For a high-net-worth professional, insurance isn't just a recurring expense; it's the architectural foundation of your entire global wealth strategy. Your life, your assets, and your career are not confined to a single country, and your protection shouldn't be either. Understanding the correct type of insurance is the first step in constructing a formidable financial defense.

Building Your Global Financial Fortress

This guide is not about standard, off-the-shelf policies. It is designed for expatriates in demanding financial hubs such as Singapore or London who face a completely different landscape of risk. We will deconstruct how specialized insurance products integrate to form a comprehensive shield for your assets, your health, and your legacy.

The objective is simple: to reframe how you perceive insurance. It is not a cost center. It is an indispensable tool for securing financial continuity and genuine peace of mind, irrespective of your global location.

Consider your insurance portfolio not as a collection of separate policies, but as an integrated security system. Each component must be selected to work in concert, protecting against specific threats to your international lifestyle and wealth.

A Framework for International Professionals

Navigating the world of insurance requires a strategic mindset, particularly when your career demands global mobility. Relying on a generic domestic policy is analogous to navigating London with a map of New York—it is fundamentally inadequate for your journey.

For expatriate professionals, the core categories of protection are as follows:

- Global Health and Medical: This extends far beyond simple travel insurance. We are discussing robust, continuous medical care regardless of your location.

- Life and Legacy: These are not merely safety nets but strategic instruments for estate planning and wealth transfer across complex tax jurisdictions.

- Asset and Property: Securing high-value real estate and personal belongings in multiple countries requires specialized underwriting that standard insurers cannot provide.

- Income and Liability: Protecting your most valuable asset—your earning potential—from professional risks and unforeseen disability is entirely non-negotiable.

The Growing Demand for Specialized Coverage

This shift toward borderless protection is not a niche concept; it is reflected in empirical data. The global health insurance market was valued at USD 2.69 trillion in 2023. A significant portion of this growth stems from private providers offering the client-centric models that public systems often lack.

The Asia-Pacific region is a major growth engine, fueled by rising incomes in financial hubs where professionals demand seamless, high-quality coverage. With projections showing the market expanding to a staggering USD 5.45 trillion by 2035, the trend is unambiguous: discerning individuals are eschewing one-size-fits-all plans in favor of tailored solutions for comprehensive care. You can read the full research on global health insurance trends to review the data.

The Cornerstones of Your Coverage: Health and Life Insurance

When all other considerations are stripped away, two types of insurance form the absolute bedrock of your personal security: health and life. For a globally mobile professional, however, this is not as simple as selecting a plan from a domestic menu.

Standard, local policies are constructed for individuals who remain in one location. They are constrained by geographical borders, provider networks, and regulations that do not accommodate the reality of an international career. Your health coverage must function as effectively in Singapore as it does in London, without excuses or exceptions.

This is precisely where International Private Medical Insurance (IPMI) becomes essential. Unlike a domestic plan, IPMI is engineered for a borderless lifestyle. It is designed to provide unrestricted access to top-tier medical care and ensure your coverage follows you, regardless of where your work or life takes you. You can delve deeper into the specifics in our guide to https://www.riviera-expat.com/international-private-medical-insurance/.

The global trend is clear: professionals are opting for specialized, private care. In fact, private payors now represent a substantial 57.94% of the entire health insurance market share, largely because these plans cover advanced treatments that public systems often exclude. While North America leads in market size, Asia's health premium growth is surging at over 12.6%, demonstrating the rapid pace of this landscape's evolution. This makes obtaining objective, expert advice more critical than ever to secure a policy that truly moves with you.

Domestic Health Insurance vs International Private Medical Insurance (IPMI)

It is easy to underestimate the differences between a local plan and a true IPMI policy until you face a medical issue abroad. The table below clarifies the distinction, showing why one is built for a stationary life and the other is essential for a global one.

| Feature | Typical Domestic Health Insurance | International Private Medical Insurance (IPMI) |

|---|---|---|

| Geographic Coverage | Restricted to a single country or region. | Global or multi-country, designed for portability. |

| Provider Network | Limited to in-country doctors and hospitals. | Extensive global network of top-tier facilities. |

| Currency & Claims | Pays claims in one local currency. | Multi-currency options for premiums and claims. |

| Portability | Coverage typically ends when you move abroad. | Fully portable; coverage continues as you relocate. |

| Evacuation & Repatriation | Rarely includes medical evacuation coverage. | Standard feature for emergency transport to adequate care. |

| Specialist Access | Often requires referrals and has network limits. | Direct access to specialists worldwide is common. |

| Customer Service | Local business hours, single language support. | 24/7 multilingual assistance for global time zones. |

Viewing the features side-by-side makes the distinction sharp. For anyone living or working internationally, IPMI is not a luxury—it is a fundamental requirement for ensuring consistent, high-quality medical care.

