A journey to Turkey is an investment in rich culture, profound history, and unforgettable luxury. To ensure that investment is protected, premium travel insurance is not merely advisable—it is an essential component of your preparations. This guide moves beyond rudimentary advice, providing an executive perspective on why robust protection is entirely non-negotiable.

Securing Your Journey with Premier Insurance

Consider travel insurance not as a perfunctory item on a checklist, but as a critical element of your travel portfolio. A meticulously planned Turkish itinerary deserves an equally meticulous protection strategy. It is your silent partner, operating behind the scenes to safeguard your financial investment and provide the peace of mind required to fully appreciate your experience.

This is not about covering minor inconveniences. It is about strategic preparation for any eventuality, from a sudden medical emergency to a significant travel disruption. With the appropriate policy, you can immerse yourself in the wonders of Turkey, secure in the knowledge that a comprehensive safety net is in place.

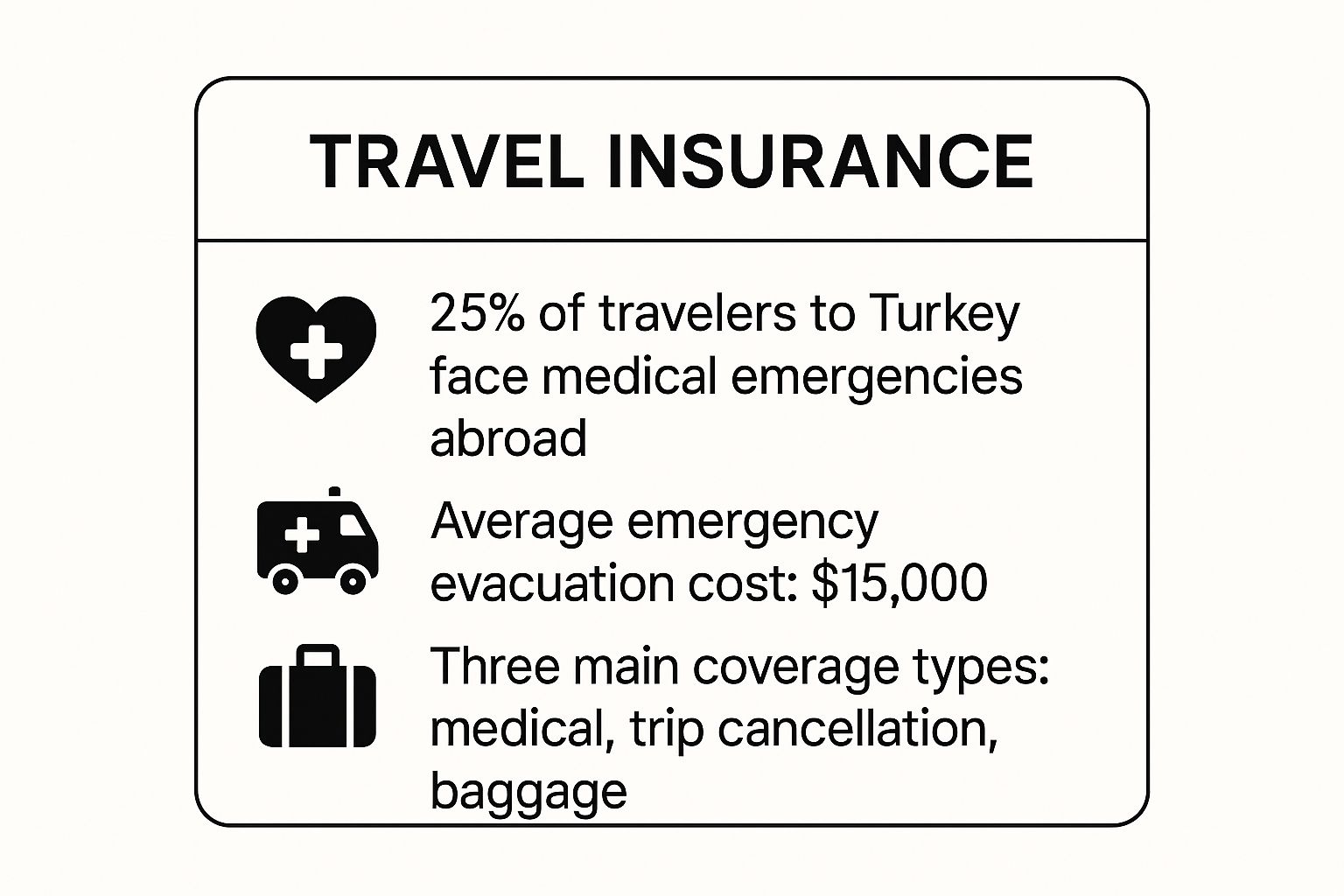

The image below delineates the key risks and the types of coverage every discerning traveler should prioritize.

