Picture this: a sudden medical emergency strikes while you are in a remote location, miles from the top-tier medical facilities you are accustomed to. For global executives and high-net-worth families, this is not just a health scare—it is a significant financial and personal risk. A solid travel insurance medevac plan is not a line-item expense; it is an essential layer of protection for your most critical assets: your health and your family's security.

Protecting Health And Wealth Across Borders

For anyone operating at the highest levels of international business and finance, standard insurance is insufficient. Your domestic health plan likely offers minimal to no effective coverage once you cross a border, and the complimentary insurance that comes with your premium credit card is often riddled with fine print and limitations that only become apparent during a crisis.

These plans are notorious for falling short, leaving you dangerously exposed to staggering medical bills and logistical nightmares.

This guide is designed to cut through the noise and demonstrate why robust medevac coverage is a non-negotiable part of any serious international risk strategy. It is all about maintaining control and clarity when circumstances become challenging.

Why This Coverage Is More Critical Than Ever

The need for this kind of specialized protection is not merely anecdotal; the data substantiates it. The global medical travel insurance market, driven heavily by demand for emergency medical and evacuation services, was recently valued at a significant USD 30.59 billion.

Looking ahead, the market is expected to grow at a compound annual growth rate of 13.2% through 2030. This is not arbitrary growth; it is a direct reflection of the expansion in international business travel, where executives are constantly facing heightened health risks far from their trusted medical teams.

A medical evacuation is a massive logistical undertaking. Without the right coverage, you are looking at a bill that can easily reach six or even seven figures for a single incident. This is the kind of liability that can seriously impact personal wealth and your family's future.

This is precisely why a specialized approach is required. It is time to shift your thinking from basic trip cancellation to a comprehensive strategy that protects your health with the same rigor you apply to your financial portfolio.

A Complete View Of Global Security

True peace of mind on the global stage is about more than just medical readiness. In an era where you are constantly connecting to public networks in airports, hotels, and lounges, your digital security is just as vital.

While a top-tier insurance plan has your back in a medical crisis, a crucial part of staying safe involves protecting your data. Following a traveler's guide to staying safe online is a critical layer in your overall security plan, especially when using public Wi-Fi.

Ultimately, operating globally with confidence means having safeguards for every contingency. This allows you to focus on your professional objectives, knowing you are protected from every angle.

Understanding Medical and Emergency Evacuation

When you are managing a global portfolio, getting the terminology right is non-negotiable. The same applies to your personal safety, but here, a simple misunderstanding can have life-altering consequences. The terms 'emergency medical evacuation' and 'medical evacuation' (medevac) sound similar, but they represent two vastly different services. Conflating them can leave you dangerously exposed when you need protection most.

Think of it as a two-part logistics chain for your health in a crisis. The first part, emergency evacuation, is about removing you from immediate danger and stabilizing your condition. The second, medevac, is a strategic move to secure the absolute best care, wherever that may be.

Emergency Evacuation: The First Response

An emergency evacuation is the initial, urgent step. It is the rapid transport from wherever you are—a remote project site, a rural village, the scene of an accident—to the nearest medical facility that can stabilize you. The singular goal here is stabilization.

Imagine you are on a remote island in Southeast Asia and have a serious accident. An emergency evacuation is the helicopter or speedboat ride to the closest regional hospital equipped to handle the initial trauma. It is a critical service, but it only answers one question: "Where can we get you stable right now?" It does not answer, "Where can you get world-class treatment for the best possible recovery?"

Medical Evacuation: The Strategic Move

This is where the dynamic changes, especially for professionals who demand a higher standard of care. A true travel insurance medevac is the planned, coordinated transport from that initial hospital to a superior, more advanced facility. This is not just a reaction; it is a strategic decision to access a center of excellence for your specific condition, often across international borders.

Following our island example, after you are stabilized at the regional hospital, a medevac would be the medically-equipped private jet that flies you to a top-tier hospital in Singapore, Bangkok, or even back to your home country.

The core difference is the mission. Emergency evacuation is about getting you to a place of adequacy. Medical evacuation is about getting you to a place of excellence. For high-net-worth individuals and global professionals, that distinction is everything.

Why This Distinction Matters

Here is the critical point: many basic travel insurance plans will cover your evacuation to the "nearest appropriate facility" and consider their obligation fulfilled. This could leave you in a hospital that, while capable of saving your life, is far from your first choice and certainly not a leader in the specialized care you now need for a full recovery.