Securing Your Legacy with Strategic Life Insurance

For high-net-worth individuals, life insurance is far more than a safety net. It is a sophisticated financial tool used for wealth preservation, tax planning, and seamless estate transitions. The discussion is not merely about term versus whole life; it is about selecting the appropriate vehicle to achieve specific financial objectives.

For the modern global professional, life insurance is less about preparing for an end and more about ensuring a seamless continuation—of your family’s lifestyle, your business interests, and your financial legacy.

Term life insurance provides pure protection. It is a cost-effective method to cover liabilities with a defined end date, such as a mortgage or your children's university tuition. It is simple and powerful for a specified period.

Whole life insurance, conversely, is a permanent asset that builds cash value over time. It can be a strategic tool for creating liquidity, ensuring your heirs can cover estate taxes without being forced to liquidate property or business interests.

When managing a complex international portfolio, the right life insurance strategy is absolutely indispensable. To add another layer of protection and control, many explore structures like a life insurance trust, which can offer powerful asset protection and tax advantages. This ensures your wealth is transferred efficiently and precisely according to your wishes, preserving the legacy you have worked diligently to build.

Protecting Your Global Asset Portfolio

Your assets are as mobile and diverse as your career. This means your standard, single-country property insurance policy is fundamentally inadequate. It was not constructed for this purpose.

Attempting to protect a primary residence in London, a vacation property in Bangkok, and an investment apartment in Singapore with a domestic plan is a formula for failure. A specialized approach is required.

These policies are engineered to navigate the labyrinth of multiple legal systems and account for the unique risks inherent in different global financial hubs. A domestic insurer simply lacks the underwriting expertise to value a property subject to foreign laws, currency fluctuations, and unique environmental threats.

Securing High-Value International Real Estate

Forget basic fire and theft coverage. True international property insurance must be structured to solve the specific challenges expatriate owners face.

The goal is a policy that offers seamless claims processing across borders and in multiple currencies. The last thing you want is to be caught in a bureaucratic nightmare when you need support the most.

Here’s what to look for in a robust international property policy:

- All-Risk Coverage: This is non-negotiable. It provides broad protection against all perils unless they are specifically excluded, which is vital for high-value properties with unique features or contents.

- Political Risk Endorsements: In certain regions, this adds a crucial layer of protection against losses that stem from political instability or government actions.

- Liability Across Jurisdictions: This ensures your personal liability protection is recognized and enforceable in the country where your property is located, shielding you from lawsuits.

Securing a global property portfolio is analogous to managing an international investment fund. You would not hire a small-town broker to manage your global equities. Do not rely on a domestic insurer to protect assets scattered across continents. The expertise must match the scope of the asset.

Insuring Your Mobility and Personal Effects

Beyond real estate, your constant movement between global hubs demands a completely different class of travel insurance. Forget the inexpensive, single-trip plans offered by airlines; they are practically worthless for your lifestyle.

For an executive with a demanding international schedule, an annual, multi-trip policy is the only logical choice. This type of insurance is designed for frequent, often last-minute travel.

The focus here must be on features that provide genuine security, not just box-ticking. High-limit personal property protection is essential, covering the expensive electronics, timepieces, and business equipment that accompany you. Similarly, robust cancellation and interruption coverage ensures that significant prepaid travel expenses are never at risk.

Most importantly, elite annual plans provide immediate access to emergency assistance services, from medical referrals to logistical support. This ensures that no matter where you are in the world, a network is standing by to manage a crisis efficiently, protecting both your well-being and your schedule. You can learn more about finding the right type of insurance cover for your international lifestyle in our other guides.

Insulating Your Greatest Asset: Your Earning Potential

While we spend considerable time protecting our physical assets and health, for a high-earning professional, the greatest asset is not tangible. It is your ability to generate a substantial income, year after year.