As illustrated, the potential for a medical incident and the substantial cost of emergency care make robust insurance a necessity, not a luxury.

Why Your Policy Matters More Than Ever

The necessity for high-quality travel insurance has become even more critical as Turkey solidifies its position as a premier global destination. The country's ambitious tourism objectives have catalyzed a significant expansion in its domestic travel insurance market. A recent surge in international arrivals has directly fueled demand for policies tailored to foreign visitors, particularly those requiring high-limit medical and trip cancellation benefits.

A policy is more than a document. It is the assurance that empowers you to engage fully in your journey—whether for business or leisure—with absolute confidence and security.

This market growth is a positive indicator for travelers. It reflects the maturation of the Turkish insurance industry, where rising economic stability and consumer awareness are fostering the development of superior, more specialized products. This means you can have greater confidence in the quality and reliability of the coverage available. For those interested in the data, you can explore this trend in a recent industry report.

Key Travel Insurance Protections for Turkey at a Glance

To distill the essential information, a quick-reference summary of what truly matters in a policy for Turkey is invaluable. This table outlines the absolute must-have protections.

This table highlights the core components you should look for in any premium travel insurance policy for your Turkish itinerary.

| Coverage Component | Why It Is Essential for Turkey | Recommended Minimum Coverage |

|---|---|---|

| Emergency Medical & Evacuation | Covers the high costs of private hospitals and the potential need for air ambulance services, particularly if traveling outside major urban centers. | $100,000 USD for medical; $500,000 USD for evacuation |

| Trip Cancellation & Interruption | Protects your significant pre-paid investments in flights, luxury accommodations, and private tours from unforeseen, covered events. | 100% of non-refundable trip costs |

| Baggage & Personal Effects Loss or Delay | Crucial for replacing high-value items or covering necessary purchases if luggage is lost or delayed, a risk inherent in international transfers. | $2,500 USD for loss; $500 USD for delay |

| Travel Delay | Reimburses for meals and lodging if your flight is significantly delayed, a common occurrence in major international travel hubs. | $200 USD per day after a 6-12 hour delay |

Consider these the foundational pillars of your travel safety net. A policy that meets these minimums provides a strong starting point for a secure and worry-free journey.

Getting to the Heart of Your Medical Coverage

To be direct, the primary reason to acquire travel insurance for Turkey is not for a lost suitcase; it is for managing significant medical events. The core of any worthwhile policy is its medical protection.

While your journey is focused on exploring ancient ruins and vibrant bazaars, this coverage is your silent partner, guarding against the unexpected. It is what grants you immediate access to Turkey's impressive network of private hospitals and clinics should an incident occur, without the need to liquidate personal assets to cover the expense.

Think of it less as an insurance policy and more as a priority pass to top-tier medical care. A premium plan will offer high limits for emergencies, unforeseen hospitalizations, and specialist consultations. This is not an area for cost-cutting—inadequate medical coverage can place you in an untenable position, facing both a health crisis and a financial catastrophe.

The Two Most Important Words: Evacuation and Repatriation

Delving deeper into medical benefits, two features stand out as absolutely critical: emergency medical evacuation and repatriation. They sound similar, but they perform distinct and equally vital functions.

-

Emergency Medical Evacuation: Imagine you are injured while hiking a remote section of the Lycian Way. The local clinic is not equipped to manage your injuries. Evacuation coverage finances your transport from that location to the nearest appropriate medical center—perhaps in Istanbul or Izmir—that can provide the specialized care you require. It is your lifeline from a precarious situation to a superior one.

-

Medical Repatriation: Now, imagine you are stable but require long-term recovery. Repatriation is the benefit that covers the cost of returning you to your home country, allowing you to recover in a familiar environment with your family and trusted physicians. It is the "return me home" provision.

These are not ancillary add-ons; they are non-negotiable lifelines. The cost and logistical complexity of arranging an air ambulance can be staggering, easily reaching six-figure sums. A policy lacking robust evacuation and repatriation coverage is, frankly, incomplete.