A superior policy with robust travel insurance medevac coverage gives you control. It ensures you have the option—and the funding—for transport to a world-class institution. It places you in command of your own medical outcome. The critical questions to ask about any policy are:

- Choice of Destination: Does the policy restrict you to the "nearest" facility, or does it allow transport to a hospital of your choice or back to your home country (repatriation)?

- Definition of Necessity: Is a transfer only "medically necessary" if the local hospital is inadequate? Or does the policy allow for a move to a superior facility to ensure better long-term outcomes?

- Logistical Coordination: Does the insurer's assistance partner handle the entire complex process of logistics? This includes chartering the appropriate aircraft, assembling a specialized medical crew, navigating international clearances, and coordinating ground ambulance transfers on both ends.

Getting these details right transforms your insurance from a simple safety net into a powerful tool for protecting your health at the highest standard, no matter where your work or life takes you. It is not just about surviving an emergency; it is about ensuring you have access to the care required to thrive afterward.

The Financial Realities of a Medical Evacuation

A private air ambulance mission is not just a flight. It is a highly complex logistical operation—essentially mobilizing a flying intensive care unit at a moment's notice—with a price tag to match. Moving beyond theoretical risk, let's discuss the hard numbers. The costs for a travel insurance medevac can escalate into six or even seven figures for a single incident.

This is the kind of financial exposure that can derail a lifetime of careful wealth planning. Without the right coverage, a medical crisis abroad instantly becomes a financial one.

Anatomy of Medevac Costs

The final invoice for a medical evacuation is a sum of several significant variables, each demanding expert coordination. It bears no resemblance to chartering a standard private jet.

Here is what drives the substantial costs:

- Specialized Aircraft: The type of medically equipped jet required, such as a long-range aircraft capable of a transatlantic flight, is a primary expense.

- Onboard Medical Team: You are funding a highly specialized crew. This could include a flight physician, a critical care nurse, and respiratory therapists, all with specific aeromedical training.

- Flight Distance and Logistics: Longer distances mean more fuel, more crew hours, and potentially multiple stops, each adding thousands to the bill.

- Permits and Fees: Securing international landing permits, overflight rights, and paying airport fees—especially for after-hours operations—accumulate quickly.

- Ground Support: The costs also include coordinated ground ambulances at both the departure and arrival points, ensuring a seamless bedside-to-bedside transfer.

A medical evacuation from a remote location can cost anywhere from $25,000 to well over $250,000. An intercontinental flight, say from Asia back to Europe or the U.S., can easily exceed $250,000, and that is before factoring in extreme medical complexity.

Breaking down these costs makes it unequivocally clear why a low coverage limit on a standard insurance policy is such a significant gamble. You can learn more about how policy limits, excesses, and deductibles impact your financial exposure by reading our guide on the fine print of insurance policies.

The Growing Market for Protection

The need for this level of protection is expanding rapidly. For sophisticated investors and wealth managers operating between global hubs like Singapore and Zurich, the medical travel insurance segment is an indispensable safeguard. Valued at USD 30.59 billion, this market is projected to hit USD 63.98 billion by 2030, growing at a robust 13.2% CAGR. This growth is fueled by the very nature of global business and leisure travel, amplifying the demand for solid medevac plans that can head off the financial fallout from an accident or illness abroad. Discover more insights about the global medical travel insurance market.

Estimated Medevac Costs for Common Expat Scenarios

To put these numbers into perspective, let's look at a few realistic scenarios. These are not exaggerated, worst-case estimates; they are representative costs for situations that global professionals can and do face.

| Evacuation Route | Medical Scenario | Estimated Cost (USD) |

|---|---|---|

| Bali to Singapore | Severe Cardiac Event | $50,000 – $80,000 |

| Buenos Aires to Miami | Neurological Emergency | $120,000 – $170,000 |

| Dubai to London | Complex Trauma Injury | $100,000 – $150,000 |

| Tokyo to New York | Acute Respiratory Failure | $200,000 – $275,000 |

These examples underscore a critical point: the cost of a single medevac can erase years of investment returns. The financial case for securing a policy with an unlimited or multi-million dollar travel insurance medevac benefit is undeniable. It is a strategic decision to insulate your wealth from the severe and unpredictable costs of a medical emergency far from home.