A sudden illness, a severe accident, or a single professional error can shut down that engine of wealth creation instantly. This is where two very specific types of insurance become non-negotiable: disability insurance and professional liability coverage.

These are not generic safety nets. They are precision instruments designed to protect a multi-million-dollar earning potential. For anyone in a specialized financial role, a standard, off-the-shelf disability policy is dangerously inadequate. What you require is an ‘own-occupation’ disability insurance policy.

This is a specific type of coverage engineered for experts whose skills are not easily transferable.

Understanding Own-Occupation Disability Insurance

Imagine a private wealth manager who develops a neurological condition. Suddenly, they can no longer analyze complex market data with the necessary speed and accuracy. They might be physically capable of performing another job, but their unique ability to excel in their highly specific, lucrative profession is gone.

A standard disability policy would likely deny their claim, arguing that they can still work elsewhere. An ‘own-occupation’ policy, however, pays benefits because the individual can no longer perform the core duties of their specific role.

An own-occupation policy doesn't just ask if you can work; it asks if you can continue to be the high-performing professional you are. It protects your unique expertise and the income stream that flows directly from it.

For investment bankers, traders, and family office managers, this is not a minor detail—it is the entire purpose of income protection. The policy is structured to replace a significant portion of your income, ensuring a career-altering event does not become a full-blown financial catastrophe.

Defending Your Reputation and Assets

Beyond your personal health, your professional actions carry their own set of risks. A single client alleging negligence or an error in judgment can trigger a lawsuit that threatens not just your professional reputation, but your personal wealth.

This is where Professional Liability Insurance, often called Errors & Omissions (E&O) coverage, provides a critical line of defense. This insurance is designed to cover the staggering costs associated with defending yourself against claims of malpractice or professional negligence.

It typically covers:

- Legal Defense Costs: These fees can accumulate incredibly quickly, even if the claim against you is entirely baseless.

- Settlements and Judgments: The policy can pay for negotiated settlements or court-ordered damages, up to your policy limit.

Consider a financial advisor accused of providing unsuitable investment advice that led to significant client losses. The legal battle alone could cost hundreds of thousands in fees, regardless of the verdict. Professional Liability insurance steps in to fund that defense, preserving the personal assets you would otherwise have to liquidate just to contest the claim. This coverage is an essential firewall between your financial world and the inherent risks of your profession.

A Strategic Framework for Selecting Your Insurance Portfolio

Selecting the right insurance for a global life is not about comparing premiums on a spreadsheet. That is a rudimentary error. It is about building a fortress, where each policy is a carefully chosen stone designed to stop a specific, predictable threat to your financial life.

Think of it as an investment portfolio. You would never allocate all your capital to a single stock. You diversify to manage risk. Your insurance should function in the same way. Each piece—from your IPMI to professional liability—has a job to do in your overall financial defense strategy. This framework is about asking the right questions to see past marketing materials and find coverage that actually performs when you need it.

Forensic Review of Policy Exclusions

Here is a hard truth: the real value of an insurance policy is not in what it covers, but in what it specifically excludes. The glossy brochure will always highlight broad protections. But the fine print in the exclusions section is where the insurer’s promises meet reality. A forensic, almost obsessive, review of this section is non-negotiable.

This means you must dig deeper than the summary page. For instance, your high-limit disability policy might look excellent until you see it excludes injuries from skiing or scuba diving—your two favorite hobbies. Or your property insurance might not cover a specific type of water damage common in your region. Knowing this before you sign prevents a catastrophic shock when you actually need to file a claim. You can get a much deeper look at the jargon in our guide to understanding health insurance policy language.

Assessing Operational Excellence

A policy is merely a document until you need to make a claim. Its true worth is determined by how the provider behaves in a crisis. Are they a responsive partner or a bureaucratic obstacle? Before you commit, you must investigate their track record for paying claims efficiently and fairly.