How to Tell If Your Medical Coverage Is Strong Enough

When comparing policies, do not simply glance at the aggregate coverage amount. You must understand the market in which you are traveling. The Turkish Health and Medical Insurance Market was valued at USD 0.75 billion in 2023 and is projected to reach USD 1.04 billion by 2028.

This growth, led by major insurers like Allianz Sigorta and Anadolu Sigorta, indicates a strong, mature market that comprehends the need for quality coverage, including benefits for overseas treatment. You can see more details on Turkey's expanding medical insurance sector on mordorintelligence.com.

The true measure of a medical insurance policy is not its cost, but what it delivers in a moment of crisis. For travel to Turkey, that means direct access to premier care and a clear path home.

What this growing market signifies for you is confidence. You can find high-quality insurance products. By selecting a policy with high coverage limits and robust evacuation benefits, you ensure your health is properly protected. That peace of mind allows you to cease worrying and focus on the true purpose of your trip.

Protecting Your Investment with Trip Cancellation Coverage

A bespoke journey to Turkey represents a significant financial investment. You have likely committed substantial, non-refundable deposits for everything from first-class flights and exclusive boutique hotels to a private gulet charter along the stunning Turquoise Coast.

These upfront costs can accumulate rapidly. This is precisely where trip cancellation and interruption coverage transitions from a discretionary benefit to an essential component of your travel planning.

Consider it a financial safeguard. If a sudden, covered event arises and forces you to cancel or curtail your trip, this coverage facilitates the recovery of your funds. It is analogous to hedging a financial asset; you are protecting your travel investment from unexpected—and costly—disruptions.

Imagine a plausible scenario: an urgent business imperative recalls you to the office, or a sudden illness prevents you from flying. Without the right travel insurance for Turkey, you could forfeit every dollar you have prepaid. With it, you can recover those non-refundable expenses, transforming a potential total loss into a manageable situation.

Standard vs. Cancel for Any Reason Coverage

When you begin to evaluate policies, you will quickly encounter two main types of cancellation coverage: standard and 'Cancel for Any Reason' (CFAR). Understanding the distinction is critical.

Standard coverage is straightforward but circumscribed. It only applies for a specific list of reasons articulated in your policy document, such as a documented illness, a death in the immediate family, or a severe weather event.

For high-value itineraries with substantial non-refundable deposits, a standard policy may not offer sufficient flexibility. A Cancel for Any Reason rider provides the ultimate level of control over your investment.

A 'Cancel for Any Reason' (CFAR) rider is precisely as it sounds—an optional upgrade that provides a much broader safety net. It allows you to cancel for reasons that fall outside your base policy's list of covered perils. Perhaps a work conflict emerged, or you have a personal reason you prefer not to disclose. With CFAR, you can still recover a large portion of your trip cost, typically between 50% and 75%, provided you cancel within the specified timeframe (usually no later than 48 hours before departure).

Yes, this upgrade entails a higher premium. But for complex, high-value trips where you have significant financial exposure, the peace of mind is invaluable. It grants you the ultimate flexibility, ensuring that your financial decisions remain your own, irrespective of life's unforeseen turns.

Understanding the Turkish Insurance Market

It is imperative to correct a common misconception.

When considering Turkey's insurance market, do not envision a small, emerging player. This is a frequent error in judgment.

The reality is that Turkey hosts one of the most mature and competitive insurance landscapes in its region. This is not mere trivia; it is a significant strategic advantage for you as a traveler. A mature market translates to better products, stronger companies, and more reliable protection.

Understanding this provides a crucial layer of confidence. This is not about advocating for a local company over an international one. It is about recognizing that the entire system—the regulatory framework, the financial stability, the network of hospitals—is exceptionally solid. This foundation underpins whichever travel insurance for Turkey you select, confirming the country's status as a top-tier, well-supported destination.

A Market Built on Serious Growth and Stability

Turkey's insurance sector is a true heavyweight.

With total gross written premiums having recently surpassed $25 billion, it stands as a major insurance market in its geographic sphere. Moreover, it is not static. Industry experts project that figure to nearly double in the next five to ten years. That is not just growth; it is indicative of a dynamic, reliable, and forward-looking industry.

This powerful growth is excellent news for you. A larger, more competitive market compels providers to innovate. This results in more sophisticated products, superior service, and much stronger financial guarantees behind your policy. It signals a deeply embedded culture of risk management in the country. You can read more about Turkey's impressive insurance market trajectory on globalreinsurance.com.