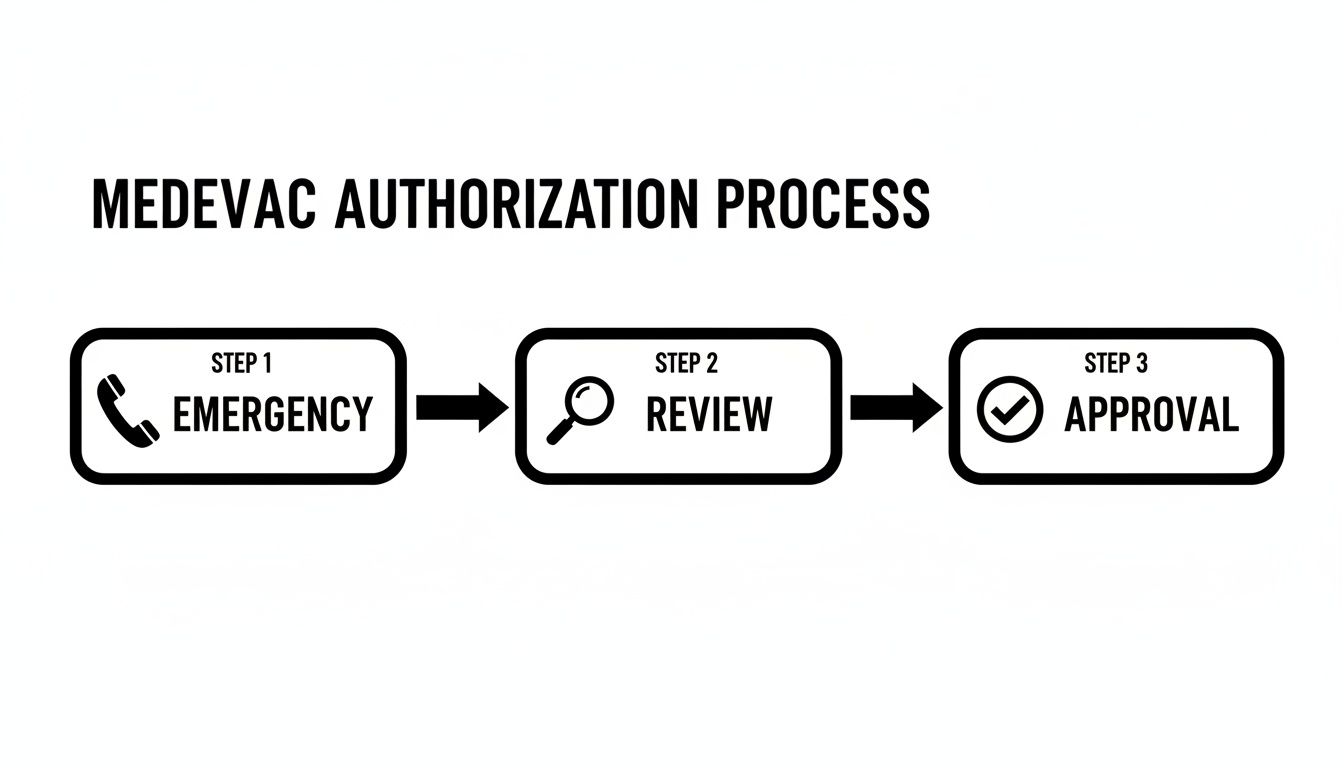

Navigating the Medevac Authorization Process

When a medical crisis occurs overseas, the last thing you want is ambiguity. Authorizing a travel insurance medevac is not an automatic approval; it is a specific, managed process that initiates the moment you make one crucial emergency call. Understanding this process provides a sense of control when you need it most.

A top-tier insurer is more than just a company that pays invoices—they become your emergency case manager. Their global assistance teams, staffed by medical professionals, take control immediately. This lifts the immense administrative and logistical burden from your shoulders. Your only responsibility is to call their 24/7 emergency hotline.

It All Comes Down to Medical Necessity

The entire authorization process hinges on a single, critical principle: medical necessity. This is not a vague concept. The insurer's medical team will communicate directly with your local attending physician to determine one thing: can the current facility provide the care you require for a successful recovery?

An evacuation is approved only when it is clinically confirmed that moving you to a better-equipped hospital is essential for your health. This is not about securing a more comfortable room or being closer to home; it is a purely medical decision based on your condition versus what the local healthcare system can realistically offer. For expatriates accustomed to first-world care, it is vital to have a policy that defines 'medical necessity' in your favor.

This entire workflow is designed for speed and clarity.

As you can see, it moves from your initial call to a professional medical review and, finally, to the approval that sets the entire evacuation in motion.

The Paperwork and Coordination Machine

Once medical necessity is confirmed, the provider's team springs into action, coordinating every last detail. They will require specific documents from the local hospital, but their assistance team will help you gather everything.

Here is what they typically request:

- A detailed medical report from the treating doctor explaining your diagnosis, current condition, and the care you have received.