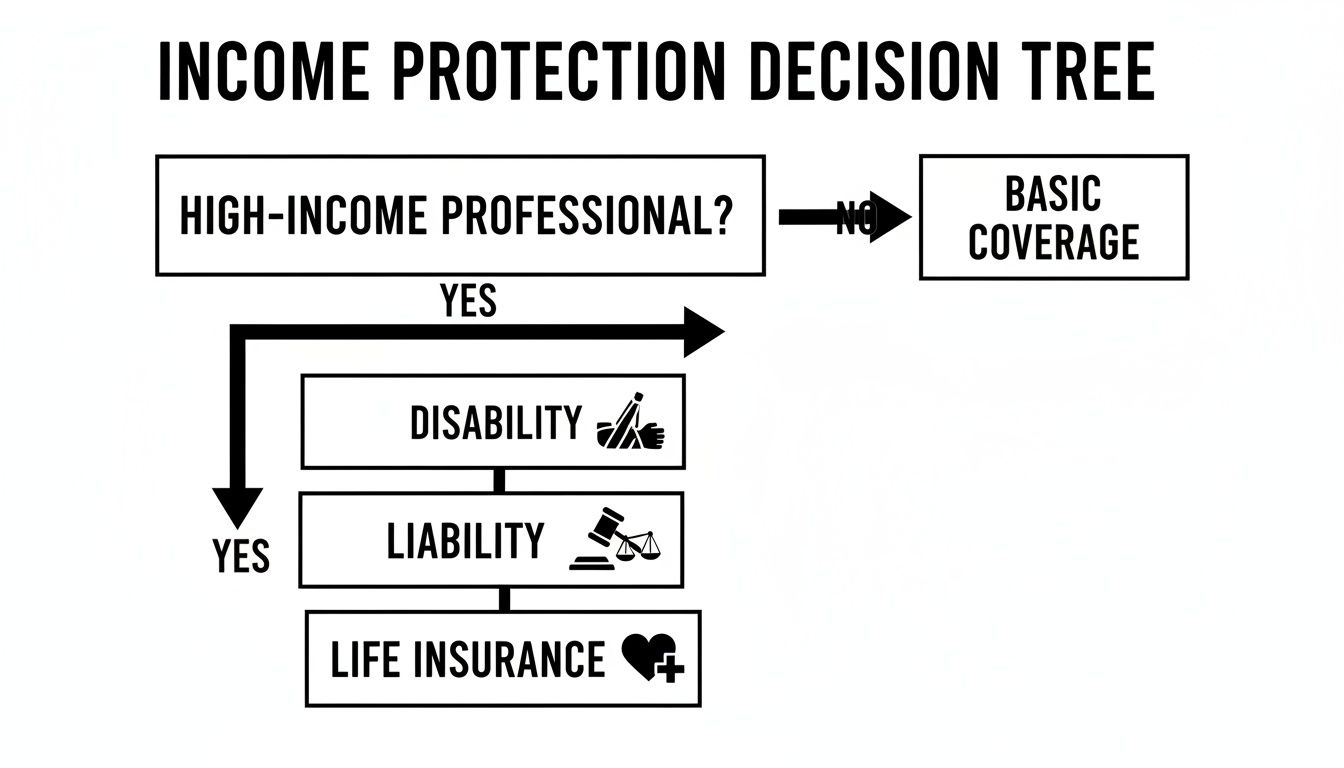

This decision tree gives you a simplified look at how to protect your most critical asset—your income.

As the visual illustrates, for high-earning professionals, protecting your future income is not about one policy. It is a multi-layered defense that must include both disability and liability coverage to be effective.

Here are the key signals of a quality provider:

- Global Claims Support: You require 24/7 multilingual assistance and a claims process that is simple, not complicated.

- Financial Strength Ratings: Check their scores from independent agencies like AM Best or S&P. This is an objective assessment of their financial capacity to pay claims.

- Peer and Broker Reviews: What are other expatriates saying? A specialized broker who deals with these insurers daily will know who pays and who creates obstacles. Their direct experience is invaluable.

Ensuring True Global Portability

For anyone living an international life, your coverage must move with you. Seamlessly. This means getting absolute confirmation that your policy remains in force, with the same terms, as you move from one country to another. No requalifying. No surprises.

True portability isn't just about being covered in different places. It's about the uninterrupted continuation of your benefits and terms as your life and career cross borders.

Many domestic plans, or even "international-lite" policies, become worthless or are cancelled the moment you change your country of residence. A genuinely robust IPMI or global life insurance policy is built for mobility. It ensures your financial fortress remains standing, no matter where your work takes you. This is a critical stress test for any policy you are considering.

Building a resilient insurance portfolio requires a critical eye for detail. The table below outlines a checklist of essential criteria to apply when evaluating any policy, helping you distinguish robust protection from hollow promises.