What This Really Means When You're Choosing a Policy

So, how does this high-level market analysis actually assist you in selecting a better insurance plan? A mature insurance environment translates into several practical benefits that directly impact your coverage:

- Rigorous Regulatory Oversight: A market of this magnitude does not operate on trust alone. It is governed by stringent government regulations that compel insurers to maintain high standards for financial solvency and claims handling.

- Deeply Entrenched Networks: Insurers here have longstanding relationships with Turkey's best private hospitals and clinics. This is what facilitates direct billing and smooth, rapid access to quality care.

- A Wide Range of Choices: Fierce competition means you have more options. Providers are constantly creating a diverse array of products, from basic plans to specialized policies designed for discerning international visitors.

Evaluating the Turkish insurance market is akin to analyzing a blue-chip stock. You are not just purchasing a policy; you are investing in a system known for stability, reliability, and performance. Your protection is secure because the entire ecosystem is secure.

Ultimately, knowing the strength of Turkey's insurance sector should provide a genuine sense of assurance. It is proof that the country is not only a world-class destination for its culture and coastline but also one where the financial and medical safety nets are exceptionally well-constructed and prepared for any eventuality.

Tailoring Your Policy with Advanced Coverage

A standard travel insurance policy provides a solid foundation, but it is often just that—a foundation.

A truly exceptional journey to Turkey, complete with unique experiences and high-value equipment, demands protection that is anything but standard. You must elevate your coverage beyond the basics to align with the specifics of your itinerary.

Consider this analogy: a standard policy is like a well-made suit purchased off the rack. It fits adequately, but it is not perfect. Advanced coverage is the bespoke tailoring that ensures a flawless fit for every contour of your itinerary. This means looking beyond basic limits and adding specialized enhancements, often called riders or endorsements.

Securing Your Valuables and Electronics

One of the first areas to consider for an upgrade is your personal effects coverage. The limits on standard baggage loss or delay benefits are often disappointingly low—insufficient for what a discerning traveler typically carries.

If you are traveling with designer luggage, fine jewelry, or other high-value personal items, a basic policy could leave you exposed to significant financial loss.

High-limit baggage riders can increase your coverage to a level that reflects the real-world value of your possessions. Even more important is to consider a dedicated rider for high-value electronics. Laptops, professional camera equipment, and drones are frequently subject to very low sub-limits or are excluded entirely from base coverage.

A policy's true worth is revealed when it addresses the specific, high-value elements of your personal itinerary. Ensuring your coverage for possessions and activities aligns with their actual cost is the hallmark of a well-designed protection strategy.

Adding Coverage for Unique Turkish Experiences

Your itinerary might include once-in-a-lifetime experiences that fall completely outside the scope of a typical policy. For instance, a hot air balloon flight over Cappadocia’s surreal landscape, or chartering a private gulet to sail the pristine waters of the Turquoise Coast.

Insurers often classify these as "adventure activities."

To ensure you are protected during these signature moments, you must add an activity-specific rider. Without this explicit endorsement, any incident related to these activities will likely not be covered. It is a critical step to review your planned excursions and match them with available riders to close any dangerous gaps in your protection.

For those contemplating longer stays or more intricate travel, understanding different policy structures is vital. It is worthwhile to learn more about the types of insurance policies for expatriates to see how these specialized needs are addressed.

Aligning your travel insurance for Turkey with your exact plans is non-negotiable. By meticulously identifying potential coverage gaps and utilizing endorsements to create a custom-fit policy, you ensure every element of your sophisticated journey is comprehensively protected, leaving nothing to chance.

Selecting and Purchasing Your Premier Policy

You have conducted the research. Now it is time to convert that knowledge into a tangible asset. Purchasing premier travel insurance for Turkey is not a last-minute, click-through exercise. It is a deliberate, well-informed decision that ensures the policy you acquire is perfectly suited to your trip, not merely "good enough."

Regard this as the final, critical step before a major investment. You are securing a financial backstop for your health, your belongings, and your peace of mind. The objective is to proceed with total confidence, knowing you have addressed every angle.

Your Four-Step Purchase Protocol

Following a structured process eliminates guesswork and ensures no crucial detail is overlooked. This four-step protocol will enable you to methodically select and secure the right policy.