- Written confirmation that the current hospital lacks the necessary capabilities for a successful outcome.

- Patient identification and your insurance policy information to activate your benefits.

A great provider handles all the moving parts so you do not have to. We are talking about arranging the air ambulance, selecting the appropriate medical crew for your condition, handling flight plans, securing landing rights, and even organizing the ground transport at both ends. Their expertise guarantees a seamless, bedside-to-bedside transfer without you ever touching a single piece of the logistics.

This is the real value of a robust travel insurance medevac plan. It is all built around a pre-authorization and direct settlement system designed to eliminate financial stress in the heat of the moment. You can get a deeper look into how these systems function in our guide on pre-authorisation and direct settlement in health insurance.

Ultimately, a quality insurer’s authorization process provides expert oversight and decisive action. It turns a chaotic, frightening event into a structured, professionally managed response, ensuring your health and safety are the absolute priority.

How to Choose the Right Medevac Coverage

Selecting the right travel insurance medevac coverage is not a simple box-ticking exercise. It is more akin to performing due diligence on a critical investment—because that is precisely what it is. The nuances are always in the details, and the fine print can mean the difference between a seamless rescue and a financial catastrophe.

For global professionals, this is not about finding the cheapest plan; it is about securing the most effective one. You need a methodical approach to ensure the policy you choose can actually deliver when you are at your most vulnerable.

First, let's discuss the coverage limit. This is the absolute make-or-break number. Many standard travel policies offer limits of $50,000 to $100,000. While that might sound like a substantial amount, it is a dangerously low figure for a serious international medical evacuation.

A complex, intercontinental air ambulance mission can easily cost six or even seven figures. A low coverage cap leaves you exposed to devastating out-of-pocket costs. For this reason, you should only consider policies with multi-million dollar limits or, ideally, unlimited coverage. Anything less is an unacceptable risk.

Scrutinize the Definition of Medical Necessity

Beyond the dollar amount, the policy's definition of "medical necessity" is where you will find the real weak spots. A restrictive definition might only approve an evacuation if the local facility is completely incapable of treating you. This could leave you stranded in a hospital that is merely adequate, not excellent.

A superior policy, on the other hand, defines medical necessity more broadly. It allows for an evacuation to a higher standard of care to ensure a better long-term outcome. This is a crucial distinction that separates basic, bare-bones coverage from a plan built for professionals who demand world-class care. Digging into these nuances is vital, and our guide on expat medical insurance policy terms explained can shed more light on this.

The demand for this level of detail is growing. Data from the U.S. Travel Insurance Association shows that travelers are now spending 46% more on protection than they did in 2019, signalling a clear shift towards truly robust emergency coverage.

Evaluate Your Destination Options

Another critical point to investigate is where the policy will actually transport you. Many plans are structured to cover transport only to the "nearest appropriate medical facility." For a global professional, this is a major red flag. What if the "nearest" facility is not the best one?

The best policies offer far more flexibility. Look for these options:

- Hospital of Choice: This is the gold standard. It allows you to be transported to a pre-eminent medical institution known for treating your specific condition, regardless of its location.

- Medical Repatriation: This benefit covers transport back to your home country, placing you in the hands of your own trusted doctors and support network.

Having the power to choose your destination gives you an invaluable level of control over your medical journey.

Choosing medevac coverage is not about finding the cheapest option; it is about securing the most effective one. The right policy acts as a powerful logistical partner, removing barriers to premier medical care when you are at your most vulnerable.

Understand the Exclusions

Finally, you must meticulously comb through the policy's exclusions. Every single plan has them, and being caught unaware can lead to a denied claim at the worst possible moment.

Here are the common exclusions you need to identify:

- Pre-existing Conditions: Look for the specific waiting periods or clauses related to any conditions for which you have been treated in the past.

- High-Risk Activities: If you enjoy activities like scuba diving, mountaineering, or even amateur competitive sports, you must ensure your policy explicitly covers them. Many standard plans will not.

By carefully assessing these four key areas—coverage limits, the definition of medical necessity, your destination options, and the exclusions—you can confidently select a travel insurance medevac plan that truly aligns with your standards for health and financial protection.

Integrating Medevac into Your Global Strategy

Viewing travel insurance medevac as just another line item in a policy is a critical error. For global professionals, it is a cornerstone of wealth preservation and personal security. In a world of boundless opportunity—and inherent risk—the ability to access world-class medical care, no matter where you are, is the ultimate safety net for you and your family.

