Riviera Expat, we specialize in securing world-class international private medical insurance for financial professionals with a global lifestyle. We provide the clarity and control you need to protect your most valuable asset—your health. Get expert guidance by visiting us at https://riviera-expat.com.