-

Calculate Total Trip Investment: Begin by aggregating every non-refundable cost for your trip. This includes first-class airfare, luxury hotel bookings, pre-paid private tours, and any other significant items paid for upfront. This total serves as your baseline for setting the trip cancellation coverage limit.

-

Assess Your Personal Risk Profile: Be forthright about your specific needs. Do you have any pre-existing medical conditions that require explicit, written confirmation of coverage? Are you packing high-value items, such as professional camera equipment or expensive luggage, that necessitate a higher limit for personal effects?

-

Meticulously Compare Premier Providers: Never accept the first quote you receive. You must compare policies from at least three top-tier international providers. Look beyond the price and delve into the actual policy wording. Pay close attention to definitions, exclusion clauses, and per-incident payout limits.

-

Scrutinize the Claims Process: A policy is only as good as its ability to pay out when needed. Investigate each provider's claims process. Is it managed by an in-house team available 24/7? Do they have a solid reputation for paying claims fairly and promptly? This information can often be found through independent reviews and customer testimonials.

Before you finalize the purchase, you must be able to answer one question with absolute certainty: "Does this specific policy language, as written, fully cover my unique trip and personal situation without ambiguity?" If any doubt remains, obtain clarification from the provider in writing.

For expatriates or long-term travelers whose needs extend beyond a single trip, a more permanent solution may be appropriate. It is worthwhile to get a quick quote for international private medical insurance to understand how these long-term plans function and what they cover. This provides a clear comparison between short-term travel protection and ongoing global health coverage.

By arming yourself with the right questions and demanding clear, unambiguous answers, you ensure the policy you choose truly meets your high standards.

Your Top Questions About Turkey Travel Insurance, Answered

Let us address the most pertinent questions directly. When planning a sophisticated journey to a destination like Turkey, a few key inquiries about travel insurance invariably arise. Obtaining clear, straightforward answers is the best way to proceed with your plans confidently.

Is Travel Insurance Mandatory for Turkey?

For many nationalities, no, it is not a strict government mandate for tourist entry. However, this does not represent the full picture.

Proof of robust medical travel insurance is frequently a non-negotiable requirement for specific visa applications. Furthermore, many premier tour operators and private yacht charters will stipulate it as a condition of booking.

Beyond any official regulations, consider it an essential element of your travel strategy. It is the safeguard that protects your health, your well-being, and the significant financial investment you have made in your trip. Before traveling, it is always prudent to verify the latest entry requirements with the official Turkish embassy or consulate in your country of residence.

What Is a Sufficient Level of Medical Coverage?

For a trip to Turkey, a quality policy should provide a minimum of $100,000 USD in emergency medical coverage. For those who demand the highest standard of care and complete assurance, policies with limits of $500,000 USD or more are strongly recommended.

Equally critical is the coverage for emergency medical evacuation. Your policy must offer at least $500,000 USD for this specific benefit. This ensures that, should a serious incident occur, you can be transported to the best possible medical facility or repatriated home without concern for the staggering cost.

The operative question is not merely "Am I covered?" It is "Does my coverage guarantee the quality of care and speed of response I expect?" For that peace of mind, high limits on medical and evacuation benefits are non-negotiable.

Does My Policy Cover My Specific Activities?

This is an area where many travelers encounter difficulties. Standard policies are known for excluding activities they classify as "high-risk." You cannot assume you are covered; you must verify the policy details.

Are you planning a hot air balloon ride over Cappadocia? Or chartering a gulet along the coast? You will almost certainly need to add a specific rider for "adventure sports" or for the activity itself. Always confirm with your provider that every planned excursion is explicitly covered before you purchase the policy. This simple step eliminates dangerous gaps in your protection.

For a broader overview of common questions, you may find this helpful FAQ page useful, as it covers many related insurance topics.

How Do I Access Medical Care with My Insurance?

Every reputable international insurer operates a 24/7 global assistance hotline. This number is your lifeline. In any medical situation, your first call should always be to them.

Their team will immediately direct you to the nearest approved, high-quality private hospital or clinic. More importantly, they manage the logistics, coordinating direct payment to the hospital for all covered costs and arranging any necessary medical evacuations. Keep this contact number and your policy details in a place that is instantly accessible—not packed away in your luggage.

At Riviera Expat, we specialize in providing clarity and confidence for your international health and travel protection needs. Our expertise ensures your coverage aligns perfectly with your lifestyle and expectations.

Secure your peace of mind with a complimentary consultation today.