This is not just about health; it is about strategic asset management. You would not leave your financial portfolio to chance, so why would you gamble with your most valuable asset—your health? Just as you meticulously structure investments to hedge against risk, your approach to global health security needs to be just as precise.

A sudden accident or illness in a country with subpar medical facilities should not be permitted to derail your life's work or place your family's future in jeopardy.

A Proactive Stance on Global Well-Being

Taking control means treating your international medical coverage with the same gravity as any critical business decision. It is about digging into the policy language, insisting on high (or unlimited) coverage limits, and choosing a provider who can execute complex logistics under immense pressure. This is not a passive purchase; it is an active strategy.

For companies, this means building medevac into a robust global mobility plan. It involves establishing clear and actionable policies, including strong guidance on corporate travel policy best practices that cover employee safety and emergency response anywhere on the map. A solid framework ensures every team member is protected to the same high standard.

Integrating robust medevac coverage is the final, essential layer of a truly global lifestyle. It transforms uncertainty into confidence, empowering you to operate anywhere in the world with the knowledge that your health, your family, and your legacy are protected by a world-class safety net.

The Ultimate Assurance

Ultimately, the right medevac plan delivers far more than just financial protection from catastrophic medical bills. It gives you control over your medical destiny.

It is the guarantee that if the worst happens, you will be in the hands of the world’s best medical experts—not just the ones who happen to be closest. This level of preparedness allows you to pursue opportunities on the world stage without hesitation. It is the definitive statement that you have planned for every contingency, ensuring your well-being is never left to chance.

The Big Questions: Your Medevac FAQs Answered

When dealing with medevac coverage, the details are paramount. For professionals accustomed to financial precision, obtaining that same clarity for your personal safety is non-negotiable. Here are direct answers to the questions we hear most often.

Think of this as the essential briefing you need before you travel, ensuring your health and wealth are shielded, no matter where you are in the world.

Is My Premium Credit Card Insurance Enough?

The direct answer is that the premium credit card in your wallet is dangerously inadequate for a true medical crisis. These cards often advertise travel insurance, but the medevac coverage is usually a nominal benefit. You will typically find low coverage caps, sometimes as little as $50,000 to $100,000, which an international air ambulance can exhaust before it even leaves the runway.

What is more critical is the fine print. Most of these policies will only transport you to the "nearest appropriate facility." That might mean you are stable, but you are left in a hospital that is a world away from the standard of care you expect. A proper International Private Medical Insurance (IPMI) plan offers multi-million dollar or unlimited coverage and gives you control over where you are treated. It is a completely different league of protection.

What Is The Difference Between Medevac and Repatriation?

These terms are often used interchangeably, but they have distinct meanings. Understanding this is crucial to ensuring a policy performs as you expect in an emergency.

- Medical Evacuation (Medevac): This involves transporting you from a location with substandard care to a nearby hospital that can provide definitive treatment. For example, moving you from a regional hospital in Cambodia to a world-class facility in Singapore.

- Medical Repatriation: This means transporting you all the way back to your home country for medical care.

For most high-net-worth expatriates, repatriation is the objective. You are treated by your own doctors, in a system you trust, and are close to your family. A top-tier plan should cover both, but you must verify that repatriation is explicitly included. Do not assume it is.

Can an Insurer Refuse a Medevac?

Yes, they can, and it is vital to understand why. The most common reason an insurer denies a medevac request is that their medical team determines it is not "medically necessary." In short, they consult with your local doctor and conclude that the facility where you are located is adequate to treat you.

A denial can also occur if the emergency is related to a policy exclusion. This could be an undeclared pre-existing condition, an injury from a high-risk activity you did not disclose, or traveling in a region specifically excluded by your plan. This is precisely why you must review the policy details before you travel.

How Does a Specialized Insurance Broker Actually Help?

Attempting to navigate the maze of IPMI and medevac policies on your own is an inefficient use of your time and risks costly oversights. It is not just about finding quotes; it is about understanding the intricacies of what you are actually purchasing. A specialized broker is your expert guide and advocate.

We use proprietary tools to run a detailed market analysis, but we go deeper than just price. We scrutinize the definitions of medical necessity, compare medevac limits, and confirm the repatriation options for elite insurers. Our job is to translate complex policy language into clear, actionable advice, saving you time and preventing a catastrophic oversight. From selecting the right policy to navigating a claim, we ensure your coverage meets your exacting standards.

At Riviera Expat, we provide the clarity and control you need to secure your health and wealth across borders. Our expertise is tailored to the unique demands of financial professionals operating in global hubs. Secure your consultation today.