Key Evaluation Criteria for Your Insurance Portfolio

| Evaluation Criteria | What to Look For (Positive Indicators) | Red Flags to Avoid |

|---|---|---|

| Policy Language | Clear, unambiguous definitions. Clearly defined terms for "disability," "illness," or "residence." | Vague or overly broad definitions. Phrases like "at the insurer's discretion." |

| Exclusions Clause | Specific, narrow, and predictable exclusions (e.g., acts of war). | Long lists of exclusions for common activities, pre-existing conditions, or specific regions. |

| Portability Terms | Explicit "worldwide" coverage that continues without medical underwriting upon relocation. | Clauses that require re-application or new underwriting when changing your country of residence. |

| Claims Process | Direct billing networks, simple online submission forms, 24/7 multilingual support. | Complicated paper-based processes, slow response times, poor online reviews of their claims handling. |

| Provider Reputation | Strong financial ratings (A- or better from AM Best/S&P), positive broker feedback. | Declining financial ratings, history of claim disputes, negative press. |

| Renewal Guarantees | "Guaranteed renewable" or "non-cancellable" terms, protecting you from being dropped after a large claim. | Policies that can be cancelled by the insurer at renewal, especially based on your claims history. |

This checklist isn't just about ticking boxes; it's a strategic filter. Applying these criteria consistently ensures that every policy you add to your portfolio actively strengthens your financial security, rather than just giving you a false sense of it.

Your Insurance Questions Answered

When you are a globally mobile professional, your questions about insurance are not mere details—they are high-stakes decisions. Obtaining the correct answers is critical. Here, we address some of the most common and pressing questions we hear from clients like you.

Consider these less as hypotheticals and more as real-world financial tripwires. Incorrect information or a poorly chosen policy can have devastating consequences. The right insurance, however, offers a precise solution to each of these complex problems.

Why Is My Domestic Health Insurance Useless Abroad?

Simply put, your domestic health insurance was built for one country. It is geographically fenced in by design, providing solid coverage at home but leaving you dangerously exposed the moment you travel internationally.

International Private Medical Insurance (IPMI) is engineered for a life without borders. It represents the difference between seamless access to top-tier global hospitals and facing six-figure medical bills out-of-pocket. Relying on your home-country plan as an expatriate is not just a risk; it is a fundamental misunderstanding of how global healthcare operates.

How Is Life Insurance Calculated for a High-Net-Worth Individual?

For a high-net-worth individual, life insurance is not just about replacing a salary. It is a powerful financial instrument used to protect and transfer wealth. A generic online calculator will not even begin to address what is required.

A proper valuation must solve for specific, multi-million dollar problems:

- Neutralizing estate taxes to ensure your wealth transfers to your heirs, not the government.

- Eliminating international mortgages and other significant liabilities across your portfolio.

- Injecting liquidity into a business to fund a smooth succession plan.

- Funding a philanthropic legacy without touching the assets you have designated for your family.

Using a simple multiple of your income is a starting point, but the substantive work involves collaborating with a financial advisor to map the policy to your global asset structure and long-term vision.

Is Own-Occupation Disability Insurance Really Worth the Cost?

For a highly specialized professional, it is not just worthwhile—it is essential. Think of it as protecting the asset that generates your wealth. A standard disability policy might only pay out if you are unable to work at any job, a low threshold that offers little real protection for a high earner.

An 'own-occupation' policy is radically different. It protects your ability to perform the specific duties of your highly-skilled profession. If an illness or injury prevents you from being a surgeon, a pilot, or a senior partner at your firm, you receive your full benefit—even if you are perfectly capable of teaching or consulting. The higher premium reflects the true value of what you are insuring: your most valuable financial asset, which is your unique expertise and the income it generates.

What Does a Specialized Broker Actually Do?

Think of a specialized broker as your personal risk management partner, not a salesperson. We are immersed in the complex world of global insurance products, like IPMI, so you do not have to be. Our role is to cut through the noise and provide clear, objective guidance.

For example, we use our own proprietary analysis to match your specific career path, family situation, and international location against policies from the world's leading insurers. This process delivers the clarity you need to make a confident decision. Because we are compensated by the insurers, our advice comes at no cost to you. Our focus is entirely on finding the right fit for your needs.

At Riviera Expat, we bring clarity and deep expertise to building resilient insurance portfolios for financial professionals in global hubs. Our exclusive focus is securing premier International Private Medical Insurance. Secure your consultation with us today.